In the banking industry, banking automation is no longer a nice-to-have but rather a must. Customers of today look for banks that are more than simply financial institutions; they want banks that are genuine partners in their banking journey, creating experiences that are personalized for them through all available channels. The crucial query is this, though: are banks meeting these contemporary standards?

Several intriguing statistics were revealed by the World Retail Banking Report. Customers believe that banking is not enjoyable for 52% of them, and 48% believe that their banking connections do not fit well with their everyday life. Several clients also expressed dissatisfaction with their banks’ need for more emphasis on modern technology, seamless experiences, and the level of personalization they desire. This serves as a reminder to banks to use automation technologies more effectively.

Now consider the banks that are mastering the art of banking automation. Along with providing for the requirements of their clients, they are also forging deep emotional bonds with them, increasing client loyalty, and turning them into devoted supporters. Automation in banking is also giving banks more leverage and freeing up staff time so they can concentrate on important work rather than getting bogged down in the day-to-day grind.

What is leading this movement, and why? Automation in the banking industry is being driven by artificial intelligence (AI) and AI chatbots, which are the true MVPs.

In this blog we will go further into AI in BFSI market and examine how it has developed into a vital component of the banking industry, improving client experiences, reducing expenses, optimizing operational precision, and simplifying staff management. Now let’s get started and explore the fascinating field of banking automation!

What Does Banking Automation Involve?

Banking automation is the hidden hero of the financial industry’s backend. It all comes down to using advanced technology and creative software to expedite and streamline banking processes. Imagine reducing the amount of physical labor you undertake. Gone will be the days of tedious data entering, lengthy account opening processes, and difficult transaction processing. It saves a significant amount of money and supports accuracy and efficiency.

Once banks automate such types of procedures, everything functions like a well-oiled machine. We’re talking about increased cost savings, decreased errors, and better services. It benefits both parties! Automated banking increases client happiness by ensuring that all of their bank interactions are more streamlined and dependable.

What Does the BFSI Sector Demonstrate?

By offering vital financial services that promote stability and economic progress, the banking, financial services, and insurance (BFSI) industry plays a vital role in the global economy. It includes a wide range of services, such as asset management, banking, investing, and insurance, all of which are intended to satisfy the various financial requirements of people, companies, and governments. A robust regulatory framework to guarantee consistency and safeguard customers, creativity through fintech and digital banking, and an emphasis on risk management to reduce financial uncertainties.

Furthermore, the industry is progressively embracing modern technologies, like blockchain, artificial intelligence, and data analytics to boost security, optimize operations, and improve customer experience. BFSI is a dynamic and constantly evolving industry that is essential to controlling financial risks, influencing economic policy, and promoting sustainable economic growth.

How is AI Transforming the BFSI Sector?

These devices can learn, organize, and interpret data to provide predictions. As such, it has evolved into a crucial component of technological creativity in the BFSI sector, transforming the way goods and services are provided.

Identification of Fraud

When it comes to identifying fraudulent activity, artificial intelligence is essential for the following reasons:

- By Comparing synthetic data, AI finds patterns suggestive of fraud by creating synthetic data and contrasting it with real data. After that, financial institutions can create fraud detection models that are more successful.

- For Example, JP Morgan Chase employs Gen AI to identify irregularities in transaction data and stop fraud. Significant cost reductions and an improvement in consumer trust have resulted from this.

Client Support

For BFSI firms, providing individualized customer service is a major responsibility. One way that artificial intelligence helps is by:

- Recommendation engines: AI creates tailored goods and services advice based on the customer’s financial history and preferences. Customer satisfaction is increased by this strategic approach.

- For instance, HSBC’s AI-powered virtual assistant offers tailored investing advice, increasing client satisfaction and engagement.

Assessment of Risks

An essential BFSI function is risk assessment, risk prediction is improved by AI technology by:

Simulating different scenarios and creating artificial information based on historical records, Making well-informed decisions is facilitated by this assessment of the likelihood of various outcomes.

Optimization of Portfolios

Financial organizations must optimize their investment portfolios in which AI technology could be a great help in such a way:

Scenario modeling is the process of simulating various investment scenarios by creating artificial data. Financial organizations can create successful investment plans by spotting chances of diversification.

Why are BFSI Institutions in Search of Automation?

Ever wonder why financial organizations and banks alike are concentrating on banking automation in the hectic world of modern finance? That’s a calculated action, not just a trend. Technology such as machine learning (ML), natural language processing (NLP), conversational AI, generative AI, and others enable BFSI institutions to automate complex operations, understand and identify emotions in human language, and react to real-time changes.

Let’s examine the reasons behind this trend toward automation as well as how AI in the BFSI market is assisting banks in handling complicated jobs, understanding human language, and even identifying emotions.

