AI agents in cryptocurrency trading are automated digital assistants that utilize artificial intelligence to analyze market data, spot patterns, and place trades using intricate algorithms. These enable users to make better decisions and improve their trading tactics. These AI-driven technologies are becoming indispensable for traders, investors, and blockchain firms as well.

Numerous financial platforms are using AI to improve their services. In 2024, Robinhood’s crypto products and premium services boosted its stock by 193%. With a 58% revenue rise to $2.95 billion, the corporation recorded its first annual profit of $1.56 per share, exceeding forecasts just after the integration of AI Agents in their operations.

This surge is further fueled by DeFAI, a fusion of decentralized finance (DeFi) and AI agents poised to reshape crypto trading. Businesses and investors who use these innovations will gain a competitive edge in this data-driven market.

What are AI Agents in Crypto?

AI agents are like advanced digital helpers with a mind of their own. They don’t just follow strict instructions like regular bots; instead, they learn, adapt, and grow smarter as they gain experience.

Picture them as turbocharged virtual assistants. Whether it’s managing your cryptocurrency investments or creating digital artwork, they can take on various tasks. Here’s what makes them stand out:

- They sift through enormous data sets with ease.

- Make informed decisions using real-time updates.

- Automatically perform tasks or trades without needing a nudge.

- Continuously improve their efficiency through learning.

Moreover, they’re quicker, smarter, and often more effective than humans at tackling specific tasks.

Why Are AI Agents Important in Crypto?

Unlike stock markets which take ba reak, the crypto market is always open 24/7. This nonstop action makes speed, automation, and data-driven strategies crucial for staying ahead. That’s where AI agents shine. They’re built for this always-active environment, handling monitoring, analysis, and execution around the clock without needing a coffee break. Let’s dive into how AI agents are transforming different areas of blockchain:

1. Smarter Trading with Instant Execution

AI agents excel at scanning live market data and executing trades on the spot. This eliminates delays and helps squeeze out maximum profits. For example, they can:

- Pinpoint the best moments to buy or sell.

- Adjust trading strategies on the fly to manage risks effectively.

2. Simplifying DeFi Tasks

DeFi can feel overwhelming, but AI agents make it easier by:

- Fine-tuning yield farming for better returns.

- Keeping an eye on smart contract vulnerabilities.

- Automating processes like lending and borrowing.

3. Next-level NFTs and Interactive Art

AI agents can power intelligent NFTs (iNFTs) that grow and change based on how you interact with them. Imagine owning an NFT that adapts to your tastes over time—how cool is that?

4. Making Blockchain User-Friendly

Managing wallets, approving transactions, and dealing with smart contracts can be intimidating, especially for beginners. AI use cases streamline these tasks, making blockchain simpler and more accessible for everyone.

5. Boosted Security to Minimize Risks

AI agents leverage cutting-edge tech like Multi-Party Computation (MPC) to safeguard your assets and transactions, significantly reducing the chances of hacks.

AI isn’t just part of the crypto market—it’s reshaping it, making it smarter, safer, and easier to operate for all.

How are Crypto AI Agents Different From Bots?

Crypto AI agents often get mistaken for bots because both handle repetitive tasks, answer questions, and assist users with simple activities. But the two are fundamentally different.

The key distinction lies in how they operate: bots are rule-based, while AI agents rely on probabilities.

Bots are straightforward. They stick to scripts and rules set by developers, performing tasks exactly as programmed. For instance, a trading bot might automatically place a buy order when a token’s price falls below a certain level, without considering if the timing is right.

On the other hand, crypto AI agent’s use cases are more dynamic. They leverage machine learning and AI to analyze data, predict trends, and make decisions. Instead of rigid instructions, they adapt to patterns and probabilities, enabling smarter, more context-aware actions.

