Non-fungible tokens (NFTs) quickly became a hot trend in the world of digital assets. The first NFT, created in 2014 for the artwork Quantum, aimed to establish its digital provenance. Soon after, developers found diverse uses for NFTs, extending beyond art to areas like gaming. By January 2022, interest in NFTs had skyrocketed, even though the intense market of 2021 had calmed down.

Even today, NFTs continue to dominate discussions. Notably, NFTs from popular series such as CryptoPunks and Bored Ape Yacht Club consistently fetch prices exceeding $100,000, according to CryptoSlam. Unfortunately, these hefty price tags put them out of reach for the average investor. Enter fractionalized NFTs—a solution that eliminates the financial barriers, making these tokens more accessible. The market capitalization of fractionalized assets has already exceeded $200 million.

In this article, we’ll delve into the world of fractionalized NFTs, exploring their advantages, challenges, use cases, and what the future holds for this innovative approach. Now, let’s dive in.

What Is Fractionalized NFT?

Fractional NFTs (F-NFTs) are essentially portions or shares of a single NFT. They represent tokenized ownership of NFTs that have been divided and distributed among multiple individuals. By breaking down the ownership of an NFT into smaller fractions, it becomes feasible for several people to collectively own a valuable NFT without a hefty individual cost.

Consider high-value NFT assets like luxury yachts or real estate, which may be financially out of reach for an individual. Fractional NFTs step in as a solution, enabling people to invest a modest amount of money to acquire a share of ownership in an otherwise expensive asset.

How are Fractional NFTs Different From Traditional NFTs?

In simple terms, a traditional NFT encompasses the entire entity, while an F-NFT signifies a part or fraction of the original NFT asset.

Typically, a single buyer or an organization representing multiple NFT collectors owns traditional NFTs. In contrast, Fractional NFTs are owned jointly by multiple investors.

The fractionalization of NFTs has made it easier for everyday buyers to enter the market, enhancing accessibility. This investment strategy extends beyond the NFT realm, finding application in the metaverse and alternative sectors like real estate and fine art.

Can You Split an NFT Into Smaller Parts?

Well, it’s a bit tricky!

Technically, NFTs are non-divisible because they’re non-fungible. It’s like trying to cut the Mona Lisa in half (even though, technically, you can’t). Similarly, you can’t split a Bored Ape NFT in two. Well, you can, but this is where fractionalized NFTs come into play.

So, the original non-fungible token can’t be divided, but Multifunctional Fractionalized NFT offers a solution. They create a fungible token representing a share of the original NFT, allowing it to be divided among multiple owners.

There was a suggestion for a token standard, ERC-864, on the Ethereum blockchain that could have made divisible non-fungible tokens possible. However, it doesn’t seem to have gone anywhere. For now, fractionalized NFTs remain the only way to split NFT assets.

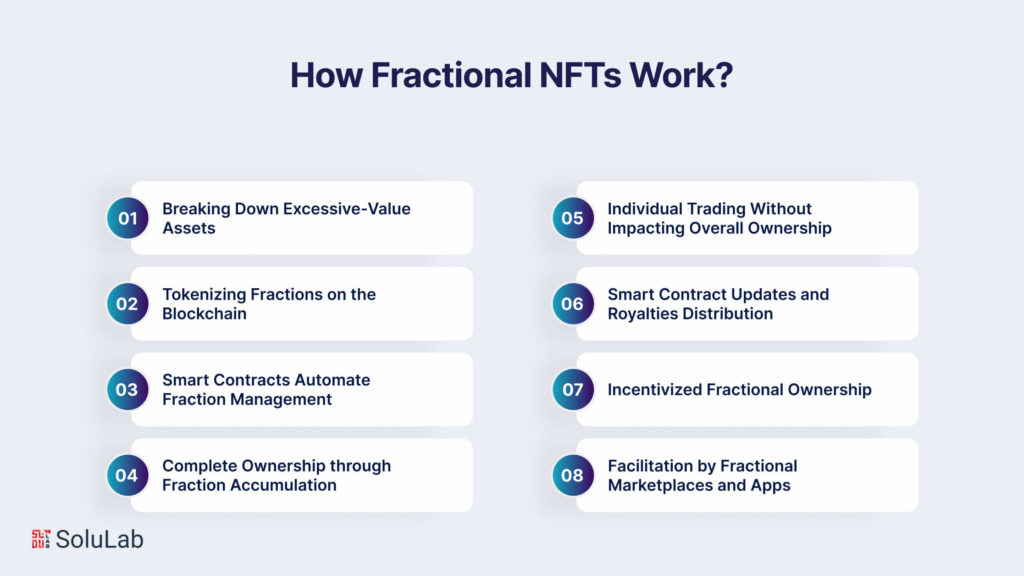

How Fractional NFTs Work: A Step-by-Step Guide?

