In the financial realm, the transformative wave of asset tokenization is reshaping conventional investment paradigms, offering a glimpse into a future where assets are digitized, decentralized, and universally accessible. As we venture into the year 2025, this blog aims to unravel the key trends in asset tokenization. Defined by the conversion of both tangible and intangible assets into digital tokens on blockchain platforms, this innovative approach not only promises fractional ownership but also introduces unprecedented liquidity and inclusivity. Throughout this blog, we will navigate the intricate landscape, dissecting regulatory frameworks, delving into trending technologies, and examining how asset tokenization is permeating diverse sectors, from real estate to commodities.

Finally, the blog will cast a forward gaze, projecting the future trajectory, anticipating potential disruptions, and considering the overarching economic trends that will define the destiny of asset tokenization in the coming years. Join us on this exploration of 2025’s key trends, where the convergence of finance and technology is rewriting the rules of ownership and investment.

So, let’s get started!

What is Asset Tokenization?

The process by which a user generates digital tokens for representing physical assets or digital assets on a Blockchain or other distributed ledger is known as asset tokenization. Blockchain technology ensures that an item is completely immutable once you purchase tokens representing it, meaning that no one authority can remove or alter your ownership. Bitcoin transforms the issuance, management, and trading of assets and investments.

One crucial component of decentralized finance is asset tokenization. Here is an example for you to better understand the area: let’s say you need to raise $50,000 and you own a property worth rupees $500,000. Now you don’t want to use your property as a security for that loan, or do you want to sell it to raise that money, so the ownership of that particular property might be converted into 500,000 tokens through ace tokenization each of which would represent 0.0002% of the property. Tokens are issued based on the public distributed ledger, such as Hedera Hashgrapg, which permits restricted buying or selling on various exchanges.

Purchasing a token and title the owner to 0.0002% of the ownership of the asset. No one can take away the ownership of the investor who purchases the tokens in this case, shares of real estate become unchangeable due to distributed ledger tech technologies.

Significance of Asset Tokenization in the Financial Landscape

The emergence of asset tokenization trends represents a seismic shift in the traditional financial landscape, introducing a myriad of transformative possibilities and challenging age-old norms. At its core, asset tokenization brings a new level of efficiency, accessibility, and liquidity to a diverse range of assets, revolutionizing the way value is created and exchanged. One of the key advantages lies in fractional ownership, allowing investors to own a portion of high-value assets that were once out of reach, such as prime real estate or rare artworks. This democratization of ownership not only fosters financial inclusion but also broadens investment opportunities for a wider demographic.

Moreover, Tokenization of illiquid assets address the issue of liquidity in traditionally illiquid markets. By converting assets into digital tokens that can be traded on blockchain platforms, this innovative approach facilitates faster and more cost-effective transactions. Previously encumbered assets, such as private equity or non-listed securities, can now be bought or sold with relative ease. The enhanced liquidity not only benefits investors but also injects dynamism into markets that were historically characterized by prolonged settlement periods and limited trading windows.

Furthermore, the transparency and immutability inherent in blockchain technology contribute to increased trust and security. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, automate and enforce the terms of transactions, reducing the need for intermediaries. This not only lowers transaction costs but also mitigates the risk of fraud, adding an extra layer of security to the financial ecosystem.

In essence, the significance of asset tokenization lies in its ability to redefine ownership structures, amplify market liquidity, and infuse a new level of trust and efficiency into the financial landscape. As we navigate the complexities of the evolving financial ecosystem, asset tokenization stands as a beacon of innovation, challenging traditional norms and unlocking unprecedented possibilities for investors, businesses, and the global economy at large.

What can be Tokenized?

Since tokenization enables both partial ownership and proof of ownership, the options are virtually limitless. Stablecoins, NFTs, sports teams, racehorses, artwork, celebrities, and examples in addition to conventional assets such as real estate, securities, and products. Login technology is used by businesses all over the world to tokenize nearly everything. Nonetheless, they are divided into four primary groups:

- Resources: any valuable thing that may be turned into cash is considered an asset. It is worth separating into two categories, commercial and personal assets listed on the balance sheet are considered as business assets.

