Generative artificial intelligence (AI) has captivated the globe with its capacity to answer complicated questions, write novels, and produce music and art. ChatGPT and Bard, two of the most popular platforms today, have become common names. In the meanwhile, payments are progressively changing due to generative AI.

Generative AI is a form of artificial intelligence that involves machine learning algorithms. It can evaluate raw data, identify patterns, and draw connections on its own. Its main advantage is its capacity to rapidly handle massive volumes of data. An average individual can read around 238 words per minute. ChatGPT was trained on 300 billion words, which equates to nearly 2,400 years of reading.

In the payments industry, which relies on rich data, generative AI has the potential to become an effective technology. It is intended to greatly enhance fraud detection, assistance, and underwriting. However, new and novel applications for AI in payments are already appearing. In a decade, this developing technology will most certainly have affected almost every corporate sector.

We’ll discuss generative AI and its significance for payments in this blog. We’ll also discuss a generative AI system that can help retailers make the best use of their payment data.

What is Generative AI?

Generative AI refers to a type of artificial intelligence that can create new content rather than merely analyzing existing data. This innovative technology uses deep learning models, particularly neural networks, to understand and replicate patterns found in the training data, allowing it to produce original text, images, music, and videos. For example, a text-based generative AI like GPT-4 can generate coherent and contextually relevant text by learning from a vast array of language data, including grammar, semantics, and context.

Overview of Generative AI in Payments

Generative AI is revolutionizing the payments industry by introducing advanced capabilities that enhance efficiency, security, and customer experience. Generative AI payment systems leverage sophisticated algorithms to create intelligent solutions for various aspects of the financial ecosystem, including transaction processing, fraud detection, customer service, and personalized financial products.

One significant application of generative AI in banking is the development of advanced fraud detection systems. These systems can generate predictive models to identify unusual patterns and anomalies in transaction data, significantly reducing the risk of fraudulent activities. By continuously learning from new data, generative AI enhances the accuracy and effectiveness of these models, providing robust security measures for both banks and their customers.

Importance of GenAI in Payments

Generative AI (GenAI) is revolutionizing the payments industry by enhancing efficiency, security, and customer experience. Generative AI payment systems are able to examine enormous volumes of transaction data and spot trends that point to fraud. By learning from historical data, these systems detect anomalies in real time, significantly reducing the risk of fraud. This not only protects consumers but also helps financial institutions maintain trust and reliability. As fraud detection becomes more sophisticated, the overall security of the payment ecosystem improves, fostering a safer environment for transactions.

Incorporating Generative AI in banking allows for highly personalized customer experiences. AI payments can tailor recommendations based on individual spending habits, offer customized financial advice, and enhance customer interactions through chatbots and virtual assistants that understand and respond to queries in a natural, human-like manner. This level of personalization improves customer satisfaction and loyalty, as users receive services that are closely aligned with their personal financial needs and preferences. Moreover, GenAI helps banks anticipate customer needs, providing proactive support and creating a more engaging banking experience.

Furthermore, AI payments streamline the transaction process, reducing the time required to complete payments and minimizing errors. Automation of routine tasks such as invoice processing, reconciliation, and compliance checks enhances operational efficiency, allowing financial institutions to focus on more strategic activities. Advanced risk management capabilities enable better assessment of creditworthiness and transaction behaviors, leading to more accurate decision-making and improved financial stability. The development of innovative payment solutions, such as dynamic pricing models and real-time financial forecasting, is also facilitated by Generative AI payment systems, driving the evolution of the payments ecosystem and setting new standards for financial transactions.

