Loan underwriting has historically been a complicated and error-prone process, struggling to keep up with the fast-paced demands of today’s financial markets. Traditional approaches often lead to inefficiencies, with underwriters dedicating as much as 40% of their time to non-essential activities. These inefficiencies could result in a projected $160 billion in losses over the next five years, as per Accenture. Furthermore, dissatisfaction with the claims process may lead to a potential risk of $170 billion in premiums, as customers are likely to switch providers if their needs are not properly met.

Artificial Intelligence (AI) is proving to be a game-changing solution for these issues. Through automating repetitive tasks such as data gathering and risk evaluation, AI loan underwriting can drastically reduce the time and effort required for manual processes. AI systems can quickly and accurately process vast amounts of data, minimizing human errors and accelerating decision-making. In fact, McKinsey reports that automation in the insurance sector could cut claims processing costs by up to 30%, demonstrating the potential for AI and underwriting to boost efficiency across financial services.

In this blog, we will dig into the transformational impact of AI in loan underwriting, examining how machine learning algorithms accelerate data processing, strengthen risk assessments, and, ultimately, speed up loan approval procedures. This blog will shine a light on the issues faced by traditional underwriting methods, as well as the novel solutions brought to the forefront by AI, bringing in a new era of effectiveness, precision, and agility in loan sanctioning.

What Exactly is Loan Underwriting?

Loan underwriting is the method by which a financial institution examines a borrower’s creditworthiness and determines the risk involved with providing money to them. During underwriting, the lender evaluates the borrower’s credit history, income, employment security, and debt-to-income ratio. The goal is to analyze the borrower’s capacity to repay the loan based on their financial profile. Underwriting allows lenders to make educated judgments about whether to approve, alter, or refuse a loan, as well as to set the terms and conditions, which include interest rates and loan amounts. The underwriting process is critical for risk management and accountable lending practices.

Traditional Loan Underwriting vs. AI-Based Loan Underwriting

| Aspect | Traditional Loan Underwriting | AI-Based Loan Underwriting |

| Processing Time | A slow, manual process | A fast, automated process |

| Efficiency | Labor-intensive and subject to delays | Highly efficient and streamlined |

| Accuracy | Varies, reliant on human judgment | Consistent and data-driven |

| Consistency | Prone to human error and bias | Uniform decisions based on algorithms |

| Data Utilization | Limited to standard financial data | Leverages a broad range of data, including unconventional sources |

| Scalability | Difficult to scale | Easily scalable with increased data and resources |

| Cost Implications | Higher operational costs due to labor | Lower operational costs, with an initial investment in technology |

| Risk Assessment | Based on fixed criteria and manual reviews | Dynamic and continuous risk evaluation using real-time data |

| Decision Speed | Takes days to weeks | Completed within minutes to hours |

| Customer Experience | Slower response times | Faster approvals and an improved user experience |

| Compliance | Manual compliance checks | Automated compliance with real-time updates |

| Adaptability | Slow to adapt to new trends | Quickly incorporates new data and trends |

