Cryptocurrencies have effectively aligned with blockchain platform industry demands by addressing the general populace’s needs. In the early months of 2022, there existed many coins but, as of 2023, there were over 9,000. But keep in mind that many cryptocurrencies may not be all that important, there are more than 20,000 cryptocurrencies in existence because the process of creating a cryptocurrency is open and quite simple. Digital cryptocurrency is famously volatile yet exhibits considerable stability over a limited time frame. Even though the leading cryptocurrency market lacks sustainability and entails several dangers, most investors lack confidence in their assets. This is the primary obstacle hindering individuals from adopting cryptocurrency as a conventional payment method.

Meanwhile, stablecoins have entered the market. They have demonstrated potential as a viable alternative due to the volatility of cryptocurrency prices. The development of asset-backed stablecoins is a significant advancement. Stablecoins function as blockchain-based assets that exhibit little fluctuations. The crypto industry is inundated with asset-backed stablecoins, encompassing various varieties, practical applications, and other aspects. Many corporations create their coins and anchor them to additional valuable resources.

This blog will guide you through the basic concepts of stablecoins, What are asset-backed stablecoins, their characteristics, and their benefits.

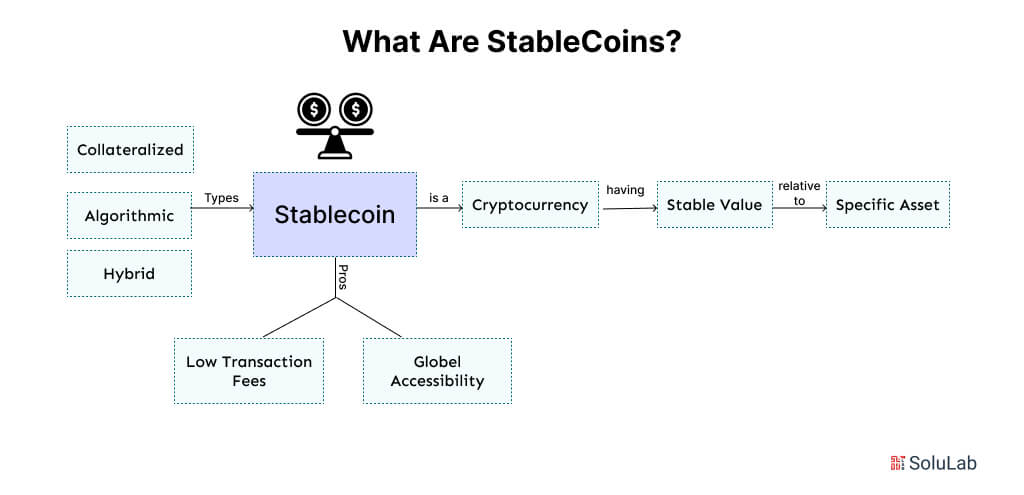

What are StableCoins?

Stablecoins retain their value compared to an asset. Traditional cryptocurrencies are volatile, whereas stablecoins offer price stability to carry out transactions and for savings. It exists in forms where collateralized involves real-world assets like fiat currencies or commodities. Algorithmic and smart contracts control supply and demand with no physical backing, and hybrid involve the balance of both stability and flexibility.

Pros of Using StableCoins:

1. Low Transaction Fees: for worldwide payments, stablecoins have lower transaction costs than typical payment methods.

2. Global Accessibility: Stablecoins enhance financial inclusion worldwide by providing a digital solution for internet users.

As they combine the benefits of cryptocurrencies with the inherent security of traditional assets, stablecoins are becoming more popular as financial tools.

What Does Asset-Backed Stable Coins Mean?

Stablecoins backed by assets provide investors with confidence in the age of decentralization by providing assets that are identifiable on an individualized basis. A wider acceptance and implementation of cryptocurrencies globally. The value of assets that support these cryptocurrencies, combined with the stability provided by the defi platform, exerts pressure for broader integration of cryptocurrencies into the global financial market.

