Artificial intelligence is becoming more and more accepted in the insurance sector, this development is expected to have a big influence on insurers and consumers. Insurers can comprehend risk control with speed and accuracy by properly utilizing artificial intelligence with which large datasets can easily be analyzed. This enhances underwriting and claims management, increases the identification of risks, and results in a more affordable rate.

AI increases underwriter productivity by 50% or more when used for insurance underwriting. It also offers novel underwriting models and the introduction of personalized client experiences, which enables insurers to increase revenue by 15%.

This article deals with what underwriting is for insurance, why is it important, the main use cases of AI in insurance underwriting, and how is AI working to provide a changed environment in the insurance industry.

What is Underwriting in Insurance?

The process of assessing risk to see if the insurance company will insure, and if so how much it will cost is known as Underwriting. Initially, underwriting was done by hand and relied solely on acquired knowledge. These days, the procedure also makes use of technologies like artificial intelligence and data analytics.

To keep a good loss ratio, any insurance firm must follow an underwriting procedure. It is the foundation of the company and the primary force driving the financial performance, coupled with investment returns. Poor underwriting choices result in high loss ratios, which means the insurance provider will ultimately have to pay out more in claims than it gets paid in premiums. Insurance businesses might invest in underwriting training and establish an underwriting strategy.

Market Information of AI for Insurance Underwriting

- With a predicted growth of 32.56%, the worldwide insurance AI industry is expected to grow up to $45.74 billion by 2031 from its estimated $2.74 billion in 2021. One of the main insurance industry use cases for AI is underwriting.

- 40% of the underwriter’s time is being spent on non-core tasks, which will cost the industry between $85 and $160 billion in lost productivity over the next 5 years.

- Over the past 5 years, AI has developed and costs have decreased dramatically, providing insurers with ever-increasing value.

How Does AI Work in Underwriting?

The conventional underwriting procedure is streamlined by leveraging artificial intelligence. Insurance underwriting AI companies may make quicker, more precise, and rapid underwriting decisions by using sophisticated algorithms that evaluate hundreds of data pieces. Here is a closer look at the working of AI software in underwriting for insurance:

Data Lake |

Data that is related to the structured and unstructured customer and risk data, as well as multi-informant insurance papers gathered from various sources, are later stored in a data lake. |

Data Hub |

To keep the completely clean, organized, and ready to analyze data, a data center is required. |

Neural Network |

A pre-trained machine learning model is the central component of an advanced analytics engine. It provides insightful recommendations on the best possible individual insurance rates by a comparison between lost and profit ratios. |

Database |

The analytical findings are kept in an analytical database and made accessible for later use such as informing consumers and agents about prices, ongoing, and self of AI models. |

App for Underwriters |

AI insurance underwriters can easily report and collect the risks that may be associated with data and analytical outcomes, with the help of comprehensive visualization features in the app. |

