According to a recent study published by CoinDesk, blockchain technology development will continue to expand rapidly in the years to come. Those who are interested in blockchain technology would also have a greater desire to learn about it.

Blockchain will also find its way and explore modern uses in practically every vertical and horizontal. Blockchain technology is the underlying framework behind cryptocurrencies like Bitcoin and Ethereum, but it’s much more than that. A decentralized, distributed ledger enables secure, transparent, and tamper-proof data storage and transactions. Imagine a digital book shared across multiple computers, updated in real-time, and validated by a network of nodes – that’s essentially what Blockchain is.

In this beginner’s guide, we’ll take you on how to understand blockchain technology, including its history, key components, and applications. We’ll explore the benefits and limitations of Blockchain, as well as its potential uses in various industries, from finance and healthcare to supply chain management and voting systems.

Whether you’re a tech enthusiast, a business owner, or simply curious about the future of technology, this blockchain guide will equip you with the knowledge you need to navigate the world of Blockchain. So, let’s get started!

What is Blockchain Technology?

Blockchain is a shared digital ledger that is shareable and irreversible. It uses a network of computers to keep transactions or data in several locations. Here, every confirmed transaction is added to a section known as a block, which uses cryptography to link with other blocks in order to construct a chain.

If that explanation left you perplexed, let’s take a more basic look at blockchain technology for beginners. In other words, a blockchain is a collection of connected blocks that contain records. Now, let’s understand what exactly the difference between a database and a blockchain in brief!

Database vs. Blockchain

A database gathers a lot of data and organizes it tabularly so that users may simply and concurrently change it. Larger databases also employ servers with strong computers to process and store large amounts of data. Since a database is often owned by a business or a person, access to it is controlled and managed by them.

Blockchain, on the other hand, gathers data in blocks or groups that have a certain amount of storage. A block forms a chain with other blocks when its capacity is reached. The new block is comprised of all the newly created records that come after the next newly added block.

A blockchain is not owned by a single party like a typical database is; rather, anybody with authorization can access it. This is the reason behind its other name, decentralized system, as the blockchain is not managed by a single center. Distributed Ledger Technology (DLT) is the term used to refer to blockchain technology. It is a distributed ledger of records that enables peer-to-peer data sharing and transaction execution without the need for a central authority.

An unidentified person named Satoshi Nakamoto created blockchain technology as a public record for Bitcoin transactions. It attempts to guarantee that no one can tamper with a digital document by timestamping it. It facilitates the resolution of double record problems and safe asset transactions without the need for a third-party middleman like a bank or government agency.

This internet-based technology consists of several components, including software applications, databases, networked computers or nodes, and more.

What Makes Up Blockchain’s Components?

The layers of the blockchain architecture include hardware, data, and networking components including nodes, applications, verification, and information distribution. Let’s examine a few of its elements for understanding blockchain technology basics.

1. Block

Blockchain, as previously said, is a collection of linked blocks that hold records or data. Additionally, the type of blockchain determines the data in each block. A blockchain used for banking, for instance, would comprise blocks with data like account numbers, account holders’ names, branch names, etc. A blockchain’s Genesis block is the first block, and every subsequent block hashed and encoded legitimate entries. A chain is formed by the cryptographic hashes of each block, which link to each other and to the preceding block in the same blockchain. Digital signatures are used in this iterative procedure to confirm the integrity of the earlier blocks.

2. Hashing

Similar to a fingerprint, a hash is specific to each block. It is a code that converts digital data into a lengthy string of characters and numbers by utilizing a mathematical formula. Each block and its contents are uniquely identified by this 64-digit hexadecimal number, and once a block is formed, any changes made to it will alter the hash.

As a result, if an attacker modifies data in a block, the hash of that block is updated, but the previous block’s hash remains unchanged. As a result, all subsequent blocks become invalid and are traceable with ease.

3. Assets

Tangible and intangible assets are both possible. Intangible assets are non-physical things like intellectual property contracts, copyrights, patents, etc., whereas tangible assets are actual things like land, homes, machinery, etc. Curiously, money may be both material and immaterial.

4. Distributed Peer-to-Peer (P2P) Network

A distributed peer-to-peer (P2P) network without a central authority to regulate data facilitates every transaction on a blockchain. Anyone with access may join the blockchain, and each new machine added to the network becomes a node. As a result, if an attacker modifies data in a block, the hash of that block is updated, but the previous block’s hash remains unchanged. As a result, all subsequent blocks become invalid and are traceable with ease.

