As we navigate through the forthcoming sections, we will uncover the profound impact of asset tokenization on traditional financial markets, where assets are being digitized and made available to a wider audience. We’ll also explore how tokenization is empowering decentralized finance (DeFi) and non-fungible tokens (NFTs) as innovative instruments for investment and wealth management. Beyond finance, we’ll venture into real estate, supply chain management, art, and gaming to illustrate the far-reaching influence of tokenization.

What Exactly is Tokenization?

Tokenization is the process of converting tangible or intangible assets into digital tokens or representations, typically utilizing blockchain technology. These tokens can represent ownership, value, or access rights to the underlying asset. In essence, tokenization transforms physical or traditional assets into a format that can be easily traded, managed, and transferred in the digital realm. It provides a secure and transparent means of recording ownership, enabling fractional ownership, enhancing liquidity, and reducing the barriers to entry for a broader range of investors and participants in various industries.

Importance of Digital Assets

Digital assets, in the context of tokenization, are the driving force behind the transformation of industries. These assets, represented as tokens on blockchain networks, offer several crucial advantages. First, they enable increased accessibility and inclusivity, allowing a wider range of individuals to invest in assets that were previously out of reach. Secondly, digital assets enhance transparency and traceability, reducing the risk of fraud and ensuring that ownership records are accurate and immutable. They also facilitate fractional ownership, meaning that multiple stakeholders can own a portion of an asset, making it easier to pool resources and invest collaboratively.

Read Our Blog: What is Asset Tokenization?

Furthermore, the digitization of assets enhances liquidity, as tokens can be traded more easily and swiftly than their physical counterparts. This liquidity can unlock capital and provide more significant opportunities for investment. Finally, the importance of tokenization and digital assets lies in their potential to disrupt traditional industries, offering new avenues for innovation and revenue generation.

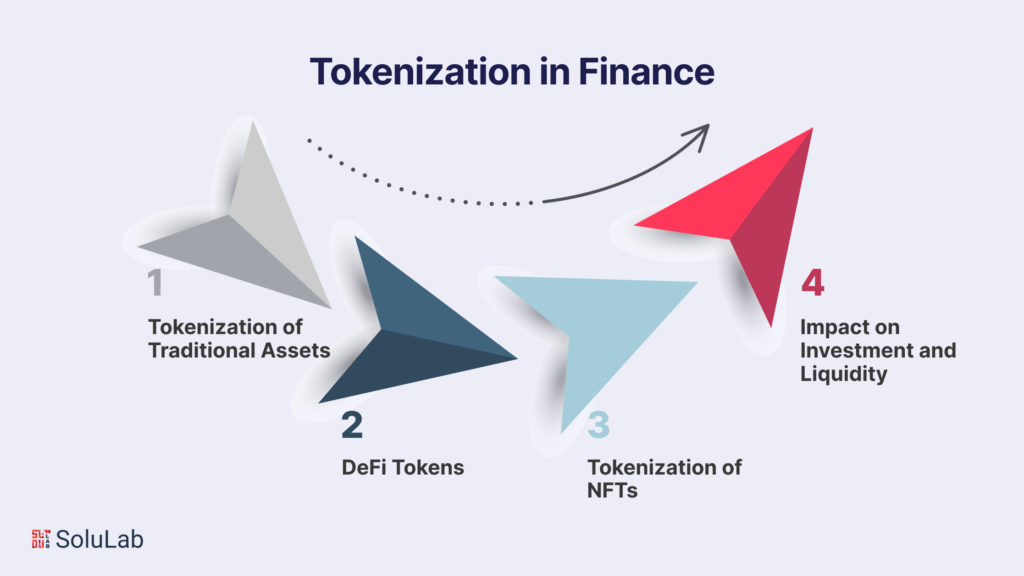

Tokenization in Finance

In the financial sector, the importance of tokenization is making a significant impact by transforming the way traditional assets are bought, sold, and managed. This section delves into the key facets of tokenization in finance, from the digitization of traditional assets to the rise of decentralized finance (DeFi) tokens and the emergence of non-fungible tokens (NFTs).

