Fintech Software Development Company

At SoluLab, our Fintech software development company builds secure, innovative financial software that meets end users' expectations and generates steady revenue for financial institutions using the latest software development standards. Your business will benefit from our custom fintech software development solutions with lower expenses, smooth updates, and high adoption, all of which boost your revenue as a service provider.

250+

Developers

150+ Software Products

Delivered

500+ Global Clients

10+ Total Years of

Experience

Increase Your Business Revenues With Our Fintech

Development Services

At SoluLab, we offer comprehensive fintech software development services designed to elevate your business and increase your revenue. As a fintech software development agency, our expertise in end-to-end fintech application design and development ensures that your innovative ideas are transformed into agile and robust applications.

Financial Software Development

Our financial software development services provide extensive technical and strategic support to fintech companies. We ensure your business objectives are met with precision. As one of the top fintech software development companies, we align our strategies with your goals for optimal results, helping you achieve long-term success.

Mobile Banking Software Development

As a leading fintech software development company, we assist tech vendors in planning and implementing sophisticated mobile banking solutions. Our approach ensures the creation of secure and user-friendly mobile banking applications. Trust us to design scalable solutions that align with the best practices of the biggest fintech companies.

Wealth Management Software Development

SoluLab excels in developing wealth management software that integrates financial data, portfolio management, and analytics tools. Our fintech application development services include seamless integration of various financial services, enhancing your wealth management offerings with top-notch functionality.

Accounting Management Software Development

Leveraging our expertise in fintech software development, we create advanced accounting management solutions. Our fintech development company ensures your accounting software is robust, accurate, and compliant with industry standards, helping you streamline financial processes.

Crowdfunding Platform Development

Our crowdfunding platform development services help you create secure, user-friendly platforms that enable efficient fundraising. As a fintech custom software development company, we design solutions that support various crowdfunding models, ensuring your platform is competitive and effective.

Our fintech software company includes creating secure and scalable digital wallets. We develop solutions that facilitate seamless transactions, user authentication, and Compliance with regulatory standards. Enhance your fintech software offerings with our cutting-edge digital wallet development.

Peer-to-Peer (P2P) Lending Platforms

We specialize in developing P2P lending platforms that connect borrowers and lenders directly. Our fintech software developers design solutions that ensure transparency, security, and efficiency in lending processes, making your platform reliable and user-friendly.

Robo-Advisory Solutions

Our fintech software outsourcing agency offers robo-advisory solutions that automate investment advice using algorithms and AI. We create intuitive platforms that provide personalized financial advice, enhancing your service offerings and customer experience.

Online Banking Solutions

Transform your banking services with our online banking solutions. Our software for fintech designs secure, scalable, and user-friendly online banking platforms that cater to the needs of modern customers, ensuring seamless digital banking experiences.

Regtech Solutions

Our regtech solutions help financial institutions comply with regulatory requirements efficiently. We develop software that automates compliance processes, reduces risks, and enhances operational efficiency, keeping your business ahead of regulatory changes for top financial software companies

Financial Data Analytics

At SoluLab, our financial data analytics services provide insights that drive informed decision-making. Our software development for fintech solutions includes advanced analytics tools that process financial data accurately, offering valuable insights to improve your financial strategies.

As a fintech software development company, we specialize in blockchain solutions that enable secure and transparent financial transactions, smart contracts, Decentralized Finance, and cryptocurrency applications, ensuring trust and efficiency in your operations.

How Do Fintech Software Development Technologies Work at SoluLab?

Fintech software development technologies work by integrating advanced tools and methodologies to revolutionize the financial industry. Key technologies such as blockchain ensure secure and transparent transactions, artificial intelligence (AI) and machine learning (ML)enhance decision-making through predictive analytics and personalized services. Cloud computing provides the scalable infrastructure necessary for handling large volumes of financial data, and APIs (Application Programming Interfaces) enable seamless integration with third-party services, enhancing the functionality and connectivity of FinTech applications. These technologies collectively support the development of mobile banking apps, payment gateways, investment platforms, and personal finance management tools.

Fintech application development services further tailor these technologies to meet the unique needs of financial institutions and startups. This involves a detailed requirement analysis to understand specific client needs, followed by designing, prototyping, development, and rigorous testing to ensure reliability and security. The deployment and maintenance phases ensure that the software remains up-to-date and effective in a dynamic market. By leveraging these technologies and services, our fintech solutions at SoluLab can address industry-specific challenges such as risk management, regulatory compliance, fraud detection, and streamlined lending processes, ultimately enhancing operational efficiency and customer experience.

