What if you could invest in a diamond—without ever holding it in your hand?

No wonder diamonds have represented durability, elegance, and wealth for years. They have been among the most opaque and complicated assets—harder to value, more difficult to trade, almost impossible to fractionalize. However, now diamonds taking centre stage in a culture where gold tokenization is becoming the norm, all because of blockchain technology.

| The global diamond market is expected to grow from $105.2 billion in 2024 to $110.1 billion in 2025, indicating a steady increase in demand and value. By 2032, the market is expected to grow to USD 140.1 billion. With natural diamonds at USD 86.86 billion and synthetic diamonds at USD 53.24 billion. |

A blockchain-based invention, diamond tokenization turns actual diamonds into digital tokens that are marketable, divisible, and easily accessible. This blog explores the basics of diamond tokenization.

Let’s get started!

What is Diamond Asset Tokenization?

Diamond asset tokenization is the conversion of ownership rights of actual diamonds into blockchain-based crypto tokens backed by diamonds. This modern method enables digital possession, trade, or transfer of the value of diamonds without the actual touch of the stones, hence enhancing the accessibility, security, and liquidity of diamond investments.

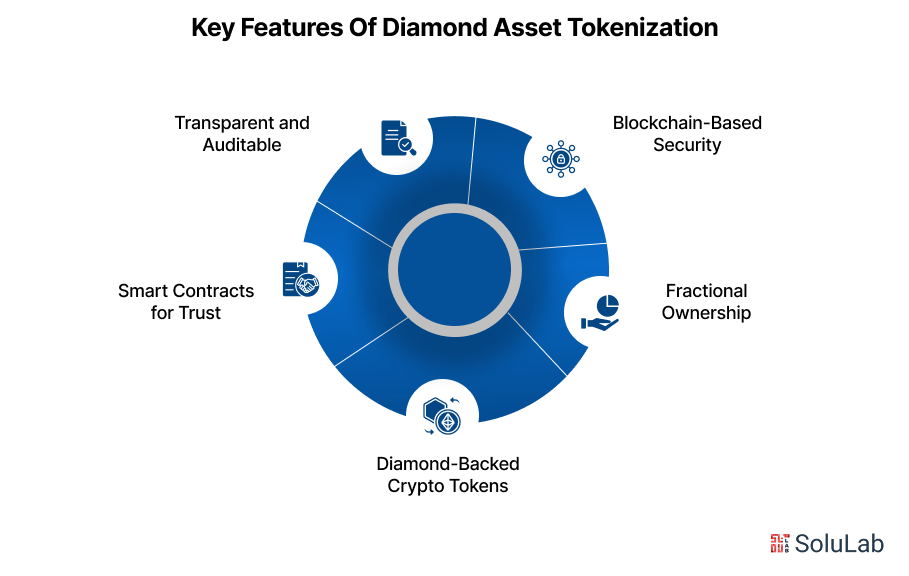

Key Features Of Diamond Asset Tokenization

By turning real diamonds into digital tokens on the blockchain, this innovative model brings transparency, liquidity, and fractional ownership to the traditionally opaque diamond market. Diamond asset-backed tokens are a feature-packed solution:

- Blockchain-Based Security: Each token is recorded on a blockchain, ensuring transparency, immutability, and tamper-proof ownership records. It reduces fraud and verifies the authenticity and origin of the diamond.

- Fractional Ownership: Instead of an entire diamond, investors can buy tokenized diamonds in portions, and they own a fraction of it through tokens. This makes luxury assets more affordable and accessible to the average investor.

- Diamond-Backed Crypto Tokens: These tokens precisely correspond to a particular diamond or a collection of diamonds stored in secure vaults, often verified by trusted third-party grading agencies like GIA.

- Smart Contracts for Trust: Smart contracts handle things like ownership transfers, royalty payments, or investment returns, reducing the need for intermediaries. This results in faster, cheaper, and trustless transactions.

- Transparent and Auditable: All data, containing ownership and evaluation, is immutably kept on the blockchain, providing complete transparency to both buyers and sellers.

Diamond tokenization services transform the conventional luxury asset into a dynamic digital financial instrument, facilitating wider involvement and enhanced efficiency in the diamond market.