- Equity: it is possible to talk in equity share, but the assets are in the virtual form of security tokens that are kept in an online wallet. Shares are normally available for purchase over a stock exchange.

- Funds: one kind of asset that investors can organize is an investment fund. Tokens representing each investor. A portion of the funds are given to them.

- Services: offering products and services is one way for a firm to conduct business or raise money. Tokens can be used by investors to buy products or services from the supplier.

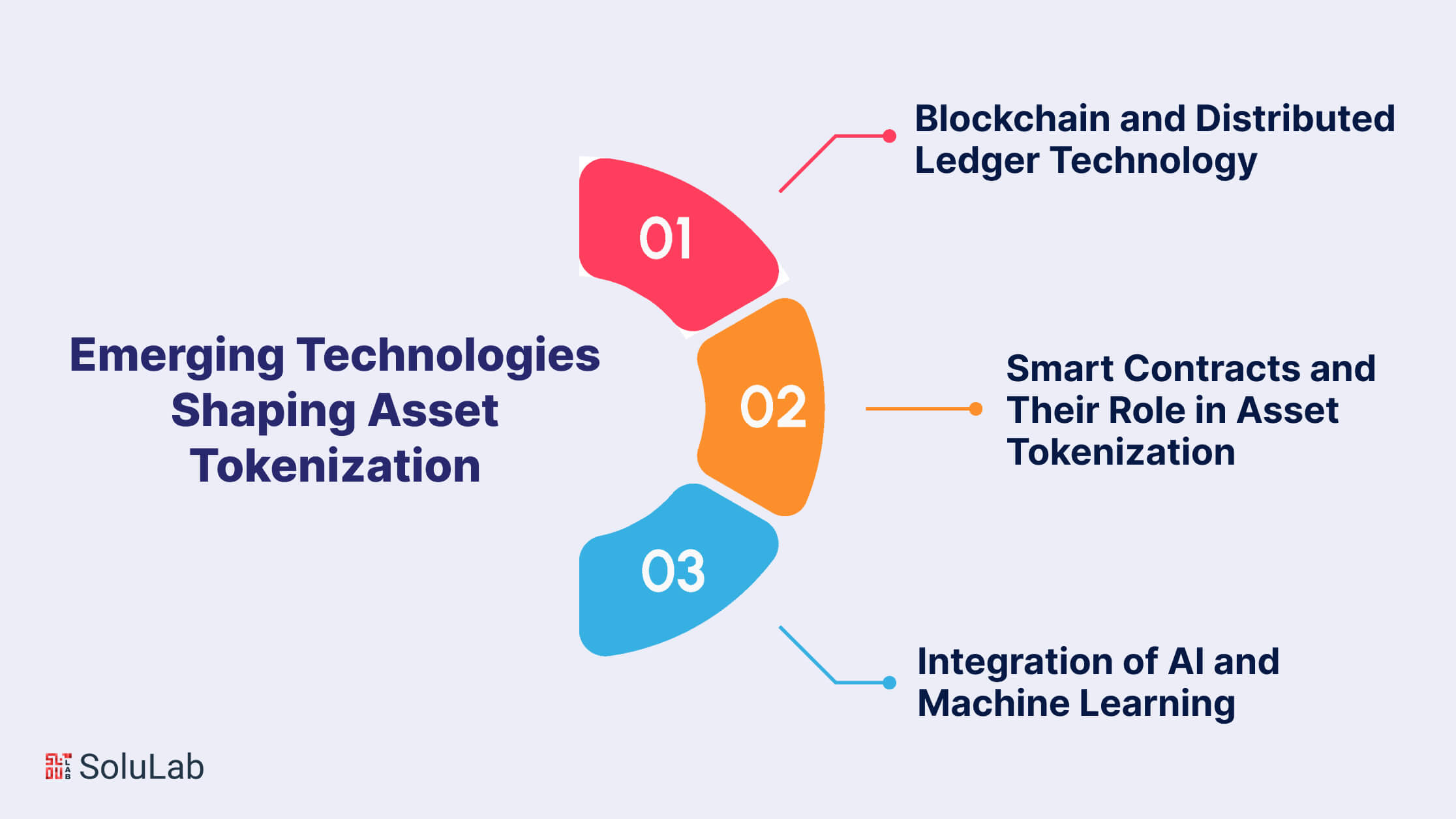

Emerging Technologies Shaping Asset Tokenization

As we witness the convergence of blockchain, smart contracts, and artificial intelligence in the realm of asset tokenization, the synergy of these technologies is expected to redefine the very fabric of financial transactions. The transparent and decentralized nature of blockchain, coupled with the self-executing capabilities of smart contracts, creates a foundation of trust and efficiency. Moreover, the infusion of artificial intelligence and machine learning augments decision-making processes, elevating the sophistication of investment strategies and risk management. This harmonious integration not only addresses existing challenges in traditional financial systems but also opens doors to novel possibilities, offering a glimpse into a future where the tokenization of assets is not just a technological evolution but a catalyst for a more inclusive, transparent, and dynamic financial landscape. As these technologies continue to mature, their collective impact on asset tokenization promises to reshape the financial industry and unlock unprecedented opportunities for businesses and investors alike.

-

Blockchain and Distributed Ledger Technology

Central to the revolution of asset tokenization is the implementation of blockchain and distributed ledger technology (DLT). Blockchain, a decentralized and tamper-resistant ledger, ensures transparency and security in recording transactions. In the context of asset tokenization, blockchain provides an immutable record of ownership, enabling efficient tracking and verification of digital tokens. The distributed nature of the ledger also eliminates the need for a centralized authority, reducing the risk of fraud and enhancing the overall integrity of the tokenization process. As a foundational technology, blockchain underpins the transformative potential of asset tokenization, fostering trust and transparency in a decentralized financial ecosystem.

-

Smart Contracts and Their Role in Asset Tokenization

