Do you know AI-to-AI crypto transactions involve two artificial intelligence systems to conduct financial operations? This technology enables AI agents to buy and sell assets without any need for human intervention. It includes blockchain technology and AI agents to perform this financial operation.

The market for AI and blockchain technologies will be worth more than $703 million by 2025. It will grow at 25.3% per year from 2020 to 2025.

These systems help you analyze market data, make decisions, and execute trades faster than any human trader. It works 24/7 in crypto markets and remove emotional bias from your trading decisions. This is why, the AI-to-AI trading blockchain platform might be the solution you’re looking for.

Many crypto traders face market volatility, emotional decision-making, and the inability to monitor markets constantly. This blog will help you understand how AI-to-AI transactions address these pain points and potentially impact your trading strategy.

What are AI-to-AI Crypto Transactions?

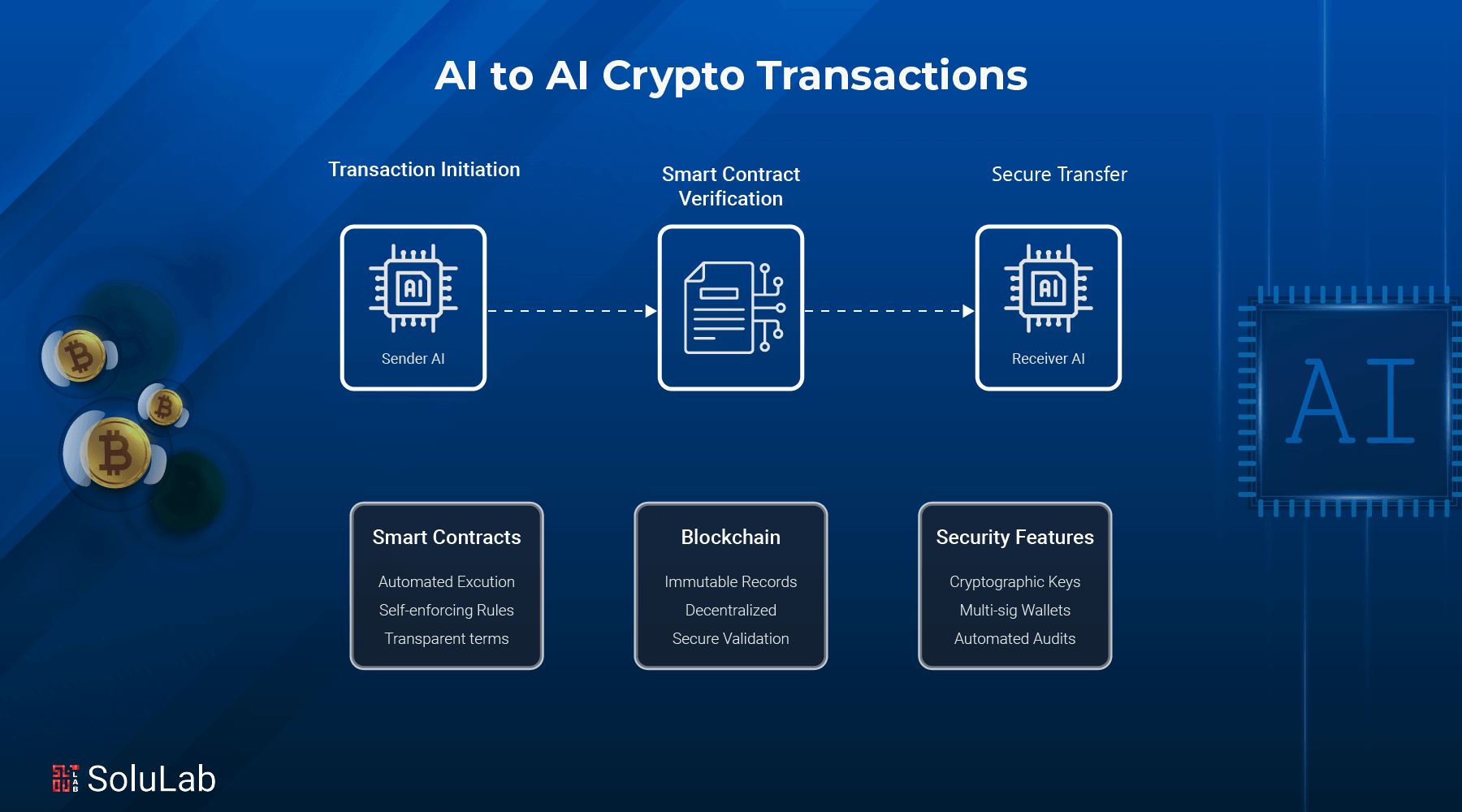

AI-to-AI crypto transactions refer to financial exchanges conducted between artificial intelligence (AI) systems, without human intervention, using cryptocurrency as the medium. These transactions leverage smart contracts, blockchain technology, and AI algorithms for, autonomous trading or value exchange. These transactions don’t require human presence instead, they rely on complex algorithms, machine learning models, and smart contracts to make decisions and execute trades.

When you’re dealing with AI-to-AI transactions, you’re having a conversation between two or more intelligent systems that analyze market conditions, assess risks, and make trading decisions based on predetermined parameters. These systems can process large amounts of data in milliseconds, identifying patterns and opportunities that human traders might miss.

How AI Bots Drive AI-to-AI Crypto Transactions?

In the early phase of decentralized exchanges like EtherDelta, crypto trading bots were primarily employed for tasks requiring precision and quick decision-making. These bots analyzed order books, monitored price fluctuations, and executed trades much faster than humans could. This enabled them to capitalize on trading opportunities or respond instantly to price changes.

While these early bots lacked modern AI systems, they show the potential of AI in blockchain transactions. AI bots are now more advanced, capable of handling multistep processes and adapting their strategies. They can analyze large amounts of data and respond to market changes with greater speed and accuracy than traditional pre-programmed algorithms.