To make it simple, fractionalized NFT means turning one special token into many regular ones. So, if you have a unique token, you can use a smart contract with specific instructions to create lots of regular tokens. Learn step by step and see how you can be a part of owning unique digital treasures.

1. Breaking Down Excessive-Value Assets

Fractional NFTs operate by dividing high-value virtual assets, such as unique paintings or digital creations, into smaller tokenized shares on the blockchain. Instead of owning the entire NFT, individuals can now own a fraction of it. This process allows for wider participation in the ownership of premium assets.

2. Tokenizing Fractions on the Blockchain

Once the asset tokenization is identified for fractionalization, it is split into smaller parts, usually ranging from 10 to 1,000 equal fractional pieces. Each of these fractions becomes an independent NFT token, possessing a unique ownership record. This division is executed through the blockchain, ensuring transparency and security.

3. Smart Contracts Automate Fraction Management

Smart contracts play a crucial role in managing these fractions. They automate the process to ensure that the sum of all fractions consistently equals the original complete NFTs. This automation simplifies ownership tracking and ensures the integrity of the fractionalized asset.

4. Complete Ownership through Fraction Accumulation

If, for instance, a painting is divided into 100 fractional tokens, possessing all 100 tokens equates to complete ownership. Smart contracts ensure that these fractions can be collectively traded without impacting the overall ownership of the original NFT.

5. Individual Trading Without Impacting Overall Ownership

One key feature of fractional NFTs is the ability to trade and sell individual fractions independently. When a fraction is sold, the new owner securely stores their portion in a crypto wallet like MetaMask. This allows them to freely sell or exchange their specific fraction without affecting the ownership status of the complete NFT.

Related: NFTs and Their Use Cases

6. Smart Contract Updates and Royalties Distribution

As fractions change hands through individual trades, smart contracts are updated to reflect the new owner’s stake. Meanwhile, the royalties from subsequent sales of the original NFT are distributed fractionally among all current fraction owners. This ensures that everyone holding a fraction continues to benefit from the ongoing success of the asset.

7. Incentivized Fractional Ownership

The distribution of royalties is based on the percentage stake each owner holds. This incentive structure encourages ongoing participation and investment. Even with multiple individual trades of fractions, the original owners’ stakes remain unaffected.

8. Facilitation by Fractional Marketplaces and Apps

NFT marketplaces and dedicated apps play a pivotal role in the entire process. They handle the complexities of splitting, tracking, and exchanging fractions. These platforms make it easy for individuals to buy even the smallest fraction, allowing them to gain exposure to high-value NFTs more cost-effectively.

Benefits Of Fractionalized NFTs

Owning a piece of something valuable, like an NFT, is now easier and more affordable, thanks to fractionalization in NFTs. Instead of needing a lot of money to buy a whole NFT, you can buy a smaller fraction based on what you can afford, starting as low as $50. This opens up opportunities for more people to get involved.

Here are some benefits of fractional NFTs:

1. Liquidity and Accessibility

- Breaking down expensive NFTs into smaller pieces makes them easier to buy and sell.

- It allows people with lower budgets to participate.

- Trading fractions is quicker and more frequent, increasing overall market activity.

2. Enhanced Governance

- Co-ownership enables new ways of making decisions together.

- Token holders can vote on important matters based on their ownership percentage.

- This decentralized approach ensures fairness and transparency.

3. Secondary Market Growth

- Fractionalized NFTs contribute to a more active and growing market.

- Easier trading leads to more transactions and helps establish stable prices.

- This encourages more people to get involved and strengthens the market.

4. Financial Innovation

- Fractional NFTs open up opportunities for new financial tools.

