Stock trading is becoming smarter, faster, and more efficient than before. AI-powered systems can scan huge amounts of data and identify patterns and AI trends that traders may miss for weeks. AI can help traders optimize strategies and make better decisions with predictive analytics. AI is changing stock trading along with high-frequency trading and robo-advisors.

However, many traders still face difficulties like information overload. Even traders are overwhelmed by market data. Trading is emotional, and fear and greed can lead to actions that get profitability. From 2024 to 2033, the global AI in trade market will rise 10.7% to USD 50.4 billion.

In this blog, we’ll explore how AI can solve these problems and make stock trading easier and more effective for everyone. We’ll discuss AI in stock trading types, use cases, risks, and how traders might use it to compete.

What Is AI Trading?

Using AI and machine learning to look at market trends and make deals instantly is what responsible AI trading is all about. Because it uses data-driven processes, it doesn’t depend on feelings and only makes decisions based on logic. This is what makes AI trade unique:

- Market Analysis: It looks for patterns and changes in huge amounts of market data, news, and economic signs.

- Automated Actions: Trades are carried out instantly based on rules or strategies that have already been set up. This saves time and effort.

- Machine Learning: These systems are always getting better because they learn from new data with machine learning.

- Learning about AI trading is important if you want to use technology in the business world. It changes the way trades are made because it is so fast, accurate, and efficient.

To get the most out of it, you need to know both the tools and the risks. As AI keeps getting better, staying up-to-date and adaptable will help you use it to its fullest in your trade.

How AI Stock Trading Works?

Adaptive AI trading companies leverage tools to make sense of the financial market. These tools analyze data to predict price movements, uncover the reasons behind fluctuations, execute trades, and keep a close watch on the constantly shifting market landscape.

