Automation dominates in the constantly shifting Bitcoin business, and tools for trading have become the essentials when it comes to the trading of all hues, allowing for regular, objective strategy execution, and 24/7 attention. The development of algorithmic trading has been especially notable according to this report, algorithmic trading bots account for over 70% of all trade activities in the digital currencies market.

Algorithmic trading bots use machine learning to evaluate enormous datasets to adjust to shifting market trends, whereas traditional algorithmic trading depends on preset rules and technical indicators. This development represents a transforming change in the way trading strategies are created and implemented, offering formerly unachievable levels of predictive power and flexibility.

In this blog, we will talk about what is algorithmic trading, what bots are in algorithmic trading, the trading strategies, and the benefits of using algorithmic trading bots.

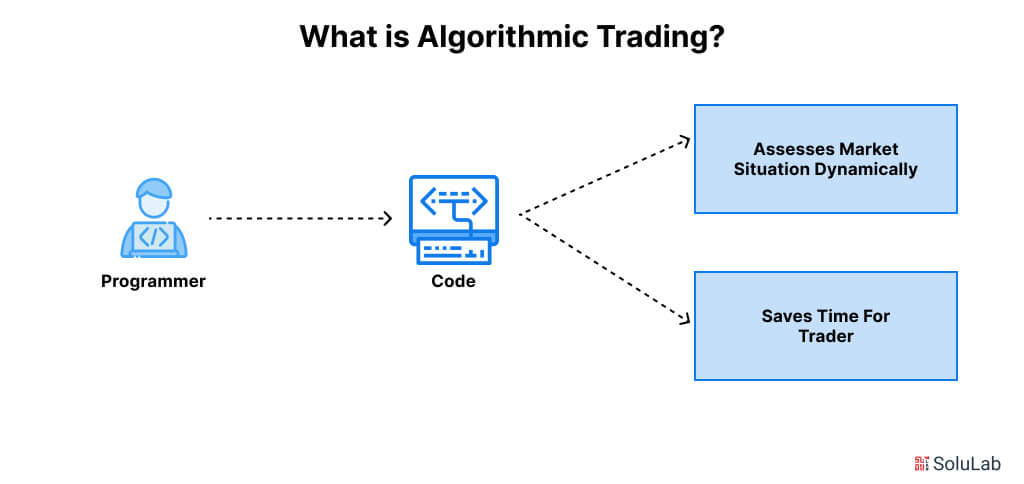

What is Algorithmic Trading?

A computer program that executes a predetermined set of instructions (an algorithm) is used in algorithmic trading, also known as a black box, automated, or algo trading to execute trades. Theoretically, the deal can provide profits more quickly and frequently than a human trader could.

Algorithmic crypto trading bot development uses financial markets and computer programming to execute deals at exact times. In addition to ensuring the most effective trade execution, placing orders instantly, and perhaps reducing trading fees, algorithmic trading aims to remove emotion from trades. Common trading methods include trend-following tactics, arbitrage possibilities, and mutual fund rebalancing.

What are Bots in Algorithmic Trading?

In algorithmic crypto trading, robots are sophisticated computer applications designed to enter into and exit financial instruments based on specific specifications. These algorithms perform trades significantly faster than ordinary human traders can since they can analyze large volumes of market information quickly. If you build an algorithmic trading bot it makes trading far more efficient as it eliminates the thought processes that often cause problems while trading manually due to the influence of emotions.

How trades are carried out in financial markets has been completely transformed by automated trading tools like Crypto Arbitrage Flash Loan Bot. The fact that these bots can complete deals in a few milliseconds is one of their biggest advantages. Due to their quick execution, they can take advantage of price differences and inefficiencies in markets that human traders are unable to take advantage of because of the constraints of human reactions.

For example, trading bots can quickly assess the situation and place trades before the chance passes while a sudden price movement occurs either as a result of sudden developments or a massive market order.

