In the cryptocurrency market, traders face constant challenges managing risk and maintaining portfolio stability. Traditional cryptocurrencies, while innovative, often see price changes that can lead to substantial losses. Over 27.5 million active users engage with stablecoins, with transaction volumes growing by 50% year on year.

However, this is why having automated systems like stablecoins – digital assets designed to maintain a stable value relative to a reference asset, is crucial, typically the US dollar. But what happens when we combine the stability of stablecoins with the power of blockchain technology and artificial intelligence?

In this blog, we’ll explore what are AI-powered stablecoins, and what role they play in the crypto ecosystem. We will also explore its benefits, challenges, operational mechanisms, and associated costs to help you understand their transformative potential in digital finance.

What are AI-powered Stablecoins?

AI-powered stablecoins provide stability and security. Stablecoins are cryptocurrencies that seek to tie their market value to an external reference. Stablecoins are superior to volatile cryptocurrencies as a means of exchange.

These digital assets leverage machine learning and advanced analytics to maintain their peg-to-reference assets more efficiently than their conventional counterparts.

In a crypto market known for its extreme volatility, where prices can fluctuate by double-digit percentages within hours, Decentralized finance and AI-powered stablecoins offer a haven of relative calm. For traders seeking to preserve wealth or execute strategies without the constant worry of market swings, these innovative assets provide a compelling solution.

What are the Popular AI-powered stablecoins?

The blockchain platform integration of AI into stablecoin technology has led to several innovative projects reshaping the cryptocurrency market. Here are some notable examples:

-

SingularityNET (AGIX)

While not a stablecoin, SingularityNET’s technology has been instrumental in developing AI-powered stability mechanisms for various digital assets. Its neural networks and machine learning algorithms help predict market movements and optimize collateral management. The platform’s AI marketplace enables developers to integrate multiple AI tools into their stablecoin projects.

-

DAI

Though traditionally algorithmic, DAI has incorporated AI elements to enhance its stability mechanisms and risk assessment capabilities. Its smart contracts now utilize machine learning models to predict market volatility and adjust collateral requirements accordingly. The system also employs AI for flash crash prevention and automated liquidation protection.

-

FRAX

FRAX combines algorithmic and collateralized approaches with AI-driven market analysis to maintain its peg. Its fractional-algorithmic protocol uses machine learning to dynamically adjust the collateral ratio based on market conditions. The system also employs neural networks for price prediction and risk assessment.

