Crypto Trading Bot Development Company

SoluLab offers industry-leading crypto trading bot development services, enabling you to automate trading strategies and achieve exceptional ROI. Leverage our expertise to launch cryptocurrency trading bot solutions equipped with advanced features, superior performance, and robust security. Whether you need an arbitrage trading bot or a custom-built solution, our team ensures seamless functionality, empowering you to maximize profits with ease and efficiency.

250+ Developers

20+ Crypto Bots Developed

500+ Global Clients

10+ Years of Experience

Improve Your Trading Success with Our Crypto Trading Bot

Development Services

Our crypto trading bot development services are tailored to empower traders and investors to navigate the fast-paced world of cryptocurrency with confidence. Our automated crypto trading bot solutions are designed to remove these obstacles, using data-driven algorithms to make split-second decisions that optimize profitability. Here are the services that we offer:

Bot-as-a-Service (BaaS)

Access our cloud-based automated crypto trading bot solutions from any location, featuring customizable options to align with trading and compliance needs.

Custom AI Auto Trading Bot Development

Build powerful crypto trading bots that leverage AI and machine learning to analyze market trends and execute trades for optimal returns.

Trading Bot Consultation Services

Get expert insights into crypto trading bot development to identify the right automated trading strategies tailored to your investment goals.

AI Auto Trading Bot Integration Services

Our bot integration services ensure seamless integration of third-party or custom-built bots into your preferred crypto exchanges or trading platforms.

Cross-Exchange Arbitrage Bot Development

Develop cross-exchange crypto arbitrage trading bots that monitor price discrepancies across multiple exchanges for profitable trading opportunities.

Decentralized Exchange (DEX) Bot Development

Create crypto trading bots designed specifically for decentralized exchanges, utilizing smart contracts to execute trades in decentralized liquidity pools.

Crypto Arbitrage Trading Bot Development

Our crypto arbitrage trading bot development service enables users to capitalize on real-time price differences across various crypto markets.

Statistical Arbitrage Bot Development

Use statistical models with automated crypto trading bots to manage portfolios and execute high-precision, short-term trades.

Market-Making Bot Development

Our market-making crypto trading bots provide liquidity to selected markets, enabling high-frequency bid-ask spread maintenance and generating volume-driven profits.

Algorithmic Trading Bot Development

Develop algorithmic crypto trading bots that use custom rules and data analytics for real-time decision-making in volatile markets.

Crypto Scalping Bot Development

Create high-frequency crypto trading bots designed for scalping, enabling traders to make quick, small-profit trades in liquid markets.

Backtesting and Optimization Services

Test and refine strategies with our backtesting services for crypto trading bots, enabling accurate performance analysis and optimization before live deployment.

Revenue Streams of Starting a Crypto Trading Bot

Launching a crypto trading bot offers multiple revenue opportunities for both operators and users, making it a lucrative venture in the cryptocurrency ecosystem. As more traders turn to automation for efficiency and profitability, a well-developed bot can serve diverse trading needs while generating steady revenue. Here are some primary revenue streams when starting a crypto trading bot:

Trading Commissions

Each transaction made through the bot platform can generate a small commission fee, which serves as a reliable income stream. As the bot facilitates high-frequency trades, even minimal fees can accumulate significantly, especially in volatile markets. This revenue stream is a core aspect of many trading automation platforms.

Subscription Models and Premium Features

Offering the bot as a subscription-based service with different tiers for standard and premium users enables steady revenue. Advanced features like AI-driven trading strategies, custom bot configurations, and exclusive market analytics can be part of the premium packages, giving users added value for their subscriptions. This approach benefits crypto trading bot developers looking to diversify offerings.

Performance-Based Fees

Implementing a performance-based fee structure allows users to share a percentage of profits with the platform. This model aligns the bot’s success with that of its users, encouraging usage while rewarding successful trading strategies. With algorithmic trading and AI crypto trading bot development, these bots optimize performance to generate profits for both users and operators.