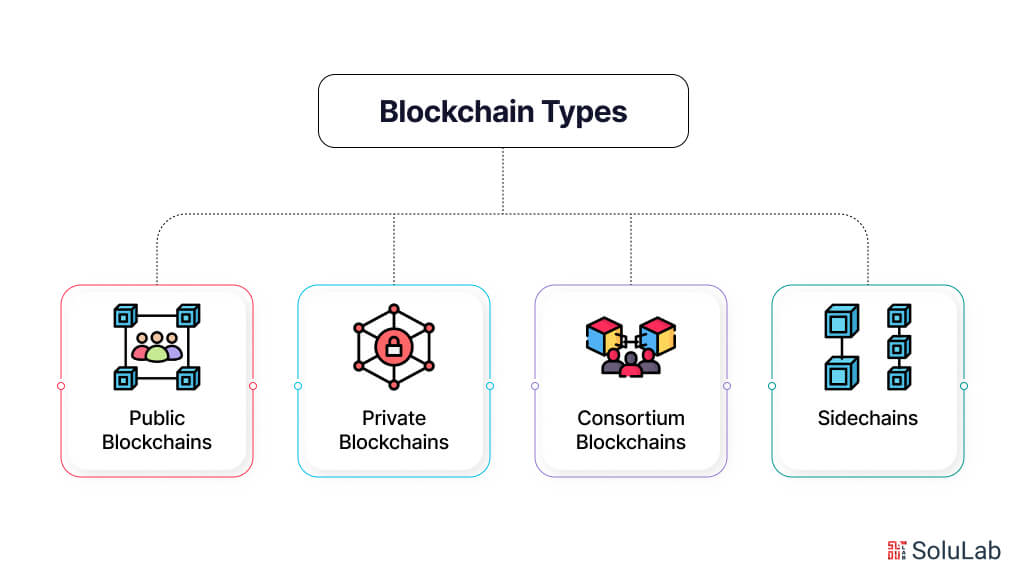

Different Blockchain Types

Depending on its kind, blockchain technology is used for a wide range of purposes by users. Thus, several kinds of blockchains include:

-

Public Blockchains

A decentralized, public network of several computers that anybody may use to request or check the correctness of a transaction is made possible by blockchain technology. It enables users to validate the data, add new blocks, and view every block on the blockchain. They make use of ideas like proof of stake or proof of labor since they are transparent and require high levels of security. Block miners receive cash compensation for validating transactions. The two primary uses of public blockchains are for bitcoin exchange and mining.

-

Private Blockchains

Private blockchains are controlled and centralized by an individual or group that also determines who may add new nodes, access the blockchain, and validate data. Private blockchains feature access limits and are closed systems in contrast to public blockchains.

-

Consortium Blockchains

These permissioned blockchains are not governed by a single entity, but rather by a consortium of businesses or organizations. To benefit from greater security, they are more decentralized than a private blockchain. Access is restricted, and the consensus process is decided by the active nodes.

Additionally, when member nodes are authorized to start or accept transactions, it functions as a validator node to originate, receive, and validate transactions. In this case, consumers may more effectively and scalable move digital assets between blockchains.

-

Sidechains

A blockchain that runs concurrently to the main chain is known as a sidechain. Enabling consumers to transfer digital assets across two distinct blockchains enhances efficiency and scalability. The Liquid Network is an illustration of a sidechain.

How Does a Blockchain Transaction Work?

