Crypto liquidity pools are the cornerstone of decentralized finance (DeFi), facilitating essential operations like token exchanges, lending, and yield farming. These pools use smart contracts to manage funds and automate transactions rather than depend on conventional order books, inaugurating a new era of permissionless finance.

As of Q3 2024, the Total Value Locked (TVL) in DeFi protocols had exceeded $160 billion, indicating that liquidity pools are a significant catalyst for development in the blockchain ecosystem.

In this blog, we will discuss the essential aspects of crypto liquidity pools, including their functionality, significance, and the associated risks and rewards of participation. We will look at the mechanics of automated market makers (AMMs), emphasize prominent platforms such as Uniswap and Curve (which possess over $5 billion in total value locked), and offer insights into the provision, incentivization, and management of liquidity in the current DeFi ecosystem.

What are crypto liquidity pools?

Crypto liquidity pools are collectively sourced reserves of cryptocurrency coins and tokens secured under a smart contract. These pools primarily enable automated and permissionless trading of cryptocurrencies and tokens on decentralized exchanges (DEXs). In contrast to conventional exchanges that utilize order books, decentralized exchanges (DEXs) enable users to exchange one cryptocurrency for another by executing transactions against a liquidity pool, which supplies the requisite liquidity for the transaction.

Fundamental cryptocurrency liquidity pools are often bilateral, necessitating two distinct forms of crypto assets. Liquidity providers (LPs) must contribute equivalent values of both assets to a basic pool on a decentralized exchange (DEX) to furnish liquidity. In exchange, LPs obtain LP tokens, which signify their stake in the liquidity pool and provide them with a percentage of the trading fees accrued.

Difference Between Cryptocurrency Liquidity Pools and Traditional Solutions

| Feature | Cryptocurrency Liquidity Pools | Traditional Liquidity Solutions |

| Intermediaries | No intermediaries; fully decentralized | Involves brokers, exchanges, and financial institutions |

| Trading Mechanism | Automated via smart contracts and AMMs | Order book-based, with human or algorithmic matching |

| Access | Open to anyone globally with an internet connection | Limited to institutions or verified users |

| 24/7 Availability | Operates round the clock without downtime | Limited to market hours, especially in stock markets |

| Fees | Lower fees, with LPs earning a share | Higher fees due to middlemen and operational overhead |

| Risk Exposure | Exposed to smart contract bugs and impermanent loss | Exposed to counterparty risk and market manipulation |

| Liquidity Source | Pooled from multiple users (decentralized) | Provided by market makers or centralized institutions |

| Transparency | Fully transparent on-chain data | Opaque; relies on internal systems and delayed reports |

| Speed of Settlement | Near-instant settlements via blockchain | Can take hours or days, especially for cross-border |

| Customization & Innovation | Highly customizable (e.g., yield farming, synthetic assets) | Rigid, with slower innovation cycles |

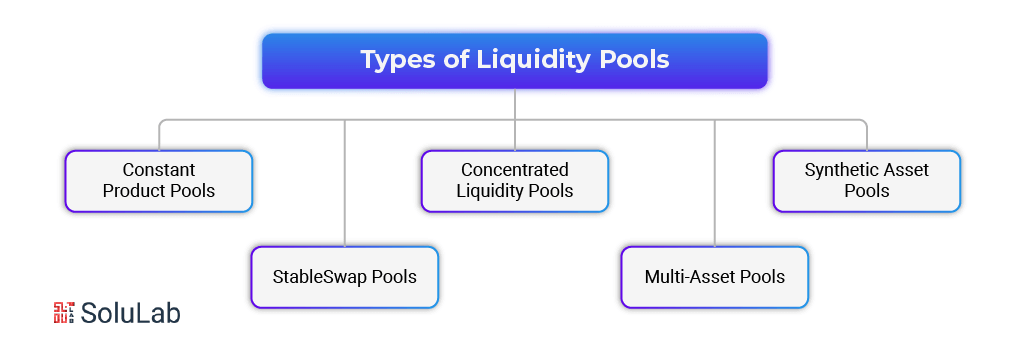

Types of Liquidity Pools

Liquidity pools vary in kind according to their applications, token composition, and pricing methods. Although they serve the fundamental purpose of enabling decentralized trade and financial services, their structures and designs might vary considerably.

