With decentralized applications running on hundreds of distinct blockchains and second-layer solutions, each with security and trust strategies, the Web3 ecosystem is increasing cross-chain compatibility. Recent events demonstrate how crucial the cross-chain protocol has become since its introduction in 2021. Wormhole, a well-known cross-chain messaging technology has transported over $39 billion across its token bridge and just reached $1 billion cross-chain communications. Similarly, Axelar has grown significantly within the last year with active addresses rising by 430% and interchain transactions rising by 478%.

Communication across blockchain platforms is not a native feature. Therefore, blockchain interoperability is essential for a multi-chain ecosystem to reach its full potential. Cross-chain messaging protocols are the foundation of blockchain interoperability since they allow smart contracts to read and write data from different blockchains. Web3 requires strong cross-chain interoperability solutions to allow tokens and data to flow securely.

This article will discuss cross chain bridging, the types of it, and why you need to incorporate it to overcome the constraints while operating.

What are Cross-Chain Bridges and Their Types?

Software programs known as cross-chain bridges make it possible for transactions to take place between different blockchains. Cross-chain bridges are crucial components of any transaction that involves the transfer of Bitcoin, NFTs, and Decentralized Finance (DeFi) within blockchain networks. A significantly wider digital ecosystem is produced by cross-chain bridges, which allow inter-network transactions even while the majority of digital assets are linked to a particular blockchain.

Many other creative activities can take place with the help of cross-chain bridges, but there are security issues with them because hackers have targeted these programs Cross-chain bridges are technical, therefore it’s advisable to utilize them only if you know what you are doing and how they work. There are three primary types of cross-chain bridges:

- As a type of IOU, lock and mint involves a user locking tokens within a smart contract on the origin chain and the minting wrapped replicas of these locked tokens on the destination chain. Oppositely, the original coins on the source chain are unlocked by burning the wrapped tokens.

- The same native tokens are reissued or minted from the destination chain after a user burns them on the source chain.

- After locking tokens on the same source chain, a user unlocks the same tokens on the destination chain from a liquidity pool. Typically, these kinds of cross-chain bridges draw cash from both parties via revenue sharing.

After the bridge function is finished, programmable token bridges allow for more intricate cross-chain capabilities. Within the same transaction in which the bridging function is performed, the tokens can be swapped, lent, staked, or deposited in a smart contract onto the destination chain.

Cross-chain bridge technology can also be categorized by looking at where they fall on the trust-minimization spectrum in terms of sending the resulting transaction to the recipient blockchain and verifying the status of the source blockchain.

Main Cross-Chain Bridges

Users should confirm that the particular blockchain network, coin, or NFT they want to bridge is supported before selecting a cross-chain bridge. Additionally, the costs charged by various networks vary and are subject to sudden changes. The following are well-known cross-chain bridges:

1. Celer cBridge

The celer cBridge facilitates liquidity across many blockchains by utilizing the celer state guardian network. It supports a wide array of blockchain networks such as Boba network, Heco, Clover, Moonbean, Shiden, Aurora, Polygon, etc. These are a few cryptocurrency tokens supported by Celer cBridge Binance USD, Dodo, Unified Society, Lyra, etc.

2. Portal Token Bridge

A wormhole protocol, which facilitates tokens and NFT transfers between chains, powers the portal token bridge. Acala, Fantom, Aurora, and Binance smart chains are among the supported blockchain networks. These are among the cryptocurrency tokens that support the portal token bridge Tether, Frax protocol token, the sandbox, and Uniswap.

3. Synapse Bridge

The synapse protocol’s universal interoperability concept makes secure cross-chain communication possible. Ethereum, Cronos, Optimism, Polygon, Boba network, and Moonriver are among the supported blockchain networks.

Read Blog: Multi-Chain Vs. Cross-Chain

4. MultiChainq

Multichain earlier known as Fantom Anyswap, bills itself as a cross-chain router technology that facilitates the transfer of assets and data between several blockchain networks. This provides a greater variety of token kinds than any other cross chain bridging service.

What are Cross-Chain Bridge Platform Solutions?

Blockchain cross-chain solutions are crucial components of the blockchain ecosystem since they allow for smooth communication across various blockchain networks. These platforms get around the drawbacks of siloed systems by enabling the exchange of information and assets between different blockchains.

- Transactions between blockchain networks are made possible by cross-chain bridge platform solutions.

