AI Agents will be in the vanguard of this transformation as AI and DeFi come together to alter investment concepts. As AI trends are surging, the market is expected to grow rapidly from $5.1 billion to $47.1 billion by 2030. This exceptional rise demonstrates the growing need for self-governing systems that can perform intricate jobs with outstanding effectiveness. At the same time, IDO launchpads, which provide improved liquidity and instant trading opportunities, have become the go-to method for decentralized financing.

The incorporation of AI Agents in IDO launchpads is an intricate combination of finance and technology that results in an intelligent independent platform. This not only optimizes fundraising results by facilitating decision-making but also offers real-time analysis. Investors benefit from this convergence in two ways: they may profit from the growing AI industry and use modern fundraising technologies that offer substantial profits. It is a progressive investment that is expected to pay off well in the changing financial environment.

What are AI-Agents IDO Launchpads?

AI-Agent IDO Launchpads smartly and effectively fundraising by combining artificial intelligence with distributed token solutions. These systems leverage AI-driven agents to examine market trends, maximize token sales, and improve security, unlike conventional initial Dex Offerings (IDOs). Working independently, AI bots manage liquidity, forecast investor behavior, and instantaneously run transactions. This guarantees just participation, eliminates human mistakes, and speeds up decision-making. For investors, it implies lower risks and improved insights.

For projects, it guarantees more seamless, data-driven starts with real-time modifications. AI-Agent IDO Launchpads improve transparency, security, and access by automating important procedures. This creativity democratizes investment possibilities and increases fundraising efficiency. These systems will transform how blockchain companies get finance as artificial intelligence develops.

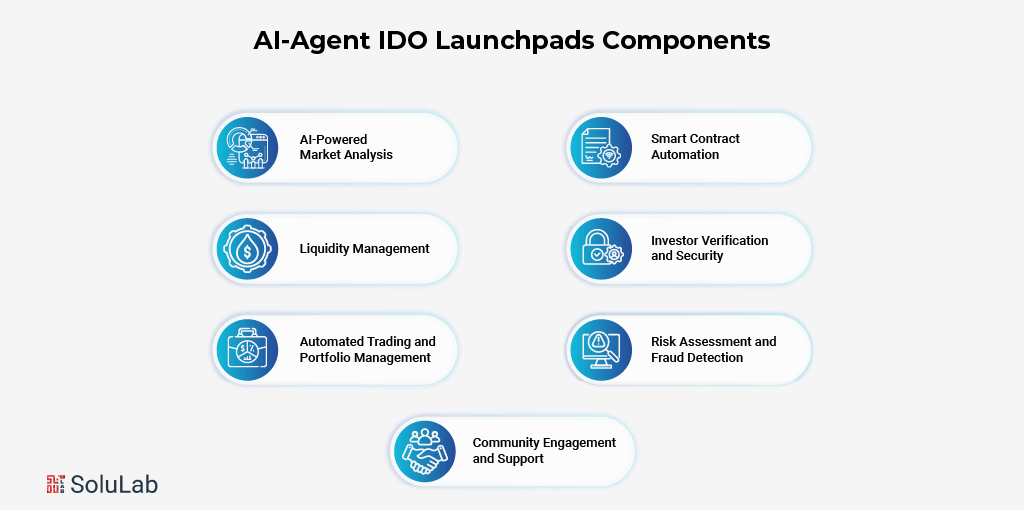

Major Components of AI-Agent IDO Launchpads

IDO Launchpads use artificial intelligence to enhance decentralized token fundraising strategies through their combination of AI algorithms. The systems consist of essential features that drive productivity expansion alongside better security measures and enhanced decision-making capabilities.

- AI-Powered Market Analysis

Digital currencies receive optimized launch strategy and pricing decisions through artificial intelligence systems, which combine market trends with investor feelings and historical analytic structures. Data-driven decisions made through this process help projects identify the right funders, which leads to better success rates.

- Smart Contract Automation

Smart contracts create protected token buying procedures that maintain open financial operations while ensuring no alteration of transactions. The platform handles fund payment and regulates rule implementation while executing automatic operations such as token distribution and time-controlled vesting procedures.

- Liquidity Management

The system examines liquidity pools through artificial intelligence agents while it adjusts the operational parameters right away. Smart trading occurs because these measures protect price stability while creating a satisfactory experience for investors.

- Investor Verification and Security

The two key requirements for financial transactions include KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance. The system uses artificial intelligence to verify investor identification, thus protecting both the platform and investors from being smudged up by fraudsters and regulatory problems.

- Automated Trading and Portfolio Management

The system performs trading operations at high speeds because it utilizes market-related data to handle investor portfolios efficiently.