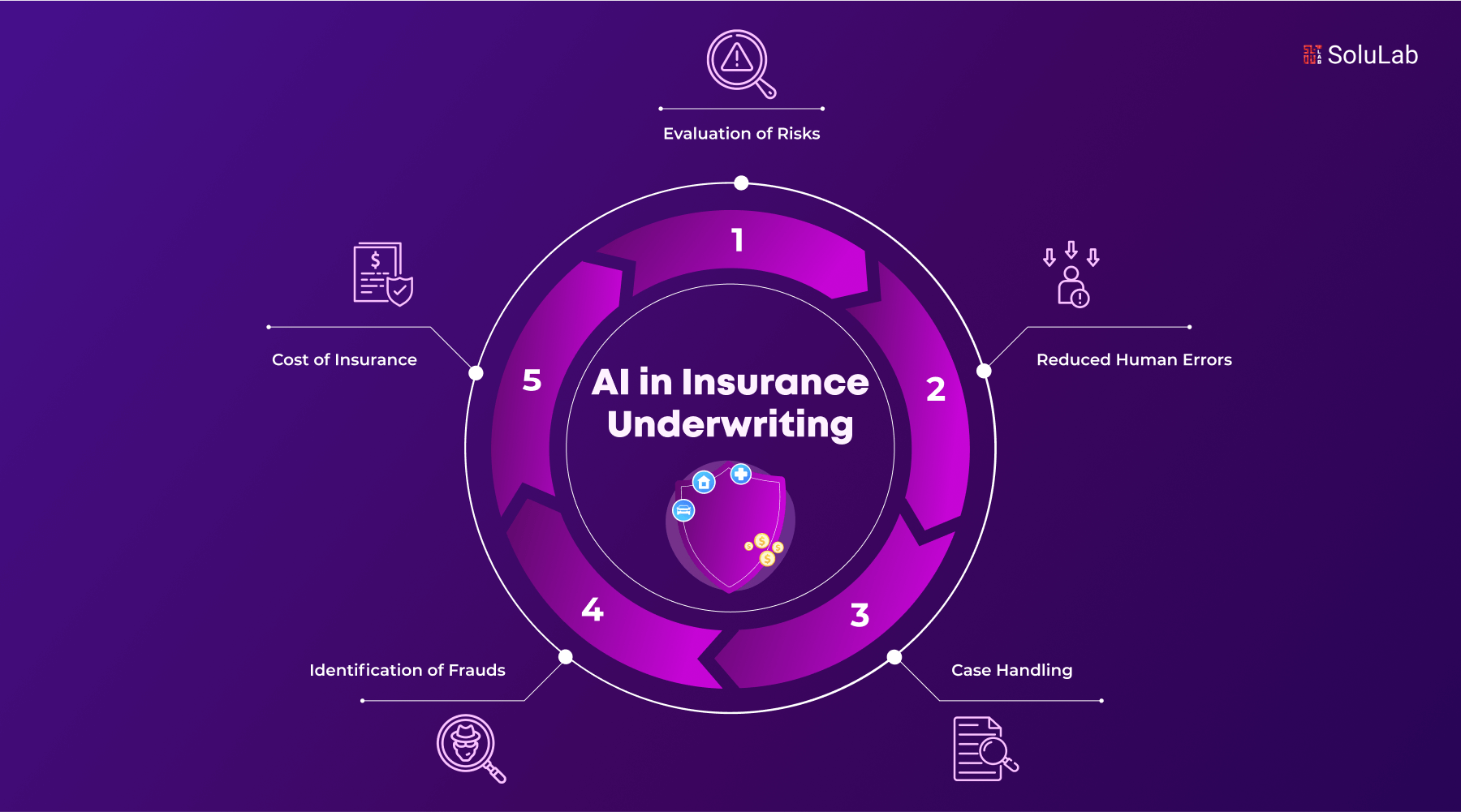

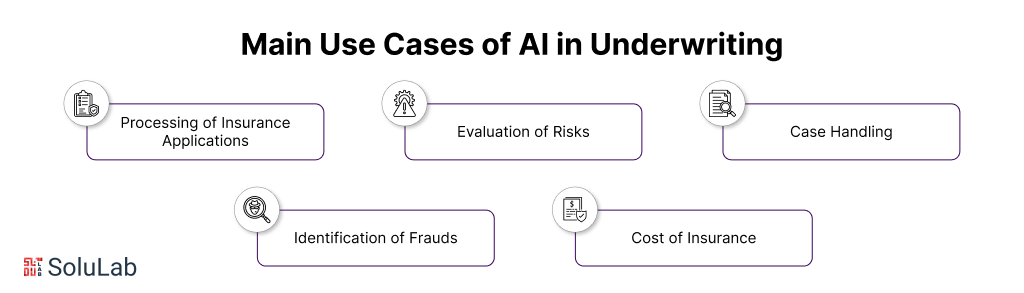

Main Use Cases of AI in Underwriting

All the different insurers tend to use AI insurance underwriting differently. Here are the major ways in which AI for underwriting in insurance are used:

-

Processing of Insurance Applications

Intelligent application triaging is necessary for Automated omnichannel insurance application processing to expedite the request-to-quote cycle and relieve underwriters leakage. Automation greatly simplifies the application process from development to processing. To speed up the quote process, AI underwriting insurance also enables the underwriter to obtain relevant data from various sources and automate that collected data for processing.