-

A Customized Experience for the Customer

Personalization is the new standard in the banking industry. The key ingredient is what transforms infrequent browsers into devoted patrons and those patrons into passionate brand promoters. AI chatbots are the new designers of individualized banking. They are there to understand you, not only to provide you with answers to your questions. These sophisticated bots constantly learn from your input, examine your preferences, and predict what you want to provide optimal customer service. It goes beyond convenience, though. This in-depth exploration of personalization enables banks to make more informed, data-driven decisions that are centered around the client.

-

Markedly Increased Effectiveness

In the current fast-paced financial industry, “high efficiency” is the required norm for success, not merely a goal. Thus, cutting-edge innovations like conversational AI and AI chatbots are starting to make a big difference. They not only expedite customer service but also free up human workers to concentrate on more difficult jobs, thus increasing total productivity.

Artificial Intelligence AI in BFSI enables banks to make quick, well-informed choices by processing and analyzing massive amounts of data rapidly. AI chatbots play a key role in enabling the high-efficiency model that modern banking requires, from enhancing customer interaction to optimizing internal procedures.

-

Adaptability

In contrast to human resources, growing up in AI chatbot services doesn’t mean paying more money for the same job. Once put into use, Chatbots AI in BFSI ecosystem for banking provides unmatched scalability, allowing organizations to effectively handle changing client demands with little need for more funding. Their adaptability makes it simple to adjust to different languages, markets, and regulations, which makes them perfect for banks looking to expand internationally.

Furthermore, by continuously enhancing their efficacy and efficiency through machine learning, these chatbots ideally complement the ever-changing banking industry.

-

Lower Running Expenses

AI chatbots are significantly more capable than human workers in handling many queries at once. This effectiveness lowers the operating expenses related to handling a high volume of transactions and questions while also enhancing customer service.

Furthermore, the necessity for physical facilities such as call centers or customer service centers is decreasing as more client interactions are handled digitally. Real estate, utility, and maintenance costs are immediately reduced as a result of this physical infrastructure decrease.

-

Improved Worldwide Presence, Diversity, and Accessibility

Artificial intelligence chatbots are transforming the banking industry by eliminating language barriers and enabling universal access to financial services. A diversified consumer base is the standard, not the exception, in the globalized world of today. Chatbots of Artificial intelligence AI in BFSI meet this difficulty by assisting in a wide range of languages and dialects.

More than just a perk, its multilingual capacity opens the door to inclusive banking services. The truly impressive aspect of these chatbots is their ability to adjust to different linguistic subtleties, making every consumer feel appreciated and understood regardless of their level of language competence.

-

Banking Beyond the Box

From being only transaction hubs, modern banks, and financial institutions have developed into full financial instructors. They now provide a variety of services, such as financial well-being, economic education, and literacy initiatives, by utilizing the power of AI chatbots.

With everything from retirement planning to budgeting guidance available on a single, easily accessible platform, this change represents a shift towards understanding and meeting the wider financial needs of clients.