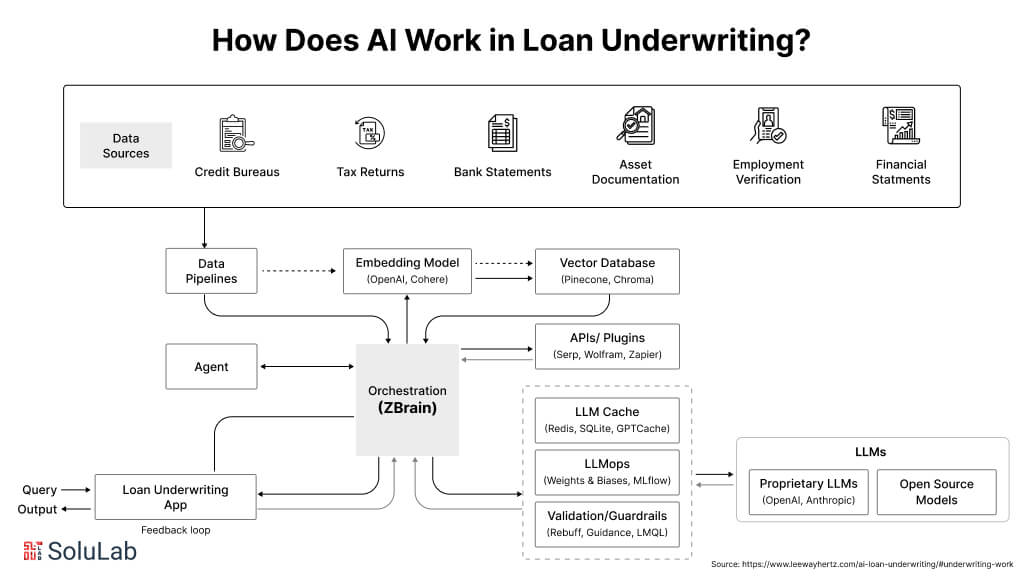

How Does AI Work in Loan Underwriting?

Integrating AI in underwriting involves multiple components that automate data analysis, accelerate processing, and extract actionable insights to make more informed lending decisions. This advanced system surpasses traditional methods by using Large Language Models (LLMs) integrated with a financial institution’s knowledge base, enhancing analysis and enabling faster decision-making. Below is a detailed overview of how artificial intelligence underwriting operates:

1. Data Sources

The first step in the loan underwriting process is gathering data from various sources, including:

- Credit Bureaus: Credit reports from major bureaus like Equifax, Experian, and TransUnion help evaluate the borrower’s credit history, payment behavior, and creditworthiness.

- Financial Statements: Borrowers provide income statements, balance sheets, and cash flow statements to assess financial health and repayment ability.

- Tax Returns: Tax filings verify the borrower’s income and provide insights into their financial stability.

- Employment Verification: Confirming employment status and income through direct contact or employment documents.

- Bank Statements: Analyzing cash flow and spending patterns from bank records to assess debt management and repayment potential.

- Asset Documentation: Evaluating assets like real estate, investments, and collateral to determine the borrower’s financial standing.

- Credit References: Gathering additional creditworthiness information from other lenders.

2. Data Pipeline

Collected data is processed through a data pipeline, which handles tasks like ingestion, cleaning, filtering, and structuring. This step ensures that data is properly prepared for analysis.

3. Embedding Model

The processed data is broken into segments and fed into an embedding model, which converts text into numerical vectors, making it understandable to AI models. Popular embedding models include those from OpenAI, Google, and Cohere.

4. Vector Database

The numerical vectors generated are stored in a vector database for efficient querying and retrieval. Vector databases such as Pinecone, Weaviate, and PGvector manage billions of vectors, aiding in fast comparisons and retrievals.

5. APIs and Plugins

APIs and plugins like Serp, Zapier, and Wolfram connect various components and add extra functionalities. These enable smooth integration and access to additional data for enhanced analysis.

6. Orchestration Layer

An orchestration layer, such as ZBrain, manages the entire workflow. It handles tasks like prompt chaining and interaction with external APIs. This layer organizes data flow, retrieves contextual information from vector databases, and maintains memory across LLM calls, optimizing the overall process.

Read Our Blog: AI in Banking: Transforming Financial Services

7. Query Execution

When a user submits a query through the loan underwriting application, it initiates the data retrieval and generation process. Queries may cover the borrower’s financial history, creditworthiness, employment, or loan conditions.

8. LLM Processing

Once the query is received, the orchestration layer retrieves relevant data from the vector database and LLM cache. It then forwards the data to the appropriate LLM for processing, selecting the LLM based on the query type.

9. Output

The LLM generates an output based on the query, which could include assessments of creditworthiness, risk identification, draft loan agreements, or a summary of the borrower’s financial profile.

10. Loan Underwriting App

The validated output is displayed in the loan underwriting app, consolidating all the data and insights. Decision-makers can then review the findings and make informed lending decisions.

11. Feedback Loop

User feedback on the output is continuously fed back into the system to improve the AI underwriting process over time, ensuring more accurate and relevant results.

