Do you know document review time might be cut by 70%, allowing professionals to focus on strategic decision-making? Besides document inspection, AI can find trends and anomalies in financial data, revealing fraud or other irregularities that humans would miss. AI can quickly and reliably process and analyze massive datasets, making it a great tool for discovering tiny anomalies that may indicate larger difficulties.

Accenture found that 70% of professionals believe generative AI will boost M&A results. It could improve the reliability, efficiency, and speed of planning and executing these transactions, according to 84%. Impressively, 82% of firms see generative AI as a reinvention tool.

Due diligence apps will become more advanced as AI technology advances. Future AI systems will identify hazards, analyze complex market trends, and negotiate contract terms for firms. These innovations will improve due diligence, making it proactive and predictive. By anticipating and resolving challenges, businesses, and legal professionals will gain extraordinary efficiency, accuracy, and insight.

This article explores AI agents’ use cases, applications, benefits, and implementation in due diligence. Understanding how AI transforms due diligence can help professionals prepare for a future when AI-driven insights and efficiency are vital to their processes, enabling more informed and strategic decision-making in the fast-paced corporate environment.

What is Due Diligence?

Due diligence means carefully checking and studying something to understand it better before making an important decision. For example, people or companies do due diligence when they want to invest money, buy a business, or sign a contract. This process involves collecting useful information, checking facts, looking at risks, and making smart choices based on what they find.

Think of it like being a detective for decisions! Investors use due diligence to figure out if an idea will make money. Companies use it to ensure a partnership or business deal will work well for them. Lawyers check contracts to avoid problems, and banks study if someone can pay back a loan. Even governments do it to make sure everyone follows the rules.

In simple terms, due diligence is about being careful and prepared so people can avoid mistakes and make good decisions. It helps everyone, from big companies to regular people, stay safe and succeed.

Why is GenAI Critical in Due Diligence?

Before signing contracts or choosing to invest, a company or individual is evaluated through a vital inquiry and process known as due diligence. It guarantees that every operational, legal, and financial detail is well considered and comprehended.

Due diligence is essential in many corporate processes, including partner evaluations, investment analysis, and mergers and acquisitions. It typically entails carefully reviewing enormous volumes of data, which can be laborious and prone to human mistakes.

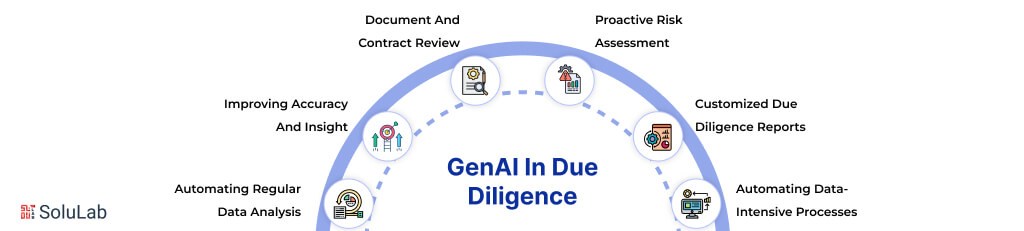

This procedure is changed by generative AI by:

1. Automating Regular Data Analysis: Due diligence teams can concentrate on more strategic duties by using AI agents for data analysis to automate the examination of massive datasets, which saves time spent gathering and processing information.

2. Improving Accuracy and Insight: GenAI reduces human error and offers deeper insights into possible hazards and opportunities by creating thorough profiles and reports based on the data that is already accessible.

3. Enhancing Document and Contract Review: Generative AI can swiftly shift through intricate documents, contracts, and legal papers using natural language processing (NLP) techniques, extracting important information that is essential for comprehensive due diligence.

4. Proactive Risk Assessment: Generative AI algorithms examine operational and compliance data to spot trends and abnormalities in credit risk models with machine learning offering insights into possible hazards that human analysts might miss.

5. Customized Due Diligence Reports: Customized due diligence reports can be generated based on the preliminary analysis, incorporating results and extra input from the due diligence team. This greatly expedites the review process.

6. By Automating Data-Intensive Processes: Improving analytical precision, and facilitating quicker, better-informed decision-making, Generative AI is revolutionizing the scope and effectiveness of due diligence. Adopting GenAI in due diligence is advantageous and increasingly necessary for organizations to properly manage risks and preserve competitiveness as they continue to negotiate complicated regulatory and operational landscapes.

