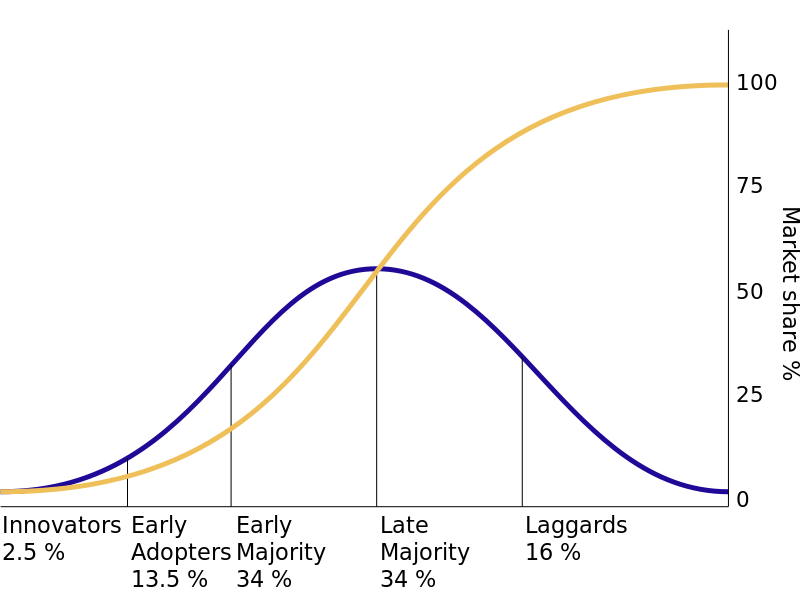

There is a predictable pattern to the adoption of new technologies. Web3 is no different. Introduced in 1962, in his seminal work, Diffusion of Innovations, Everett Rogers laid out the framework below.

This framework proved true time and again and has been adapted by the tech world over the past couple of decades.

As the graph shows, the first group to adopt a new innovation is, no surprise, the innovators.

Traits of innovators

Innovators are people that are motivated and excited about new things. They are tinkerers already spending their time and energy with new related technologies. One can be an innovator in a particular field and a complete laggard in another. In other words, the person that sees the next fashion trends years before they hit the scene is unlikely to have that same foresight on the next agrotech innovation that’s going to take the food production world by storm.

Let’s look at the start of blockchain. It began with engineers and tech geeks. People that contribute to open source projects and are excited to go knee-deep into cryptography. This is the group that came across Sitoshi’s original white paper on Bitcoin and thought it was going to change the world. They set up the first Bitcoin mines and couldn’t stop talking about it.

When innovators see something new and novel, they tell all their friends and peers about it. They are trustworthy experts and expose other innovators and adopters.

Innovators look past the rough edges and are patient with shortcomings. They will work through common friction points. They see the potential. They see the bigger vision and implications. More than anything, they want to be part of shaping it.

Traits of early adopters

The early adopter group is similar to innovators, but they don’t necessarily have the same level of expertise. They are enthusiastic about new innovations and are willing to spend time trying them out. They are also just as willing to look past the rough edges.

When Jeff Bezos started Amazon he had a vision of having an online store that sold everything. But he didn’t start by loading up the website with a random array of items. He started with books.

Amazon learned how to do books well. They quickly established catalogs of millions, found ways to ease the shipping process, and were able to stock so much more than a local bookstore. They kept old books that local retailers couldn’t and half of their early sales were for books that people couldn’t find at a local bookstore. Who buys these old and hard-to-find books? Enthusiasts. Early adopters.

Once they dominated the book market, they had two options: continue serving a customer base who reads books or expand to other markets.

eBay has a similar story. The auction site started as a platform with mostly Beanie Baby collectors that would buy and sell from each other. After monopolizing that market they didn’t go straight to selling sports cars and industrial surplus. They stuck with hobbyists and continued to be a place for trading collectibles online.

Early adoption of blockchain and web3

Returning to web3 and blockchain, we can’t ignore money as a critical driving force. Blockchain is literally using the internet to mint money! So of course, greed and speculation have been huge in driving swaths of people to this world.

In the early days, a single bitcoin was barely worth pennies, but as the value continued to rise, it attracted new enthusiasts.

Folks with technical chops continued finding their way to Bitcoin and the innovators continued building on the existing infrastructure, sharing their knowledge, and documenting their work. By doing this, they allowed others with less in-depth knowledge to participate.

Vitalik Buterin was writing for Bitcoin Magazine and exploring his own ideas that eventually led to the creation of a distributed virtually networked computer known as the Ethereum network.

Others were building exchanges to ease the process of buying and selling bitcoin and other goods using bitcoin.

