Real estate and blockchain technology are coming together to change how we handle property transactions. As the global real estate market grows, there’s a need for faster, safer, and more transparent ways to buy and sell. Stablecoins—digital currencies tied to fiat money or assets—are the best to buy and sell. They make transactions easier, faster, and less risky by reducing fraud and exchange rate issues.

In 2024, the global market for real estate tokenization using blockchain and stablecoins was worth $3.8 billion. It’s expected to grow at a 2.9% CAGR and could hit $26 billion by 2030.

This blog will explain how stablecoins can transform real estate. Moreover, you’ll learn about their use in property purchases, rent payments, mortgages, and even owning a share of a property on a blockchain platform.

We’ll also cover the benefits of stablecoins, how they solve problems in traditional methods, the top stablecoins in the market, and their future in real estate. By understanding these trends, businesses and investors can stay ahead of their competitors.

Overview of Stablecoin Development in Transforming Real Estate Transactions

The demand for stablecoins in real estate transactions is growing, and there are clear reasons why. Stablecoins reduce volatility and make it a reliable option compared to traditional cryptocurrencies. This stability is vital for real estate deals, where price predictability matters.

However, they also speed up and cut costs for international payments. Also, avoid the high fees and delays often seen in cross-border transactions. With smart contracts, stablecoins enable money, automating agreements and cutting out middlemen for better efficiency. Blockchain use cases like these showcase the potential for transforming financial systems.

Blockchain technology adds transparency, building trust among all parties. Plus, stablecoins are accessible worldwide, inviting more investors into the real estate market. They support legal compliance and improve liquidity by enabling fractional property ownership. Together, these benefits are driving stablecoin adoption in real estate.

Can Stablecoins Address The Pain Points of Conventional Real Estate Transactions?

Stablecoin solutions can improve real estate transactions. They tackle key issues in the traditional process and make things simpler.

Using blockchain, stablecoins speed up transactions, make them secure, and cut out inefficiencies. No more long delays or relying on middlemen for settlements—it’s all transparent and makes processes easier with a smart contract platform.

They also make cross-border deals easier, breaking jurisdictional barriers and boosting trust between international buyers and sellers.

Challenges Faced By Traditional Real Estate Transactional Systems

The traditional real estate transaction process can feel hectic, full of delays and endless paperwork that frustrates both buyers and sellers. Let’s break down the key challenges that make property deals so complicated.

The settlement process takes too long to complete. Property closings can stretch to 30-60 days or more—leaving everyone waiting. Banks, title companies, and other intermediaries add layers of processing time, turning a simple transaction into a lengthy deal.

Then there are the costs. Real estate deals come with hefty fees—wire transfers, currency conversions, title insurance, and administrative expenses too. These can easily total thousands of dollars, reducing profits for sellers and increasing buyers’ expenses.

Even, paper-based documentation slows everything down. Physical documents require manual verification, in-person signatures, and physical storage. This adds time and risk, as documents can be lost or damaged. Blockchain smart contract solutions can streamline these processes by enabling secure, automated, and digital transactions.

Cross-border transactions are even more complex. Different legal systems, currency exchanges, and regulations create hurdles. Wire transfers between countries take days, and fluctuating exchange rates can impact the final deal.

Trust and verification are also major issues. Buyers and sellers rely on intermediaries to verify ownership and ensure clear titles, which adds costs and delays if something goes wrong.

Finally, the lack of transparency in the process keeps everyone in the dark. Without real-time updates, both parties are stuck chasing stakeholders to figure out the status of their transactions.