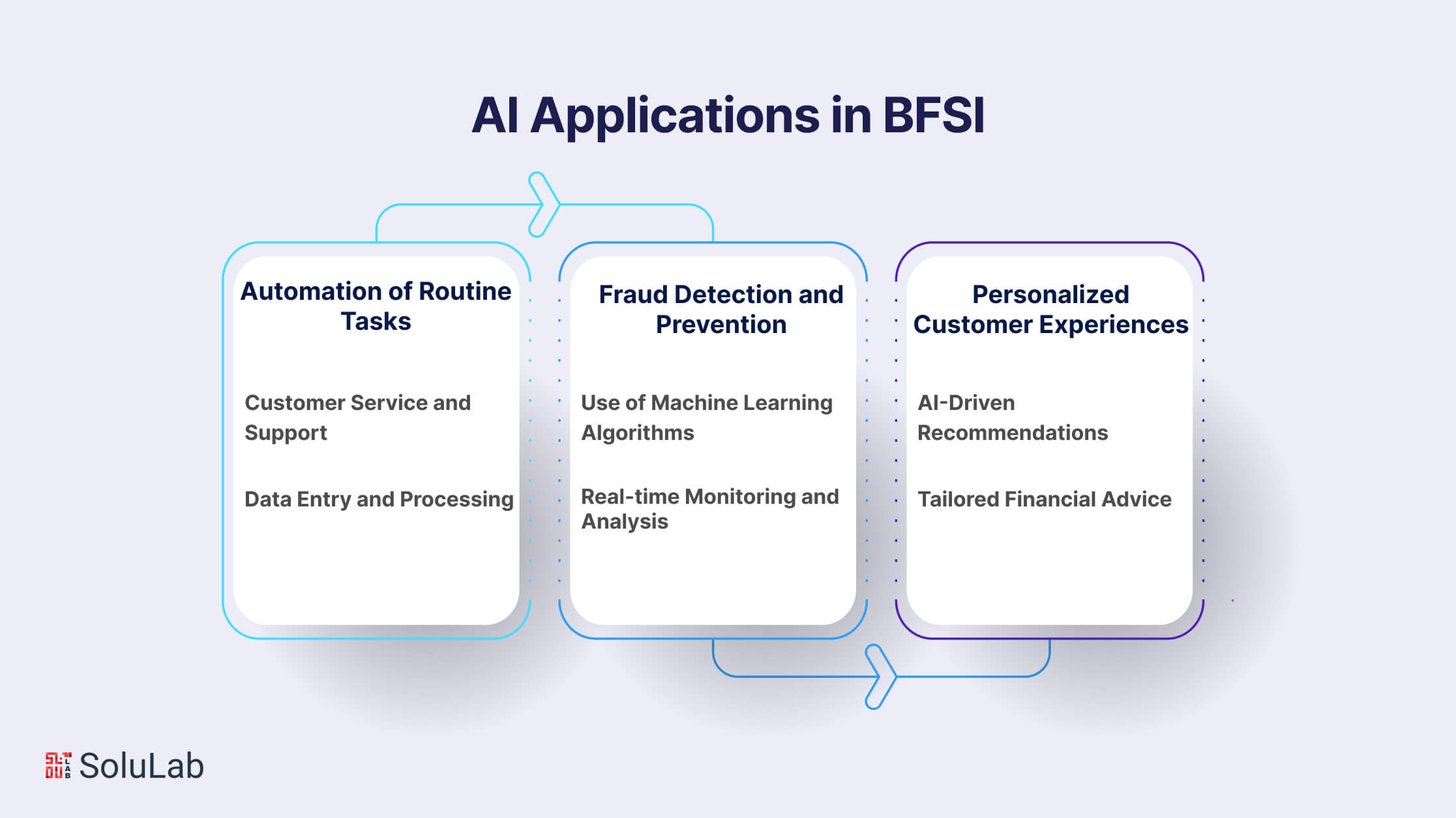

Key AI Applications in BFSI

Artificial Intelligence (AI) has emerged as a game-changer for the Banking, Financial Services, and Insurance (BFSI) sector, introducing transformative applications that optimize processes, enhance security, and deliver personalized services. Below are detailed insights into applications of AI in BFSI:

A. Automation of Routine Tasks

Customer Service and Support:

- Introduction of Chatbots and Virtual Assistants: AI-powered chatbots have revolutionized customer interactions. They offer real-time responses to customer queries, provide account information, and facilitate transactions.

- 24/7 Availability: Automated customer support ensures round-the-clock assistance, improving accessibility for clients across different time zones.

- Issue Resolution: Chatbots can address routine issues, allowing human agents to focus on more complex problems, thereby improving overall service efficiency.

Data Entry and Processing:

- Reducing Manual Work: AI technologies automate data entry processes, reducing the reliance on manual input and minimizing the risk of errors.

- Operational Efficiency: Automation streamlines data processing tasks, improving the speed and accuracy of operations. This, in turn, enhances overall back-office efficiency.

B. Fraud Detection and Prevention

Use of Machine Learning Algorithms:

- Pattern Recognition: AI employs machine learning algorithms to analyze historical data and identify patterns associated with fraudulent activities. This enables early detection and prevention.

- Adaptive Models: Machine learning models continuously learn from new data, evolving to recognize novel fraud patterns and adapting to the dynamic nature of financial fraud.

Real-time Monitoring and Analysis:

- Immediate Identification: Real-time monitoring systems analyze transactions as they occur, identifying anomalies and potentially fraudulent behavior instantly.

- Proactive Prevention: By intervening in real-time, AI systems prevent fraudulent transactions before they can escalate, minimizing financial losses and safeguarding customer assets.

C. Personalized Customer Experiences

AI-Driven Recommendations:

- Behavioral Analysis: AI algorithms analyze customer behavior, transaction history, and preferences to generate personalized product and service recommendations.

- Enhanced Cross-selling: Tailored suggestions improve cross-selling opportunities, boosting revenue streams by presenting relevant financial products to customers.

Tailored Financial Advice:

- Robo-Advisors: AI-powered robo-advisors offer automated, algorithm-driven financial planning and investment advice tailored to individual customer goals and risk profiles.

- Continuous Monitoring: These tools provide continuous portfolio monitoring, automatically adjusting investments based on market trends and changing financial circumstances.

