Have you ever thought about how artificial intelligence may revolutionize the financial world? By 2027, AI in finance is expected to be a $130 billion sector. But what exactly does that mean, and why does it matter?

Finance has historically been about assessing data to forecast both risks and profits. Human analysis, however, has extremely limited capabilities in today’s digital age because to the massive volumes of data. This is where artificial intelligence comes in: to discover the needles in the haystack of financial data.

Artificial Intelligence (AI) is transforming numerous sectors and finance is at the forefront of this revolution. From automating mundane tasks to providing deep insights into market trends, AI is reshaping the financial era in unprecedented ways. In this blog, we will get to know the various facets of AI in finance, its benefits, challenges, and the future it holds.

An Overview of Artificial Intelligence in Finance

Artificial Intelligence (AI) is revolutionizing the finance industry by integrating advanced technologies such as machine learning (ML), natural language processing (NLP), and robotic process automation (RPA). These technologies enable financial institutions to analyze vast amounts of data, identify patterns, make predictions, and automate various processes, thereby transforming traditional financial operations.

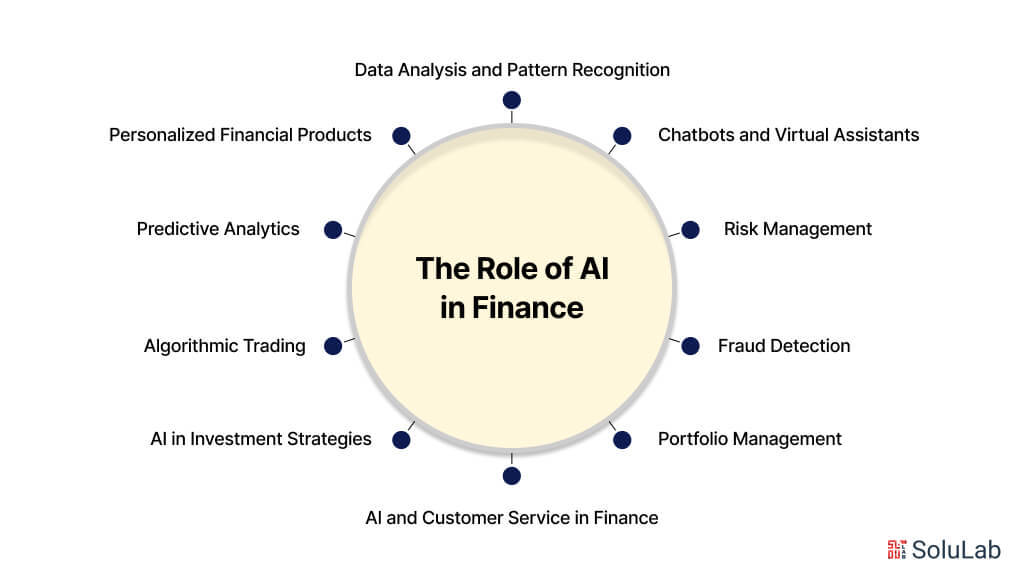

The Role of Artificial Intelligence in Finance

AI in finance is reshaping how financial services are delivered, making them more efficient, accurate, and customer-centric. The integration of AI in financial services allows institutions to handle large datasets, which are essential for making informed decisions. The following are some of the key areas where AI is making a significant impact:

-

Data Analysis and Pattern Recognition

AI systems can process and analyze enormous volumes of financial data far more quickly and accurately than humans. Machine learning algorithms, a core component of AI, are particularly adept at recognizing complex patterns in data. These patterns can provide valuable insights into market trends, customer behavior, and potential risks. By using AI, financial institutions can gain a deeper understanding of the market dynamics and make more informed investment decisions.

-

Predictive Analytics

Predictive analytics is another powerful application of AI in finance. By analyzing historical data, AI algorithms can forecast future market movements, helping investors and financial managers to anticipate changes and adjust their strategies accordingly. This capability is especially useful in high-frequency trading, where split-second decisions can lead to significant gains or losses.