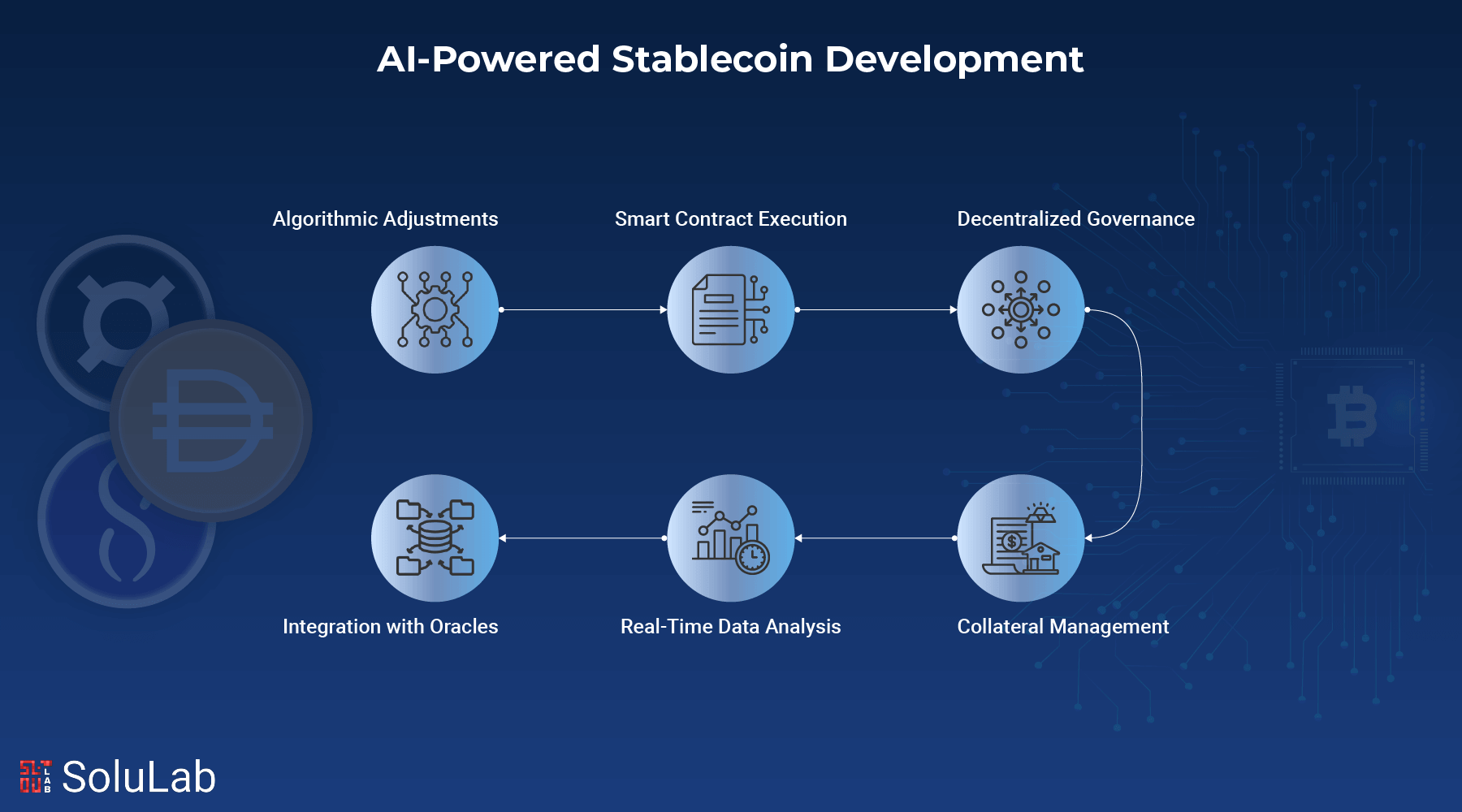

How AI-Powered Stablecoins Operate?

Stablecoins rely on artificial intelligence to control and preserve their value. Unlike traditional stablecoins, which rely on manual adjustments or fixed reserves, AI-powered systems constantly monitor market data, trends, and even external factors such as global financial news. This allows them to make real-time choices and keep the coin steady.

1. Algorithmic Adjustment

AI systems continuously monitor market conditions and automatically adjust token supply to maintain price stability. These adjustments occur through neural networks that analyze multiple market indicators simultaneously, including trading volume, price movements, and market sentiment. The AI can predict potential price changes and initiate corrective measures before significant fluctuations occur.

2. Smart Contract Execution

Intelligent protocols manage collateral, minting, and burning of tokens based on market conditions and user demand. The AI systems optimize gas fees, transaction timing, and execution parameters to ensure efficient operations. Machine learning models continuously improve contract execution by learning from historical transaction patterns.

3. Decentralized Governance

AI assists in governance decisions by analyzing market trends and user behavior patterns. The system can propose optimal parameters for key protocol decisions and help evaluate the potential impact of governance proposals in decentralized exchanges (DEXs). Advanced natural language processing helps analyze community feedback and discussions.

4. Collateral Management

Machine learning algorithms optimize collateral requirements and composition based on market conditions. The AI continuously evaluates different collateral assets’ risk profiles and suggests portfolio rebalancing when necessary. Real-time monitoring ensures collateral remains sufficient during market stress.

Read Blog: Stablecoin Development on Solana

5. Real-Time Data Analysis

AI systems process market data to make informed decisions about stability mechanisms. This includes analyzing on-chain metrics, social media sentiment, macroeconomic indicators, and cross-chain data. The systems can identify correlations and patterns that might affect stablecoin stability.