These applications showcase how AI is not just automating processes but revolutionizing customer interactions, improving fraud detection, and delivering highly personalized financial services. The integration of AI technologies positions BFSI institutions to stay competitive in a rapidly evolving digital landscape. The subsequent sections will delve into the impact of AI on data security, risk management, and the challenges associated with its adoption in BFSI.

Enhanced Data Security and Privacy

Data security is paramount in the Banking, Financial Services, and Insurance (BFSI) sector, where the handling of sensitive financial information demands the highest levels of protection. Artificial Intelligence (AI) has emerged as a critical ally in fortifying data security and preserving customer privacy within BFSI.

A. Importance of Data Security in BFSI

Protecting Financial Assets:

- Customer Trust: BFSI institutions thrive on trust. Robust data security measures build and maintain customer trust by assuring them that their financial information is handled with the utmost care.

- Regulatory Compliance: Stringent regulations, such as GDPR and various financial industry standards, mandate the secure handling of customer data. Non-compliance can result in severe consequences, including hefty fines.

Preventing Fraud and Cyber Threats:

- Fraud Prevention: Data security is intricately linked to fraud prevention. A secure system mitigates the risk of unauthorized access and fraudulent activities, safeguarding both the institution and its customers.

- Cyber Threats: In an era of sophisticated cyber threats, data breaches can have severe financial and reputational consequences. Robust security measures are essential to repel cyber attacks and protect against data breaches.

B. AI-Driven Cybersecurity Measures

Behavioral Analysis:

- Anomaly Detection: AI employs behavioral analysis to identify unusual patterns or deviations from established norms in user behavior. This proactive strategy enables the early discovery of possible security threats.

- Continuous Monitoring: AI systems continuously monitor user activities, analyzing patterns to distinguish between legitimate actions and suspicious behavior. This real-time monitoring ensures swift response to potential security breaches.

Biometric Authentication:

- Enhanced Identity Verification: AI-driven biometric authentication methods, such as facial recognition, fingerprint scans, and voice recognition, provide more secure and reliable identity verification compared to traditional methods like passwords.

- Reducing Unauthorized Access: Biometric authentication mitigates the risk of unauthorized access, as it is significantly harder to replicate biometric features than to compromise passwords or PINs.

These AI-driven cybersecurity measures not only fortify data protection but also enhance the overall security posture of BFSI institutions. By leveraging advanced technologies like behavioral analysis and biometric authentication, these institutions can stay ahead of evolving cyber threats and ensure the confidentiality and integrity of customer data. The following sections will explore AI’s role in risk management within BFSI and discuss future trends in AI adoption in the sector.

AI-driven Customer Experiences in the BFSI Ecosystem

In the Banking, Financial Services, and Insurance (BFSI) sector, the infusion of Artificial Intelligence (AI) has revolutionized the way institutions interact with and serve their customers. This section delves into the multifaceted dimensions of AI-driven customer experiences within the BFSI ecosystem, highlighting key advancements and their impact.

A. Personalized Recommendations and Products

-

Understanding Customer Behavior with Machine Learning

In the data-rich landscape of the BFSI sector, AI algorithms powered by machine learning sift through vast datasets to decipher intricate patterns in customer behavior. By analyzing transaction histories, spending patterns, and financial goals, these algorithms enable financial institutions to gain profound insights into individual preferences.

-

Tailored Financial Solutions

Armed with the insights derived from machine learning, AI in the BFSI ecosystem facilitates the creation of tailor-made financial solutions. From personalized investment portfolios to bespoke loan offerings, financial institutions can craft products that align seamlessly with the unique needs and aspirations of their customers.

-

Cross-selling and Upselling Opportunities

AI algorithms, cognizant of customer preferences and financial habits, identify opportune moments for cross-selling and upselling. By precisely targeting products and services that resonate with individual customers, financial institutions optimize their marketing efforts and enhance the likelihood of customer engagement.

B. Enhanced Customer Service Through Chatbots

-

24/7 Availability and Instant Responses

The integration of AI-powered chatbots has transcended traditional customer service paradigms. These intelligent virtual assistants operate around the clock, providing customers with instant responses to inquiries and issues. The seamless availability of support enhances customer satisfaction and contributes to a positive overall experience.

-

Natural Language Processing for Seamless Interactions

Natural Language Processing (NLP) technologies enable chatbots to understand and respond to customer queries in a manner that emulates human conversation. This linguistic fluency ensures that customers can interact with the system using their natural communication style, fostering a more intuitive and user-friendly experience.

-

Process Automation for Efficiency

Routine and repetitive tasks, such as balance inquiries and transaction history requests, are automated through AI-driven chatbots. By offloading these tasks to virtual assistants, human customer service representatives can dedicate their efforts to addressing more complex issues, thereby improving overall service quality.