- Cryptocurrency along with other digital assets and Defi protocols is used by the software that powers the cross-chain platform solutions.

- Cross-chain bridge platform solutions are open to security including hacking.

How Cross-chain Bridges Work?

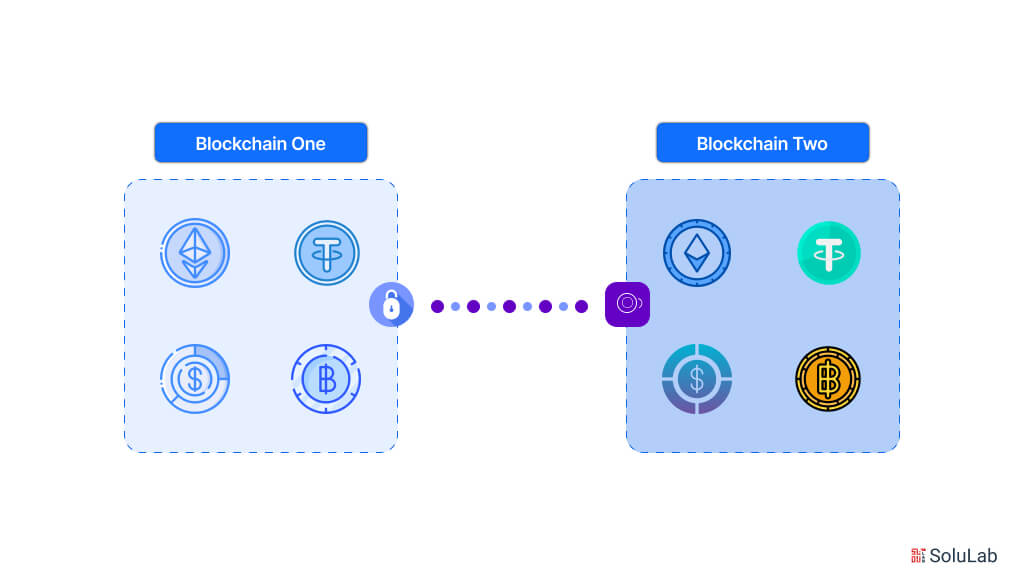

The blockchain bridge platform essentially functions by locking or burning tokens on the blockchain (the source) and then unlocking or creating equal-wrapped copies of these valuables on a different network (the target). The original asset is represented by this “wrapped” token, which is always redeemable or exchangeable. By utilizing decentralized protocols, validators, and smart contracts, this procedure can be customized to incorporate various chains. Here is the breakdown of how cross-chain bridges work:

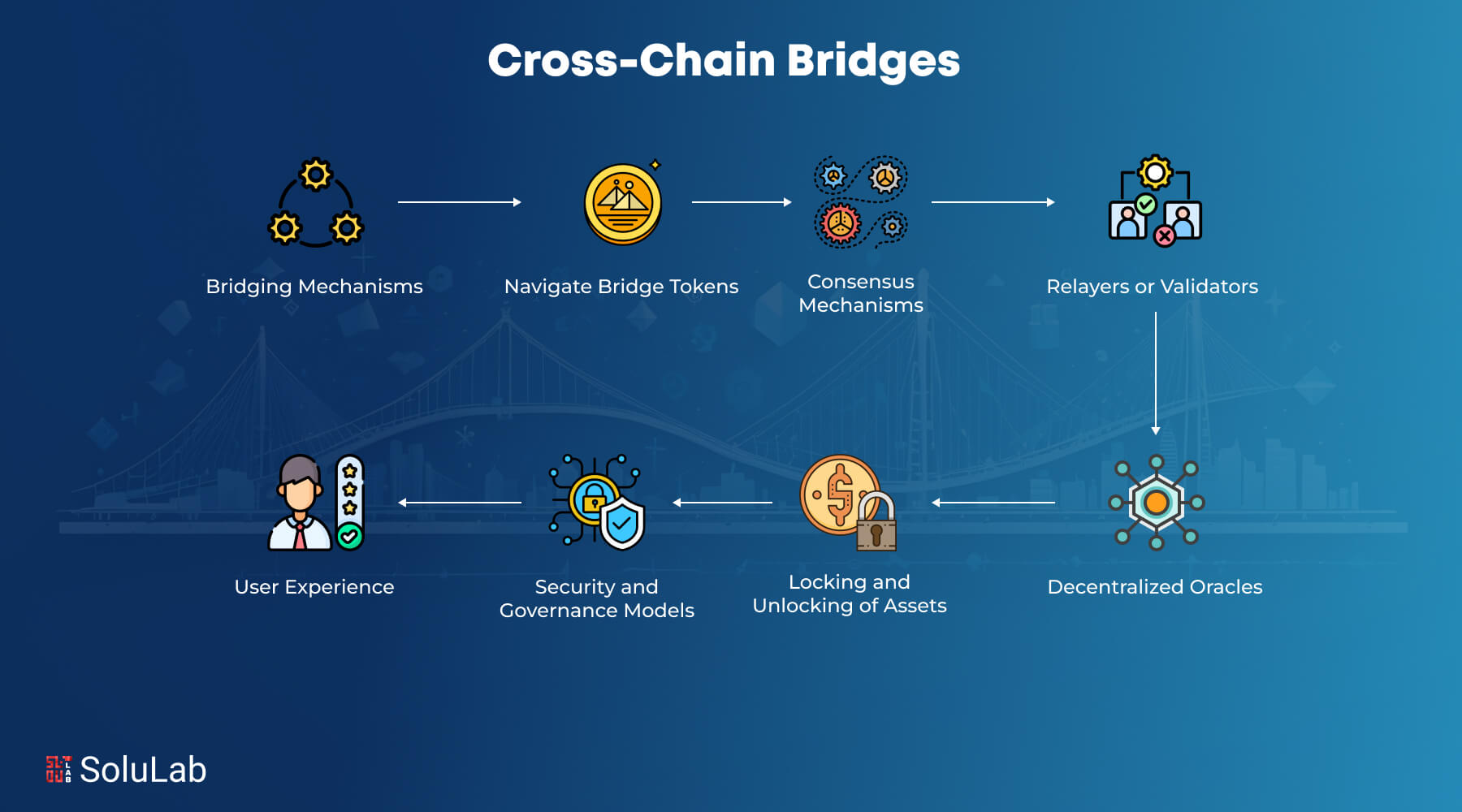

1. Bridging Mechanisms

To make it easier to move assets and data between different blockchain platforms, cross-chain bridge platform solutions make use of oracles, smart contracts, and various other platforms.

2. Navigate Bridge Tokens

In the bridging procedure, a native token is essential. To secure the bridge and guarantee the integrity of the transaction, it is reinforced as collateral and symbolizes the transferred value.

3. Consensus Mechanisms

Cross-chain bridge development solutions mostly use consensus techniques, such as multi-signature wallets and threshold signatures, to guarantee the legitimacy of transactions over several chains.

4. Relayers or Validators

These individuals ensure consensus among the involved networks and validate transactions. They may be reputable third-party validators or independent organizations compensated for their involvement.

5. Decentralized Oracles

To enable cross-chain data or asset transfers, sophisticated cross-chain bridge platform solutions use decentralized oracles to retrieve real-time data from off-chain sources or external blockchain networks.

6. Locking and Unlocking of Assets

To ensure process security and integrity, the asset transfers between various blockchain platforms via this interoperability solution frequently entail locking in the items in question in the source as well as unlocking them on the destination chain.

7. Security and Governance Models

The development of cross-chain bridge solutions can be combined with governance models in which participants vote on ideas that determine how the bridge will function. S cross-chain bridges are hacker honeypots, security procedures like audits are essential to ensure their credibility.

8. User Experience

To move assets between blockchains, users interact directly with cross-chain bridge platforms. Therefore, to facilitate easy accessibility of notifications, transaction records, etc, cross-chain bridge-building companies must carefully design user-friendly interfaces.

Do You Require A Cross-Chain Bridge Platform Solution?

Cross-chain bridge platform solutions are essential in various ways for different blockchain stakeholders as they facilitate improved interoperability and user engagement. Expanding operations over several networks can greatly help Decentralized Finance (DeFi) and Decentralized applications (dApp) projects by reaching a wider audience and employing a variety of blockchain technologies.

Both centralized and decentralized cryptocurrency exchanges improve user experiences by enabling smooth trade between several blockchains through cross-chain swaps. These systems are used by NFT marketplaces to provide NFT trading over many networks, hence expanding liquidity and market reach. Additionally, by including cross-chain functionality decentralized apps can draw users from various networks and provide more adaptable services. By enabling users to move in-game assets between networks, cross-chain bridges help gaming platforms create a more flexible gaming environment.