Understanding the various forms of liquidity pools helps in selecting the appropriate platform and approach according to objectives such as generating fees, mitigating risk, or facilitating low-slippage transactions.

The primary types of liquidity pools are as follows:

Constant Product Pools

These represent the predominant variety popularized by platforms such as Uniswap. The constant product formula (x * y = k) enables individuals to trade against the pool at a price that fluctuates dynamically according to supply and demand.

StableSwap Pools

Utilized by platforms such as Curve, these pools are tailored for assets with comparable prices, such as stablecoin pairings (e.g., USDC/DAI). They provide less slippage and superior rates for stable assets owing to their distinctive pricing curve.

Concentrated Liquidity Pools

Uniswap V3 introduced the capability for liquidity providers to disperse their money within designated price ranges rather than throughout the full spectrum. This enhances capital efficiency and enables LPs to generate increased fees with reduced capital.

Multi-Asset Pools

These pools accommodate many tokens, shown by Balancer pools, which may include up to eight distinct tokens. They employ a generalized AMM formula and permit changeable asset weighting, facilitating tailored portfolio strategies.

Synthetic Asset Pools

Platforms such as Synthetix utilize liquidity pools to support synthetic assets that mirror the prices of real-world assets like gold and equities. These pools are essential for sustaining the peg and facilitating synthetic trade.

How do Crypto Liquidity Pools work?

Let’s first understand what is a liquidity pool in crypto. Cryptocurrency liquidity pools are smart contracts that secure tokens to enable decentralized trading and various financial services without requiring a centralized middleman. Fundamentally, they are engineered to address the issue of illiquidity on decentralized exchanges (DEXs), guaranteeing sufficient asset availability for seamless trading. Liquidity providers (LPs) contribute token pairs (such as ETH and USDC) to a pool, thereby earning a portion of the transaction fees and, at times, supplementary incentives.

How they work?

Cryptocurrency liquidity pools are smart contracts that secure tokens to enable decentralized trading and various financial services without requiring a centralized middleman. Fundamentally, they are engineered to address the issue of illiquidity on decentralized exchanges (DEXs), guaranteeing sufficient asset availability for seamless trading. Liquidity providers (LPs) contribute token pairs (such as ETH and USDC) to a pool, thereby earning a portion of the transaction fees and, at times, supplementary incentives.

This is the operational procedure, outlined sequentially:

- Token Pair Deposits: Liquidity providers contribute equivalent amounts of two tokens (e.g., ETH/DAI) to a liquidity pool. The tokens are retained under a smart contract.

- Automated Market Maker (AMM): It utilizes a mathematical formula, often the constant product formula (x * y = k), to ascertain the price of tokens in the pool, rather than relying on an order book.

- Trading Without Order Books: Traders engage directly with the liquidity pool instead of with fellow traders. The price automatically varies according to the ratio of tokens within the pool.

- Reward Acquisition: Liquidity Providers (LPs) get a fraction of the trading fees (e.g., 0.3% per transaction on Uniswap) commensurate with their stake in the pool. Certain systems further provide incentives, such as governance tokens.

- Impermanent Loss Risk: Should the price of the deposited tokens fluctuate considerably from the time of their addition, liquidity providers crypto may experience impermanent loss, a transient decline in value relative to merely retaining the tokens.

- Withdrawal: Limited Partners may withdraw their tokens at any moment, including with accrued fees and benefits, less any transitory loss that may have transpired.

What exactly are crypto liquidity pool tokens?

When liquidity providers deposit funds in a pool, they are given a liquidity provider token (LPT) representing their portion of the pool.

Liquidity provider tokens (LPTs) are used to determine the number of funds donated by LPs to a pool as well as their share of transaction fees for providing liquidity. This gives LPs ownership of their assets while they are in the pool.

LPTs can be staked, sold, or transferred to other protocols on the same blockchain because they share the same qualities as other tokens on the blockchain.

A BNB-BUSD LPT, for example, can be staked on PancakeSwap to earn the trading platform’s protocol token, CAKE.

Real-World Examples of Crypto Liquidity Pools

Let’s examine some relative measures from well-known decentralized exchanges, such as UniSwap, Curve Finance, and PancakeSwap to better grasp how these liquidity pools in crypto perform when they are practiced. These systems highlight the variety of performance measures, user incentives, and functionality within the Defi ecosystem.

