Blockchain is reshaping the future of finance, with contributions from top researchers, innovative startups, and major financial institutions. It’s not just giving more people access to financial services; it’s also making things more transparent, improving the liquidity of hard-to-sell assets, boosting market resilience, and cutting costs.

One of the key changes here is the rise of tokenized assets—digital tokens stored on blockchain that represent real-world assets like currencies, bonds, or gold. Gold has always been a core part of the global financial system, often used by investors to protect their wealth, especially in uncertain times.

In a piece of recent news, it has been showcased that HSBC has successfully tested quantum-secure technology for buying and selling tokenized physical gold, marking a breakthrough in safeguarding against future quantum computing threats. This builds on HSBC’s previous achievements, including launching tokenized physical gold for institutional investors and the HSBC Gold Token for retail investors in Hong Kong, allowing fractional gold ownership. Utilizing their HSBC Orion platform, the bank also tested post-quantum cryptography to ensure secure interoperability across distributed ledgers, enabling the conversion of gold tokens into ERC-20 fungible tokens for broader distribution.

As tokenization and gold become increasingly trusted to stabilize the global economy, demand for gold-backed tokens on the blockchain is growing fast. The total value of tokenized gold has recently crossed $1 billion.

In this guide, we’ll break down everything you need to know about gold tokenization, from how it works to its benefits, and explore how this growing trend is revolutionizing the financial world. Whether you’re curious about the mechanics or want to know why gold-backed tokens are seeing such high demand, this blog covers you.

What is Tokenized Gold?

Tokenized gold is a digital representation of actual gold that resides on the blockchain. Each digital token represents a certain quantity of actual gold that is securely kept. Using a gold tokenization platform, investors may purchase, sell, and trade gold in the form of digital tokens, granting them ownership of gold without having to physically keep it.

Investors may benefit from tokenized gold in a variety of ways, including fractional ownership, which allows them to acquire a tiny portion of a gold bar rather than the entire bar. Additionally, ERC20 token development facilitates seamless integration of these tokenized assets on the blockchain. Transactions on the blockchain are visible and verifiable, ensuring security and confidence for all parties involved.

Companies that provide gold tokenization development services may assist enterprises in developing these platforms, allowing for the seamless integration of gold-backed tokens into the financial ecosystem. These services support the introduction of safe, user-friendly tokenization solutions that assure compliance and confidence for both issuers and investors.

Tokenized gold is transforming the way people invest in this timeless asset, making it more accessible and liquid than ever before.

Why Has Gold Been Valued Throughout History?

Gold has been highly valued throughout history for a variety of reasons. Though gold is rather heavy in physical form, it is extremely resistant to corrosion and interactions with common substances like water and air. It is only influenced by compounds such as aqua regia and cyanide solutions. Unlike silver, which was historically used in payments, gold does not tarnish, making it more suitable for long-term storage.

Gold is also the most ductile of any metal, which means it can be readily sculpted and separated into smaller pieces. Gold’s value stems from its versatility and scarcity. It is uncommon enough to be valuable, but not so rare that it is difficult to obtain.

While gold is no longer closely linked to any current monetary system, it is nonetheless a popular investment choice. Unlike fiat currency, gold must be mined, so governments cannot artificially expand its supply by printing more. One of the reasons why gold investment is becoming increasingly popular is its inherent steadiness.

However, traditional banking systems and hedge funds are no longer required for gold investment. With the emergence of gold standard tokenization, investors may now own tokenized gold assets. These digital tokens reflect ownership of actual, physical gold, providing an updated and accessible method to invest in a timeless asset.

How Does Gold Tokenization Work?

Gold tokenization follows a process similar to that used for any real-world asset, though specific steps may vary depending on the project’s unique needs, use cases, and the issuer involved. Here’s a typical breakdown of how gold standard tokenization works:

-

Selecting the Gold Asset

The first step involves choosing the physical gold to be tokenized. This can range from small items like a 1 oz American Gold Eagle coin to larger assets like a 1 kg gold bar.

-

Defining the Token Type

Next, it’s crucial to determine the type of token to be used, such as ERC-20 or ERC-721. The token type dictates how the digital asset will function, how the tokens will be minted, and how many tokens will initially be created.

