Generative artificial intelligence (AI) has captivated the globe with its capacity to answer complicated questions, write novels, and produce music and art. ChatGPT and Bard, two of the most popular platforms today, have become common names. In the meanwhile, payments are progressively changing due to generative AI.

Generative AI is a form of artificial intelligence that involves machine learning algorithms. It can evaluate raw data, identify patterns, and draw connections on its own. Its main advantage is its capacity to rapidly handle massive volumes of data. An average individual can read around 238 words per minute. ChatGPT was trained on 300 billion words, which equates to nearly 2,400 years of reading.

In the payments industry, which relies on rich data, generative AI has the potential to become an effective technology. It is intended to greatly enhance fraud detection, assistance, and underwriting. However, new and novel applications for AI in payments are already appearing. In a decade, this developing technology will most certainly have affected almost every corporate sector.

We’ll discuss generative AI and its significance for payments in this blog. We’ll also discuss a generative AI system that can help retailers make the best use of their payment data.

What is Generative AI?

GenAI is a branch of artificial intelligence that focuses, on producing new content that replicates human-generated data, such as text, photos, audio, or video. According to a survey around 73% of the population of India is making use of Generative AI. With the use of machine learning (ML), GenAI models can produce new material based on the structures and patterns they discover from massive datasets, in contrast with conventional artificial intelligence (AI) tools that are usually task-oriented and dependent on preset rules or patterns.

This modern technology creates creative text, images, audio, and videos by using deep learning models, specifically neural networks, to recognize and recreate patterns in the training data. For instance, by learning from a wide range of language inputs, such as grammar, semantics, and context, a content-based generative artificial intelligence like GPT-4 may produce text that is logical and regarding its context.

Improvements Made to Gen AI

Important milestones in the fields of mathematics, statistics, machine learning, and artificial intelligence have been used to record the progression of GenAI.

1. From ML to AI

Machine learning rose the prominence with the rapid development and growth of GenAI. In the beginning, machine learning algorithms were built to process data and reduce predictions, which were frequently based on mathematical models. In the course of their development, of machine learning approaches, the group was proficient in the management of increasingly difficult tasks, such as NLP, and image processing. The algorithms that were used for image processing allowed computers to understand and evaluate visual input, whereas the algorithms that were used for natural language processing allowed computers to understand and provide responses that could be easily understood by a person.to understand

2. Mathematical Contributions

Mathematics and statistics have made significant contributions to the development of artificial general intelligence (GenAI) by laying the foundation for technological development in these fields. To gain a deeper comprehension of the data and the process of constructing models, the framework was developed with the assistance of many mathematical concepts, including probability theory, algebra, linear, calculus, and optimization algorithms. The early machine learning algorithms were built on the foundation of statistical approaches, which played a significant part in the process of analyzing patterns and producing predictions.

3. Better Training with Datasets

A significant turning point in the development of general, artificial intelligence is the capability of systems to analyze and understand last-scale datasets as a result of an increase in computational power. This was one of the main changing points in the development of GenAI. Researchers were able to train more complex models, thanks to the availability of enormous amounts of data, which enhanced their ability to recognize detail patterns and subtleties in a variety of fields. Consequently, this result resulted in the development of LLMs such as GenAI, which was capable of producing text that resembled humans and carrying out a wide range of tasks, in two languages with amazing precision.

Importance of GenAI in Payments

Generative AI (GenAI) is revolutionizing the payments industry by enhancing efficiency, security, and customer experience. Generative AI payment systems can examine enormous volumes of transaction data and spot trends that point to fraud. Here is the breakdown of how important Generative AI can be in payments:

- Fraud Detection: By learning from historical data, these systems detect anomalies in real time, significantly reducing the risk of fraud. This not only protects consumers but also helps financial institutions maintain trust and reliability.

- Personalized Experiences: Incorporating Generative AI in banking allows for highly personalized customer experiences. This can tailor recommendations based on individual spending habits, offer customized financial advice, and enhance customer interactions through chatbots and virtual assistants

- Customer Support: GenAI helps banks anticipate customer needs, providing proactive support and creating a more engaging banking experience.

- Streamlined Processes: AI payments streamline the transaction process, reducing the time required to complete payments and minimizing errors. Automation of routine tasks such as invoice processing, reconciliation, and compliance checks enhances operational efficiency, allowing financial institutions to focus on more strategic activities.

- Improved Risk Management: Advanced risk management capabilities enable better assessment of creditworthiness and transaction behaviors, leading to more accurate decision-making and improved financial stability.

