Fintech companies, enterprises, and ordinary people are all driven to include AI in their digital strategies. Intelligent software helps businesses and people make money by removing needle expenses and improving the convenience of handling finances. Fintech uses artificial intelligence (AI) as a potent catalyst, integrating it smoothly into financial operations to improve security, expedite data processing, and provide individualized consumer experiences. Around 60% of businesses employ AI for a minimum of one function as per the McKinsey survey.

By utilizing machine learning, natural language processing, and predictive analytics it can easily enhance the detection of any fraudulent activity, manage risks, improvise custom services, and analysis of investments. The fintech industry is becoming more and more creative and competitive with the implementation of AI and keeps providing financial solutions that are more effective, precise, and suitable for every user.

This article will talk in detail about the functioning of AI in the fintech industry, the benefits, the challenges, and also the opportunities it projects for the financial sector.

What is AI in the Fintech Industry?

Artificial intelligence is the process by which machines especially those driven by computing systems emulate cognitive abilities. Artificial intelligence in finance technology includes a variety of technologies such as machine learning and natural language processing. These AI services are changing banking, insurance, and investing portfolios among other financial domains. The mix of AI and finance can improve decision-making techniques and drastically reduce operating costs while also augmenting the customer experience.

This dynamic field of fintech AI is at the forefront of creation in financial services and is represented by the intersection of AI and the technology of finance. Fintech businesses are changing consumer expectations and bringing in a new era of individualized, easily accessible, and effective financial operations. AI fintech companies are quickly taking center stage in the next-generation finance business, from credit prediction algorithms to enterprise chatbots that answer customer inquiries.

AI in Fintech Market Review

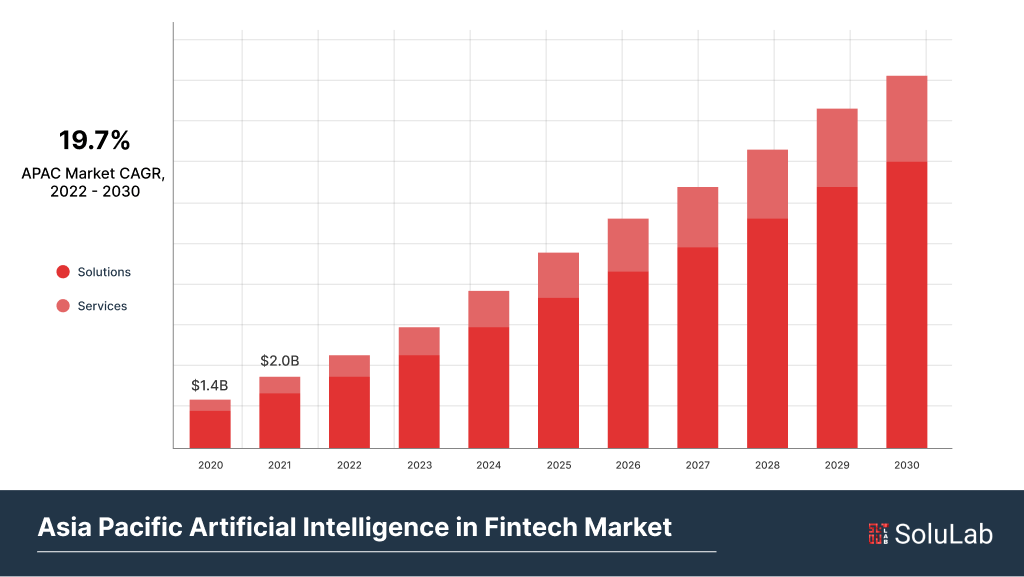

The size of AI in the fintech industry is projected to be USD 14.79 billion in 2024 and will also increase at a projected rate of CAGR of 23.82% and reach USD 43.04 billion. Here is the overall market review of fintech trends 2024:

A. Fraud Detection Market Growth

- Finding quick and efficient approaches to spot financial fraud and misconduct can be aided by AI. They make it possible for machines to process massive datasets, which humans occasionally find difficult. Its greater efficiency over manual procedures eliminates false positives and frees specialists to work on more difficult problems.

