A triangular arbitrage trading bot is a strategic trading tool. Used to take advantage of market inefficiencies in the cryptocurrency market. Trading is a guessing game, and you feel stuck waiting for the market to move, overthinking whether your predictions are right.

According to the study, certain kinds of triangle arbitrage methods accounted for about 2.71% of all trades on Binance. Compared to direct exchange techniques, these trades improved the exchange ratio by an average of 0.144%, or 14.4 basis points.

However, building this trading bot not only enhances your trading strategy but can also generate income. Also, you can provide this service to other traders. But why this triangular arbitrage trading? A bot can spot the opportunity and execute trades instantly, faster than humans, and skip the manual work.

Triangular arbitrage is a smart way to trade in today’s competitive market, leveraging techniques like NLP applications for better efficiency. It requires setting up, such as coding a bot and understanding its process, but once implemented, it simplifies trading significantly.

In this blog, we will help you understand what a triangular trading bot is, how to build one for your crypto arbitrage development company, and how it works. Let’s get started.

What is a Triangular Arbitrage Trading Bot?

A triangular arbitrage trading bot is a software tool that helps people automate the execution of triangular arbitrage strategies in cryptocurrency markets. This triangular strategy includes three different currency price discrepancies to pair and generate profit. The bot constantly monitors and identifies exchange rates across these three different currencies. Then, it calculates exchange rates and pairs two of them where it seems there is a profit opportunity.

However, a triangular arbitrage bot can spot opportunities instantly that humans might miss or be too slow to act on. This automation improves trading efficiency and reduces the impact of human emotions, overthinking, and delays in decision-making as well.

Advanced bots, developed by a Crypto Trading Bot Development Company, can handle risks, adapt to real market changes, manage trading parameters, and execute strategies well. These features make them valuable tools for traders looking to trade effectively.

Features for Your Triangular Arbitrage Bot

Here are some features you will get if you use a triangular arbitrage bot:

- Market Analysis Module: The market analysis module catches real-time data, analyzes exchange rates by pairing different trades, and spots any profitable opportunity.

- Trade Execution Engine: A powerful execution engine will oversee currency buying and selling, ensuring trades are completed quickly and efficiently.

- Risk Management Tools: It supports features that include managing risks like setting stop-loss orders and reducing the amount of capital allocated to each trade.

- User Interface: A user-friendly interface enables traders to simply monitor the success of their bot and alter trading methods.

- Reporting and Analytics: Implement reporting capabilities that provide information about trade performance, profit margins, and other important indicators.

How to Build a Triangular Arbitrage Trading Bot: Step-by-Step Guide

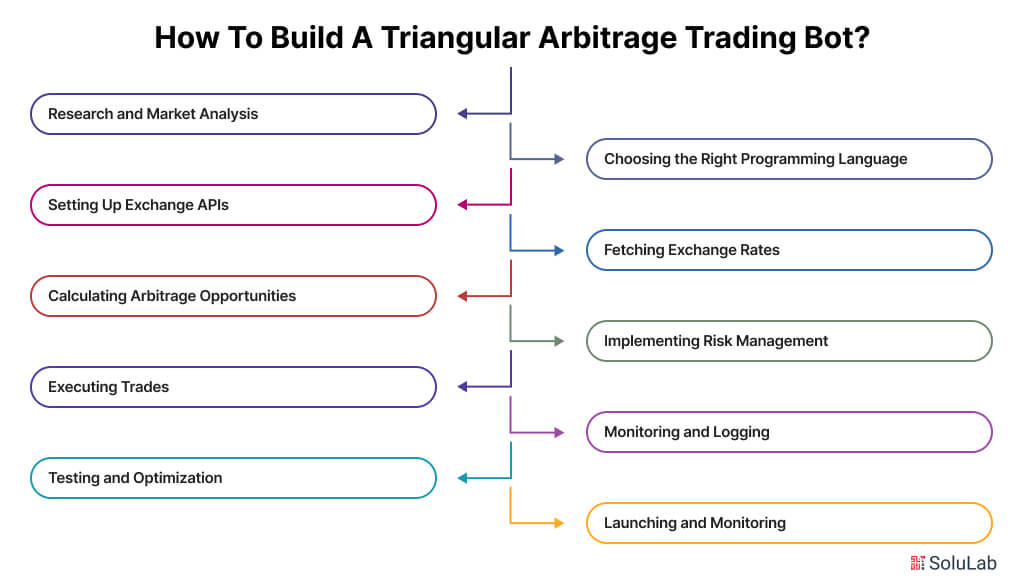

Follow this step-by-step guide to build crypto arbitrage bot:

1. Research and Market Analysis

Before creating one, you should understand what a triangular arbitrage bot is. The triangular arbitrage trading bot is nothing but a software tool used to identify differences in prices among three currencies in the foreign exchange market to capitalize on market inefficiencies.