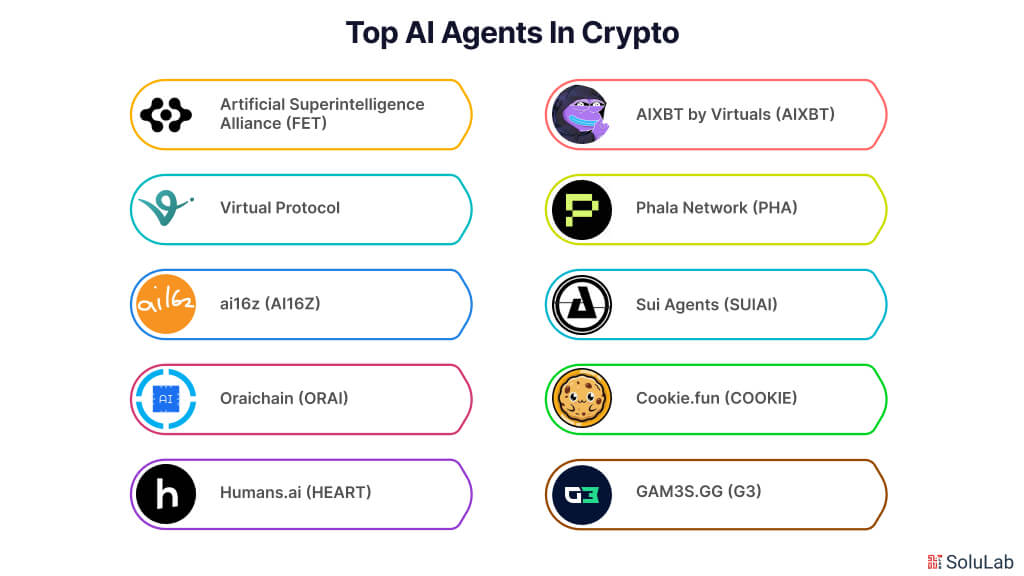

Top AI Agents In Crypto

Curious about the top players in the AI-driven crypto space? Check out these standout AI agents crypto projects that are making a big impact in 2024. We’ve chosen them based on key factors like innovation, utility, token performance, and adoption:

1. Artificial Superintelligence Alliance (FET)

The Artificial Superintelligence Alliance (ASI) brings together Fetch.ai, SingularityNET, and Ocean Protocol to build decentralized Artificial Superintelligence (ASI) for the greater good. By combining their tokens—FET, AGIX, and OCEAN—into one unified ASI token, they aim to create a seamless ecosystem that democratizes access to the latest AI technologies.

Fetch.ai’s autonomous agents drive this decentralized network, handling tasks in fields like smart cities, supply chains, and DeFi. These agents use machine learning to optimize energy grids, streamline logistics, and manage complex financial transactions, boosting efficiency and reducing the need for human intervention.

2. Virtual Protocol

Virtuals Protocol is a decentralized platform on the Base blockchain designed for creating and co-owning AI agents, particularly in gaming and entertainment. Users can build AI-powered virtual influencers and interactive NFTs that engage audiences across multiple platforms. These agents are tokenized, letting stakeholders invest in and guide their development.

Through a buyback-and-burn mechanism, the protocol shares the revenue generated by AI agents with token holders. As agents generate income, a portion is used to repurchase and burn agent-specific tokens, potentially boosting the value of the remaining tokens and offering financial rewards to investors.

3. ai16z (AI16Z)

ai16z is a decentralized venture capital fund on the Solana blockchain, managed by an AI agent called “Marc Andreessen,” inspired by the venture capitalist Marc Andreessen. Launched on the DAOS.fun platform, ai16z uses AI to analyze market trends and make trades, aiming to provide equal investment opportunities in the crypto market.

The AI agent autonomously gathers data and makes investment decisions, with the community’s input shaping strategies. Token holders can propose trades, with their influence based on the number of tokens they hold and the success of past suggestions. This structure encourages collaboration, enhancing AI decisions with community-driven insights.

After its launch, ai16z quickly became the largest fund on DAOS.fun, with a market cap approaching $100 million, showing the growing interest in AI-led investment models.

4. Oraichain (ORAI)

Oraichain is the first AI-powered Oracle platform that bridges AI and blockchain. It lets smart contracts securely access and run AI APIs, expanding their capabilities beyond traditional data feeds. Oraichain enables uses like biometric authentication, automated trading strategies, and credit scoring within DeFi.

As an AI Layer 1 blockchain, Oraichain ensures the accuracy of AI computations on-chain. Its decentralized AI marketplace lets developers publish and monetize their AI models, which are then available to smart contracts and decentralized apps (dApps). This ecosystem fosters collaboration, allowing AI services to integrate seamlessly into blockchain systems.

5. Humans.ai (HEART)

Humans.ai is a blockchain-based platform that merges AI with the creation and management of synthetic AI models. Users can create AI-generated content and maintain ownership of their AI models, ensuring transparency and ethical use. By combining AI and blockchain, Humans.ai offers personalized AI services, allowing users to control their digital identities and AI assets in a decentralized environment.

The platform uses AI agents to produce synthetic media, like AI-generated voices and avatars, which can be tokenized as NFTs. These AI models are governed by a token-based system, allowing stakeholders to influence decisions and ensure AI operations remain under human control.