Types of Fintech Solutions We Develop

At SoluLab, we specialize in a wide range of fintech solutions that cater to the diverse needs of financial institutions and businesses. Our expertise in fintech software development enables us to create innovative, secure, and scalable applications that enhance operational efficiency and drive business growth. Here are the key types of fintech solutions we develop:

Fraud Detection and Prevention Systems

We develop advanced fraud detection and prevention systems that use machine learning algorithms and real-time data analysis to identify and mitigate fraudulent activities. These solutions help financial institutions protect their assets and ensure the security of their transactions.

Automated Loan Servicing

Our automated loan servicing solutions streamline the entire loan lifecycle, from origination to repayment. These systems automate tasks such as payment processing, interest calculation, and delinquency management, improving efficiency and customer satisfaction.

Investment Management Platforms

We create comprehensive investment management platforms that support portfolio management, performance tracking, and risk assessment. These solutions enable financial advisors and individual investors to make informed investment decisions and optimize their portfolios.

Microfinance Solutions

Our microfinance solutions empower financial institutions to provide financial services to underserved communities. These platforms support microloans, savings accounts, and financial education, promoting financial inclusion and economic development.

We develop secure and scalable cryptocurrency exchange platforms that facilitate the trading of digital assets. These platforms offer features such as real-time market data, secure wallet integration, and robust security measures to ensure a safe trading environment.

Personal Finance Management (PFM) Apps

Our PFM apps help individuals manage their personal finances by providing tools for budgeting, expense tracking, and financial planning. These applications offer insights into spending habits, helping users achieve their financial goals.

Regulatory Reporting Solutions

We create regulatory reporting solutions that automate the generation and submission of compliance reports to regulatory authorities. These systems ensure accuracy, reduce manual effort, and help financial institutions stay compliant with evolving regulations.

Financial Planning and Analysis (FP&A) Tools

Our FP&A tools provide businesses with comprehensive financial planning and analysis capabilities. These solutions support budgeting, Forecasting, and financial modeling, enabling organizations to make data-driven decisions and optimize their financial performance.

Tax Management Software

We develop tax management software that simplifies tax calculations, filing, and compliance. These solutions support multiple jurisdictions and tax regulations, ensuring accuracy and reducing the risk of non-compliance for businesses.

Our Diverse Industry Reach

As a leading fintech development company, SoluLab caters to diverse industries, delivering innovative solutions that transform businesses. Our expertise as a trusted fintech software company enables us to provide tailored applications that meet industry-specific challenges and requirements. Explore how we empower businesses across various sectors:

Enhance customer experience and operational efficiency with secure and scalable banking software solutions.

Streamline processes and improve customer service with tailored insurance software applications.

Optimize investment strategies and portfolio management with advanced fintech software solutions.

Payments

Facilitate secure and seamless payment processing with our innovative payment gateway solutions.

Lending

Improve lending processes and customer experience with robust P2P lending platforms and loan management systems.

Benefits of Choosing Our Fintech Software

Development Services

Partnering with SoluLab for your fintech software development needs ensures a range of benefits tailored to drive your business forward:

Expertise in Fintech Development

SoluLab brings extensive knowledge as a leading fintech software development company, delivering high-quality applications that align precisely with your business objectives and industry standards.

Customized Solutions

Our fintech applications are meticulously crafted to meet your specific needs, addressing unique challenges with tailored features and functionalities that enhance operational efficiency.

Agile Development Approach

Embracing agile methodologies, we facilitate rapid development cycles and seamless adaptation to evolving requirements. This approach ensures continuous improvement and timely delivery of robust fintech solutions.

Seamless Integration

SoluLab’s fintech solutions seamlessly integrate with your existing infrastructure and third-party applications. This integration enhances overall functionality, user experience, and operational synergy across platforms.

Scalability and Flexibility

Designed for scalability, our fintech architectures empower your business to grow effortlessly. Whether accommodating increased user demand or expanding into new markets, our solutions scale seamlessly to support your growth trajectory.

Cost-Effective Solutions

Benefit from cost-effective fintech development services that optimize resources and minimize overhead costs. Our solutions are engineered to deliver superior performance and ROI, ensuring efficient utilization of your investment.