1. UniSwap Vs Curve Finance: Renowned for its creative contribution to the automated market maker, AMM systems, Anisha preserves liquidity with the constant product formula. ETH/USDC is one of the biggest pools of daily volumes. Average around $300 to $400 with an annual percentage that reels for liquidity providers between 20-30%.

Focusing on stablecoins, finance maximizes liquidity with the little sleep age and creates efficiency. For example, with lesser temporary loss, due to stable asset pairs, the DAI/USDC/USDT pool and curve typically have daily trading volumes passing $200 million, usually falling between 5-10%, APYs for this pool.

2. PancakeSwap: when operated on a finance, smart chain, pancake swap uses its token, CAKE, to incentivize, liquidity and presents the use of a friendly interface for example, depending on marketing conditions and the level of CAKE incentives given the liquidity pool of BNB/CAKE is recorded to produce APYs above 50%

3. Balancer: Multi Token Pools, gives more bestiality than unique swap or curve by letting users build pools with up to 8 different tokens. For instance with a rebalancing system to maximize portfolio management for liquidity providers, the WESH/dai/bAl pool boot NAPY of roughly 15-25%.

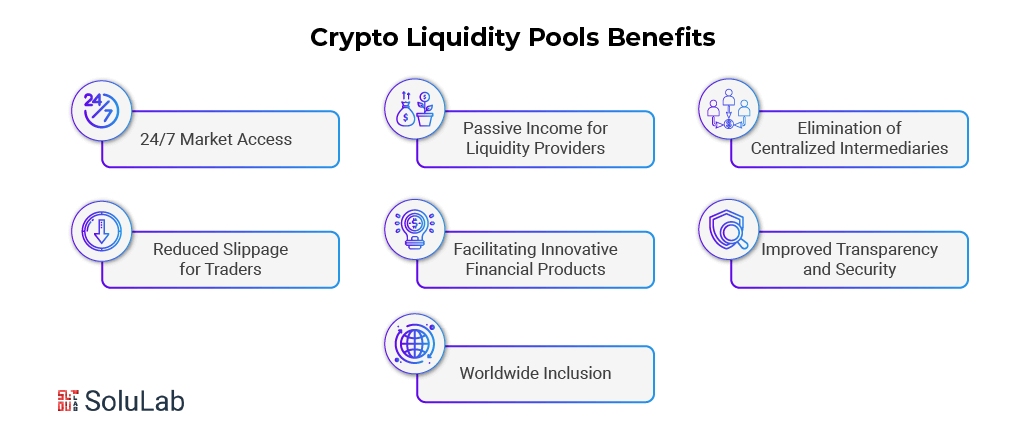

Benefits of Crypto Liquidity Pools

Cryptocurrency liquidity pools have grown as a fundamental component of the decentralized finance ecosystem by facilitating permissionless and efficient trading. In addition to enabling swaps, they provide several advantages for traders, investors, and developers.

Below are a few key benefits of the best crypto liquidity pools:

24/7 Market Access

Liquidity pools function continuously, independent of conventional market hours. This guarantees that consumers may engage in trading or supply liquidity at any moment, from any location globally.

Passive Income for Liquidity Providers

Users can earn a portion of the trading fees earned by a liquidity pool by putting tokens into it. Numerous platforms furthermore include supplementary incentives such as governance tokens, enhancing potential rewards.

Elimination of Centralized Intermediaries

Liquidity pools eliminate the necessity for brokers or centralized exchanges, facilitating genuinely decentralized trading and asset management, hence diminishing dependence on third-party custodians.

Reduced Slippage for Traders

In well-capitalized pools, particularly those employing sophisticated AMM architectures (such as Curve’s StableSwap), transactions may be conducted with negligible slippage, even for substantial orders.

Facilitating Innovative Financial Products

Liquidity pools facilitate yield farming, synthetic assets, flash loans, and several other DeFi applications. Their adaptability enables developers to devise innovative financial products unattainable in conventional finance.

Improved Transparency and Security

As liquidity pools operate via smart contracts, all transactions and liquidity information are transparently recorded on-chain. This transparency fosters confidence and enables real-time auditing by any individual.

Worldwide Inclusion

Individuals possessing a cryptocurrency wallet and internet access can engage, therefore democratizing financial possibilities and equalizing conditions across various regions.

