Decentralized Finance, more commonly referred to as DeFi, has emerged as a groundbreaking force within the financial industry. In this blog, we will embark on a journey to unravel the intricate world of DeFi and delve into the top defi trends that are currently shaping its future. DeFi stands at the forefront of a financial revolution, challenging conventional systems and offering a novel perspective on the provision of financial services.

The term “DeFi” encompasses a wide array of financial applications and services built on blockchain technology. What sets it apart is its decentralized nature, enabling financial transactions and services to be conducted without the need for traditional intermediaries, such as banks. Instead, DeFi relies on smart contracts and blockchain technology to create an open, transparent, and accessible financial ecosystem.

The Rise of DeFi

The ascent of DeFi has not been sudden but rather an evolutionary process that began with the inception of blockchain technology. It has been driven by a combination of factors, including the widespread adoption of blockchain, the Ethereum platform’s emergence, and a growing desire for financial inclusivity. As we explore the historical trajectory of DeFi ecosystem, several significant milestones and pivotal developments.

One of the driving forces behind DeFi’s emergence was the release of Ethereum in 2015. Ethereum introduced the concept of smart contracts, self-executing agreements with the terms of the contract written directly into code. These smart contracts paved the way for decentralized applications (DApps) and laid the foundation for DeFi protocols. Ethereum’s programmability allowed developers to create decentralized financial applications, setting the stage for the DeFi ecosystem to flourish.

In the years that followed, DeFi saw substantial advancements in lending and borrowing protocols, decentralized exchanges (DEXs), yield farming, and governance tokens. These innovations, each building upon the other, contributed to DeFi’s rapid growth. The possibilities for decentralized finance trends expanded as new projects and platforms emerged, offering a spectrum of financial services previously monopolized by traditional institutions.

In essence, the rise of DeFi can be likened to the emergence of a parallel financial universe, one that operates on blockchain technology, is open to anyone with an internet connection, and is governed by code rather than intermediaries. The journey to this point has been marked by innovation, experimentation, and a continuous quest to redefine the DeFi and the future of finance.

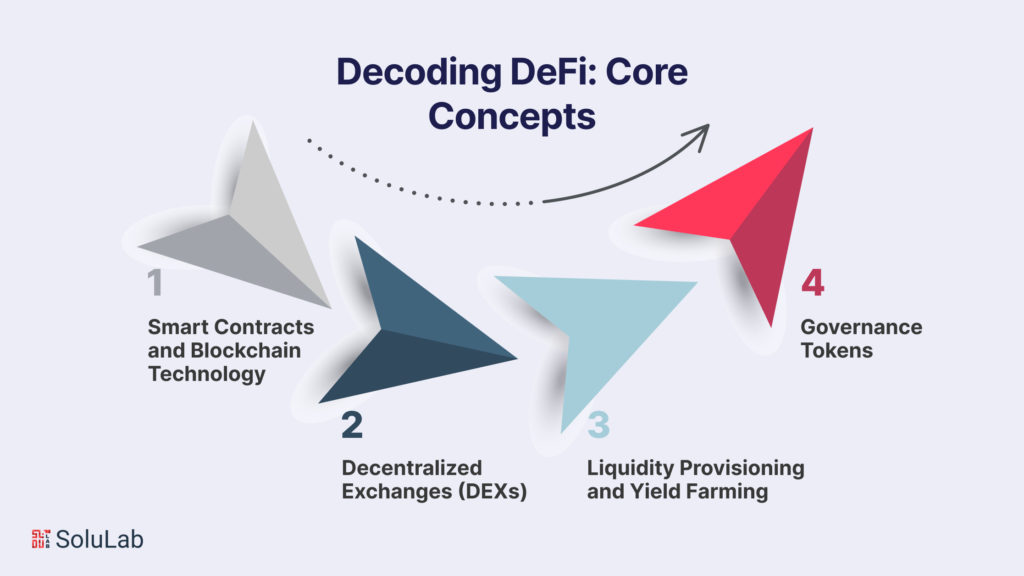

Decoding DeFi: Core Concepts

To truly grasp the trends and developments within the DeFi landscape, it’s essential to understand the fundamental concepts that underpin this financial revolution. DeFi isn’t just a buzzword; it’s a complex and innovative ecosystem built on a foundation of blockchain technology. In this section, we’ll decode the core concepts that are central to DeFi’s operation.

-

Smart Contracts and Blockchain Technology

At the heart of DeFi are smart contracts, self-executing agreements with the terms and conditions directly encoded into computer programs. These contracts automate financial processes, ensuring that transactions occur when predefined conditions are met. Ethereum, a blockchain platforms designed to support smart contracts, has been the epicenter of DeFi’s growth. Smart contracts have replaced the need for intermediaries, executing tasks like lending, borrowing, and trading without the involvement of traditional banks or financial institutions.

Blockchain technology, on the other hand, provides the decentralized and immutable ledger on which DeFi solutions operates. Transactions and data are stored across a network of computers, ensuring transparency and security. This foundation of blockchain ensures that DeFi transactions are trustless, meaning they can occur without the need for trust between parties.