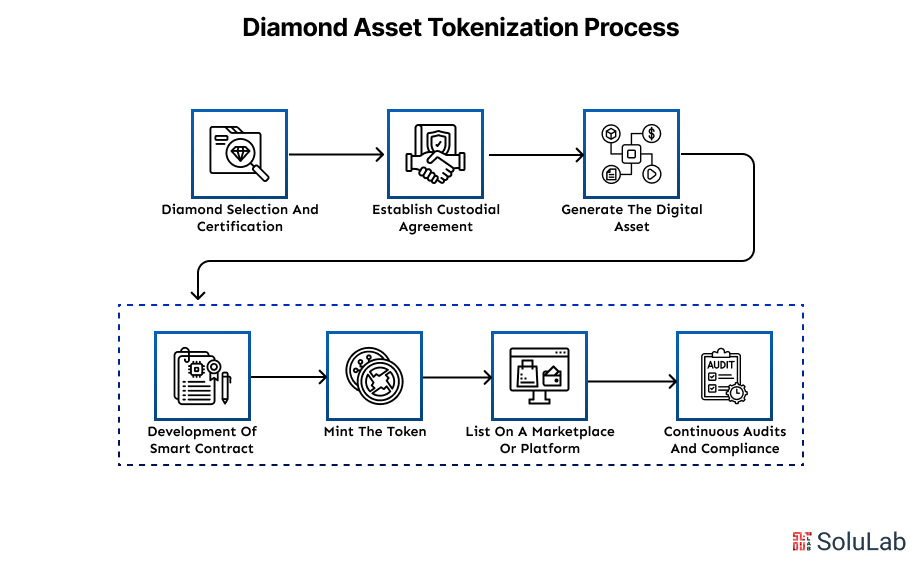

How to Tokenize Diamond Assets in 2025?

Tokenizing a diamond may appear to be a task exclusive to technical specialists; nonetheless, it is a clearly outlined procedure that integrates physical asset management with blockchain technology. Regardless of whether you are a diamond proprietor, an investor, or a firm investigating diamond asset-backed tokens, comprehending the process of tokenizing a diamond asset enables you to get liquidity, transparency, and expanded market access.

Here is a step-by-step process on how to tokenize diamond assets:

Step 1: Diamond Selection and Certification

The procedure starts with the selection of the diamond or collection of diamonds intended for tokenization. These should preferably be authenticated by a reputable body such as GIA, IGI, or HRD. Certification guarantees that all grading attributes—carat, cut, clarity, and color—are authenticated and recorded, establishing the basis of the token’s information.

Step 2: Establish Custodial Agreement

Upon certification, the actual diamond is relocated to a safe, insured vault overseen by a reputable third-party custodian. This stage is essential since investors want confirmation that the token they are purchasing is backed one-to-one by a genuine, safely stored diamond.

Step 3: Generate the Digital Asset (Metadata Creation)

A digital profile is established for every diamond. This encompasses:

- Details of certification

- Images of high resolution

- Distinctive identifiers (e.g., laser-engraved identification or tracking code)

- Origin, grading laboratory, and timestamp information

This metadata is then associated with the blockchain token, guaranteeing transparency and verifiability.

Step 4: Development of Smart Contracts

A smart contract is established to regulate the behavior of the diamond token. It delineates:

- Regulations on Ownership Transferability

- Authorization for trading

- Fractional ownership arrangements (if applicable)

Smart contracts automate and enforce regulations, eliminating middlemen and enhancing the speed and security of transactions.

Step 5: Mint the Token

Upon completion of the smart contract, a token is produced on a selected blockchain network, such as Ethereum, Polygon, or Solana. This mark signifies ownership of the diamond. It may vary according to the model.

- A non-fungible token (NFT) symbolizes an individual, unique diamond.

- A fractional or fungible token signifies collective ownership of a diamond or a diamond pool.

Step 6: List on a Marketplace or Platform

After minting, the token may be published on a digital asset marketplace, enabling investors to buy tokenized diamonds, sell, or exchange. Certain tokenization systems have integrated liquidity pools or DeFi lending features, enabling token holders to realize additional value.

Step 7: Continuous Audits and Compliance

Periodic audits are undertaken to verify that the physical diamonds are stored and correspond with the digital data, hence preserving investor faith. Certain platforms further incorporate KYC/AML verifications and regulatory compliance structures, particularly when aiming at institutional investors.

By adhering to these procedures, diamond owners and platforms can effectively tokenize diamonds and integrate them into the digital investing ecosystem. This approach effectively modernizes traditional luxury assets, rendering them borderless, liquid, and more accessible than ever before. Grabbing professional diamond tokenization services can add to the ease, along with the best outcomes.

Use Cases of Diamond Tokenization

Tokenizing diamonds is about opening up whole new opportunities in how we invest, borrow, purchase, and engage with highly valuable goods, not only about turning them digital. From fashion to business, diamond-backed crypto tokens are finding their home in many different fields. Let us explore a few of the most common use cases of diamond asset tokenization:

1. Trading and Investing

Tokenized diamonds allow individuals to invest in high-value gemstones just like they would with stocks or cryptocurrency, so maybe the most instant and common use case. On digital platforms, investors may buy tokenized diamonds, keep, or sell their tokens fractionally or totally without regard to logistics, appraisal, or liquidation delays. This offers a fresh degree of accessibility, particularly for younger or tech-savvy investors wishing to diversify their portfolios with luxury assets.