C. Virtual Financial Advisors and Wealth Management

-

AI-driven Investment Strategies

Virtual financial advisors leverage AI algorithms to analyze market trends, assess risk, and formulate personalized investment strategies. By dynamically adapting to changing market conditions, these advisors ensure that investment recommendations align with individual financial goals and risk tolerances.

-

Automated Portfolio Management

AI facilitates real-time monitoring of investment portfolios. Automated systems, informed by AI insights, ensure that portfolios remain aligned with predefined investment strategies. This dynamic approach to portfolio management includes automatic rebalancing based on market fluctuations and optimizing overall portfolio performance.

-

Educational Insights and Financial Planning

Beyond transactional interactions, AI-powered virtual advisors contribute to financial education. By providing informative content and interactive tools, these advisors assist customers in enhancing their financial literacy. Customized financial planning tools empower users to set and achieve long-term financial goals, fostering a sense of financial empowerment.

In short, the incorporation of AI in BFSI sector has ushered in a new era of customer-centricity. From the nuanced personalization of financial products and services to the seamless interactions facilitated by AI-driven chatbots and the sophistication of virtual financial advisors, these advancements not only elevate customer experiences but also position financial institutions at the forefront of technological innovation in the competitive landscape.

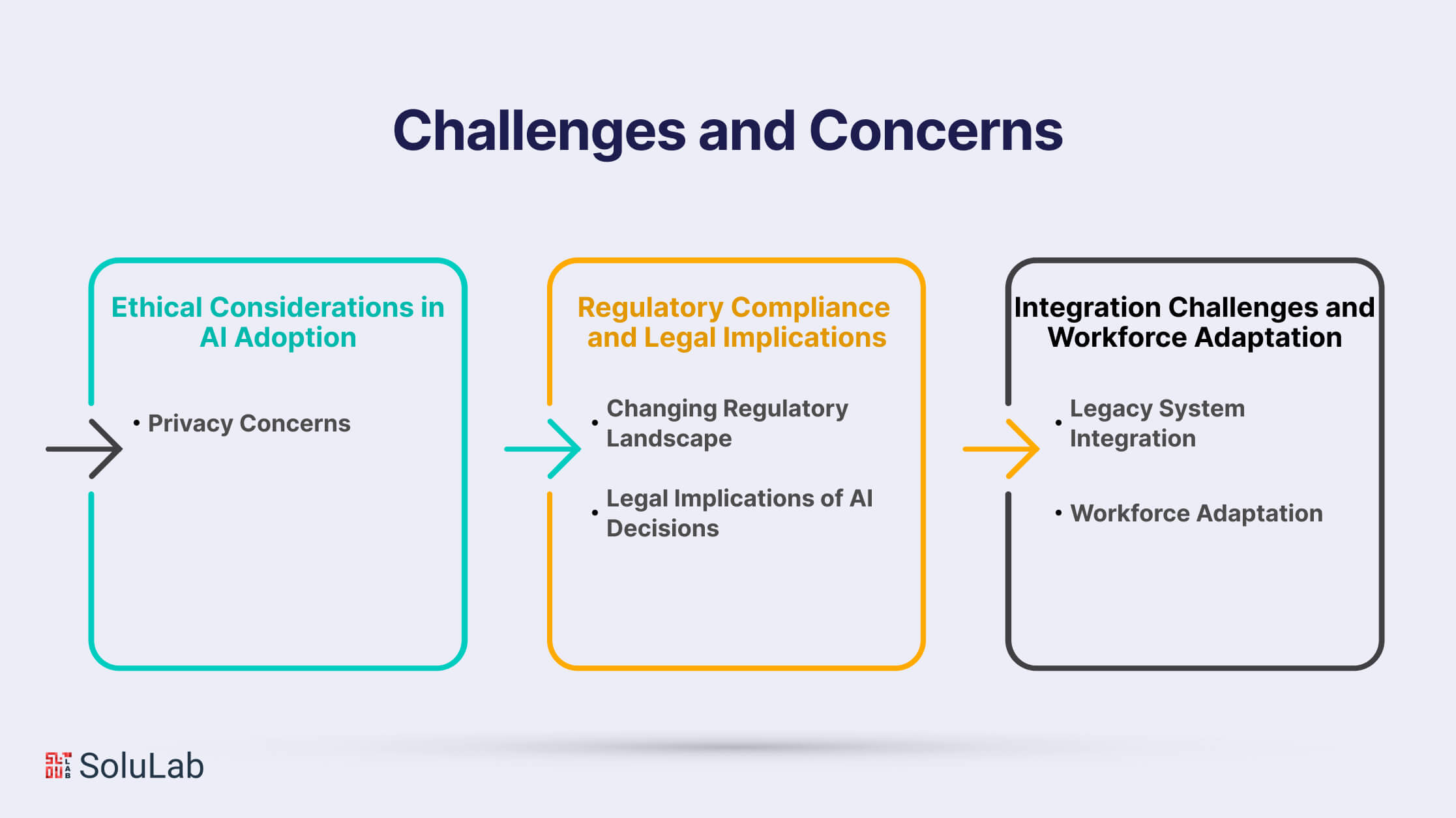

Challenges and Concerns

As the Banking, Financial Services, and Insurance (BFSI) sector increasingly adopts Artificial Intelligence (AI) technologies to innovate and streamline operations, several challenges and concerns emerge, ranging from ethical considerations to regulatory compliance.

A. Ethical Considerations in AI Adoption

- Algorithmic Bias: AI algorithms may inadvertently perpetuate biases present in historical data, leading to discriminatory outcomes. Ensuring fairness in decision-making processes is a critical ethical challenge.

- Transparency: The lack of transparency in some AI algorithms poses ethical concerns, as users may not fully understand how decisions are made, particularly in sensitive areas such as credit scoring or loan approvals.

Privacy Concerns:

- Data Usage and Consent: The extensive use of customer data raises privacy concerns. Institutions must navigate the balance between utilizing data for personalized services and respecting customer consent and privacy rights.