Potential Use Cases of AI Agents with Due Diligence Process Automation

In due diligence, let’s examine the extensive applications of generative AI. Check out the following comprehensive tables to learn more about the AI agent use cases of AI agents with due diligence process automation capabilities.

1. Regulatory Monitoring

| Use Case | Description |

| Automated Tracking | Monitors updates in laws and regulations across multiple jurisdictions to ensure that due diligence reflects legal standards. |

| Alert Generation | Sends real-time alerts to due diligence teams about relevant regulatory changes, ensuring swift responsiveness to potential impacts. |

| Trend Analysis | Uses historical data to analyze regulatory trends, helping firms prepare for likely changes that could affect their operations. |

| Compliance Documentation | Automatically updates and maintains compliance documents in response to new regulations, ensuring due diligence records are current and comprehensive. |

2. Document Management

| Use Case | Description |

| Sorting and categorization | Automatically organizes due diligence documents by type, relevance, or other criteria, improving accessibility and workflow efficiency. |

| Document retrieval | Enables quick search and retrieval of specific documents using natural language queries, significantly reducing the time spent navigating large data sets. |

| Version control | Manages multiple versions of documents to ensure that the most current and relevant information is used during the due diligence process. |

| Access control | Implements robust security measures that restrict document access to authorized personnel only, enhancing security and ensuring compliance with privacy regulations. |

3. Risk Assessment

| Use Case | What It Does |

| Automated Analysis | Evaluates potential financial, legal, or operational risks using advanced algorithms for thorough data analysis. |

| Risk Scoring | Automatically assign risk scores to different aspects of due diligence findings. |

| Trend Detection | Identifies patterns or anomalies that signal potential emerging risks. |

4. Contract Review

| Use Case | Description |

| Clause Extraction | Precisely identifies and extracts specific clauses from contracts to aid in a quicker and more accurate assessment. |

| Summarization | Summarizes lengthy contracts into concise reports, saving time and highlighting key points for review. |

| Compliance Checks | Cross-references terms and clauses against current regulations to ensure all contracts comply with existing laws. |

| Risk Mitigation Recommendations | Analyzes contracts to identify potential risks and suggests modifications or actions to mitigate these risks, enhancing the contractual outcomes and protecting the company’s interests. |

5. Data Extraction

| Use Case | Description |

| Key Data Identification | Extracts critical data points from complex datasets, ensuring no significant information is overlooked during analysis. |

| Data Normalization | Standardizes data formats for consistency across various sources, simplifying data handling and analysis. |

| Metadata Tagging | Tags extracted data with metadata for easier sorting, tracking, and retrieval in future audits or reviews. |

6. Data Analysis

| Use Case | Description |

| Key Data Identification | Extracts critical data points from complex datasets, ensuring no significant information is overlooked during analysis. |

| Data Normalization | Standardizes data formats for consistency across various sources, simplifying data handling and analysis. |

| Metadata Tagging | Tags extracted data with metadata for easier sorting, tracking, and retrieval in future audits or reviews. |

7. Insight Generation

| Use Case | Description |

| Actionable Recommendations | Provides specific, actionable advice based on comprehensive data analysis, helping guide business strategy and due diligence conclusions. |

| Benchmarking | Compares company performance against industry standards or competitors to identify strengths and weaknesses. |

| Scenario Planning | Simulates various business scenarios based on current data, helping analyze how different strategies might play out. |

| Data Correlation Analysis | Identifies and interprets complex relationships between different data sets, providing deeper insights into hidden patterns and potential implications for the business. |

