Cryptocurrency has been available for more than a decade and has been utilized as a form of transaction and payment in a variety of organizations, including B2B online firms, but it is far more commonly employed in B2C settings.

The first cryptocurrency, eCash, was micro-implemented in the 1990s. However, cryptocurrency did not gain traction until 2009, when Bitcoin was launched. Stable cryptocurrency currencies appeared a few years later, in 2014, when the first successful stablecoin, Tether, was established.

Since then, the number of normal cryptocurrencies and stablecoins has increased as more individuals and companies use them. According to the latest source, stablecoins now account for around 10% of the overall cryptocurrency market, as assessed by market capitalization. While the stablecoin market contracted following the 2022 cryptocurrency meltdown, total market capitalization and trade volumes are now nearly back to their 2022 highs. Global companies including SAP, PayPal, and Visa are now using stablecoins for business as an alternate payment and settlement option.

In this article, we will go over the fundamentals of stablecoins, including what they are, the many types of stablecoins the benefits they provide, and how organizations may use stablecoins for B2B payments with the least work and risk.

What is a Stablecoin?

A stablecoin is a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset, such as a fiat currency (like the US dollar), precious metals, or even other assets. Unlike traditional cryptocurrencies, which can have extreme price fluctuations, stablecoins provide price stability, making them ideal for business and enterprise use.

Using stablecoins in business payments is gaining traction because they offer faster, more cost-effective cross-border transactions compared to traditional banking systems. Businesses can send and receive payments without worrying about currency conversion fees or delays, improving cash flow and efficiency.

Enterprise stablecoin solutions are also transforming how large organizations handle transactions. By leveraging stablecoins, enterprises can automate payments, streamline accounting processes, and ensure transparency across their financial operations.

For companies looking to implement such solutions, stablecoin development for B2B payments provides customized systems tailored to specific business needs. These solutions ensure secure, real-time payments, reduce transaction costs, and simplify international trade, making stablecoins a game-changer for B2B transactions.