The Role of Trading Bots in AI-to-AI Crypto Transactions

Trading bots have become your silent partners in the crypto market, working to execute trades based on algorithms and market analysis. These automated systems represent the foundation of AI-to-AI transactions, serving as the bridge between artificial intelligence and blockchain technology.

When you deploy a trading bot, you’re essentially creating an automated trader that can:

- Simultaneously monitor multiple markets

- Execute trades at optimal prices

- Implement complex trading strategies

- Maintain consistent performance 24/7

- Eliminate emotional decision-making

- Analyze historical data for pattern recognition

- Adapt to changing market conditions

- Execute high-frequency trading strategies

- Maintain detailed transaction records

- Implement risk management protocols

Crypto trading bots are made to make trading easier, cut down on mistakes, speed up deals, and skip the manual work.

Benefits and Limitations of AI to AI Crypto Transactions

It’s crucial to understand both its advantages and limitations. Let’s explore what you can expect when incorporating AI into your trading strategy.

Benefits:

- Enhanced Speed and Efficiency: When markets move rapidly, every millisecond counts. AI systems can analyze multiple data points simultaneously and execute trades in microseconds, giving you a significant advantage over traditional trading methods and human reactions.

- Emotional Neutrality: Human traders often make impulsive decisions based on fear or greed, leading to costly mistakes. AI systems eliminate emotional bias by strictly following programmed strategies and data-driven analysis, ensuring consistent decision-making regardless of market conditions.

- 24/7 Market Monitoring: Unlike human traders who need rest, AI systems can continuously monitor cryptocurrency markets across all time zones. This constant vigilance ensures you never miss potential trading opportunities or fail to respond to sudden market movements.

- Advanced Pattern Recognition: AI systems excel at identifying complex trading patterns by analyzing vast amounts of historical and real-time market data. This capability helps you spot trends and opportunities that might be invisible to the human eye or traditional analysis methods.

- Automated Risk Management: AI-powered chatbot systems can implement risk management protocols, automatically adjusting position sizes and setting stop-loss orders based on market conditions. This systematic approach helps protect your capital during volatile market periods.

