Welcome to the future of finance where artificial intelligence is constantly working on transforming the way you manage money and invest for a brighter future. Understand the dynamic world of AI Agents for finance by exploring how are they reshaping the industry from algorithmic trading to personalized customer service, AI agents in finance are driving unprecedented efficiency and creativity in financial decision-making.

Explore the technologies that are propelling the finance industry into a new era of intelligent automation and data-driven insights.

Understanding AI Agents

The agents of artificial intelligence represent cleverly designed computer programs to perceive the environment, carry out free-decision analyses, and act for themselves, achieving the desirable goal. Unlike the usual software, AI agents are developed to have the property of learning, adaptation, and, with time, improvement, unlike the conventional software, which is bound by stringent constraints.

Think of AI agents as a supercharged virtual assistant that understands your demands, secure data, and accomplish tasks on your behalf. An AI agent could schedule meetings, draft emails, or even conduct research. But their talents reach far beyond being just helpful. AI agents find applications in many areas. They can be used to effectively look after customer service experience because they can respond to questions and resolve problems. In the financial industry, they study market trends and can offer investment advice. Businesses extract critical insights from data to optimize their operations or for automating tasks. The basic components of AI agents are as follows:

- Perception: The agent should have the ability to receive information from the environment, which can be obtained through sensors or other types of data inputs.

- Reasoning: It involves gathering information, examining the data, and arriving at conclusions.

- Action: Performing the actions in a virtual or physical environment.

- Learning: Gradually improving performance based on feedback and experiences.

It is expected with the advancement of AI technology, the capability of agent artificial intelligence will increase constantly, and so with time novelties are expected to be employed increasingly, therefore evolving ways the human is related to technology. AI agents are tremendous automation that helps improve productivity, efficiency, innovation, and other related fields of people and companies.

Role of AI Agents in Finance

Through process automation, better decision-making, and improved consumer experience, AI Agents in Accounting are pacing up tremendous changes in the way finance industries do business. In operations, their uses span immensely across the financial industry, ranging from wealth management and investment banking to accounting and risk management.

1. Operational Finance and Accounting

Financial operations management is changing with Accounting AI agents intervening and turning around the systems. They accomplish this by taking over human resources for use in other more significant projects, relieving them of repetitive processes of inputting data, processing invoices, and reporting expenses. The efficiency and accuracy of financial data analysis can further be enhanced by AI-driven systems, which can also identify trends, abnormalities, and even fraud in financial reporting.

2. Risk Assessment

AI Agents powered finance is necessary for the reduction of financial risk. They can analyze current market situations and past data to detect potential risks that may cause an upset to the stability of the financial system. These agents can develop prediction models that will help to predict a change in markets, hence guiding the risk management techniques using complex algorithms. AI-driven systems can help keep an eye on cases related to identity theft and money laundering so that financial institutions are always safeguarded against any sort of negative activities, ensuring their customers’ interests are protected.

3. Trading and Investment Banking

Finance AI agents are used to make the decision-making process in investment more enhanced. They can forecast asset values and find investment opportunities, besides improving trading techniques, by analyzing enormous volumes of market data. In that aspect, artificial intelligence agents could get the advantage of extracting insightful data regarding web information, social media, financial reports, and newspaper articles using the mechanisms provided by natural language processing. Even further, by employing AI agents-powered finance systems, trade automation is made easy to free human errors.

4. Asset Allocation

AI financial advisors are going to make a massive difference in the wealth management sector due to the delivery of personalized financial advice. To provide personalized investment portfolios, they may consider their client’s risk tolerance, investing preference, and financial goals. The agent in artificial intelligence can provide suggestions, answer to customer queries, and provide live financial advice. The AI bots monitor the market trends as well, for the best performance of portfolios.

5. Customer Support

AI chatbots and virtual assistants better client experiences across the banking industry. The representatives are capable of answering consumer requests instantly, solving problems, and developing tailor-made advice. AI use cases can offer more engaging and more rewarding consumer experiences by learning what makes their clients tick.