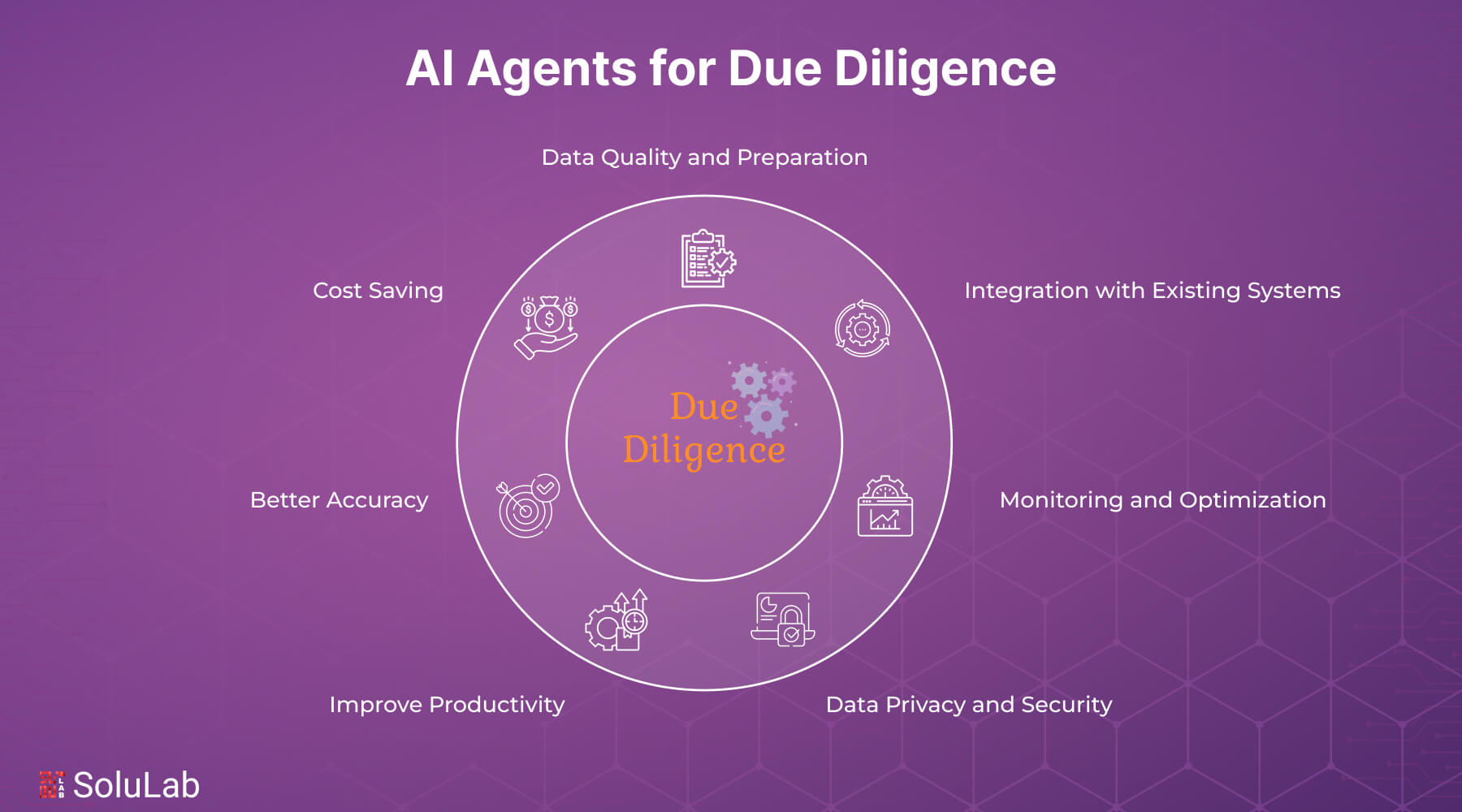

Benefits of AI Agent for Due Diligence

Here are some of the benefits of AI agents for due diligence:

- Improved Productivity: AI agents work like for teams! They gather and check data fast. This means the team has more time to focus on bigger, more important tasks. With these AI helpers, everyone gets more done in less time.

- Better Accuracy: AI is at understanding words and patterns in data. It doesn’t make the mistakes humans might. This makes sure the information it finds is spot-on, which helps companies make better choices.

- Cost Savings: Hiring lots of people to do boring, repetitive tasks can cost a ton of money. AI agents can do these jobs instead! This saves money that companies can use for other important things.

- Faster Decisions: Need answers quickly? AI agents can give reports and insights in just a few clicks. This means companies can act fast when something big happens, like a new opportunity or a tricky problem.

- Continuous Monitoring: It keeps an eye on important data all the time. If something changes—like a new risk something should need an update or anything it can analyze.

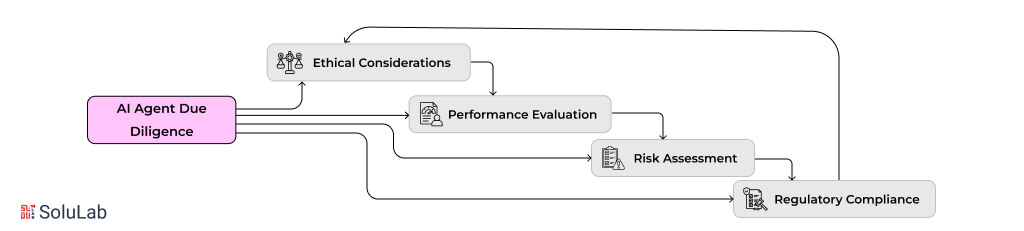

Considerations of AI Agents for Due Diligence

When using AI agents to automate due diligence, there are some important things to consider. Let’s break them down step by step so it’s easy to understand:

1. Define Clear Objectives

Start by asking, “What do we want these AI agents to do?” Maybe it’s to work faster or make fewer mistakes when checking important details. Having clear goals helps us know if the AI is doing well.