12. AI Agent

AI Agents are key to the underwriting process. They solve complex problems, interact with external environments, and improve learning after deployment through reasoning, planning, tool utilization, memory, recursion, and self-reflection.

13. LLM Cache

Frequently accessed data is stored in an LLM cache using tools like Redis, SQLite, or GPTCache, improving system response times by caching important information.

14. Logging/LLMOps

Throughout the process, LLMOps tools such as Weights & Biases, MLflow, and Helicone log activities and monitor the system’s performance, allowing for continuous optimization through feedback loops.

15. Validation

A validation layer ensures the accuracy of the LLM’s output by using tools like Guardrails, Rebuff, and LMQL, providing reliable and precise results.

Check Our Blog Post: AI in Finance: A Guide for Financial Leaders

16. LLM APIs and Hosting

For executing loan underwriting tasks, LLM APIs and hosting platforms are essential. Developers can use APIs from OpenAI or Anthropic or explore open-source models, while cloud platforms like AWS, GCP, and Azure offer hosting options based on the project’s needs.

This Agentic RAG architecture enables seamless, efficient, and data-driven decision-making in AI-based underwriting.

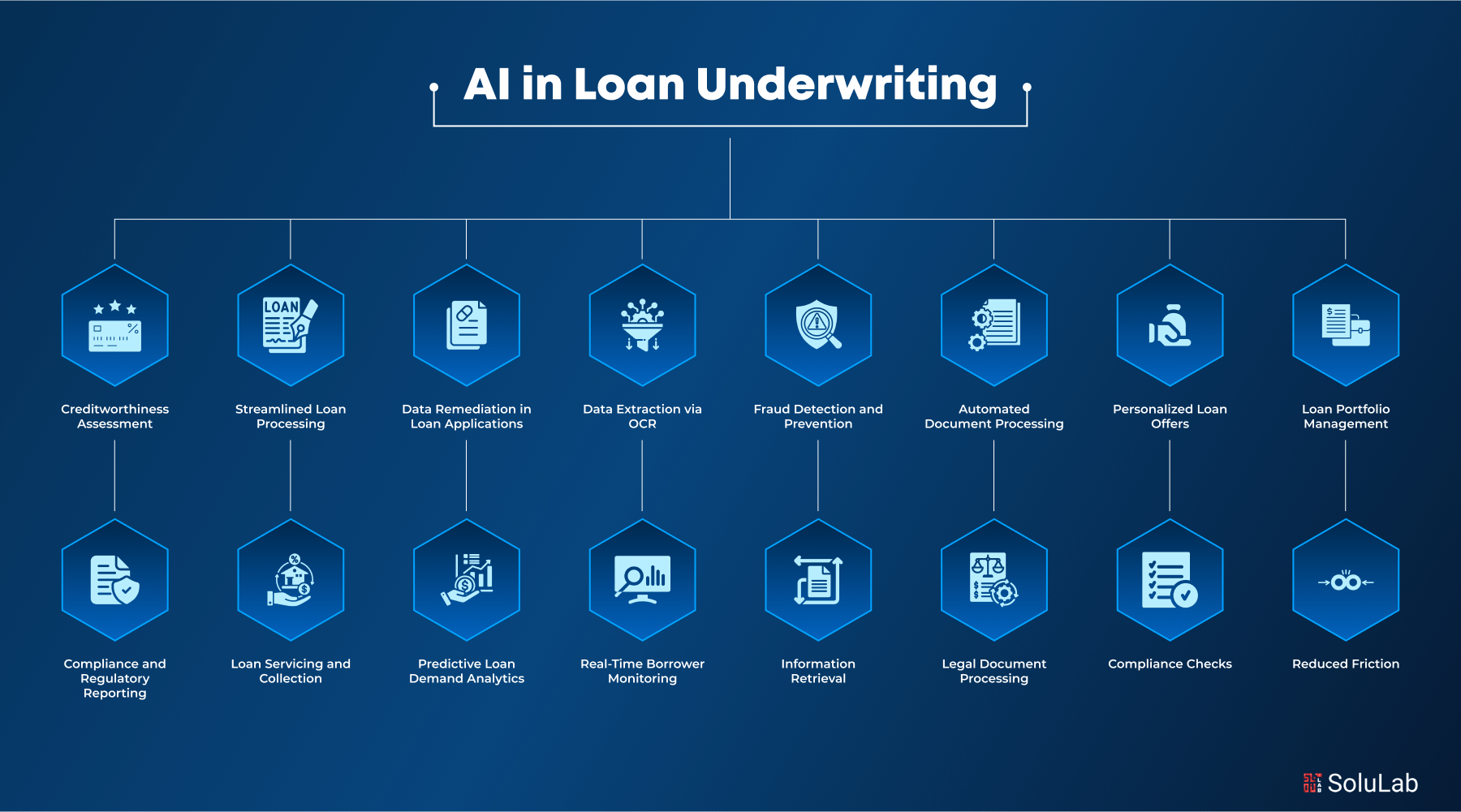

Use Cases of AI in Loan Underwriting

AI has significantly impacted many industries, including loan underwriting. Here are the key use cases of AI in loan underwriting, which demonstrate its transformative role:

1. Creditworthiness Assessment

- Enhanced credit scoring: AI systems evaluate various data points like credit history, transaction details, and even social media activity, generating more accurate credit scores.

- Predictive risk models: AI improves risk prediction by assessing multiple factors, allowing lenders to make informed decisions.

2. Summarization and Classification

- Document summarization: AI efficiently condenses lengthy documents, providing critical insights and summaries.

- Business document classification: AI assists in classifying business documents, streamlining organization, and processing.

3. Filling Information Gaps

- Form completion: AI simplifies the process of completing forms, ensuring all necessary data is entered correctly.

- Data enrichment: AI fills in missing information by cross-referencing external data sources, providing a holistic view of the borrower.

- Automated data validation: AI systems verify the accuracy of data against historical trends, reducing errors and improving consistency.