-

Choosing the Blockchain

The blockchain on which the tokens will live is another important decision. Options include public blockchains, private networks, Layer1 vs. Layer2 blockchain solutions, or other Distributed Ledger Technology (DLT)-based networks. Platforms like Ethereum are often favored for their established smart contract capabilities, making them a popular choice for tokenization projects.

-

Enriching the Token with Data

For HSBC gold tokenization or other large-scale projects, it’s important to back the token with essential data such as proof of reserves, identity verifications, and on-chain market data. This transparency builds trust with investors.

-

Ensuring Blockchain Interoperability

To enhance the liquidity of tokenized gold assets, it’s essential to ensure interoperability across different blockchain networks. This allows the tokens to be easily transferred across various chains, improving access and market reach.

-

Token Issuance

Once everything is in place, the token smart contract is deployed on the blockchain. The minting process begins, creating the tokenized gold assets that will be made available to investors.

-

Distribution

After the tokens are minted, they need to be distributed to markets and users. This involves providing access to trading platforms, exchanges, and other ecosystems where investors can buy, sell, or trade the tokens.

-

Synchronization Across Networks

Even after the tokenized gold has been distributed, it’s critical to keep the smart contracts in sync. This ensures that the tokens can be tracked and updated as they move across different blockchain networks within the multichain environment.

This process makes gold standard tokenization an efficient and secure way to convert physical gold into digital tokens, allowing for increased liquidity, accessibility, and transparency for investors worldwide.

How Physical Gold Tokenization Is Beneficial to All Parties?

Tokenizing real gold gives companies a number of benefits and provides investors with a novel opportunity to diversify their holdings. Experts anticipate that the market for tokenized gold will continue to increase, thus this strategy is working well for all parties involved. Here’s how blockchain technology adds value to gold investments:

- Enhanced Liquidity: By permitting smaller transactions, tokenizing gold enables more liquidity. Large volumes of gold are typically exchanged, which may be a hurdle for investors wishing to acquire or sell lesser quantities. Tokenized gold makes micro-sized transactions possible, which facilitates trading and investing in gold.

- Fractionalization of Gold: Thanks to blockchain technology, it is now possible to purchase even very small amounts of gold—less than a gram. These blockchain-based tokens function as physical reserves, removing the need for gold storage and providing unchangeable documentation to confirm the gold’s authenticity.

- Decreased Transaction Expenses: Purchasing and selling physical gold typically entails a number of additional, add-on middleman expenses. However, these expenses are greatly reduced when gold tokens are used using blockchain technology. Effective blockchain networks lower the costs of exchanging tokenized gold.

- Increased Security and Transparency: The use of blockchain technology guarantees extremely transparent and safe transactions involving tokenized gold. Public blockchains provide strong security features and openness between investors and businesses by allowing transactions to be verified without disclosing critical information.

- Improved Efficiency: By eliminating obstacles like storage problems and logistical security, decentralized networks accelerate and enhance the efficiency of gold token transactions. The financial market’s acceptance of tokenized gold must proceed quickly because of its efficiency.

- Integration with the DeFi Space: Tokenised gold’s use cases may be expanded by integrating it with decentralized finance (DeFi) apps. Gold-based tokens can be used as collateral for loans on DeFi systems since gold usually has a steady value, which helps to solve some of the problems the present DeFi ecosystem is facing.

Businesses and investors may gain from higher security, decreased costs, improved liquidity, and integration into the DeFi ecosystem by utilizing blockchain technology in gold investments. By considering Multi-Chain vs. Cross-Chain solutions, they can optimize flexibility and interoperability across different blockchain networks, further promoting wider use and growth in the market.

Examples of Tokenized Gold

Tokenized gold is transforming the way investors access and trade this traditional asset, offering digital representations of physical gold through blockchain technology. These tokenized gold assets are backed by actual gold reserves, making it easier to buy, sell, and trade fractions of gold. Here are some examples of platforms and initiatives leading the way in gold tokenization:

- Paxos Gold (PAXG): Paxos offers a gold tokenization platform where each PAXG token represents one fine troy ounce of a 400-ounce London Good Delivery gold bar stored in secure vaults. This allows investors to access physical gold ownership with the flexibility and liquidity of digital tokens.

- Tether Gold (XAUT): Tether, known for its stablecoin, also provides a tokenized gold option. XAUT tokens represent ownership of physical gold stored in a Swiss vault, giving users a chance to trade or hold gold-backed tokens on various blockchain networks.