- Risk Assessment and Fraud Detection

Invoking AI helps uncover possible sand scams and wash transactions along with irregular token alterations. The implementation of these features increases investor protection alongside raising trust levels for the platform.

- Community Engagement and Support

The combination of AI-powered chatbots alongside sentiment analysis tools promotes user interaction while rendering immediate responses, which results in an overall enhancement of investor experience.

Benefits of AI Agents IDO Launchpads

The AI-Agent IDO Launchpads had been building the way to fund blockchain projects by automating, intelligence, and efficiency in the fundraising process. The systems that are used across the board use artificial intelligence to optimize operations, improve investor experiences, and increase security. We’ll now identify the features of an AI-Agent IDO Launchpad:

1. Improved Fundraising Efficiency

- Decreased Token Sale

Reserving a table, verifying the investor, or helping the customer- all these basic jobs are being automated by AI agents. In doing so, human error is reduced, delays are shortened, and the token sale is smooth.

- Reduced Manual Intervention

If it’s a repetitive operation, AI can eliminate this cost & reduce the time, reduce administrative costs on the project, and launch faster while maintaining compliance and transparency.

- Token Pricing and Liquidity Management Automation

With the use of AI, the pricing of tokens is determined ideally by market movements, demand, and liquidity levels. This prevents projects from manipulating the price and makes the launch more steady.

- Effective Whitelisting and KYC Verification

AI-backed KYC and AML verification technologies evaluate investors’ identities in real time for fewer fraud risks and perform regulatory compliance at scale without human inspection.

2. Increased Investor Engagement

- AI-Recommended Personalized Investment Opportunities

The AI agents take into consideration investor preferences, risk tolerance, and market conditions before making recommendations for the investment. This facilitates the making of informed decisions by investors and the attendant overall experiential value for them.

- Dynamic Dashboards Offer Real-Time Insights to Investors

There are also AI-powered analytics tools that help to get real-time information about market trends, token performance, and project updates. In addition to these, investors can access them on user-friendly dashboards, which lets them make better investments.

- Automatic Alerts and Notifications

The AI system provides people with personal alerts of price swings, the unlocking of tokens, and key ICO project progress, so they do not need to spend all of their hours monitoring manually.

- Community Engagement with AI Chatbots

With the help of AI-powered chatbots, filling the gap is easy, answering investor questions, quickly solving the problem, forging discussions, and driving up the project’s community.

3. Advanced Risk Management and Security

- AI-Powered Tools for Detecting and Mitigating Fraudulent Behaviors

The use of AI algorithms monitoring transactions for suspicious activity such as wash trading, pump and dump schemes, bogus token listings, etc. is constant. It protects both investors and projects from money losses.

- Monitoring of transactions for Anomalies

All transaction data around the clock is reviewed by AI agents who try to find any unusual trends that might imply fraud or security problems. Imitative notifications keep the platform administrators in the loop.

- Automatic Smart Contract Audits

Smart contracts can be audited by an AI-driven auditing system for vulnerabilities and can help the developer resolve the flaw before launching and reduce the possibility of exploitation.

4. Cost Reduction and Scalability

- Reduce Operational Costs with Automation

By using AI automation to replace human processes, projects can save huge on administrative costs, and therefore, financing will be more accessible to startups without access to a lot of market resources.

- Ability to Grow

High-demand launches are less of a concern for AI-enabled IDO platforms, which can handle enormous amounts of users and will ensure that token distribution goes smoothly on high-demand launches.

- Reduced Human Errors in Fund Distribution

The precision with which AI agents allocate tokens decreases the differences and reduces common human errors in distributing funds.

5. Fairer and Transparent Fundraising

- Enhanced Transparency with AI-Generated Reports

What makes this true in this case is the availability of transparent, reliable statistics produced by AI platforms for token sales, investor involvement, and fund distribution.

- Automated Compliance and Regulatory Monitoring

With AI application solutions, projects are made compliant with legal laws so that teams stay informed of changing compliance requirements and get alerted to the required changes.