- Data Security: The risk of data breaches and unauthorized access raises ethical questions about the responsibility of BFSI institutions to safeguard customer information.

B. Regulatory Compliance and Legal Implications

Changing Regulatory Landscape:

- Adapting to Evolving Regulations: The BFSI sector is subject to numerous regulations, and the rapid evolution of AI requires continuous adaptation to compliance standards. Ensuring AI systems align with current and future regulatory requirements is a significant challenge.

- Cross-Border Regulations: Operating in multiple jurisdictions with different regulatory frameworks adds complexity to compliance efforts, requiring institutions to navigate diverse legal landscapes.

Legal Implications of AI Decisions:

- Explainability: The opacity of some generative AI models raises concerns regarding the explainability of decisions. In situations like loan approvals, explaining the rationale behind an AI-driven decision becomes crucial to maintaining trust and meeting legal requirements.

- Liability: Determining liability in the event of AI-related errors or failures poses legal challenges. Establishing accountability for AI decisions that result in financial losses or other adverse outcomes is a complex legal consideration.

C. Integration Challenges and Workforce Adaptation

Legacy System Integration:

- Compatibility Issues: Integrating AI technologies with existing legacy systems can be challenging, leading to compatibility issues and potential disruptions in operations.

- Cost of Integration: The financial investment required for integrating AI systems into existing infrastructure is a significant consideration for BFSI institutions, particularly smaller entities with limited resources.

Workforce Adaptation:

- Skill Gaps: The rapid adoption of AI may outpace the development of necessary skills among the workforce. Bridging the skill gap and ensuring that employees can effectively work alongside AI systems is a crucial challenge.

- Employee Resistance: Resistance to change is a common challenge during AI adoption. Employees may fear job displacement or be hesitant to trust AI-driven processes, necessitating effective change management strategies.

Addressing these challenges requires a comprehensive approach that encompasses ethical guidelines, ongoing regulatory awareness, and strategic workforce planning. As the BFSI sector continues to embrace AI, institutions must navigate these challenges to ensure responsible and effective implementation.

