In the banking industry, regulatory compliance and client onboarding are both being profoundly altered by the incorporation of Artificial Intelligence in KYC (know-your-customer) procedures. It is impossible to overstate AI trends and their contribution to improving KYC operations, effectiveness, precision, and security as organizations work to comply with the complicated AML laws.

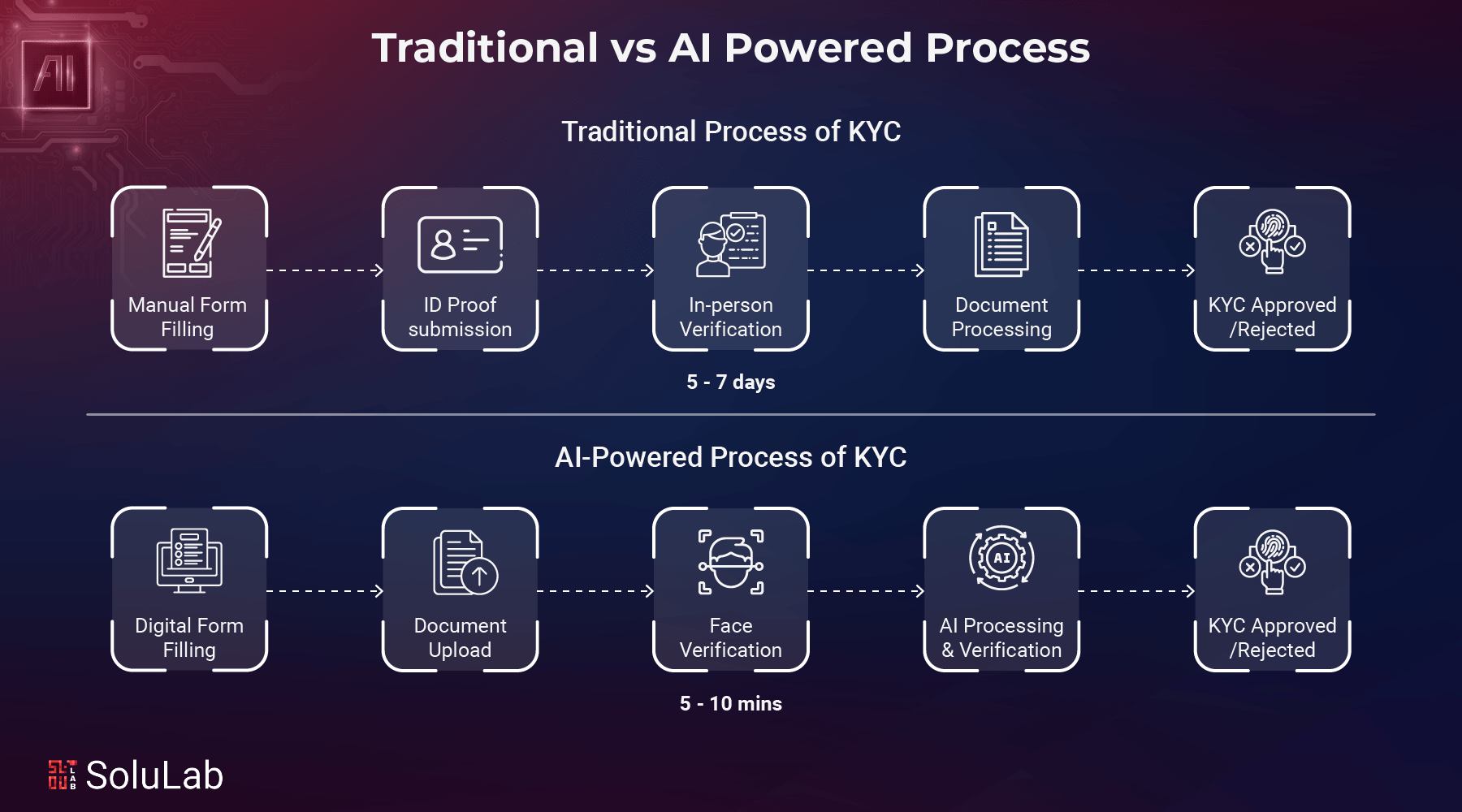

Over the past 10 years, technological advancements, especially in artificial intelligence and, more recently, generative AI chatbots, have significantly changed the work of KYC analysts. In the past, a KYC analyst’s duties included manually processing volumes and data, examining client profiles, verifying identification, cross-referencing, screening for negative media, and making sure that constantly shifting regulatory requirements were followed. This process was labor-intensive and time-consuming due to the growing complexity of international financial regulations and the enormous amounts of data produced by companies and their clients.