2. Data Quality and Preparation

AI needs good data to do its job. Think of it as feeding a car the right fuel—otherwise, it won’t run well. This data includes financial records, legal papers, and market details. Everything should be neat and easy to read so that the AI can understand.

3. Integration with Existing Systems

Imagine adding a new toy to your toy collection—it must fit well with what you already have. The same goes for AI. It should work smoothly with tools like CRMs (where customer info is stored) and platforms that keep important documents. This makes the AI.

4. Monitoring and Optimization

Once the AI is up and running, we need to check on it regularly. Is it working well? Can it do better? Feedback from users helps us make the AI smarter and more useful over time.

5. Data Privacy and Security

AI works with sensitive info, so keeping it safe is a must! Think of it like locking your diary. Strong rules and protections make sure private information stays private and follows important laws.

Organizations can make sure that AI agents fit perfectly into their due diligence work and make everything easier. AI agents for Security Token Offerings‘ due diligence are like special parts, each doing something important to make sure the job is done well. Let’s explore these parts step by step!

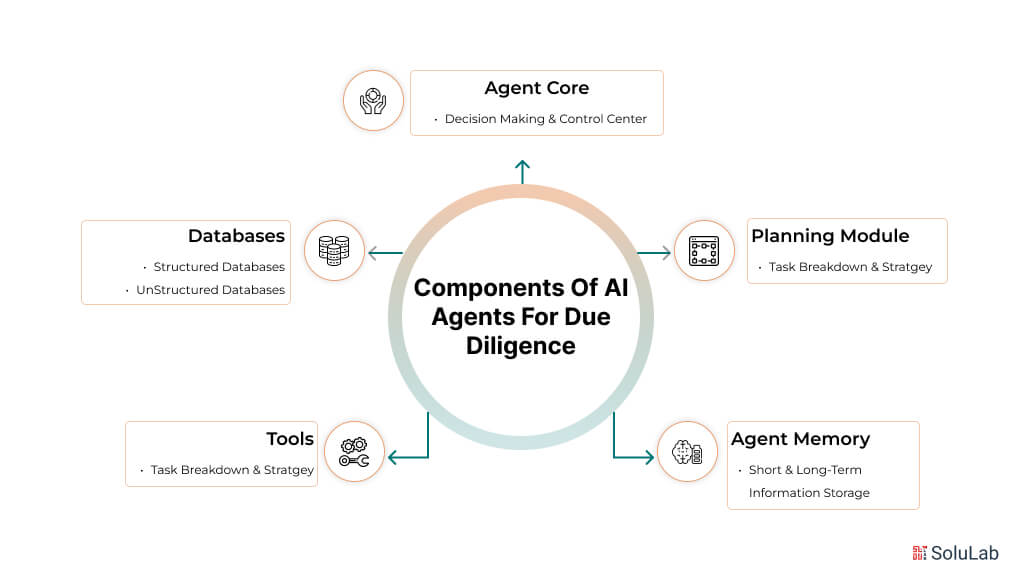

Components of AI Agents for Due Diligence

Here are some of the components of AI agents for due diligence:

1. Agent Core

The agent core is like the brain of the AI agent. It controls everything, making decisions and keeping everything running smoothly.

What it does:

- Big Goals: Think of it as the boss who decides what’s important—checking if a company is financially healthy, spotting risks, and following the rules.

- Tools to Get the Job Done: It has a toolbox full of stuff like data analyzers and tools for checking documents.

- Planning Smarts: It knows when to use different strategies, like double-checking finances or spotting risks.

- Memory Magic: It remembers important things from before, like a detective keeping notes for follow-up tasks.

- Role-Playing: It acts like an expert, focusing on following rules or carefully checking financial details.

2. Planning Module

The planning module is like a map maker. It figures out how to tackle big, tricky tasks step by step.

How it Works:

a). Breaking Tasks into Pieces: Let’s say the job is to check if Company X is financially stable. The AI will split it into smaller jobs like:

- Look at the latest money reports.