2. Choosing the Right Programming Language

Select a suitable programming language, such as Python, for building a bot due to its powerful libraries for data analysis, natural language processing (NLP), and trading. Pair it with a framework like CCXT for cryptocurrency exchange integration.

3. Setting Up Exchange APIs

Connect APIs from various cryptocurrency exchanges that support the currencies involved in the arbitrage.

4. Fetching Exchange Rates

Implement the logic to obtain real-time exchange rates for currency pairs, including in triangular arbitrage.

5. Calculating Arbitrage Opportunities

Use algorithms to measure potential arbitrage opportunities based on analyzed exchange rates, which leads to profitable arbitrage opportunities.

6. Implementing Risk Management

Create risk management strategies to manage potential risks like slippage, transaction fees, and market uncertainties.

7. Executing Trades

Teach your bot to implement trades automatically if any profitable arbitrage opportunities are spotted.

8. Monitoring and Logging

Arrange a monitoring and logging mechanism in the bot to track the performance, executed trades, and other issues.

9. Testing and Optimization

Test your bot multiple times, refine it for trading strategies, and optimize it for improved performance.

10. Compliance and Legal Considerations

Provide compliance with relevant regulations and legal considerations in your jurisdictions, specifically for automated trading.

11. Launching and Monitoring

Once testing and optimization are done as per your expectations, launch it in a live trading environment and constantly monitor for improvement or any necessary changes.

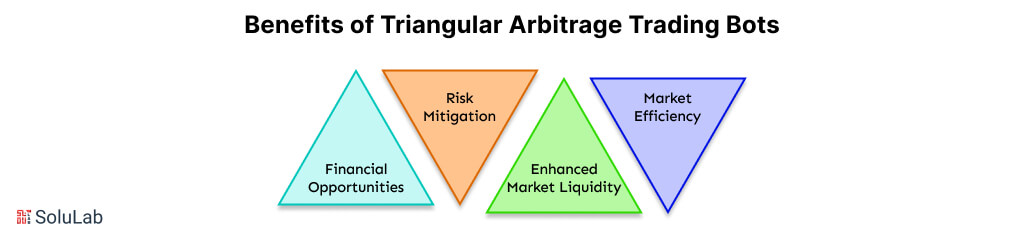

Benefits of Triangular Arbitrage Trading Bots

A triangular arbitrage bot is a risk-free trading strategy you can use to make profits. Here are some of its benefits you should know before building a crypto trading bot:

- Financial Opportunities: Traders can earn profit from price discrepancies between three different currency pairs simultaneously, exploiting inefficiencies across multiple exchanges while minimizing direct market exposure.

- Risk Mitigation: This trading bot is an automated system that executes trades only when specific profit thresholds are met; it reduces emotional trading decisions and implements strict risk management protocols.

- Enhanced Market Liquidity: Arbitrage bots contribute to market depth by continuously buying and selling across exchanges, helping you to maintain consistent pricing and reduce spread variations.

- Market Efficiency: Bots help equalize prices across different exchanges by quickly identifying and exploiting price disparities. This creative strategy leads to more uniform pricing in cryptocurrency markets plus reduces risks.

Limitations of Triangular Arbitrage Bots

Here are some limitations of the triangular arbitrage bot given below:

1. Transaction Costs: Exchange fees, withdrawal charges, and network transaction costs can significantly reduce or eliminate potential profits, especially during periods of high network congestion.

2. Technical Glitches and Downtime: System failures, API issues, or exchange maintenance can disrupt bot operations, leading to missed opportunities or incomplete trade executions.

3. Market Liquidity: Low liquidity in any of the trading pairs can prevent the successful execution of arbitrage opportunities or result in significant slippage.

4. Market Risks: Rapid price movements and market volatility can eliminate arbitrage opportunities before trades are complete, potentially resulting in losses rather than profits.

5. Strategy Effectiveness: Increasing competition from other arbitrage bots reduces available opportunities while market makers actively work to minimize price discrepancies.

How Does A Triangular Arbitrage Bot Work?