- DigixGlobal (DGX): One of the pioneers in the field, DigixGlobal tokenizes gold using the Ethereum blockchain. Each DGX token represents 1 gram of physical gold, securely stored and fully audited, offering fractional ownership in a highly transparent manner.

- HSBC Orion: HSBC Gold Tokenization enables both institutional and retail investors to purchase tokenized physical gold. Their recent advancements in quantum-secure technology further ensure that the tokenized assets are protected against future threats from quantum computing.

These examples showcase how the gold tokenization platform revolutionizes the gold market by making it more accessible, liquid, and secure for a wider range of investors, bridging the gap between traditional assets and modern decentralized finance.

Important Factors to Consider for a Gold-based Token Project

Creating a gold-based token project involves more than just tokenizing physical gold; it requires careful planning, compliance, and technical execution to ensure success. Whether you’re building a platform or investing in gold standard tokenization, here are key factors to consider:

1. Asset Custody and Security: The first step is ensuring that the physical gold is securely stored. Trusted third-party vaults with insurance coverage are essential to instill investor confidence. The gold tokenization development services you choose should provide robust custodial solutions that guarantee the backing of tokens with real gold reserves.

2. Regulatory Compliance: Every jurisdiction has different regulations regarding asset tokenization. You’ll need to ensure that your project complies with local and international laws governing the issuance and trading of gold-backed tokens. Collaborating with legal advisors who specialize in tokenization can help navigate this complex landscape.

3. Blockchain Selection: The underlying blockchain network is critical to the project’s success. Consider factors like scalability, transaction costs, and security when choosing the blockchain. Public blockchains such as Ethereum, with its established ecosystem, are often used for gold standard tokenization, but private or permissioned blockchains might also be suitable depending on your needs.

4. Tokenization Model: Define the type of tokens your project will use, such as fungible tokens (ERC-20) or non-fungible tokens (ERC-721). This decision impacts how the gold can be fractionalized and traded. Many gold tokenization development services offer customizable token models to suit different project requirements.

5. Transparency and Auditability: A major appeal of tokenizing gold is transparency. Your project should provide clear and easily accessible proof of gold reserves, such as regular audits or real-time verification through blockchain records. This increases trust among investors and improves market credibility.

6. Liquidity and Market Accessibility: Ensuring that tokenized gold can be easily bought and sold is crucial for project success. To achieve this, it’s essential to list tokens on decentralized exchanges (DEXs) or integrate them with other digital assets within decentralized finance (DeFi). This improves liquidity and makes the asset accessible to a broader range of users.

7. Transaction Costs: High transaction fees can deter investors, especially when dealing with fractionalized gold tokens. Choose an efficient and low-cost blockchain solution, or even consider layer-2 solutions that reduce transaction costs while maintaining security.

By keeping these factors in mind, you can design a successful gold tokenization platform that not only facilitates efficient and secure trading but also adheres to global standards, ensuring long-term viability in asset tokenization development.

Challenges of Physical Gold Ownership and Investment

While purchasing physical gold from a bank or specialized firm remains a common method, it presents several challenges that hinder its efficiency as an investment. Despite gold’s long-term stability and reliability, tying up funds in gold bullion can immobilize capital for years, reducing the operational efficiency of the investment. Essentially, money invested in physical gold becomes locked, and it cannot be applied elsewhere.

Using gold bullion as loan collateral is also problematic, and liquidating physical gold isn’t as straightforward as it seems. Finding a buyer willing to purchase the bullion at a favorable price can be challenging. Banks often buy gold from retail sellers at a substantial discount from the spot price, reducing the potential return on investment.

Fungibility poses another significant challenge. For instance, if an investor holds a 5-ounce gold bar but wants to sell only 1 ounce, dividing the bullion becomes difficult, expensive, and may even result in some loss of the precious metal. Secure gold transactions can also be a concern, particularly for buyers, as there is always the risk of receiving impure or counterfeit gold.

Finally, the cost of storing physical gold is an ongoing issue. Gold is a valuable asset that can’t simply be stored at home. Investors typically need to rent a secure bank deposit box, which adds to the overall cost and may diminish the gains from the rising price of gold. In comparison, gold tokenization services and leveraging blockchain in gold investment help overcome these hurdles, providing more liquidity, fractionalization, and transparency while eliminating storage concerns.