- Check if income and spending changed a lot.

- Calculate if they can pay bills easily.

b). Thinking Deeper: It uses clever methods (like brainstorming) to ensure it solves problems correctly.

3. Agent Memory (RAG)

It stores information to use later and makes sure the AI gives smart answers. This is where the Retrieval-Augmented Generation (RAG) comes in.

Memory Types:

- Short-Term Memory (STM): It remembers what’s happening now so the AI can respond smartly while it works.

- Long-Term Memory (LTM): This is like a diary, keeping track of everything over time. If the AI worked with someone before, it remembers!

- Hybrid Memory: It mixes STM and LTM, so the AI is both quick.

4. Tools

These are the gadgets the AI uses to do its job, like a spy with high-tech gear.

Some tools:

- Financial Statement Analyzer: Spots patterns and problems in money reports.

- Risk Checker: Finds risks like market changes or rule-breaking.

- Compliance Checker: Makes sure companies follow the rules.

- Document Reviewer: Reads contracts and finds important stuff.

- Market Analyzer: Checks if a company is winning or losing in the market.

- Background Check API: Digs into people’s history to find red flags.

- Data Visualizer: Turns boring data into charts and graphs.

- Web Scraper: Collects useful info from the internet.

5. Databases

Databases are like treasure chests, storing everything the AI needs to know.

Types of Databases:

- Structured Databases: Like neatly organized spreadsheets with financial records and reports.

- Unstructured Databases: Messy but useful stuff, like documents, emails, and contracts.

By using all these parts together, AI agents become helpers for due diligence. They can check if a company is doing well, spot problems, and make sure everything follows the rules.

Future of AI Agents for Due Diligence

AI is getting smart, and this will make a big difference in how these clever agents handle their work. With new Natural Language Processing (NLP) skills, they’ll be able to read and understand tricky legal and money-related documents much better. This means they can help finish work faster and easier.

Here’s the part! AI agents will be able to do more work on their own devices without sending data to faraway servers. This makes them quicker and keeps important data safer. Plus, with so many gadgets like smartwatches and smart homes (that’s the Internet of Things), these agents can use live data to make even smarter guesses.

Now imagine computers that can think, like a billion times faster than today! That’s what quantum computers might do. When they’re ready, AI agents for customer service can handle mountains of data at lightning speed.

In the future, AI agents won’t just follow orders. They’ll be like teammates, figuring out what businesses need and helping them adjust to changes. They’ll solve problems, find exciting new chances, and make everything run smoother.

Conclusion

AI-powered due diligence is changing the way decisions are made in business, like when companies buy or merge with other businesses, or make investments. With AI, organizations can quickly look at a lot of data, find any risks, and spot chances for growth. This makes the due diligence process faster and more accurate.

But it’s not just about using new technology—it’s about making smarter decisions. As businesses keep up with changes in the market, AI is becoming an important tool that helps them deal with tough situations more confidently. Whether it’s in finance, healthcare, manufacturing, or law, AI is being used more and more to make better decisions and reduce risks. This shows just how important AI is for making good business choices in different industries.

SoluLab helped AI-Build, a construction tech company, use generative AI and machine learning for advanced product development in the CAD space. Their goal was to automate design processes, improve productivity, and enhance accuracy. The challenge was creating a system that could generate optimized designs while reducing manual tasks and ensuring scalability. SoluLab’s an AI agent development company expertise enabled AI integration, improving efficiency and performance. SoluLab has a team of experts ready to solve your business queries—contact us today!

FAQs

1. How does AI improve the due diligence process?

AI streamlines the process by quickly analyzing large volumes of data, interpreting complex documents, and providing actionable insights to save time and resources.

2. What role does NLP play in AI for due diligence?

Natural Language Processing (NLP) helps AI agents understand and interpret legal, financial, and technical documents, ensuring accurate and efficient analysis.

3. How do AI agents ensure data privacy?

With technologies like federated learning and edge computing, AI agents process data locally, reducing the need to share sensitive information with external servers.

4. What is the impact of quantum computing on AI for due diligence?

Quantum computing could significantly enhance AI capabilities, allowing agents to process massive datasets and perform complex calculations at unprecedented speeds.

5. Will AI agents replace human professionals in due diligence?

AI agents are designed to assist and enhance human efforts, not replace them. They handle repetitive tasks, allowing professionals to focus on strategic decisions.