Data Analytics and Market Insights

Charging for real-time data and predictive market insights offers an additional revenue stream. Users interested in tracking trends and making informed decisions can access live market analysis through the bot. This value-added feature caters to traders who rely on cryptocurrency bot technology for instant data to guide trading decisions.

Custom Bot Development Services

For businesses or high-volume traders seeking tailored solutions, offering custom bots can be a high-margin revenue source. These bots are designed to meet specific trading requirements, such as bespoke risk management strategies or cross-exchange arbitrage, enhancing overall profitability and attracting a broader client base.

Incentivizing users through a reward system or affiliate program allows for both revenue generation and user engagement. Tokenized rewards can encourage user activity, and affiliate programs can expand the bot’s reach through referrals, providing additional income channels for AI crypto trading bot development ventures.

Boost Your Profits with Our Crypto Trading Bot Platform

Types of Crypto Trading Bot Solutions We Offer

At SoluLab, our crypto trading bot development services offer a variety of specialized bot solutions designed to optimize your trading experience. From rapid execution bots to sophisticated trend analysis bots, our solutions cater to traders of all levels, helping you maximize returns, manage risks, and streamline operations. Here are some of the advanced crypto trading bot solutions we provide:

Our arbitrage bots help you capitalize on price discrepancies across multiple exchanges, executing trades quickly to secure profits. This bot development solution enables you to take advantage of rapid market changes and boost returns.

Margin Trading Bots

Gain more from your investments with our margin-trading bots, designed for managing leveraged positions. These bots are built to optimize trade execution while protecting your capital by balancing risk and return for maximum gains.

Market-Making Bots

Our market-making bots ensure liquidity by continuously placing buy and sell orders. By stabilizing trading conditions, these bots create smoother transactions and a more reliable trading environment, especially for decentralized exchanges

Technical Trading Bots

Use market trends to your advantage with our technical trading bots, which are designed to execute strategies based on market analysis and technical indicators. This algorithmic trading solution provides accurate trade execution, allowing you to stay ahead in a volatile market.

Copy Trading Bots

Our copy trading bots enable you to replicate the strategies of successful traders. This approach allows you to benefit from the expertise of seasoned traders, enhancing your own strategy with proven techniques.

MEV Bots (Miner Extractable Value)

Maximize returns with MEV bots that capture profit opportunities created within the Ethereum ecosystem. These bots detect miner-specific value opportunities, providing a unique avenue to enhance potential earnings.

Sniper Bot

Designed to execute trades within milliseconds of a token's launch or price change, Sniper Bots help users secure advantageous positions before the broader market reacts. Ideal for high-volatility environments, these bots ensure early entry and maximize profits.

DCA (Dollar-Cost Averaging) Bot

Our DCA bots automate the investment strategy of dollar-cost averaging, buying fixed amounts of a cryptocurrency at regular intervals. This bot helps reduce the impact of market volatility on your overall investment, offering a more stable approach to long-term holdings.

Grid Trading Bot

Grid Trading Bots are built to place buy and sell orders at regular intervals above and below a set price, capturing profits in a sideways market. This bot is ideal for traders looking to capitalize on minor price fluctuations and generate steady returns.

Scalping Bot

For traders focused on rapid, high-frequency trades, our Scalping Bots execute numerous small trades to capture minimal price changes. Ideal for liquid markets, these bots are programmed to optimize execution speed and maximize short-term profits.

Portfolio Manager Bot

Our portfolio manager bots help traders diversify and balance their holdings across multiple assets. This bot monitors asset performance and reallocates funds based on predefined criteria, helping to maintain a stable and well-distributed portfolio.

Hedge Trading Bot

Hedge Trading Bots are designed to protect against adverse market movements by taking positions that offset potential losses. Common in volatile markets, these bots provide risk mitigation and help stabilize returns during market fluctuations.

Did You Know!

Global cryptocurrency trading bot market is projected to grow to $1.7 billion USD by 2028, driven by demand for automated trading solutions.

Did You Know!

Statistics reveal that the global cryptocurrency trading bot market is projected to grow to $1.7 billion USD by 2028, driven by demand for automated trading solutions.