Tokenization of Traditional Assets

- Real Estate: The tokenization of real estate assets is revolutionizing property investment. By converting physical properties into digital tokens, real estate can be divided into fractional ownership, making it more accessible to a broader range of investors. This democratization of real estate investment is opening doors for smaller investors to participate in high-value properties and presents opportunities for diversification and reduced barriers to entry.

- Stocks and Bonds: Traditional financial instruments like stocks and bonds are being tokenized, enabling them to be traded with greater ease and efficiency on blockchain platforms. This digitization process not only enhances the liquidity of these assets but also streamlines the settlement process, reducing intermediaries and costs in traditional financial markets.

Decentralized Finance (DeFi) Tokens

Decentralized Finance, or DeFi, is a burgeoning ecosystem of financial applications built on blockchain technology. DeFi tokens are at the heart of this movement, representing a wide range of financial assets and services, from cryptocurrencies to lending, borrowing, and decentralized finance exchanges. DeFi tokens are decentralized, and autonomous, and offer increased accessibility, enabling users to bypass traditional financial institutions and engage in peer-to-peer financial activities.

Tokenization of NFTs

Non-Fungible Tokens (NFTs) have taken the art and entertainment worlds by storm. These digital tokens represent ownership of unique, non-interchangeable digital or physical assets, such as digital art, collectibles, and even real estate. The tokenization of NFTs has introduced a novel paradigm for artists, collectors, and creators, revolutionizing the way we value and exchange art and digital collectibles.

Impact on Investment and Liquidity

The impact of tokenization in finance goes beyond digitization. It has the potential to redefine investment strategies and enhance liquidity in various ways. Tokenization enables fractional ownership, allowing a single asset to have multiple owners, making it easier for individuals to invest in high-value assets. This, in turn, can unlock new sources of capital, broaden investment portfolios, and democratize investment opportunities.

Furthermore, the digitization of assets enhances liquidity by facilitating easy and efficient trading on digital platforms. Tokens can be bought, sold, and transferred with reduced friction, leading to faster settlements and potentially greater market efficiency. This transformation in liquidity has the potential to alter the dynamics of financial markets, making them more accessible, transparent, and cost-effective for all participants.

In the ever-evolving landscape of finance, the trend of tokenization is paving the way for a more inclusive and efficient financial ecosystem, changing the way we invest and interact with traditional financial assets.

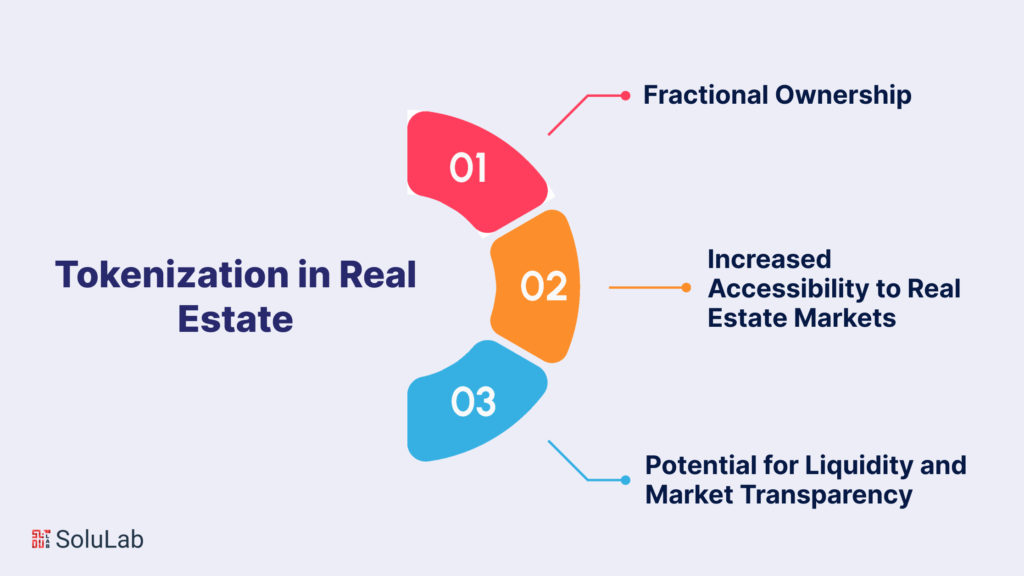

Tokenization in Real Estate

Tokenization is ushering in a new era for the real estate industry, offering innovative solutions that enhance investment opportunities, accessibility, and transparency. This section explores the impact of tokenization on real estate, including fractional ownership, increased market accessibility, and the potential for improved liquidity and transparency.