Enhanced Security

Security is paramount in every fintech solution we develop. SoluLab implements robust security measures throughout the development lifecycle to safeguard your data, ensuring compliance with stringent industry standards.

Continuous Support and Maintenance

We provide comprehensive support and maintenance services to keep your fintech applications operating at peak performance. Our proactive approach includes regular updates, monitoring, and troubleshooting to minimize downtime and maximize efficiency.

Customer-Centric Approach

At SoluLab, we prioritize your satisfaction. Our customer-centric approach fosters transparent communication, collaborative partnership, and a deep understanding of your business goals, ensuring we deliver solutions that exceed your expectations.

Request a Free Consultation

Are you curious about how our fintech software development services can benefit your business? Request a free consultation with our experts and explore customized solutions designed to meet your unique needs. Get in touch with SoluLab today!

Our Fintech Software Development Tech Stack

Fintech Software Development Use Cases

As a leading fintech development company, SoluLab provides top-notch fintech development services tailored to meet the diverse needs of businesses across various industries. Our expertise in fintech development enables us to create scalable, secure, and user-friendly applications that drive business growth and innovation. Here are some common use cases where our fintech development solutions have proven to be invaluable:

Our fintech development services can help you build powerful CRM platforms that streamline customer interactions, manage sales pipelines, and improve customer service. These solutions enable businesses to track customer behavior, manage leads, and enhance customer retention strategies.

We develop comprehensive ERP systems that integrate various business processes, such as inventory management, human resources, finance, and procurement. Our ERP solutions help businesses achieve operational efficiency, reduce costs, and improve decision-making.

Project Management

Our project management fintech applications are designed to facilitate collaboration, task tracking, and resource management. These tools help teams stay organized, meet deadlines, and enhance productivity, making project management more efficient and effective.

E-Commerce Platforms

SoluLab's fintech development services extend to creating robust e-commerce platforms that support online sales, inventory management, and customer service. Our solutions are designed to provide seamless shopping experiences, secure transactions, and scalability to handle growing customer bases.

We offer fintech solutions for HRM that simplify employee onboarding, payroll processing, performance tracking, and benefits administration. These tools help HR departments manage their workforce more effectively and enhance employee satisfaction.

Financial Management

Our fintech financial management solutions offer tools for budgeting, forecasting, and financial reporting. These applications provide businesses with real-time insights into their financial health, helping them make informed decisions and maintain financial stability.

Collaboration Tools

We develop collaboration tools that enhance communication and teamwork within organizations. These include messaging apps, video conferencing solutions, and document-sharing platforms that facilitate real-time collaboration and information sharing.

Marketing Automation

Our fintech marketing automation platforms enable businesses to streamline their marketing efforts, track campaign performance, and nurture leads. These solutions help in executing effective marketing strategies, generating higher ROI, and improving customer engagement.

SoluLab's fintech development services also cater to the healthcare sector by providing solutions for patient management, electronic health records (EHR), and telemedicine. These tools help healthcare providers enhance patient care, improve operational efficiency, and ensure compliance with industry regulations.

Our Fintech Software Development Projects

We have successfully delivered numerous projects for our clients, ranging from mobile banking applications to blockchain-based security platforms. Our expertise extends across a broad spectrum of fintech domains, enabling us to tackle complex challenges and deliver high-quality solutions.

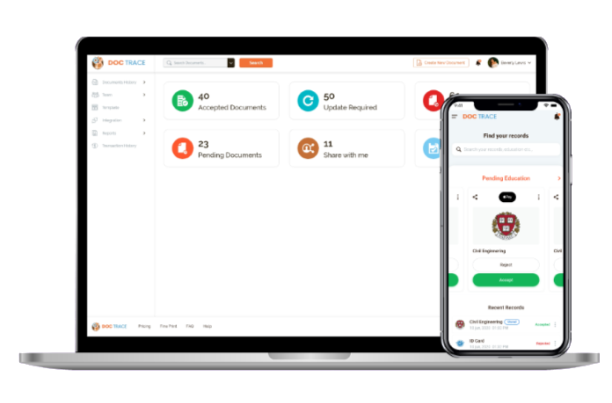

DOCTRACE

- Safe Management of documents

The professionals at the Texas-based business DocTrace provide dependable engineering solutions to the construction industry and the general public. Due to the extensive document exchanges inherent in this procedure, the company set out to create a safe and user-friendly document management system for