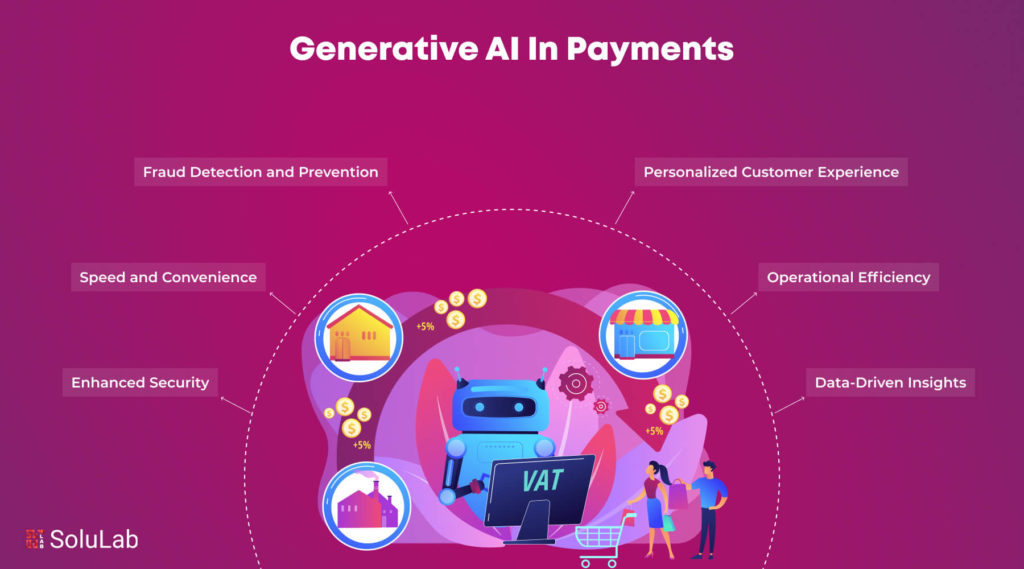

Benefits of Generative AI in Payments

Generative AI is revolutionizing various industries, and the payments sector is no exception. There are several benefits to integrating AI technology into payment systems, including increased effectiveness, security, and user experience. Here are some AI payment benefits for businesses:

1. Fraud Detection and Prevention: Generative AI can analyze vast amounts of transaction data to identify patterns indicative of fraudulent activity. By continuously learning from new data, AI systems can detect anomalies in real time, significantly reducing the risk of fraud. This proactive approach not only protects consumers but also saves financial institutions billions of dollars annually.

2. Personalized Customer Experience: AI can provide tailored experiences by analyzing user behavior and preferences. For instance, AI-driven chatbots can offer personalized support, answer queries, and guide users through payment processes. Additionally, AI can recommend products or services based on past transactions, enhancing customer satisfaction and loyalty.

3. Operational Efficiency: Automation of routine tasks is one of the major AI payment benefits. Generative AI can streamline processes such as invoice management, transaction reconciliation, and customer support. By automating these tasks, companies can reduce operational costs and allocate resources to more strategic initiatives.

4. Enhanced Security: AI enhances the security of payment systems through advanced encryption techniques and biometric authentication methods like facial recognition and fingerprint scanning. These technologies ensure that only authorized individuals can access sensitive financial information, thereby reducing the risk of data breaches.

5. Speed and Convenience: Generative AI can process transactions faster than traditional methods. For example, AI-powered payment gateways can approve or decline transactions in milliseconds, leading to quicker checkouts and improved customer satisfaction. This speed and convenience are crucial in today’s fast-paced digital economy.

6. Data-Driven Insights: AI can analyze transaction data to provide valuable insights into consumer behavior and market trends. Financial institutions can leverage these insights to make informed decisions, optimize pricing strategies, and develop new products that meet customer needs. This data-driven approach can lead to increased revenue and market competitiveness.

7. Cost Reduction: Implementing Payment AI solutions can significantly reduce costs associated with manual processing and error rectification. AI systems can handle large volumes of transactions accurately, minimizing the need for human intervention and reducing the likelihood of costly mistakes.

8. Scalability: AI systems can easily scale to handle increasing transaction volumes, making them ideal for growing businesses. Unlike traditional systems that may require significant upgrades to accommodate growth, AI solutions can adapt to changing demands with minimal disruption.

9. Regulatory Compliance: Generative AI can help financial institutions stay compliant with regulatory requirements by continuously monitoring transactions for suspicious activities and ensuring adherence to legal standards. This capability is particularly important in the context of anti-money laundering (AML) and know-your-customer (KYC) regulations.