Major Benefits of Cross-Chain Bridge Platform Development

Cross-chain bridges offer users real benefits and are more than simply technological achievements. Here are the following benefits of a multi-chain bridge platform:

1. Increased Liquidity

By facilitating the exchange of assets between various blockchain networks, cross-chain bridges increase liquidity and give consumers new ways to access and use their cryptocurrency holdings.

Increased token utility contributes to the expansion of economic activity in the decentralized finance (DeFi) space, and cross-chain liquidity also helps to avoid economic barriers.

2. Availability of Several Ecosystems

Cross-chain bridges act as entry points to various blockchain environments. They allow users to engage with various ecosystems by opening up opportunities for decentralized apps(Dapps) on several blockchains.

They improve the user experience overall and promote a more linked Web3 environment by enabling users to make use of the distinct qualities and advantages of various blockchain platforms.

3. Benefits of Cost and Speed

Cross-chain bridges provide scalability and efficiency in addition to connectivity. By facilitating the adoption of more effective blockchains and removing the need to exchange, bridges can speed up transactions.

By dividing up transaction loads and speeding up processing, bridges can increase scalability. When opposed to transactions on expensive networks like the Ethereum mainnet, bridges that support Ethereum Layer-2 methods of scaling can also offer a more affordable alternative.

4. No Single-Chain Reliance

By facilitating asset allocation and diversification over several blockchain platforms, cross-chain bridges can help reduce the risks connected with single-chain dependence. It could be especially helpful to diversify across multiple chains in case of network disruptions, that are known to happen on Solana blockchains.

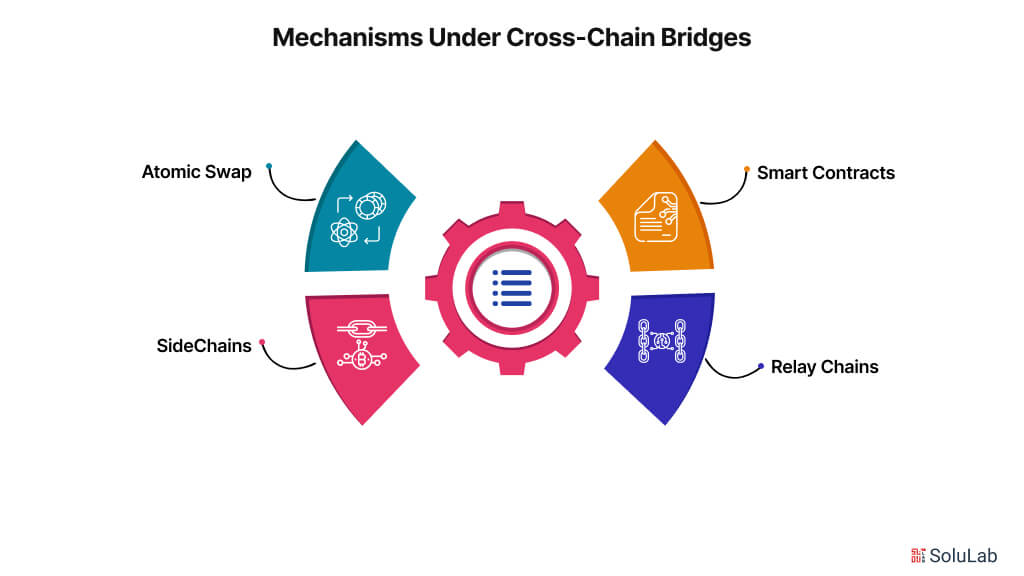

Mechanisms Under Cross-Chain Bridges

The blockchain development solution makes it possible for assets and data to be transferred between dissimilar systems facilitating interoperability between various blockchain networks. Enhancing blockchain functionality, scalability, and usefulness requires these mechanisms:

-

Atomic Swaps

These fundamental principles enable individuals to trade cryptocurrencies from various blockchains without the assistance of a reliable third party. This procedure reduces the possibility of loss during the exchange by guaranteeing that both transactions take place or neither does.

-

Smart Contracts

Smart contracts also known as Hash Time-Locked Contracts (HTLCs) use a cryptographic hash function to ensure that transactions are only carried out when specific requirements are satisfied within a predetermined window of time. By freezing money until both parties meet their responsibilities, this approach improves security.