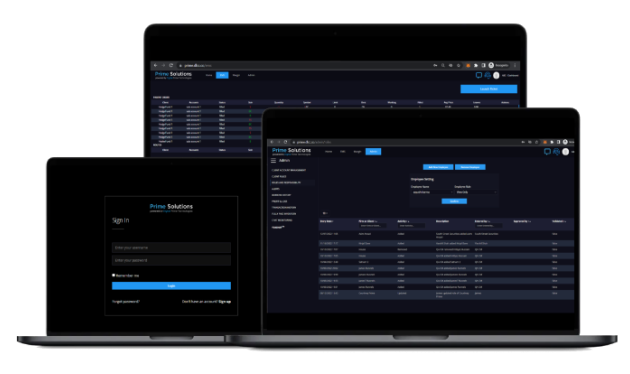

DLCC

- Blockchain in digital asset lending

DLCC is building the future of regulated crypto & digital asset lending. We developed a blockchain- based solution for the financial area that makes lending and borrowing simpler than ever. We handled all regulatory compliance issues and simplified digital asset financing.

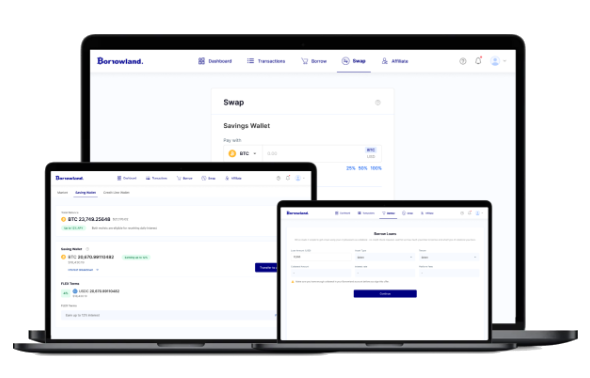

Borrowland

- Hassle-free bookings!

ETABIBO simplifies appointment booking. The booking platform streamlines hospital, pharmacy, and physician bookings using technology. SoluLab's skilled professionals identified the project's scope and split healthcare duties. The smart contract was added to the marketplace to simplify and improve work.

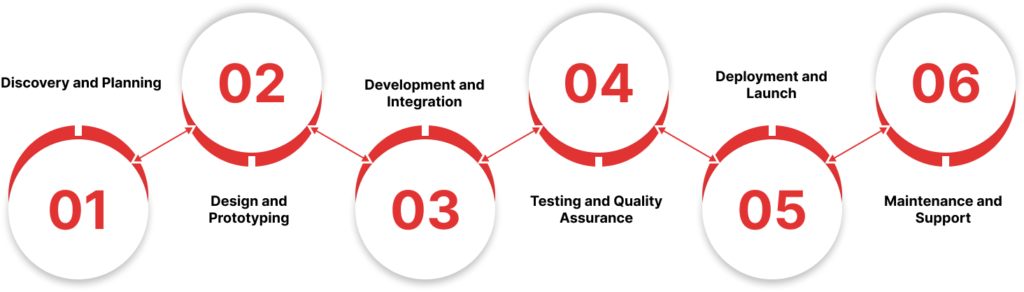

The Roadmap to Our Fintech Development Success

At SoluLab, our fintech software development services are driven by a well-defined and strategic roadmap that ensures the delivery of high-quality, innovative, and scalable solutions. Our roadmap to success is built on a series of meticulously planned and executed stages, each designed to maximize the value we bring to our clients. Here’s a closer look at the key phases in our fintech development process:

Discovery and Planning

The journey begins with a comprehensive discovery phase where we understand your business needs, goals, and challenges. We conduct market research, and competitor analysis, and gather detailed requirements to create a clear project roadmap. Our planning phase involves defining the project scope, timelines, and budget, and selecting the appropriate technology stack.

Design and Prototyping

In this phase, our design team creates intuitive and user-centric designs that align with your brand identity. We develop interactive prototypes to visualize the application’s functionality and user experience. This step ensures that all stakeholders have a clear understanding of the final product and can provide valuable feedback early in the process.

Development and Integration

Our Experienced Developers bring your vision to life by writing clean, efficient, and scalable code. We follow agile development methodologies, allowing for iterative progress and continuous feedback. Throughout this phase, we ensure seamless integration with existing systems, third-party APIs, and compliance with industry standards.

Testing and Quality Assurance

Quality is at the core of our fintech development services. Our dedicated QA team conducts rigorous testing to identify and rectify any issues. We perform various types of testing, including functional, performance, security, and usability testing, to ensure that the application is robust, and secure, and performs optimally.