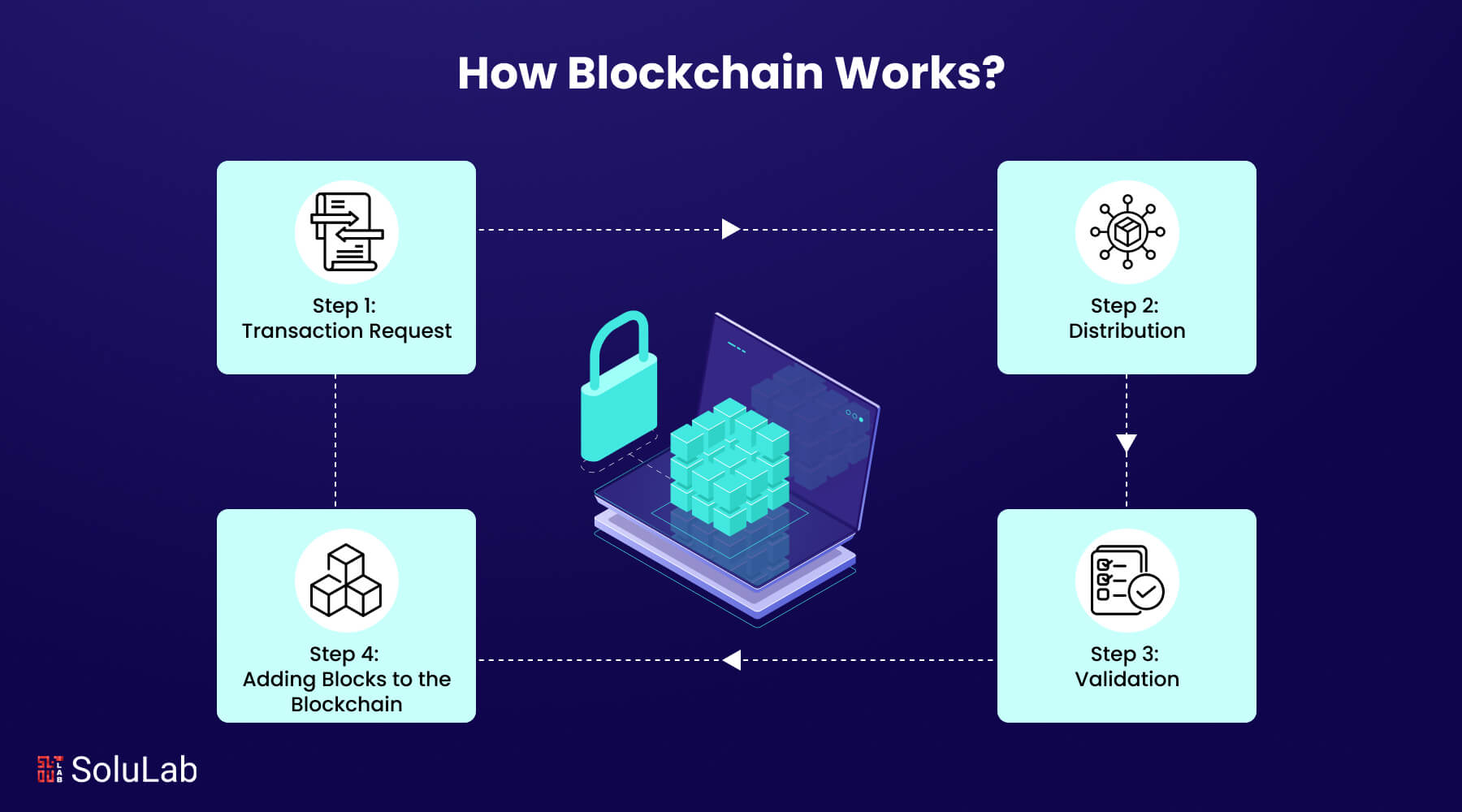

A blockchain transaction is a secure and transparent process that involves multiple steps, ensuring the data’s integrity and authenticity. Here’s a step-by-step breakdown of how a typical transaction occurs in a blockchain:

Step 1: Transaction Request

A user initiates a transaction, which can be a request for a specific action, such as transferring funds, updating records, or executing a smart contract. This request is then broadcast to the network.

Step 2: Distribution

The transaction is distributed across the peer-to-peer network, reaching nodes located globally. These nodes are responsible for verifying and validating the transaction.

Step 3: Validation

The nodes in the network validate the transaction using advanced algorithms and complex mathematical equations. If they find the transaction legitimate, the records are entered into blocks. This validation process ensures the integrity and authenticity of the transaction.

Step 4: Adding Blocks to the Blockchain

Once the transaction is validated, the newly created block is added to the blockchain. Each block contains a unique hash code that connects it to the previous block, creating a chain of blocks (hence the name blockchain). The hash code is generated using cryptography and encryption, ensuring that each block is tamper-proof. Blockchain development services often focus on refining each of these steps to make transactions faster and even more secure for businesses and individuals alike.