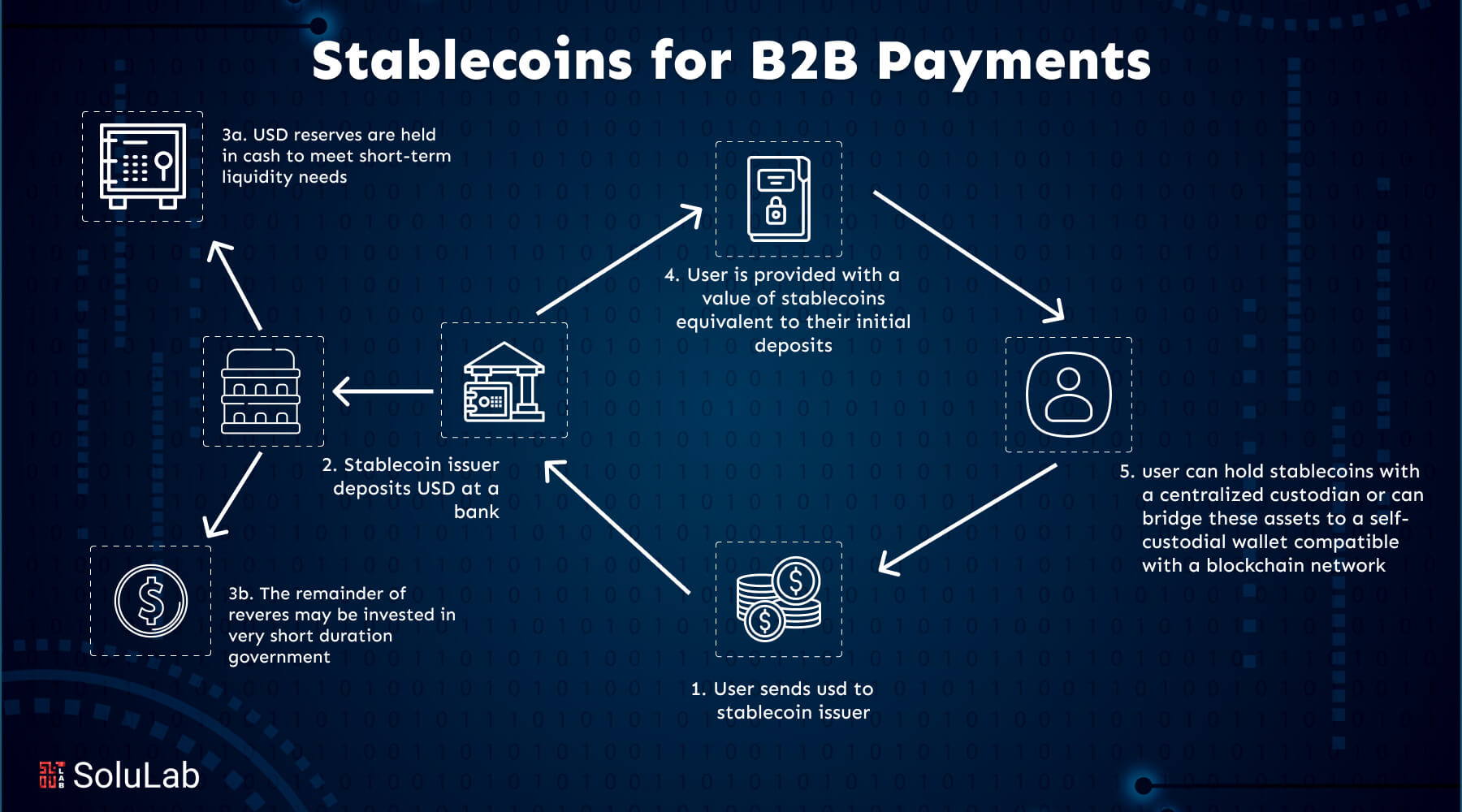

How Stablecoins Work for B2B?

Stablecoins are impacting B2B payments by providing a fast, secure, and cost-effective alternative to traditional payment methods. Unlike volatile cryptocurrencies, stablecoins maintain a consistent value, making them ideal for business-to-business (B2B) transactions. Through stablecoin-based B2B payment systems, businesses can streamline cross-border payments, reduce transaction fees, and avoid delays often associated with traditional banking.

Here’s how stablecoins work for B2B:

1. Instant Settlements: With a stablecoin payment gateway for B2B, transactions settle in real-time, eliminating delays in payment processing and improving cash flow management.

2. Lower Transaction Costs: Stablecoin payments bypass intermediaries like banks, reducing transaction fees and ensuring cost savings for businesses.

3. Global Accessibility: Stablecoin integration for businesses enables seamless cross-border payments without the hassle of currency exchange or high conversion rates.

4. Transparency and Security: Transactions are recorded on the blockchain, offering complete transparency, traceability, and robust security for B2B payments.

5. Simplified Integration: Businesses can easily integrate stablecoin solutions into their existing systems, providing a smooth transition to modern payment infrastructure.

By adopting stablecoin-based payment systems, businesses can enhance operational efficiency, minimize costs, and facilitate secure, scalable B2B transactions globally.

Types of Stablecoins

Stablecoins are digital currencies that operate within the blockchain ecosystem. They can be categorized based on their collateral structures, which determine their stability and use cases. Understanding these types of stablecoins helps businesses make informed decisions when exploring why businesses use stablecoins for payments, investments, and operational efficiency.

1. Fiat-Collateralized Stablecoins

Fiat-collateralized stablecoins are the most common and straightforward type of stablecoin. These stablecoins are backed by fiat currencies such as the US Dollar, Euro, or GBP on a 1:1 ratio. This means that for every stablecoin issued, an equivalent amount of fiat currency is held in reserve.