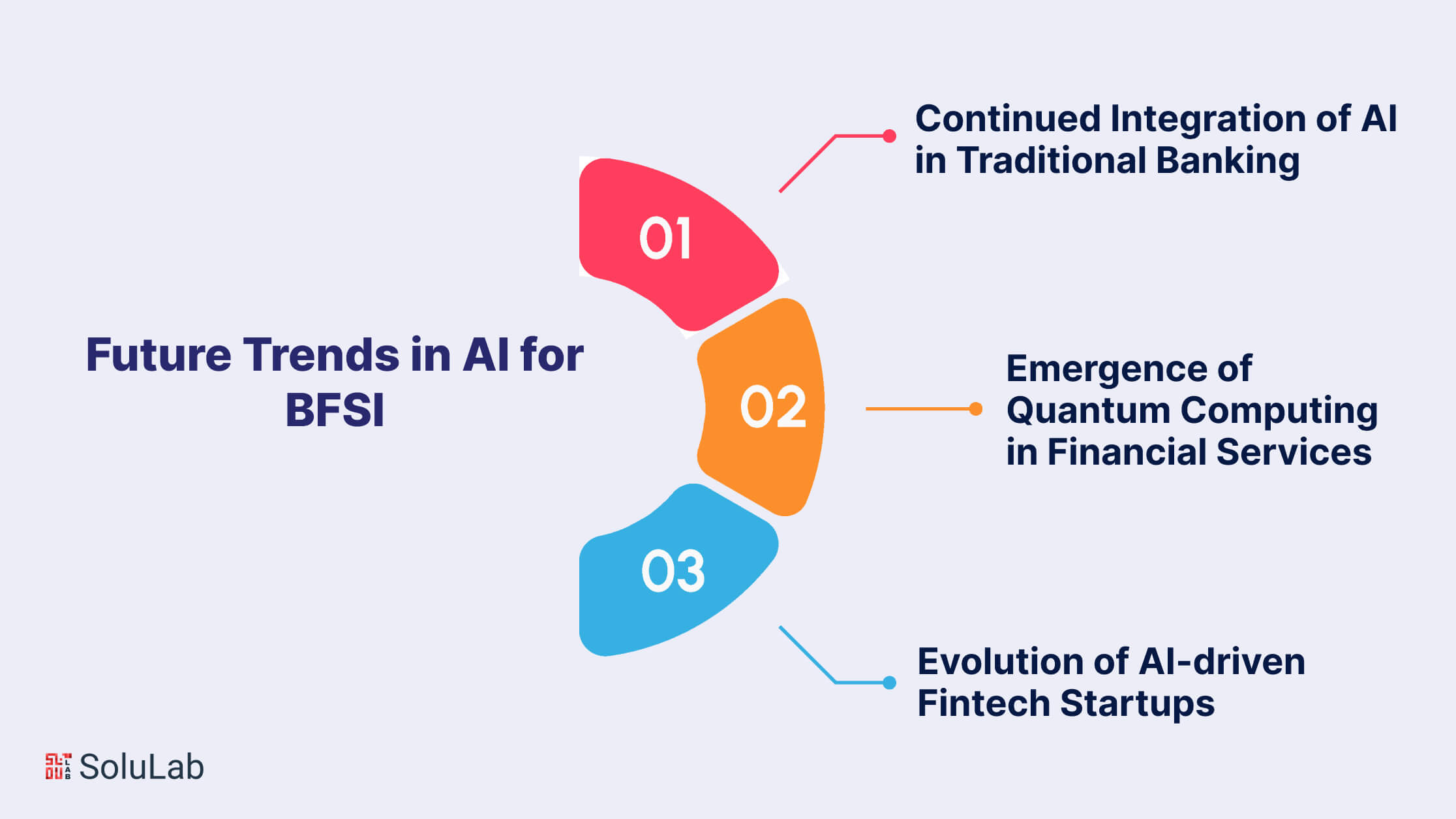

Future Trends in AI for BFSI

The future of Artificial Intelligence (AI) in the Banking, Financial Services, and Insurance (BFSI) sector holds exciting prospects, promising to redefine traditional practices and foster innovation. Here, we explore key trends that are set to shape the trajectory of Artificial Intelligence AI in BFSI market.

A. Continued Integration of AI in Traditional Banking

-

Enhanced Customer Engagement and Personalization

As technology continues to advance, traditional banks are increasingly leveraging AI to deepen customer engagement. AI-driven tools will enable banks to offer hyper-personalized services, predicting customer needs and preferences to deliver tailored financial solutions.

-

Risk Management and Fraud Prevention

The integration of AI into traditional banking systems will fortify risk management practices. Advanced machine learning algorithms will provide real-time risk assessments, aiding in the prevention and detection of fraudulent activities, and ultimately ensuring the security of financial transactions.

-

Operational Efficiency and Cost Reduction

AI applications in traditional banking will extend to optimizing operational processes. Automation of routine tasks through robotic process automation (RPA) and AI-driven algorithms will streamline workflows, leading to increased efficiency and substantial cost savings.

B. Emergence of Quantum Computing in Financial Services

-

Unprecedented Computational Power

The emergence of quantum computing is poised to revolutionize the BFSI sector by providing unparalleled computational power. Quantum computers have the potential to solve complex financial calculations and simulations at speeds unimaginable with classical computers, offering a quantum leap in processing capability.

-

Advanced Cryptography for Enhanced Security

Quantum computing brings both opportunities and challenges to cybersecurity. While it poses a threat to traditional encryption methods, it also opens the door to quantum-resistant cryptographic techniques. The BFSI sector will need to adapt to quantum-safe encryption to ensure the continued security of financial transactions.

-

Optimization of Portfolio Management

Quantum computing’s ability to process vast datasets in real-time will significantly impact portfolio optimization. Financial institutions can leverage quantum algorithms to fine-tune investment strategies, manage risk more effectively, and explore new frontiers in algorithmic trading.