Synthetic cryptocurrency on the other hand is intrinsically tied to physical goods, stablecoins backed by real assets, or standard financial securities as opposed to more basic cryptocurrencies like Bitcoin or Ethereum which are created purely out of thin air, and pure demand for their coins or tokens. This stimulates demand because with the help of this merger – both experienced and inexperienced investors will benefit from the fact that this combination takes the digital financial system to a new level of security, transparency, and verifiability.

Types of StableCoins

Before delving into the concepts of stablecoins here are the types of stablecoins:

-

Centralized StableCoins

Centralized stablecoins are conventionally supported by a fiat cast held in an off-chain bank account, which serves as the reserve backing for the on-chain tokens. TrueUSD and USDC are two instances of centralized stablecoins that utilize this approach. Centralized stablecoins may seek to peg their value to another asset, such as a commodity or index. Stablecoin designs often necessitate reliance on the custodian, however, Chainlink proof of reserve can offer robust transparency assurance via automated verification.

-

Digital Bank Currencies

Central bank digital currencies (CBDC) are another kind of digital asset akin to centralized stablecoins. Central bank digital currencies resemble centralized stablecoins, however, central banks issue them so they are not required to be backed by fiat currency in an off-chain bank account. CBDCs are recognized as legal cash by the issuing government and facilitate payments between individuals and institutions.

-

Decentralized StableCoins

Decentralized stablecoins utilizing an over-collateralized structure necessitate a blockchain price database to facilitate liquidations and maintain protocol solvency. LUSD is an immutable Defi protocol that allows users to collateralize their ETH at a 110% ratio mint the LUSD stablecoin. The protocol is supported by Chain Link pricing feeds, which deliver precise and high-quality pricing data utilized by concerned smart contracts. Asset-Backed Securities (ABS) vs. Mortgage-Backed Securities (MBS), a variant of decentralized stablecoins, generally do not maintain reserves, rather than employ smart contracts to establish a mechanism that preserves their peg for the next index with supply change or alternate ways.

Key Characteristics of Asset-Based StableCoins

Technologies such as Bitcoin and Ethereum which are conventional coins operate using blockchain technology. Asset-backed stablecoins are, however, real and backed by an asset. Nevertheless, they bring about a shift in the usage of digital assets. This list of traits of best asset-backed stablecoins includes some of the following:

1. Easy to Understand and Available

Asset-backed coins generally perform better than standard tokens in terms of clarity. As pointed out above, these tokens depend on real assets and thus they can be verified by a third party. It is beneficial to the users and investors because the value of their ABC shares is secured by some form of fixed assets.

2. Getting Rid of Risks

The above assets help relieve some of the risks typical for normal cryptocurrencies and support asset-backed cryptocurrencies lower. This is because these stablecoins have something real behind them, and as such have a little cushion in the falls of the market. However, the traditional cryptocurrency which has no underlying value attached to it can be easily manipulated by the market feeling and even bubbles.

3. Tangible Assets That Support

The major point of difference between asset-backed stablecoins and other cryptocurrencies is that stablecoins have actual assets, underlying them. Possibly, they are not completely digital like freely traded Bitcoin and other tokens in the market. Some of their values originate from real-world asset stablecoins, metals, fiat currency, and merchandise. These real reserves can certainly produce these stablecoins with a certain degree of stability and assurance because they are very much tied to the worth of the underlying assets.

4. Better Following of the Rules

Asset-backed cryptocurrencies are usually backed up by officials and regulators because they are associated with real assets. Real reserves will ensure that integration into current regulatory systems is eased because they add extra legitimacy and accountability.

Related: How to Create A Stablecoin?

5. Prices Staying the Same

They found that one of the major drawbacks of standard cryptocurrencies is volatility since their prices fluctuate constantly. There is a high possibility that the worth of freed coins floated in the market is significantly influenced by external factors, the attitude of investors, and market expectations. As with the asset-backed stablecoins, these businesses are more stable since they have low-base assets. The justification for ABCs is higher in comparison to other costs because the changes in the prices are directly proportional to the performance of the resources at issue.