Smart contracts, self-executing agreements with coded terms, play a pivotal role in automating and enforcing the conditions of asset tokenization. These programmable contracts execute predefined actions when specified conditions are met, eliminating the need for intermediaries and streamlining complex processes. In asset tokenization, smart contracts govern the issuance, transfer, and redemption of digital tokens. They enable fractional ownership, automate dividend distribution, and ensure compliance with regulatory requirements. The use of smart contracts not only enhances the efficiency of asset tokenization trends but also reduces operational costs and minimizes the potential for human error. The intersection of blockchain and smart contracts marks a paradigm shift in how assets are managed and transacted, bringing a level of automation and efficiency previously unseen in traditional financial systems.

-

Integration of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are increasingly becoming integral components in the asset tokenization landscape. These technologies contribute to the optimization of investment strategies, risk management, and decision-making processes. AI and ML algorithms analyze vast amounts of data to identify patterns, forecast market trends, and assess the value of Tokenization of assets. This predictive capability aids investors in making informed decisions, while also enabling automated trading strategies. Additionally, AI-driven compliance tools enhance regulatory adherence, ensuring that tokenization processes align with evolving legal frameworks. As the financial ecosystem continues to evolve, the integration of AI and ML in asset tokenization not only enhances efficiency but also opens new avenues for innovation and strategic decision-making in the dynamic world of digital assets.

Upcoming Trends That Might Dominate in 2025

At the end of 2023, a global survey found that roughly two-thirds of online retailers used tokenization in some capacity for their payment systems. The increasing reliability for safe, effective payment handling is demonstrated by the fact that 43% of these companies have adopted network tokens and over 50% are using takeaway tokens. Here are the top upcoming trends that might dominate in 2025:

-

Democratization of Assets and Growth of Fractional Ownership

Taking down entry barriers by enabling fraction ownership, tokenization makes assets available to a larger group of investors. For individual investors with less money, the democratization of the ownership makes it easier to access asset classes like real estate, private, cutie, and high-value art that were previously unreachable, organization makes it simpler to purchase and sell shares of a liquid asset such as real estate or private property. It also promotes more participation within the worldwide economy by providing fractional ownership.

-

DeFi and Tokenization Interaction

Organizations and protocols are being used more and more to provide modern financial services and solutions by integrating tokenized assets into DeFi protocols, investors can profit from yield farming and staking strategies. Assets that are tokenized open up new credit access channels by serving as collateral for decentralized lending services. The possibilities of tokenized assets inside the Defi ecosystem are further by smart contracts, which make it possible to create intricate instruments for money and automate processes.