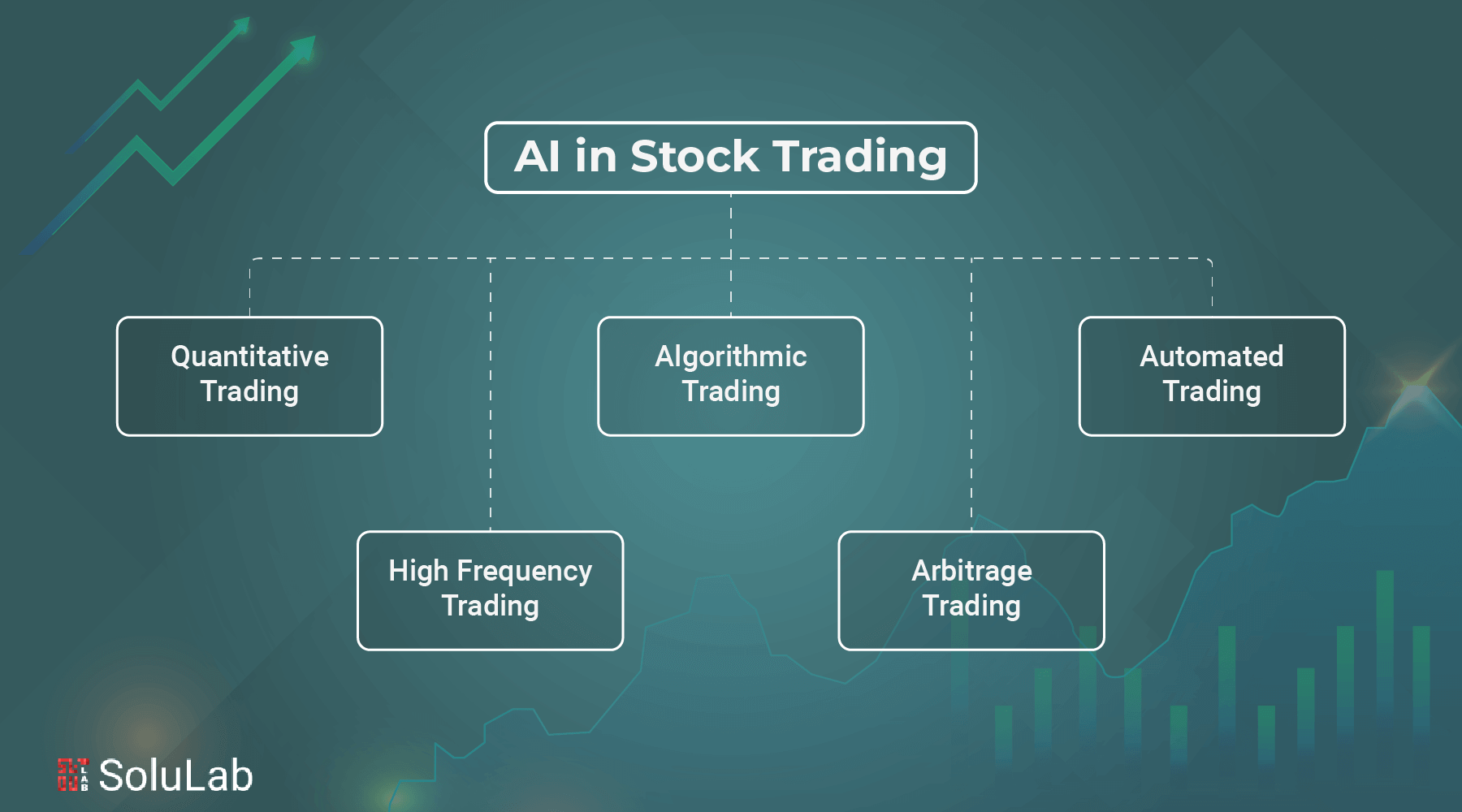

Here are some popular types of AI-driven trading:

1. Quantitative Trading (Quant Trading): This method uses advanced mathematical models to study stock prices and trading volumes, pinpointing the best investment opportunities. It’s particularly favored for large-scale transactions, often involving hundreds of thousands of shares.

2. Algorithmic Trading (Algo-Trading): In this approach, algorithmic trading relies on historical data to guide trading decisions. By applying machine learning and deep learning, these systems assess market trends and financial news to execute trades in smaller, calculated portions.

3. High-Frequency Trading (HFT): HFT involves buying and selling large quantities of stocks at lightning speed. It’s powered by sophisticated computers capable of analyzing multiple markets simultaneously and executing millions of trades in mere seconds, offering a significant edge to investors.

4. Automated Trading: Also known as AI trading, this strategy uses pre-set instructions to carry out trades. While similar to algorithmic trading, it focuses on simpler trading strategies.

5. Arbitrage Trading: This strategy takes advantage of price differences across markets. AI tools like crypto arbitrage bots scan multiple markets in, spotting inconsistencies and enabling investors to buy low in one market and sell high in another, earning small but consistent profits.

Benefits of AI Stock Trading

Here are some benefits of AI trading mentioned below:

- Reducing Research Time and Boosting Accuracy: AI trading simplifies research and enables faster, data-driven decision-making. This frees up investors to focus more on managing trades and advising their clients instead of deep research. According to a survey, traders using algorithmic strategies saw their productivity jump by 10%. With AI using financial data, decisions become more precise, reducing human errors significantly.

- Spotting Patterns: AI trading systems utilize sentiment analysis—an approach that processes language to detect patterns in subjective content. By analyzing news and social media trends, these systems can predict market swings and provide insights into potential investor behavior.

- Better Risk Management: AI tools improve data collection and build predictive models based on past trends. Investors can use these insights to gauge possible outcomes, review their strategies, and adjust accordingly. Automated investing powered by AI in risk management ensures that decision-making is logical and free from emotional biases. This application of AI helps in creating a steady and reliable approach to trading, ultimately enhancing financial outcomes.

- Cutting Costs: While traditional firms may need large teams of brokers, analysts, and advisors, AI trading can handle repetitive tasks more efficiently. While there are upfront costs for implementation, over time, firms save significantly on overhead. Plus, AI systems operate around the clock, continuously monitoring the stock market.