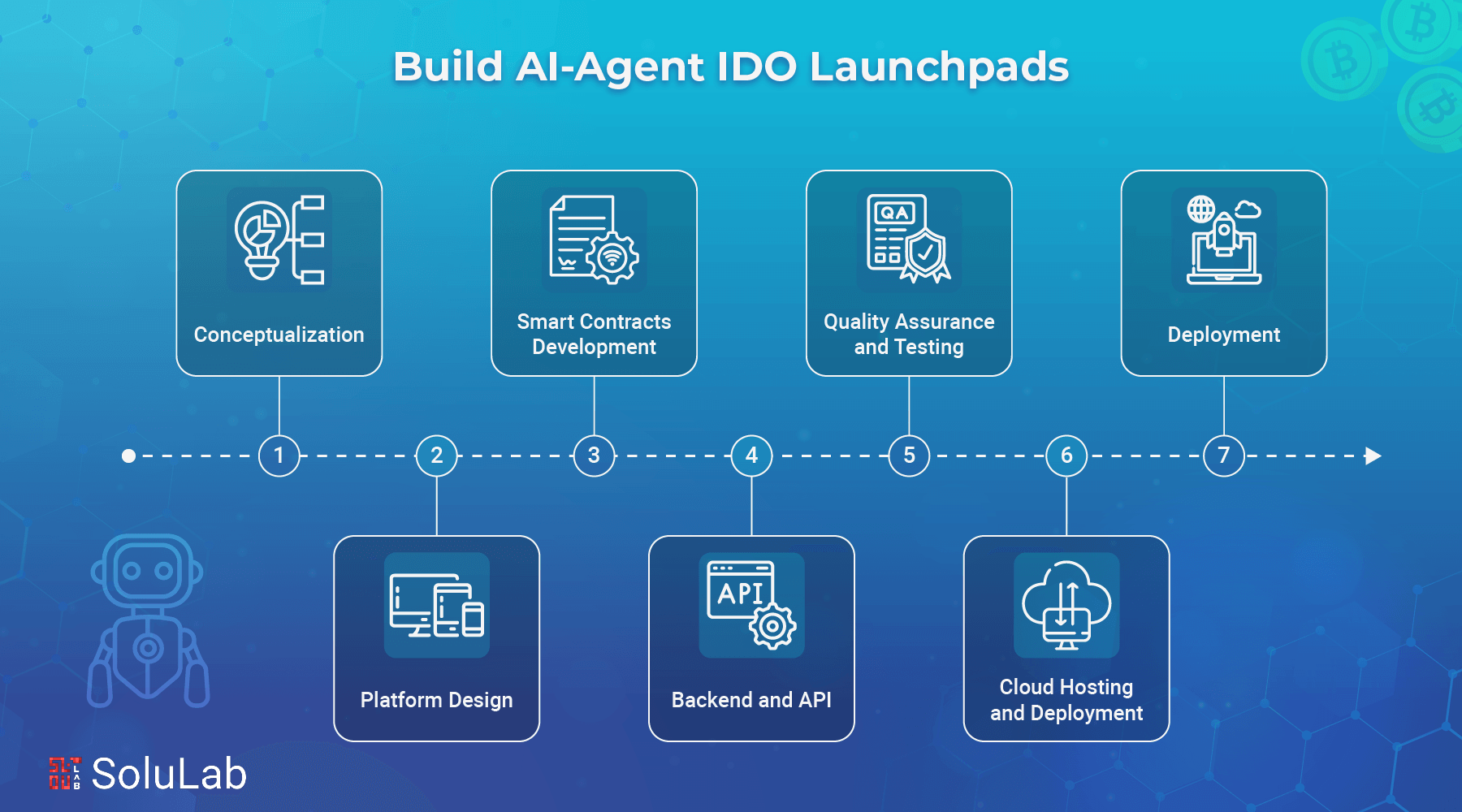

How to Build AI Agents IDO Launchpads?

Creating an AI-agent-integrated IDO launchpad combines powerful AI with Decentralized platforms to transform fundraising procedures. This integration allows for automatic token sales, sophisticated investor targeting, and immediate analysis. Your launchpad may set a new standard for decentralized fundraising by leveraging AI agents to enhance liquidity, increase security, and ensure smooth execution. Here is the breakdown of how to create an AI-Agent Launchpad:

Step 1: Conceptualization

Define the vision and breadth of your AI-agent-linked IDO launchpad, with an emphasis on standout features like AI-powered investor insights and automated compliance. Conduct a thorough feasibility analysis to identify technical specifications, AI framework integration, and blockchain selection.

Step 2: Platform Design

Create the system architecture using modular parts for AI-agent integrations, frontend, and backend. Create UI prototypes and wireframes to see how users interact and work together.

Step 3: Smart Contracts Development

Develop and check smart contracts that will automate token distribution together with fundraising initiatives. The platform requires the development of artificial intelligence models to detect fraud while performing market sentiment analysis and investor research.

Step 4: Backend and API

Integrate blockchain with AI modules and user interface through API development to build the backend system. The platform should enable clear communication that connects its features with AI insights as well as smart contracts.