- Real-time monitoring and anomaly detection driven by AI. To stay ahead of emerging dangers, they also prioritize security through regular audits and train employees and customers on the latest techniques.

B. North America’s Highest Share

- Due to the well-known AI in banking systems and software, coupled with financial institution expenditures in AI projects and the widespread use of the greatest number of AI in fintech solutions. North America is anticipated to lead the AI in the fintech market.

- The United States National Science Foundation committed USD 10.9 million in October to support research, highlighting the critical alignment of advances in AI in the fintech industry for user security.

Read Also: AI in Australian Fintech Industry

Understanding the Roles of AI in the Fintech Industry

In terms of financial digital transformation the greatest applications of AI and ML in fintech are evident in a way that they explain the role of AI in fintech:

1. Safety

Every year banks end up losing billions of money due to fraudulent activities, but with the incorporation of AI use cases a company’s ability to identify suspicious activities has improved and cybersecurity has strengthened.

2. Investing

On a global scale, robo-advisors are responsible for managing assets that are worth over $4.6 trillion. Additionally, modern websites like Vinovest open up new avenues for investing.

3. Efficiency

AI-based software has an extensive list of applications and a track record of success when it comes to enhancing data processing and taking over administrative activities which includes invoicing.

4. Customer Service

Chatbots with artificial intelligence and machine learning capabilities benefit customers and save expenses for companies.

AI applications in fintech not only save costs but also provide a better way of making informed decisions. AI-powered solutions improve operational efficiency at the same time offering safe and secure experiences. Here is the breakdown of major AI technologies which clears the question of how is ai used in fintech.

| Technology | Function |

| Recognition of Speech | Artificial intelligence and finance use speech recognition to create virtual assistants that can be activated by voice and can conduct financial transactions with the utilization of natural language requests and give users immediate access to account information and transaction history. It can instantly detect suspicious activity by analyzing voice patterns it plays a crucial role in security and fraud detection. |

| Natural Language Processing | This fundamental technique is used by AI fintech companies for sentimental analysis. To access market sentiment and make wise investment decisions, NLP algorithms can examine enormous volumes of textual data, such as news reports, posts on social media, and consumer reviews. Fintech companies enable traders and investors to respond quickly to market patterns and news events by using NLP. |

| Computer Vision | AI in the fintech industry has enabled organizations to extract and validate from papers such as passports, identification cards, and financial accounts using computer vision. This solution guarantees regulatory compliance expedites the ongoing process for customers, and lowers the possibility of identity theft. The utilization of computer vision has enhanced the precision and efficacy of Know Your Customer (KYC) procedures in the banking industry. |

Benefits of AI in Fintech

Given all of the advantages of AI in the fintech market, it is understandable why so many financial organizations are utilizing this technology. Here are the following top 5 benefits of AI in fintech:

-

Saves Money

According to a survey by McKinsey 44% of companies use AI technology to reduce costs. By employing AI-powered solutions, the fintech industry may save billions of dollars on capital, labor, and resource expenditures. Manual processes sometimes need more time and money due to the labor expense. AI automation conserves resources by taking the place of various jobs and activities. Many questions are addressed through artificial intelligence technology, so customer Support staff do not invest much funds in recruiting new employees. With the cost cutbacks that come with the use of AI-related technologies, banks are in a position of being able to appeal to more customers and offer them better rates. Make more money yet spend less.

-

Enhanced Client Satisfaction

It often takes some time before consumers adjust to waiting for a reply the moment they reach out to you. To accept transactions, financial inquiries, and reports they ought to be open seven days a week 24/7. Making work less burdensome is the ability of these interfaces, such as chatbots or virtual assistants, to answer as frequently asked questions or deal with problems from users. This way customer support agents can extend adequate time in solving intricate questions from the clients. Another way through which AI is assisting the development of fintech customer service is through the use of point sentiment analysis where the interest is in assessing the client experience, identifying areas of weakness, and subsequently training the Chatbots to overcome the area of weaknesses. Applying AI technology, there are enhanced ways of client communication with the finance industry. Happy customers and customer service representatives mean a more successful firm.