-

Risk Management

Effective risk management is crucial in the financial sector, and AI is enhancing this aspect significantly. AI-powered risk assessment tools can evaluate vast amounts of data to identify potential risks and vulnerabilities. These tools can detect subtle signs of financial instability or fraudulent activities that may not be apparent to human analysts. By providing early warnings, AI helps institutions mitigate risks and protect their assets.

-

Fraud Detection

AI is instrumental in detecting and preventing fraud in financial transactions. Machine learning algorithms can evaluate transaction trends and detect abnormalities that might suggest fraudulent activity. Natural language processing (NLP) can also be used to analyze textual data from emails, social media, and other sources to detect potential fraud schemes. By implementing AI-driven fraud detection systems, financial institutions can significantly reduce the incidence of fraud and enhance the security of their operations.

-

AI and Customer Service in Finance

Customer service is a critical area where AI is making a substantial impact. Financial institutions are using AI to provide more personalized and responsive customer service. Here are some ways AI is enhancing customer interactions:

-

Chatbots and Virtual Assistants

Chatbots and virtual assistants driven by AI are becoming more prevalent in the financial industry. These tools can handle a wide range of customer queries, from account balances to transaction details, providing instant responses and freeing up human agents to handle more complex issues. Advanced chatbots can also offer personalized financial advice based on the customer’s transaction history and financial goals.

-

Personalized Financial Products

AI allows financial companies to provide individualized financial goods and services. By analyzing customer data, AI can identify individual needs and preferences, allowing institutions to tailor their offerings accordingly. For example, AI can recommend specific investment products, loan options, or insurance policies that best match a customer’s financial situation and goals.

-

AI in Investment Strategies

Investment strategies are also being transformed by AI. The ability of AI to process and analyze large datasets allows for more sophisticated and effective investment strategies. Here are some ways AI is optimizing investment decisions:

-

Algorithmic Trading

Algorithmic trading, often known as automated trading, utilizes artificial intelligence algorithms to carry out transactions at ideal moments. These algorithms can analyze market data in real time and execute trades within milliseconds, taking advantage of market opportunities that human traders might miss. This high-speed trading can lead to significant profit gains while minimizing risks.

-

Portfolio Management

AI is also improving portfolio management by continuously monitoring market conditions and adjusting investment portfolios accordingly. Machine learning models can optimize asset allocation to maximize returns and minimize risks. By using AI, portfolio managers can make more informed decisions and achieve better investment outcomes for their clients.

Why Are Fintech Companies Using AI?

Fintech organizations are using Artificial Intelligence (AI) for a variety of reasons. Here are some tangible ways that Artificial Intelligence development services could assist firms in the financial sector:

1. Data Analysis and Decision Making

AI can move vast volumes of data faster and more efficiently than humans. This is significant because fintech organizations sometimes have to make judgments based on rapidly changing and evolving data.

2. Improved Customer Experience

AI enables fintech development businesses to adapt their services for each consumer by knowing their individual wants and preferences. As a result, AI in fintech businesses may offer a more personalized experience, which is expected to increase client happiness and loyalty.

3. Establish a Competitive Edge

The use of artificial intelligence in the financial services industry might help your company stay ahead of the competition. As more firms join the finance market, those who can utilize AI to create a competitive advantage will most likely win in the long term.

4. Fraud Detection and Security

Artificial intelligence systems aid in the detection of fraudulent behavior patterns in real-time. It improves security and mitigates financial hazards. Machine learning algorithms, in conjunction with artificial intelligence, examine massive amounts of data to detect abnormalities and flag questionable transactions.

5. Scalability and Innovation

AI drives technological innovation by allowing fintech businesses to rapidly create and deploy new services. By utilizing AI-driven insights, your company may remain ahead of the competition and respond to changing market needs.

6. Lower Expenses

Artificial intelligence (AI) for financial operations lowers costs in a number of ways, including by automating tedious jobs and identifying and stopping fraud. For instance, banks utilize chatbots driven by AI to answer customer support questions, freeing up human staff to work on more difficult jobs.

