Stablecoin Development Company

As a #1 stablecoin development company in USA, SoluLab builds custom fiat-pegged and algorithmic tokens that safeguard your ecosystem from volatility, whether you're running a DeFi platform, payment gateway, or fintech app.

250+ Developers

150+ Projects Delivered

50+ Custom Stablecoin Solutions

10+ Years of Experience

Our Result-Oriented Stablecoin Development Services

At SoluLab, we offer end-to-end stablecoin development services designed to help businesses build secure, scalable, and regulation-ready digital assets. Our expert team is always ready to help your business with stablecoin development that enhances successful technology innovation, market growth, and user adoption.

Strategic Stablecoin Consulting

With our experienced stablecoin consultant team, you can launch, validate business models, shape strategies, and create technical roadmaps for smooth project execution.

Stablecoin Development

Our team builds secure, scalable, stablecoin development solutions, integrating smart contracts, payment systems, and compliance frameworks as per your market and regulatory requirements.

Marketing & Growth Strategy

We boost your stablecoin’s reach through campaigns and pre-/post-launch marketing, connecting with web3 and traditional investors for sustainable adoption.

Regulatory Compliance & KYC Integration

Our AML/KYC solutions ensure secure investor onboarding, real-time transaction monitoring, and adherence to global financial regulations, fostering trust among users and regulators.

Security Audits & Threat Mitigation

Protect your stablecoin with security audits, penetration tests, and continuous monitoring to identify vulnerabilities, prevent breaches, and safeguard user funds from potential threats.

Token Integration & Wallet Development

Enable seamless user transactions through our token integration and development, ensuring interoperability, convenience, and high adoption rates across platforms.

Global Token Distribution Platforms

Expand your token’s reach with tailored ICO, STO, or distribution platforms designed to attract both crypto-native and traditional investors through efficient, large-scale sale events.

Whitepaper Creation Services

Our team delivers technical whitepapers that showcase tokenomics, architecture, and market potential, which communicate your stablecoin vision to investors, regulators, and the community.

Community Management & Support

We build strong user engagement with 24/7 community support, moderated channels, and responsive helpdesks, ensuring every investor query is addressed promptly and professionally.

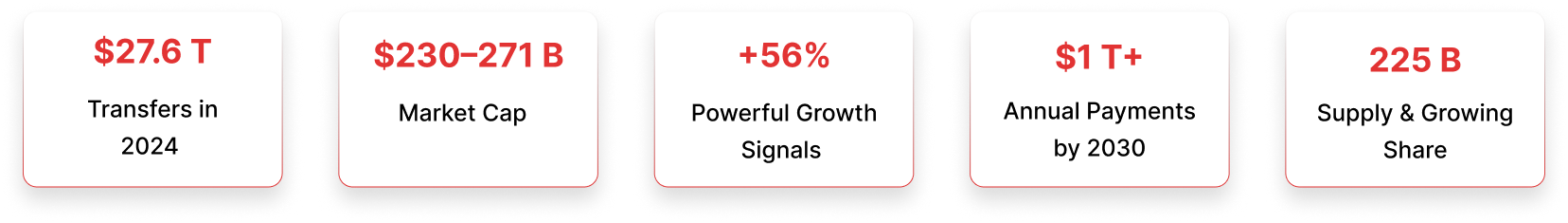

Stablecoins: Where Your Vision Meets Market Reality

Your Project Deserves to Lead This Momentum. Be the Next $230B Success Story With Us!

Innovative Features Behind Our Stablecoin

Development Services

At SoluLab, we don’t just create digital tokens; we engineer future-ready stablecoins that are secure, scalable, and adoption-driven. Our stablecoin development services are designed with innovative features that empower businesses to build trust, streamline payments, and stay ahead of market disruptions.

Value Stability Mechanisms

Cross-Chain Interoperability

Collateral-Backed Assurance

Robust Security Framework

Transparent Governance & Audits

Regulatory & Compliance Alignment

Consumer Protection Protocols

Real-Time Reserve Reporting

Types of Stablecoin We Work on

At SoluLab, we specialize in developing all major categories of stablecoins to match diverse business models and market needs. Our stablecoin development company covers solutions for the following types:

Centralized Stablecoins

Operated by a central entity, ensuring regulatory compliance, fiat reserves, and user trust through licensed custodians.

