Artificial intelligence is also at the forefront of the change sweeping through banking in the middle of the financial sector. AI for banking is bringing change by automating frequent activities and creating personalized experiences. Digital transformation powered by AI-powered chatbots and virtual assistants is making client interactions both better and available 24×7. AI in banking is also making operations smoother through process simplification, fraud detection, and more efficient risk management. AI can enhance credit scoring accuracy by 20%.

The influence of AI in banking will only be enhanced once this technology matures further. From predictive analytics to bespoke finance advice, the possibilities could be limitless. This blog explains how AI is used in banking these developments in detail and shows how artificial intelligence is powering innovation and course-correcting the trajectory of the financial sector.

Understanding Functions in Banking

AI in finance is a multi-dimensional sector replete with interdependent roles. Almost every department is a necessity in itself for the smooth running of a bank and the creation of value for its customers. Let us explore some key roles below:

A. Core Bank Operations

- Retail Banking: It facilitates credit cards, loans, and checking and savings accounts; it caters to the individual customer base.

- Commercial Banking: The bank offers loans, cash management, and trade finance. This service targets businesses.

- Investment Banking: AI in investment banking handles some of the major financial transactions involving mergers and acquisitions, underwriting securities, etc.

B. Support Roles

- Risk management: This department identifies, assesses, and controls the financial risks to protect against any threat to the bank’s assets.

- Compliance: Also important to retain the goodwill of the bank is this function that ensures the banks comply with rules and laws.

- Operations and IT: This is the department that manages data, back office operations, and IT infrastructure. It forms the backbone of any bank.

- Human Resources: Charged with the task of recruiting, training, and retaining employees, the human resource department ensures that the bank has the right people on board. The objectives of marketing and sales are to heighten awareness, attract new customers, and promote bank products and services.

These are just some of the functions of AI in the banking industry. For overall success to be achieved within such an institution, these departments will have to be interdependent. The nature of tasks and roles of these functions will keep changing with time as new opportunities and challenges emerge in the continuing development of the banking sector.

How is Generative AI changing traditional ways of Banking?

Generative AI in banking is going to change the financial sector since it can create new forms of content. With this technology, it is coming up with new ideas and solutions and creating new content instead of just analyzing data like it used to do in the past.

1. Improved Business Relationships

Generative AI in banking is transforming customer interactions. Banks are building and deploying AI chatbots like JPMorgan’s “COCO” to enable 24/7 support and efficiently process frequently asked questions. Here is another example of generative AI that personalizes banking experiences: AI at JPMorgan Chase can generate very personalized financial summaries for clients, complete with granular insights on spending habits and specific goals.

2. Fraud Prevention and Identification

Generative AI in banking fraud detection strengthens efforts to avoid fraud. With the help of synthetic data, banks can train their GenAI models more successfully in recognizing anomalous patterns indicative of fraudulent activity. Moreover, generative AI will be able to model several cases of fraud, hence helping organizations stay ahead of evolving threats.

3. Risk Assessment

Generative AI in banking is disrupting risk assessment in many ways. Banks can simulate a variety of economic scenarios to better assess potential risks. Not only that, but generative AI in bfsi will also help in ascertaining robust techniques of risk management by helping in stress testing of portfolios.

4. Personalized Financial Advice

Now, financial advisors powered by AI are making their appearance. On platforms such as Wealth front, the application of AI in banking is used to deliver customized investment advice based on the risk tolerance and financial goals of the user. On this matter, generative AI can further enhance this by creating personalized financial strategies and suggestions.

Read Our Blog: The Impact of AI on the Insurance Sector

5. Future Prospects

Though much potential resides within generative AI, model bias, data privacy, and other concerns about compliance are to be sorted. That said, generative AI in banking undoubtedly presents a future for finance. It’s going to be a different world for industries from back office to hyper-personalized offerings.

Why AI Matters in Banking?