-

Expanded Analytics

AI systems are always able to tell what could work and what wouldn’t by pulling data from hundreds of sources. AI can also analyze a customer database and predict the future preferences of consumers, products, and a distribution plan. Algorithms of high skill levels give far better results than those of human analysts. Unlike a human being, AI means that I can step inside and see how the brain came to that conclusion.

-

Availability

They are available to a significantly larger audience than traditional financial advisors and new-generation banks. The former charge smaller fees, although, like many human advisors, they demand a $100,000 minimum account balance.

-

Easy Access

That is why, fintech applications may be used anywhere having a phone and an internet connection. Chatbots are implemented to give quick answers to common questions and issues. A financial counselor was only available for the rich a decade ago. Today, one can take a market statistic investing opportunity or bill tracking information in his/her palm.

Examples and Use Cases of AI in Fintech

Here is a list of AI use cases in fintech in the real world along with three examples:

1. WealthFront: Accountability

The use of AI in fintech is mostly because of the latter’s capacity to provide financial reports. They could be produced with the aid of AI and finance data. Large amounts of data are held by banks and other financial institutions, which use this data to produce reports following a thorough investigation. One of the leading robot advisors on the market. Wealthfront has 440,000 members and $25 billion in assets under control. With a $500 minimum account requirement, there are plenty of options for investing, including Bitcoin. It also offers comparatively low fees of 0.25% with zero transaction fees.

Read Blog: Top 10 AI Development Companies in Finance

2. Kasisto: Encounter With Customers

Large financial institutions have dozens, perhaps even millions of consumers. It would be very difficult to serve so many diverse people without AI-powered technologies. AI systems collect and evaluate customer data when users download baking apps. AI applications in fintech are inherently capable of learning, thus their capacity to interpret customer data and deliver customization experiences will only increase. Kasisto created KAI, a conversational artificial intelligence platform that improves customer experiences in the banking industry. By offering self-service options and solutions to consumers, KAI assists banks in reducing contact center traffic. Additionally, by providing wise counsel, chatbots driven by AI assist users in making deliberate financial decisions.

3. Vectra: Fraud Detection

Artificial intelligence can detect patterns and connections, react quickly to data, and potentially even identify fraudulent activity. This is tremendously beneficial to the banking industry because of the enormous volume of digital transactions that occur every hour, which calls for increased cyber security and efficient fraud detection. AI for fintech finds the small problems in the background while fraud analysts focus on the higher-level issues. Vectra is a tool that tracks and identifies cyber threats. Vectra’s software expedites event investigations, detects compromised data, and detects cover attackers especially those who choose to target financial institutions, and automates threat detection.

4. HDFC: Trading With Algorithms

One of the most widely used AI applications in fintech is algorithmic trading, which is essential to the operation of contemporary financial markets. AI-driven algorithms can quickly and accurately evaluate large datasets, spot trends in the market, and perform trades in milliseconds. This automated method ensures that financial choices are based on data-driven insights increasing returns and reducing losses. One of the most successful algorithmic trading companies and AI use cases in fintech globally is Renaissance Technologies LLC, a hedge fund with headquarters in New York. Since its launch in 1988, the company’s Medallion Fund has produced returns that have averaged 66% annually. Based on data and mathematical models, the fund employs a variety of quantitative trading techniques.

Challenges and Considerations of Using AI in Fintech

AI has endless opportunities for fintech organizations, but some issues and conditions affect the process and should be addressed appropriately. Areas that require concern are privacy, data privacy, use of ethical principles, customer relations, and legal requirements.

- Privacy and Data Protection: Two significant issues are privacy and data protection, which remain paramount given that, being involved in the increasing volume of petitions, FIs and various fintechs use AI to process and analyze vast amounts of financial and other data about customers. This data is best guarded against any intrusion and cases of illegitimate admittance. It therefore means that the companies shall turn and conform to laws like the GDPR and also adopt good encryption and cybersecurity.

- Ethical Considerations: It contains complications such as bias and objectivity of the system to make decisions for the people. At other times, AI systems are opaque, and it becomes equally hard to understand how the execution and decision-making took place. The lack of transparency yields decision-making biases which may prejudice some groups of people. As a result, to provide an equally fair and accountable service, fintech organizations should apply bias checks regularly, while the work towards making AI models clearer is in progress.