When a user redeems fiat-backed stablecoins, the managing entity withdraws the corresponding amount of fiat currency from the reserve and transfers it to the user’s bank account. Simultaneously, the equivalent amount of stablecoins is removed from circulation or burned.

The simplicity of fiat-backed stablecoins makes them ideal for businesses and beginners exploring why businesses use stablecoins. Their stability is tied to the strength of the fiat currency and the underlying economy, ensuring minimal price fluctuation. This stability promotes confidence and encourages broader adoption of stablecoins.

2. Commodity-Backed Stablecoins

Commodity-backed stablecoins are supported by interchangeable physical assets, such as precious metals (e.g., gold), real estate, or oil. Among these, gold is the most commonly used collateral for this stablecoin type.

With commodity-backed stablecoins, users essentially own tangible assets with intrinsic value. This offers a significant advantage compared to volatile cryptocurrencies. These stablecoins also allow investors worldwide to access commodities traditionally reserved for high-net-worth individuals, such as gold or real estate, providing a democratized investment opportunity.

For example, Digix Gold (DGX) represents one gram of physical gold held in a reserve in Singapore. Similarly, the Tiberius Coin (TCX) is backed by seven different precious metals, and SwissRealCoin (SRC) is tied to Swiss real estate. Businesses may adopt commodity-backed stablecoins to hedge against market volatility and benefit from asset appreciation, further supporting why businesses use stablecoins.

3. Crypto-Collateralized Stablecoins

Crypto-backed stablecoins may seem counterintuitive due to the volatility of cryptocurrencies. However, these stablecoins achieve stability through over-collateralization. Businesses can lock in cryptocurrency (e.g., Ether) worth more than the value of the issued stablecoins to absorb potential price fluctuations.

For instance, if $1,000 worth of Ether is deposited to issue $500 worth of stablecoins, the over-collateralization ensures stability even if the price drops by 25%. In cases of extreme price drops, the stablecoin system triggers liquidation to maintain value.

Crypto-collateralized stablecoins are fully decentralized, making them ideal for businesses prioritizing security, transparency, and trustlessness. Some models even use multiple cryptocurrencies as collateral to distribute risk effectively. However, these types of stablecoins are complex to implement, requiring careful planning for businesses integrating them into financial operations.

4. Algorithmic Stablecoins

Algorithmic stablecoins are unique as they are not backed by any collateral. Instead, they rely on algorithms to control the supply and demand of stablecoins, maintaining price stability. This model, also known as “seigniorage shares,” ensures that new coins are created when demand increases to lower prices, and coins are bought back to reduce supply when prices fall.

Algorithmic stablecoins are highly decentralized and operate independently without reliance on external assets. However, their success depends on consistent market growth and liquidity. If market conditions fail, algorithmic stablecoins can collapse, leading to significant losses.

Despite the risks, algorithmic stablecoins highlight innovation in the blockchain ecosystem. Businesses exploring why businesses use stablecoins might consider algorithmic models for their decentralization and independence, but these require careful risk assessment.

By understanding the various types of stablecoins—fiat-collateralized, commodity-backed, crypto-backed, and algorithmic stablecoins—businesses can identify the most suitable options for payments, investments, and operational efficiency. Stablecoins offer stability, transparency, and cost-effectiveness, which are critical reasons why businesses use stablecoins in modern financial systems.

Best Stablecoins for Businesses

When it comes to using stablecoins in business operations, selecting the right stablecoin is crucial for ensuring stability, security, and efficiency. Stablecoins can simplify cross-border payments, reduce transaction costs, and improve financial processes, which is why they are increasingly adopted by enterprises. Here are some of the best stablecoins for businesses:

-

USDC (USD Coin)

USDC is a fiat-collateralized stablecoin backed 1:1 by the US Dollar. It is one of the most trusted stablecoins, widely adopted by businesses for B2B payments and cross-border transactions. With regular audits and high transparency, USDC ensures reliability and security, making it an excellent choice for companies seeking stable digital payments.