But the question is, how is AI for KYC processes bridging the gap within, and how is it pushing traditional KYC procedures away? Continue reading to find out!

Evolution of KYC

KYC standards deliver protection against illegal activity by providing standardized procedures that have received recognition. Multiple aspects of its development phase require explanation, including the following:

1. Regulations

KYC took its first major stride forward with the US Bank Secrecy Act passed during the 1970s when financial institutions needed to track records of cash purchases of negotiable instruments. The Bank of England released complete KYC requirements during the 1990s.

Evaluating new customers requires dedicated procedures, so these innovations built a worldwide method to Know Your Customer regulations. The Financial Action Task Force (FATF) has promoted money laundering and terrorism funding as the core subject of KYC since implementing its requirements.

Financial organizations, together with banks, adopted hand-operated verification systems using paper records to validate customer information throughout the early KYC compliance years. The core of KYC compliance operations accepts simple customer information combined with verification of their identity documents.

2. Essential Requirements for KYC Processes

Authorities across the world initiated a KYC procedure analysis after the tragic attacks of September 11, 2001. The Patriot Act issued by the USA prompted additional KYC requirements for American financial enterprises to adhere to. With the addition of Customer Identification Programs (CIP), KYC enhanced its overall functionality to detect crimes beyond terrorism financing by increasing organizational alertness. Cognitive departments across the globe introduced digital KYC compliance technologies during this period.

3. KYC Compliance Systems

The early 2000s produced innovative technology that revolutionized KYC services permanently. The development of digital KYC compliance tools resulted from the growth of internet adoption and advanced data analysis technologies. The creation of specialist KYC compliance solutions gained momentum because regulators strengthened their oversight and showed the importance of KYC.

Limitations of Traditional KYC Processes

The combination of various factors leads traditional Know Your Customer (KYC) systems to become both costly and inefficient and accessible to financial crime. The following statement describes KYC restriction specifics:

KYC compliance for financial institutions leads them to spend significant sums of money, mainly during new client onboarding procedures. Each year, financial institutions allocate between $20 and $30 million to develop their KYC operations.

The price for KYC corporate client reviews ranges between $1,500 and $3,000, according to 54% of banking institutions, and exceeds $3,000 for 21% of these institutions.

Standard KYC system technology can lead to severe regulatory consequences, together with a damaged reputation, when financial crimes evade detection.

In 2018, the Commonwealth Bank of Australia paid AUD 700 million (USD 530 million) in penalties for failing to supervise over 778000 accounts that might be used for money laundering activities. Traditional software systems proved they could not handle sophisticated criminal methods during this specific incident.

Traditional KYC methods are difficult to handle, thus creating client dissatisfaction and slowing down the onboarding process for new customers. Research reveals that inadequate onboarding procedures within banks result in the loss of 48% of their customers. The time needed for banks to capitalize on market opportunities diminishes because of these delays.

The digital KYC system, known as eKYC, delivers two benefits through modernized procedures that boost client satisfaction rates.

Institutions adopting old KYC approaches encounter heightened vulnerability to financial crime activities. Markets in the United States suffered a loss of more than $1.1 million from suspicious money transfers through a bank located in Missouri because of insufficient anti-money laundering regulation enforcement. The authorities enforced financial penalties because of this operational failure to demonstrate the importance of robust AML regulations.