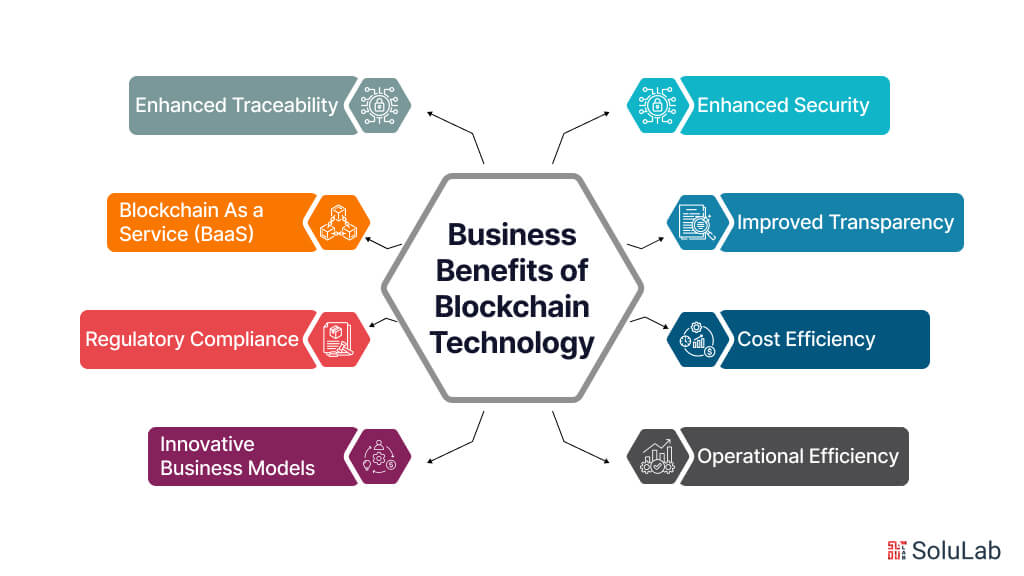

Business Benefits of Blockchain Technology

Blockchain technology offers numerous advantages for businesses across various industries, providing solutions that enhance efficiency, security, and transparency. Below are some key business benefits:

1. Enhanced Security

- Immutability: Transactions recorded on a blockchain cannot be easily altered or deleted, ensuring the integrity and reliability of data.

- Encryption: Advanced cryptographic techniques protect data from unauthorized access and tampering.

- Reduced Fraud: The decentralized nature of blockchain reduces the risk of fraud and cyberattacks, as there is no single point of failure.

2. Improved Transparency

- Auditability: Every transaction is recorded on a public ledger, providing a clear and traceable history. This transparency is particularly beneficial in industries such as finance and supply chain management.

- Trust: By offering a transparent and tamper-proof system, blockchain helps build trust among stakeholders, including customers, partners, and regulators.

3. Cost Efficiency

- Reduced Intermediaries: Blockchain enables peer-to-peer transactions, eliminating the need for intermediaries such as banks and brokers. This reduces transaction fees and speeds up processes.

- Automation: Smart contracts automate and streamline complex processes, reducing the need for manual intervention and lowering operational costs.

4. Operational Efficiency

- Streamlined Processes: Blockchain simplifies and accelerates processes such as cross-border payments, supply chain tracking, and compliance management.

- Real-Time Updates: Businesses can access real-time data updates, leading to better decision-making and more efficient operations.

5. Enhanced Traceability

- Supply Chain Management: Blockchain provides end-to-end visibility of the supply chain, enabling businesses to track the origin, movement, and status of goods. This improves inventory management and reduces the risk of counterfeits.

- Product Recalls: In case of product recalls, blockchain allows for quick and precise identification of affected products, minimizing the impact on consumers and reducing recall costs.

6. Blockchain As a Service (BaaS)

- Ease of Adoption: BaaS platforms, such as those offered by Microsoft Azure, IBM, and Amazon Web Services (AWS), allow businesses to implement blockchain solutions without needing extensive technical knowledge. These platforms provide the necessary infrastructure and tools to develop, deploy, and manage blockchain applications.

- Scalability: BaaS solutions offer scalable services that can grow with the business, ensuring that blockchain technology can be adapted to meet changing needs and demands.

- Cost-Effective: By using Blockchain as a service, businesses can reduce the upfront investment required for blockchain development and maintenance, making it more accessible for small and medium-sized enterprises.

7. Regulatory Compliance

- Automated Compliance: Blockchain can automate compliance with regulations by providing transparent and auditable records, reducing the risk of non-compliance and associated penalties.

- Real-Time Reporting: Regulators can access real-time data on blockchain networks, enabling faster and more accurate reporting and monitoring.

8. Innovative Business Models

- Tokenization: Blockchain enables the tokenization of assets, allowing for fractional ownership and new investment opportunities. This can revolutionize industries such as real estate, art, and finance.