-

Beyond Digital Assets, Real-World Assets

Reorienting attention to the tokenization business is becoming more and more focused on organizing real-world assets, with platforms that allow actual property ownership, encoded income from rentals, and even the tokenization of complete real estate development projects, the real estate tokenization industries are still growing. By tracking products, conferring authenticity, and enabling safe and transparent transactions organizations can increase supply chain efficiency.

-

Institutional Adoption and Regulatory Development

To create a more secure and regulated environment for investors, government and regulatory agencies are putting more effort into creating a comprehensive and transparent framework for token securities. The tokenization market is expanding because of growing interest from large investors, including insurance, firms, hedge funds, and pension funds. To save investors and preserve market integrity, the emphasis is on improving security measures and making sure that regulations are followed.

Key Sectors Embracing Asset Tokenization

In the wake of the digital revolution, key sectors across the economic spectrum are fervently embracing asset tokenization as a catalyst for unlocking new avenues of liquidity, accessibility, and efficiency. From real estate to intellectual property, traditional assets are undergoing a profound transformation, becoming digital tokens on asset tokenization platforms. This paradigm shift not only democratizes ownership but also broadens investment opportunities in historically exclusive markets. The digitization of assets facilitates fractional ownership, allowing investors to participate in high-value ventures, thereby democratizing financial opportunities and reshaping the investment landscape.

As the asset tokenization guide continues to gain traction, its impact is distinctly visible across various sectors, each presenting unique opportunities and challenges. The versatility of this transformative technology extends beyond conventional financial instruments, reaching into tangible and intellectual realms. Here, we explore key sectors that are at the forefront of embracing asset tokenization and the implications for the future of each.

-

Real Estate

The real estate sector, known for its historically rigid investment structures, is experiencing a paradigm shift through asset tokenization platforms. These platforms offer a conduit for dividing real estate assets into digital tokens, enabling investors to own fractional shares of high-value properties. This not only lowers the barriers to entry for individual investors but also enhances liquidity in the real estate market. The transparency and efficiency introduced by blockchain technology in real estate transactions have the potential to revolutionize property investment, making it more accessible, tradable, and liquid. Asset tokenization platforms are facilitating a democratization of real estate ownership, unlocking a realm of opportunities for investors globally.

-

Art and Collectibles

The art and collectibles market, long characterized by exclusivity and opaqueness, is undergoing a transformative wave through asset tokenization. By representing ownership of artworks and collectibles as digital tokens on blockchain platforms, these assets become divisible, tradable, and accessible to a broader audience. Art lovers and investors alike can now participate in the art market without the traditional barriers, fostering a more inclusive and dynamic ecosystem. Asset tokenization platforms are not only reshaping how art is owned and traded but also introducing new possibilities for artists to monetize their work and gain exposure. This fusion of technology and creativity marks a significant evolution in the art and collectibles sector, providing a glimpse into a more democratized and globally connected art market.

-

Intellectual Property

Intellectual property, including patents, trademarks, and copyrights, is undergoing a revolution in the era of asset tokenization. Traditionally Tokenization of illiquid assets and challenging to value, intellectual property assets are finding new life as digital tokens on blockchain platforms. Asset tokenization allows creators to tokenize their intellectual property, facilitating the fractional ownership of patents or copyrighted works. This not only unlocks new avenues for creators to monetize their intellectual assets but also provides investors with opportunities to participate in the potential financial success of groundbreaking innovations. The integration of asset tokenization platforms in the realm of intellectual property signifies a shift towards a more transparent, tradable, and accessible landscape for innovation and creativity.

-

Stocks and Equities

The traditional stock market is undergoing a digital transformation as asset tokenization platforms revolutionize the way stocks and equities are bought and sold. Digital tokens representing ownership shares in publicly traded companies offer a more efficient and accessible means of investment. Investors can engage in fractional ownership, reducing the financial barriers to entry and diversifying their portfolios. The implementation of blockchain technology ensures transparent and secure transactions, enhancing the overall integrity of the stock market. Asset tokenization platforms are democratizing access to equities, reshaping the dynamics of stock trading, and fostering a more inclusive financial environment.