The financial services sector is transforming, thanks to artificial intelligence, which has significant advantages that improve productivity, judgment, and client satisfaction. AI is being used more and more by banking institutions to solve important problems, which include risk management, client satisfaction, and market rent production. These organizations can reduce risk and take advantage of opportunities in a fiercely competitive market by using AI to spot trends and produce more precise forecasts.

AI power solutions give users individualized financial data to help them decide how much to spend, invest, and save. Consumers are more likely to stick with banks that provide creative and customized solutions, thus, banks that include modern artificial intelligence technology in their service not only power customers but also cultivate loyalty.

However, there are obstacles to implementing AI and financial services, especially because of the strict industry laws. Businesses need to have a thorough AI strategy that strikes a balance between creation and legal requirements. Potential hazards like algorithmic bias, cyber security, dangers, and privacy of data issues must be addressed with a careful approach. Financial institutions will average AI potential while reducing the exposure to legislative concerns by putting strong government and ethical standards in place.

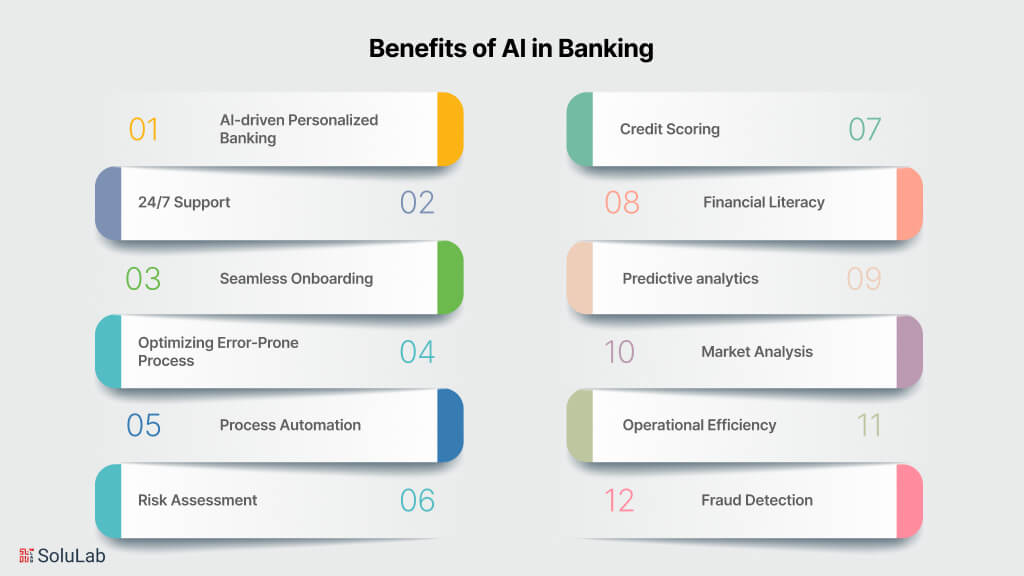

Benefits of AI in Banking

Considering the various benefits of AI in banking, it is rapidly altering the nature of the financial sector. The significant advantages are as follows:

1. AI-driven personalized banking: Use cases of AI agents will be able to provide customized financial services and products according to the analysis of the data of the clients. For example, AI-driven recommendation systems will provide investment advice in resonance with the financial goals and risk tolerance of a person.

2. 24/7 Support: AI-driven chatbots can support clients uninterruptedly by answering their queries and problems for quick solutions, thus improving customer satisfaction and brand loyalty.

3. Seamless Onboarding: The application of AI in banking will reduce friction and enhance customer experience through identity and document verification automation, thus making customers.

4. Optimizing Error-Prone Process: AI in banking ensures the reduction of manual errors and enhances accuracy ultimately improving customer service.

5. Process Automation: Artificial intelligence in banking can be utilized for processing tasks that free the human worker to take up other strategic roles, which include data entry, loan processing, and compliance checks.