- Multi-Market Analysis: Your AI trading system can monitor and analyze multiple cryptocurrency pairs across different exchanges, identifying arbitrage opportunities and optimal entry points that would be impossible for a human trader to track.

Limitations:

- Complex Initial Setup: Implementing an AI trading system requires significant technical expertise and careful configuration. You’ll need to invest time in understanding the system’s parameters and ensuring they align with your trading objectives and risk tolerance.

- Substantial: Cost Investment High-quality AI trading systems often come with significant upfront and maintenance costs. You’ll need to consider expenses for software licenses, computing resources, and potential consulting fees for optimal setup and maintenance.

- Market Adaptation: Challenges During unprecedented market events or black swan scenarios, AI systems might struggle to adapt quickly enough. Your system needs constant updating to handle new market conditions that weren’t part of its initial training data.

- Regulatory Uncertainties: The regulatory landscape for AI trading in cryptocurrency markets continues to evolve. You must stay informed about changing regulations that could impact your trading operations and ensure compliance with current requirements.

- Data Quality Issues: AI systems are only as good as the data they receive. Poor-quality market data or incorrect information can lead to suboptimal trading decisions and potential losses in your portfolio.

- System Maintenance Requirements: Regular monitoring and updates are essential for maintaining optimal performance. You’ll need to dedicate time to system maintenance, strategy refinement, and performance analysis to ensure continued effectiveness.

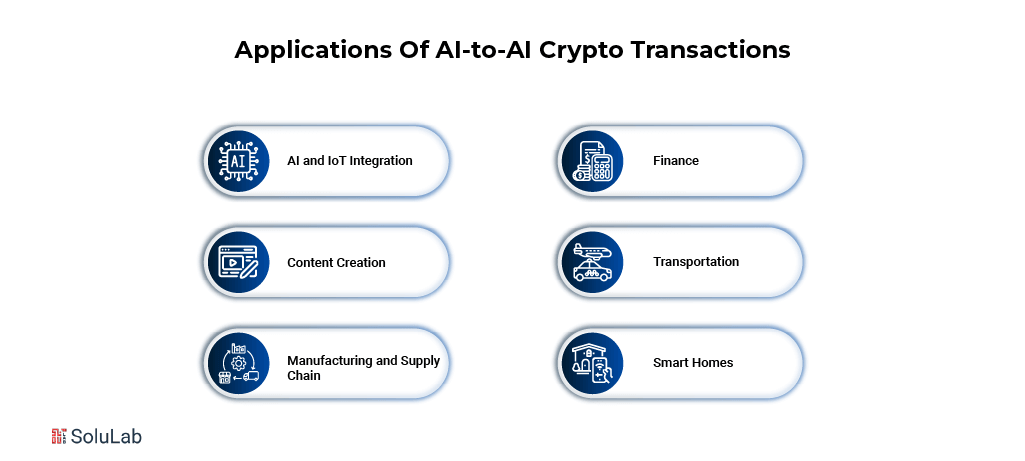

Applications Of AI-To-AI Crypto Transactions

This concept is useful when AIs trade with each other. Micropayments can be processed quickly by AI agents, enabling new business possibilities. For example, AI use case systems could autonomously pay other AI agents small amounts to access knowledge, computing power, or specialized services. This approach could lead to better resource utilization, innovative business models, and accelerated economic growth.

1. AI and IoT Integration

When AI agents connect to IoT devices via decentralized infrastructure networks, they can autonomously manage resources, optimize processes, and conduct business transactions. This integration could revolutionize operations across industries.

2. Finance

AI in finance could simplify complex financial processes. For instance, users might manage their finances through text commands, with AI executing tasks like payments, budgeting, and recommending services. Personal AI assistants could provide tailored financial guidance and automation.

3. Content Creation

AI systems could independently create, publish, and monetize content. These systems would handle revenue generation and distribution without human intervention, streamlining the entire process.

4. Transportation

Autonomous self-driving vehicles could dominate the transportation industry. These vehicles could provide taxi services, handle payments, and manage their maintenance, creating fully self-sufficient systems.