-

Decentralized Exchanges (DEXs)

Decentralized exchanges are a key component of the DeFi ecosystem. These platforms enable users to trade cryptocurrencies directly with one another, without the need for a centralized intermediary. DEXs operate through smart contracts, facilitating peer-to-peer trading while allowing users to maintain control of their funds. This approach significantly reduces counterparty risk and enhances the security of transactions.

-

Liquidity Provisioning and Yield Farming

Liquidity provisioning is the practice of providing assets to decentralized exchanges, enabling other users to trade them. In return, liquidity providers earn fees and rewards. Yield farming, a popular DeFi practice, involves optimizing the use of these assets to maximize returns. Users can earn interest, lending fees, and governance tokens by participating in liquidity provision and yield farming protocols.

-

Governance Tokens

Governance tokens are tokens that provide users with decision-making power within a DeFi ecosystem. Holders of these tokens can vote on proposed changes, upgrades, and alterations to the protocol. This democratic approach to governance empowers the community to have a say in the development and management of DeFi lending platforms.

Understanding these core concepts is crucial for anyone looking to navigate the DeFi trends effectively. They serve as the building blocks for the multitude of financial services and applications that DeFi has to offer. As we move forward in this blog, we will explore the trends and innovations emerging within DeFi and how they relate to these core concepts.

DeFi Trends in 2024

As we journey into 2024, the DeFi landscape continues to evolve rapidly. In this section, we’ll delve into the key trends and developments that are shaping the DeFi space this year.

-

Decentralized Finance 2.0 (DeFi 2.0)

DeFi 2.0 represents the next phase of decentralized finance, building upon the foundation laid by the first wave of DeFi projects. This evolution is characterized by a focus on enhancing the scalability, security, and user experience of DeFi applications. DeFi 2.0 aims to address some of the limitations that were observed in the initial top DeFi trends projects, such as high gas fees and network congestion. Layer 2 solutions and alternative blockchain networks are expected to play a crucial role in achieving DeFi 2.0’s objectives.

-

Cross-Chain Interoperability

Interoperability has become a central theme in the DeFi space. As the DeFi ecosystem expands, there is a growing need to connect various blockchain networks, enabling seamless asset transfers and interactions across different chains. Cross-chain solutions like Polkadot, Cosmos, and bridges are gaining prominence, allowing users to access a more extensive range of assets and services.

-

Non-Fungible Tokens (NFTs) in DeFi

Non-fungible tokens, or NFTs, have gained immense popularity in recent years, primarily in the context of digital art and collectibles. In 2024, NFTs are finding their way into DeFi applications. DeFi projects are exploring the integration of NFTs for collateral, enabling users to leverage their digital assets to access loans and other financial services. This trend opens up new possibilities for NFT holders to derive value from their digital collectibles beyond mere ownership.

Regulatory Challenges and Responses

The DeFi ecosystem is increasingly attracting the attention of regulators worldwide. As top DeFi trends projects expand and handle more significant amounts of value, regulatory scrutiny is on the rise. While DeFi aims to operate in a decentralized and permissionless manner, it’s confronting challenges related to compliance with financial regulations. In 2024, we can expect to see more discussions and potential regulatory actions to address these challenges. Top DeFi trends in 2024 projects and users alike are navigating these uncharted waters, seeking ways to balance innovation with compliance.

These trends highlight the dynamic nature of the DeFi space. DeFi is not a static concept; it continues to evolve and adapt to the changing landscape of the broader financial industry and blockchain technology. As we move forward in this blog, we will explore the implications of these trends and what they mean for the future of decentralized finance.

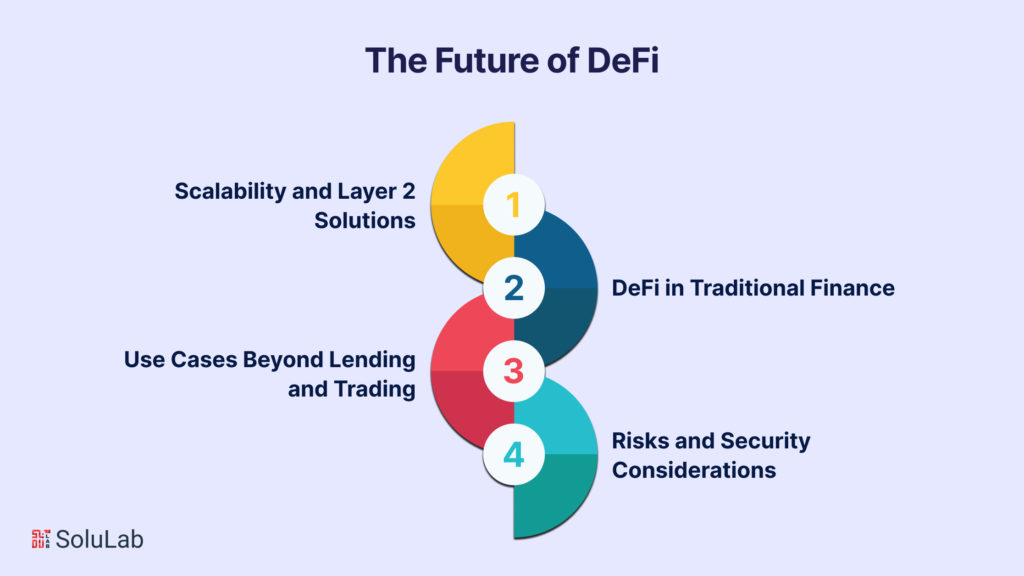

The Future of DeFi

The future of DeFi holds immense promise and potential for reshaping the global financial landscape. As we look ahead, several key factors and developments are likely to play a significant role in shaping the future of decentralized finance.