4. Elevating Customer Experience

- Personalized financial advice: AI analyzes transaction data to provide tailored financial advice, assisting borrowers with savings and major purchases.

- Exclusive offers: AI notifies specific customers of exclusive offers, enhancing the overall experience through conversational AI engagement.

5. Streamlined Loan Processing

- Automated decision making: AI handles up to 95% of manual underwriting decisions, particularly for SME lending, speeding up the process.

- Data aggregation: AI tools rapidly gather and process vast datasets from various sources to produce comprehensive risk assessments.

6. Data Remediation in Loan Applications

- Improved data quality: AI resolves data quality issues, ensuring accurate personal and financial information.

- Efficiency gains: Machine learning models integrated with AI accelerate the remediation process, reducing errors and backlogs.

7. Data Extraction via OCR in Loan Underwriting

- Efficient data extraction: AI-powered OCR technology extracts text from physical documents, converting it into readable formats for underwriting purposes.

- Enhanced decision making: AI-enabled OCR captures additional data points from financial records, providing a broader view of an applicant’s financial status.

8. Loan Underwriting with Behavioral Analytics

- Transactional insights: AI categorizes transactions and creates simplified financial statements, delivering real-time insights into borrower finances.

- Customer experience: Behavioral analytics enhances customer interaction, enriching NLP applications in financial data processing.

9. Fraud Detection and Prevention

- Anomaly detection: AI detects irregular patterns in loan applications that could indicate fraud.

- Real-time monitoring: AI continuously monitors transactions, identifying and preventing fraudulent activities in real-time.

10. Automated Document Processing

- Optical Character Recognition (OCR): AI quickly extracts necessary information from documents like tax returns and pay stubs.

- Data verification: AI ensures the accuracy of provided information by cross-verifying it against external sources.

11. Personalized Loan Offers

- Tailored recommendations: AI personalizes loan offers based on the customer’s financial needs and history.

- Dynamic interest rates: AI adjusts interest rates in real-time using risk assessments, ensuring fair pricing.

12. Loan Portfolio Management

- Portfolio analysis: AI analyzes the performance of loan portfolios, identifying high-risk loans and recommending solutions.