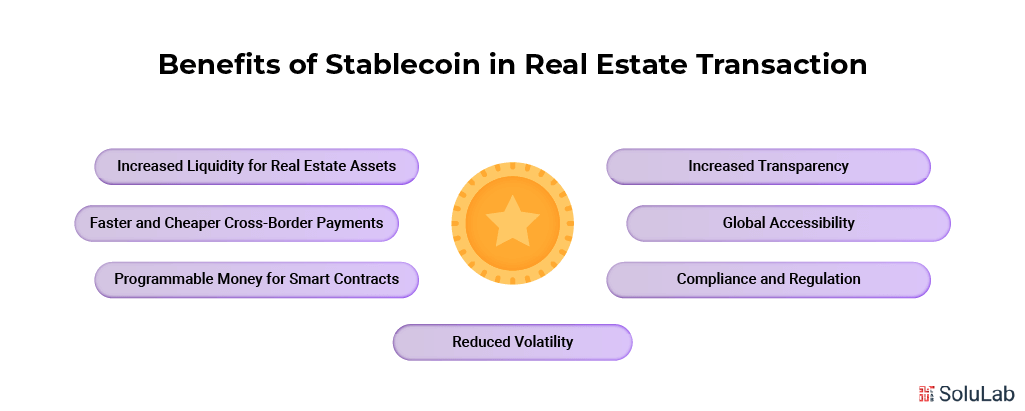

Benefits of Stablecoin Development Solutions in Real Estate Financial Transaction

Asset-backed Stablecoins are real estate transactions by offer a perfect blend of cryptocurrency innovation and traditional financial stability, making property deals more efficient, transparent, and accessible globally.

1. Reduced Volatility

Unlike traditional cryptocurrencies, stablecoins maintain a steady value by being pegged to stable assets, typically the US dollar. This stability makes them particularly attractive for real estate transactions where price predictability is crucial. Property buyers and sellers can confidently negotiate deals without worrying about sudden value fluctuations during the transaction period.

Read Also: Stablecoin Development on Solana

2. Faster and Cheaper Cross-Border Payments

Real estate transactions involving international parties traditionally face delays and high fees through conventional banking channels. Stablecoins eliminate these barriers by enabling near-instantaneous settlements at a fraction of the cost. A transaction that might take days and cost hundreds in bank fees can be completed in minutes for minimal fees.

3. Programmable Money for Smart Contracts

Smart contracts powered by stablecoins automate many aspects of real estate transactions. These self-executing contracts can handle everything from initial deposits to final payments, reducing the need for intermediaries and minimizing human error. Rental payments can be automated, and escrow services can be programmed to release funds only when specific conditions are met.

4. Increased Transparency

Every stablecoin transaction is recorded on a blockchain, creating an immutable audit trail. This transparency helps prevent fraud and simplifies due diligence processes. Buyers, sellers, and other stakeholders can easily verify transaction histories and property ownership records.

5. Global Accessibility

Stablecoins break down geographical barriers in real estate investment. Now, investors from any part of the world can participate in property deals without worrying about currency exchange complications or banking restrictions. This increased accessibility helps create a more inclusive real estate market.

6. Compliance and Regulation

Modern stablecoin platforms incorporate robust KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols, making it easier for real estate transactions to comply with regulatory requirements while maintaining efficiency.

7. Increased Liquidity for Real Estate Assets

Stablecoins enable fractional ownership of properties through tokenization, making real estate investments more liquid and accessible to a broader range of investors. This increased liquidity can help property owners access capital more easily.

How Does Stablecoin Development Help Safeguard Real Estate Investments Against Inflation?

Stablecoins are a powerful tool for protecting real estate investments from inflationary pressures while maintaining flexibility and control over assets.

- Hedging Against Inflation: Stablecoins pegged to stable assets provide a reliable store of value during inflationary periods. By converting real estate profits into stablecoins, investors can protect their returns from local currency devaluation while maintaining the flexibility to reinvest quickly when opportunities arise.

- Preserving Value: The stable nature of these digital assets helps maintain the purchasing power of real estate investments. Unlike traditional fiat currencies that may lose value over time, properly backed stablecoins maintain their worth, providing a reliable medium for storing real estate value.

- Facilitating Quick Transactions: When market conditions change, stablecoins enable investors to move quickly. Whether it’s taking advantage of new opportunities or protecting assets during market downturns, the speed of stablecoin transactions gives investors unprecedented agility.

- Integration with Tokenized Real Estate: The combination of stablecoins and tokenized real estate creates new opportunities for portfolio diversification. Investors can easily rebalance their holdings and maintain optimal exposure to different property types and markets.