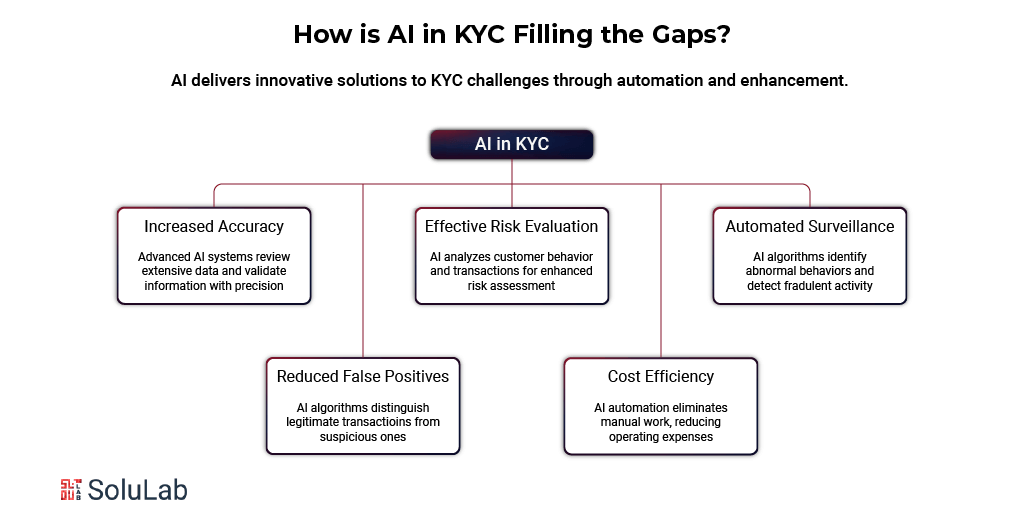

How is AI in KYC Filling the Gaps?

AI in banking delivers an innovative solution to these challenges through enhanced KYC process automation and enhancement. These are the five fundamental ways banking institutions respond to fast AI in KYC procedures.

1. Increased Accuracy for Identification

Advanced artificial intelligence systems review extensive data while performing accurate information validation through complex algorithms together with machine learning capabilities. The identity verification process becomes more reliable through the precise identification of fake documents combined with decreased error possibilities.

2. Effective Evaluation of Risks

The analysis of customer behavior combined with transaction data allows AI for KYC processes to conduct enhanced and more efficient risk assessments. The human-based evaluation process would fail to identify both irregularities and possible dangers that machine-learning programs can find. AI systems detect abnormal financial activity and high-risk events by providing financial institutions with immediate, proper responses.

3. Automated Surveillance and Notifications

Several methods focus on suspect activity detection that requires sustained observation because they enable the discovery of money-laundering schemes. The analysis of financial activities by AI algorithms throughout the entire process identifies abnormal data behaviors persisting beyond regular patterns. A proactive approach by organizations enables them to detect fraudulent activity before it progresses so they can apply suitable corrective measures, thereby enhancing security performance and achieving better compliance levels.

4. Cutting Down on Faulty Positives

Traditional KYC methods notoriously produce numerous wrong alarms that incorrectly identify normal transactions as suspicious. AI algorithms that demonstrate an improved ability to discern honest transactions from fraudulent ones help decrease wrong positive results in KYC processes. The improved accuracy through this approach leads to better customer satisfaction while reducing the strain on compliance teams who work with KYC.

5. Efficiency in Terms of Cost

Process automation through AI-powered KYC Technology eliminates the requirement for extensive manual work, so organizations cut down their operating expenses. Through simplified identity verification procedures, financial organizations preserve substantial financial resources while improving their resource allocation.

Read Also: Generative AI in Payments

A Stronger Basis for AI in KYC

AI in finance creates exceptional opportunities to design superior customer interactions and better decision-making systems and organizational performance. For successful implementation, there are three key requirements comprising strong processes, human involvement, and high-quality data.

-

The Significance of Superior Data

AI achieves its effectiveness based on the quality of data it handles. The reliability of the results suffers when the input data is insufficient or of poor quality, thus reducing its operational efficiency. A data fabric should function as a connective architecture that links data across the whole organization because of this requirement. AI models receive their best operational results through the implementation of data processing standards that produce clean, complete information. AI outputs become better integrated into existing workflows because of a system that enables easy implementation, leading to improved execution of compliance monitoring and fraud detection programs.