- Predictive analytics: AI forecasts future trends and borrower behavior, optimizing portfolio management through Hybrid AI techniques.

13. Customer Service and Support

- AI chatbots: AI-driven chatbots assist customers with inquiries, loan status updates, and application support.

- Virtual assistants: AI virtual assistants guide users through the loan application, offering a smoother experience.

14. Compliance and Regulatory Reporting

- Automated compliance checks: AI ensures that loan applications comply with regulations.

- Regulatory reporting: AI streamlines the creation of regulatory reports by organizing necessary data accurately.

15. Loan Servicing and Collection

- Proactive customer engagement: AI identifies borrowers at risk of default and offers personalized repayment plans.

- Automated collection: AI optimizes communication with delinquent borrowers and suggests the best collection strategies.

16. Predictive Loan Demand Analytics

- Forecasting loan demand: AI analyzes trends and customer behavior to predict loan demand, helping lenders strategize effectively.

- Customer segmentation: AI segments borrowers based on behavior and patterns, enabling targeted marketing.

17. Sentiment Analysis

- Customer feedback analysis: AI assesses borrower feedback from surveys and social media to improve service.

- Market sentiment: AI gauges broader market trends, influencing risk assessment and decision-making processes.

18. Real-Time Borrower Monitoring

- Ongoing assessment: AI continuously evaluates borrowers’ financial health, alerting lenders of potential risks.

- Dynamic adjustments: AI dynamically updates loan terms based on real-time data, ensuring favorable outcomes for both parties.

19. Portfolio Diversification Strategies

- Risk diversification: AI identifies opportunities for spreading risk across sectors, geographies, and borrower types.

- Optimal allocation: AI provides insights for adaptive AI solutions to optimize capital allocation and manage risk effectively.

20. Information Retrieval

- Data extraction: AI extracts relevant information from unstructured data, improving data retrieval efficiency.

- Contextual understanding: AI enhances the accuracy of information extraction by analyzing the context, ensuring meaningful results.

21. Legal Document Processing in Loan Underwriting

- Information gathering: AI organizes and summarizes legal documents like loan agreements, ensuring compliance.

- Automated contract review: AI tools analyze loan contracts, identifying risks and ensuring regulatory adherence.

22. Compliance Checks

- Automated compliance: AI performs checklist verifications and real-time monitoring of regulatory changes.

- Error detection: AI identifies potential compliance issues in underwriting documents and processes.

23. Training and Double-Checking

- Training simulations: AI creates simulated underwriting scenarios to improve decision-making skills.

- Error detection: AI double-checks underwriting decisions, reducing human error.

24. Reduced Friction in Commercial Underwriting

- Streamlined processes: AI optimizes asset scheduling in commercial underwriting, reducing inefficiencies.

- Automated risk assessment: AI rapidly assesses risks, minimizing manual intervention.

These use cases highlight how Data Annotation and AI in loan underwriting improve accuracy, efficiency, and decision-making in this process.

Related: AI for Insurance Underwriting

Process of Loan Underwriting

The loan underwriting process involves a series of steps where a lender evaluates the creditworthiness and risk profile of an applicant before approving a loan. Leveraging modern technology like loan underwriting AI significantly enhances the efficiency and accuracy of this process. Below are the key steps involved:

1. Application Submission: The process begins when a borrower applies, providing essential financial details such as income, debts, and assets. Loan underwriting AI streamlines this by automatically collecting and validating the necessary data, minimizing human intervention.

2. Credit Evaluation: Lenders assess the borrower’s credit history, income, and debt obligations to determine their ability to repay the loan. AI-powered models enhance traditional credit scoring methods by analyzing a wider range of data points and using predictive models to provide more accurate assessments.

3. Risk Assessment: The lender evaluates the potential risks of lending to the applicant. This step includes assessing the likelihood of default and other financial risks. Loan underwriting AI significantly improves this step by analyzing large datasets and using machine learning algorithms to offer a more detailed and accurate risk profile.

