Cryptocurrency can also be overwhelming as the market operates 24/7, with prices changing every second. This affects human behavior and even makes it difficult to keep track. A crypto trading bot, an automated assistant, can help simplify the scenario of trading with automatic execution strategies, reducing the stress of manual trading.

A crypto trading bot is software that tracks market conditions and makes trades based on preset rules. It acts as a tireless trader that never sleeps, reacts faster than humans, and isn’t influenced by FOMO or panic selling. These bots are useful not just for beginners who are still exploring trading but also for experts looking to scale their strategies.

| The global crypto trading bot market was valued at approximately $41.61 billion in 2024, it is projected to reach $154 billion by 2033, growing at a CAGR of about 14%. |

In this guide, we’ll walk you through the step-by-step process of setting up a crypto trading bot, why it is important, its examples, and more. Let’s get started!

What are Crypto Trading Bots?

About ten years ago, cryptocurrencies swept the globe, bringing the idea of decentralized, unsupervised monetary options to the world and making many early adopters insanely wealthy. The current value of transactions in the worldwide cryptocurrency market is around $1.3 trillion, also the market is growing at a remarkable pace of 30%. Even after the long-term crypto market downturn during 2022-2023, the global trading cryptocurrency sector is expected to have a bright future having surpassed the $5 billion mark in 2024.

Cryptocurrency algorithmic trading bots are AI-powered programs that are made to automate cryptocurrency trading. As these bots can quickly evaluate large volumes of data, identify trends, and execute trades based on preset criteria or self-learning algorithms, they are becoming more and more popular among traders. An advanced method of trading cryptocurrencies is the incorporation of machine learning and AI into trading bots. These models can examine past data, pick up on market trends, and modify their trading plans in response to fresh data. By spotting lucrative trading chances that human traders would overlook, this dynamic adjustment technique can greatly improve trading success.

Examples of Cryptocurrency Trading Bots

Even though there is a big industry for cryptocurrency trading bots, there are a few notable examples that show how far this technology has come.

1. Sniper bot

A piece of automated software designed to place a first-second bid on a cryptocurrency exchange or digital auction is called a sniper bot, sometimes referred to as a sniping bot. Modern technology guarantees sniping speed, which guarantees that the bot outperforms the other bidders and makes the final bid after weighing all other bids. Additionally, it is a DEX bot that executes trades with extreme accuracy and only completes a transaction when a predefined set of criteria is satisfied.

2. Copy Trade Bot/Copy Cat

These bot kinds are the most basic forms of back-running bot technology since they locate profitable traders on the internet and reproduce their transactions, making the final product as close to the copied market participants as feasible. To imitate the actions of other profitable traders on the platform, for example, you can start a Uniswap trading bot.

3. Crypto Trading Bot on Telegram

Numerous bots have surfaced to assist users in trading cryptocurrency on different exchanges as Telegram becomes more and more crypto-friendly. If you connect their accounts to your API, the Telegram trading bot will begin trading in your place. You can also configure a Telegram crypto alert bot to notify you of particular events, news, or asset prices. Therefore, all things considered, Telegram bots are quite practical since they offer quick, easy, and accessible solutions that are only a smartphone click away.

Why Do You Need Crypto Trading Bots?

The rise of the crypto wallet are crucial resource for the emergence of AI crypto trading bots for investors managing the unstable cryptocurrency market. Their capacity to work all the time, constantly observing market circumstances and placing deals, is one of the major reasons to indulge in AI crypto bots. Even if they are not actively trading traders, can take advantage of chances that may present themselves at any time thanks to ongoing awareness. These bots can also execute transactions in milliseconds and evaluate large volumes of data, which minimizes slippage and guarantees that trades are done at the best pricing.

The removal of emotional trading is another reason why you should use crypto trading bots, while human tendencies such as fear and greed can impair judgment and result in bad choices, bots follow preset algorithms, and tactics to stay disciplined while trading. Improved risk control and diversification are made possible by their ability to concurrently apply sophisticated trading methods across numerous accounts and assets. All things considered, crypto wallet solutions increase productivity and reliability, which makes them incredibly useful for both new and seasoned traders in the continuously shifting cryptocurrency market.

How Do Build A Crypto Trading Bot?