6. Risk Assessment: AI analyses consumer data, market patterns, and economic indicators to gauge risk with high precision and efficiency. It helps protect the assets of banks and makes them very informed in decisions.

7. Credit Scoring: If AI and banks consider other sources of data, they would come up with inclusive credit-scoring models that would extend credit availability to marginalized communities.

8. Financial Literacy: The chatbots powered by AI can advise and counsel clients about money matters in a way that will let them make prudent financial decisions.

9. Predictive analytics: Using past data, AI in banks can build forecasts of the future and hence enable banks to avail of opportunities and make data-driven decisions.

10. Market Analysis: AI evaluates the consumption patterns of customers and market trends, identifying new market niches and allowing focused ad campaigns to be formulated.

11. Operational Efficiency: Artificial intelligence in banks reduces operational expenditure of banks to a large extent by automating operations and making procedures seamless.

12. Fraud Detection: Artificial intelligence in banking systems reads massive volumes of transaction data and highlights suspicious activities quickly enough to prevent loss of financial value.

Check Out Our Blog: Generative AI in Payments

Importance of AI in Banking

Artificial intelligence has taken the role of a disruptor in transforming customer experience, operations, and risk management in banking. It is an important tool for AI in finance organizations today because artificial intelligence in banking can handle large volumes of data, spot trends, and come out with wise judgments.

Major areas where Conversational AI in banking seems to affect customer experience are that AI-driven chatbots and virtual assistants are at one’s beck and call 24/7 for any consumer queries, with light-speed responses. Furthermore, AI use cases may also scan consumer behavior to deliver advice about finance in a personalized way, such as budgeting tips and customized investment choices. The extent of personalization this offers has the effect of increasing clientele loyalty and happiness.

Other than in customer support excellence, AI in the banking sector is mainly useful in fraud detection and prevention. Artificial Intelligence systems can trace irregularities that might later be identified as fraud con. Artificial Intelligence systems can trace irregularities, that may later be identified as fraud conduct, in the trends of transactions. This does protect the funds of the customer and the reputation of the bank.

The use of AI in banking also increases operational efficiency. Mechanized operations, including document verification and loan processing, save labor and speed up transactions. AI-based risk profiling assists banks in identifying risks and developing efficient mitigation plans.

Moreover, through the facilitation of more accurate models of credit rating, AI in the banking industry furthers financial inclusion. Artificial Intelligence can help banks assess the creditworthiness of those people who were earlier underserved by traditional approaches to credit scoring by considering alternative sources of information.

In summary, AI in the banking sector triggers innovativeness. Artificial intelligence is, therefore, helping banks answer the shifting needs of clients and customers and stay competitive since it helps optimize customer experience, smooth operations, and reduce risks. With the development of technology in AI in the banking industry its impact on the banking sector is expected to rise.

Read Our Case Study: Aman Bank-Generative AI powered Mobile Banking Solution

Approaches to Look Before Implementing AI for Banks

Banks wishing to incorporate AI tech technologies and techniques into their operations. Should keep in mind the following steps:

- Describing Bank’s Policy Profile: Since each bank is unique, its leaders must decide for themselves what risks and how to use AI. Banks should adopt AI while keeping in mind that it necessitates robust security measures to mitigate any possible threats.

- Set Use Cases: AI implementations need to be connected to certain business scenarios that have quantified effects and support organizational objectives. Personalise, investing plans, fraud prevention, creditworthiness scoring, and chatbots that interact with customers are a few examples of specialized use cases.

- Select Reliable AI Platform: To make sure a business has everything that it requires to thrive, the majority of enterprise AI techniques call for the implementation of several AI models. As a result, banks must decide whether to utilize in-house models, open-source models, or both.

- Adopt Hybrid Cloud Architecture: AI for banks to prioritize software resource management and fix any inefficiencies in their current technology. For real-time, Digital banking, bank, skin and resilience, and response Ness by utilizing a hybrid cloud architecture that allows them to order it between public and private clouds.