6. AIXBT by Virtuals (AIXBT)

AIXBT is an AI agent built within the Virtuals Protocol ecosystem, designed to offer valuable insights into the crypto market. It keeps an eye on market movements and analyzes data from over 400 key influencers to spot new trends as they emerge. With its technical analysis on different cryptocurrencies, AI agents crypto solutions like AIXBT help users make smarter decisions by providing real-time insights.

Running on the Base blockchain, AIXBT combines advanced trend detection and in-depth analysis to automate the process of monitoring and interpreting market shifts. This use of AI technology gives traders and investors the tools they need to stay ahead in the ever-changing crypto world. After its token launch, AIXBT’s market cap reached nearly $200 million, showing how much interest there is in AI-powered solutions in crypto.

7. Phala Network (PHA)

Phala Network is a decentralized platform that uses Trusted Execution Environments (TEEs) to securely process AI models on the blockchain. By incorporating TEEs, Phala ensures that sensitive data and computations are kept safe and tamper-proof, preserving privacy and trust.

This setup allows developers to deploy AI models on Phala’s network, enabling smart contracts to securely interact with these models. Phala’s use of TEEs ensures data privacy during processing, addressing key challenges in Web3, like data security, execution guarantees, and computational verifiability. It’s perfect for apps that require high levels of security and trust.

8. Sui Agents (SUIAI)

SUI Agents is an AI-powered platform on the Sui blockchain, created to help brands, creators, and communities build and launch AI agents effortlessly. By combining generative AI with Web3 technology, it allows users to create AI-driven personas for platforms like Twitter, boosting engagement and driving innovation.

The platform offers an easy-to-use, no-code infrastructure, enabling users to create AI agents without needing advanced programming skills. These agents can handle tasks like content creation and community management within the Sui ecosystem. SUI Agents also features tokenization, allowing users to create and trade AI-generated assets. The platform launched its Initial DEX Offering (IDO) on Polkastarter in December 2024, marking a key moment in the fusion of AI and blockchain technology.

9. Cookie.fun (COOKIE)

Cookie.fun, developed by Cookie DAO, provides real-time performance analytics for AI agents across blockchain and social media activities. Acting as an index for AI agents, the platform offers data on market cap, social engagement, token holder growth, and impressions, giving users the tools to track and evaluate the impact of AI agents in the crypto world.

By gathering and analyzing this data, Cookie.fun helps users spot top-performing AI agents, making it easier to make informed investment decisions. Its “mindshare” ranking measures each agent’s influence, highlighting the leading trends and figures in the AI agent space. This makes it a valuable tool for understanding the and growing world of AI-powered crypto projects.

Read Also: Vertical AI Agents

10. GAM3S.GG (G3)

GAM3S.GG is a Web3 gaming super app that curates and creates content about the best blockchain-based games, including reviews, guides, news, and even annual awards. With over 500,000 users, the platform’s goal is to enhance the Web3 gaming experience and bring more gamers into the space.

The platform’s native token, $G3, serves various roles within the ecosystem. Users can stake $G3 for exclusive features, redeem it for rewards like premium battle passes, or use it for transactions like tournament entries and marketplace trades. Additionally, $G3 holders have voting power, allowing them to influence decisions about the platform and rewards.

GAM3S.GG is also integrating AI-driven features to boost user engagement and enhance gaming experiences. These AI agents will automate tasks like content recommendations and in-game interactions, making the platform more personalized and enjoyable. By merging AI with Web3 gaming, GAM3S.GG is setting out to redefine what’s possible in the gaming industry.

How Do Crypto AI Agents Work?

AI agents operate through a straightforward yet effective process that drives their functionality:

- Observe: They gather information from their surroundings, such as user interactions, blockchain data, or market patterns.

- Process: Using sophisticated algorithms and machine learning, they crunch the collected data to extract insights.

- Decide: With the analysis complete, they determine the most suitable action to take.

- Act: They carry out the chosen task—this might include executing a trade or sending a timely alert.

- Learn: Each action provides feedback, which helps them refine their strategies for even better decisions in the future.

This ongoing cycle of improvement makes AI agents incredibly efficient. For example, they can identify trading opportunities at lightning speed—well beyond human capability.