Benefits of Generative AI in Payments

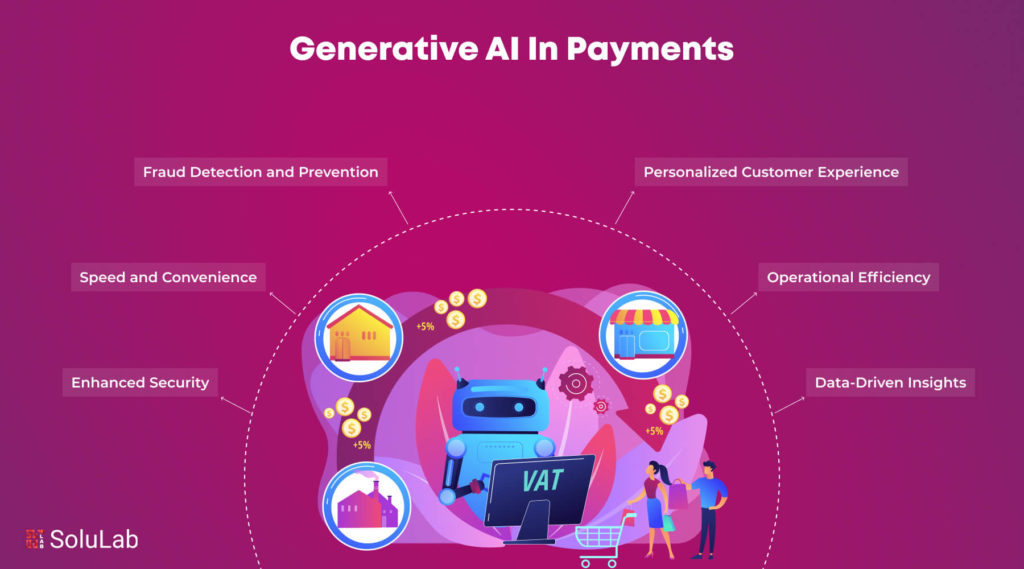

Generative AI is revolutionizing various industries, and the payments sector is no exception. There are several benefits to integrating AI technology into payment systems, including increased effectiveness, security, and user experience. Here are some AI payment benefits for businesses:

1. Fraud Detection and Prevention: Generative AI can analyze vast amounts of transaction data to identify patterns indicative of fraudulent activity. By continuously learning from new data, AI systems can detect anomalies in real time, significantly reducing the risk of fraud. This proactive approach not only protects consumers but also saves financial institutions billions of dollars annually.

2. Personalized Customer Experience: AI can provide tailored experiences by analyzing user behavior and preferences. For instance, AI-driven chatbots can offer personalized support, answer queries, and guide users through payment processes. Additionally, AI can recommend products or services based on past transactions, enhancing customer satisfaction and loyalty.

3. Operational Efficiency: Automation of routine tasks is one of the major AI payment benefits. Generative AI can streamline processes such as invoice management, transaction reconciliation, and customer support. By automating these tasks, companies can reduce operational costs and allocate resources to more strategic initiatives.

4. Enhanced Security: AI enhances the security of payment systems through advanced encryption techniques and biometric authentication methods like facial recognition and fingerprint scanning. These technologies ensure that only authorized individuals can access sensitive financial information, thereby reducing the risk of data breaches.

5. Speed and Convenience: Generative AI can process transactions faster than traditional methods. For example, AI-powered payment gateways can approve or decline transactions in milliseconds, leading to quicker checkouts and improved customer satisfaction. This speed and convenience are crucial in today’s fast-paced digital economy.

6. Data-Driven Insights: AI can analyze transaction data to provide valuable insights into consumer behavior and market trends. Financial institutions can leverage these insights to make informed decisions, optimize pricing strategies, and develop new products that meet customer needs. This data-driven approach can lead to increased revenue and market competitiveness.

7. Cost Reduction: Implementing Payment AI solutions can significantly reduce costs associated with manual processing and error rectification. AI systems can handle large volumes of transactions accurately, minimizing the need for human intervention and reducing the likelihood of costly mistakes.

8. Scalability: AI systems can easily scale to handle increasing transaction volumes, making them ideal for growing businesses. Unlike traditional systems that may require significant upgrades to accommodate growth, AI solutions can adapt to changing demands with minimal disruption.

9. Regulatory Compliance: Generative AI can help financial institutions stay compliant with regulatory requirements by continuously monitoring transactions for suspicious activities and ensuring adherence to legal standards. This capability is particularly important in the context of anti-money laundering (AML) and know-your-customer (KYC) regulations.

10. Innovation and Competitive Advantage: Companies that adopt AI technologies in their payment systems can gain a competitive edge by offering innovative solutions that meet the evolving needs of consumers. AI-driven payment systems can enable new business models and services, fostering a culture of innovation and growth.

Thus, the integration of generative AI into payment systems brings a multitude of benefits, including enhanced security, personalized experiences, operational efficiency, and data-driven decision-making. As technology continues to evolve, the role of Payment AI in shaping the future of financial transactions will only become more significant, driving the industry towards greater innovation and customer-centricity.