Features of Our Automated Crypto Trading Bots

Our cryptocurrency trading bots at SoluLab come equipped with powerful features designed to enhance trading efficiency, manage portfolios, and provide seamless user experiences. Here are some of the key features that set our trading bots apart:

Push Notifications

Stay informed with real-time alerts on market movements, executed trades, and portfolio updates. Push notifications ensure users can make timely decisions by keeping them updated on key activities and market changes directly through the bot interface.

Automated Trading

With automated trading capabilities, our bots execute trades on your behalf based on pre-set parameters or market conditions. This feature removes the need for constant monitoring, allowing users to focus on strategy rather than manual trade execution.

Semi-Automatic Bots

For traders who prefer more control, semi-automatic bots offer a hybrid approach, allowing users to manually approve or reject trades before execution. This feature is ideal for those who want automated insights but retain decision-making authority on trades.

Fully Automatic Bots

Fully automatic trading software bots handle all aspects of trading, from market analysis to trade execution, based on predetermined settings. These bots are perfect for users seeking a hands-off approach, as they continually adapt to market conditions without user intervention.

Crypto Portfolio Management

Our cryptocurrency bots include comprehensive portfolio management features, allowing users to track, manage, and optimize their asset allocation. Users can easily view holdings, analyze performance, and make adjustments to align with their investment goals, all within the bot interface.

User-Friendly Interface

With a streamlined, intuitive interface, our cryptocurrency trading bots make it easy for users of all experience levels to navigate and manage their trading activities. Clear layouts, accessible controls, and responsive designs ensure a smooth trading experience, whether you’re a novice or an expert.

Benefits of Crypto Trading Bot Development

Partnering with a Crypto Trading Bot Development Company can transform your trading experience, offering the advantages of automation, efficiency, and advanced market analysis. Here are the key benefits of using automated crypto trading bots:

24/7 Trading Automation

Our automated crypto trading bots enable round-the-clock trading, capitalizing on market opportunities at any time without human intervention. This ensures no profitable trades are missed, even in highly volatile markets.

Precision and Speed in Execution

Cryptocurrency trading bot development is designed to execute trades instantly based on pre-set parameters, eliminating delays and reducing the impact of human error. With real-time data processing, these bots make quick, precise decisions to optimize trading outcomes.

Advanced Bot Integration Services

Our bot integration services ensure seamless functionality with popular crypto exchanges and trading platforms. This integrated approach provides users with direct access to advanced features and allows for enhanced data synchronization and performance.

Customizable Strategies

With custom crypto trading bot development, traders can implement tailored strategies, from arbitrage and scalping to long-term holding and trend-following. Customized bots adapt to unique trading goals, maximizing returns based on specific user needs.

Crypto Arbitrage Opportunities

As a leading crypto arbitrage trading bot development company, we build bots that take advantage of price differences across exchanges. Our bots detect and act on arbitrage opportunities within seconds, allowing traders to generate consistent profits through price discrepancies.

Enhanced Risk Management

Our trading bots incorporate advanced risk management features, including stop-loss orders and portfolio rebalancing. By implementing these tools, users can protect their investments and minimize losses during market fluctuations.

Increased Efficiency and Reduced Emotions

Trading bots help eliminate emotional decision-making by following algorithmic rules, which increases consistency and reduces impulsive trades. This automated approach helps traders stay focused on strategy, ultimately improving profitability.

Real-Time Market Analysis

Bots equipped with analytical capabilities continuously monitor and interpret market trends, providing data-driven insights for each trade. This allows for smarter trading strategies based on live market conditions and trends.

Scalability for High-Volume Trading

Our crypto trading bots are designed to handle large volumes of trades simultaneously, making them ideal for traders or firms looking to scale their operations. This scalability ensures that as your trading volume grows, the bot can efficiently manage increased transaction loads without compromising performance.

Maximize profits with our Customizable Crypto Trading Bot Solutions.

Boost your trading with reliable, expert-driven cryptocurrency bot development. Reach out to discuss your project today!