Fractional Ownership

One of the most compelling aspects of tokenization in real estate is fractional ownership. Traditional real estate investment often requires substantial capital, making it inaccessible to many. With tokenization, properties can be divided into smaller, more affordable fractions, and these fractions are represented by digital tokens. Investors can now purchase fractions of real estate tokenization assets, thereby reducing barriers to entry and enabling a broader demographic to participate in property investment. This democratization of real estate investment is reshaping the industry and opening up new opportunities for investors, especially in high-value urban properties.

Increased Accessibility to Real Estate Markets

Tokenization is transforming the way individuals access real estate markets. Instead of navigating complex and often region-specific real estate procedures, investors can now access a global array of properties via tokenized platforms. This increased accessibility allows for diversification across different properties, locations, and real estate asset types. As a result, investors can tailor their portfolios to suit their preferences and risk tolerance. Real estate markets, traditionally known for their illiquidity, are now becoming more dynamic and open to a broader range of participants.

Potential for Liquidity and Market Transparency

Tokenization has the potential to significantly impact the liquidity and transparency of real estate markets. Traditional real estate transactions are often lengthy and involve numerous intermediaries, leading to slow settlements. Tokenization streamlines these processes by providing a digital platform for real estate trading. Digital tokens representing property assets can be swiftly bought, sold, and transferred, enhancing liquidity and making the market more dynamic.

Check Our Blog Post: Understanding The Carbon Credit Tokenization

Moreover, the use of blockchain technology and smart contracts can increase transparency in property transactions. Ownership records, property histories, and transaction details can be recorded securely and immutably on the blockchain, reducing the risk of fraud and disputes. This technology can also provide a new level of trust and confidence in the market, which is essential for both individual and institutional investors.

NFT Digital Asset are also entering the real estate arena, where unique digital properties are being tokenized and sold as non-fungible tokens. Tokenization development companies play a pivotal role in enabling these innovations, providing the technology and infrastructure to digitize real estate assets and create opportunities for fractional ownership and liquidity in this traditionally rigid market. As tokenization continues to gain momentum, it is redefining how we engage with real estate and presenting a promising future for both investors and the industry as a whole.

Tokenization in Art and Collectibles

Tokenization is not limited to traditional assets; it is also reshaping the art and collectibles market, providing new avenues for ownership, provenance verification, and opportunities for artists and collectors. In this section, we will explore how Non-Fungible Tokens (NFTs) and digital art are at the forefront of this transformation, and how blockchain technology is revolutionizing the art and collectibles world.

NFTs and Digital Art

Non-Fungible Tokens (NFTs) have catapulted digital art into the spotlight. These tokens represent unique, non-interchangeable digital or physical assets, making them ideal for the art world. NFTs have enabled artists to tokenize their digital creations, turning them into scarce digital assets that can be bought and sold. Top asset tokenization platforms have sprung up to facilitate these transactions, providing artists with a platform to showcase and sell their work directly to a global audience. The use of blockchain technology ensures the rarity and provenance of each piece, adding a layer of trust to the art market.

Provenance and Ownership Verification

Blockchain technology applications are particularly relevant for the art and collectibles market. Each tokenized artwork is linked to a blockchain, which serves as an immutable ledger of ownership. This ensures that the provenance of an artwork is transparent and indisputable, reducing the risk of art fraud and counterfeit pieces. Collectors and buyers can trace the history of the artwork from its creation to the current owner. The digital signature of each piece is secured using blockchain’s cryptographic techniques, enhancing trust and confidence in the authenticity of art and collectibles.