6. Integration with Oracles

Advanced AI models work with Oracle networks to ensure accurate price feeds and market data. The systems can detect and filter out anomalous data points and maintain stability during Oracle outages or attacks. Machine learning helps aggregate data from multiple sources for more reliable price discovery.

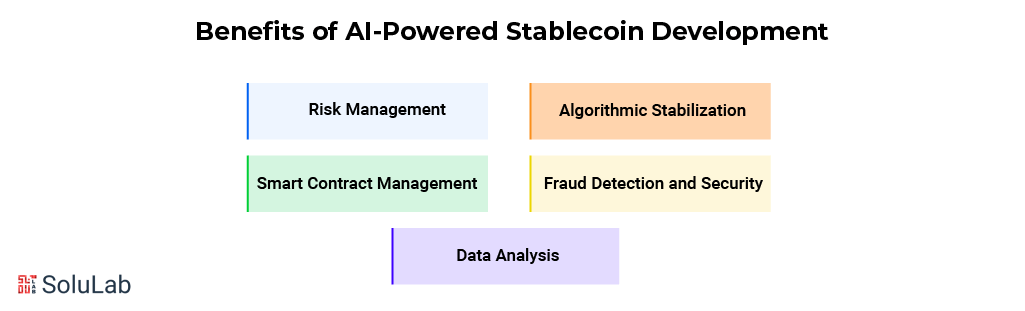

Benefits of AI-Powered Stablecoin Development

Stablecoins enhanced by artificial intelligence offer unprecedented stability and security for digital assets. Here are the key benefits they bring to the cryptocurrency ecosystem:

- Risk Management: AI algorithms continuously monitor market conditions and adjust parameters in real time, significantly reducing the risk of de-pegging events. Machine learning models can predict potential market stress and implement preventive measures before issues arise.

- Algorithmic Stabilization: Advanced AI systems maintain price stability through sophisticated mathematical models that automatically adjust supply and demand. These systems can process vast amounts of market data to make more accurate and timely adjustments than traditional algorithmic stablecoins.

- Smart Contract Management: AI enhances the efficiency and security of Solana smart contracts by automating complex operations and identifying potential vulnerabilities before they can be exploited. This leads to more reliable and secure stablecoin operations.

- Fraud Detection and Security: Machine learning algorithms excel at detecting suspicious patterns and potential security threats, providing an additional layer of protection for stablecoin users and their assets.

- Data Analysis: AI systems process and analyze market data in real time, enabling better decision-making for stability mechanisms and risk management protocols.

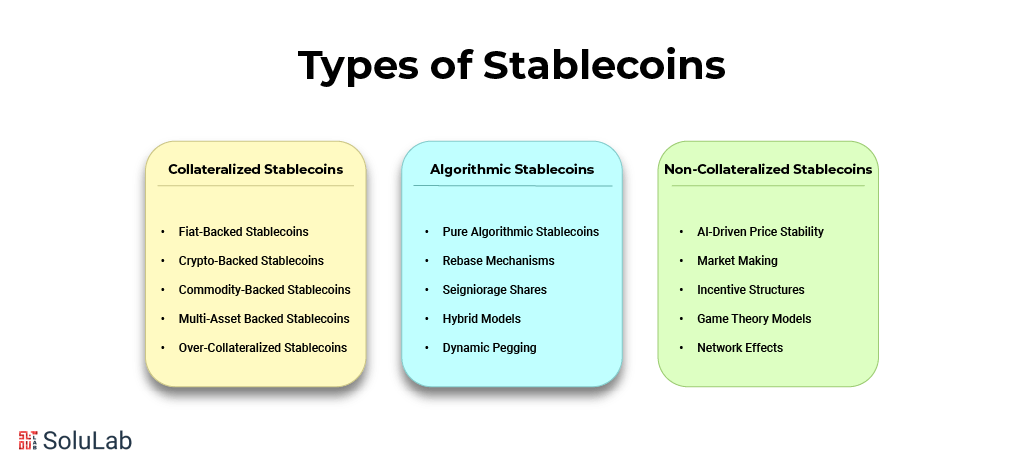

Types of Stablecoins

Stablecoins are a special type of cryptocurrency designed to keep their value stable, unlike regular cryptocurrencies that can swing wildly in price. There are three main types of stablecoins, each with its unique way of maintaining stability.