-

Relay Chains

Relay chains serve as bridges between blockchains and are used by certain cross-chain platforms. These chains keep an eye on several networks and help with cross-network communication and transaction validation. This design preserves each blockchain’s integrity while enabling smooth asset transfers.

-

SideChains

These allow assets to be transferred between a secondary chain and a primary blockchain. Scalability and experimentation are made possible by this approach without clogging the main network. Sidechains increase flexibility by being able to be customized for certain use cases.

What Impact Does Cross-Chain Bridges Have?

The blockchain ecosystem is transformed by cross-chain bridges, which solve important issues with security, simplicity, diversification, and interoperability.

1. Diversification

Cross-chain bridges let users diversify their distributed ledger portfolios by facilitating the bridging of assets across several blockchain ecosystems. For managing risks in the unstable Bitcoin market, this diversification is essential. Users are not limited only to a single ecosystem and can access different tokens and Decentralized Finance (DeFi) chances across numerous chains. Therefore, by utilizing the distinct benefits of various blockchains such as reduced fees or quicker transaction speeds, investors can minimize their plans.

2. Interoperability

Communication and asset transfers between various blockchain networks are made easier by cross-chain bridges. The expansion of Defi platforms depends on this interoperability, which enables users to transfer assets between platforms without restriction. To increase the usefulness of their assets, a user can, for example, make use of Bitcoin’s liquidity according to DeFi protocols.

3. Simplicity

By enabling people to avoid the difficulties of directly managing numerous native assets, cross-chain bridges make the user experience simpler. Users may engage with a single interface that takes away the underlying complexity, rather than navigating different wallets and interfaces for every blockchain. By lowering obstacles to entry for newcomers, this simplified strategy not only improves user convenience but also promotes wider involvement in the cryptocurrency field.

4. Safety

When it comes to cross-chain blockchain platform transactions, security is crucial. Improves security features are incorporated into these bridges to safeguard users when transferring assets. Cross-chain bridges make sure that transactions are carried out securely and dependably by using tools such as smart contracts and cryptographic protocols. Users are more inclined to participate in cross-chain activities without worrying about fraud or loss as a result of this emphasis on security.

How is SoluLab Helping With the Development of Cross-Chain Platform Solutions?

In the creation of cross-chain platform solutions, SoluLab is essential, as demonstrated by their creation of Morpheus Network, which is primarily focused on simplifying and securing logistics by spearheading the shift for logistics companies into the new decentralized reality. This promises to provide logistics companies with increased efficiency, real-time insights, and strategy that streamlines operations and improves supply chain management.

SoluLab uses modern and developed technologies to improve communication and asset transfers by enabling smooth interoperability across various blockchain ecosystems. Their proficiency in developing strong, safe, and intuitive platforms guarantees that companies can successfully negotiate the challenges of cross-chain transactions.

Working with an experienced team like SoluLab can help encourage growth and accomplish strategic objectives as the need for decentralized solutions continues to increase. Contact us today to discover the possibilities of blockchain technology for your needs and requirements or to investigate how cross-chain platforms might help your business.

FAQs

1. What exactly is a blockchain bridge?

In the realm of digital assets, a blockchain bridge is crucial for a technological tool that connects various blockchain networks. It enables data, assets, and smart contracts to be shared and transferred between different blockchain ecosystems.

2. What are blockchain interoperability platforms?

The capacity of various blockchain networks to interact and share information is known as blockchain interoperability. Since interoperability, helps get over present obstacles and realize the full potential of decentralized networks, it is essential for the advancement of blockchain technology.

3. What are Cross-Chain Bridges in Web3?

Decentralized tools that let users move assets between blockchain networks. After Bitcoin and Ethereum, every Web3 blockchain usually includes its bridge, such as Base, Arrbitum (ARB), Avalanche (AVAX), and polygon (MATIC). These improve interoperability by facilitating smooth money transfers and boosting liquidity on several platforms.

4. What are the main examples of cross-chain bridges?

Cross-chain bridge examples are Polkadot bridges, which allow interoperability across several blockchains, RenBridge which facilitates the transfer of several assets to Ethereum, and Polygon Bridge, which links Ethereum and Polygon.

5. How is SoluLab helping with blockchain development for organizations?

SoluLab provides customized solutions for every need and preference which includes smart contracts development, development of Dapps, and integration of blockchain services that help your business with blockchain development.