Use Cases of Generative AI in Payments

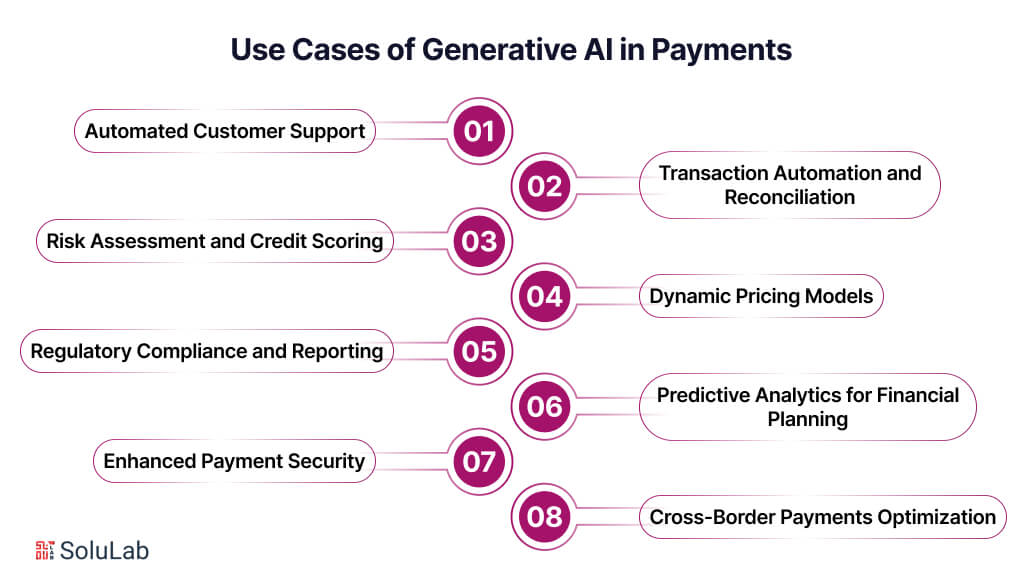

Generative AI is rapidly transforming the payments landscape by introducing innovative solutions that enhance security, efficiency, and customer experience. Here are some practical generative AI use cases in banking and payments:

- Automated Customer Support: Generative AI can power virtual assistants that handle customer inquiries and support requests efficiently. These AI-driven chatbots can assist with tasks such as resetting passwords, checking account balances, and processing payments, providing 24/7 support without the need for human intervention.

- Transaction Automation and Reconciliation: AI can automate repetitive tasks like transaction processing and reconciliation. By streamlining these processes, banks and financial institutions can reduce operational costs and minimize human errors, leading to more efficient and accurate payment systems.

- Risk Assessment and Credit Scoring: Generative AI can enhance risk assessment by analyzing a wide range of data points to predict a customer’s creditworthiness. This allows banks to make more informed lending decisions, offering loans and credit products that align with the borrower’s financial situation.

- Regulatory Compliance and Reporting: AI can help banks and payment processors stay compliant with regulatory requirements by monitoring transactions for suspicious activities and generating reports for regulatory authorities. This ensures adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations, reducing the risk of fines and legal issues.

- Enhanced Payment Security: AI can improve payment security through advanced techniques like biometric authentication and anomaly detection. For instance, AI can use facial recognition or fingerprint scanning to verify a customer’s identity, ensuring that only authorized individuals can access sensitive financial information.

- Dynamic Pricing Models: Generative AI can help develop dynamic pricing models by analyzing market trends, customer behavior, and competitive data. This enables banks and payment providers to adjust their pricing strategies in real time, optimizing revenue and staying competitive in the market.

- Predictive Analytics for Financial Planning: AI can offer predictive analytics that help customers manage their finances better. By forecasting income and expenses, AI tools can provide insights and suggestions for budgeting, saving, and investing, empowering customers to make informed financial decisions.

- Cross-Border Payments Optimization: AI can streamline cross-border payments by optimizing currency conversion and reducing transaction times. By analyzing exchange rates and payment routes, AI can ensure that international transactions are processed quickly and cost-effectively, benefiting both businesses and consumers

These generative AI use cases in banking and payments highlight the transformative potential of AI in creating more secure, efficient, and user-friendly financial services. As technology advances, we can expect even more innovative applications of AI in the payments industry, driving further improvements in how we conduct financial transactions.