-

USDT (Tether)

Tether (USDT) is another leading fiat-backed stablecoin pegged to the US Dollar. It is widely used in business transactions due to its high liquidity and compatibility across multiple blockchain networks. For businesses looking to implement a stablecoin payment gateway for B2B, USDT offers speed, low fees, and extensive market acceptance.

-

DAI

DAI is a crypto-backed stablecoin maintained by the MakerDAO system. It is over-collateralized with various cryptocurrencies, ensuring decentralization and transparency. Businesses exploring decentralized solutions can use DAI for cross-border payments or integrate stablecoin solutions without reliance on traditional financial systems.

-

BUSD (Binance USD)

BUSD is a fiat-collateralized stablecoin regulated and approved by financial authorities, offering strong credibility for businesses. Its integration with the Binance ecosystem makes it ideal for enterprises seeking stablecoin integration for businesses that require scalability, compliance, and fast settlements.

-

PAX Gold (PAXG)

PAXG is a commodity-backed stablecoin pegged to physical gold. Businesses can leverage PAXG for secure, tangible value storage or as a hedge against economic instability. For enterprises dealing with international trade or wealth preservation, PAXG provides unique opportunities to integrate stable, asset-backed digital payments with the help of asset-backed stablecoins.

-

EUROC (Euro Coin)

For businesses operating in Europe or dealing with Euro-based transactions, EUROC offers a reliable fiat-backed stablecoin pegged to the Euro. It simplifies transactions within the European market while reducing the complexities of currency conversions.

How Stablecoin Development Enhances B2B Payment Systems?

Stablecoin development is transforming the way businesses handle B2B payments by providing faster, cost-effective, and secure financial solutions. With the limitations of traditional banking systems—such as high transaction fees, lengthy settlement times, and currency conversion challenges—stablecoin-based systems offer a modern alternative that aligns with global business demands.

Here’s how AI stablecoin development supports B2B payments:

1. Instant Cross-Border Transactions: Stablecoins enable real-time settlements across borders, eliminating delays caused by intermediaries. Businesses can transfer funds instantly, improving cash flow and operational efficiency.

2. Lower Transaction Costs: Traditional payment systems often involve high fees for international transactions. AI-powered stablecoin development reduces these costs by cutting out banks and intermediaries, making B2B payments more affordable.

3. Stability and Predictability: Unlike volatile cryptocurrencies, stablecoins maintain a consistent value, ensuring businesses can rely on them for predictable and stable financial transactions. This makes them ideal for long-term agreements and recurring payments.

4. Seamless Integration: Stablecoin integration for businesses allows enterprises to incorporate stablecoin solutions into existing financial systems or ERPs, providing a smooth and scalable transition to blockchain-based payments.

5. Transparency and Security: Stablecoins operate on blockchain technology, ensuring every transaction is recorded securely and transparently. Businesses benefit from enhanced trust and traceability, reducing risks of fraud.

6. Improved Liquidity: Stablecoins offer businesses access to instant liquidity without waiting for bank approvals, helping enterprises manage operations more efficiently.

By using a stablecoin payment gateway for B2B, stablecoin in DeFi, and tailored stablecoin-based B2B payment systems, businesses can streamline their payment processes, save on operational costs, and ensure faster, more reliable transactions. As stablecoin development evolves, it is set to redefine the future of B2B payments, delivering unparalleled efficiency and global accessibility.