6. Cases of Use and Utility

Unlike other kinds of cryptocurrencies, asset-backed ones are also usable and advantageous in other ways different from gambling and trading. It thus emerged that some of the ABCs might for instance facilitate cross-border transfers, establish and conduct business, or share ownership of assets. The following are real-life use cases that make ABCs more practical and achievable from being mere theoretical instruments to what they are.

Issuers of StableCoins

While over five hundred stablecoins are being utilized, two companies, Tether and Circle, release most of such assets. However, other issuers with a minor market share are already changing the relocation of stablecoins in one way or another. Here are the issuers of asset-backed stablecoins examples:

Tether (UDST)

Tether holds the largest market share in stablecoins and offers exceptional connectivity for many blockchains explaining why most stablecoins originate from it. Despite much controversy regarding Tether’s reserves and the company’s financial reporting, the business argues that it has undergone audits and conducts stress tests based on live market data. Tether stands as a reserve asset giant akin to large nations holding nearly $100 billion in US Treasury notes with the lion’s share from Cantor Fitzgerald.

Circle (USDC)

Circle is the second largest stablecoin by circulation in the market. Particularly, USDC has become famous for its weekly attestations of its reserves. The reserves give the users a high, transparent, and confident level because they are held in cash short-term U.S. government securities.

The Paxos

Besides Pax Dollar (USDP), Paxos also provides the underpinnings for PayPal USD (PYUSD), the various stablecoin offerings on a global level. Portfolio management practices and releasing the monthly attestation reports to affirm reserves are valued at Paxos since the company adopts the principle of openness to boost the clients’ confidence.

PayPal (USD)

PYUSD or PayPal USD, is PayPal’s stablecoin baby that was launched in conjunction with Paxos. The PYUSD has reserves from which it draws value and is meant to be a form of currency; it is managed by Paxos. The public can also get regular updates on the transparency reports.

The obvious flaw with fiat-backed stablecoins is demonstrated by a brief examination of the USDTs reserve breakdown. Users must constantly have faith that Tether won’t lose or abuse their money, which is against the fundamental principles of defi ecosystem and cryptocurrency. For instance, Tether’s earlier assertion that each USDT is backed by one USD has drawn harsh regulatory attention. In actuality, Tether has spread its reserves across riskier assets, including corporate debt and “other” investments.