1. Collateralized Stablecoins

Collateralized stablecoins are a type of cryptocurrency coin that derives their value from tangible or digital assets held as collateral. These stablecoins are designed to maintain a stable price, making them a reliable option for everyday use or investments.

- Fiat-Backed Stablecoins: These are supported by reserves of traditional currencies like the US dollar. Examples include USDT and USDC, which rely on fiat currency to maintain their value.

- Crypto-Backed Stablecoins: Collateralized by other cryptocurrencies, these stablecoins, such as DAI, use over-collateralization to handle price volatility in the backing assets.

- Commodity-Backed Stablecoins: These are linked to tangible assets like gold or real estate, providing a stable and asset-backed value.

- Multi-Asset Backed Stablecoins: These use a combination of different assets as collateral, spreading risk and enhancing stability.

- Over-Collateralized Stablecoins: These maintain an excess of collateral compared to the stablecoin’s issued value, offering added security and reliability.

2. Algorithmic Stablecoins

Algorithmic stablecoins represent a more innovative approach to maintaining price stability by relying on automated mechanisms and algorithms instead of direct collateral.

- Pure Algorithmic Stablecoins: These use supply and demand mechanics to keep their value stable. AMPL is a notable example of this model.

- Rebase Mechanisms: The supply of these stablecoins is automatically adjusted based on price changes, ensuring stability.

- Seigniorage Shares: This model uses a multi-token system to balance supply and demand, helping maintain a stable price.

- Hybrid Models: Combining algorithmic methods with collateralization, these stablecoins offer the best of both worlds for price stability.

- Dynamic Pegging: These stablecoins adapt their stability mechanisms based on current market conditions, making them highly flexible.

3. Non-Collateralized Stablecoins

Non-collateralized stablecoins take a unique approach by not relying on physical or digital assets. Instead, they use advanced techniques and community dynamics to maintain stability.

- AI-Driven Price Stability: Machine learning and AI are used to monitor and control price stability dynamically.

- Market Making: Integration with automated market makers ensures liquidity and price balance.

- Incentive Structures: Reward systems encourage participants to help maintain the stablecoin’s value.

- Game Theory Models: Economic incentives are strategically designed to promote stability through user behavior.

- Network Effects: These stablecoins leverage user participation to create a self-sustaining and stable ecosystem.

Related: RWA-Backed Stablecoins

What Challenges Does AI Address in the Stablecoin Development Space?

The development of stablecoins has a unique set of obstacles, particularly in sustaining its basic promise—price stability. AI plays an important role in tackling these issues, ensuring that stablecoins remain dependable, efficient, and scalable. Here’s how AI addresses important challenges in this field:

1. Price Stabilization Mechanism: Maintaining price stability is one of the most difficult difficulties for stablecoins. AI contributes by managing complex arbitrage calculations that necessitate advanced models, providing the seamless balance of many stabilizing mechanisms. It also handles unexpected market shocks, black swan events, and extreme market conditions to keep the stablecoin pegged. Additionally, AI addresses cross-chain price inconsistencies, ensuring that stablecoins remain consistent across different blockchain networks.

2. Market Monitoring Challenges: Monitoring turbulent cryptocurrency markets necessitates real-time analysis of high-frequency trade information. AI systems excel at identifying market manipulation efforts while also maintaining data quality and reliability. They also address network latency and coordinate data from numerous sources and streams to provide precise insights into deFi economy stablecoin stability.

3. Technological Infrastructure: The technical infrastructure for stablecoins must be able to manage increasing transaction volumes without fail. AI improves system scalability, manages computing resources, and assures high availability and redundancy. It also ensures system performance during high loads and employs reliable backup solutions to avoid data loss or downtime.

4. Regulatory Compliance: Adapting to ever-changing regulatory standards is another area where AI is quite useful. It helps to develop Know Your Customer (KYC) and Anti-Money Laundering (AML) standards, manage cross-border compliance, and keep precise audit trails for AI choices. At the same time, it promotes transparency while protecting proprietary algorithms, achieving a balance between innovation and regulation.