4. Verification of Information: All the provided information, such as employment status, income, and assets, is verified. AI-driven systems can cross-reference this data with external databases, reducing the time spent on manual verification.

5. Approval or Rejection: Based on the gathered data, credit evaluation, and risk assessment, the underwriter either approves or rejects the loan application. Loan underwriting AI helps speed up this process by automating decision-making for standard cases, allowing underwriters to focus on more complex applications.

6. Loan Offer & Terms: If approved, the lender presents the borrower with the loan terms, including the interest rate, repayment schedule, and other conditions. AI models can also dynamically adjust interest rates based on real-time risk assessments.

By incorporating AI into the loan underwriting process, lenders can make faster, more accurate decisions while providing a better experience for borrowers.

The Operational Benefits of AI in Loan Underwriting

The integration of artificial intelligence underwriting brings numerous advantages, transforming the speed, accuracy, and overall efficiency of the lending sector:

1. Increased Efficiency and Speed: AI automates traditionally time-consuming tasks in underwriting, greatly accelerating decision-making. With real-time data analysis, borrowers receive quicker responses, creating a more agile and streamlined lending workflow.

2. Enhanced Accuracy and Risk Assessment: AI-powered systems use vast datasets to identify patterns and assess risk factors, improving the accuracy of creditworthiness predictions. This precision enables financial institutions to make informed decisions, reducing the risk of defaults.

3. Personalized Decision-making: AI’s customization capabilities allow lenders to tailor decisions based on individual borrower profiles, including interest rates and loan terms. This personalization enhances the lending experience for a wide range of clients.

4. Cost Reduction: Automation of manual tasks through technologies like Robotic Process Automation (RPA) significantly reduces operational costs. AI-driven efficiency in resource management results in a more sustainable and cost-effective underwriting process.

5. Enhanced fraud detection: AI uses sophisticated algorithms to detect anomalies and identify potential fraud in loan applications. This advanced fraud prevention capability strengthens security, benefiting both lenders and borrowers.

6. Streamlined document processing: AI technologies such as Natural Language Processing (NLP) and Computer Vision optimize the analysis of unstructured data in loan applications, accelerating document processing and improving accuracy.

7. Increased Objectivity and Consistency: AI operates based on predefined rules, reducing the influence of human bias in lending decisions. By consistently applying algorithms, AI fosters fairness and objectivity across the decision-making process.

8. Scalability: AI-driven underwriting systems are highly scalable, efficiently handling large volumes of data and applications. This scalability is especially beneficial for financial institutions with growing loan portfolios, maintaining efficiency as the business expands.

9. Data-driven Insights: AI’s data analytics capabilities provide actionable insights, allowing lenders to make strategic decisions. This intelligence helps financial institutions identify trends, refine underwriting practices, and maintain a competitive edge.

10. Adaptability to Dynamic Conditions: AI’s ability to adapt in real-time to changing economic conditions ensures that underwriting models stay responsive to market trends. Retrieval Augmented Generation (RAG) allows continuous learning, making the system agile and adaptable to economic fluctuations.

11. Improved Customer Experience: Faster loan processing and personalized offerings lead to a better customer experience. Efficient and transparent underwriting builds trust with borrowers, strengthening the relationship between financial institutions and their customers.

12. Regulatory Compliance: AI systems can be programmed to ensure compliance with regulatory standards, reducing the likelihood of errors. Automated processes improve accuracy in adhering to legal requirements, addressing regulatory challenges faced by lenders.

Incorporating artificial intelligence underwriting not only addresses the limitations of traditional methods but also delivers an array of benefits that improve overall efficiency, reduce costs, and elevate customer satisfaction within the lending industry.

The Future of AI in Loan Underwriting

The future of AI loan underwriting offers promising developments as technology advances and financial institutions adopt advanced solutions. Below are key factors that will shape the future of AI in loan underwriting:

1. Expanded Use of Alternative Data: Financial institutions are set to use alternative data sources beyond traditional credit scores increasingly. These may include social media activity, online behaviors, and other non-conventional indicators, offering a more holistic view of an applicant’s financial habits.