-

Commodities

Commodities, ranging from precious metals to agricultural products, are entering a new era of digitization through asset tokenization platforms. Digital tokens representing ownership in physical commodities provide investors with a seamless and efficient way to participate in commodity markets. Fractional ownership allows for more flexible investment strategies, and the transparency of blockchain technology ensures the authenticity and origin of commodities. Asset tokenization platforms in the commodities sector are streamlining the trading process, reducing transaction costs, and democratizing access to these essential assets. This convergence of technology and commodities marks a significant step towards a more accessible and liquid commodity market.

Challenges and Opportunities in Digital Asset Tokenization

In navigating the challenges and opportunities within digital asset tokenization, it is evident that the transformative power of this technology extends beyond its hurdles. As the industry grapples with security concerns, liquidity dynamics, and interoperability issues, the proactive adoption of mitigation strategies and standardization efforts becomes paramount. However, within these challenges lie unique opportunities for innovation, growth, and the redefinition of traditional financial paradigms.

Embracing these challenges as catalysts for progress positions digital asset tokenization on the cusp of groundbreaking advancements, heralding a new era in finance where accessibility, security, and innovation converge to reshape the global economic landscape.

-

Security Concerns and Mitigation Strategies

While digital asset tokenization offers unprecedented opportunities, it is not without its challenges, and security remains a paramount concern. The immutable and transparent nature of blockchain technology, the backbone of asset tokenization, is a double-edged sword. On one hand, it enhances security by providing an unalterable record of transactions, but on the other, the exposure of sensitive information poses risks. Mitigating these concerns necessitates robust encryption, secure key management, and adherence to best practices in cybersecurity. Ongoing advancements in blockchain security protocols, coupled with education and awareness initiatives, are critical in fortifying the resilience of digital asset tokenization platforms against potential threats.

-

Liquidity and Market Dynamics

The liquidity landscape of digital asset tokenization introduces both challenges and opportunities. While tokenization enhances liquidity by fractionalizing traditionally illiquid assets, managing market dynamics becomes crucial. Market depth, order execution speed, and the ability to convert digital tokens to traditional currency seamlessly are factors that influence liquidity. Ensuring a balance between supply and demand is essential to prevent price volatility, and this requires continuous monitoring and strategic planning. Asset tokenization platforms must actively address these challenges, leveraging technological solutions such as liquidity pools and market-making algorithms to optimize trading environments and maintain stable market dynamics.

-

Interoperability Issues and Standardization Efforts

The interoperability of digital asset tokenization platforms is a critical concern as the ecosystem expands. Ensuring that tokens can seamlessly move across different blockchain networks is essential for a globally interconnected financial system. However, the lack of standardized protocols and interoperability frameworks poses challenges for seamless asset transfer. Standardization efforts within the industry, driven by collaborations and industry-wide initiatives, are crucial to overcoming these challenges. Establishing common standards for smart contracts, token formats, and cross-chain communication will enhance interoperability, fostering a more cohesive and efficient digital asset tokenization ecosystem.

-

Opportunities for Innovation and Market Growth

Amidst the challenges, the realm of digital asset tokenization is ripe with opportunities for innovation and market growth. The ability to Tokenization of Assets, from real estate to intellectual property, opens up new avenues for investors and businesses. Innovations in blockchain technology, such as layer-two scaling solutions and consensus mechanisms, contribute to the scalability and efficiency of digital asset tokenization platforms. Moreover, the evolving regulatory landscape offers an opportunity for the establishment of clearer frameworks, providing legal certainty and boosting investor confidence. As the industry matures, collaborative efforts between industry players, regulators, and technology innovators will drive further innovation, expanding the scope and impact of digital asset tokenization in the broader financial landscape. The journey ahead is marked by challenges, but the strategic navigation of these hurdles presents a roadmap for sustained innovation and transformative growth in the domain of digital asset tokenization.