How Much Does an AI-Based Stablecoin Development Cost?

There are numerous costs associated with developing an AI-based stablecoin. While exact figures are difficult to determine, the following components play a significant impact in influencing the entire cost, including DeFi protocols:

- Algorithm Complexity: The expense of developing AI algorithms increases as they become more complex. Complex algorithms necessitate intensive research and invention, which can dramatically increase costs.

- Smart Contract Development: Building smart contracts that are both secure and functional is crucial. The complexity and extent of these contracts affect costs, necessitating a careful balance between robust security and affordability.

- Data Integration and Analysis: AI-powered stablecoins use real-time data. Integrating and processing massive amounts of data increases development expenses, yet it is necessary for building a dependable platform.

- Security Features: Advanced security measures, like as AI-powered protocols, are critical for securing the platform. While they add to the budget, they are an essential investment for establishing user trust and maintaining stability.

- Regulatory Compliance: Meeting regulatory requirements is critical. Implementing AI tools to monitor and adapt to compliance rules may incur additional expenses, but it is critical for long-term performance in a highly regulated environment.

- Expert Team: Hiring competent engineers who specialize in AI and blockchain might be costly. However, having a knowledgeable team is essential for the complexity of creating a stablecoin development and achieving a positive end.

Conclusion

AI-powered stablecoins represent a significant leap in cryptocurrency technology, providing automated stability mechanisms that eliminate manual work and market volatility. These improvements help traders manage digital assets, save time, and eliminate the need to constantly watch market fluctuations.

While these technologies provide significant stability, security, and efficiency benefits, it is critical to recognize their limitations. The complexity of AI systems, the possibility of manipulation, and the risk of algorithmic bias make professional supervision critical for successful implementation and use.

SoluLab a Stablecoin development company is a blockchain-based solution for secure document creation, sharing, and authentication. It supported decentralized storage, access control, and version management while overcoming technical challenges such as converting media to strings and enabling social media sharing.

SoluLab partnered with DocTrace and they needed a secure, efficient way to manage legal documents, replacing paper with a blockchain-based system. They faced issues like document loss, counterfeiting, and high verification costs.

As a result, DocTrace improved transactions, reduced fraud threats, and increased document management efficiency for their clients. Contact us today to discuss your difficulties and collaborate on growing your business.

FAQs

1. What industries benefit from AI-powered Stablecoins?

E-commerce platforms leverage AI stablecoins for instant settlements and reduced fees. International trade benefits from automated currency conversions. DeFi protocols utilize them for lending and yield farming. Remittance services achieve faster cross-border transfers. Gaming industries integrate them for in-game economies and rewards.

2. How is transparency ensured in AI-powered Stablecoins?

Blockchain technology provides immutable transaction records accessible to all participants. AI systems generate real-time analytics on reserve ratios and market dynamics. Smart contracts automate and publicly display collateralization levels. Regular audits verify algorithmic decisions and system integrity through on-chain data.

3. What are the challenges in developing AI-powered Stablecoins?

Developing robust AI models that accurately predict market volatility remains complex. Regulatory compliance across jurisdictions poses ongoing challenges. Maintaining impenetrable security against smart contract vulnerabilities is crucial. Scalability issues emerge when handling high transaction volumes. Technical integration with existing financial systems requires significant resources.

4. Can AI-powered Stablecoins promote financial inclusion?

AI stablecoins enable access to financial services without traditional banking infrastructure. They offer automated risk assessment for lending, reduced transaction costs, and simplified cross-border payments. Smart contracts eliminate intermediaries, while AI algorithms help maintain price stability, making them accessible to underserved populations.

5. How does AI improve Stablecoin stability?

AI algorithms continuously monitor market conditions and trading patterns to predict price movements. Machine learning models optimize collateral ratios and automate rebalancing mechanisms. Neural networks analyze multiple data points to maintain peg stability and manage liquidity pools effectively through dynamic adjustments.