Deployment and Launch

Once the application passes all quality checks, we proceed with deployment. Our team ensures a smooth and error-free launch, handling all aspects of the deployment process. We also provide training and support to your team to ensure they are well-equipped to use and manage the new application.

Maintenance and Support

Our commitment to your success doesn’t end with the launch. We offer ongoing maintenance and support services to ensure your application remains up-to-date, secure, and performs optimally. We monitor the application, provide regular updates, and quickly address any issues that arise.

Why Choose SoluLab As Your Fintech

Development Company?

Selecting the right partner for your fintech software development needs is crucial to the success of your project. At SoluLab, we stand out as a leading fintech development company, offering unparalleled expertise, innovation, and a commitment to delivering exceptional results. Here are compelling reasons why you should choose SoluLab for your fintech development services:

Extensive Industry

Experience

Innovative Solutions

Customized Approach

Advanced Technology

Integration

Security and Compliance

Seamless Integration

Get Started with SoluLab Today!

Ready to transform your financial services with advanced fintech solutions? Partner with SoluLab to leverage our expertise and drive your business forward. Whether you need a custom application or a comprehensive fintech platform, we’re here to help. Contact us today to discuss your project requirements and discover how our tailored solutions can enhance your business operations.

What Our Clients Have to Say for Us

“Choosing SoluLab for our fintech software development was a wise decision. Their team's expertise, attention to detail, and commitment to delivering a high quality solution impressed us. We couldn't be happier with the results”

David Thompson

“SoluLab proved to be the perfect partner for our fintech software development needs.

Their professionalism, timely communication, and

exceptional technical skills ensured successful project delivery.”

Jackson Patel

“Working with SoluLab for our fintech

software development was a gamechanger.

Their expertise and dedication resulted in a highly recommended solution

that exceeded our expectations!”

Ella Ramirez

Frequently Asked Questions

Fintech software development companies offer a wide range of services, including financial software development, mobile banking software development, wealth management software development, accounting management software development, crowdfunding platform development, digital wallet development, peer-to-peer (P2P) lending platforms, robo-advisory solutions, online banking solutions, regtech solutions, and financial data analytics.

Fintech software development solutions boost business revenues by enhancing operational efficiency, improving customer experience, enabling seamless transactions, ensuring regulatory compliance, and providing valuable financial insights. These solutions streamline processes, reduce costs, and open up new revenue streams.

Mobile banking software development is significant in fintech as it provides customers with convenient and secure access to banking services via their mobile devices. It enhances customer experience, increases engagement, and enables banks to offer innovative services, driving customer loyalty and business growth.

Wealth management software solutions benefit financial institutions by integrating financial data, portfolio management, and analytics tools. They enhance the efficiency and accuracy of wealth management processes, enable personalized investment advice, and improve client satisfaction.

Digital wallets play a crucial role in fintech software development by facilitating secure and seamless electronic transactions. They provide users with a convenient way to make payments, transfer money, and manage their finances, driving the adoption of digital financial services.

SoluLab ensures the security of fintech applications by implementing robust security measures throughout the development lifecycle. This includes encryption, secure authentication, regular security audits, compliance with industry standards, and continuous monitoring to safeguard against potential threats.

Fintech development services can benefit various industries, including banking, insurance, investment management, payments, lending, and healthcare. These services provide tailored solutions to meet industry-specific challenges and improve operational efficiency, customer experience, and regulatory compliance.

SoluLab supports the continuous improvement of fintech applications by gathering user feedback, analyzing performance data, and implementing enhancements. Our proactive approach ensures that applications remain relevant, competitive, and aligned with evolving business goals and market trends.

The process of developing a fintech application at SoluLab involves several key phases: discovery and planning, design and prototyping, development and integration, testing and quality assurance, deployment and launch, maintenance and support, and continuous improvement. This well-defined roadmap ensures the delivery of high-quality, innovative, and scalable solutions.

Tell Us About Your Project

Latest Blogs

How AI in KYC (Know Your Customer) Makes It Easy-Peasy?

Discover how AI in KYC streamlines customer onboarding, enhances security,...

Read MoreAI in CRM: Improve Lead Management & Customer Retention

Learn how AI-powered CRM systems personalize customer experiences, optimize sales...

Read MoreAI Model Training: How It Works & Why It Matters

AI model training is the key to smart AI. Learn...

Read More