AI risk management is the organized process of finding, reducing, and dealing with the risks that come with AI technologies. Implementing formal AI in finance risk management frameworks is a big part of this. It includes a mix of tools, practices, and concepts.

From chatbots to finding fraud, AI and ML are used in banks to not only automate tasks to help the front and back offices run more but also to improve the customer experience as well. In 2022, the global market for AI trust, risk, and security management was worth $1.7 billion. It is expected to hit $7.4 billion by 2032, a 16.2% compound annual growth rate (CAGR).

In this blog, we’ll help you understand what AI is in risk management, its benefits, future predictions, and challenges.

What is AI in Risk Management?

AI risk management is a suite of tools and practices deployed to protect organizations and end users from the risks of AI. It involves measuring the risks and implementing solutions to minimize them. As per the definition of AI risk, it can be minimized by reducing the likelihood or severity of the impact. Although it may resemble some software engineering best practices, AI risk management is entirely different.

According to NIST, as defined in their AI Risk Management Framework:

AI risk management is a component of responsible development and the use of AI systems. Responsible AI can help align the decisions about AI system design, development, and uses with the intended aims and values. AI risk management can encourage responsible uses and behaviors by pushing companies and the teams within them that create, test, and use AI to think more deeply about the situation and the unexpected good and bad effects that could happen—core concepts in responsible AI human centricity, social responsibility, and sustainability. Understanding and managing the risks of AI systems will help to enhance trustworthiness, and in turn, gain public trust.

Why do Companies Need AI in Risk Management?

Nowadays, companies face many risks which is why having AI is an essential tool to identify, assess, and mitigate potential threats with speed and accuracy.

1. Security Risk

Security risks arise when AI systems have vulnerabilities that attackers could exploit or users might unknowingly introduce. It leads to unintended outputs. These risks can involve attacks targeting the model itself, the data it processes, or the underlying software. Whether proprietary, commercial, or open-source, AI and ML in data integration models face threats like supply chain risks, data poisoning, prompt injection, personal information leaks, and even theft of the model itself.

2. Ethical Risk

Ethical risks occur when an AI system’s behavior clashes with societal norms, legal requirements, or governance policies. These issues often stem from biases in training data or evolve from new patterns in production data over time. Common examples include producing biased predictions, generating toxic or offensive outputs, or responding in ways that display prejudice or exclusion.

3. Operational Risk

Operational risks surface when an AI model’s predictions deviate from expected outcomes. These issues might be caused by phenomena such as data drift, hallucinated results, corrupted datasets, unusual inputs, or broken data pipelines. Silent failures pose a unique challenge—they don’t cause the model to crash but subtly degrade its performance, making them hard to spot while impacting downstream processes.

Use Cases of AI in Risk Management

AI is organizing and handling risks across industries. From banking to healthcare, artificial intelligence is making risk management more accurate, efficient, and proactive. Here’s how AI use cases is improving various aspects of risk management:

1. Fraud Detection and Prevention in Banking: AI analyzes transaction patterns in real-time, spotting unusual activities that might signal fraud. For instance, if your card is suddenly used for multiple high-value purchases in different locations, AI algorithms can identify it immediately. Banks now catch fraudulent transactions faster and more accurately, saving millions in financial losses.

2. Credit Scoring and Assessment for Loan Disbursement: AI in banking looks beyond traditional credit scores by analyzing various data points like spending patterns, income stability, and bill payment history. This helps banks make smarter lending decisions and reduces the risk of defaults while making loans more accessible to people with limited credit history.

3. Market Risk Analysis: AI systems process vast amounts of market data, news, and social media sentiment to predict market trends and potential risks. This helps traders and investors make informed decisions by identifying early warning signs of market volatility or downturns.

4. Anti-Money Laundering Compliance: AI monitors transactions and customer behavior to detect suspicious patterns that might indicate money laundering. It can process millions of transactions quickly, identifying complex networks of suspicious activities that human analysts might miss.

5. Cybersecurity Threat Detection: AI automation continuously monitors network traffic and user behavior to spot potential cyber threats. It can identify unusual login attempts, detect malware, and prevent data breaches before they happen, learning from each new threat to improve security.

6. Supply Chain Risk Prediction: AI analyzes supplier data, weather patterns, political events, and market conditions to predict potential supply chain disruptions. This helps companies take preventive action and maintain smooth operations by identifying alternative suppliers or routes in advance.