Considerations of AI for Finance

Although AI agents hold a great deal of promise for the financial sector, there are a few things that need to be taken into careful consideration before their adaptation.

-

Privacy and Data Quality

AI agents in hr are based on high-quality data. Consistency, correctness, and completeness should be ensured in their data by a financial institution if it wants to come up with trustworthy AI agents. Sensitive financial data must be kept safe. Relevant security measures, together with adequate data privacy legislation, should guarantee the protection of client information and thus help to maintain trust.

-

Moral Considerations

These biases can be directly transferred to the AI algorithm from the training datasets and thus lead to discriminating results. AI in finance decision-making needs to be ensured, and bias needs to be reduced by financial institutions. It needs to be explainable, and transparent. On themes as far-reaching as credit scoring or investment advice, for example, users have to be positioned to know how an AI bot derives its conclusions.

-

Compliance with Regulations

The financial sector is heavily regulated. Applications of Generative AI in Banking and Finance need to meet existing legal obligations and keep pace with evolving regulatory landscapes. Financial institutions have to put investments in compliance programs, conduct regular audits, and remain current with the law as it changes.

-

Common Control of Risks

AI in accounting models are complex, supersensitive systems that can surprise users. To that end, financial organizations must incorporate robust processes for model risk management. This would involve prolonged testing, validation, and monitoring for AI models to detect and repair such issues. The retraining of the models at required intervals to maintain performance and frequent model updates also become essential.

-

Human-AI Collaboration

Though many tasks can now be automated by AI agents, human skill is in no way less important. For best results, AI in bfsi shall have to work with humans, and humans with AI. Until humans can still make decisions and exercise oversight, AI agents may support human talents through the provision of insight and advice.

Although AI agents bring a lot of potential value to the financial sector, their successful deployment will require elaborate testing of data quality, ethical considerations, regulatory compliance, model risk, and human-AI collaboration. If taken into consideration, these things can help financial institutions realize the power of AI while minimizing the risks associated with this technology.

Real-world Use Cases of AI for Finance

The financial industry is changing very fast with AI agents automating procedures, improving decision-making, and improving the experience for consumers. A few of the AI agent use cases:

1. Fraud Prevention and Identification

Fraud detection and prevention are among the most important and useful AI applications in banking. AI Agents in Accounting can instantaneously analyze enormous transaction data, thereby identifying trends and anomalies indicative of potential fraud. An AI system in this regard may enable the detection of unusual spending patterns, identify probable identity theft cases, or put up red flags on suspicious activity over an account. Such a proactive approach will therefore help financial institutions reduce potential financial losses and protect their customers.

2. Personalized Advisory

It is due to Finance AI agents that financial advisory itself is changing. AI systems can make customized recommendations based on analyzing consumer data to determine investment preferences, tolerance towards risk, and financial goals. AI-driven robo-advisors offer automated investment management and financial planning. These platforms construct diversified portfolios in keeping with the specific investor profile and rebalance them as and when appropriate.

3. Virtual assistant – chatbots

AI agents-powered finance chatbots and virtual assistants work wonders for customer experience across the financial sector. The representatives respond to consumer queries within a second, provide personalized suggestions, and work on account management tasks. For example, a chatbot can walk an end-user through resetting passwords, transferring funds, and checking an account balance. This enhances client satisfaction and relieves human representatives to focus on more complex issues.

4. Trading Algorithms

AI-driven algorithms are making a revolution in the trading industry. Agent in artificial intelligence play their role in HFT, assessing market data, recognizing trade opportunities, and providing swift transaction execution. Such algorithms allow for snap judgments on trade to be made from huge volumes of data, ranging from market data through social media sentiment and news feeds. Although this forms a niche in its entirety, it is a sophisticated realm of HFT, foreshadowing the very powerful role AI can play within the trading industry.