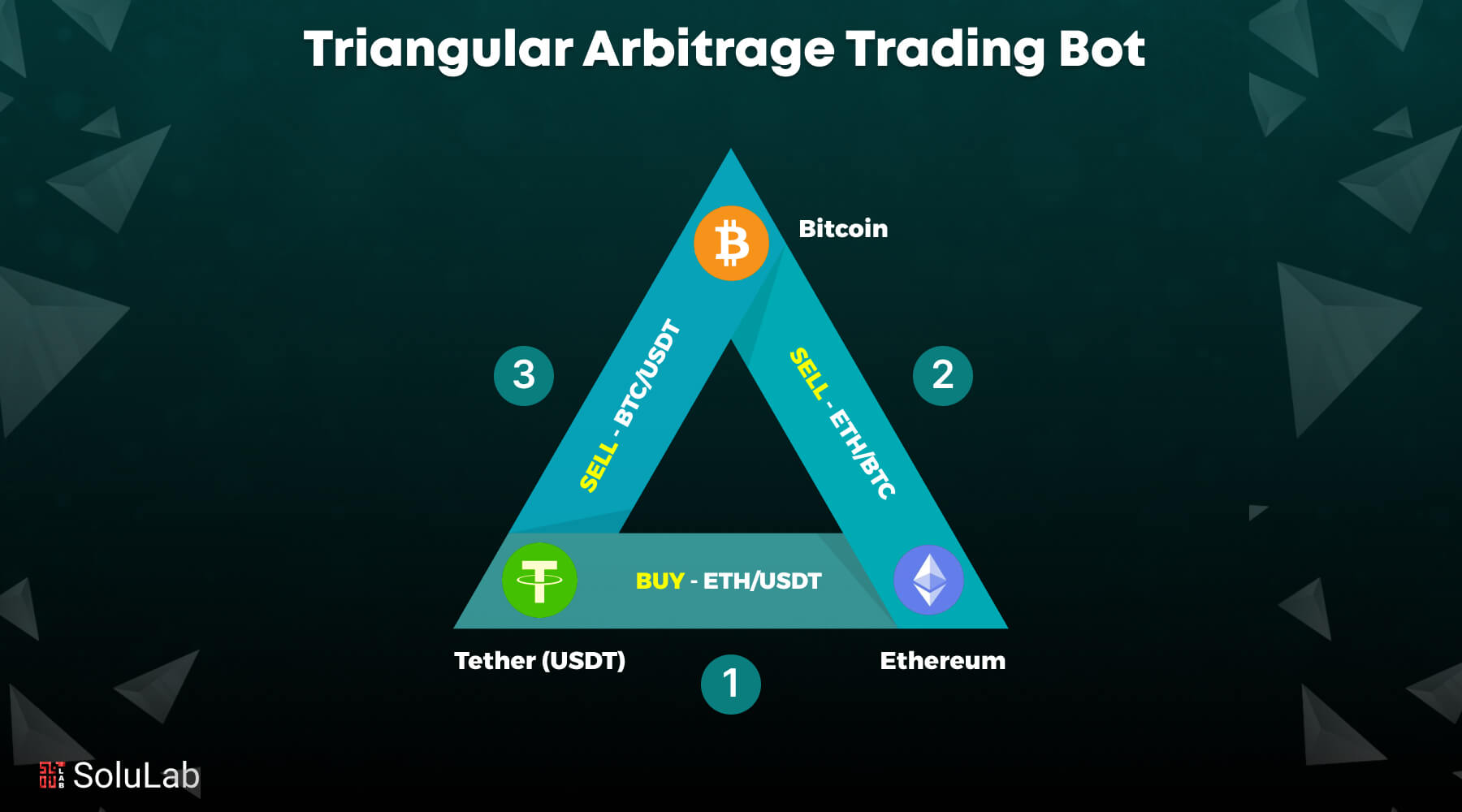

A triangular arbitrage trading bot works based on exploiting price discrepancies among three different currencies on multiple exchanges. Here’s how it works:

Identifying Opportunities: The triangular arbitrage bot constantly monitors the rices of all three different currencies (like BTC, ETH, and LTC) across multiple exchanges.

Calculating Arbitrage Opportunity: Once a bot detects a price difference where the exchange rates on these currencies do not match in any pair (e.g., BTC/ETH, ETH/LTC, LTC/BTC), then it identifies a potential arbitrage opportunity.

Executing Trades: The bot executes a couple of trades across these three pairs and utilizes the price difference. For instance:

- Buy ETH for LTC on exchanges A

- Buy ETH with BTC on Exchange B.

- Sell LTC for BTC on Exchange C.

There is a higher chance that this process will result in a profit due to price differences.