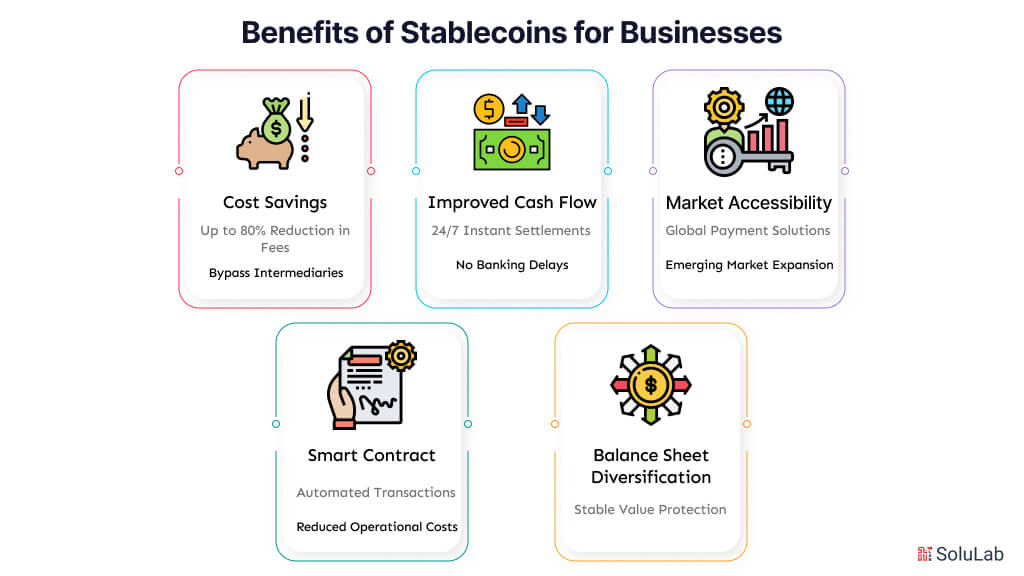

Benefits of Stablecoins for Businesses

Stablecoins are increasingly becoming a go-to solution for businesses seeking faster, cost-effective, and reliable payment methods. As digital currencies built on blockchain technology, they address many challenges associated with traditional financial systems, such as high transaction costs, slow settlement times, and limited accessibility. The ability to provide stability, global reach, and integration with smart contracts makes stablecoins a valuable tool for modern businesses looking to optimize their operations and financial strategies.

Here are the key benefits of stablecoins for businesses:

1. Cost Savings: Leading stablecoins operate on decentralized blockchains, enabling businesses to bypass traditional intermediaries, expensive currency conversions, and stringent compliance-related costs. Research shows that remittance fees in foreign exchange markets can be reduced by up to 80% using stablecoins. Even when bridging fiat transactions (on- and off-ramping) through third parties, significant savings are achievable. For instance, moving funds from Southeast Asia to Europe can be 3-4 times cheaper than using the SWIFT network, while transfers from Africa to Europe can cost 5-10 times less. High-volume businesses with lower risk profiles can also secure more competitive rates.

2. Improved Cash Flow: Cash flow is a critical challenge for businesses, and slow payment settlement exacerbates the issue, especially for cross-border transactions. Traditional payments often pass through multiple intermediary banks and face foreign exchange (FX) delays. In contrast, stablecoins operate 24/7, free from such bottlenecks, enabling near-instant settlements. This ensures businesses have the working capital they need, improving financial planning and operational efficiency.

3. Enhanced Market Accessibility: Stablecoins provide a reliable alternative payment system in regions with underdeveloped banking infrastructure or restricted access to traditional banking services. Businesses selling into emerging markets benefit from improved payment options, while local recipients can access a wider variety of goods and services. This expanded market reach drives growth and inclusion.

4. Automation and Smart Contract Integration: Stablecoins integrate seamlessly with smart contracts, which automate payment terms and conditions. By leveraging smart contracts, businesses can streamline settlement processes, reduce manual errors, and lower operating costs. This automation ensures payments are executed faster, more accurately, and with minimal administrative overhead.

5. Balance Sheet Diversification: Stablecoins offer businesses a stable and reliable alternative to fiat currencies, particularly in regions affected by inflation, economic instability, or restricted access to tier-1 currencies like the US Dollar. By holding stablecoins, businesses can safeguard their assets and diversify their balance sheets, ensuring a dependable store of value and reducing exposure to market volatility.