New Opportunities for Artists and Collectors

Tokenization has introduced exciting opportunities for both artists and collectors. Artists can now reach a global audience directly through digital platforms, bypassing the traditional art market’s gatekeepers. This allows emerging artists to gain recognition and establish themselves in the art world. Additionally, artists can receive royalties from secondary sales of their work due to blockchain’s smart contract capabilities.

For collectors, the tokenization of art offers fractional ownership opportunities. This means that individuals can co-own high-value artworks or collectibles, reducing the financial barriers to entry. Tokenized art can be traded easily on various online marketplaces, promoting liquidity in the art market and providing collectors with the flexibility to diversify their art portfolios.

In the art and collectibles market, blockchain technology application is fundamentally changing the way art is created, bought, and sold. It provides new opportunities for artists to showcase their work, for collectors to diversify their holdings, and ensure the provenance and ownership verification of artworks. As the art and collectibles tokenization trend continues to evolve, it has the potential to reshape the dynamics of the art world and offer fresh perspectives on the value and ownership of creative works.

Regulatory Challenges

While tokenization presents exciting opportunities and transformations across various industries, it is not without its regulatory challenges. As the adoption of tokenization technology and digital assets continues to gain momentum, governments and regulatory bodies are tasked with addressing a range of complex issues. In this section, we will explore the regulatory challenges associated with tokenization.

Security and Compliance

Ensuring the security of digital assets and compliance with existing and evolving regulatory frameworks is a critical concern. As digital assets are often borderless, it can be challenging for regulators to monitor and enforce compliance. Additionally, the security of digital asset platforms and exchanges is paramount, as breaches can lead to significant financial losses. Striking the right balance between innovation and the protection of investors and consumers is an ongoing challenge that regulators face.

Legal Implications

The legal landscape for tokenization is evolving and can be ambiguous in some jurisdictions. Determining the legal status of digital tokens, whether they are considered securities, commodities, or something entirely different, can vary from one country to another. This lack of international standardization creates a complex environment for businesses and investors alike. Clear and consistent legal frameworks are essential to foster innovation while mitigating risks associated with regulatory uncertainty.

Read Our Blog Post: Importance Of Tokenization Of Assets

International Perspectives

Tokenization often transcends borders, and the lack of international harmonization in regulations poses a challenge. Conflicting regulations and varying compliance requirements across different countries can hinder the growth of tokenization. Collaborative efforts on an international scale are needed to create a cohesive and globally recognized regulatory framework.

In navigating these regulatory challenges, industry participants, including businesses, investors, and regulatory bodies, must work together to develop solutions that strike a balance between fostering innovation and protecting stakeholders. The continued development and implementation of clear, adaptable regulations will be crucial in harnessing the full potential of tokenization while mitigating risks and ensuring a secure and transparent digital asset ecosystem. As tokenization matures, regulatory frameworks will likely evolve, bringing greater clarity and stability to this transformative technology.

Future Potential of Digital Assets

As tokenization trends continue to reshape industries, it’s essential to examine the future potential of this transformative technology. This section explores the anticipated growth of the tokenization market and the potential for tokenization to extend beyond its current applications.

Growth of the Tokenization Market

The tokenization market is poised for substantial growth in the coming years. With the increasing recognition of digital assets and blockchain technology, the adoption of tokenization is set to expand across various industries, from finance and real estate to supply chain management and art. The growth of the tokenization market is being driven by the desire for increased liquidity, enhanced transparency, and improved accessibility to assets. As more businesses and individuals recognize the benefits of tokenization, investment in this technology is expected to surge.

Blockchain asset tokenization guides are emerging as invaluable resources, providing a framework for businesses and individuals looking to tokenize their assets. These guides offer insights into the best practices and regulatory considerations when tokenizing assets, ensuring a smooth and compliant tokenization process. Furthermore, top asset tokenization platforms are continually improving their offerings, making it easier for businesses and individuals to participate in the tokenization trend.