Investor Perspectives on Digital Asset Tokenization

As the financial landscape undergoes a profound transformation with the advent of digital asset tokenization, investor perspectives have become a crucial lens through which to understand the evolving dynamics of the market. The surge in investor appetite for tokenized assets signifies a departure from traditional investment paradigms, fueled by the allure of fractional ownership, increased liquidity, and the promise of democratized access to once-exclusive markets. Yet, investors tread this uncharted territory with a keen awareness of the benefits and risks inherent in digital asset tokenization. This section delves into the nuanced perspectives of investors, exploring their appetites, the perceived advantages and challenges, and the influential role played by institutional investors in steering the course of adoption. In a landscape where innovation and uncertainty coexist, understanding investor sentiments provides a valuable compass for charting the future of digital asset tokenization.

-

Investor Appetite for Tokenized Assets

The evolving landscape of digital asset tokenization has piqued the interest of investors worldwide, reflecting a growing appetite for novel and diversified investment opportunities. The prospect of fractional ownership, increased liquidity, and the democratization of traditionally exclusive markets has resonated with a broad spectrum of investors, ranging from individual retail investors to institutional players. This surge in investor appetite for tokenized assets underscores a shift toward a more inclusive and dynamic investment environment where barriers to entry are lowered, and portfolios are diversified across a spectrum of tokenized assets.

-

Benefits and Risks Perceived by Investors

Investors navigating the realm of digital asset tokenization weigh a set of perceived benefits against potential risks. The benefits include enhanced liquidity, allowing for quicker and more flexible trading of assets, as well as fractional ownership, enabling investors to participate in high-value ventures. Additionally, the transparency and immutability of blockchain technology instill a sense of trust. However, investors are cognizant of risks such as market volatility, regulatory uncertainties, and cybersecurity threats. Striking a balance between the potential advantages and risks requires a nuanced understanding of the digital asset landscape, as well as a proactive approach to risk management strategies.

-

Role of Institutional Investors in Driving Adoption

Institutional investors are emerging as key players in propelling the adoption of digital asset tokenization to new heights. Their participation brings not only substantial capital but also a level of credibility and validation to the market. As institutional investors increasingly recognize the potential benefits of tokenized assets, from increased liquidity to improved efficiency, their engagement becomes a catalyst for broader market acceptance. The involvement of institutional players not only contributes to the maturation of the digital asset ecosystem but also sets the stage for regulatory frameworks to evolve, providing a more stable foundation for investors across the spectrum. In essence, the role of institutional investors is pivotal in shaping the trajectory of digital asset tokenization, turning it from a niche innovation into a mainstream investment avenue.

Future Outlook of Asset Tokenization

As we embark on the horizon of the financial frontier, the Tokenization of future trends of asset tokenization blockchain unveils a landscape defined by transformative innovation and unprecedented opportunities. Projections for the growth of asset tokenization paint a picture of a financial ecosystem where real-world assets seamlessly transition into digital tokens on blockchain platforms. The momentum gained by this evolution extends beyond the digitization of assets; it signifies a fundamental shift in how we perceive, invest in, and trade value. Anticipating the potential disruptive factors, from regulatory dynamics to technological advancements, the resilience of asset tokenization platforms underscores their capacity to navigate challenges and drive market evolution. In this dynamic interplay of technology, regulation, and economic forces, the future outlook of asset tokenization beckons a new era in finance, inviting stakeholders to explore, adapt, and shape the path forward.

-

Projections for the Growth of Asset Tokenization

The future of asset tokenization is poised for exponential growth, as projections indicate an era where traditional boundaries between physical and digital assets continue to blur. The momentum gained by blockchain technology and real-world asset tokenization is expected to propel the market into new dimensions. Projections anticipate an increase in the tokenization of diverse asset classes, ranging from real estate to fine art, as the technology matures, regulatory frameworks evolve, and market participants gain a deeper understanding of the benefits offered by digital asset tokenization. The democratization of investment opportunities and the increased liquidity of assets are likely to drive a surge in adoption, transforming the financial landscape into a more accessible and dynamic ecosystem.