7. Drug Safety: AI helps pharmaceutical companies predict potential drug side effects by analyzing clinical trial data and patient records. AI in Drug Discovery can identify dangerous drug interactions and adverse reactions earlier in the development process, making medication safer.

8. Vehicle Diagnostics: AI monitors vehicle performance data to predict potential mechanical failures before they happen. It analyzes sensor data from various car components to alert drivers about maintenance needs, preventing accidents and breakdowns.

9. Risk Management in Insurance: Insurance companies use AI to assess risk more accurately when setting premiums. It analyzes factors like driving habits for car insurance or lifestyle for AI in healthcare insurance, offering fairer rates based on actual risk levels.

10. Customer Churn Prediction: AI identifies signs that customers might leave by analyzing their behavior patterns, complaints, and engagement levels. This helps companies take proactive steps to keep valuable customers happy and address issues before they lead to churn.

11. Third-Party Vendor Risk Evaluation: AI evaluates vendor reliability by analyzing their financial health, compliance records, and performance history. It continuously monitors news and updates about vendors to alert companies about potential risks in their partner network.

12. Employee Misconduct Detection: AI monitors workplace communications and activities to identify potential misconduct like insider trading or harassment. It can spot unusual patterns in emails, trades, or access logs that might indicate problematic behavior while respecting privacy guidelines.

How is AI in Risk Management Different from Traditional Software Risk?

AI models aren’t just about the “code” behind them—they’re equally shaped by the data they’re trained on. In traditional software, developers rely on clearly defined rules and logic to transform inputs into outputs. AI, on the other hand, learns these rules directly from large datasets instead of requiring them to be manually programmed. This unique ability to “learn” introduces a challenge: since users can’t directly see how the model arrives at decisions, testing becomes more complex. Checking a handful of examples or edge cases is no longer enough to guarantee that the model works correctly. Instead, it requires robust evaluation using comprehensive datasets to ensure it can handle a vast range of possible data scenarios.

Metrics for AI Are Different From Traditional Software Testing

Evaluating adaptive AI models calls for a completely different approach compared to testing regular software. Unlike traditional programs, which can often achieve near-perfect functionality, AI works with noisy, imperfect data, making 100% accuracy nearly impossible in most cases. For instance, classification models are typically assessed using metrics like accuracy, while traditional software might focus on usability or functionality. However, relying solely on top-level metrics can be misleading, as AI models can fail in unexpected ways across various dimensions.

The Many Modalities and Challenges of AI

AI spans a wide range of tasks and applications, from simple binary classifications in spreadsheets to complex, language-based outputs from generative AI tools. Each type of AI has its own set of unique challenges and potential points of failure. Moreover, since Generative AI in Insurance often automates critical decision-making processes, additional testing is required. These tests should examine bias and fairness within the model and ensure sensitive information is not improperly used or exposed.

Why AI Demands a New Approach to Risk Management? The unique nature of AI introduces challenges that traditional methods can’t address. From ensuring fairness to protecting privacy and maintaining reliability, managing the risks associated with AI requires fresh thinking and innovative strategies.

How Does AI in Risk Management Help Organizations?

While the AI in customer service risk management process can look different across various organizations, there are some core benefits that most companies can expect if they successfully implement AI risk management practices.

1. Enhanced Security

AI risk management is great for boosting an organization’s security, particularly in the cybersecurity.

By regularly assessing risks and conducting audits, organizations can spot potential vulnerabilities throughout the entire AI lifecycle. Once risks are identified, the next step is implementing strategies to address or eliminate them. This could include technical solutions, like strengthening data security or enhancing model robustness, as well as organizational changes, such as creating ethical guidelines and tightening access controls.

Taking a more proactive approach to threat detection and response helps companies tackle risks before they blow up into bigger problems, reducing the chances of data breaches or the impact of cyberattacks.

2. Improved Decision-making

AI risk management also helps organizations make better decisions overall. By blending both qualitative and quantitative data, including statistical analysis and expert opinions, companies get a clearer picture of their potential risks. This well-rounded view allows organizations to prioritize the highest risks and make smarter decisions about deploying AI—striking a balance between innovation and risk control.

3. Regulatory Compliance

With a growing focus on data protection, various global regulations have popped up, such as GDPR, the California Consumer Privacy Act (CCPA), and the EU AI Act.

Failing to comply with these laws can result in major fines and legal issues. AI risk management can help companies stay compliant, which is especially important as regulations around AI change just as quickly as the technology itself.