The Role of Blockchain in Gold Investment

Blockchain technology is revolutionizing the way we invest in gold, offering new opportunities for both investors and businesses. By digitizing physical gold through blockchain, the investment process becomes more transparent, secure, and efficient. With blockchain in gold investment, gold can be tokenized, allowing investors to purchase, trade, and hold fractions of gold digitally, all while enjoying the stability and value preservation that gold traditionally offers.

One of the most significant advantages of blockchain is its ability to create immutable records, ensuring that every transaction involving tokenized gold is verifiable and transparent. This level of transparency reduces the risk of fraud and ensures the legitimacy of the gold backing each token. Investors no longer need to worry about counterfeit gold or impurities, as blockchain provides reliable, digital proof of ownership.

Additionally, blockchain in gold investment facilitates increased liquidity by enabling micro-transactions. Instead of being forced to buy or sell large quantities of physical gold, tokenization allows investors to trade small fractions of gold, making it more accessible to a broader market. This fractionalization opens up new possibilities for portfolio diversification and short-term trading strategies.

Moreover, blockchain eliminates the need for physical storage and security measures, reducing associated costs. Investors can own gold-backed tokens without the hassle of renting secure vaults or worrying about physical theft. By integrating gold into decentralized finance (DeFi) platforms, these tokens can also be used as collateral for loans, further expanding their utility in the financial ecosystem.

Overall, blockchain in gold investment is enhancing the traditional gold market by improving security, increasing liquidity, and lowering barriers to entry, making gold a more versatile and modern investment option.

Investment Opportunities of Gold Tokenization

Gold tokenization has transformed the way investors can interact with and capitalize on the value of this precious metal. By converting physical gold into digital tokens stored on a blockchain, new avenues for investment are opening up, creating more flexibility, security, and accessibility. Let’s explore some of the key investment opportunities that gold tokenization offers.

1. Fractional Ownership

Gold tokenization allows investors to purchase fractions of gold rather than entire bars or coins, making it accessible to those who may not have the means to buy large amounts of physical gold. Even small portions, such as grams or milligrams of gold, can be bought and sold digitally, democratizing gold investment for retail investors.

2. Enhanced Liquidity

In traditional gold markets, selling physical gold can be a slow process that requires finding a buyer, transferring fractional ownership, and dealing with intermediaries. With gold tokenization, investors can trade tokenized gold instantly on digital platforms, increasing liquidity. This allows for quicker buying and selling, making gold a more dynamic asset in an investor’s portfolio.

3. Global Accessibility

Tokenized gold can be bought and sold across borders without the need for physically transporting the gold. Investors from any part of the world can invest in tokenized gold through online platforms, expanding market access and increasing the potential for broader participation in the gold market.

4. Lower Storage and Security Costs

Owning physical gold requires secure storage, such as in bank vaults or safety deposit boxes, which incurs additional costs. With tokenized gold, ownership is stored securely on the blockchain, eliminating the need for physical storage and reducing the associated costs. Blockchain’s inherent security features further protect investors from theft or loss.

5. Integration with Decentralized Finance (DeFi)

Gold-backed tokens can be integrated into the growing Decentralized Finance (DeFi) ecosystem, where they can be used as collateral for loans, yield farming, or liquidity provision. This opens up new financial opportunities that were previously unavailable with physical gold. Tokenized gold can now be part of automated financial strategies, adding another layer of value for the investor.

6. Real-Time Market Exposure

Investors holding gold tokens can enjoy real-time market exposure without waiting for traditional processes to take place, such as shipping or certifying physical gold. This instant exposure allows for more strategic market plays, especially in times of economic volatility where gold typically acts as a safe haven asset.

Gold tokenization is not only making the precious metal more accessible and flexible but also paving the way for innovative financial strategies. With opportunities for fractional ownership, enhanced liquidity, and integration into modern finance platforms like DeFi, investors have more ways to capitalize on gold’s stable value and historic reputation as a safe asset.