AI Trading Tools

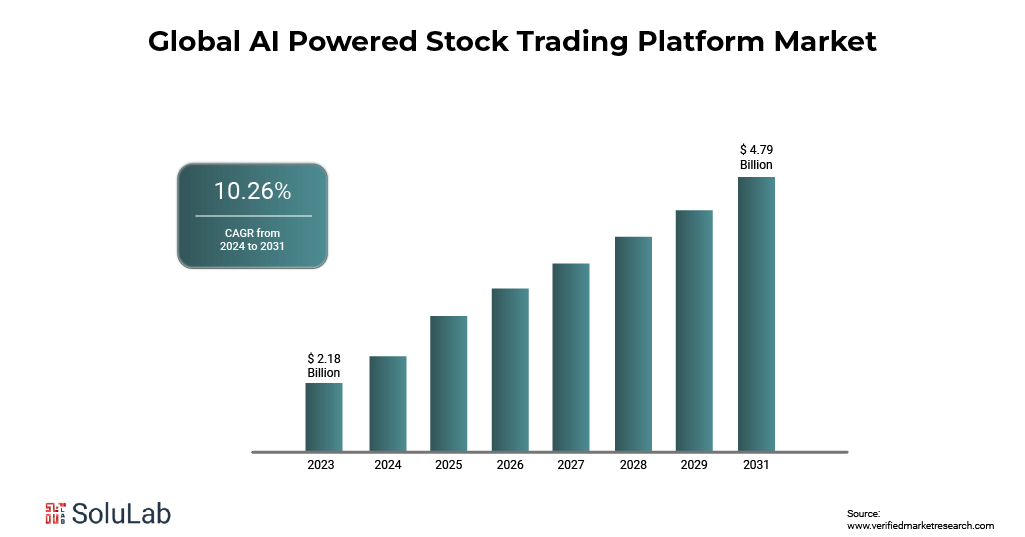

An AI-Powered Stock Trading Platform market is expected to increase at a compound annual growth rate (CAGR) of 10.26% from 2024 to 2031, from its 2023 valuation of USD 2.18 billion to USD 4.79 billion. When it comes to AI-driven trading, investors have plenty of options to explore. Let’s break it down:

1. Portfolio Managers

These AI tools are like having a smart assistant for your investments. They automatically pick assets to build a portfolio and keep an eye on it, making changes when needed. You can also get financial advice from them—just share your goals and risk tolerance, and the algorithm takes it from there, offering tailored guidance for your financial journey.

2. Trading Robots

Trading are robots programmed with “if/then” logic, so they only execute trades under specific conditions. Once you set up the software on your trading platform, it can run independently, following the rules you’ve put in place without needing constant supervision.

4. Signals

AI signals act like an alert system. They scan the market and notify you through the NLP application when stocks meet certain criteria. Unlike trading robots, these tools don’t make trades for you—they just send alerts. You’ll get a notification via email, text, or app, and it’s up to you to decide whether to act on the information.

5. Strategy Builders

For those who like customization, strategy builders are the way to go. You can train these tools to follow your specific rules and even test how they would have performed in past market scenarios. By simulating trades with virtual funds, you can tweak your strategies before putting them into action in the market. It’s a great way to refine your approach and build confidence in your trading plan.

What are AI Trading Signals in AI-Powered Stock Trading?

AI trading signals are indicators generated by artificial intelligence systems to guide stock trading decisions. These signals are derived from the analysis of large amounts of market data, such as price movements, volume trends, news sentiment, and even social media. The AI-powered chatbot systems use machine learning algorithms to identify patterns in the data, which can predict future price movements and help traders make informed buy or sell decisions.

In AI-powered stock trading, these signals are valuable because they:

- Analyze Large Data Sets: An AI assistant can process much more data than a human trader, identifying trends and patterns that might not be immediately obvious.

- Generate Insights: AI systems can react to market changes, giving traders up-to-the-minute advice on when to act.

- Reduce Emotional Bias: Unlike human traders, AI doesn’t let emotions drive decisions, leading to more consistent and rational trading strategies.