- Decentralized Finance (DeFi): Blockchain supports the development of decentralized financial services, offering new ways for businesses to lend, borrow, and invest without traditional financial intermediaries.

Use Cases of Blockchain Technology

Blockchain is currently becoming increasingly widely used in a variety of business sectors to provide them with advantages including security, anonymity, and transparency. Let’s examine a few of the applications for blockchain.

-

Cryptocurrency

There are more cryptocurrencies than Bitcoin. Cryptocurrencies are virtual money that securely record transactions in a ledger via the use of powerful cryptography (blockchain). Its control is decentralized, and it is not issued by a central authority. In addition to Bitcoin, there are several other cryptocurrencies, including Dogecoin (DOGE), Namecoin (NME), Litecoin (LTC), Ethereum (ETH), Ripple (XRP), TRON (TRX), and many more. With the growing diversity of digital currencies, the concepts of multi-chain vs. cross-chain technology have become increasingly significant. Multi-chain technology involves multiple blockchains operating in parallel without interacting, while cross-chain technology enables interoperability between different blockchains, allowing seamless transactions across various cryptocurrency networks.

-

Smart Contracts

Smart contracts are suggested contracts that are digital and blockchain based. They don’t require communication with people to be implemented or enforced. It does away with the requirement for a middleman between two parties to a contract; the blockchain handles it.

-

Banking and Finance

Because blockchain in fintech industry reduces costs and allows for quicker transaction speeds, several institutions, including UBS, are considering integrating it. Tokenization of different equities is also taking place, and new financial services such as Security Token Offerings (STOs) and Initial Coin Offerings (ICOs) are making their appearance. Properties such as real estate can be tokenized with the use of these services.

-

Supply Chain

Blockchain is being used in supply chain industries including software development, food production, furniture manufacturing, and the mining of valuable commodities like diamonds.

Conclusion

In conclusion, blockchain in fintech industry is a revolutionary concept that has gained immense popularity in recent years. With its decentralized and transparent nature, blockchain in trade finance has the potential to transform various industries and sectors. As a beginner’s guide, this article has provided a comprehensive overview of blockchain technology, its features, and its applications.

However, despite its numerous benefits, blockchain technology is not without its challenges. One of the major issues that arises with blockchain technology is the complexity of its development process. Building a blockchain-based application requires a deep understanding of multi-chain vs. cross-chain technology, cryptography, distributed systems, and software development. Moreover, with the increasing demand for blockchain solutions in fintech industry and trade finance, there is a growing need for skilled professionals who can develop and maintain these applications. This is where SoluLab comes in – as a leading blockchain development company, we provide expert services to help businesses and entrepreneurs build robust and scalable blockchain-based solutions. Whether you’re looking to develop a blockchain-based application or integrate blockchain technology into your existing system, we can help you achieve your goals. If you’re interested in learning more about our services, please contact us today to schedule a consultation.

FAQs

1. What is blockchain technology?

Blockchain technology is a decentralized and distributed ledger that records transactions and data across a network of computers. It’s a way to record and verify transactions without the need for a central authority or intermediary.

2. What is the purpose of blockchain technology?

The primary purpose of blockchain technology is to create a secure and transparent way to record and verify transactions. It’s often used to facilitate secure financial transactions, but it can also be used for other applications such as supply chain management, voting systems, and more.

3. How does blockchain technology work?

Bockchain in fintech industry works by using a network of computers to verify and record transactions. Each transaction is added to a “block” of transactions, which is then linked to a previous block through a unique code called a “hash”. This creates a chain of blocks, hence the name “blockchain”. The blockchain is maintained by a network of nodes, which work together to verify and validate transactions.

4. Is blockchain technology secure?

Yes, blockchain technology is considered to be highly secure. The decentralized nature of the blockchain, combined with the use of advanced cryptography, makes it difficult for hackers to manipulate or alter the data stored on the blockchain. Additionally, the use of consensus algorithms, such as proof-of-work or proof-of-stake, ensures that all nodes on the network agree on the state of the blockchain.

5. Can I invest in blockchain technology?

Yes, you can invest in blockchain technology through various means, such as buying cryptocurrencies like Bitcoin or Ethereum, investing in blockchain-based startups or companies, or even using blockchain-based investment platforms. However, it’s essential to do your own research and understand the risks involved before investing in any blockchain-related project.