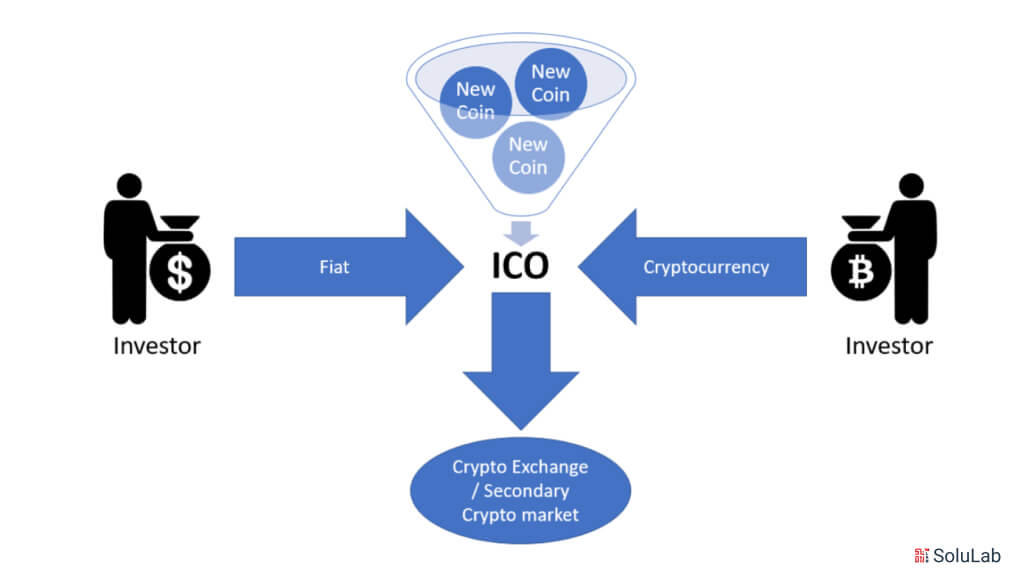

In an initial coin offering (ICO), a company creates and sells a digital asset, known as a token, to investors utilizing blockchain technology. This method was pioneered by Willet in 2013 with MasterCoin, later renamed OMNI, resulting in the successful fundraising of $500,000 worth of Bitcoin. The funds were allocated to development, rewarding contributors, and other critical activities. A significant milestone was reached in 2015 when Ethereum introduced a standard for implementing tokens (ERC20), further simplifying the ICO process. Subsequently, the ICO market witnessed exponential growth, increasing from just 9 ICOs in 2015 to over 1,000 ICOs in 2018. ICOs serve as digital tokens issued by budding ventures in exchange for crypto-assets or traditional currencies. They represent an approach for early-stage ventures to secure funding and accelerate their growth.

What is Initial Coin Offering (ICO)?

In cryptocurrency and blockchain technology, Initial Coin Offerings (ICOs) have emerged as a way for startups and businesses to raise capital. ICO initial coin offerings have democratized the investment process, enabling anyone with internet access to invest in early-stage blockchain projects. Unlike traditional fundraising methods, which typically require navigating complex regulations and intermediaries, ICOs offer a direct, decentralized approach that has captured the attention of both investors and entrepreneurs.

An Initial Coin Offering (ICO) is a fundraising mechanism in which new projects sell their underlying cryptocurrency tokens in exchange for capital. These tokens can have various functions within the project, such as providing access to a service, granting voting rights, or being used as a currency within the project’s ecosystem. The ICO process is akin to an Initial Public Offering (IPO) in the stock market but with several key differences rooted in the decentralized nature of blockchain technology.

How Initial Coin Offerings Work? A Step-by-Step Process

Before you start with the ICO process, it’s crucial to thoroughly research and understand blockchain technology, regulatory, and token economics. This knowledge will empower you to make informed decisions and navigate the ICO journey successfully.

1. Whitepaper Creation

The first step in launching an ICO is drafting a comprehensive whitepaper. This document outlines the project’s goals, the technology behind it, the team involved, and the tokenomics—details about the token’s distribution, supply, and use cases. The whitepaper is essential for building investor confidence and providing transparency on what is an initial coin offering and how an initial coin offering works.