Maximize profits with our Customizable Crypto Trading Bot Solutions.

Boost your trading with reliable, expert-driven cryptocurrency bot development. Reach out to discuss your project today!

Use Cases of Crypto Trading Bot Development

Crypto trading bots have become essential tools for traders and investors looking to automate trading processes, optimize strategies, and maximize profits in the volatile cryptocurrency market. Here are some common use cases:

Automated Trading

Crypto trading bots enable automated trading strategies that execute buy and sell orders based on pre-defined parameters. These bots can respond to market trends and execute trades 24/7 without requiring manual intervention, ensuring that traders never miss an opportunity.

Arbitrage Trading

Bots can take advantage of price differences across different exchanges by buying low on one platform and selling high on another. Arbitrage trading bots monitor multiple exchanges and execute trades almost instantly to capitalize on discrepancies in asset prices.

Market Making

Market-making bots provide liquidity to cryptocurrency exchanges by continuously placing buy and sell orders around the current market price. This helps narrow the bid-ask spread and allows traders to profit from small price fluctuations while contributing to market stability.

Portfolio Rebalancing

Crypto trading bots can automatically rebalance a portfolio based on a trader’s target asset allocation. This ensures that the portfolio remains diversified according to the desired investment strategy, helping manage risk and optimize returns.

Backtesting and Strategy Optimization

Bots can be used for backtesting trading strategies using historical market data to evaluate performance before deploying them in live trading. This helps traders refine their strategies and improve the likelihood of success.

Risk Management and Hedging

Bots can be programmed to implement risk management strategies such as stop-loss orders or hedging techniques. This minimizes losses by automatically closing positions when the market moves unfavorably or offsets potential losses by taking counter positions.

Scalping

Scalping bots execute high-frequency trading strategies that target small price movements to accumulate profits over time. These bots can perform numerous trades per day, aiming for quick profits from minor market fluctuations.

News-Based Trading

Bots can be integrated with news feeds and social media monitoring tools to execute trades based on sentiment analysis. When a significant market-moving event or news article is detected, the bot can automatically buy or sell assets in response.

Flash Crash Protection

Trading bots can be programmed to detect sudden, drastic drops in asset prices and temporarily halt trading or execute specific orders to protect against substantial losses during flash crashes.

Our Works

Our crypto trading bot development projects focus on creating intelligent, automated trading solutions that maximize profitability and minimize risks. These bots use advanced algorithms and real-time data analysis to make swift, informed trading decisions across diverse crypto markets:

Token World- A Crypto Launchpad Platform

Token World is a premier cryptocurrency launchpad designed to connect blockchain projects with investors through a user-friendly platform. It enables project creators to showcase their initiatives and investors to explore curated projects with a focus on transparency, security, and an exceptional user experience. Token World simplifies project launches and investments, contributing to the growth of the blockchain ecosystem.

Borrowland- Crypto Borrowing & Lending Platform

Borrowland is a blockchain-powered platform reshaping the traditional lending-borrowing experience for global users. It enables seamless borrowing, lending, swapping, depositing, withdrawing, and transferring of crypto assets, offering users daily interest on balances and savings. With features like currency swapping between fiat and crypto, Borrowland makes capital access secure and efficient, providing automatic collateral returns upon loan repayment.