7. Enhancing the Customer Experience

Financial institutions employ artificial intelligence (AI) in a number of ways to enhance the customer experience. These methods include deploying chatbots to communicate with clients via text or voice, automating guidance and recommendation systems, and customizing financial services based on individual requirements.

Related: Generative AI in Customer Service

8. Making Additional Services Available

Financial institutions may develop and produce new goods, services, and customer solutions with the use of AI. AI has aided banks in creating Robo-advisory systems, for instance, which utilize algorithms to assist customers in managing their finances.

5 Ways AI Will Change the Investment World

Artificial intelligence (AI) will transform the investment landscape by introducing a range of advanced tools and capabilities. Here are seven ways AI will revolutionize the world of investing:

-

Advanced Analytics

AI finance tools excel at analyzing historical data and market trends, providing more accurate predictions of future price movements for stocks, bonds, and other assets. By identifying patterns that were previously undetectable, AI enables investors to make more informed decisions, anticipate market fluctuations, and ultimately enhance their profitability while minimizing losses.

Related: AI Agents in Healthcare

-

Enhanced Risk Assessment and Management

Artificial intelligence in fintech allows investors to evaluate the risks associated with various investment options more accurately. By analyzing factors such as volatility, liquidity, and asset correlation, AI helps investors make safer and smarter choices. This improved risk assessment ensures better-informed investment decisions and enhances overall portfolio management.

-

Personalized Investment Recommendations

AI platforms utilize machine learning techniques to offer personalized investment recommendations based on individual goals, preferences, and risk tolerance. By considering factors like age, income, and investment objectives, these AI-driven systems tailor suggestions to meet unique investment needs, providing a more customized and effective investment strategy.

-

Behavioral Analysis

AI systems can analyze investors’ behavioral patterns and sentiments from various sources, including financial reports. By understanding these sentiments, AI helps investors avoid emotional decision-making and maintain discipline during market fluctuations. This behavioral analysis contributes to more rational and strategic investment decisions.

-

Real-time Market Monitoring

AI in investing enables continuous monitoring of market data and news in real-time, something humans cannot achieve on their own. AI tools can swiftly identify relevant information and significant events, alerting investors immediately. This real-time market monitoring allows investors to react promptly to market shifts and adjust their strategies as needed.

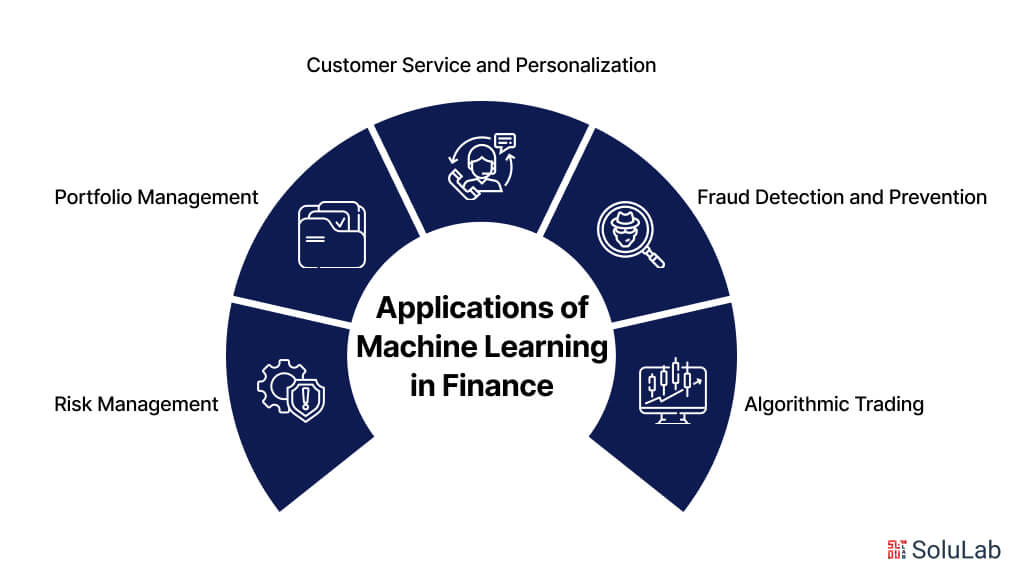

What is ML in Finance?