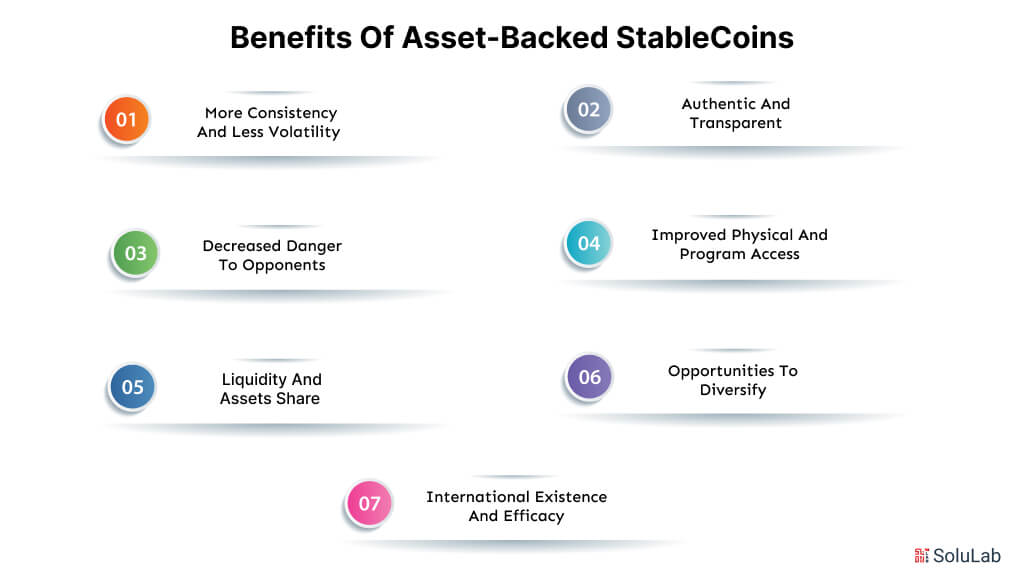

Benefits of Asset-Backed StableCoins

ABCs or asset-backed digital currencies, change the way digital money works by combining blockchain technology with real assets. This gives investors and customers around the world special benefits. People of all skill levels are interested in these advanced tools. Find out what the benefits of asset-backed stablecoins are:

-

More Consistency and Less Volatility

When compared with other cryptocurrencies, they are more stable because they are backed by real estate, rare metals, fiat currencies, and asset-backed cryptocurrencies. Investors are more confident in it because of the stability it offers and people who don’t like taking risks and are looking for reliable online stores are drawn to it.

-

Authentic and Transparent

Asset-backed stablecoins make the financial sector more verifiable and open because they keep real assets in reserve and allow public audits because these tokens’ value is closely tied to real assets, the fact that digital assets build trust and responsibility, leads more people to use and accept them.

-

Decreased Danger to Opponents

The concept of Asset-backed cryptocurrencies deals with the use of blockchain technology for P2P, while traditional financial systems introduce intermediaries to introduce counterparty risk. Smart contracts will limit cases of fraud or default because the conditions set have to be met – hence the completion of the needed tasks.

-

Improved Physical and Program Access

For people who cannot get any sort of financial services, the asset-backed cryptocurrency opens new financial opportunities. When these are acquired they can help marginalized individuals globally with little or no access to traditional banking facilities to become more economically active and financially included as all that is required to trade in these digital assets are a smartphone and an internet connection.

-

Liquidity and Assets Share

This essentially turns complex and large assets into smaller effective portfolios that may be easily traded because they make ownership of large assets possible when the assets are tokenized. This innovation democratizes investing since anyone is capable of owning a stake in attractive assets since blockchain-based exchanges have facilitated easy trade of these fractional tokens which increases the number of potential buyers.

-

Opportunities to Diversify

Asset-backed cryptocurrencies expand the investment choices to be between conventional assets, cryptocurrencies, and commodities. Robo-advice can also help to decrease risk and increase reward more effectively by diversifying a portfolio.

-

International Existence and Efficacy

Governments & corporations and others need asset-backed cryptocurrencies that can be easily used for cross-border transactions which ABCs offer, by deploying blockchain technology, the middlemen and their costs, the border are removed. This makes the processes of value transfer less expensive.