Benefits of AI Agents for Finance

AI agents are ushering in an age of effectiveness, precision, and creativity within the financial sector. Here are some of the Benefits of AI Agents in Finance:

1. Increased Productivity and Efficiency

AI Agents in Accounting are good at the automation of repetitive jobs, hence freeing human resources to work on higher-valued jobs. Such agents increase overall productivity, reduce errors, and smoothen operations from data entry and reconciliation to fraud detection and compliance checks. AI-powered chatbots can also nicely handle the queries of consumers by providing quick answers and freeing human agents to concentrate on more complex problems.

2. Bigger Ability in Decision Making

AI Agents in finance can process large volumes of data quickly, thereby noticing patterns and trends pretty hard for a human to notice. With this in mind, financial professionals are more placed to make educated and data-driven decisions. AI agents provide insightful analyses of consumer behavior, market trends, and risk factors that help in investment and strategic planning.

3. Risk Mitigation

AI agents for finance perform two of their most critical functions for the identification and mitigation of financial risk. These agents reduce financial crime, such as money laundering and fraud, by recognizing trends and anomalies in data. For managing portfolios and making better loan decisions, AI-based systems aid in assessing creditworthiness and market volatility.

4. Personalized Experience of Clients

Finance AI agents can analyze consumer data to determine preferences, wants, and behaviors, and, hence, financial institutions can provide very personalized products and services. Chatbots and virtual assistants improve customer happiness and loyalty through the provision of personalized financial advice, customer question answering, and the speedy redressal of grievances.

5. Lower Costs

The benefits of AI Agents in Finance can drastically bring down costs for any financial organization through process automation and efficiency enhancement. In addition, the AI-driven solution discovers opportunities for cost savings and is involved in the optimization of resource allocation, further boosting profitability.

From the perspective of efficiency, judgment, risk management, customer experience, and saving money, AI Agents in Accounting will never stop remodeling the face of financial sectors with provable benefits. We may well foresee even more innovative applications of AI technology and a greater impact on the financial industry as it matures.