Machine Learning (ML) in finance refers to the application of algorithms and statistical models that enable computers to learn from and make predictions or decisions based on financial data. Machine learning and finance go together and leverage techniques from various domains such as statistics, data mining, and artificial intelligence to analyze vast amounts of data, identify patterns, and provide insights that can drive better financial decision-making. Here are some key applications and benefits of ML in the financial industry:

Applications of Machine Learning in Finance

1. Algorithmic Trading: ML algorithms are used to develop trading strategies that can execute orders at optimal prices. These algorithms analyze historical data, detect market trends, and make real-time decisions, often outperforming human traders by reacting swiftly to market changes.

2. Risk Management: ML models help in assessing and managing financial risks. By analyzing historical data and identifying potential risk factors, these models can predict future risks and help in developing strategies to mitigate them. This includes credit risk assessment, fraud detection, and market risk analysis.

3. Customer Service and Personalization: Financial institutions use ML to enhance customer experiences through personalized services. Chatbots and virtual assistants powered by ML can provide customer support, answer queries, and offer financial advice. Additionally, ML can analyze customer behavior to offer tailored financial products and services.

4. Fraud Detection and Prevention: ML algorithms can detect fraudulent activities by identifying unusual patterns in transaction data. These systems continuously learn from new data, improving their ability to detect and prevent fraud in real time, thereby protecting both institutions and customers.

5. Portfolio Management: Robo-advisors use ML to provide automated, algorithm-driven financial planning services with minimal human intervention. These systems create and manage a diversified investment portfolio based on the investor’s risk tolerance and financial goals.

Leading Industries Using AI Technology

Because of its disruptive potential, artificial intelligence in fintech is widely used across a variety of sectors. Below is a list of a few of these industries:

- Healthcare: AI assists physicians in diagnosing patients, finding malignant cells, and creating individualized treatment strategies.

- Retail Sector: AI-driven chatbots assist with product recommendations, product sales and cross-selling, and customer service.

Read Blog: Artificial Intelligence in Healthcare: Future Outlook

- Banking and Finance Sector: Artificial Intelligence for fintech is utilized by banking solution companies for fraud detection, investment advice, and loan approval procedures.

- Automotive: AI is utilized in the automotive industry for enhanced driver assistance systems, driverless cars, and infotainment systems.

- Tourism: Artificial intelligence plays an important part in travel planning by recommending tourist sites based on customer interests and discovering new places.

Benefits of AI in Finance

Artificial Intelligence (AI) is revolutionizing the financial services industry by providing advanced tools and capabilities that enhance efficiency, accuracy, and customer experience. The integration of AI into financial services offers numerous benefits, including improved decision-making, cost savings, enhanced customer service, and strengthened risk management. Here are some key benefits of AI in financial services:

1. Operational Efficiency and Cost Reduction

- Automation of Routine Tasks: AI can automate repetitive and time-consuming tasks such as data entry, compliance checks, and transaction processing. This not only reduces operational costs but also frees up human resources for more strategic activities.

- Process Optimization: AI helps streamline processes, improving overall operational efficiency. For example, AI-powered systems can optimize trade execution, manage portfolio allocations, and enhance supply chain finance operations.

2. Improved Customer Service and Personalization

- Chatbots and Virtual Assistants: AI-driven chatbots and virtual assistants provide 24/7 customer support, handling inquiries, processing transactions, and offering financial advice. This improves customer satisfaction by providing instant, accurate responses and reducing wait times.

- Personalized Services: AI analyzes customer data to offer personalized financial products and services tailored to individual needs and preferences. This can include personalized investment advice, customized loan offers, and targeted marketing campaigns.