The adoption of stablecoins allows businesses to reduce costs, access new markets, and enhance liquidity, making them a transformative tool for global trade and operational efficiency.

Risks of Using Stablecoins for Businesses

While stablecoins offer numerous benefits for businesses, such as faster transactions and lower costs, they also come with certain risks that organizations must consider before adoption. These risks can impact the reliability and efficiency of stablecoin-based B2B payment systems and the overall success of stablecoin development for B2B payments.

1. Regulatory Uncertainty

Stablecoins operate in a space that is still evolving in terms of regulation. Governments and financial authorities are implementing or planning stricter rules, which could impact the availability and usability of stablecoins. Businesses relying on stablecoin-based B2B payment systems may face challenges in compliance, especially across different jurisdictions.

2. Collateral Risks

The stability of a stablecoin depends on the collateral backing it. For example:

- Fiat-backed stablecoins require reserves to be audited and maintained transparently. A lack of proper reserve management could lead to trust issues.

- Crypto-backed stablecoins face the inherent volatility of cryptocurrency markets, which may threaten over-collateralized structures.

- Algorithmic stablecoins are riskier as they rely on demand-supply algorithms and can collapse if market conditions deteriorate.

These risks could undermine confidence in stablecoin development for B2B payments, particularly for businesses that depend on stablecoin stability.

3. Counterparty Risk

Businesses adopting stablecoins are often dependent on third-party providers, such as exchanges, wallet providers, or platforms that facilitate stablecoin integration. Any failure, mismanagement, or security breach on the part of these intermediaries could result in financial losses and operational disruptions.

4. Security and Fraud

While blockchain technology offers robust security, stablecoins remain vulnerable to cyberattacks, hacking, and fraudulent activities. Businesses implementing stablecoin-based B2B payment systems need to prioritize secure infrastructure and wallet management to mitigate these risks.

5. Liquidity Challenges

Certain stablecoins may face liquidity issues, particularly during periods of market stress or regulatory scrutiny. Businesses using less established stablecoins might struggle to convert stablecoins into fiat currencies or other assets when needed.

6. Dependence on Technology

Stablecoin adoption requires technical infrastructure, including wallets, smart contracts, and blockchain platforms. Any disruptions, such as network congestion, protocol errors, or software bugs, could delay payments and affect business operations.

How Businesses Can Begin Using Stablecoins for B2B Payments?

Adopting stablecoins for B2B payments can offer businesses faster transactions, reduced costs, and enhanced cross-border payment efficiency. However, transitioning to a stablecoin-based payment system requires a structured approach to ensure smooth integration and minimal risk. Here’s a step-by-step guide to help businesses get started with stablecoins for B2B payments:

1. Identify Business Use Cases

Before adopting stablecoins, businesses should evaluate where they can add value. Use cases may include cross-border payments, supplier settlements, employee payouts, or holding reserves as a hedge against inflation. Clearly identifying objectives will help align stablecoin adoption with business goals.

2. Choose the Right Stablecoin

Selecting the appropriate stablecoin is crucial. Businesses should consider factors such as:

-

Stability and collateral type (fiat-backed, crypto-backed, or commodity-backed).

-

Regulatory compliance in target regions.

-

Transparency and auditing of reserves.

Popular options like USDC, USDT, and DAI are widely adopted in stablecoin-based B2B payment systems due to their liquidity and reliability.

3. Partner with a Stablecoin Payment Gateway

Businesses need to integrate a stablecoin payment gateway for B2B transactions to send and receive payments. Payment gateways enable seamless integration with existing financial systems and provide secure wallet infrastructure. Platforms like Circle, Binance Pay, or BitPay offer robust solutions for B2B payments.

4. Ensure Regulatory Compliance

Stablecoin adoption comes with varying regulatory requirements across jurisdictions. Businesses must work with legal and compliance teams to ensure adherence to anti-money laundering (AML), know-your-customer (KYC), and tax regulations to avoid potential legal risks.