2. Choosing an ICO Platform

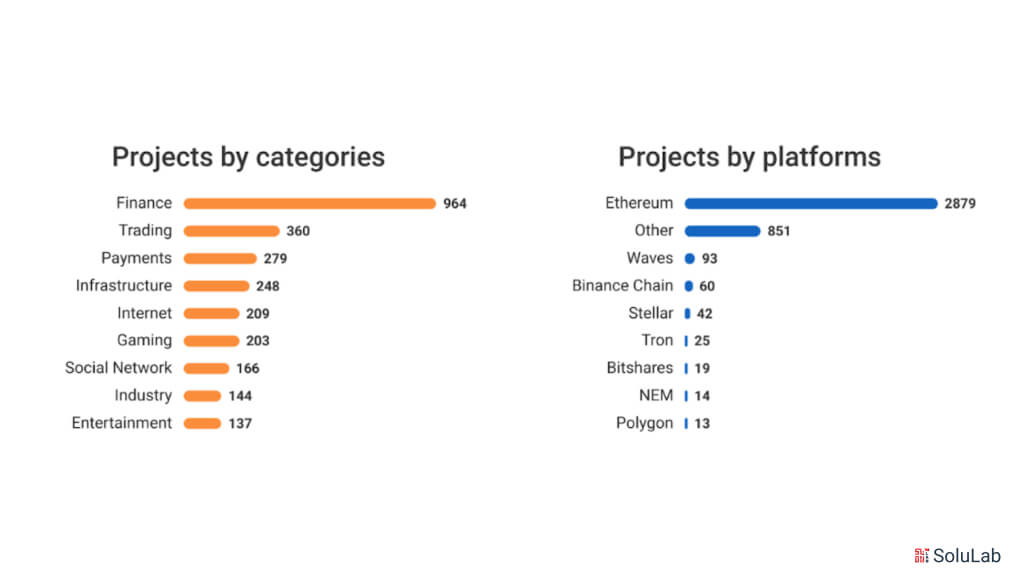

Projects often choose a blockchain platform to host their ICO. The Ethereum blockchain, with its ERC-20 token standard, is one of the most popular choices due to its robust smart contract capabilities. These smart contracts automate the ICO process, ensuring that transactions are secure and that tokens are distributed correctly once the ICO concludes.

3. Token Creation

The project team creates the digital tokens that will be sold during the ICO. These tokens are often designed as utility tokens that provide access to a product or service within the project’s ecosystem. Alternatively, they can be security tokens that represent an ownership stake in the project, similar to traditional securities.

4. Marketing and Promotion

To attract investors, the project team must engage in extensive marketing efforts. This includes listing the ICO on ICO initial coin offering lists, promoting it on social media, and participating in blockchain events. The goal is to build a community around the project and generate buzz that will drive the success of the ICO.

5. Token Sale and Distribution

During the ICO, tokens are sold to investors in exchange for cryptocurrency, typically Bitcoin or Ethereum. The ICO can be structured in various ways, such as a fixed-price sale, where all tokens are sold at a set price, or a Dutch auction, where the price decreases over time until all tokens are sold.

6. Post-ICO Project Development

Once the ICO concludes, the project team uses the funds raised to develop the product or service outlined in the whitepaper. Investors typically monitor the project’s progress through updates from the team and community engagement, closely watching how ICO works.

Types of ICOs

There are various types of ICOs, each with its own characteristics and regulatory considerations. Here’s a brief overview of the most common types of ICOs:

-

Public ICOs

Public ICOs are open to anyone who wants to invest. These ICOs are highly inclusive and often attract a large number of small investors. However, they also face significant regulatory scrutiny and may require compliance with securities laws in various jurisdictions.

-

Private ICOs

Private ICOs are restricted to a select group of investors, often institutional investors or high-net-worth individuals. These ICOs tend to raise larger sums of money but are less accessible to the general public.

-

Security Token Offerings (STOs)

STOs are ICOs that issue tokens classified as securities. This means they are subject to stringent regulatory oversight, providing investors with a higher degree of legal protection. STOs are often seen as a more secure and regulated alternative to traditional ICOs.