10. Innovation and Competitive Advantage: Companies that adopt AI technologies in their payment systems can gain a competitive edge by offering innovative solutions that meet the evolving needs of consumers. AI-driven payment systems can enable new business models and services, fostering a culture of innovation and growth.

Thus, the integration of generative AI into payment systems brings a multitude of benefits, including enhanced security, personalized experiences, operational efficiency, and data-driven decision-making. As technology continues to evolve, the role of Payment AI in shaping the future of financial transactions will only become more significant, driving the industry towards greater innovation and customer-centricity.

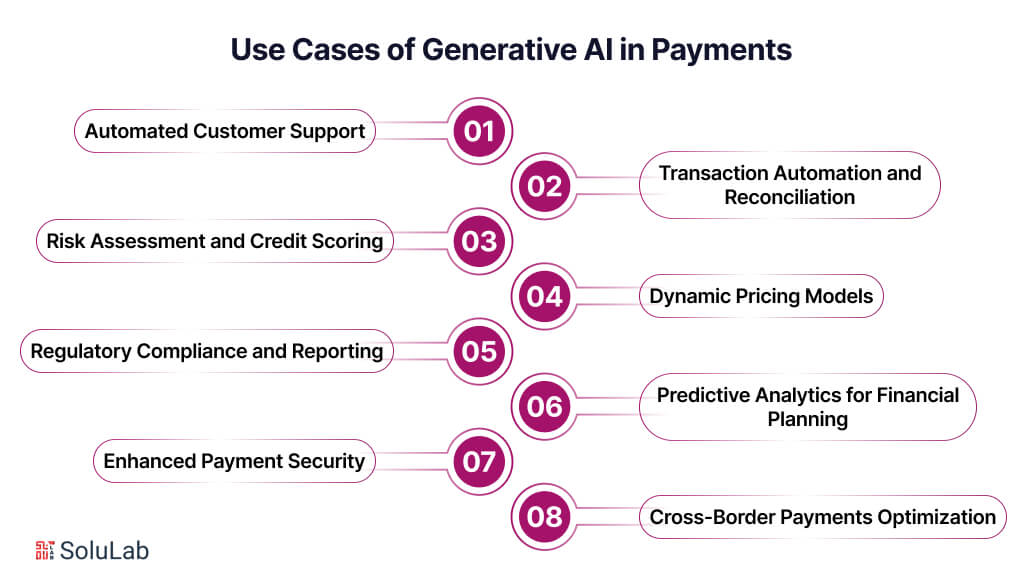

Use Cases of Generative AI in Payments

Generative AI is rapidly transforming the payments landscape by introducing innovative solutions that enhance security, efficiency, and customer experience. Here are some practical generative AI use cases in banking and payments:

- Automated Customer Support: Generative AI can power virtual assistants that handle customer inquiries and support requests efficiently. These AI-driven chatbots can assist with tasks such as resetting passwords, checking account balances, and processing payments, providing 24/7 support without the need for human intervention.

- Transaction Automation and Reconciliation: AI can automate repetitive tasks like transaction processing and reconciliation. By streamlining these processes, banks and financial institutions can reduce operational costs and minimize human errors, leading to more efficient and accurate payment systems.

- Risk Assessment and Credit Scoring: Generative AI can enhance risk assessment by analyzing a wide range of data points to predict a customer’s creditworthiness. This allows banks to make more informed lending decisions, offering loans and credit products that align with the borrower’s financial situation.

- Regulatory Compliance and Reporting: AI can help banks and payment processors stay compliant with regulatory requirements by monitoring transactions for suspicious activities and generating reports for regulatory authorities. This ensures adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations, reducing the risk of fines and legal issues.

- Enhanced Payment Security: AI can improve payment security through advanced techniques like biometric authentication and anomaly detection. For instance, AI can use facial recognition or fingerprint scanning to verify a customer’s identity, ensuring that only authorized individuals can access sensitive financial information.

- Dynamic Pricing Models: Generative AI can help develop dynamic pricing models by analyzing market trends, customer behavior, and competitive data. This enables banks and payment providers to adjust their pricing strategies in real time, optimizing revenue and staying competitive in the market.

- Predictive Analytics for Financial Planning: AI can offer predictive analytics that help customers manage their finances better. By forecasting income and expenses, AI tools can provide insights and suggestions for budgeting, saving, and investing, empowering customers to make informed financial decisions.