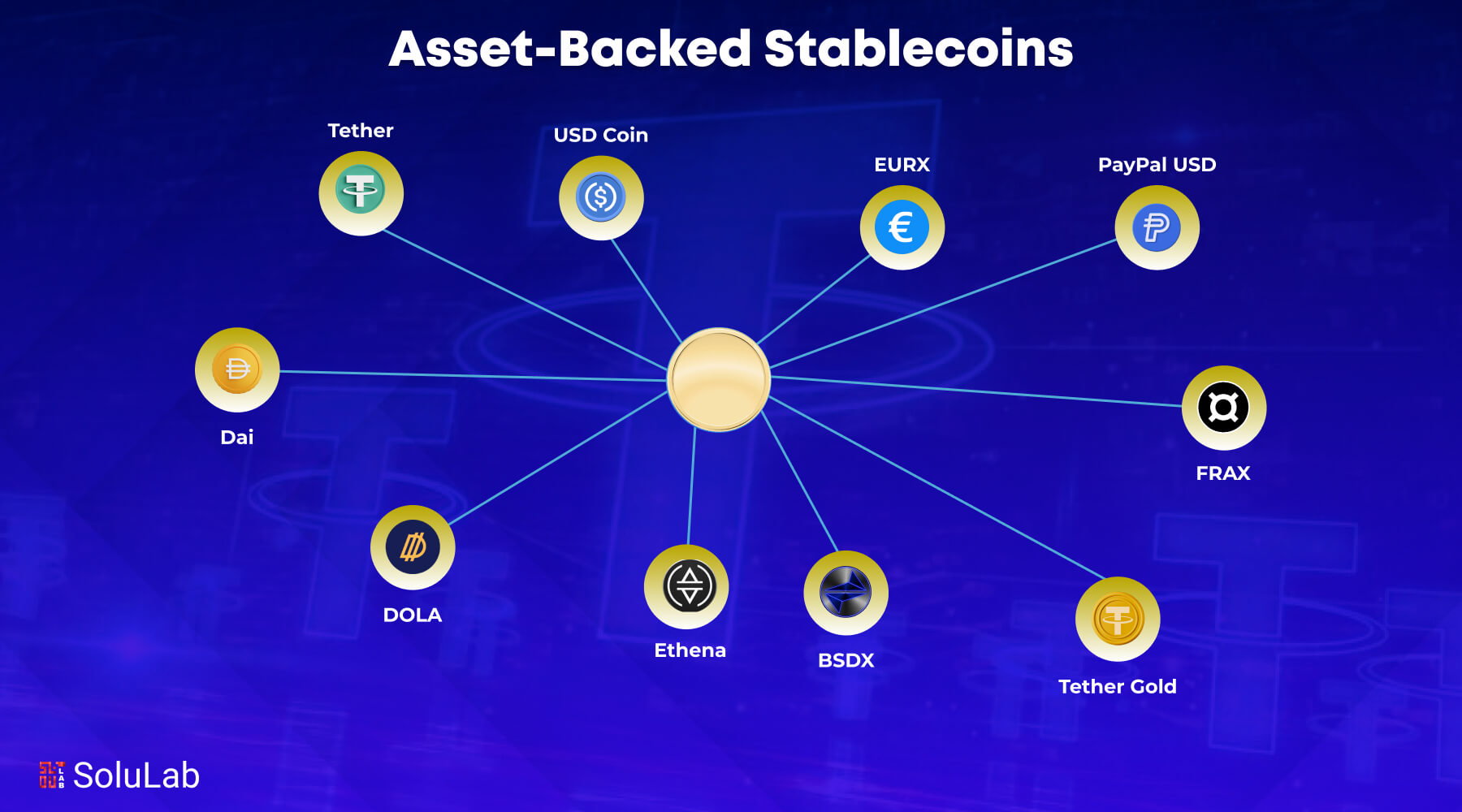

Top 10 Asset-Backed Stablecoins

Here is the list of Top 10 asset-backed stablecoins that you should be aware of:

- Tether

- USD Coin

- Dai

- Ethena

- FRAX

- PayPal USD

- BSDX

- Tether Gold

- EURX

- DOLA

Use Cases of Asset-Backed StableCoins

Stablecoins backed by digital assets have gained so much popularity recently due to their tremendous utility. In this regard, while stablecoins are also used similarly to bitcoins, they have more benefits on average. The emergence of crypto-backed stablecoins is often applied to store money, launch daily P2P transactions, and upgrade an exchange platform. Since their adoption does not require faith in future market growth and an impressive ability to crash, stablecoins are considered an excellent workhorse for mitigating the impact of a cryptocurrency fire sale. Here are the asset-backed stablecoins use cases:

1. Undo Harm Caused by Market Instability

The use of asset-backed stablecoin is being applied in practice, subsiding the harm realized from an extremely volatile Cryptoasset. To maintain the holding value investors can swap their depreciating cryptocurrency to asset-backed stable coins. Even this trading method can be compared to investing in random markets such as gold. For example, without leaving the crypto market, traders can reduce their risks using stablecoins.

2. Typical Transactions

Stablecoin wallets are just like a normal currency where you can spend your wallet in anything possible. When it comes to fast and cheap money transfers, stablecoins are the best means both for sending money to relatives overseas and for buying coffee in the morning.