-

Utility Token ICOs

Utility tokens are designed to be used within the project’s ecosystem. For example, a utility token might be required to access a service, pay for transaction fees, or vote on governance issues within the platform. These tokens do not confer ownership rights or dividends, differentiating them from security tokens.

Benefits of ICOs

Before delving into the benefits of Initial Coin Offerings (ICOs), it’s important to understand how they work and the different types of ICOs available.

-

Decentralized Fundraising

ICOs eliminate the need for traditional financial intermediaries, such as banks and venture capitalists. This decentralization allows projects to raise funds directly from the public, reducing costs and increasing accessibility.

-

Global Reach

ICOs have a global audience, enabling projects to attract investors from around the world. This global reach increases the potential for raising significant capital and building an international community around the project.

-

Liquidity

Tokens issued in an ICO can often be traded on cryptocurrency exchanges, providing liquidity to investors. This allows investors to buy or sell tokens as they see fit, potentially realizing returns on their investment even before the project is fully developed.

-

Innovation and Accessibility

ICOs provide an opportunity for projects to secure funding without the need for traditional venture capital. This has led to a surge in creativity and projects in the blockchain space, driving the industry forward.

| Year | ICOs Published | Funds Raised |

| 2016 | 29 | $90 million |

| 2017 | 875 | $6 billion |

| 2018 | 1,253 | $7.5 billion |

| 2019 | 109 | $370 million |

| 2020 | 14 | $55.6 million |

| 2021 | 320 | $378 million |

| 2022 | 217 | $117 million |

Who Can Launch an ICO?

While anyone can initiate an ICO, strict monitoring by authorities in developed nations like the U.S. ensures necessary registration. However, the ease of setting up an ICO as a scam, including fabricating registration documents, makes it crucial for potential investors to be vigilant. Before launching an ICO, entrepreneurs should carefully assess whether their business genuinely requires one. Initiating a security registration with the SEC is often essential in such endeavors.

Buying Into an ICO

Before investing in a new ICO, thorough research is essential. Begin by verifying the identities and accountability of the individuals behind the ICO. Next, investigate the project leaders’ track record in the cryptocurrency and blockchain industries. Beware of projects that lack individuals with verifiable and relevant experience in these fields, as this could be a red flag for a potential scam.

Identifying ICOs and Scams

In 2019, ICO activity experienced a significant decline, primarily due to the uncertain legal landscape surrounding ICOs. While there is no foolproof method to stay updated on all the latest initial coin offerings, interested individuals can research and participate in ICOs. Websites like TopICOlist.com offer comparisons of different ICOs. Additionally, investors can examine registered cryptocurrency exchanges to gain insights into newly listed and unlisted coins. Since many exchanges thoroughly vet the coins before listing, this approach can enhance safety.

Cryptocurrency aggregators can assist in identifying potential scams or genuine opportunities. However, it’s crucial to note that aggregators do not vet cryptocurrencies but provide purely informational services. They frequently include links to the project’s GitHub pages, websites, and social media platforms, discussing the problems the project aims to address. If there is no dedicated section describing a coin and no readily available information on websites, except for nonsensical phrases, it might be advisable to avoid such opportunities.

DO YOU KNOW?

“The U.S. Securities and Exchange Commission (SEC) can intervene in an ICO if necessary. For example, after the creator of Telegram raised $1.7 billion in an ICO in 2018 and 2019, the SEC filed an emergency action and obtained a temporary restraining order, alleging illegal activity on the part of the development team.4 In March 2020, the U.S. District Court for the Southern District of New York issued a preliminary injunction. Telegram was ordered to return $1.2 billion to investors and pay a civil penalty of $18.5 million.”

When investing in an ICO, there’s no guarantee you won’t fall victim to a scam. However, you can take several steps to reduce the risk of becoming involved in an ICO scam:

- Scrutinize the Project’s Goals: Successful ICOs typically have clear, concise goals outlined in straightforward, understandable white papers. Ensure that project developers can clearly define their objectives.