-

Evaluation of Risks

Quick and precise measurement of risks unique to a client to assist underwriters in setting insurance prices and accelerating the issue of policies. To quickly respond to the changing financial threats, risk-relevant data is continuously collected and analyzed from all accessible sources. With so much paperwork and data to manage, AI for insurance underwriting provides underwrites with vital assistance.

Read Our Case Study: Generative AI in Insurance Industry

-

Case Handling

AI-driven underwriting solutions enhance case workflows, such as case prioritization, initial review, and logic-based underwriting assignments. Underwriters receive resources to enhance teamwork among peers, leading to a quicker claims procedure. AI solutions improve case management and expedite claims processing by automating the gathering of data from documents to employing AI to evaluate data for improved insights.

-

Identification of Frauds

Instantly comparing the information supplied by clients with the information found in the pertinent public sources. It stops unauthorized usage of financial services and assists in identifying identity fraud and document fabrication. Analytics of underwriter activity to pinpoint underwriter non-compliance with regulatory and internal requirements.

-

Cost of Insurance

Smart recommendations on the best insurance rates, case by case, to increase profits and reduce loss risk. Flexible pricing models with real-time data based on price recalculation with reasonably priced services.

How Does AI Work With Insurance Underwriting?

In many insurance categories, technology was still somewhat antiquated less than ten years ago. AI and insurance underwriting would often use manually updated spreadsheets to manage their books of business. Before data-driven underwriting, risk assessment required underwriters to sort through data without always seeing the big picture, pulling threads as they went along. Thankfully, increasingly advanced technology, including artificial intelligence (AI), has been adopted and effectively utilized in the years that have passed. These days, underwriting procedures and instruments are far more reliable and well-coordinated.

These days AI is utilized to categorize risk and order submissions based on the Standard Industrial Classification System (NAICS) codes. This is beneficial and saves time. An insurer may unintentionally take on risks beyond the company’s appetite or drastically undervalue a risk by choosing to accept it with incomplete or inaccurate data. But Will AI replace insurance underwriters? AI for insurance underwriting has the potential to enhance its productivity and efficiency but it cannot replace underwriters because it requires human judgments to keep adapting to changes and keep transforming ways that can not align with human expertise.

For instance, AI is frequently used in cyber risk underwriting to scan information technology infrastructure that is visible to the public. AI tools use this data to create risk rankings based on the vulnerable abilities found by the scans.