Generative AI Outcomes in Payments

The integration of generative AI into the payments sector is leading to significant improvements and transformative outcomes. The impact of generative AI payments is far-reaching, affecting everything from fraud detection to customer experience. Generative AI is making significant strides in payments by leveraging the power of artificial intelligence to streamline processes and enhance user experiences. With the integration of AI in payments, businesses can now automate tasks, detect fraudulent activities, and personalize customer interactions like never before.

One of the key outcomes of using Generative AI payments is the ability to predict customer behavior and preferences accurately. By analyzing vast amounts of data, AI algorithms can anticipate payment patterns, enabling businesses to tailor their offerings and promotions to individual customers. This level of personalization not only improves customer satisfaction but also boosts sales and loyalty.

Another important outcome is the enhanced security measures that AI in payments provides. Generative AI can detect unusual activities or suspicious transactions in real-time, flagging them for further investigation. This proactive approach to fraud detection helps protect both businesses and consumers from potential financial losses.

Moreover, Generative AI payments can automate routine tasks such as payment processing, reconciliation, and reporting, saving time and resources for businesses. By streamlining these processes, organizations can focus on strategic initiatives and growth opportunities, ultimately driving efficiency and profitability.

Thus, the integration of AI in payments through Generative AI technology offers a range of benefits, including predictive insights, enhanced security, and operational efficiency. As businesses continue to adopt these innovative solutions, the future of payments looks promising with increased convenience, security, and personalized experiences for all stakeholders involved.

Conclusion

Generative AI is revolutionizing the payments industry by enhancing security, efficiency, and customer experience. From real-time fraud detection to seamless customer onboarding, optimized payment routing, dynamic credit scoring, enhanced customer support, and predictive analytics, the benefits of integrating AI in payments are substantial. Financial institutions that leverage these advancements can offer more personalized and secure services, drive operational efficiencies, and stay ahead in the competitive financial landscape. The transformative impact of Generative AI in payments is setting new standards for how financial transactions are conducted, ultimately creating a more robust and customer-centric financial ecosystem.

However, the adoption of Generative AI in payments also presents several challenges. These include ensuring data privacy and security, integrating AI systems with existing infrastructure, managing the cost of AI implementation, and addressing regulatory compliance. To navigate these challenges, partnering with a specialized AI development company like SoluLab can make a significant difference. SoluLab provides tailored AI solutions that address the unique needs of the payments industry, ensuring seamless integration, robust security measures, and compliance with regulatory standards. By using SoluLab’s expertise, financial institutions can unlock the full potential of Generative AI in payments. To learn more about how SoluLab can assist you in transforming your payment systems with AI, contact us today.

FAQs

1. What is Generative AI and how does it apply to payments?

Generative AI refers to a class of artificial intelligence models that can generate new content, such as text, images, or even financial transactions, based on the data they have been trained on. In the context of payments, Generative AI can be used to enhance fraud detection, automate customer support, personalize financial services, and improve transaction processing efficiency by analyzing patterns and generating predictive insights.

2. How can Generative AI improve fraud detection in payment systems?

Generative AI improves fraud detection by analyzing large volumes of transaction data to identify patterns and anomalies that may indicate fraudulent activity. These AI models can generate predictive alerts and flag suspicious transactions in real time, enabling faster response and mitigation. Additionally, Generative AI can adapt and learn from new types of fraud tactics, continuously improving its accuracy over time.

3. What are the benefits of using Generative AI for automating customer support in the payments industry?

Generative AI can automate customer support by providing instant, accurate responses to common queries through chatbots and virtual assistants. This reduces the workload on human agents, speeds up response times, and enhances customer satisfaction. Moreover, AI can handle complex issues by generating tailored solutions based on the specific context of each customer interaction, improving the overall service experience.

4. How does Generative AI contribute to personalized financial services?

Generative AI contributes to personalized financial services by analyzing individual customer data to generate customized recommendations and offers. For instance, AI can suggest tailored financial products, optimize spending habits, and provide personalized budgeting advice based on a customer’s unique financial behavior and goals. This level of personalization helps financial institutions build stronger relationships with their customers.

5. What are the potential challenges of implementing Generative AI in payment systems?

Implementing Generative AI in payment systems comes with several challenges, including data privacy concerns, the need for high-quality and diverse training data, and the potential for algorithmic bias. Ensuring compliance with regulatory requirements and maintaining the security of AI systems are also critical. Additionally, integrating AI into existing payment infrastructures requires significant investment in technology and talent, as well as ongoing maintenance and updates.