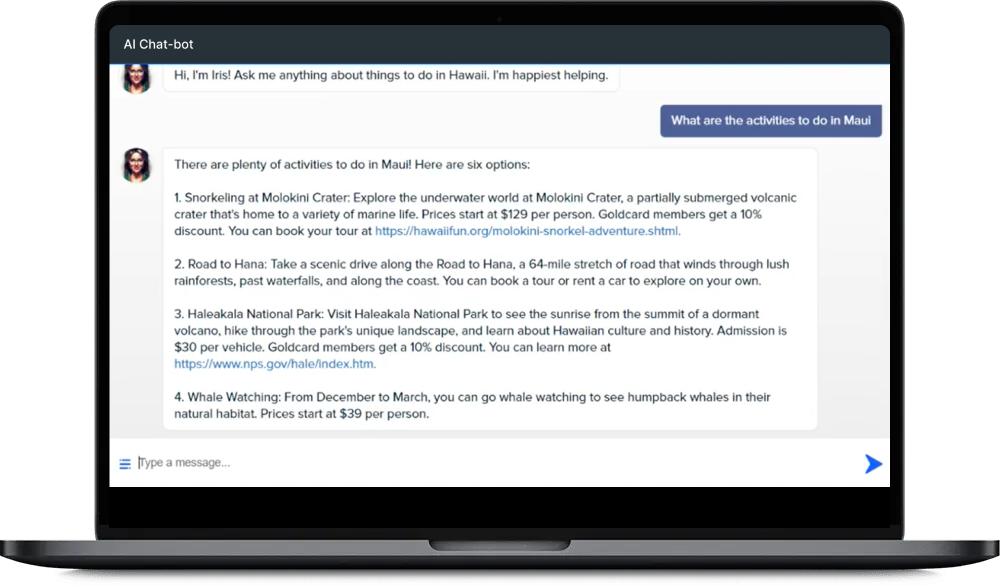

Digital Quest- AI-Powered Chatbot for Travel Recommendations

Digital Quest partnered with SoluLab to create an AI-powered chatbot that enhances customer engagement by providing personalized travel recommendations. Utilizing Generative AI, the chatbot extracts relevant information directly from the website, offering users tailored suggestions for destinations and excursions. This interactive tool includes a feedback section, allowing users to share insights, which helps continuously improve the chatbot and elevate the user experience.

Technology Stack for Crypto Trading Bot Development

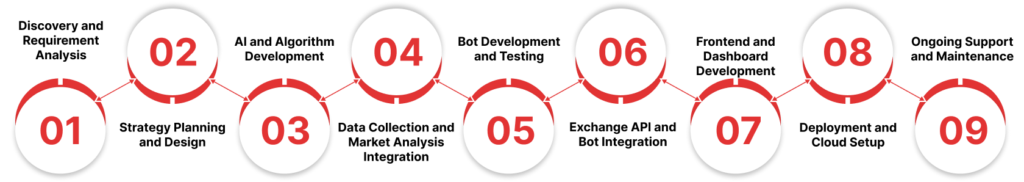

The Roadmap to Our Crypto Trading Bot Development Success

Our structured approach to crypto trading bot development ensures we deliver high-quality, efficient, and reliable trading solutions tailored to our clients’ needs. Here’s a step-by-step roadmap that guides our AI crypto trading bot development from initial consultation to deployment:

Discovery and Requirement Analysis

We begin by understanding the client’s trading goals, preferred strategies, and technical requirements, aligning our roadmap with specific outcomes.

Strategy Planning and Design

Our team designs the bot architecture, selecting algorithms and creating trading strategies that align with client objectives, whether for arbitrage, scalping, or long-term trading.

AI and Algorithm Development

Leveraging AI crypto trading bot development, we integrate machine learning models and advanced algorithms to enhance the bot’s decision-making capabilities, ensuring precise trade execution.

Data Collection and Market Analysis Integration

We incorporate real-time data collection tools, including WebSocket and REST APIs, along with advanced libraries like Pandas and TA-Lib, to support effective market analysis.

Bot Development and Testing

Our developers build the bot, combining high-performance coding and security protocols. Rigorous testing and backtesting with historical data verify the bot’s performance across different market conditions.

Exchange API and Bot Integration

Using bot integration services, we connect the bot to the chosen crypto exchanges, ensuring seamless trade execution through robust API connections.

Frontend and Dashboard Development

For clients who need it, we create a user-friendly interface with tools to monitor performance, track trades, and adjust settings, using platforms like React or Vue.js.

Deployment and Cloud Setup

Deploying the bot in a secure and scalable environment with AWS, Google Cloud, or Azure, we use Docker and Kubernetes for easy management and scalability.

Ongoing Support and Maintenance

After deployment, we provide continuous support, updates, and optimization, ensuring the bot performs reliably and meets evolving market conditions.