Types of Algorithmic Trading Strategies

With the use of technology, algorithmic trading techniques carry out deals according to preset rules, enabling readers to quickly and accurately take advantage of market opportunities. Here are a few examples of the best algorithmic trading bots strategies:

1. Mean Reversion Techniques

Mean reversion techniques make use of asset values’ propensity to return to their historical mean following notable fluctuations. Usually, these algorithms sell assets with a large price increase and purchase assets with a decline. Using two moving averages a slow-moving average that evens out fluctuations and a rapid average that responds swiftly to price changes is a popular approach. This rapid average provides a buying opportunity when it crosses beyond the slow average and a sell indication when it passes below.

2. Strategies for Arbitrage

Arbitrage techniques take advantage of disparities in prices of different marketplaces or associated assets. While statistical arbitrage deals with using historical relationships between securities to look for trading opportunities, pure arbitrage is all about purchasing an item in one market and selling it in another to earn a profit on the price difference. These tactics often involve high-frequency trading abilities and may well be complex.

3. Algorithms for Market-Making

Market-making algorithms also create liquidity, by placing buy, as well as, sell orders for an item and, then selling it at a higher price than buying it. These algorithms provide particularly high effectiveness in markets with high volatility levels. In addition to constructing a large inventory, market makers could earn profits from temporary fluctuations in stock prices by changing the orders regarding the current conditions.

4. Momentum Strategies

Momentum strategies on the other hand profit from the persistence of trends by betting that assets with an upward trend of movement will continue to go up while betting that assets in a downward movement trend will keep going down. Because often these methods seek entry and exit positions, they sometimes incorporate such indicators as the Moving Average Convergence Divergence or the Relative Strength Index. That is why it is most effective when used in trending markets in which price shifts are more prolonged.

5. Tools and Approaches Linking Machine Learning

When it comes to analyzing large datasets and predicting further price fluctuations machine learning strategies apply complex tactics with the help of algorithms. Thus, using such technical factors as indicators, other data, and previous price records these models emphasize possible trends that are not detected using traditional research. Some of the use cases include sentiment analysis with NLP applications, price prediction, and effective trading price execution.

6. Sentiment Analysis Techniques

These tactics sentiment analysis, extract the position of the market from articles on the internet and other genres of text-based works using natural language processing. It can also help traders make rational decisions on the possibility of a change in price depending on the existing attitudes.

How These Bots Work?

Complex computer programs called algorithmic trading bots are made to automatically make decisions regarding trading in the financial markets, as they follow algorithms and preset rules that also allow participants to trade at frequencies and speeds that are not feasible for human traders. Here is the breakdown of how algorithmic trading works:

-

Understanding the Approach

Clearly defining a trading strategy is the first stage in developing a crypto algorithmic trading bot. This entails figuring out the standards for purchasing and disposing of assets. Traders can select strategies based on fundamental analysis, which focuses on news events and economic data, or technical analysis, which uses tools like momentum indicators or moving averages.

-

Information Gathering

Collecting pertinent market data comes next after the approach has been decided. This comprises past trading volumes, price data, and other market indications that might help guide trading choices. Algorithmic trading crypto platforms and monetary data providers are among the platforms from which data can be obtained. For an accurate study, this data’s quality and granularity are essential.

-

Development of Analysis

Developers can start programming the algorithm once a plan has been established and data has been gathered. This entails converting the market rules into executable code for the bot. Depending on the specified criteria, the algorithm must provide precise instructions on when to enter and leave deals. To reduce possible losses, it could also include risk management tools like stop-loss orders.

-

Backtesting

The bot is backtested before being deployed in live markets. To simulate traders and evaluate performance, the algorithms are run against historical data. By determining the degree to which an approach would have worked in different market scenarios, backtesting enables traders to hone their plans and make the required changes to increase profitability and lower risk.

-

Optimization

Optimization is done to improve the Crypto Arbitrage Bot’s performance after backtesting, this could entail modifying risk management settings or transaction entry and exit points, among other aspects. Based on backtested data, optimization seeks to minimize decreases (periods of loss) and maximize returns.

-

Deployment in Real Time

After this, the algorithm is ready to be used in real-time once again and further optimized if necessary. A bot can transact and trade on its own, and in real-time through integration with a trading platform or brokerage account API. At this stage, traders monitor carefully the performance of the bot to ensure it delivers as it was expected.