Future Outlook with AI for Finance

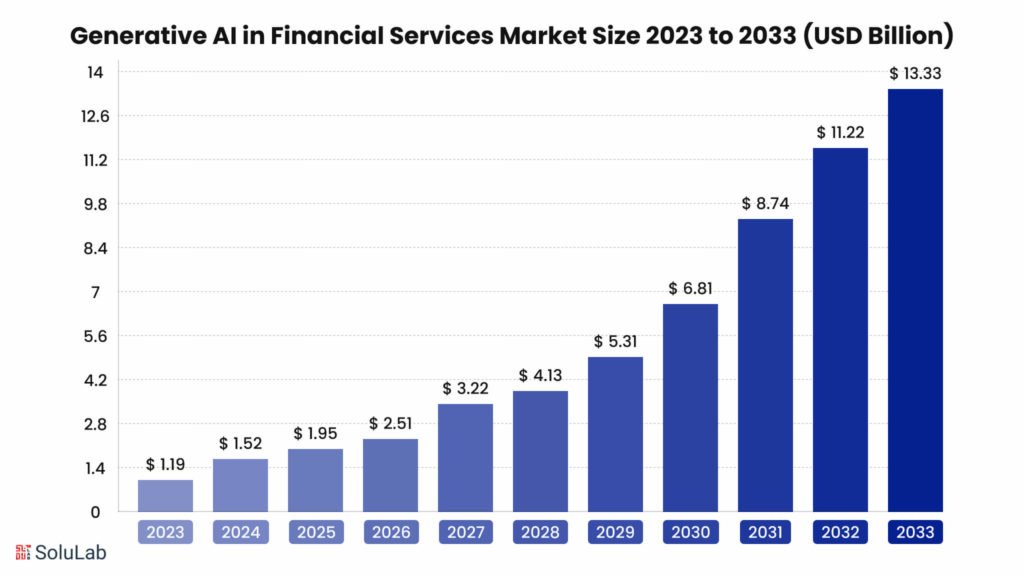

AI is about to make a huge difference in the financial industry. One can only expect that AI will be at the core of deciding the way forward for finance with progressing technology. One such most promising area of all is that of hyper-personalized financial services. Generative AI for Data Analysis and Modeling will be empowered to offer highly personalized products and services that meet the needs, preferences, and financial goals of every individual customer. Customer loyalty and satisfaction, given this level of personalization, will skyrocket.

Investment management will also see dramatic changes with the advent of AI. Advanced algorithms will dig through terabytes of data—much of which comes from non-traditional sources—to analyze for investment opportunities and better ways of portfolio management. This could give rise to a greater number of AI agents-powered finance robo-advisors concerning investment management and holistic financial planning services. Artificial intelligence will also play a key role when it comes to fraud prevention. The role of artificial intelligence-driven solutions would be imperative in fraud detection and prevention, given the sophistication cyber threats are prone to take. Financial organizations will be able to identify suspicious patterns from transaction data analyzed in real-time, thereby preventing customers’ financial losses if they hire an AI developer.

Even with the huge potential of AI Agents in finance for the field of finance, the challenges it poses to data privacy, ethical considerations, and regulatory compliance need to be sorted out. Against the backdrop of such challenges, which the sector is bargaining with, we can certainly look ahead and visualize AI playing a very important role in innovation thus leading to superior financial outcomes for both individuals and corporations.

SoluLab Transforms Banking and Finance with Gen AI

Challenge

The banking industry struggles with meeting rising customer expectations, streamlining manual processes, managing risks, adapting to evolving regulations, and protecting data from increasing cyber threats.

Solution

SoluLab used Gen AI to automate tasks, deliver personalized customer experiences, and improve cybersecurity, helping banks operate more efficiently.

Impact

- 3x increase in customer satisfaction with personalized services.

- 70% faster processes, cutting operational costs.

- 98% fewer cyber threats, ensuring data safety.

The Final Word

The financial sector is changing at an unprecedented rate just because of artificial intelligence. The benefits of AI Agents in Finance from automation of all kinds of functions to improved decision-making and reduced risks, including improved consumer experiences. We can only expect more revolutionary applications of AI technology as it grows and evolves.

What the organizations need is an AI agent development company to support the full promise that AI holds for finance. SoluLab brings deep expertise in both financial services and artificial intelligence to help in overseeing the challenges in the use of AI. Our experts can help you design custom AI solutions to foster the productivity and growth of our clients’ businesses.

Are you ready for it? Want to start harnessing AI’s potential for your finance company? Reach out to SoluLab now.

FAQs

1. What are some of the major benefits that AI agents can bring to the financial sector?

Among others, the following are the benefits AI agents can offer: offering a personalized experience for clients, risk management, increased efficiency, better decision-making, and reduced costs.

2. What do you think is the role that AI can play in avoiding financial fraud?

AI-driven systems can analyze massive transaction data for trends and odd behaviors that might indicate fraud. Since this will be a proactive stance, it makes it easier for FIs to protect their assets and clientele.

3. What are some of the challenges of implementing AI in finance?

Although AI is vastly promising, it comes with a host of challenges regarding qualified people who can design and govern AI systems, privacy issues, ethical dilemmas, and compliance issues.

4. How can AI improve client experience for the financial sector?

The AI-driven chatbot and virtual assistant may, in their interactions with customers, offer them personalized financial advice, answer their queries related to account management, and thus raise customer satisfaction and loyalty.

5. How can Solulab leverage AI to help my bank?

Since SoluLab is experienced in both AI and financial services, we can develop customized solutions concerning the needs of your case. We will be glad to help you achieve your business goals, develop robust models, and look for practical implementation of AI initiatives.