Customers typically believe that the creation team will handle the bot’s setup on their own. However, as a crypto professional, we believe that you can successfully manage how to make a trading bot and meet your specific trading requirements if you have some grasp of the process. A fascinating effort that blends technology and finance is creating a top AI cryptocurrencies trading bot. The following crucial actions must be taken to create an automated crypto trading bot that can conduct trades on its own depending on present criteria:

Step 1: Selecting A Programming Language

There are several important choices to consider when choosing the ideal language for programming your AI crypto trading algorithm, each with advantages and disadvantages:

- Python: Well-known for its readability and simplicity of use, Python is a proclaimed option because of its extensive library ecosystem, which is beneficial for applications involving machine learning and data analysis. It might not be the best choice for memory-intensive activities, though and its execution speeds might be slower.

- JavaScript: It can handle many API requests synchronously, this language is useful for bots that must communicate with web-based services. However, it might not work as well for computationally demanding jobs.

- Rust and Go: Also known as Golang are renowned for their excellent performance, Go has robust concurrency support, while Rust offers memory safety measures. Depending on your particular needs, each has special benefits.

- C#: This is mainly designed for real-time data processing, it provides excellent performance and effective memory management. A higher learning curve and maybe longer development times are the trade-offs.

The needs of your project, your level of language proficiency, and the particular features you desire for your crypto scalping bot will all influence your language choice.

Step 2: Developing the Architecture

The team gets right into the telegram tap to earn bot games after the client clarifies their requirements and provides all the information regarding the bot’s components, process, and approach. The team leader establishes that the overall framework identifies the required development phases and milestones, concentrates on the goals, and specifies a bot. The project’s schedule and anticipated completion data are usually established during this phase.

Connecting to cryptocurrency exchanges via their APIs is the following stage. Your trading bots need APIs to send and receive data from cryptocurrency exchanges. On every exchange that you want to trade on, you must generate API keys and set up your bot to use them.

Step 3: Creating A Trading Strategy

Your cryptocurrency trading bot’s trading strategy serves as its central component, directing its decision-making. Common tactics consist of using the trends following strategies, the bot finds and profits from current market patterns by purchasing assets when prices are increasing and dumping them when they are falling.

- Arbitrage: This crypto arbitrage trading bot’s tactic takes advantage of price differences between exchanges, enabling the bot to profitably purchase inexpensively on one platform and be sold on higher on the other.

- Market Making: Under this situation, the bot continuously purchases and sells assets to benefit from the difference in buying and selling prices, thereby supplying the market with liquidity.

Selecting the appropriate approach is essential since it affects the bot’s design and complexity. Choose a trading approach that fits your objectives, risk tolerance, and degree of proficiency to optimize efficiency.

Step 4: Programming the Bot

It’s time to start doing some math now. The statistical model that will decide what your telegram bot performs and when it completes a trade is called its architecture, or brain. At this point, you should develop the entire decision-making logic for your bot and establish the set of guidelines it will follow. Coding is the next stage, this includes establishing your development environment, including APIs, putting your trading plan into action, and fully testing the bot before release. For instance, installing the required libraries and dependencies is important if you are using Python.

Step 5: Backtesting and Testing

- Testing Your Bot: Testing is essential to make sure your bot operates as intended under actual trading circumstances. Your strategy may be bridged between trading view and stock exchanges like Binance by using middleware like AlphaShifter, which enables you to transmit personalized signals straight to your exchange account. You should test your bot on the Binance Testnet prior to deploying with real money. Although Testnet liquidity is constrained and might not accurately reflect live market circumstances, this environment replicates authentic trading without danger.

- Backtesting Your Bot: Backtesting is the process of testing your bot’s performance using historical market data. Backtesting tools are available on platforms such as Bitsgap and Gainium, which let you modify your settings based on historical performance to predict future results. These tools support various stats and analytics to help you refine your strategy, and they support a variety of bots.

Step 6: Cloud Infrastructure Deployment

Once you start a crypto exchange on a cloud platform such as AWS, Google Cloud, or Azure, you can be sure that it will operate continuously and handle trade opportunities at any time of the day. The general procedure is customizing your trading tactics, establishing a server, and package for your bot, and making sure your preferred cryptocurrency exchanges have safe API connectivity, but specific stages may differ based on the cloud provider. Think about cloud services that provide dependable uptime, and scalability to accommodate varying market situations and strong security measures.

Step 7: Monitoring and Optimization

Maintaining the bot’s efficacy once it goes live requires constant optimization and monitoring. Keep up with cryptocurrency market developments, evaluate its success indicators on a regular basis, and modify tactics as circumstances change. You can refine your bot’s decision-making process by using technical analysis tools such as trading view charts and indicators that are integrated into backtesting platforms.