- Adapt to Market Changes: As markets evolve, AI systems continuously learn and adapt, refining their trading strategies over time.

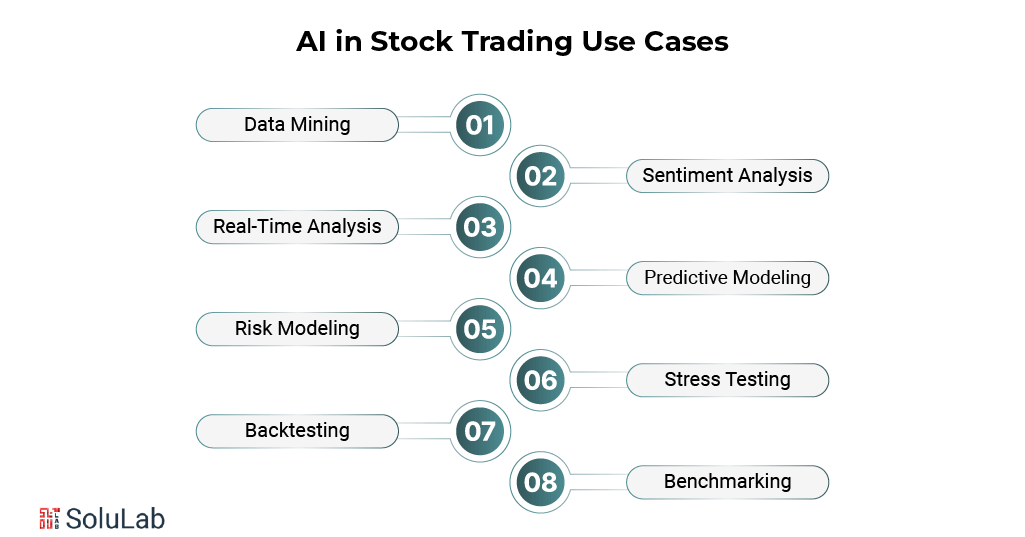

AI in Stock Trading Use Cases

While AI can handle trades independently, it also supports various stages of the investing journey. Here’s how:

1. Data Mining

Think of data mining as gathering and analyzing mountains of information to uncover patterns and trends. In stock trading, AI uses cases in historical data to uncover insights about how markets have behaved in the past. Investors can rely on these insights to make better-informed decisions when trading.

2. Sentiment Analysis

AI doesn’t look at stock charts it also scans the web! Sentiment analysis examines everything from social media chatter to news articles and forum discussions about the financial world. This gives investors a better understanding of market sentiment, helping them make more thoughtful trading decisions.

3. Real-Time Analysis

Analysis is all about processing data the moment it’s available. AI-powered trading tools can shift through massive amounts of information to identify trends and opportunities. Investors can act quickly on these insights, giving them an edge in the market.

4. Predictive Modeling

By studying past data, predictive modeling helps forecast future trends. In stock trading, AI processes millions of historical transactions to predict market behavior under similar conditions. This gives investors the foresight to plan their strategies while accounting for potential market swings.

5. Risk Modeling

Risk modeling takes predictive analysis a step further. Using historical data, AI creates scenarios to estimate the likelihood of various events. Investors can assess these possibilities to evaluate investment risks, refine their portfolios, and steer clear of common pitfalls. Learn more about credit risk models with machine learning to understand how these technologies enhance predictive accuracy and decision-making.

6. Stress Testing

Ever wondered how your strategy would hold up under pressure? Stress testing uses simulations or historical data to evaluate investment strategies against different scenarios. This helps investors spot weaknesses and take steps to strengthen their financial game plan, ensuring they’re prepared for uncertainties.

7. Backtesting

Backtesting lets investors test an investment strategy on historical data before putting it into action. Essentially, it’s like letting AI “practice” with virtual money to see how the strategy performs. Investors can tweak their approach based on the results before committing actual funds.

8. Benchmarking

Benchmarking involves comparing your investment strategy to industry standards or stock market indices. AI tools can help

Risks of AI in Stock Trading

AI has changed the way we deal with the financial markets. It’s important to know the risks, though, before jumping in.