-

Monitoring in Real Time

It must not be forgotten that Monitor MHz must remain even after the start of deployment. The performance metrics incantations, such as profitability, trading rates, and compliance with its trading policies, can be checked by traders. Anything that may arise as an issue or even an anomaly that can be experienced as market environments vary or when there are technical glitches may be identified through constant monitoring.

-

Modifications and Upkeep

Algorithmic trading is not a one-time cure; it requires frequent adjustments as well as maintenance. This is as a result of changes in data form, or the need to introduce new sources/indicators, or as a result of necessary reactions to emerging market conditions.

Technical Conditions for Trading Algorithms

The last step in algorithmic trading is putting the algorithm into practice with a computer program and backtesting it (testing the method on historical periods of prior stock-market activities to see if utilizing it would have been lucrative). Once you develop crypto arbitrage trading bots the difficulty lies in turning the chosen approach into an automated, integrated procedure that can place orders using a trading account. The conditions for algorithmic trading are as follows:

1. The necessary trading strategy can be programmed using pre-made trading software, professional programmers, or computer programming expertise.

2. Network connectivity and order placement access to trading platforms.

3. Accessibility to market data sources, which the program will watch for order placement chances.

4. The infrastructure and capability to backtest the technology after it is constructed, before its launch on actual markets.

5. The amount of backtesting data that is available depends on how sophisticated the algorithm’s rules are.

Risks to Be Aware of Before Using Algorithmic Trading Bots

Anyone who wants to deploy algorithmic trading bots using NLP (Natural Language Processing) must be ready for these risks. It shows that general trading can be facilitated and these risks lessened with the help of proper research, constant monitoring, and the help of good risk management.

- Technical Failures: Trading bots rely on technology, and therefore may be halted by technical glitches for example a bug, a serve,r or connectivity issues. These failures can result in high financial costs – when the bot is incapable of trading as planned or when it makes mistakes interpreting market trends because of the software’s glitch.es

- Market Volatility: Trading robots could struggle to adapt to quick or unexpected varieties in price or other events as a result of the high amount of variability inherent in the financial markets. This slow response time not only leads to the making of bad deals or missing opportunities but is crucial in fast-moving environments like bitcoin markets.

- Fraud Risk: It should be important to note that trading bots are not all the same; some of them are poorly designed, or they are just scams. Users are exposed to the risk of meeting bots that have viruses or come across frauds with unreasonably high yields. Bots from reliable sources and doing an incredible amount of research

- Insufficient Risk Management: Many algorithmic trading systems provide inadequate measures of risk management, which might mean that traders are overly exposed to risk whenever the market remains unproductive. For every martingale strategy where the trader uses high-risk strategies like Martingale, they only stand to hit big and suffer even bigger losses if they don’t set the most appropriate stop losses and when it comes to position size.