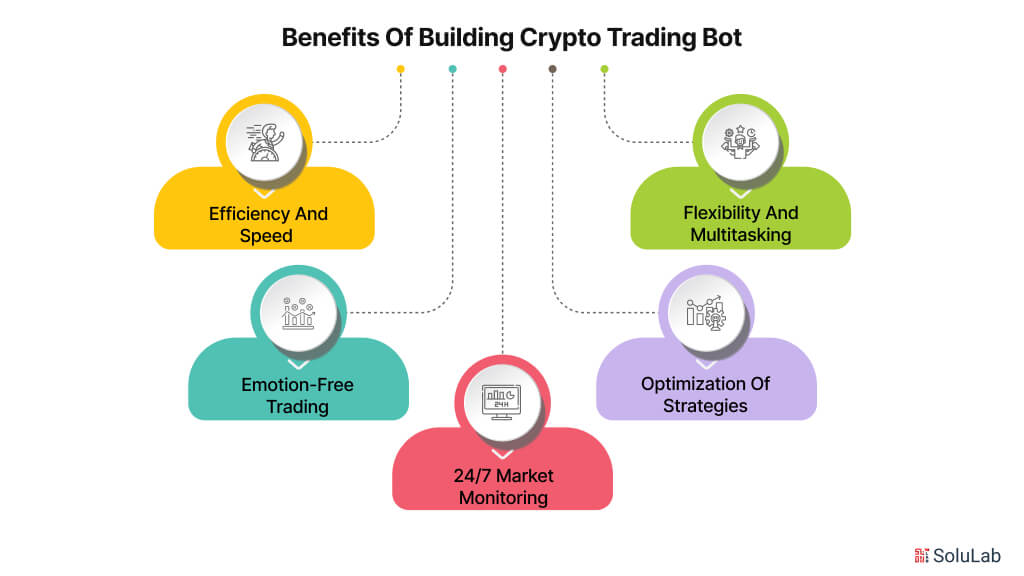

Benefits of Building Crypto Trading Bot

As the cryptocurrency market has advanced, trading bots have become vital for traders wanting to fine-tune their crypto payment gateway & improve on performance. These automated systems are programmed by advanced algorithms so that they help execute trades even faster in core market data analyzed over any kind of exchange, and portfolio management with minimal human input. In this section, we will briefly touch on the more important edge that crypto bots bring to currency traders.

-

Efficiency and Speed

These AI-powered chatbots are far beyond humans in trading expediency and efficiency thanks to black box trades. It is capable of analyzing massive quantities of market data in real-time thereby enabling it to act within fractions of a second on an opportunity that may be unavailable only seconds later. This rapid execution diminishes the possibility of missing profitable trades — something, which human traders oftentimes fail to catch due to its relatively slower response due to time limits or inattentiveness.

-

Emotion-Free Trading

One of the major advantages of using a bot cryptocurrency trading system is the complete absence of any kind of emotional influence on all decisions of the trade. Emotions, such as fear and greed, haunt the human trader daily because our emotions will quickly trump when setting up impulsive moves or bad decisions. A bot cryptocurrency trading system, however, works via predefined rules and strategy to make sure that trades occur logically without being emotive. The discipline of this plan can boost trading performance if it maintains consistency during losing runs.

-

24/7 Market Monitoring

This cryptocurrency space is running 24/7, which means the window for crypto assets trading opportunities opens for human traders around the clock. And yet again, bots help with this: they can watch markets 24/7 for good setups and are ready to trade when the right conditions arrive. In this way, 24/7 surveillance prevents even a single profit-generating chance from slipping when human traders are off the clock.

-

Optimization of Strategies

Another feature of crypto trading bots is that they can test strategies against historical data. In doing so, the trader can put his strategy on historical market conditions before rolling it into a live trading process. Equipped with the might of this knowledge, users can refine and optimize their strategy to minimize risks or what’s known as capital drawdown further improving their chances when investing real money.

-

Flexibility and Multitasking

For instance, you are going to be able to launch hundreds of bots at a time because you have prepared several strategies that are suitable for different market conditions. Diversification — Traders will be able to diversify their portfolios to the maximum extent possible and route all the adjacent trading pairs without getting tired of complex order operations. Using a diversified approach among different assets, traders can theoretically take in more money in total and spread their risk.

Things to Consider Before Creating a Crypto Trading Bot

Plan after deciding to develop a crypto trading bot. This ensures you get what you expect and saves money on unnecessary features and technology.

- Find a trustworthy development team, choose the appropriate technological mix, choose a safe cloud platform, consider cybersecurity, etc.

- Plan beforehand. Developers need a roadmap with goals and timetables for progress tracking.