3. Enhanced Risk Management and Fraud Detection

- Fraud Detection and Prevention: AI systems can detect fraudulent activities in real time by analyzing transaction patterns and identifying anomalies. This helps prevent financial fraud and protects both institutions and customers from financial losses.

- Risk Assessment and Management: AI models assess various types of financial risks, including credit risk, market risk, and operational risk. By predicting potential risk factors and outcomes, these models enable institutions to develop effective risk mitigation strategies.

4. Compliance and Regulatory Adherence

- Regulatory Compliance: AI assists in ensuring compliance with regulatory requirements by automating the monitoring and reporting processes. AI systems can quickly analyze transactions and documents to identify compliance issues and generate reports for regulatory authorities.

- Anti-Money Laundering (AML): AI enhances AML efforts by monitoring transactions for suspicious activity, identifying potential money laundering schemes, and ensuring adherence to AML regulations.

5. Enhanced Security

- Cybersecurity: AI strengthens cybersecurity by detecting and responding to cyber threats in real-time. AI algorithms analyze network traffic and user behavior to identify potential security breaches and mitigate risks.

- Identity Verification: AI improves identity verification processes by using biometric authentication, such as facial recognition and fingerprint scanning, ensuring secure access to financial services.

Read Blog Post: Importance of Generative AI in Cybersecurity

6. Scalability and Adaptability

- Scalable Solutions: AI systems can easily scale to handle growing volumes of data and transactions, making them suitable for large financial institutions as well as smaller firms. This scalability ensures that AI solutions remain effective as the business grows.

- Adaptability to Changing Markets: AI systems continuously learn and adapt to changing market conditions, ensuring that financial institutions remain competitive and responsive to new challenges and opportunities.

Use Cases of AI in Finance

Artificial intelligence in finance has become a transformative force, driving innovation and efficiency across various financial services and processes. The finance industry leverages AI to improve decision-making, optimize operations, enhance customer experience, and mitigate risks. Here are some prominent use cases of AI in finance industry:

1. Algorithmic Trading: Artificial intelligence in finance is revolutionizing trading with algorithmic trading systems that execute trades at optimal prices. These AI-driven systems analyze vast amounts of historical and real-time market data to detect patterns and trends, enabling them to make trading decisions with speed and precision that surpasses human capabilities.

2. Risk Management: Finance AI is critical for assessing and managing risks. AI models evaluate credit risk by analyzing borrower data, including financial history and transaction patterns. They predict potential defaults and help institutions set appropriate credit limits. Additionally, AI in finance industry applications includes market risk analysis, where AI algorithms assess market conditions and forecast potential impacts on investment portfolios.

3. Personalized Financial Services: AI enhances customer experience by offering personalized financial services. Finance AI systems analyze customer data to understand individual preferences and financial behaviors. This information is used to provide tailored recommendations for investment, savings, and loan products, thereby improving customer satisfaction and loyalty.

4. Customer Support: AI-powered chatbots and virtual assistants are transforming customer support in the finance industry. These AI-driven solutions provide 24/7 assistance, answering customer queries, processing transactions, and offering financial advice. They improve response times and accuracy, ensuring a better customer service experience.

5. Credit Scoring: Traditional credit scoring models are being enhanced by finance AI systems that consider a wider range of data points, including social media activity, online behavior, and transaction history. This results in more accurate and inclusive credit assessments, enabling financial institutions to extend credit to a broader customer base.

Future of AI in Finance

The future of AI in finance will bring unprecedented advancements, driving the industry toward greater efficiency, personalization, and security. As AI technologies continue to evolve, financial institutions will increasingly leverage machine learning, natural language processing, and advanced analytics to enhance decision-making processes and operational workflows. The integration of AI will lead to more sophisticated algorithmic trading systems, capable of making real-time decisions with higher precision and speed. Additionally, AI-powered predictive analytics will offer more accurate forecasts of market trends and economic indicators, empowering financial firms to develop proactive strategies and gain a competitive edge.