- Bonds, loans, and derivatives can be created, allowing for more flexible investment strategies.

- It also allows for the fractional representation of real-world assets on the blockchain.

5. Reduced Ownership Costs

- Sharing ownership costs among many fractional owners reduces individual expenses.

- Maintenance, insurance, and transactions become more affordable.

- This structure removes economic barriers, making it easier for more people to participate in owning digital assets.

6. Diversified Opportunities

- Fractional NFTs allow investors to diversify their portfolios easily.

- Instead of putting all their money into one expensive NFT, they can spread it across different fractional shares.

- This reduces risk because they’re not relying on the success of just one asset.

7. Community Engagement

- Fractional ownership creates a sense of community among investors.

- People with shared interests can come together to collectively own and support an NFT.

- This communal aspect enhances the overall experience of owning digital assets.

8. Increased Transparency

- Fractional NFTs often come with transparent and easily accessible information.

- Owners can track the performance of their investment more easily, fostering trust in the system.

- This transparency is a positive feature for both new and experienced investors.

9. Accessibility for Creators

- Fractionalization opens up new possibilities for artists and creators.

- They can reach a wider audience by offering affordable shares of their work.

- This democratization of access allows more people to support and engage with the creations of their favorite artists.

Fractionalized NFTs: Use-Cases

Fractionalized NFTs go beyond just giving a peek into the NFT market; they have various practical uses that add significant value. Let’s explore some real-world use cases of fractionalized NFTs to gain a deeper understanding of how they contribute to different sectors.

-

Real Estate Investment

The emergence of the metaverse has brought forth exciting opportunities in virtual real estate, yet acquiring prime parcels for development or commerce often requires substantial capital. Fractionalization in NFTs revolutionizes this space by enabling co-ownership, allowing multiple individuals to pool their resources for investments in virtual worlds. Similar to real-world Real Estate Investment Trusts (REITs), fractional owners collaborate on property management and share proportional income and gains. This approach democratizes access to the metaverse, fostering innovation and economic growth in these digital landscapes. Co-owners can trade portions of their virtual real estate holdings like liquid equity, reducing individual risk. Experienced managers can further diversify risk by utilizing fractional shares across a broad spectrum of Metaverse real estate opportunities.

-

Collectibles and Memorabilia

Fractional NFTs redefine the world of collectibles by making limited-edition items accessible to a broader audience. Rare sneakers, trading cards, fashion items, and unique NFTs capturing cultural moments can now be divided among dedicated collectives. Groups collaborate to acquire exclusive items from their favorite creators, with each member receiving a tradeable token representing ownership. This shared ownership enhances the connection between creators and their supporters, turning ownership into a shared experience. Owners proudly showcase their fractional pieces in virtual galleries, creating a dynamic display of virtual “history.” Even boutique collections become accessible to a wider audience, allowing memorabilia investors to diversify across various collectives. Creators benefit by tokenizing their followings, creating invested fan tribes with a lasting stake in future releases and marketing initiatives.

-

Music and Entertainment

Musicians, influencers, sports leagues, and publishers leverage fractionalization to fund new projects and strengthen fan relationships. This innovative approach combines the support of paying subscriber “equity holders” with creative control over content. Fractional NFTs allow backers to crowdfund videos, archival box sets, charter jets, or other perks tied to an NFT with a share of ongoing revenue. This model provides owners with a sense of participation in the success of the work beyond a mere financial investment. Artists maintain independence while easily launching ambitious endeavors, and teams can sell functionalizations of jerseys and players to secure operating capital. Broadcasters can fractionalize intellectual property rights, distributing partial streaming revenue or ad income as NFTs. This unique model aligns fan passions with creator monetization, creating a mutually beneficial community where everyone prospers as the works themselves gain value and stature.

-

Virtual Real Estate

In addition to the metaverse, fractional NFTs also find applications in traditional virtual real estate. Virtual worlds and online platforms often feature exclusive properties that command high prices. Fractionalization allows users to collectively invest in these virtual properties, expanding ownership opportunities. Whether it’s a virtual storefront, a unique digital space, or a coveted location within an online community, fractional NFTs provide a means for users to share ownership, collaborate on management, and benefit from the economic value generated by these virtual assets. This opens up new avenues for creativity, collaboration, and investment in the evolving landscape of online spaces.