How is Gold Tokenized? A Step-by-Step Process

Gold tokenization is a process that transforms physical gold into digital assets, enabling investors to trade and own gold in a more flexible and accessible manner. Here’s an overview of how the tokenization of gold typically works in technical terms, outlining the key steps involved:

- Asset Verification and Authentication: The first step in the gold tokenization process involves verifying the amount of physical gold you intend to tokenize. This step ensures that the gold is genuine and available, and serves as proof of ownership. Proper audits and certifications are essential to validate the physical asset before digitizing it.

- Selection of the Tokenization Platform: Choosing the right gold tokenization platform is crucial. Various platforms like Polymath, Meld Gold, and Tokensoft are used for minting the digital tokens. These platforms provide the technical infrastructure to issue tokens while offering support for legal compliance and transaction management.

- Creation of Smart Contracts: Smart contracts form the backbone of any crypto project, including tokenized gold assets. In this phase, a smart contract is developed to link the physical gold to the digital token. The contract outlines the rules of ownership, transferability, and redemption, ensuring that each token represents a specific quantity of gold.

- Token Issuance: Once the smart contract is set, the tokens are minted. This phase of the gold tokenization process involves issuing digital tokens that represent the physical gold. These tokens are generated according to the logic coded into the smart contract, ensuring transparency and accuracy.

- Custody of Physical Gold: After token issuance, the physical gold is securely stored by a custodian, often a trusted third party or financial institution. The tokens in circulation correspond to this gold reserve, ensuring that the digital tokens have tangible backing.

- Tokenization: At this stage, the physical gold is officially pegged to the issued tokens. The tokenization of gold is completed as the digital assets are now linked to the physical commodity, making it available for trading, investment, or transfer within the blockchain ecosystem.

- Liquidity and Trading: Once the tokens are issued, they are introduced into the market for trading. Liquidity is maintained to ensure seamless buying and selling without significant price fluctuations, allowing users to easily convert between gold tokens and fiat or other cryptocurrencies.

- Regulatory Compliance: Compliance with relevant regulations is essential in the gold tokenization process. Tokenized gold must adhere to digital asset regulations regarding issuance, trading, and custody, ensuring that the tokens can be exchanged for physical gold without legal complications.

- Security and Auditing: Regular security checks and audits are necessary to maintain the trustworthiness of tokenized gold assets. Timely reports on the gold reserves and storage conditions are required to guarantee the asset’s integrity and provide assurance to investors.

By following these steps, gold tokenization projects can ensure that their digital assets remain secure, compliant, and backed by physical gold reserves, making tokenized gold a reliable investment vehicle.

Risks Involved in the Tokenization of Gold

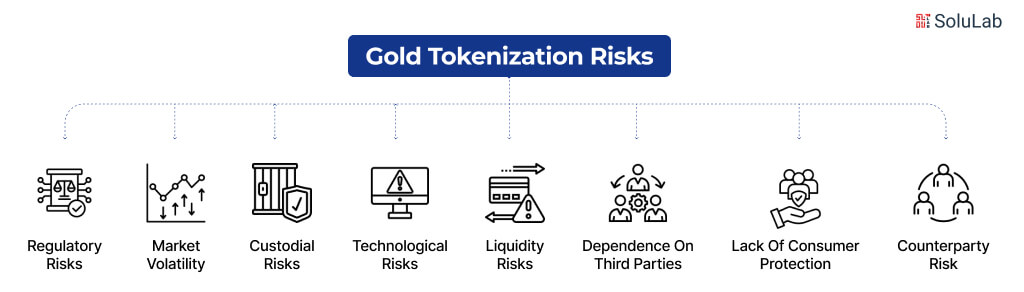

While the tokenization of gold offers numerous advantages, such as increased liquidity and easier access to ownership, it also comes with its share of risks. Understanding these risks is crucial for investors considering entering this emerging market. Here are some key risks associated with the tokenization of gold:

1. Regulatory Risks: The regulatory landscape surrounding digital assets and tokenized commodities is still evolving. Governments may impose new regulations or change existing laws that could affect the legitimacy and operational framework of gold tokenization projects. This uncertainty can impact investor confidence and lead to potential legal challenges.

2. Market Volatility: Although gold is traditionally considered a stable investment, the market for tokenized gold assets may experience volatility due to external factors, such as cryptocurrency market trends and broader economic conditions. Price fluctuations can affect the value of gold tokens, leading to potential losses for investors.