Potential for Tokenization Beyond Current Applications

While tokenization has already disrupted numerous sectors, its potential reaches beyond its current applications. The ability to represent ownership, value, and rights through digital tokens is a versatile concept that can be adapted to various assets and industries. As technology evolves, we can expect to see tokenization in areas we might not have envisioned yet.

For instance, tokenization could find its way into intellectual property rights, allowing artists, authors, and content creators to tokenize their work, ensuring they receive fair compensation and credit for their creations. Additionally, tokenization could be applied to supply chain management for pharmaceuticals, luxury goods, and even agricultural products, enhancing traceability, quality control, and trust among consumers.

Read Also: Tokenization in Natural Language Processing: Methods, Types, and Challenges

The future of tokenization is undoubtedly filled with innovative possibilities. As blockchain technology matures and becomes more mainstream, we can anticipate a broadening of tokenization applications, with new sectors and asset classes embracing the benefits of this digital revolution. Tokenization’s transformative potential is far-reaching, and its growth and diversification are poised to redefine the way we interact with assets in the digital age.

Conclusion

In the rapidly evolving landscape of digital assets and blockchain technology, tokenization is emerging as a formidable force reshaping industries and economies. From its transformative impact in finance, real estate, supply chains, art, and gaming, to the promise of creating new avenues for investment and innovation, tokenization represents a paradigm shift in the way we perceive and interact with assets. The power of blockchain, coupled with the creativity of individuals and businesses, has paved the way for fractional ownership, increased accessibility, and enhanced transparency in a wide array of sectors. As top asset tokenization platforms and blockchain asset tokenization guides continue to mature, they are empowering users to navigate this dynamic landscape with confidence.

The future of tokenization holds great promise, both in terms of market growth and in its potential to venture into uncharted territories. As regulatory challenges are addressed and legal frameworks solidify, tokenization is expected to continue its upward trajectory. Its potential is not limited to what we currently observe; it extends into new industries and unexplored applications, promising to redefine how we interact with assets and, in the process, usher in a more inclusive, transparent, and efficient digital economy. In this era of transformation, tokenization represents a powerful and unstoppable force, one that will undoubtedly play a pivotal role in shaping the future of industries and investment.

SoluLab, as an Asset Tokenization Development Company, with its expertise in blockchain technology and deep understanding of tokenization, is well-positioned to provide invaluable assistance to businesses and individuals looking to harness the power of digital assets. Their experience in developing blockchain-based solutions and top asset tokenization platforms enables them to guide clients through the complex process of tokenization with confidence. SoluLab’s blockchain asset tokenization guides offer a roadmap to navigate the intricacies of this transformative technology, ensuring compliance with evolving regulatory frameworks while achieving efficient and secure tokenization. With a track record of delivering innovative blockchain solutions, hire dedicated developers from SoluLab as it is a trusted partner in the journey toward embracing the full potential of tokenization and blockchain technology.

FAQs

1. What is tokenization, and how does it work in the context of digital assets?

Tokenization involves converting tangible or intangible assets into digital tokens using blockchain technology. These tokens represent ownership or rights to the underlying asset. It’s a way to make assets more accessible and tradable in digital form.

2. How is tokenization changing the real estate market, and what are the benefits for investors?

Tokenization in real estate allows for fractional ownership, making it more accessible to investors. It also increases liquidity and transparency in the market, enabling investors to diversify their portfolios and invest in high-value properties.

3. What are some regulatory challenges associated with tokenization, and how can they be addressed?

Regulatory challenges include security, compliance, and legal uncertainties. To address these issues, businesses and regulators need to collaborate in developing clear and adaptable regulatory frameworks to balance innovation and investor protection.

4. How are Non-Fungible Tokens (NFTs) transforming the art and collectibles market?

NFTs have brought digital art into the spotlight, enabling artists to tokenize their work. They provide a new way to verify ownership and provenance while offering opportunities for artists to reach a global audience directly.

5. What is the future potential of tokenization, and where might we see its application beyond current use cases?

The future potential of tokenization is immense, with anticipated growth in the tokenization market. It’s expected to expand into areas like intellectual property rights, supply chain management, and beyond, thanks to the versatility of blockchain technology and the power of digital tokens.