C. Evolution of AI-driven Fintech Startups

-

Innovative Product Offerings

Fintech startups are at the forefront of AI innovation in the BFSI market. These nimble organizations leverage AI to create innovative financial products and services, challenging traditional models and catering to the evolving needs of tech-savvy consumers.

-

Data-driven Decision Making

AI-driven fintech startups harness the power of big data and machine learning to make data-driven decisions. This enables them to assess creditworthiness, customize financial products, and create agile business models that adapt swiftly to market changes.

-

Partnerships and Collaborations

As AI becomes increasingly central to the BFSI landscape, traditional financial institutions are recognizing the value of collaboration with fintech startups. Partnerships facilitate the infusion of cutting-edge AI technologies into established banking systems, fostering a symbiotic relationship that benefits both parties.

In summary, the future trends in AI for BFSI encompass a spectrum of advancements that promise to reshape the industry. From the continued integration of AI in traditional banking to the potential revolution brought about by quantum computing and the dynamic evolution of AI-driven fintech startups, these trends underscore the transformative power of artificial intelligence in the financial services landscape.

SoluLab Transforms Banking and Finance with Gen AI

Challenge

The banking industry struggles with meeting rising customer expectations, streamlining manual processes, managing risks, adapting to evolving regulations, and protecting data from increasing cyber threats.

Solution

SoluLab used Gen AI to automate tasks, deliver personalized customer experiences, and improve cybersecurity, helping banks operate more efficiently.

Impact

- 3x increase in customer satisfaction with personalized services.

- 70% faster processes, cutting operational costs.

- 98% fewer cyber threats, ensuring data safety.

Conclusion

In conclusion, the integration of Artificial Intelligence (AI) into the Banking, Financial Services, and Insurance (BFSI) sector has propelled the industry into a new era of innovation and efficiency. The personalized customer experiences facilitated by AI-driven recommendations, chatbots, and virtual financial advisors have not only elevated user satisfaction but have also optimized internal processes, leading to improved operational efficiency. Furthermore, the exploration of future trends such as the continued integration of AI in traditional banking, the emergence of quantum computing, and the evolution of AI-driven startups promises to redefine the BFSI landscape, offering unprecedented opportunities for growth, security, and collaboration.

As the BFSI sector continues to navigate the transformative impact of AI, partnering with experts becomes crucial for harnessing the full potential of these technologies. SoluLab, an AI consulting company, stands at the forefront of empowering BFSI institutions with its AI development services. From personalized customer engagement platforms to implementing state-of-the-art security measures, SoluLab ensures seamless integration of AI into financial systems. With a commitment to innovation and a focus on client success, SoluLab is poised to drive the future of AI in BFSI sector. Take the next step in your AI journey – contact SoluLab today for tailored AI solutions that empower your organization and propel you ahead in the dynamic world of banking and finance.

FAQs

1. How is AI transforming traditional banking practices in the BFSI sector?

AI is transforming traditional banking by enhancing customer engagement through personalized services. Machine learning algorithms analyze customer data to provide tailored financial solutions, while chatbots offer 24/7 support, and virtual financial advisors optimize investment strategies. Additionally, AI in BFSI market aids in risk management, fraud prevention, and operational efficiency, reshaping the banking experience.

2. What role does quantum computing play in the future of financial services?

Quantum computing holds immense potential in the BFSI sector. It offers unprecedented computational power for solving complex financial calculations, optimizing portfolio management, and exploring new frontiers in algorithmic trading. However, it also necessitates the adaptation of quantum-safe encryption to ensure the security of financial transactions in the face of evolving cybersecurity threats.

3. How are AI-driven fintech startups influencing the BFSI landscape?

AI-driven fintech startups are at the forefront of innovation, creating dynamic financial products and services. Leveraging big data and machine learning, these startups make data-driven decisions, customize financial offerings, and challenge traditional banking models. Collaborations with established financial institutions pave the way for a symbiotic relationship, benefiting both the startups and the incumbents.

4. Can AI development services enhance security in the BFSI sector?

Absolutely. AI development services play a crucial role in bolstering security measures in the BFSI sector. From fraud detection and prevention to the implementation of advanced cryptographic techniques, AI ensures the integrity and confidentiality of financial transactions. Solutions provided by experts like SoluLab focus on the seamless integration of AI to fortify cybersecurity in financial systems.

5. How can SoluLab assist in AI development services for the BFSI sector?

SoluLab is a leading provider of AI development services, specializing in empowering BFSI institutions with innovative solutions. From personalized customer engagement platforms to robust security measures, SoluLab’s expertise ensures the seamless integration of AI into financial systems. With a commitment to innovation and client success, SoluLab stands ready to drive the future of AI in the BFSI sector. Contact SoluLab today for tailored AI solutions that propel your organization forward in the dynamic world of banking and finance.