-

Robust Mechanisms for Mixed Autonomy

AI currently operates under “mixed autonomy” by performing work that requires humans to oversee critical choices. The fundamental need in this area is an efficient process management system. The appropriate parties for completing work—including digital systems along with human operators—can be routed through task management between AI systems and automation technologies and human workers. The better alignment between systems results in both improved accuracy and more satisfactory efficiency levels.

-

Involvement of People

Although AI holds potent capabilities, it remains vital to maintain human intellect for determining complex problems as well as ethical decision-making processes. Organizations need to combine technological systems with the knowledge of their workers to maximize beneficial AI outcomes while limiting risks.

Financial institutions can achieve full Artificial Intelligence potential through superior quality data manipulation from a robust data fabric structure alongside efficient process management and human staff maintenance. These methods enable organizations to succeed in the long term as their market transitions rapidly by improving operational efficiency and attaining enhanced results for compliance prevention and business service support.

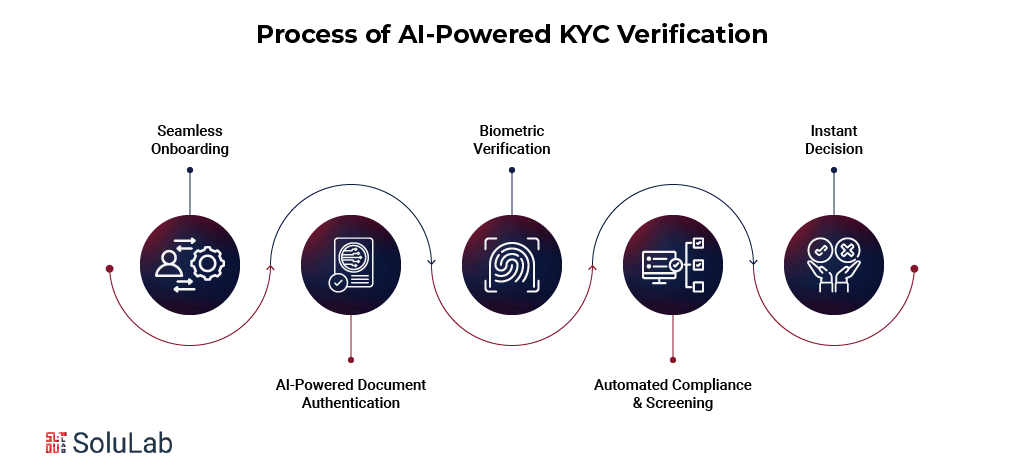

Step-by-Step Process of AI-Powered KYC Verification

AI-powered KYC verification eases identity authentication with speed, accuracy, and compliance. How it works in five streamlined steps is as follows:

1. Seamless Onboarding

Users begin the verification process by submitting personal information and uploading government-issued identification via a secure digital interface.

2. AI-Powered Document Authentication

AI-Powered chatbots analyze ID documents for authenticity, checking security features such as holograms, watermarks, and microtexts to detect any signs of forgery.

3. Biometric Verification

Users take a real-time selfie or video. AI-driven facial recognition compares it with the submitted ID, while liveness detection prevents spoofing attacks using deepfakes or static images.

4. Automated Compliance & Screening

Artificial intelligence tools cross-reference user data with global databases, including government watchlists, AML (Anti-Money Laundering) lists, and fraud detection networks to assess risk levels.

5. Instant Decision

Upon successful verification, the user is onboarded instantly. High-risk cases are flagged for manual review, and ongoing AI-powered monitoring ensures continued compliance and security.

The Search for Alternate Systems

Despite already existing KYC procedures, several industries seek new substitute procedures to improve efficiency and user experience. Substitute systems understand the importance of delivering quick verification services along with minimal user interface annoyance along with some regulatory needs.

-

Casinos Without Verification

Online gaming has recently included no-verification casinos among its alternative client verification processes. The platforms allow gambling users to skip the normal thorough KYC protocols adopted by typical online casinos. These platforms substitute cryptocurrency transactions, which deliver both private transactions and lower the requirement for personal data collection.