Decentralized Stablecoins

Managed via smart contracts, offering transparent governance, autonomy, and resistance to centralized control or censorship.

Fiat-Backed Stablecoins

Pegged 1:1 to currencies like USD or EUR, providing stability and easy onboarding for traditional finance users.

Asset-Backed Stablecoins

Supported by assets like real estate or bonds, enabling fractional ownership and liquidity in illiquid markets.

Commodity-Backed Stablecoins

Linked to assets like gold or oil, providing inflation-resistant value without physical storage complexities.

Algorithmic Stablecoins

Self-regulate supply using algorithms, maintaining price stability without reliance on physical or digital collateral.

Did You Know?

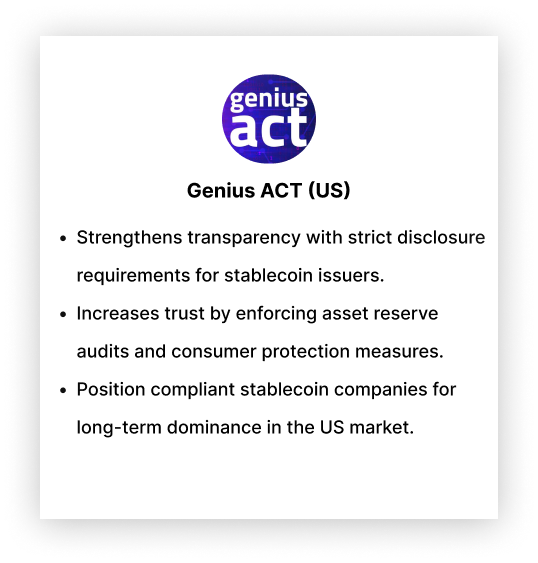

Go Global with Regulation-Backed Stablecoins Crafted by Experts!

Our experts help you launch stablecoin worldwide, with any sort of compliance, be it MiCA, Genius Act, Hong Kong bill, or any other. We render market-ready solutions in a pocket-friendly manner.

Our Success Stories

At SoluLab, we have had the opportunity of working on a number of ground-breaking stablecoin development projects that demonstrate our experience in blockchain technology and financial innovation. These are some of our notable undertakings:

Stablecoin Ecosystem

SoluLab developed a comprehensive stablecoin ecosystem to facilitate seamless value transfer, enhance liquidity, and foster trust in decentralized finance.

Key Outcomes:

- 30% Increase In User Retention

- 5% Rise In User Participation

- 20% Higher ROI

NFTY

SoluLab collaborated with NFTY to develop a decentralized finance (DeFi) reputation protocol aimed at addressing trust issues within the NFT industry.

Key Outcomes:

- Enhanced Trust

- Increased Transparency

- Improved User Experience

DLCC

SoluLab developed a decentralized blockchain-based platform to revolutionize crypto and digital asset lending, ensuring fair exchange and enhanced security.

Key Outcomes:

- Expanded User Base

- Instant Capital Access

- Collateral Management

A Look at Our Robust Tech Stack

Our tech stack, designed to deliver faster, smarter, and more reliable stablecoin solutions for every business need.