The Role of Crypto Liquidity Pools in DeFi

Crypto liquidity pools are the driving force behind a significant portion of the decentralized finance (DeFi) ecosystem. They establish the fundamental infrastructure that facilitates the operation of a multitude of DeFi applications, including yield farming, lending protocols, and decentralized exchanges (DEXs), without the need for intermediaries.

Here’s how the best crypto liquidity pools play a critical role in DeFi:

Enabling Decentralized Trading

By enabling users to exchange tokens directly through smart contracts, liquidity pool crypto supplants conventional order books. This innovation enables the rapid and permissionless trading of tokens, thereby enabling DEXs such as Uniswap, SushiSwap, and Curve

Facilitating Yield Generation

By providing liquidity to pools, garnering fees from transactions, and receiving incentives from DeFi protocols, users can generate passive income. Retail and institutional participants have been drawn to the DeFi sector as a result of this yield generation.

Borrowing and Lending

Decentralized lending and borrowing services are provided by protocols such as Aave and Compound, which utilize pooled liquidity. User deposits assets into pools, from which others may borrow, with interest rates that are dynamically adjusted in accordance with supply and demand.

Complex DeFi Strategies

Advanced DeFi activities, such as yield farming, arbitrage, and rapid loans, are facilitated by liquidity pools. The execution of these strategies is contingent upon the presence of deep, liquid pools.

Starting New Projects

Without the necessity of listing on centralized exchanges, new tokens can generate initial liquidity through pools. SushiSwap’s Onsen and Balancer’s Liquidity Bootstrapping Pools (LBPs) are examples of platforms that assist initiatives in establishing visibility and trading volume at the outset.

Incentives and Decentralized Governance

Top crypto liquidity providers are granted voting power over protocol decisions by numerous DeFi protocols in exchange for governance tokens. This aligns user interests with platform growth and promotes decentralized ownership.

Yield Farming and Crypto Liquidity Pools

To improve the trading experience, many protocols give additional incentives for users to generate liquidity by distributing more tokens for specific “incentivized” pools. Participating in these incentivized liquidity pools as a provider in order to obtain the most number of LP tokens is referred to as liquidity mining. Liquidity mining is a method used by crypto exchange liquidity providers to maximize their LP token profits on a specific market or platform.

There are numerous DeFi markets, platforms, and incentive pools where you may earn rewards for providing and mining liquidity in exchange for LP tokens. So, how does a cryptocurrency liquidity provider decide where to invest their funds? Here’s where yield farming comes in. Yield farming refers to the process of staking or locking up currency within blockchain technology to produce tokenized incentives. Yield farming is the practice of staking or locking up tokens in various DeFi apps to produce tokenized rewards that help maximize earnings. As a result of their assets being distributed to trading pairs and incentivized pools with the highest trading fee and LP token rewards across several platforms, a crypto exchange liquidity provider might earn significant returns for a slightly higher risk. This type of liquidity investing might direct a user’s funds to the greatest earning asset pairs. Yearn. Finance platforms even automate balance risk selection and returns to move your assets to other DeFi investments that give liquidity.

The Unexpected Value of Crypto Liquidity Pools

In the early phases of DeFi, DEXs suffered from crypto market liquidity problems when attempting to model the traditional market makers. Instead of having a seller and buyer match in an order book, liquidity pools helped solve this problem by incentivizing users to provide liquidity. This provided a robust, decentralized solution to DeFi liquidity, which was critical in accelerating the sector’s growth. Liquidity pools may have been born from necessity, but their innovation brings a fresh new way to provide decentralized liquidity algorithmically through incentivized, user-funded pools of asset pairs.

How to Join Crypto Liquidity Pools?

Joining a crypto liquidity pool is a simple process, but it requires a basic understanding of how DeFi platforms work and a few precautions to keep your assets safe. By providing liquidity, you’re contributing to a protocol’s trading ecosystem and, in return, earning a share of the fees or additional incentives. Here’s a step-by-step guide on how to get started:

1. Choose a DeFi Platform

Select a decentralized exchange (DEX) or protocol with strong credibility and audited smart contracts. Popular options include:

- Uniswap

- Curve Finance

- Balance

- PancakeSwap (for BNB Chain)

2. Connect Your Wallet

Use a Web3 wallet like MetaMask, Trust Wallet, or Coinbase Wallet. Connect your wallet to the DEX interface by clicking “Connect Wallet.”