3. Custodial Risks: The physical gold backing tokenized assets need to be securely stored. If the custodian fails to maintain proper security measures or if there is theft or fraud, investors could lose their investments. Trust in the custodian’s ability to protect the physical asset is paramount.

4. Technological Risks: As with any blockchain-based project, there are risks associated with the technology itself. Smart contracts may contain bugs or vulnerabilities that could be exploited, leading to potential losses. Additionally, any disruptions in the underlying blockchain network could impact the trading and transfer of gold tokens.

5. Liquidity Risks: While tokenization aims to enhance liquidity, there may be times when the market for gold tokens is illiquid. If demand decreases, investors may find it challenging to sell their tokens without significantly impacting the price. This lack of liquidity can make it difficult for investors to realize their returns.

6. Dependence on Third Parties: Tokenized gold projects often rely on multiple third parties for various functions, including storage, auditing, and trading. Any failure or mismanagement by these parties could lead to significant risks for investors, including issues related to the integrity of the underlying gold reserves.

7. Lack of Consumer Protection: Investors in tokenized gold may not have the same level of consumer protection as those investing in traditional financial assets. This lack of protection can lead to potential losses without recourse if a project fails or if there is misconduct by the project team.

8. Counterparty Risks: Investing in tokenized gold may involve various counterparties, such as exchanges and financial institutions. If any of these parties fail to meet their obligations, it could negatively impact investors. Trusting the entities involved in the tokenization process is critical.

By being aware of these risks, investors can make informed decisions when considering the tokenization of gold as part of their investment strategy. Conducting thorough due diligence and working with reputable service providers can help mitigate some of these risks while taking advantage of the benefits of gold tokenization.

How SoluLab Can Elevate Your Gold Tokenization Project?

At SoluLab, we recognize the transformative potential of gold tokenization in reshaping the investment landscape. Our expertise in gold tokenization development services allows us to provide tailored solutions that align with your specific goals. From comprehensive strategy development to customized blockchain solutions, our team collaborates with you to identify the best approach for your tokenized gold assets. We focus on building secure and transparent smart contracts that automate transactions and enforce agreements, ensuring trust and integrity in every interaction. Our guidance on navigating the complex regulatory landscape further minimizes risks and enhances investor confidence.

Moreover, we prioritize user experience by designing intuitive platforms that simplify buying, selling, and trading tokenized gold. Security is paramount, and we implement robust measures to protect your assets, coupled with regular audits to maintain compliance. SoluLab also facilitates integration with the broader decentralized finance (DeFi) ecosystem, enhancing the utility and liquidity of your tokenized gold. By partnering with us, you gain access to ongoing support and maintenance, ensuring your project remains adaptable to evolving market trends. Let us help you utilize the power of gold tokenization and transform how investors engage with this timeless asset. Contact us today.

FAQs

1. What is gold tokenization?

Gold tokenization is the process of converting physical gold into digital tokens on a blockchain. Each token represents a specific quantity of gold, allowing for fractional ownership and easier trading. This innovation enhances liquidity and accessibility for investors, making it simpler to buy, sell, or hold gold as a digital asset.

2. How does the gold tokenization process work?

The gold tokenization process involves several steps, including asset verification, selecting a tokenization platform, creating smart contracts, and issuing the tokens. Once the physical gold is verified, tokens are minted to represent ownership. These tokens can then be traded on various platforms, providing increased liquidity and investment opportunities.

3. What are the benefits of investing in tokenized gold?

Investing in tokenized gold offers numerous advantages, including increased liquidity through fractional ownership, reduced transaction fees compared to traditional gold trading, enhanced security and transparency through blockchain technology, and integration with decentralized finance (DeFi) applications. This allows investors to leverage their assets more efficiently while minimizing risks.

4. Are there any risks associated with gold tokenization?

Yes, there are risks involved in gold tokenization, including regulatory compliance challenges, potential cybersecurity threats, and the volatility of the cryptocurrency market. Investors should conduct thorough due diligence and work with experienced partners to mitigate these risks and ensure secure transactions.

5. How can I get started with gold tokenization?

To get started with gold tokenization, you can consult with our company SoluLab, which offers gold tokenization development services. We can guide you through the entire process, from strategy development and platform selection to smart contract creation and regulatory compliance, ensuring a successful and compliant gold tokenization project.