- Consider programmers’ credentials. A bot that works requires the right individuals with relevant knowledge.

Future Trends in Crypto Trading Bot Development

Blockchain technology is developing at an exponential rate, with unimaginable breakthroughs taking place daily. The following are the primary trends you should be aware of:

1. Increased automation: Future bots should exhibit greater adaptability, complexity, and sensitive sentiment analysis as AI and ML are incorporated into trading systems more quickly. Examine Chat GPT’s applications for cryptocurrency trading to understand how AI complements this sector.

2. Increased market penetration: In many financial markets, bots are enabling automated activity and infiltrating all aspects of trading. It is anticipated that their application will extend beyond cryptocurrency platforms to conventional stock markets, DeFi initiatives, and other financial domains.

3. Strong Risk Control: Future bots might have more sensitive risk adjustment features that will protect the owner from volatility, even though current bots are still not very flexible in terms of risk-limiting.

4. Intelligent arbitrage bots: An intelligent and successful cross-DEX arbitrage bot is slowly coming to pass. Cross-platform arbitrage is now done with bots, but new technologies can increase their return on investment and solve current inefficiencies.

How Is SoluLab Developing Experiences Using AI Technology?

Everyone can alter their philosophy on trading bitcoins by developing a bitcoin trading bot that matches their investing goals as well as the specified threat degree with the right resources and also details. In the sphere of digital manufacturing, the use of technologies might enhance product growth. Optional biases, execute transactions remarkably quickly and keep an eye on the market continuously without time limits by automating trading tactics. Anyone can change their approach to bitcoin trading by creating a trading bot that fits their investing objectives and risk tolerance with the correct resources and information.

The development of Sight Machine from SoluLab is a prime example crypto trading bot development company and of how utilizing AI technology to improve product development. Beyond efficient and effective data usage, this collaboration fleshed out Factory CoPilot, an end-to-end data solution that brings machine learning-based analysis to industrial applications.

This is the right time to create an effective autonomous trading bot for our trading strategies and increase performance in the cryptocurrency market if you aspire. There are several resources that SoluLab can provide you with if you want to know more about building an individual and specific trading bot that meets your needs. Begin your trading journey today to maximize the opportunity to make your trading better!

Conclusion

Setting up a crypto trading bot might seem complicated at first, but once you break it down, it’s easier than you think and worth the effort. Start by defining a clear trading strategy, picking or building the right bot, and securely connecting it to an exchange. Add well-configured technical indicators, run thorough backtesting, and monitor its performance regularly. This turns your bot into a reliable 24/7 trading assistant.

With the right tools, patience, and ongoing tweaks, a trading bot can simplify your trading, boost efficiency, and give you an edge in the fast-moving crypto market. Token World, a crypto launchpad platform, wanted a secure and scalable platform for token sales while staying compliant and transparent. SoluLab stepped in to create a tailored launchpad with features like submission forms, review systems, secure transactions, dashboards, multi-language support, and blockchain integration.

This solution helped Token World simplify processes, meet regulations, build trust, and handle high traffic effectively, enabling smooth and successful token launches worldwide. SoluLab, a trusted crypto development company, is a team of experts who can create all types of crypto trading bots with minimal effort while fixing all your queries related to trading bots. Contact us today to discuss this further.

FAQs

1. Do cryptocurrency trading bots make profits?

It depends on how you set them up, cryptocurrency trading bots can yield significant profits. Before going live, you can test your strategy and bot using backtesting tools. However, keep in mind that just because you test your bot in a certain market does not indicate that the same market conditions will be applied at the time of launch.

2. Do these crypto bots pose risks?

Financing a transaction with a borrowed enterprise AI chatbot carries a major possibility of loss. You do risk losing all your portion of the virtual assets that you put up to protect the virtual assets you borrowed.

3. Is there a free AI trading bot?

As a tool for technical analysis and charting, TradingView has become incredibly popular. Custom trade scripts and indicators can be created with more capabilities offered by AI technology. The free version of TradingView also offers limited scripting features.

4. How much would it cost to create a Crypto Trading Bot?

The entire cost of creating a cryptocurrency trading bot with Chatbot Development Company, taking into account all variables and phases of development, ranges around $60,000 to $20,000 for beginning creation, with maintenance and support expenses around $2,000 to $ 10,000.

5. Can SoluLab help you with building a crypto trading bot?

Yes, SoluLab can aid you with the creation of a crypto trading bot, with its expertise in offering specialized solutions, such as automated trading platforms that make use of modern algorithms and AI.