Fractionalized NFTs: Popular Examples

There are so many NFTs that have been divided into smaller parts that it’s hard to make a complete list. Here, we’ll just talk about some of the most popular ones you can find in the market.

1. RTFKT Studios released fractionalized NFTs for their “Space Pods” sneakers in March 2022. Each sneaker was divided into 20,000 tokens, allowing fans and collectors to own a piece of the digital collectible for as low as $15. This innovative approach opened up ownership to a wider audience and created a vibrant community around the brand.

2. Dapper Labs‘ NBA Top Shot platform fractionalized ownership of iconic NBA moments in the form of NFTs. Users can buy and sell individual moments or acquire “packs” containing multiple fractions. This democratizes access to sports memorabilia and allows fans to own a piece of history, even if they can’t afford the full price of an individual moment.

3. Kings of Leon became the first band to release an entire album (“When You See Yourself”) as an NFT in March 2021. They offered three tiers of ownership: limited-edition “Golden Tickets” with exclusive benefits, “Gold NFTs” with digital perks, and “Standard NFTs” granting basic ownership. This experiment opened new revenue streams for musicians and provided fans with unique ways to engage with their favorite artists.

4. ConstitutionDAO raised over $47 million in April 2021 in an attempt to purchase a rare first-edition copy of the U.S. Constitution. Although the bid was unsuccessful, the project demonstrated the power of fractionalized NFTs to unite individuals and collectively acquire valuable assets. This model could be applied to other high-value collectibles in the future, making them accessible to a wider pool of investors.

5. Roofstock on-chain fractionalized institutional-grade real estate assets, allowing investors to own pieces of properties with lower capital requirements. This opens up the traditionally illiquid and high-barrier-to-entry real estate market to a broader audience, democratizing access and potential returns.

6. VinoFly allows investors to buy and sell shares of fine wines through fractionalized NFTs. This provides convenient access to a sophisticated investment class, removes storage and logistics complexities, and enables fractional ownership of highly rare and expensive wines.

7. Artifact Labs fractionalized ownership of historical artifacts through NFTs, allowing individuals to own a piece of history without the full purchase price. This democratizes access to cultural heritage and ensures the long-term preservation of these valuable objects.

8. Moss Earth utilizes fractionalized NFTs to represent carbon credits, allowing individuals and businesses to offset their carbon footprint through fractional ownership of carbon-neutral projects. This innovative approach encourages participation in carbon offsetting programs and contributes to environmental sustainability efforts.

Challenges and Limitations of Fractional NFTs

Exploring the world of fractional NFTs not just brings opportunities but also challenges and limitations. Understanding these hurdles is crucial for anyone diving into the realm of digital ownership. Here are some challenges and considerations these unique digital assets may present.

-

Security Concerns

One major challenge in the world of fractional NFTs is security. Tricky individuals can fool investors by creating tokens with names that sound connected to a famous NFT. This can confuse people who don’t fully understand fractional NFTs, leading them to mistakenly buy these tokens.

-

Regulatory Risks

Fractional NFTs involve collective investments, potentially falling under the category of unregistered securities. SEC Commissioner Hester Peirce, a supporter of digital assets, has raised concerns that fractionalizing NFTs could turn them into securities. This regulatory aspect may pose challenges to the widespread acceptance of fractional NFTs.

-

Reduced Decision-Making Power

When an NFT gets fractionalized, the original owner loses some control. If they want to sell the original NFT, they must start a buyback auction. However, participating in the auction comes with a risk—the owner might lose the NFT if someone else outbids them.

The Future of Fractional NFTs

The future of fractional NFTs is promising, with potential advancements in accessibility and democratization of ownership. As technology evolves, fractionalization may become more seamless, allowing a broader audience to participate. The intersection of blockchain innovation and fractional ownership holds exciting prospects for reshaping how we engage with and invest in digital assets.

-

Opportunities for Owners and Creators

Despite challenges, fractional NFTs offer exciting possibilities. They can breathe new life into tokens that have become less popular, potentially benefiting both NFT owners and creators. This concept might also give artists, musicians, and other creators more exposure in the market.