- Systematic vulnerabilities: AI trade systems can go wrong, especially when markets act differently than how the system was taught to work. For instance, generative AI application systems might not be able to change during sudden market crashes like the Flash Crash of 2010, which would lead to bigger losses.

- Data Security: AI trading depends on methods and data that are kept secret. This information could be stolen or used in the wrong way if it isn’t kept safe. A breach could make your trade methods public, which could cost you money. For a better understanding of financial instruments, check out Asset-Backed Securities (ABS) vs. Mortgage-Backed Securities (MBS) and see how they compare.

- Regulatory Challenges: Laws about dealing with AI are always changing, so what’s okay today might not be tomorrow. Because of new rules, you may have to change your method or stop using some strategies.

- Market Manipulation: By doing things like placing and canceling big orders, some traders try to trick AI systems. This is called “spoofing.” If your AI isn’t set up to spot these tricks, this could lead to bad trades.

- Overfitting: Overfitting is when an AI does well with historical data but not with live trading. It’s like studying old test results instead of understanding the ideas. To keep from losing money, your AI needs to change with the times.

It’s not enough to just use smart tools when dealing with AI; you also need to understand the risks and handle them wisely. To stay on track, keep your system safe, follow the rules, and look over your plan often.

Conclusion

AI can spot minor market patterns and handle large volumes of data in milliseconds. Traders can see market trends better than humans by analyzing emotions across social media, news sites, and financial information.

The right mix is essential to AI-powered trading. AI can boost your investment approach, but it shouldn’t replace human judgment and basic analysis. The most successful traders employ AI technologies to improve their decision-making while staying mindful of market fundamentals.

Start slowly, learn your tools, and diversify your risk management while employing AI-powered trading. The future isn’t about handing over control entirely to AI. Human understanding and artificial intelligence will shape trading’s future.

SoluLab helped AI-Build, a construction tech company, to improve CAD product development. SoluLab implemented generative AI and ML solutions to automate design processes, enhance accuracy, and ensure scalability. Overcoming challenges in data management and AI integration, SoluLab’s tailored approach enabled AI-Build to boost productivity and streamline operations in the CAD space. SoluLab an AI development company has a team of experts to solve your business concerns and problems contact us today to discuss further.

FAQs

1. What are AI-based Stock Trading Platforms in India?

AI-based stock trading platforms in India use machine learning algorithms and advanced data analysis techniques to assist traders in making decisions. These platforms provide data, automate trades, and offer predictive insights based on historical market trends. Popular Indian apps and platforms like Upstox, Zerodha, and Groww are beginning to integrate AI and machine learning tools to enhance their trading services. These AI features aim to optimize trading strategies, improve decision-making, and reduce human bias.

2. How can Beginners Use AI for Stock Trading?

Beginners can use AI for stock trading by starting with AI-powered trading apps or platforms that offer user-friendly interfaces. These platforms analyze market data and provide trading signals, guiding beginners on buying or selling stocks. Most AI tools are designed to be intuitive and require minimal setup, making them accessible to beginners. By following the AI’s recommendations, beginners can make more informed decisions, while some platforms also allow automated trading for hands-off investment management.

3. Is it Legal for AI to Trade Stocks?

Yes, using AI for stock trading is legal. However, financial institutions must follow all relevant regulations when implementing AI-driven trading strategies. For individuals, it’s essential to be aware of the risks associated with using AI tools for trading, as they may not always guarantee success.

4. Can AI be Used to Predict Stocks?

AI can indeed help predict stock movements with a high level of accuracy. However, those relying on generative AI applications for stock predictions should be cautious about relying on the historical data and algorithms that drive these predictions, as they may not always capture future market shifts.

5. How will AI Affect Stock Trading?

AI will revolutionize stock trading by enhancing decision-making through data analysis and increasing speed, accuracy, and efficiency. It can optimize strategies but also introduces risks like over-reliance on algorithms and data inaccuracies.