-

Scalability and Layer 2 Solutions

One of the most pressing challenges facing DeFi is scalability. Ethereum, the primary platform for DeFi projects, has struggled with high gas fees and network congestion. To overcome these limitations, Layer 2 solutions such as Optimistic Rollups and zk-Rollups are being implemented. These solutions aim to enhance the scalability of Ethereum and other blockchain networks, making DeFi more accessible and cost-effective for users.

-

DeFi in Traditional Finance

DeFi is no longer operating in isolation. It is increasingly intersecting with traditional DeFi and the future of finance. Traditional financial institutions are recognizing the potential benefits of DeFi, including reduced operational costs, enhanced transparency, and improved access to financial services. We can expect to see more partnerships, integrations, and collaborations between DeFi projects and traditional financial entities in the future.

-

Use Cases Beyond Lending and Trading

While lending and trading have been the primary use cases in DeFi, the ecosystem is diversifying. New DeFi Solutions applications are emerging, including decentralized insurance, prediction markets, and decentralized identity solutions. These innovations extend the scope of DeFi, offering users a broader array of financial services that were once the domain of centralized institutions.

-

Risks and Security Considerations

With the rapid expansion of the DeFi ecosystem, the risk landscape is evolving. Security remains a paramount concern. Smart contract vulnerabilities, hacks, and scams are real threats. Users and projects must remain vigilant and prioritize security. The development of decentralized insurance and risk management solutions within DeFi is a step toward mitigating these risks.

Conclusion

In conclusion, the future of DeFi is marked by innovation, growth, and integration. DeFi is not just a niche sector of finance; it has the potential to redefine how financial services are accessed and utilized worldwide. However, with its expansion comes increased responsibility. Users and projects must adapt to regulatory changes, enhance security measures, and maintain a commitment to responsible financial practices.

As we journey into the future of DeFi trends, it’s important to remember that this landscape is continually evolving. The transformative potential of DeFi is palpable, and it will be fascinating to witness how it continues to reshape the financial industry in the years to come. Decentralized finance trends is not merely a trend; it’s a fundamental shift in the way we think about and interact with the world of DeFi and the future of finance.

Solulab is a prominent technology company specializing in blockchain and DeFi development services. With a strong foundation in blockchain development, smart contracts, and DApp creation, Solulab is actively contributing to the DeFi ecosystem. They offer services that align with the core technologies underpinning DeFi development company and security of DeFi platforms, thus supporting the growth and innovation in the DeFi space.

FAQs

1. What is DeFi, and how does it differ from traditional finance?

DeFi, short for Decentralized Finance, is a financial ecosystem built on blockchain technology that operates without traditional intermediaries like banks. It allows users to access financial services, such as lending and trading, directly through decentralized applications (DApps) and smart contracts. Unlike traditional finance, DeFi is open, permissionless, and operates on a global scale.

2. What are the main challenges facing DeFi in terms of scalability and transaction costs?

One of the primary challenges in DeFi is scalability. Many DeFi platforms, notably those on Ethereum, have faced network congestion and high gas fees. This can hinder the user experience and limit accessibility. To address this, Layer 2 solutions are being developed to improve scalability and reduce transaction costs.

3. How are non-fungible tokens (NFTs) integrated into DeFi, and what are the potential use cases?

NFTs, which represent unique digital assets, are finding their way into DeFi. They can be used as collateral for loans, providing NFT holders with liquidity without needing to sell their valuable digital collectibles. NFTs can also be used for fractional ownership and participation in DeFi protocols, expanding their utility beyond the art and gaming sectors.

4. How does DeFi interact with traditional financial institutions and regulations?

DeFi is increasingly interacting with traditional financial institutions. Some banks and financial entities are exploring partnerships and integrations with DeFi projects to leverage the benefits of blockchain technology. However, this intersection poses regulatory challenges, as DeFi operates in a largely decentralised and borderless manner. The relationship between DeFi and regulatory compliance is an ongoing topic of discussion.

5. What are the risks associated with DeFi, and how can users protect themselves?

DeFi is not without risks. Smart contract vulnerabilities, hacks, and scams have occurred. To protect themselves, users should conduct thorough research before participating in Top DeFi Trends in 2024 projects, utilise secure wallets and hardware wallets, and consider purchasing decentralized insurance to mitigate potential losses. Additionally, staying informed about security best practices is essential for safe DeFi engagement.