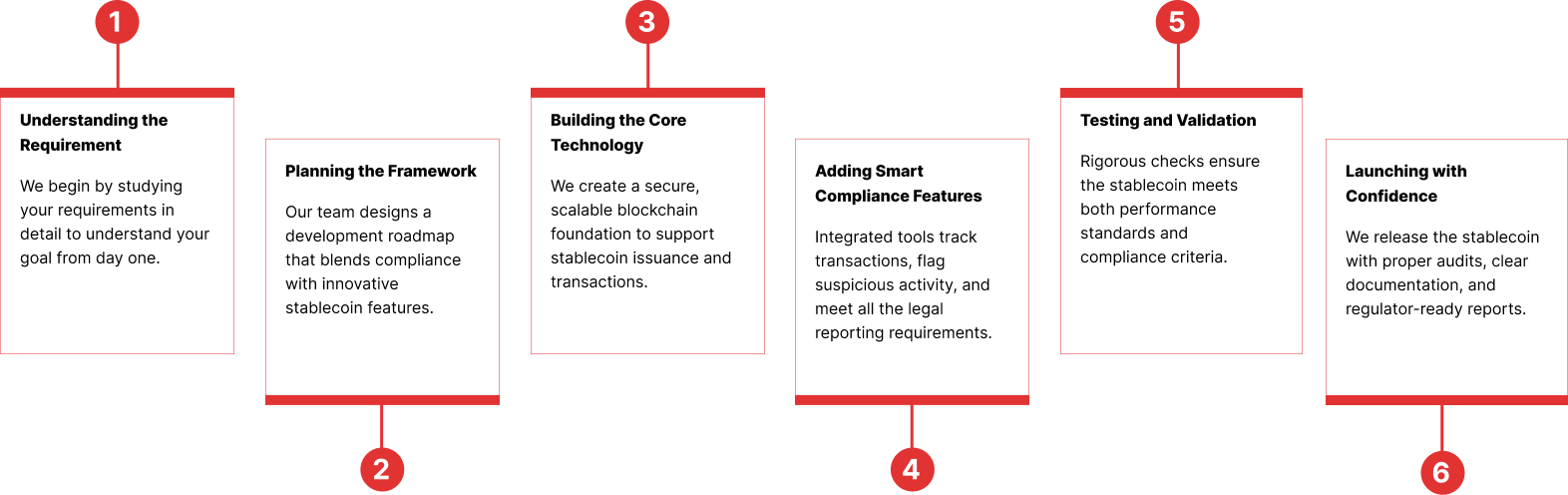

The Stablecoin Development Blueprint That Delivers Results

Our expert team follows a meticulous process for enhanced stablecoin development to grow your business to new heights. At SoluLab, our blueprint ensures your stablecoin project is robust, scalable, and market-ready.

Why Choose SoluLab As Your Stablecoin

Development Company?

Building a stablecoin solutions requires more than technical expertise—it demands trust, innovation, and a deep understanding of the blockchain ecosystem. SoluLab combines all three to turn your stablecoin vision into a reality.

Our Extended Capabilities

What Our Clients Have to Say for Us

Frequently Asked Questions

A stablecoin is a type of cryptocurrency designed to maintain a stable value, usually pegged to a fiat currency (like USD) or other assets, minimizing price volatility.

We develop fiat-backed, crypto-collateralized, and algorithmic stablecoins tailored to your business goals and ecosystem requirements.

Development timelines vary based on complexity, blockchain choice, and regulatory integration, but most projects are delivered within 8–16 weeks.

Yes. We ensure KYC/AML integration, legal compliance, and audit-ready smart contracts for global standards.

Absolutely. We ensure smooth integration with major exchanges, wallets, and DeFi platforms to maximize adoption and usability.

Yes. Our stablecoins are built with scalable architecture to handle increasing transactions, users, and ecosystem expansion.

Yes. We offer flexible options including fiat-collateralized, crypto-backed, and hybrid mechanisms.

The cost depends on factors like type of stablecoin (fiat-backed, algorithmic, crypto-collateralized), features, security layers, blockchain integration, and smart contract complexity. Typical projects range from $10,000 to $120,000+. Connect for a custom quote!

We combine technical expertise, regulatory compliance, security-first development, and scalable architecture to deliver results-driven stablecoin solutions.

Tell Us About Your Project

Latest Blogs

Hong Kong Stablecoin Regulation: New Crypto Law Explained

Hong Kong's new stablecoin law is here—see how it impacts...

Read MoreTop 10 Stablecoin Development Companies in the USA to Work With

Looking for the best stablecoin development company in the USA?...

Read MoreWhat Are Algorithmic Stablecoins In DeFi? A Beginner’s Guide

Discover how algorithmic stablecoins are changing DeFi with smart supply...

Read More