5. Set Up Secure Wallets and Infrastructure

To send, receive, and hold stablecoins, businesses must set up secure digital wallets. Options include custodial wallets (managed by third-party providers) or non-custodial wallets for greater control. Ensuring wallet security through encryption and multi-signature authentication is critical for minimizing fraud risks.

6. Educate Teams and Partners

Businesses should train their internal finance teams and partners on the use of stablecoins and blockchain-based payment systems. Education ensures smooth adoption, helps mitigate errors, and promotes confidence in stablecoin-based B2B payment systems.

7. Pilot and Scale Gradually

Start with a small pilot program to test the use of stablecoins in a controlled environment. Monitor performance, security, and cost savings before scaling up to include more partners and transactions.

By following these steps, businesses can successfully integrate stablecoin development for B2B payments into their financial processes. This transition not only enhances efficiency but also positions businesses to capitalize on the advantages of blockchain-based payment systems.

Conclusion

In conclusion, utilizing stablecoins for B2B payments presents a transformative opportunity for businesses looking to streamline their transactions and enhance financial efficiency. By leveraging the stability of these digital currencies, companies can avoid the volatility associated with traditional cryptocurrencies, reduce transaction costs, and expedite cross-border payments. As the world gradually embraces digital finance, stablecoins stand out as a reliable and innovative solution that aligns with the evolving needs of businesses in various sectors.

SoluLab just launched a project named Crypto Mining. It is a specialized crypto mining platform where interested users can come and join to either buy a miner for crypto mining or use the miners available to start operations. SoluLab’s team helped build the platform with all the necessary features to offer a superior user experience and make the platform appropriately functional.

At SoluLab, as a stablecoin development company, we understand the intricacies of stablecoin development and the unique requirements of businesses seeking to implement this technology. With our extensive expertise in blockchain solutions and a commitment to delivering customized user-friendly platforms, we can assist you with stablecoins for your B2B transactions. Let us help you by providing stablecoin development services to enhance your payment processes. Contact us today to explore how we can bring your vision to life!

FAQs

1. What are stablecoins, and how do they differ from traditional cryptocurrencies?

Stablecoins are a type of cryptocurrency designed to maintain a stable value, usually pegged to a fiat currency or another asset. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which can be highly volatile, stablecoins offer price stability, making them ideal for business transactions that require predictable valuations.

2. What advantages do stablecoins offer for B2B payments?

Stablecoins offer several advantages for B2B payments, including lower transaction fees compared to traditional banking methods, faster transaction processing times (especially for international payments), and reduced currency risk due to their stable value. Furthermore, stablecoins can enhance security and transparency in transactions due to the underlying blockchain technology.

3. How can businesses integrate stablecoins into their payment systems?

Businesses can integrate stablecoins by choosing a stablecoin that best fits their needs, setting up a digital wallet to manage their holdings, and partnering with payment processors that support stablecoin transactions. It’s also essential to establish clear guidelines for using stablecoins within your accounting and financial systems to ensure compliance and ease of use.

4. Are there any risks associated with using stablecoins for B2B payments?

While stablecoins offer many benefits, there are some risks to consider. These include regulatory uncertainties, potential liquidity issues, and the necessity for adequate security measures to protect digital assets. Companies should conduct thorough research and consultations to understand the landscape and make informed decisions before adopting stablecoins.

5. How can I find a reliable partner for stablecoin development and integration?

To find a reliable partner for stablecoin development, it’s crucial to look for companies with a strong track record in blockchain technology and expertise in the financial sector. Reading reviews, assessing portfolios, and verifying technical capabilities can help. SoluLab, for example, is a leading stablecoin development company that can assist in creating tailored solutions to enhance your B2B payment processes. Contact us to learn more about how we can support your transition to stablecoin utilization.