-

Potential Disruptive Factors and Market Resilience

While the Tokenization of future trends is promising, it is not immune to potential disruptive factors that may shape its trajectory. Regulatory shifts, technological advancements, and unforeseen market dynamics could introduce challenges. However, the inherent resilience of blockchain-based asset tokenization platforms, coupled with ongoing efforts to address security concerns and enhance interoperability, positions the market to withstand disruptions. The ability to adapt and innovate in response to emerging challenges will be crucial for the sustained growth and resilience of the asset tokenization landscape.

-

The Role of Global Economic Trends in Shaping Asset Tokenization

Global economic trends play a pivotal role in shaping the future of asset tokenization. Economic shifts, geopolitical considerations, and changes in investor sentiment are expected to influence the adoption and evolution of digital asset tokenization. As economies increasingly embrace the digitization of assets, the role of blockchain in ensuring transparency and efficiency becomes more pronounced. Economic policies, such as those favoring financial inclusion and innovation, may catalyze the growth of asset tokenization. Additionally, the alignment of asset tokenization with broader economic trends, such as sustainability and decentralized finance (DeFi), may open up new frontiers for market expansion. Understanding and navigating these global economic currents will be essential for stakeholders in the asset tokenization space, positioning them to capitalize on emerging opportunities and mitigate potential challenges as the technology continues to redefine the future of finance.

Conclusion

In closing, exploring key trends in asset tokenization for 2025 unravels a narrative of profound transformation within the financial realm. The convergence of blockchain, smart contracts, and artificial intelligence is reshaping traditional notions of ownership, liquidity, and market accessibility. As we navigate the challenges and opportunities presented by digital asset tokenization, the allure of fractional ownership, increased liquidity, and the democratization of exclusive markets emerge as a beacon guiding the financial landscape toward a more inclusive and dynamic future. Investor perspectives, regulatory frameworks, and technological advancements collectively shape a narrative where the fusion of real estate tokenization and blockchain technology not only redefines investment strategies but also challenges conventional financial paradigms.

In the pursuit of this transformative journey, SoluLab as an asset tokenization development company, emerges as a pioneering force in facilitating the tokenization of assets. With expertise in real-world asset tokenization, SoluLab provides innovative solutions that harness the power of blockchain technology to convert physical assets into digital tokens. Their comprehensive approach addresses security concerns, enhances liquidity dynamics, and ensures seamless interoperability, aligning with the evolving needs of the digital asset tokenization landscape. As a trusted partner, SoluLab plays a vital role in driving the future of finance, offering a bridge between traditional and digital assets through their solutions and expertise in the tokenization of assets. In the ever-evolving landscape of asset tokenization, SoluLab stands at the forefront, empowering businesses and investors to navigate the complexities of this transformative journey.

FAQs

1. How does asset tokenization differ from traditional asset ownership?

Asset tokenization is the process of converting tangible or intangible assets into digital tokens on a blockchain. Unlike traditional ownership, asset tokenization allows for fractional ownership, enabling investors to own a portion of high-value assets. This innovation also enhances liquidity, making traditionally illiquid assets more accessible and tradable.

2. How do blockchain and smart contracts contribute to asset tokenization?

Blockchain technology provides the decentralized and tamper-resistant ledger essential for recording tokenized asset transactions. Smart contracts, self-executing agreements with coded terms, automate and enforce the conditions of asset tokenization. Together, blockchain and smart contracts enhance transparency, security, and efficiency in the tokenization process.

3. What are the benefits of tokenizing assets?

Know your customer verification suggestions can be made more efficient and regulatory compliance made easier with token assets. Additionally, they may effectively guarantee that every transaction complies with legal requirements. The use of smart contract automation is essential to achieving these benefits.

4. What is the current trend of real-world asset tokenization?

Forecast in pattern in the organization. The industry is a recent trend in the real world as tokenization. They consist of institutional interest in tokenization assets which has increased the tokenization integration with the current banking system.

5. How does SoluLab contribute to asset tokenization, and what sets them apart?

SoluLab is a leading blockchain development company that helps in facilitating the tokenization of real-world assets. Their expertise lies in providing innovative solutions that leverage blockchain technology to convert physical assets into digital tokens. SoluLab addresses security concerns, enhances liquidity dynamics, and ensures interoperability, playing a crucial role in driving the future of finance through its solutions and expertise in the tokenization of assets.