Confidential people who want faster account setup prefer this verification solution. These digital platforms face challenging regulatory requirements that they need to fulfill to prevent participation in money laundering and other illicit actions.

-

Peer-to-Peer Platforms

Online marketplaces, together with P2P systems, utilize streamlined verification approaches for their users. These platforms employ three verification methods, including social authentication, while gathering restricted identification data instead of traditional KYC to execute transactions.

The implementation of this method enables easier access for new users while preserving security standards, which results in growing trust among platform members. Multiple digital platforms in the gig economy speed up user onboarding through simplified identity examinations that third parties execute.

Related: Best P2P Crypto Exchanges

-

Digital wallets and Currencies

The verification process for users in digital currencies and wallets backed by blockchain technology operates using alternative methods. Users on specific platforms can perform transactions since wallet addresses serve as their identification instead of personal information.

This gives users a certain amount of privacy and efficiency, but it does not remove the requirement for KYC in regulated organizations. Furthermore, smart contracts are frequently used by decentralized finance platforms to enforce regulations and transactions of conventional KYC, which depend on the technology itself for compliance and security.

Future of AI in KYC

AI-powered tools will continue to work together with human analysts in an enhanced manner to advance KYC procedures in the future. AI technological development will enable the automatic completion of repetitive work, which will subsequently give KYC experts time to focus on critical situations. The collaboration between humans and robots improves KYC’s efficiency rate and enhances overall compliance performance. Smart KYC leads the process of change by developing advanced AI tools that both advance artificial expertise and maintain essential human analyst capabilities.

Artificial intelligence (AI), along with other modern technologies, has transformed KYC analysis by replacing time-consuming manual operations, allowing analysts to allocate their efforts to essential business tasks. AI alongside GenAI helps analysts today achieve ongoing and superior profile monitoring by automating administrative tasks and extracting relevant data points and results. Artificial Intelligence functions as a valuable tool for human operations, although it lacks human intelligence capabilities. The system enables KYC professionals to put their skills toward vital tasks by ensuring international rule compliance and protecting banking and large enterprise security.

The Final Word

Financial institutions are currently experiencing a revolution in their industry through artificial intelligence (AI) integration with the Know Your Customer (KYC) compliance process. Operational efficiency grows stronger through AI because it handles data examination automatically, along with reducing counterfeit results while improving customer enrollment methods. This technology equipment enables real-time data processing, which provides accurate results, thus allowing compliance staff to focus on solving complex challenges.

Institutions that use AI stay updated on regulatory changes because this technology adapts easily, which reduces compliance risks and associated penalties. The system integration helps decrease costs as it identifies future compliance risks using predictive analysis, which enables both risk monitoring and cost reduction. SoluLab has been a trusted partner for such businesses and organizations that use AI integration services. Recently, the team got an opportunity to deliver an AI in KYC solution for a client from Libya. It’s an AI-powered banking application offering seamless banking operations, including KYC.

No wonder the intelligent implementation of AI systems makes institutions better prepared for future success in the quickly changing financial market. SoluLab holds a proven track record as an AI Development Company, delivering unmatchable quality in solutions. If you also wish to be ready for the future with minimal effort, connect with the experts now!

FAQs

1. Is KYC automation possible?

With the help of artificial intelligence, know your customer automation can be done easily. Automating KYC processes during onboarding makes information gathering and documentary review easier.

2. How is KYC using AI?

KYC has traditionally been a process with a lot of paperwork and human checks. By providing more precise and effective techniques for detecting fraud, the Inc. Corporation of AI in KYC procedures is transforming this sector.

3. By whom is KYC verified?

The banks are in charge of KYC compliance. The KYC procedure consists of biometrics, ID, cards, face, shell, and document verification, which includes utility bills as a proof of address. To reduce fraud, banks are required to abide by KYC and money laundering requirements.

4. Which AI method is utilized for KYC?

With the help of artificial intelligence, the method known as optical character recognition (OCR) can be utilized to extract digital client information from Know Your Customer forms.

5. How does AI in KYC prevent identity theft?

Artificial intelligence compares user information against multiple databases, detects forged documents, and verifies biometric data to prevent identity theft and fraud. Hence making KYC more secure.