- Developing Customer Trust: The customers must have confidence in the companies and institutions in which they work to permit them to allow an AI to control financial transactions and offer advice. Developing this type of trust is not easy especially taking into consideration recent acts of data breaches and concerns due to the somewhat near inhuman approach by AI. For a company to build and maintain trust from and for the customers, it must use AI openly, ensure the benefits are visible, and ensure compliance with privacy and ethically acceptable standards.

- Regulatory Compliance: There are often gray areas regulating the fintech industry and it might not be easy to operate in this kind of situation while introducing an AI system. International regulatory bodies have not matched the fast pace at which artificial intelligence is emerging resulting in an ever-changing and emerging regulatory environment. Otherwise, fintech companies are at risk of getting fined and losing their operating license, thus they must stay updated with such changes, and ensure their AI systems adhere to the law.

The Future Expectations of AI in Fintech

The financial industry is paving the way for creativity in technology and finance as we anticipate the applications of AI in this field. The existence of AI is accepted as a paradigm shift in the analytical, engagement, and portfolio management operations of financial institutions instead of a passing trend.

Introducing operationally efficient and effective customer interfaces for the industry More accurate evaluation leading to enhanced lending New ways of market and customer behavioral analysis Detailed and complex procedures freeing up manpower for strategic work AI-enabled independent and precise services Overwhelming amounts of data on customer behavior for smart planning. The inclusion of AI in Fintech not only changes the financial sector but also establishes it as its fundamental component while promoting adaptability, tenacity, and focus on efficiency, diversity, and customer-orientedness.

SoluLab Transforms Banking and Finance with Gen AI

Challenge

The banking industry struggles with meeting rising customer expectations, streamlining manual processes, managing risks, adapting to evolving regulations, and protecting data from increasing cyber threats.

Solution

SoluLab used Gen AI to automate tasks, deliver personalized customer experiences, and improve cybersecurity, helping banks operate more efficiently.

Impact

- 3x increase in customer satisfaction with personalized services.

- 70% faster processes, cutting operational costs.

- 98% fewer cyber threats, ensuring data safety.

How is SoluLab Improvising the Financial Sector with AI Solutions?

SoluLab’s creation of Mobyii a mobile wallet software is one example of how their modern AI technologies are improvising the banking industry. This program makes use of sophisticated AI to improve user interface and accelerate banking operations. Mobyii gives customers individualized financial insights through the integration of AI-driven features, empowering them to handle their money more skillfully.

By protecting user data and transactions with advanced fraud detection systems, SlouLab’s AI development solutions improve security safeguards. Based on the app’s capacity to examine spending trends, users can receive personalized advice that helps them develop better financial practices.

All things considered, if you are looking to utilize AI techniques not only to increase operation effectiveness but also to provide users with tools that support financial security and literacy, which can ultimately change the financial industry, contact SoluLab today.

FAQs

1. How is AI being incorporated into the Fintech Industry?

Through automation and algorithms that adhere to consistent workflows, AI is implemented in the fintech industry to assist financial services firms in managing human mistakes while handling data analytics, processing documents and onboarding, and other interactions.

2. What use does AI have in the Fintech Industry?

AI use cases such as automation of payment processing which decreases operating expenses, expedites transactions, and minimizes errors, and credit rating systems offer increased financial inclusion and more precise risk evaluations.

3. What is the role played by AI and ML in Fintech?

AI and ML in fintech provide enhanced automation and efficiency for fintech companies which frees up resources and time for more strategic endeavours. By processing data in real-time, AI can quicken the time required.

4. What does FinTech’s future hold?

Leading technology companies, incumbent banks, and even market regulators may work together more and more, spurring creativity. AI in financial services is projected to reach an estimated value of $49 billion by 2028.

5. How is SoluLab helping the banking sector?

Yes, SoluLa is helping the banking sector already with software like Chinchin, IAP Calculator, Rupiah, Mobyii, and more which are implemented to assist banking services with AI solutions which in return will enhance efficiency.