Step 5: Quality Assurance and Testing

User flow testing must be conducted simultaneously with the testing of AI components and smart contracts throughout their entire length. Platform resilience requires the elimination of all detected imperfections as well as the rectification of system weakness points.

Step 6: Cloud Hosting and Deployment

Safe cloud platforms should be used to host AI models alongside the implementation of smart contracts onto the mainnet. The system requires decentralized token sale data storage while platform scalability needs to be established.

Step 7: Deployment

The development team will introduce a beta-version release of the AI-agent-driven IDO launchpad into the market. The operation will run smoothly by performing real-time monitoring combined with user feedback to modify the platform when needed.

AI Agent Launchpad Must Haves

These AI Agent Launchpads are fast becoming the dying lungs of modern organizations seeking to make fundraising seamless and create hype around capturing more interested investors; they must be fitted with some of the key emerging factors if they are to stay relevant by 2025:

1. Real-Time Market Analysis

The artificial intelligence systems allow token value estimation by analyzing investor intentions and the current situation in the market. Such an approach to pricing guarantees that prices of tokens move parallel with market trends, as well as real demand, ultimately optimizing the proceeds of fundraising.

Using artificial intelligence-driven dynamic pricing modifies token prices in response to investors’ activities and market movements. This method captures income-earning opportunities during and post-token sales while keeping the investors’ interests intact throughout the fundraising duration.

2. Solo Interactions Over Multiple Platforms

AI agents link up directly on many platforms, including Twitter, Discord, and Telegram to provide meaningful interaction and, therefore, marketing activities. Such communications foster openness and trust within the growing community around the initiative.

Automated agents ensure that potential investors receive answers to their queries quickly and effectively, thus facilitating the entire user experience to be better. Employing pattern and anomaly analysis in real-time, AI continuously monitors transactions to discover and stop deceiving transactions. This proactive strategy enhances the security of the whole fundraising process. AI evaluates potential dangers connected with transactions and investor profiles, thus facilitating a timely response in reducing hazards and protecting the project and its investors.

3. Customizable Token Vesting and Unlock Plans

AI creates and modifies token vesting schedules to ensure smooth dispersal and prevent market manipulation after the sale. This feature ensures stability in token value while it fits into the long-range goals of the project.

Transparent and fair distribution schemes generated via AI-optimized vesting schedules will thus help to build confidence among investors as well as alleviate their concerns over dumps or price fluctuations.

The Final Word

Reinventing distributed fundraising with the help of blockchain technology and artificial intelligence is possible with AI Agent IDO Launchpads. These sites are providing automation and efficiency as well as improved security for token sales, therefore benefiting both project teams and investors. IDO launchpads are therefore set to become more fair, open, and accessible through smart contract automation, real-time risk management, and AI-powered analytics.

Expected to grow even more sophisticated with market predictive capabilities, better liquidity, and integrated investors as more artificial intelligence is incorporated into decentralized finance (DeFi). AI-powered IDO launchpads are defining blockchain-based investments by reducing human touch points, hence minimizing fraud risks and optimizing the fundraising processes. SoluLab holds a proven track record with a crypto launchpad project like Token World, which is a feature-packed launchpad. Token World simplifies project launches and investments with transparency, security, and great user experience.

The future of fundraising with IDO launchpads and AI Agent is a future-driven approach that is not only faster and smarter but also more secure for companies and investors. The evolution of DeFi will largely be defined by AI Agent IDO Launchpads as innovation in this area continues to accelerate. SoluLab is one of the reliable names in IDO launchpad development and AI integration services. Be a part of this evolution; discuss your business needs now!

FAQs

1. What does an IDO Launchpad mean?

A coin for launching coins with a meme theme using IDO is made possible by the IDO launchpad. They offer a dispersed means of getting fresh meme coins onto the market; with this, projects might generate money and get recognition.

2. What are the most commonly used IDO platforms?

Strong options for token launches are Binance and Coinlist Launchpad since both have quite good ratings. Another platform is Best Wallet Launchpad, but it has a medium score, meaning a rather lower ranking among other options.

3. How does AI help with investor engagement in IDOs?

Features in AI-powered launchpads like chatbots, predictive analytics, and automated marketing strategies personalize user interactions, resulting in boosting investors’ trust and participation.

4. How does AI improve the efficiency of token sales?

AI automates KYC/AML compliance, optimizes token allocations based on demand forecasting, and ensures fair distribution. This makes IDO participation smoother and more efficient.

5. How does AI help with KYC and AML compliance in IDO launchpads?

AI automates identity verification, scans global watchlists, and detects suspicious activities in real time, ensuring full compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.