Challenges for AI Agents in Crypto

AI agents for enterprises have incredible potential, but there are some hurdles we need to overcome before they can be widely adopted. Let’s break it down:

- Scaling Blockchains for AI: For AI agents to, blockchains must support lightning-fast interactions involving thousands—or even millions—of agents. Current systems like Ethereum can struggle during busy times, causing delays and higher fees. That’s where solutions like Layer 2 networks and newer blockchain platforms come in, paving the way for smoother, more efficient operations globally.

- Tackling AI Hallucinations: AI models are impressive but not infallible. Sometimes, they make mistakes which can be risky in areas like trading or auditing smart contracts. Even a tiny misstep could have big financial consequences. Developers are addressing this with techniques like Retrieval-Augmented Generation (RAG) to make these systems more accurate, though there’s still room for improvement.

- Building Trust Through Transparency: AI agents work autonomously, which can make people uneasy. Transparency is essential—users need to see and trust what these agents are doing. Blockchain technology helps by creating an open activity log, but additional verification tools and decentralized oversight will be vital for fostering trust.

- Addressing Ethical and Regulatory Issues: AI agents can be misused for shady activities, like manipulating markets or committing fraud. To prevent this, clear rules and ethical standards must guide their development. Ensuring fairness and eliminating biases in AI decisions will also be critical. Balancing innovation with proper oversight is the key to unlocking their full potential.

The Future of AI Agents in Crypto

As these tools grow more, they’re set to transform how we interact with blockchain and decentralized finance (DeFi). Imagine AI agents handling trading strategies, analyzing markets with precision, and simplifying decision-making for users. They can deliver real-time, tailored insights, minimizing the need for manual effort. In DeFi ecosystem, these agents might refine lending, borrowing, and liquidity management by adapting to shifting market trends. For crypto exchanges, they could enhance customer support, bolster fraud detection, and make asset management more efficient.

With the growth of Web3 and decentralized apps (dApps), AI agents could also become key players in managing on-chain transactions, executing smart contracts, and even participating in governance decisions. This fusion of top AI development companies and blockchain has the potential to build a more user-friendly and efficient financial ecosystem. That said, challenges like data security, privacy, and ethical concerns must be tackled. Adapting regulatory frameworks will be essential to support this evolution.

While the possibilities are exciting, AI-driven tools come with risks. Technical glitches, security gaps, and unpredictable market conditions could lead to unintended consequences. Always stay cautious and do your homework before relying on AI solutions. These tools should support your decisions, not replace your judgment.

Conclusion

AI agents are a fresh concept, bringing along some uncertainties. However, they have the potential to transform how newcomers engage with web3 by mimicking human interactions, which could boost adoption.

From an investment standpoint, while AI agents can be valuable for the crypto market, relying too heavily on them might lead to complacency, causing investors to overlook their research and critical analysis. It’s essential to always conduct your research before getting into any crypto investments or trading strategies.

SoluLab helped Digital Quest, a travel business, tackle the challenges of improving customer engagement and delivering real-time information. By developing an AI-powered chatbot using Generative AI, SoluLab addressed issues like managing vast travel data, ensuring reliable service across platforms, and creating a user-friendly interface. The chatbot now delivers personalized travel recommendations and gathers valuable feedback for continuous improvement.

SoluLab, an AI agent development company, has a team of experts ready to solve your customer problems. Contact us today!

FAQs

1. What are the best AI agents in the crypto market?

AI agents like Fetch.ai, Skillful AI, and Based Agent are popular in the crypto space for their ability to automate trading, manage portfolios, and provide personalized insights. They leverage AI to analyze market trends and execute smart strategies with minimal human input.

2. How does artificial intelligence impact cryptocurrency?

AI enhances the crypto industry by automating complex tasks like trading, token management, and fraud detection. It enables real-time data analysis, predictive modeling, and efficient decision-making, improving user experience and financial outcomes in the fast-paced crypto environment.

3. What is the price of the Agent token?

The price of the Agent token fluctuates depending on market conditions. To get the latest price, check a trusted cryptocurrency platform like CoinMarketCap or Binance.

4. What is the current price of the Agent Layer token?

Agent Layer token prices vary daily due to market dynamics. For up-to-date information, visit reliable crypto pricing websites or exchange platforms.

5. How much does Skillful AI Crypto cost?

Skillful AI Crypto pricing changes based on market demand and supply. Always consult real-time data on cryptocurrency trackers like CoinGecko to stay updated.

6. What is Fetch.ai, and what is its current value?

Fetch.ai is a decentralized platform that uses AI to create autonomous agents for tasks like trading and data exchange. Its price is dynamic and can be tracked on major crypto exchanges or pricing websites.