That’s why businesses turn to the best consent management platforms to meet transparency and data handling requirements. Usercentrics, a leading provider in this space, also offers insights into how emerging regulations like the EU AI Act intersect with privacy and consent obligations

4. Operational Resilience

AI risk management helps organizations keep things running smoothly by quickly addressing potential risks tied to AI systems in real-time. It also promotes long-term sustainability by encouraging clear management practices and methods for using AI responsibly.

5. Increased Trust and Transparency

AI risk management is all about making AI systems more ethical by putting trust and transparency at the forefront.

This usually involves bringing together various stakeholders—like executives, developers, data scientists, users, policymakers, and even ethicists. Having such a diverse group ensures AI systems are built and used with responsibility in mind, considering everyone’s interests.

6. Ongoing Testing, Validation, and Monitoring

Regular testing and monitoring are crucial to tracking an AI system’s performance and catching emerging threats early. This helps organizations stay on top of regulatory requirements and address risks before they turn into bigger problems, ultimately minimizing the impact of potential threats.

Applications and Key Benefits of AI in Risk Management

Artificial intelligence is making waves across various industries, proving to be a business operation. When it comes to risk management, AI application solutions and machine learning (ML) have become essential tools for boosting efficiency, streamlining processes, and cutting costs. Their ability to process and analyze massive amounts of unstructured data quickly—with minimal human involvement—sets them apart. This technology has also empowered banks and financial institutions to reduce operational and compliance expenses while enhancing accuracy in credit decision-making.

AI and ML solutions excel in generating precise, real-time data. This enables financial institutions to gain deeper insights into customer behavior, craft effective strategies, and minimize potential losses.

In risk management, AI/ML-driven tools also play a crucial role in tasks like model validation, back-testing, and stress testing, as mandated by global regulatory bodies. Here are some key advantages they bring to the table:

1. Superior Forecasting Accuracy

Traditional regression models often fall short in capturing complex, non-linear relationships between the economy and a company’s financials, especially under stress. Machine learning, on the other hand, excels in forecasting by recognizing these intricate patterns and relationships, resulting in more accurate predictions.

2. Optimized Variable Selection Process

Risk models for decision-making rely heavily on selecting the right variables, which can be a time-consuming process. With the support of Big Data analytics, ML algorithms can quickly shift through enormous datasets and identify a comprehensive set of variables. This leads to the creation of robust, data-driven models ideal for stress testing.

3. Richer Data Segmentation

Granular and detailed data segmentation is crucial for adapting to shifts in portfolio composition. ML algorithms allow for advanced segmentation by analyzing multiple attributes simultaneously. Unsupervised ML techniques, such as clustering, enhance accuracy by combining distance and density-based approaches, delivering more insightful and reliable results.

Incorporating AI and ML into risk management not only the decision-making process but also sets the foundation for long-term resilience and adaptability.

Challenges of AI in Risk Management

Even with all these advantages, there are two challenges when it comes to using AI in risk management.

1. Cost Concerns: AI can be pricey. Processing and analyzing massive volumes of data doesn’t come cheap, even with cloud-native services. The advanced AI tools and platforms essential for risk management often carry hefty price tags, making affordability a common hurdle.

2. Privacy Issues: Data privacy is another big concern. Risk managers and security experts worry about how personal data might be handled by AI applications and machine learning tools. If this data is misused, companies could face compliance breaches, legal troubles, or damage to their reputation. To prevent this, organizations must implement strict data protection measures like encryption, secure data transport, tokenization, or obfuscation for any information uploaded to the cloud.

Although many mainstream cloud storage providers include these safeguards, the same can’t always be said for specialized AI platforms like Amazon SageMaker, Amazon Rekognition, Azure AI, or Google Cloud’s Vertex AI. For instance, these services may not fully support existing encryption key management systems, which can increase the risk of data exposure. Furthermore, the physical location of sensitive data used in AI operations often raises red flags around regulatory compliance.