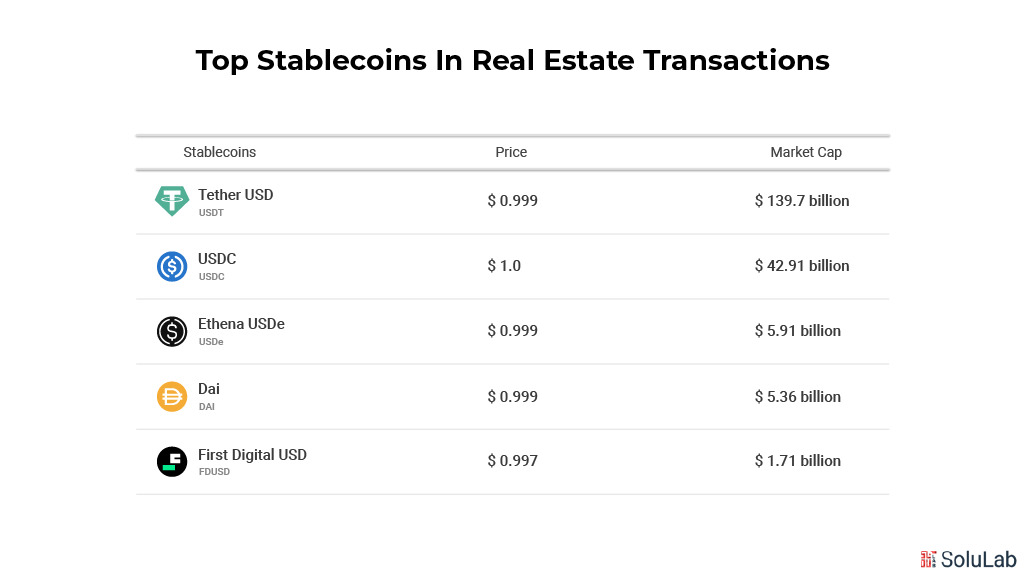

Top-Performing Stablecoins Used In Real Estate Transactions

The real estate market has embraced several reliable stablecoin options, each offering unique advantages for property transactions and investment management.

- USDT (Tether): As the most used stablecoin, Tether offers high liquidity and broad market acceptance. Its extensive trading pairs make it particularly useful for international real estate transactions, though users should stay informed about its reserve backing. Additionally, the growing popularity of cryptocurrency coin options like Tether is shaping the future of cross-border transactions.

- USDC (USD Coin): Known for its strong regulatory compliance and transparent backing, USDC has gained significant trust in real estate circles. Its regular audits and institutional backing make it a preferred choice for large property transactions.

- DAI (Dai): This decentralized stablecoin offers unique advantages through its crypto-collateralized structure. Its stability mechanism makes it particularly attractive for smart contract-based real estate transactions.

- BSC-USD (Binance Peg): Operating on the Binance Smart Chain, this stablecoin offers low transaction fees and fast settlement times, making it popular for smaller real estate transactions and rental payments.y

- USDE (Ethena): A newer entrant to the market, USDE is gaining attention for its innovative stability mechanism and focus on institutional use cases in real estate.

Conclusion

The integration of stablecoins into real estate transactions is significant in property markets. These digital assets address many traditional pain points while showing new possibilities for investment and management. As technology improves and grows every day, we can expect stablecoins to become an integral part of real estate finance.

As more real estate professionals recognize the efficiency and security benefits of stablecoin solutions. While challenges remain, particularly around regulation and standardization, the advantages of stablecoins in real estate are too significant to ignore.

When Crypto Mining, an e-commerce platform for mining hardware, wanted to simplify global transactions and improve accessibility, SoluLab a Stablecoin development company helped them develop a blockchain-based marketplace powered by smart contracts, ensuring secure, transparent, and fast transactions. By automating processes and reducing intermediaries, we helped them create a user-friendly platform that connects miners worldwide with top-notch security and minimal costs.

FAQs

1. How do stablecoins maintain their value in real estate transactions?

Stablecoins maintain value through various mechanisms, primarily by being pegged to stable assets like the US dollar and maintained through collateralization.

2. What are the tax implications of using stablecoins in real estate?

Tax treatment varies by jurisdiction, but generally, stablecoin transactions are subject to the same tax rules as traditional real estate transactions.

3. How secure are stablecoin transactions for real estate purchases?

Stablecoin transactions utilize blockchain technology, offering high security through cryptographic protection and immutable record-keeping. Additionally, AI stablecoin development is the way to even more innovative and secure solutions in this space.

4. Can stablecoins be used for rental payments?

Yes, stablecoins can be used for rental payments, often automated through smart contracts for increased efficiency.

5. What happens if a stablecoin loses its peg during a real estate transaction?

Most real estate smart contracts include provisions for such situations, often allowing for transaction reversal or adjustment.