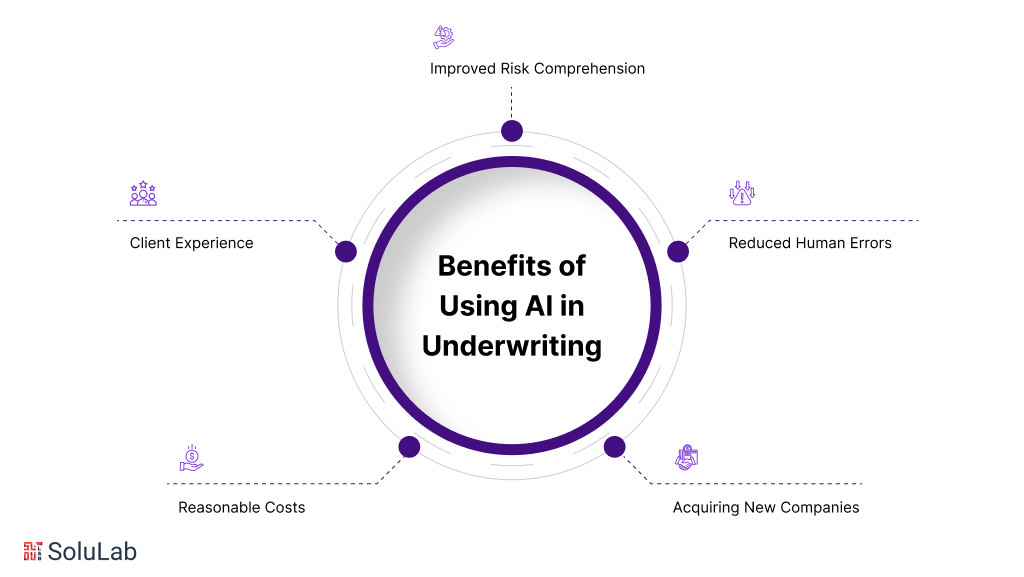

Benefits of Using AI in Underwriting

AI for underwriting in insurance has been benefiting the industry for quite some time now, here are the major benefits it provides and are making a difference:

1. Reduced Human Errors

Mistakes are always possible, regardless of how wise, rational, and perceptive people are. However how simple and basic the task is or how many figures it handles, artificial intelligence and machine learning are error-free. AI in Loan Underwriting is therefore quite important. AI in insurance underwriting can reduce error probability by synthesizing datasets in various formats.

2. Improved Risk Comprehension

A wide range of data sources are necessary for insurance underwriting best practices. Here AI in underwriting can improve risk assessments by increasing access to enhancing a variety of data sources. Insurance companies have already benefited from the introduction of big data, machine learning, and analytical prediction that AI has brought to their departments. They reduce the amount of time-consuming due diligence procedures by employing these solutions.

3. Improved Client Experience

Insurance firms can improve the client experience even throughout the sales process by implementing AI in underwriting. That would cultivate patron loyalty from the outset. A long-term retention roadmap can be developed by insurers using customized individual account services, enticing risk-sharing pricing structures, and useful loss control techniques. AI also frees up time so insurers can have detailed conversations with consumers or potential clients without urgency.

4. Possibilities for Acquiring New Companies

Larger insurance value chains are integrated with AI underwriting. Due to the insights from consolidated data lakes, there is an increase in cross-platform visibility and new opportunities for cross-platform selling. This way it is easier for insurers to provide a satisfying experience for their clients. Integrated AI-enabled technologies allow underwriters to contact clients with a customized strategy before application submission.

5. Reasonable Costs

A small business owner looking for casualty and property insurance acquired coverage amounts from different providers according to a case study by McKinsey. Remarkably, for nearly the same risk, there was a 233% difference in the coverage amounts. Automated underwriting provides better risk visibility in an increased situation of pricing insufficiencies the insurance sector is facing. The underwriters serve as knowledge gatekeepers who make necessary course corrections, and they recommend the best pricing and coverage terms.

Addressing Major Concerns in Underwriting

The insurance software development companies dealing with insurance underwriting that is AI-driven must take a proactive stance. Talking openly and honestly with insurers is crucial. Knowing whether these datasets cover a broad spectrum of industries, that include the most recent trends and developments is crucial. Companies should question insurers about the procedures that are used to mitigate biases and identify them, this raises concerns about if the AI systems are having routine checks for fairness and accuracy. They should also ask about the possibilities of human review or overrides in situations when judgments made by AI appear unfairly biased.

To guarantee complete accountability, businesses should make sure that their insurers have thorough audit trails that track AI models‘ decision-making processes. According to Stevens, “Insurers must abide by industry must make sure that their audits functions don’t fall behind regulations because companies can ask for information on how the insurer complies with ethical AI practices and regulatory guidelines.”

Knowing what kind of technical assistance insurers receive when using third-party AI solutions is also crucial. In addition to paying attention to how frequently their data is collected, insurers should try to ascertain when the next technology is expected to be released. Transparency about data processing procedures is also necessary. Maintaining trust and making sure that both parties follow the conditions for data usage and privacy can be achieved through routine audits and compliance checks.

Why is AI Important in Underwriting?

There’s a reason why every one of the top 25 insurance companies has an ongoing in-flight AI development program or is deploying at least one AI application. Insurance businesses should have an AI roadmap because the costs of not utilizing AI in insurance underwriting are too great to ignore.

Workflows from the past were just inefficient, Underwriting procedures are manual without AI, making human error a possibility. Without AI processing and analyzing every dataset, obtaining all the data required for a thorough grasp of the risk on every property can also be onerous and time-consuming.