-

Risk Mitigation in Bear Markets

During economic downturns, fractional NFTs can be a safer investment option. Investors take on less risk when purchasing these assets compared to whole NFTs. However, the potential for regulatory issues, particularly regarding unregistered securities, could slow down the widespread adoption of fractionalized NFTs.

-

Expanding to Physical Assets

Fractional NFTs aren’t limited to digital items; they can also represent partial ownership of physical assets like diamonds, paintings, or houses. This opens up new ways to sell valuable physical items but comes with similar advantages and challenges seen in traditional fractional NFTs.

Where to Find Fractional NFTs?

If you’re interested in buying fractional NFTs, here are four popular platforms where you can explore and invest:

-

Unic.ly

Unic.ly serves as a fractional NFT platform, allowing NFT holders to link their wallets and receive ERC 20 tokens. Once you have these tokens, you can trade them or bid on F-NFTs. Unic.ly also enables users to receive ETH when they fractionalize assets, adding flexibility to the platform.

-

Fractional. art

Similar to Unic.ly, Fractional. art offers a space for users to convert their assets into fractional NFTs and receive ETH in return. While it lacks bidding or staking features, this platform stands out for its straightforward and permissionless protocol design. Developers can easily build on this protocol, making it an attractive option for those looking to extend the platform’s functionality.

-

Gate.io (Gate NFT)

Known as a cryptocurrency exchange and digital asset platforms, Gate.io has ventured into the fractional NFT space with Gate NFT. This marketplace allows users to own fractional shares of renowned NFT collections like Azuki and MAYC. Gate NFT provides an additional avenue for cryptocurrency enthusiasts to explore fractional ownership of valuable digital assets.

-

Otis

Otis is a versatile platform where users can buy and sell fractional art NFTs, comics, and more. Operating with the US dollar as its primary currency, Otis sets a minimum investment price of $1,000. The platform hosts a variety of popular NFTs, including well-known items like CryptoPunks, Pokémon Red, and specific editions of Newborn 1 and Newborn 3.

Take Away

Fractional NFTs (F-NFTs) are emerging as the next big trend in the world of NFTs. They make it easier for people to invest and add more money flow into the market. If there’s a specific NFT collection you’ve been interested in but couldn’t afford the whole thing, fractional ownership lets you own a piece of it. Keep in mind to do your research (DYOR) before investing in any digital artwork to make informed decisions about your investments.

The Fractional NFT landscape is poised to be a key player in the evolving Web3 landscape, and your business can be at the forefront of this transformative wave.

At SoluLab, an NFT Development Company, we offer an innovative pathway to immerse yourself in the NFT world. Our industry-leading NFT development solutions pave the way for your success. With a team of seasoned NFT experts, we stand ready to guide you through the intricacies of Fractional NFT marketplace development, ensuring a seamless and successful entry into this dynamic space. Join SoluLab in shaping the future of NFTs and making a mark in the rapidly evolving digital landscape.

FAQs

1. What are fractionalized NFTs?

Fractionalized NFTs are tokens that represent ownership of a portion of a physical or digital asset. This allows multiple people to own a piece of the same asset, making it more accessible and affordable than traditional ownership models.

2. What types of assets can be fractionalized?

Virtually any asset can be fractionalized, including art, music, real estate, collectibles, historical artifacts, carbon credits, and even intellectual property.

3. Why would someone want a Fractional NFT?

Fractional NFTs make owning cool digital stuff more affordable. You don’t need a lot of money to join in—just a small amount can get you a share. It’s like being able to enjoy the fun and benefits of owning something special without having to spend a lot.

4. Can I sell my Fractional NFT?

Yes, you can! Selling a Fractional NFT is like selling your share of a digital item. If you decide you want to move on or if someone else is interested, you can sell your piece. It’s an easy way to share and trade digital ownership with others in the online world.

5. How does fractionalization work?

Fractionalization involves breaking down a single valuable asset, like a digital artwork or collectible, into smaller, tradable pieces represented by tokens. This process enables shared ownership, making it easier for multiple people to enjoy and invest in unique items without needing to buy the entire asset.

6. What happens if the value of the original asset changes?

If the value of the original asset changes, the value of the fractionalized NFTs may also fluctuate. This means that if the asset becomes more valuable, the fractional NFTs representing it could increase in value as well. However, it’s important to note that values in the market can go up or down based on various factors.