3. Select a Token Pair

Choose a liquidity pool pair you want to join (e.g., ETH/USDC or DAI/USDT). Make sure you have an equal value of both tokens in your wallet. Some platforms also support single-sided deposits.

4. Add Liquidity

Navigate to the “Pool” or “Liquidity” section of the DEX and input the amount you want to deposit. The interface will automatically calculate the required amount of the second token based on the pool ratio.

5. Confirm the Transaction

First, you’ll need to approve the token spend, followed by confirming the transaction. Once processed on-chain, you’ll receive LP (Liquidity Provider) tokens, representing your share of the pool.

6. Start Earning Fees

As trades happen in the pool, you’ll earn a share of the transaction fees. On some platforms, you can stake your LP tokens in yield farms to earn additional rewards or governance tokens.

7. Monitor Performance

Keep an eye on your LP position, impermanent loss, and pool performance. You can use tools like Zapper, Debank, or APY.vision for real-time tracking.

By following these steps, you can start participating in the DeFi ecosystem, earn passive income, and contribute to the liquidity of decentralized markets—all while maintaining control over your assets.

Examples of crypto liquidity pools

There are hundreds of liquidity pools in the decentralized trading space, but a handful of trading platforms have emerged as the go-to options for traders and investors looking for decentralized crypto liquidity. They include:

- Uniswap

- Balancer

- Curve Finance

- PancakeSwap

- Bancor

- Convexity Protocol

- Kyber Network

- SushiSwap

Liquidity pools exist for a wide range of assets because they can be created by users themselves. The only restriction is that the tradable tokens must be available on the chain that the liquidity pool provider operates.

For example, on Uniswap and SushiSwap, you can only trade Ethereum-based ERC20 tokens, while PancakeSwap is limited to Binance Smart Chain’s BEP20 tokens.

The most popular assets you can find in liquidity pools include ETH, BNB, and stablecoins like DAI, USDT, and USDC. Even popular “meme coins” like SafeMoon can be traded or deposited in liquidity pools.

Final Thought

Crypto liquidity pools play a crucial role in the DeFi ecosystem, enabling seamless token swaps, reducing slippage, and providing passive income opportunities for liquidity providers. Understanding how do crypto liquidity pools work and the strategies to maximize returns, is essential for anyone looking to participate in decentralized finance. As the crypto space evolves, liquidity pools will continue to be a key component in enhancing market efficiency and accessibility.

SoluLab, as a leading crypto development company, has helped projects like Crypto Mining build robust and efficient platforms. Crypto Mining is a specialized mining platform where users can either purchase a miner for their operations or use the available miners to start mining immediately.

SoluLab’s expertise ensured the platform was equipped with all necessary features, providing an intuitive user experience and seamless functionality. From secure transactions to optimized performance, SoluLab’s development capabilities bring real-world solutions to the crypto industry.

If you’re looking to develop a crypto exchange, liquidity pool, or mining platform, SoluLab’s expert team can help you build a secure, scalable, and user-friendly solution. Get in touch today to turn your crypto vision into reality!

FAQs

1. Are cryptocurrency liquidity pools profitable?

Indeed, liquidity pools can provide a foundation for long-term financial commitments. Over time, liquidity providers might generate passive revenue by receiving a portion of incentives and trading fees.

2. How can a cryptocurrency liquidity pool be started?

Choose a ‘Base Token’ (such as $BNB, $USDC, or $USDT). Select the ‘Quote Token’ for the token you want to introduce. Establish the starting price and match the quantity of the two tokens. Verify the transactions once the ‘Create Liquidity Pool’ has been selected.

3. Which is preferable, a liquidity pool or staking?

For cryptocurrency investors, staking or liquidity pools provide profitable prospects in 2025. For individuals who prefer a more cautious strategy, staking offers consistent earrings and reduced risk.

4. Which liquidity pool is the best?

Uniswap is ranked the first among decentralized exchanges offering the greatest DeFi liquidity pools. Uniswap which runs on the Ethereum blockchain, makes it simple for users to exchange.

5. Are liquidity pools secure?

There are risks associated with planning crypto assets in a liquidity pool. The most frequent threats come from market instability, smart contracts, and dApp developers. DApp developers might waste or steal deposited funds.