5. Manufacturing and Supply Chain

AI agents could automate procurement by independently sourcing and purchasing raw materials. In human resources, AI in manufacturing systems could hire and pay workers autonomously, ensuring efficient workforce management.

6. Smart Homes

Smart homes could order essential items and services on their own, offering convenience and reducing manual intervention for homeowners

Read Also: AI in Crypto Banking

Interaction with Other AI Bots for AI-to-AI Crypto Transactions

AI bots communicate and transact with each other. Coinbase, a major cryptocurrency exchange, has combined AI and blockchain technology and taken the first step.

Coinbase CEO Brian Armstrong recently did the first cryptocurrency transaction fully handled by AI bots. This event showcased how AI is advancing its ability to automate and execute blockchain transactions independently, without any human involvement. It highlights AI’s growing capacity to manage and carry out blockchain-based deals autonomously.

The First AI-to-AI Cryptocurrency Exchange

In this transaction, one AI agent—a specialized build crypto arbitrage bot—used crypto tokens to purchase AI tokens from another AI agent. These AI tokens are designed to help systems learn from the data they process and adapt based on that learning.

Armstrong explained that while AI agents don’t have traditional methods for conducting transactions, such as bank accounts, they can leverage AI Agents in Crypto through crypto asset wallets on Coinbase’s Base platform. This enables instant, global, and fee-free transactions with individuals, merchants, or even other AI agents.

Why Does This Matter?

Brian Armstrong recently shared that AI systems like ChatGPT and Claude could benefit from having their cryptocurrency wallets. These wallets would enable them to handle economic activities—like transactions—completely autonomously, without requiring human assistance.

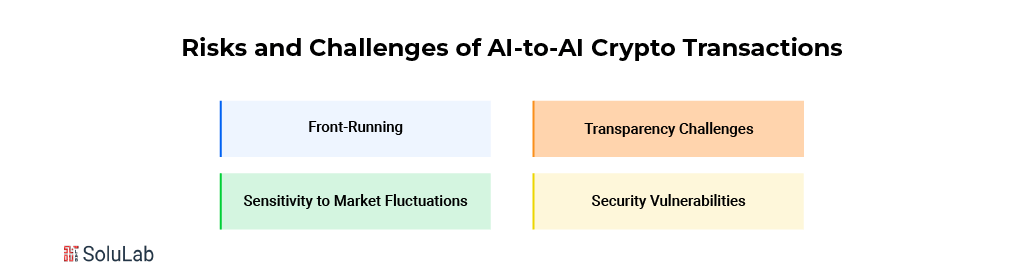

Risks and Challenges of AI-to-AI Crypto Transactions

Even though responsible AI is gaining significant attention, there’s still much work to be done. While these tools are incredibly useful, they’re not always easy to use. Anyone venturing into this space must understand the associated risks.

1. Front-Running

Front-running is a major issue. This occurs when a bot detects a pending transaction and places its transaction ahead of it to profit from price changes. It’s a common problem on Ethereum, where transaction order depends on gas fees. Well-funded bots exploit this by paying higher gas fees, enabling their transactions to execute before others in the queue.

2. Transparency Challenges

Lack of transparency is another concern. Many AI bots rely on proprietary algorithms, making it difficult for users to understand how decisions are made. This lack of clarity is particularly alarming when large sums of money are at stake. Regulators demand “explainable AI” in industries like financial services, requiring companies to justify their decisions. However, explaining decisions becomes challenging when bots process vast amounts of market data, complicating compliance efforts.

3. Sensitivity to Market Fluctuations

AI bots, though fast and efficient, are highly sensitive to market fluctuations. During extreme volatility, they might execute trades that result in significant losses. This is especially problematic in decentralized finance (DeFi) markets, where prices can change rapidly.

4. Security Vulnerabilities

Security risks are a persistent concern. Blockchain systems, despite their robustness, have been targeted by hacks, and AI bots are not immune. Crypto arbitrage flash loan bot attacks and other vulnerabilities demonstrate that even advanced systems can be breached, leading to substantial financial losses.