Over the years, these early adopters went through many boom and bust cycles. But they persevered and the technology continued to mature.

Since Bitcoin was an open source project, many replicas, and derivative blockchains were created, and eventually, Ethereum hit the scene. This culminated in the ICO boom of 2017 when new blockchain tokens were launched daily. ICOs, short for Initial Coin Offerings, allowed participants to go crazy with speculation and it was not uncommon to see a token generate 10x and even 20x returns overnight. It was just as common to see them lose that much in hours.

By this time, the blockchain space had a good deal of infrastructure and there were many ways to buy, sell, and trade cryptocurrencies from decentralized exchanges to more standardized exchanges like Binance and Coinbase. CoinMarketCap aggregated listings from all of the exchanges, making it a source for price speculation.

While you can’t ignore the greed and get rich mentality going on at the time that brought us such phrases as ‘Wen Lambo?’ And ‘Wen Moon?’ Meaning, when can I buy a Lamborghini, or when is the price going to the moon? Thousands of engineers, entrepreneurs, and other specialists dedicated their time and energy to developing the technology and experimenting. The ICO boom essentially funded a fast-moving decentralized lab for innovation.

This laid the foundation for the next group of adopters to follow. In 2017 Bitcoin went mainstream, but it was short-lived as the market expectedly crashed.

Crossing the threshold

The threshold between early adopters and late adopters wasn’t truly crossed until 2020 when the pandemic struck. Around this time, bitcoin started rising in value again from a low nearing $3,000 (after being worth nearly $20,000 at its peak in 2017). At this point, a lot of groundwork was done by early adopter investors who tried creating regulated cryptocurrency products on the public markets. Companies like Tesla declared that they are adding Bitcoin to their balance sheets. Cash App, Robinhood, and other mainstream fintech services allowed people to buy cryptocurrency as easily as stocks on their platforms.

While blockchain was going mainstream, NFTs were just gaining some traction with a new group of early adopters. Cryptopunks launched in 2018. Ten thousand unique pixelated avatars were given away for free for anyone that was willing to mint them from their website. A small group of digital artists was exploring putting their artwork on NFTs and an early group of collectors started buying.

You can also read : Tokenize Your Property to Reap Fortunes Given by Web3 Tech!

NFT marketplaces started to hit the scene and in 2021 the NFT craze began. New possibilities and uses for NFTs were explored and the term Web3 started to get thrown around. By the end of 2021, NFTs crossed the threshold from early adopters to mainstream audiences.

Today we have brands like Starbucks announcing an NFT-based rewards program. Tiffany’s is creating unique jewelry for Cryptopunk holders. Sephora and other LVMH brands are getting involved. Instagram, Twitter, Reddit, and other social media platforms already have NFT integrations.

Web3 today for the enthusiasts

Currently, opportunities to build Web3 products and communities span the whole spectrum of the adoption curve.

On the innovator side of the spectrum, there are still quite a lot of infrastructural products to create. Secure and effective bridges between blockchains are at the top of that list. Ongoing security challenges will perhaps always be on that list having massive upstream impacts. Many of these opportunities exist at the technical, governance, and protocol layers. These areas require a high levels of expertise, intelligence, and skills.

On the early adopter end, get creative with it. Especially when it comes to NFTs. They’re flexible. They can be tickets, collectibles, property contracts, and numerous other things.

Just combine NFT with any niche audience and you have a business.

How about NFT + Sports fans?

Let’s take something like Draftly. They allow sports fans to buy NFT collectibles. This is not a tech savvy group, just enthusiasts that buy sports stuff. Now they can spend as much of their families’ savings as they want collecting NFTs of their favorite sports team.

Or NFT + Live events?

YellowHeart comes to mind as an organization using NFTs for event tickets.

Or NFT + Farming?

Or NFT + Glass blowing?

Or NFT + … Well you get the idea. NFT + enthusiast of any kind is a business idea.

Web3 for the mainstream

On the other side of the chasm, the late adopters and laggards — large brands can now offer easy on-ramps like we already see by the companies mentioned earlier. Products and services for this group also require a different type of team. The innovators and early adopter products are built by makers and builders. People that enjoy the hard work of making things, but don’t necessarily enjoy the hard work of working with regulators, legal processes, and negotiating partnerships.

You can also read : Tokenize your Property — Make it for Sale

That’s critical work for the mainstream audience. This group will be owning and using NFTs without even knowing it someday.

And that’s the point — the technology should fade into the background. No one says I bought that book from a cloud-hosted website. And one day they’ll stop saying check out this NFT.

Credit : Medium