2. Ongoing Regulatory Adaptation: Regulatory frameworks will continue to evolve to address the unique challenges posed by AI in loan underwriting. Governments and regulatory authorities will work together to establish guidelines that balance the advantages of AI with the protection of consumer rights, privacy, and fair lending practices.

3. Greater Emphasis on Education and Awareness: As reliance on AI grows, efforts to educate stakeholders, including borrowers, about how AI is utilized in loan underwriting will intensify. Clear communication and awareness initiatives will play a vital role in fostering trust in AI-powered financial systems.

4. Innovations in Explainable AI: Advancements in explainable AI will focus on enhancing transparency in understanding complex AI models. This will be key to gaining trust from regulatory bodies and the public, ensuring greater acceptance of AI in lending.

5. Cross-industry Collaboration: Collaboration between financial institutions, tech companies, and regulatory agencies will become more prominent, promoting the sharing of best practices and addressing common challenges in AI loan underwriting. This cooperative approach will lead to more ethical and robust AI implementation.

The future of AI loan underwriting will be defined by ongoing innovation, improved transparency, and a careful balance between automation and human insight. As technology progresses and regulatory structures evolve, AI will play an increasingly central role in creating an efficient, personalized, and responsible lending ecosystem.

How Can SoluLab Assist with AI in Loan Underwriting?

SoluLab, a leading AI development company, specializes in creating innovative AI-powered solutions that transform the loan underwriting process. Our team of experienced AI developers leverages advanced technologies such as Robotic Process Automation (RPA) and Retrieval Augmented Generation (RAG) to automate manual tasks, improve decision-making accuracy, and enhance risk assessment. By integrating AI into your loan underwriting system, we help streamline workflows, reduce processing time, and provide a more personalized experience for your clients, enabling your financial institution to remain competitive and agile in today’s market.

When you hire AI developers from SoluLab, you gain access to customized AI solutions tailored to your specific business needs. Whether you require assistance with implementing AI models for credit risk assessment or automating document processing through natural language processing (NLP), our team is ready to provide end-to-end support. With a proven track record of delivering advanced AI technologies, we ensure that your loan underwriting process is more efficient, accurate, and secure. Ready to transform your lending operations with AI? Contact us today to learn how we can assist you in integrating AI into your underwriting processes!

FAQs

1. How does AI improve the loan underwriting process?

AI enhances loan underwriting by automating manual tasks such as document processing, risk assessment, and data analysis. With AI’s ability to analyze large datasets in real time, lenders can make quicker and more informed decisions, resulting in faster approvals and reduced operational costs. AI also improves accuracy by assessing a borrower’s creditworthiness with predictive models that consider various risk factors.

2. What are the benefits of using AI for risk assessment in loan underwriting?

AI-powered risk assessment models analyze vast amounts of data, including non-traditional financial indicators, to predict a borrower’s likelihood of default more accurately. This reduces human error, enhances precision, and ensures that lending decisions are based on comprehensive data, improving both the approval process and portfolio management.

3. How can AI help financial institutions remain compliant with regulations?

AI systems can be designed to adhere to regulatory standards by automating compliance checks, ensuring that all required documentation is in place, and reducing the risk of human error. With AI’s ability to monitor and update regulatory changes in real-time, financial institutions can remain compliant while maintaining efficient loan processing.

4. What role does AI play in fraud detection during loan underwriting?

AI employs advanced algorithms to detect patterns and anomalies that may indicate fraudulent activities in loan applications. By continuously monitoring and analyzing data, AI can flag suspicious behavior and help prevent fraud, ensuring a safer and more secure lending environment for both lenders and borrowers.

5. How can SoluLab help integrate AI into my loan underwriting system?

SoluLab offers customized AI solutions that fit your specific loan underwriting needs. Our team of expert AI developers can assist in automating tasks, implementing AI models for risk assessment, and improving overall efficiency in your lending process. By partnering with us, you gain access to innovative AI technologies that can streamline your operations, reduce costs, and provide a better experience for your customers. Contact us to learn more about our AI development services.