- Cross-Border Payments Optimization: AI can streamline cross-border payments by optimizing currency conversion and reducing transaction times. By analyzing exchange rates and payment routes, AI can ensure that international transactions are processed quickly and cost-effectively, benefiting both businesses and consumers

These generative AI use cases in banking and payments highlight the transformative potential of AI in creating more secure, efficient, and user-friendly financial services. As technology advances, we can expect even more innovative applications of AI in the payments industry, driving further improvements in how we conduct financial transactions.

Challenges in Generative AI in Payments

The following are the main risks to payments posed by generative AI:

- Cyberthreats: As digital technology advances, so do the associated risks. Not all of the possible flows of new technology can be identified right away. This could also hold for generative AI systems and algorithms. Cybercriminals might take advantage of these potential weaknesses before users fix them. Payment businesses must maintain a robber authentication system and conduct frequent updates and testing to reduce cyber attacks.

- Privacy Issues: While some generative AI systems can be taught using synthetic or anonymized datasets, others may require personal data to be implemented. Sensitive information might be included in some of this data, storage, and access raise privacy concerns for every tech-driven system, not only generative. Strong encryption and access restrictions are necessary to prevent data breaches and unauthorized access to private data.

- Reliability of Output: AI often produces synthetic output, and its accuracy compared to actual data may not be entirely known, particularly in its early phases of development. Payment firms need to confirm that generative AI models is performed independently. They should frequently examine if the synthetic data is accurate to avoid any concerns about reliability.

- Maintaining Model Integrity: Maintaining model integrity will also require payment businesses to monitor and audit the results produced by the generative models. These models depend on learning application, and any bias in the models themselves may produce unreliable results. The decision-making procedure and the client experience would be impacted.

SoluLab Transforms Banking and Finance with Gen AI

Challenge

The banking industry struggles with meeting rising customer expectations, streamlining manual processes, managing risks, adapting to evolving regulations, and protecting data from increasing cyber threats.

Solution

SoluLab used Gen AI to automate tasks, deliver personalized customer experiences, and improve cybersecurity, helping banks operate more efficiently.

Impact

- 3x increase in customer satisfaction with personalized services.

- 70% faster processes, cutting operational costs.

- 98% fewer cyber threats, ensuring data safety.

Conclusion

Generative AI is revolutionizing the payments industry by enhancing security, efficiency, and customer experience. From real-time fraud detection to seamless customer onboarding, optimized payment routing, dynamic credit scoring, enhanced customer support, and predictive analytics, the benefits of integrating AI in payments are substantial. Financial institutions that leverage these advancements can offer more personalized and secure services, drive operational efficiencies, and stay ahead in the competitive financial landscape. The transformative impact of Generative AI in payments is setting new standards for how financial transactions are conducted, ultimately creating a more robust and customer-centric financial ecosystem.

However, the adoption of Generative AI in payments also presents several challenges. These include ensuring data privacy and security, integrating AI systems with existing infrastructure, managing the cost of AI implementation, and addressing regulatory compliance. To navigate these challenges, partnering with a specialized AI development company like SoluLab can make a significant difference. SoluLab provides tailored AI solutions that address the unique needs of the payments industry, ensuring seamless integration, robust security measures, and compliance with regulatory standards. By using SoluLab’s expertise, financial institutions can unlock the full potential of Generative AI in payments. To learn more about how SoluLab can assist you in transforming your payment systems with AI, contact us today.

FAQs

1. What are the key differences between standard AI applications in the payment industry and Generative AI?

As a result of its ability to learn from data patterns and generate fresh content, like graphics or text, Generative AI is better suited to applications that require greater creation and imagination.

2. What applications does Generative AI have in banking?

To produce more precise risk assessments, Generative AI can examine credit histories, financial data, and market movements. This skill AIDS in making more educated choices on lending, investment, and other financial operations.

3. What major issues are addressed by Generative AI in the payments ecosystem?

All these major issues including overcoming skill, gaps, handling, legacy, tech issues, managing data, protection, hazards, and negotiating ethical issues, are addressed by Generative AI.

4. Is it possible for Generative AI to lower the cost of processing international payments?

Yes, by drastically, cutting operations, and expenses, and lowering risk, Generative AI in the payment systems is opening the door to smoother international transactions.

5. In what ways does GenAI enhance payment systems’ risk scoring?

GenAI models assist anomaly detection systems by learning common payment features and producing false fraud scenarios. To anticipate hazards, improve risk management, and stop financial crime, they also analyze market patterns.