- Demand Transparency: Expect 100% transparency from companies launching an ICO. Verify the team’s identities, backgrounds, and qualifications. Look for evidence of their experience and expertise in the relevant industry.

- Review the ICO’s Terms and Conditions: Given the evolving regulatory landscape, it’s your responsibility to ensure that an ICO is legitimate. Carefully review the terms and conditions, paying particular attention to the token distribution, fundraising goals, and refund policy.

- Secure Escrow Wallet: Opt for ICOs that store funds in an escrow wallet. This type of wallet requires multiple access keys, offering protection against scams.

- Consider Cryptocurrency Purchases: Some ICOs may require investment in another cryptocurrency. Be prepared to purchase these coins to participate in the project.

ICO Hyping

Initial Coin Offerings (ICOs) often create significant buzz, attracting investors to online forums where they discuss potential opportunities. Prominent figures like Steven Seagal have encouraged their followers to invest in popular ICOs. However, the SEC has warned celebrities that endorsing ICOs on social media without disclosing any compensation received is illegal.

Notable cases include boxing legend Floyd Mayweather Jr. and music mogul DJ Khaled, who promoted Centra Tech, an ICO that raised $32 million in late 2017. Centra Tech was later deemed a scam, leading to settlements with U.S. regulators by Mayweather, Khaled, and guilty pleas from three Centra Tech founders for ICO fraud.

Before participating in an ICO, investors should thoroughly educate themselves about cryptocurrencies and the specific ICO in question. Since fake ICOs are more often detected than prevented, prospective investors should exercise extreme caution when making investment decisions.

How ICOs Differ from IPOs?

While ICOs and IPOs share some similarities, such as raising capital from the public, they differ in several key ways:

- Regulation: IPOs are heavily regulated by financial authorities, whereas ICOs operate in a more decentralized and less regulated environment.

- Ownership: IPOs involve selling shares of a company, and conferring ownership rights to investors. In contrast, ICOs typically offer utility tokens that provide access to a product or service rather than ownership.

- Accessibility: ICOs are generally more accessible to the public, allowing anyone with cryptocurrency to invest. IPOs, on the other hand, often require investors to meet specific financial criteria.

Conclusion

Initial Coin Offerings (ICOs) represent a transformative approach to fundraising in the digital age. They offer a decentralized, accessible way for projects to secure capital and for investors to participate in the growth of the blockchain ecosystem. However, the success of an ICO depends on careful planning, compliance with regulations, and effective marketing.

At SoluLab, we specialize in ICO development and offer end-to-end solutions to help your project succeed. From drafting a compelling whitepaper to developing robust smart contracts and creating a customized ICO platform, our team of blockchain experts is here to guide you every step of the way. With a proven track record and a deep understanding of cryptocurrency, SoluLab is your trusted partner in launching a successful ICO.

Whether you’re an entrepreneur with an idea or an established company looking to explore new fundraising avenues, contact SoluLab to learn how we can help you achieve your goals with a tailor-made ICO strategy.

FAQs

1. What is an Initial Coin Offering (ICO)?

An Initial Coin Offering (ICO) is a fundraising method where a company issues digital tokens in exchange for capital, typically in the form of cryptocurrency. It is a popular way for blockchain-based projects to raise funds.

2. How does an ICO work?

In an ICO, a company creates a whitepaper detailing the project and the associated tokens. Investors purchase these tokens during the ICO period, often using cryptocurrencies like Bitcoin or Ethereum. The funds raised are then used to develop the project.

3. What are the types of ICOs?

There are several types of ICOs, including public ICOs, private ICOs, security token offerings (STOs), and utility token ICOs. Each type has different characteristics and serves different purposes.

4. What are the benefits of participating in an ICO?

ICOs offer various benefits, including decentralized fundraising, global reach, and the potential for high liquidity. They also allow investors to get involved in early-stage projects that have significant growth potential.

5. How can SoluLab help with ICO development?

SoluLab provides end-to-end ICO development services, including whitepaper drafting, smart contract development, and marketing strategy. Our team of blockchain experts ensures your ICO is compliant, secure, and strategically positioned for success.