Furthermore, the future will see AI playing a crucial role in transforming customer interactions and risk management. AI-driven chatbots and virtual assistants will provide more intuitive and personalized customer experiences, offering tailored financial advice and support around the clock. Enhanced risk management systems will utilize AI to detect and mitigate fraud, as well as to predict and manage various financial risks more effectively. The adoption of AI in compliance will also become more prevalent, automating complex processes and ensuring adherence to ever-evolving regulations. As AI technology advances, it will not only streamline financial operations but also foster innovation, leading to new financial products and services that better meet the needs of a diverse customer base.

SoluLab Transforms Banking and Finance with Gen AI

Challenge

The banking industry struggles with meeting rising customer expectations, streamlining manual processes, managing risks, adapting to evolving regulations, and protecting data from increasing cyber threats.

Solution

SoluLab used Gen AI to automate tasks, deliver personalized customer experiences, and improve cybersecurity, helping banks operate more efficiently.

Impact

- 3x increase in customer satisfaction with personalized services.

- 70% faster processes, cutting operational costs.

- 98% fewer cyber threats, ensuring data safety.

The Bottom Line

AI in finance is undeniably shaping the future of smart investments and risk management. The integration of AI technologies is revolutionizing how financial institutions operate, offering enhanced accuracy, efficiency, and personalized customer experiences. With advancements in machine learning, natural language processing, and predictive analytics, financial firms are better equipped to make informed decisions, optimize trading strategies, and mitigate risks. As AI continues to evolve, it promises to drive further innovation in the finance industry, introducing new products and services tailored to meet the evolving needs of customers while ensuring robust security and compliance.

SoluLab, as a leading AI development company, is at the forefront of this transformation. We specialize in developing modern AI solutions tailored to the unique challenges of the finance industry. Our team of experts leverages the latest AI technologies to create sophisticated models for algorithmic trading, fraud detection, risk management, and personalized financial services. Partnering with SoluLab means gaining access to innovative AI tools that can propel your financial operations into the future. Ready to revolutionize your financial services with AI? Contact SoluLab today to learn how we can help you harness the power of AI for smarter investments and superior risk management.

FAQs

1. What are the key benefits of using AI in finance?

AI in finance offers numerous benefits including enhanced decision-making through data-driven insights and predictive analytics, improved operational efficiency and cost reduction by automating routine tasks, personalized customer services, robust fraud detection and prevention, and strengthened risk management. AI also helps in regulatory compliance and cybersecurity, ensuring financial institutions can operate more securely and efficiently.

2. How does AI improve risk management in the financial sector?

AI improves risk management by analyzing large volumes of data to identify potential risks and predict future risk scenarios. AI models can assess credit risk by evaluating borrower data and transaction patterns, detect market risks through real-time analysis of market conditions, and prevent fraud by identifying unusual transaction patterns. These capabilities enable financial institutions to develop more effective risk mitigation strategies and reduce potential losses.

3. What role does AI play in personalized financial services?

AI plays a significant role in personalized financial services by analyzing customer data to understand individual preferences and financial behaviors. This allows financial institutions to offer tailored recommendations for investments, savings, and loan products. AI-driven chatbots and virtual assistants provide personalized customer support and financial advice, enhancing the overall customer experience and satisfaction.

4. How can financial institutions ensure compliance with regulations using AI?

Financial institutions can use AI to automate the monitoring and reporting processes required for regulatory compliance. AI systems analyze transactions and documents to identify compliance issues, generate necessary reports for regulatory authorities, and ensure adherence to anti-money laundering (AML) regulations. This reduces the risk of regulatory penalties and enhances the institution’s ability to comply with ever-evolving regulatory requirements.

5. How does SoluLab help financial institutions leverage AI?

SoluLab helps financial institutions leverage AI by developing custom AI solutions tailored to the unique challenges of the finance industry. Our expertise includes creating advanced AI models for algorithmic trading, fraud detection, risk management, and personalized financial services. By partnering with SoluLab, financial institutions can access innovative AI tools that enhance their operations, improve decision-making, and offer superior customer experiences. Contact SoluLab today to learn how we can help you harness the power of AI for smarter investments and risk management.