2. Retail Luxuries & Goods

Imagine acquiring a diamond ring and getting a tokenized certificate kept on the blockchain along with the actual item. Particularly in resale marketplaces, brands may utilize tokenization to demonstrate product legitimacy, origin, and quality, therefore inspiring more trust for consumers. For premium items, some stores are even looking into digital twins so that consumers may digitally redeem or swap an item before ever having it.

3. Collateralized Lending

Particularly in DeFi systems, tokenized diamonds can be used as collateral for loans. Like loans supported by cryptocurrencies, diamond tokens may be locked into smart contracts to guarantee borrowing without selling the real asset. For liquidity management, this is revolutionary, especially for collectors or investors seeking funds without having to part with their gems.

4. Cross-Border Asset Transfers

High-value asset transfers across borders typically call for complicated documentation, tax consequences, and legal obstacles. Tokenized diamonds enable digital and instantaneous worldwide ownership transfer without physically transporting the gem, therefore simplifying inheritance planning, wealth transfers, and foreign giving.

5. Transparent Supply Chain Management

Blockchain-powered tokenization offers end-to-end traceability in a society becoming more and more ethical sourcing and conflict-free diamonds. Every touchpoint—from mine to market—is recorded so that customers and authorities may independently confirm sourcing claims and follow the diamond’s path.

6. NFTs, Digital Art & Collectibles

Additionally, blending into the world of digital collectibles and NFTs are tokenized diamonds. Imagine possessing a rare, investment-grade diamond not just as a real-world gem but also as a digital treasure housed in a luxury NFT vault. Certain systems even enable virtual exhibits, digital art tie-ins, or augmented reality experiences connected to the token.

Why Is Diamond Tokenization Trending in 2025?

In 2025, the investment space is witnessing a major shift, and diamond tokenization is gaining much traction. But the question is, why is everyone talking about digital diamonds in 2025? Let’s break down the key reasons behind this rising trend:

1. Growing Demand for Alternative Investments

With traditional assets like stocks and bonds facing market volatility, more investors are turning to alternative assets for stability. As tokenized diamonds offer a unique combination of luxury and security, so they are an attractive option for portfolio diversification.

2. Mainstream Adoption of Blockchain Technology

Blockchain Technology is no longer limited to tech enthusiasts. In 2025, it is powering everything from banking to supply chains and now, luxury assets like diamonds also. The transparency, security, and efficiency of blockchain are perfect for solving long-standing issues in the diamond industry, such as fraud and valuation disputes.

3. Increased Global Accessibility

Before tokenization, investing in diamonds required large capital and access to elite markets. Today, anyone with a smartphone and a digital wallet can own a piece of a certified diamond. This democratization of access is pushing up the global interest in digital gemstones.

4. Enhanced Security and Ownership Control

Thanks to smart contracts and secure digital crypto wallets, investors have full control over their assets. Ownership transfers are quick, tamper-proof, and do not rely on middlemen. This level of autonomy appeals to modern investors who want full control over their investments.

All in all, diamond tokenization services are trending in 2025 because they blend the timeless value of diamonds with the power of blockchain, offering a smarter, safer, and more inclusive way to invest in luxury.

Final Words

Tokenizing diamond assets isn’t an idle trend; it’s a sensible way to modernize an established investment class by making it more transparent, secure, and accessible to everyone. An option that was previously only available to a small number of people is now available to everyone in 2025, thanks to the digitization of diamonds via the blockchain.

SoluLab, a leading asset tokenization development company, is an expert in tokenizing assets from start to finish, transforming static assets into liquid digital investments. This innovation is on display in our most recent initiative, which debuted on Token World. It is a top-tier cryptocurrency launchpad that brings together promising blockchain projects with investors from all around the world. The platform’s intuitive interface makes it simple for project creators to oversee their work, and it allows investors to interact transparently with tokenized opportunities.

Diamond tokenization services are picking up the pace, and SoluLab is all set to help you create, launch, and grow. To begin the process of your asset’s tokenization, contact us NOW!

FAQs

1. Are tokenized diamonds safe to invest in?

Yes, but only if purchased from a reputable platform. Tokenized diamonds are often backed by certified stones, stored securely, and recorded on the blockchain, which ensures transparency and traceability.

2. Is it possible to trade tokenized diamonds like cryptocurrencies?

Yes, tokenized diamonds can be traded on supported digital asset exchanges or P2P platforms. Liquidity may vary depending on market demand and platform support.

3. Can I resell my tokenized diamond anytime?

Yes, as long as the platform provides a secondary marketplace or your token is tradable on supported exchanges, you can sell your diamond asset-backed tokens at market-driven prices, often faster than selling a physical diamond.

4. What types of diamonds are commonly tokenized?

Mostly investment-grade diamonds, typically with GIA or similar certifications. Some platforms tokenize a single stone per token, while others bundle smaller stones for fractionalized investment.