Without AI in insurance underwriting, underwriters frequently have to consult multiple sources to get the specific property-related data they require to complete an accurate risk analysis. AI in underwriting will eventually determine whether an insurance carrier stays in business or goes bankrupt since more and more insurance businesses are already utilizing AI for underwriting workflows.

How is AI Benefitting Insurance Companies for Underwriting?

The rise of AI in the insurance industry is expected to have a big influence on both insurers and insureds. AI is transforming and making it better in the following ways:

- Relationships with consumers are improved with greater automation and efficiency and providing efficacy even to the decisions.

- AI is supposed to be used sensibly and applied with certain moral standards, support regulatory rulings, and support the needs of the insurance workforce of the future.

- The value provided by AI solutions and the improving economics of AI suggests that the time to invest in AI-led transformation is now.

Here is a case study of how companies are benefiting from AI-based underwriting is the most prominent AI use case for underwriting is attributed to Daido Life Insurance in Japan. This is the most effective AI prediction model for the business as it enables underwriters to conduct assessments while at the same time verifying AI’s prediction results and signals. Concerning, the decision-making process is also shown in the model. This model eliminates the black-box issue of AI and helps further improve the workspace’s back-end productivity. The company will continue enhancing the model through the collection of traits like underwriting outcomes of human evaluation and prediction of Daido Life AI.

Learn How SoluLab Builds AI for Insurance Companies

It has many advantages if a company chooses a qualified AI development company like SoluLab for the development of AI-based solutions for insurance. This indicates that a different skill and know-how is required that comprises natural language processing as well as other machine learning techniques. Facilities at SoluLab employ specialists in those areas to ensure that the AI developed is up to par with the market’s best.

The process of creating artificial intelligence is not always easy and it may take some time. AI businesses can also deliver AI solutions with greater efficiency compared to in-house generated initiatives due to method and technology improvement. This is the reason that has been ensuring lower development costs and a quicker time to market.

Through customer self-service, accelerating the duration it takes to handle claims, and issuing recommendations that are smartly generated through artificial intelligence, the customer experience may be significantly enhanced. Many of these benefits can be provided to the clients of insurance companies more efficiently through partnerships with AI firms.

While it may be expensive to invest in Artificial intelligence at the moment the cost may decline in the long run. This means intelligent employee and consumer risk management, fraud reduction, and automated repetitive operations that can lead to Operating Cost reduction and improved profitability.

With the help of SoluLab, insurance companies can utilize AI to create the thrust, improve client satisfaction rates, and gain a business edge in the market. They can deliver bespoke AI solutions that will meet the needs of insurance organizations and customers due to their expertise, efficient processes, and superior tools.

FAQs

1. What is underwriting in insurance?

The process enables insurance companies to calculate the risks that the person may endure with the insurance be it for property, person, or entity, and also provide an overview or insight about premium charges according to the risks involved.

2. How is AI transforming the insurance industry?

Insurance companies are now leveraging AI technology to assist the best insurance plans according to their client’s needs and preferences by analyzing data obtained from various sources. This technology has aided insurance companies with risk assessment, customized plans for clients, and automation of various time-consuming functions.

3. What are the major challenges faced by insurers in utilizing AI technology?

There are many issues faced by the utilization of AI for insurance but data and privacy is the major concern for both insurers and customers. Given the extensive sensitive data gathered by insurance firms, safeguarding the confidentiality and reliability of the data becomes crucial.

4. Is there any limitation to AI in Insurance?

The major limitation of AI in insurance is bias in algorithms, the need for extensive and high-quality data for AI to function effectively, and the complexity of interpreting AI-generated insights. It may also find it difficult to understand the unique situations that might be important for clients.

5. How Can SoluLab AI Solutions Help the Insurance Industry?

Through automation and customization services, Solulab AI technologies may greatly improve customer experience and efficiency in the insurance sector. Our AI services can speed up the improvement of risk assessments and the streamlining of financial procedures.