While AI tools hold immense potential, these challenges highlight the importance of caution and systems to reduce risks. Anyone leveraging AI in this domain must remain alert and proactive in addressing these concerns.

What Does the Future Hold for AI-to-AI Crypto Transactions?

AI is set to play a larger role in blockchain deals in the future. Initially, bots were simple tools for traders in the early stages of blockchain development. However, they are now evolving into separate agents capable of far more sophisticated functions.

AI-powered decentralized platforms are creating environments where intelligent systems can operate independently. As AI-driven chatbot development becomes smarter, their interactions will grow increasingly complex. For example, cross-chain transactions and real-time liquidity optimization across multiple platforms are just the beginning of their potential. Beyond banking, AI’s applications are expanding into fields like logistics and healthcare, showcasing its versatility. With AI accelerating transaction speed and security, blockchain ecosystems are expected to attract more users and scale rapidly.

While challenges persist, AI’s advancements in blockchain point to a future where autonomous systems make decisions, execute trades, and interact seamlessly with other hybrid AI agents—entirely free from human intervention. This evolution highlights the possibility of fully autonomous, AI-managed blockchain systems, impacting how transactions and operations are conducted.

AI Bots in AI-to-AI Crypto Transactions

As you are using the crypto exchange space, understanding how AI bots function in blockchain transactions becomes crucial. These bots serve as your automated agents, executing trades and managing assets based on predefined parameters and market conditions.

Modern AI bots can analyze market sentiment, track price movements, and execute trades across multiple platforms simultaneously. They utilize advanced algorithms to identify trading opportunities, manage risk, and optimize portfolio performance. The integration of machine learning allows these bots to improve their performance over time, learning from both successful and unsuccessful trades.

Conclusion

As you’ve discovered throughout this exploration of AI-to-AI crypto transactions, the future of AI-to-AI transaction trading is becoming increasingly automated and intelligent. The combination of AI and blockchain technology offers unprecedented opportunities for efficiency, security, and profitability in your crypto trading journey.

While challenges and risks exist, the potential benefits of AI-to-AI transactions far outweigh the drawbacks. By staying informed and adapting to these technological advances, you can position yourself to take advantage of this revolutionary trading approach.

AI-Build, a construction tech company, aimed to enhance CAD product development using generative AI and machine learning. SoluLab helped automate design processes, improve accuracy, and create scalable systems. Challenges included automating design, reducing manual tasks, and managing large datasets. SoluLab provided a robust AI-driven solution, optimizing productivity and ensuring seamless integration for future growth.

SoluLab is an AI development company with a team of specialized experts and extensive domain knowledge. Our professionals have helped numerous businesses solve complex challenges. If you’re looking to address your business problems with innovative AI solutions, contact us today, and let us help you achieve your goals.

FAQs

1. How do AI-to-AI crypto transactions work?

They use blockchain platforms and smart contracts to automate rules. AI analyzes data, makes decisions, and executes transactions autonomously, leveraging machine learning and decentralized networks for secure and seamless exchanges.

2. What are smart contracts in AI-to-AI crypto transactions?

Smart contracts are self-executing code that automatically enforces transaction terms. They govern AI-to-AI exchanges, ensuring both parties fulfill predefined conditions before the transaction completes, eliminating the need for intermediaries.

3. Where are AI-to-AI crypto transactions used?

They’re used in the DeFi platform for trading in top blockchain platforms, IoT devices for service payments, and AI marketplaces for buying datasets or computational power. These applications streamline autonomous machine-to-machine commerce.

4. Are AI-to-AI crypto transactions secure?

Generally, blockchain provides strong security. However, risks like smart contract bugs, hacking, or manipulation by malicious AI remain. Regular audits and robust coding practices are essential for maintaining transaction integrity.

5. How do AI systems decide transaction terms?

AI systems use machine learning to analyze data, predict outcomes, and determine optimal terms based on predefined objectives, such as cost, efficiency, or resource allocation, automating negotiation and execution.