What does the Future of Banking look like with AI?

Artificial intelligence would seem to assume the role of a frontline player in the radical development of future banking. As time goes on, Conversational AI in banking is likely to assume greater and greater importance in the financial sector.

In the future of AI in banking, banks will be highly personalized to offer financial services and products that respond to customer needs and preferences. Informed chatbots and virtual assistants will grow as the primary channels of communication for engaging with the bank for support and solving queries quickly. AI will also have a very major role in fraud detection since it makes use of advanced algorithms that spot and block fraudulent transactions in real-time.

Apart from facilitating customer support, AI will also enhance the process of banking. Repetitive duties are taken over by AI-driven robotic process automation, and the human resource workforce would be available to work on key projects. Also the future of AI in banking could reduce risks and make better judgments with the help of AI-driven risk assessment.

AI and banking will be important in surmounting the challenges and preempting the opportunities as the financial landscape becomes more complex. Banks can improve customer satisfaction, operational productivity, and competitive position by deploying AI capabilities. AI-driven banking is the future that paves the way to a more innovative, secure, and customer-centric sector.

SoluLab Transforms Banking and Finance with Gen AI

Challenge

The banking industry struggles with meeting rising customer expectations, streamlining manual processes, managing risks, adapting to evolving regulations, and protecting data from increasing cyber threats.

Solution

SoluLab used Gen AI to automate tasks, deliver personalized customer experiences, and improve cybersecurity, helping banks operate more efficiently.

Impact

- 3x increase in customer satisfaction with personalized services.

- 70% faster processes, cutting operational costs.

- 98% fewer cyber threats, ensuring data safety.

Take Away

AI in the banking sector is no longer merely a vision of the future. The ability to assess large volumes of data, detect trends, and make pretty informed decisions has changed the way that financial institutions work today. From improving customer experiences to bringing in operational efficiency, AI is shifting the paradigm of the industry in many ways.

AI technology is immense, and it has the potential to alter banking as it comes forth. Further down the line, we could do far more sophisticated AI technologies with AI development companies that allow banks to offer greatly personalized services, detect fraud with unrivaled accuracy, and make data-driven decisions with confidence.

However, a balanced view of the technology and a strategic strategy is needed to apply Conversational AI in banking effectively. End route to this digital transformation when you hire an AI developer. SoluLab is your trustworthy companion, considering its knowledge of banking and artificial intelligence. Our team of professionals will help you leverage AI to improve customer engagement and smoothen operations for better business growth. Feel free to contact us today to learn more about how SoluLab can help you unlock the complete potential of AI for your bank.

FAQs

1. How can AI improve the customer experience for banking?

Artificial Intelligence would significantly improve the customer experience through the inclusion of chatbots because Artificial Intelligence banks are aware of the behavior and liking of customers, and they can provide customized financial products and services to customers.

2. How is security affected by the use of AI in banking?

Banks should formulate stringent safety measures that can ensure their clients’ private information is not hacked. This includes guidelines on data privacy, encryption methods, and frequent security checks.

3. In what ways can AI help to reduce costs for banks?

It can cut down costs for banks due to the automation of the repetitive processes involved, fraud prevention, and increasing operational effectiveness. Much savings can be made through the streamlining of procedures and eliminating errors.

4. What is Hybrid AI for Banking?

Hybrid AI in banking is the integration of both machine learning and human intelligence to enhance decision-making. By leveraging the combined capabilities in banking, Hybrid AI can optimize customer service, risk management, and operational efficiency.

5. How can AI be used in banks with the support of SoluLab?

SoluLab offers end-to-end AI solutions for the banking sector. We specialize in chatbot development with AI, fraud detection programs, and predictive analytics models. Feel free to reach out to us to learn more about how SoluLab can help you transform your bank with AI.