Ready to dominate the crypto market?

Build your custom trading bot with SoluLab and automate your profits today! Request a free demo to see how our crypto bots can boost your trading strategy.

Ready to dominate the crypto market?

Build your custom trading bot with SoluLab and automate your profits today! Request a free demo to see how our crypto bots can boost your trading strategy.

Why Choose SoluLab as Your Crypto Trading Bot Development Company?

SoluLab stands out as a trusted crypto trading bot development company dedicated to delivering high-performance, customized, and scalable trading solutions. With a focus on innovation and client satisfaction, we empower traders and businesses with the latest AI-driven tools to thrive in the fast-paced crypto market. Here’s why SoluLab is the right choice for your trading bot development needs:

24/7 Trading Across 10+ Crypto Exchanges

Our trading bots operate around the clock across leading cryptocurrency exchanges, enabling you to capture every trading opportunity without interruptions.

Integration with 100+ APIs

We support seamless integration with over 100 APIs, providing advanced connectivity to crypto exchanges, wallets, and real-time market data providers.

Proven Security and Compliance

Security is our top priority. Our bots come with multi-layered encryption and compliance with global trading standards to safeguard your assets and transactions.

Data-Driven Market Insights and Analytics

Empower your trading with actionable insights through advanced analytics, allowing precise decision-making based on real-time market data and trends.

Global Expertise in Crypto Development

With a strong foundation in crypto development, we provide efficient solutions that align with industry trends and trading demands.

What Our Clients Have to Say for Us

“Choosing SoluLab for our fintech software development was a wise decision. their team's expertise, attention to detail, and commitment to delivering a high quality solution impressed us. we couldn't be happier with the results”

David Thompson

CFO of FinTech Solutions Plus

“SoluLab proved to be the perfect partner for our fintech software development needs. their professionalism, timely communication, and exceptional technical skills ensured successful project delivery. ”

Sarah Johnson

CTO of FinTech Innovators

“Working with SoluLab for our fintech software development was a gamechanger. Their expertise and dedication resulted in a highly recommended solution that exceeded our expectations!”

John Smith

CEO of TechFin Solutions

Frequently Asked Questions

A crypto trading bot is a software program that automates the buying and selling of cryptocurrencies based on pre-set rules and algorithms. It works by analyzing market data, identifying profitable opportunities, and executing trades without human intervention, providing faster responses and better precision.

SoluLab offers extensive experience in AI-driven crypto trading bot development, with customized solutions for different trading strategies like arbitrage, scalping, and trend-following. We prioritize security, efficiency, and seamless integration with top exchanges, ensuring your bot is both reliable and high-performing.

Yes, we specialize in custom crypto trading bot development tailored to your specific requirements. Whether you’re looking to implement high-frequency trading, hedging strategies, or long-term holding, our team can design and build a bot that aligns with your trading objectives.

At SoluLab, we follow best practices for security, including API security, encryption, and multi-factor authentication, to safeguard your trading data and transactions. Additionally, we regularly perform audits to ensure compliance with the latest security standards.

We use a range of technologies based on the requirements, including Python, JavaScript (Node.js), TensorFlow, PyTorch, and integration with REST and WebSocket APIs. We also implement cloud infrastructure (AWS, Google Cloud) and containerization (Docker, Kubernetes) for scalability and reliability.

Yes, we offer comprehensive post-development support, including maintenance, updates, and performance optimization. Our team is available 24/7 to ensure your bot operates efficiently and stays responsive to market changes.

Absolutely. Our bot integration services enable smooth integration with multiple crypto exchanges, including popular ones like Binance, Coinbase, Kraken, and more. This allows you to diversify trading and maximize opportunities across various platforms.

The cost depends on factors like bot complexity, trading features, AI capabilities, and integration requirements. After an initial consultation, we provide a tailored quote based on your project’s specific needs and desired features.

Development time varies based on bot complexity and customization. Generally, it can take anywhere from a few weeks for a basic bot to several months for an advanced, AI-integrated bot. We provide a detailed timeline after analyzing the project scope.