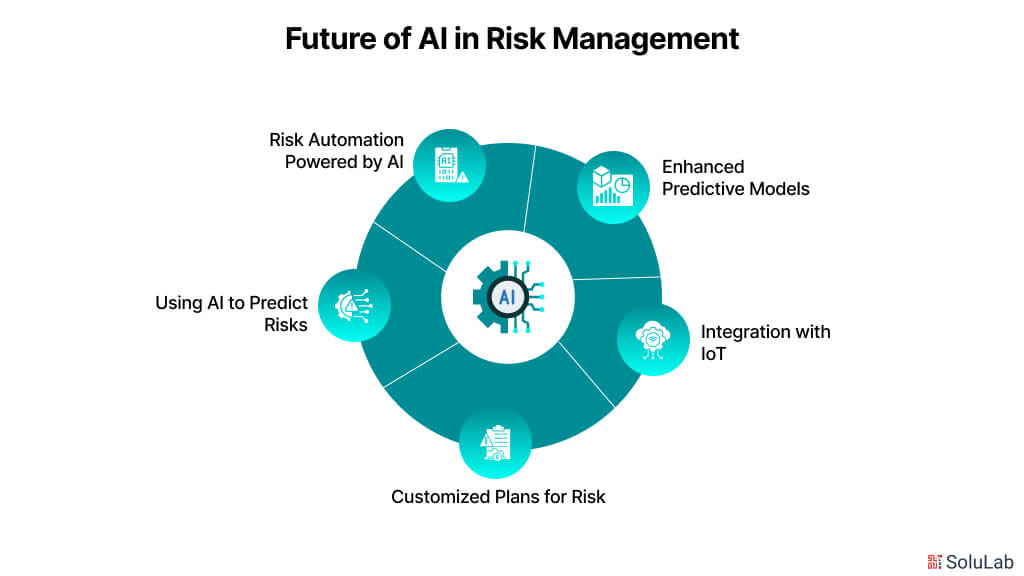

Future of AI in Risk Management

The future of top AI development companies in risk management is very exciting. It’s all about making decisions that are better, faster, and more accurate. Let’s look at some innovations that are changing the business and making it better:

1. Enhanced Predictive Models: The next level of forecasting models is being reached with AI. These models can better guess risks than ever before because they can look at huge amounts of data and find trends that people might miss. This means that companies can get ready for problems before they happen.

2. Integration with IoT: AI and the Internet of Things (IoT) work well together. Companies can keep an eye on risks by combining AI with IoT devices. This is true whether they are keeping an eye on workplace equipment or cyber threats. Being able to get comments right away helps solve problems right away.

3. Customized Plans for Risk: No longer are there answers that work for everyone. AI lets businesses make risk management plans that are specific to their needs, taking into account things like customer data, business goals, and markets.

4. Using AI to Predict Risks: AI is changing forecasting by giving us correct information that we can use right away. Tools that use AI to make predictions about market trends and evaluate supply chain risks help businesses stay ahead of the curve.

5. Risk Automation Powered by AI: Risk control is becoming easier thanks to automation. AI can do boring tasks like checking for compliance or finding oddities in data, so people can work empowered in more important tasks.

Conclusion

Artificial Intelligence is changing how businesses operate, offering exciting opportunities and possibilities. However, as executive teams begin to explore AI’s potential, they are also becoming more aware of the new risks that come with it.

Moreover, the traditional methods for assessing and managing risk may not be enough to keep the adoption of AI that leaders are aiming for. To ensure they can use AI in a way that’s ethical, legal, and financial, companies need to identify and implement a strong risk management strategy. This will give them the control they need to utilize AI’s challenges effectively.

SoluLab helped InfuseNet overcome challenges in AI model integration, intuitive interface design, and data security. By developing a drag-and-drop Flow interface and data import from various sources, InfuseNet enables businesses to create personalized AI applications, boosting productivity and ensuring data privacy throughout the process. SoluLab an AI development company has a team of experts to help you solve your business problems so, contact us today to discuss further.

FAQs

1. What are the challenges of implementing AI in risk management?

Challenges include data privacy concerns, integration with legacy systems, ensuring model accuracy, addressing bias in AI models like NLP applications, and the need for skilled professionals to manage AI tools.

2. How does AI help in fraud detection?

AI can analyze transaction patterns, detect anomalies, and flag suspicious activity in real time, improving fraud detection accuracy and reducing financial losses.

3. How does AI manage cybersecurity risks?

AI detects cybersecurity threats by analyzing network traffic, identifying unusual behavior, and responding to potential threats before they cause damage, providing a proactive security approach.

4. Which industries benefit from AI in risk management?

Industries like banking, insurance, healthcare, cybersecurity, and supply chain management use AI for fraud detection, credit scoring, cybersecurity threat detection, and predictive risk assessments.

5. What is the AI risk management framework?

The AI risk management framework involves identifying and assessing risks, collecting relevant data, training AI models, deploying risk mitigation strategies, and continuously monitoring performance. It ensures the ethical, legal, and secure use of AI while adapting to evolving risks and threats.