Risk Management: To manage risks, the bot calculates transaction and withdrawal fees, along with the time needed for transactions to be completed. It ensures that the potential profits are greater than these costs.

Automation and Speed: Speed is essential in arbitrage trading, so the bot automates the process to take advantage of temporary price differences before they disappear.

Legal and Regulatory Compliance: Depending on the jurisdictions and exchanges involved, the bot must adhere to legal and regulatory frameworks to avoid issues related to market manipulation or non-compliance.

Monitoring and Adjusting: The triangular arbitrage bot monitors market changes and adjusts its strategies based on real market data to increase profits and minimize any certain risks.

Future Trends and Innovations of Arbitrage Trading Bots

Here are some future trends you’ll see in the future and why you should start using a triangular arbitrage bot today:

1. Advanced Machine Learning Algorithms: AI systems will improve pattern recognition and prediction capabilities, enabling bots to identify more complex arbitrage opportunities across multiple markets.

2. Decentralized Finance Integration: Arbitrage bots will expand to incorporate DeFi protocols, exploiting yield opportunities and price differences across decentralized exchanges.

3. Real-Time Sentiment Analysis: Future bots will incorporate social media and news analysis to predict potential price movements and arbitrage opportunities before they occur.

4. Cloud-Based Solutions: Distributed computing will enable faster processing and execution, with improved scalability and reduced infrastructure costs for traders.

5. Customization and Personalization: Enhanced user interfaces will allow traders to customize strategies and risk parameters while maintaining automated execution capabilities.

6. Social Trading Features: Integration of social trading will enable users to share strategies and automatically copy successful arbitrage patterns from top performers.

7. Quantum Computing: Implementation of quantum algorithms will dramatically increase processing speed and pattern recognition capabilities for complex market analysis.

8. Security Measures: Advanced encryption and security protocols will protect against evolving cyber threats while maintaining high-speed execution capabilities.

9. Cross-platform integration: Bots that can trade not just cryptocurrencies but also other things like stocks, gold, and foreign currencies as well.

10. Regulatory Compliance Solutions: Creating bots with built-in rules to follow laws and regulations helps traders avoid legal problems in automated trading.

Conclusion

Building a triangular trading bot is an excellent way for cryptocurrency traders to increase profits through automated strategies. Using a Crypto Arbitrage Flash Loan Bot, traders can enhance their ability to capitalize on market inefficiencies. Setting up the bot involves understanding triangular trading mechanisms and organizing processes to ensure efficiency and profitability. This approach leverages both arbitrage opportunities and automation for better results in volatile markets.

If you are a trader and want to skip the manual work and get ahead of the competition, then you should invest your time and effort in building a strategic triangular bot that can do all the work for you.

Digital Quest, a travel company, worked with SoluLab to improve their client engagement by developing an AI-powered chatbot. The chatbot uses Generative AI to extract and present website data, offering personalized travel recommendations and real-time information. It also features a feedback mechanism to enhance the user experience. This solution addressed issues such as increasing participation in a competitive business, providing constant real-time customer care, and assuring usability for travel-related demands. The result was increased client satisfaction and more efficient communication for travel recommendations.

FAQs

1. Is triangular arbitrage profitable?

Yes, triangular arbitrage can be profitable, but it depends on market conditions, speed of execution, and transaction fees. It exploits small price differences between currency pairs and efficient strategies to capture these opportunities before they vanish.

2. Why use a trading bot for triangular arbitrage?

A trading bot automates the process; you don’t have to sit and do the work manually. It acts quickly and executes and reduces the risk of missing fleeting opportunities. It monitors markets continuously and performs calculations instantly, which is important for capitalizing on the small margins in triangular arbitrage.

3. Can a triangular arbitrage bot guarantee profits?

No, profits are not guaranteed. Market volatility, latency, and transaction fees can diminish potential gains. While bots improve efficiency, their success still depends on favorable market conditions and optimized strategies. The better you optimize, the better it works for you. This is why traders should always be checking for improvements.

4. Do I need prior trading experience to create such a bot?

While prior trading experience is helpful, technical knowledge in programming and understanding of market mechanisms are more critical for creating an effective triangular arbitrage bot. Tutorials and pre-built solutions can also assist beginners. Plus, you can get help from expert people who offer these services to minimize the risk.

5. What platforms support triangular arbitrage trading bots?

Platforms like Binance, Kraken, and Bitfinex support triangular arbitrage bots as they offer access to multiple currency pairs and APIs for automation. Ensure the platform has low fees and high liquidity for optimal results.