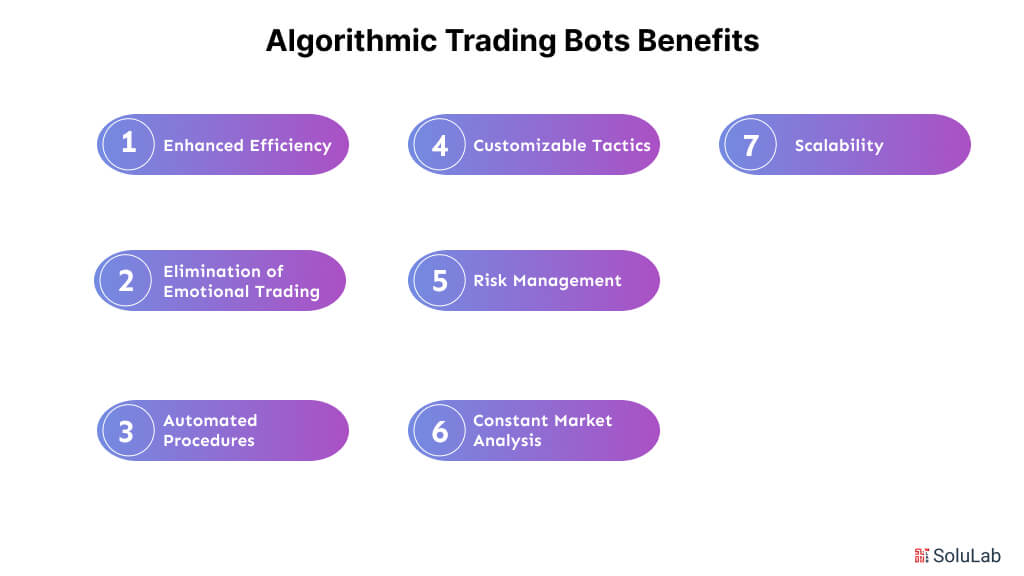

Benefits of Algorithmic Trading Bots

With these advantages of algorithmic trading with bots, traders can reduce both psychological and practical burdens resulting from manual trading and enhance the level of their trading.

-

Enhanced Efficiency

Traders being fully automated means that they can constantly monitor market conditions and do business anytime they wish. It always enhances the deals’ performance by keeping traders aware of the chances made available to them in the process.

-

Elimination of Emotional Trading

One of the biggest advantages of trading bots is the ability to remove bias from the trading equation. Human traders very often are driven by impulse reactions caused by greed or plain fear, which is not a healthy thing. In this case, since bots follow algorithms, then methods are well implemented without any interference of emotion.

-

Automated Procedures

Through bots, trading can be done automatically starting right from the following; multiple assets on different exchanges can be monitored at once. This capability significantly contributes to diversification and deeper market penetration because such changes can no longer require constant monitoring and intervention.

-

Customizable Tactics

Another aspect is that traders have the power to adjust the respective bots to fit specific investment goals and strategies, and risk profiles. Due to the flexibility in the strategy, users can be able to have a change in the tactic in regards to the market conditions or their discretion.

-

Risk Management

To help prevent huge losses, many trading bots contain integrated features such as trailing stops as well as stop-loss orders. Traders should be able to automatically apply these risk management solutions to assets so that everyone can have better control over their resources.

-

Constant Market Analysis

Through constant analysis of data from the market, bots bring information to the trader that may go unnoticed by a human trader. By this constant analysis, such procedures are utilized to make decisions and to identify potential trading opportunities.

-

Scalability

As trading bots are software-based solutions they are in a position to expand with increased trading traffic or more assets without demand for more employees. And due to the scale, it becomes possible to develop dealers.

How SoluLab Excels in Training Bots for Trading?

There are fewer human errors, less emotional investment, and faster, and among the advantages of algorithmic trading bots is the ability to backtest strategies. They minimize the risk of a blunder by humans while making it possible for the trader to seize market opportunities due to the automation of trading processes. But there is everything to strive to avoid such risks as fluctuations in the market and failures on the technical side. Taking everything into consideration trading bots can be of a huge help in the process and when used correctly they’ll enhance the overall performance of trading.

At Crypto Trading Bot development company Solulab, we understand how technology may reshape several industries. For instance, AI-Build, a construction technology company implemented generative AI and ML models to enhance their tech product in the CAD-related domain. Understanding these creative solutions might help your company in filtering similar developments. Now, let us see how we can assist you in transforming your tech product development process, contact us now!

FAQs

1. What is Algorithmic Trading?

A computer program that executes a predetermined set of instructions an algorithm is used in algorithmic trading also known as black box trading or automated trading for executing trades.

2. How much does it cost to trade algorithms?

Varying from the platform that you have chosen, different minimum capital requirements may apply for algo trading. However, most of the platforms require an initial investment of between 10,000 INR to 20,000 INR to start trading.

3. Is there a free AI trading bot?

Yes, Zorro is one free script-based program trading bot that uses deep-learning algorithms to automate quantitative investing, algorithmic trading, and financial research. It facilitates automated trading in stocks, futures options, and CFDs.

4. What distinguishes AI trading from Algorithmic Trading?

Algo trading systems are designed to identify the best trade setups and make decisions based on preset criteria whereas AI trading systems conduct trades without any need for human interaction.

5. How does SoluLab help with building bots for automated trading?

By creating automated bots for the cryptocurrency and stock markets Solulab helps with building these trading bots. Their services help with increased, profitable, and efficient trading that allows users to link brokerage accounts.