3. Trading Cryptocurrencies

To help you with this, there is a company known as Crypto Backed Stablecoin Development. Alas, there are not many exchanges that accept fiat coins because of strict regulations, though. In a way, the users can dispose of the traditional asset exchange market with the help of stablecoins tied to the rate of the US dollar. This way businesses benefit, making cryptocurrency trading profitable.

4. Regular Payments

Subsequently, through smart financial contracts which are common in blockchain-based systems, stablecoins become enforceable. These smart contracts are ideal for use in automating recurrent payments because they are digital agreements that are task-specific. A Asset Backed Stable Coin: is transparent, irreversible, and can be tracked, a fact that many of you might find interesting. Regarding paying salaries, loans, rent subscriptions, and other operational expenses, this manner is highly effective.

What is the Future of Asset-Backed StableCoins?

Given the immense possible functions that assist traditional banking with the rapidly growing cryptocurrency market, it’s clear that the predictions of asset-backed stablecoins are looking quite promising. The general spikes in value and fluctuations which are seen in the various digital currencies such as in the case of Bitcoin, are somewhat reduced because these virtual currencies are anchored on more stable forms of money or even on precious metals or physical cash. The future of asset-backed stablecoins is expected to become more significant in numerous financial use cases since the demand for stable and secure digital currencies increases.

The number, nature, and trends of their rules are one factor they have affecting their future. To ensure that users are willing to exchange fiat currencies for stablecoins due to assurance that the activities of these companies are transparent in finality, authorities including the U.S. Federal Reserve are pushing for well-developed laws covering stablecoins. There is also the possibility of this regulatory drive shaping the management and form of innovation these coins may also promote.

Likewise, the stablecoin market is experiencing evolution due to the competition of multiple issuers. To enhance general efficiency for cross-border transactions, banking institutions are now fragmenting deposits as more stable digital coins. This tendency would lead to a varied environment as many stablecoins correspond to certain user requirements. As market conditions, legislation, and technological advances put pressure on the market to change, asset-backed stablecoins are advertised as being vital components of the new financial world.

How is SoluLab Making Use of Digital Money Easier?

Asset-backed stablecoins have changed the financial industry on the whole. In the coming years with the adoption of the new blockchain-based financial systems, the asset and crypto-currency model will help redefine the existing world economy and thereby paving for Debut Infotech for a safer financial future. ABSCs do not only hold value and serve as media of exchange, and promote responsibility but also go an extra mile in stabilizing the cryptocurrency market, because of this, the procedure must initiate a creative approach.

SoluLab a Stablecoin Development Company, can help you develop and go through more creative and developed solutions that just fit right with your needs and preferences and turn your vision into reality. Our expertise in establishing safe, modern technologies, and scalable blockchain platforms helps firms create custom asset-backed stablecoins.

Contact us right away to set into the future of finance!

FAQs

1. What are asset-backed stablecoins?

Asset-supported stablecoins keep reserves in assets that are not on the blockchain. While some may retain commodities like gold reserves, the safest option might be the one that holds the fiat money in the regulated account.

2. How do these stablecoins make a profit?

Transaction fees collected from users who purchase, sell, or trade stablecoins on exchanges are typically how these stablecoins make money. They can also generate interest on reserves.

3. Which stablecoin can be backed by Gold?

PAX GOLD is the stablecoin which is backed by gold, one troy ounce of gold kept in a safe vault is represented by each PAXG. Another stablecoin that is backed by gold is TETHER GOLD.

4. Most stablecoins pegged assets are?

Stablecoins can be backed by algorithms to regulate supply, a currency like the US dollar, or the commodity’s price like gold are what these stablecoins are most pegged to. They keep reserved assets on hand as collateral.

5. How is Solulab helping businesses with asset-backed stablecoins?

Solulab uses advanced technologies for creating stable, transparent, and compliant asset-backed stablecoins. In the changing digital financial landscape, our customized solutions help businesses succeed.