P2P trading provides an alternate way to obtain cryptocurrency. P2P crypto exchanges allow users to trade, buy, and sell cryptocurrencies without relying on a third-party authority. This also means that customers can use local payment methods, and sellers can determine their prices. According to a 2021 Chainalysis report, emerging markets like Kenya, Nigeria, and Venezuela saw significant growth in P2P crypto activity, driven by currency devaluation and limited access to centralized exchanges. P2P trading now constitutes a substantial portion of crypto transactions in these areas, where local payment methods and currency flexibility are essential for users.

From 2022 to 2030, the global cryptocurrency exchange platform market is projected to expand at a compound annual growth rate (CAGR) of 27.8%, from its 2021 valuation of USD 30.18 billion. The need for cryptocurrency exchange platforms is expected to rise with the increasing popularity of digital assets like cryptocurrencies and non-fungible tokens (NFTs).

Platforms like Binance P2P have been instrumental in this expansion, with over 1.5 million active users engaging in more than 7.5 million transactions annually. This growth highlights the demand for P2P crypto exchanges, which offer lower fees and greater accessibility than traditional exchanges by enabling direct transactions between users without a middleman.

What is a Cryptocurrency Exchange & How Does It Work?

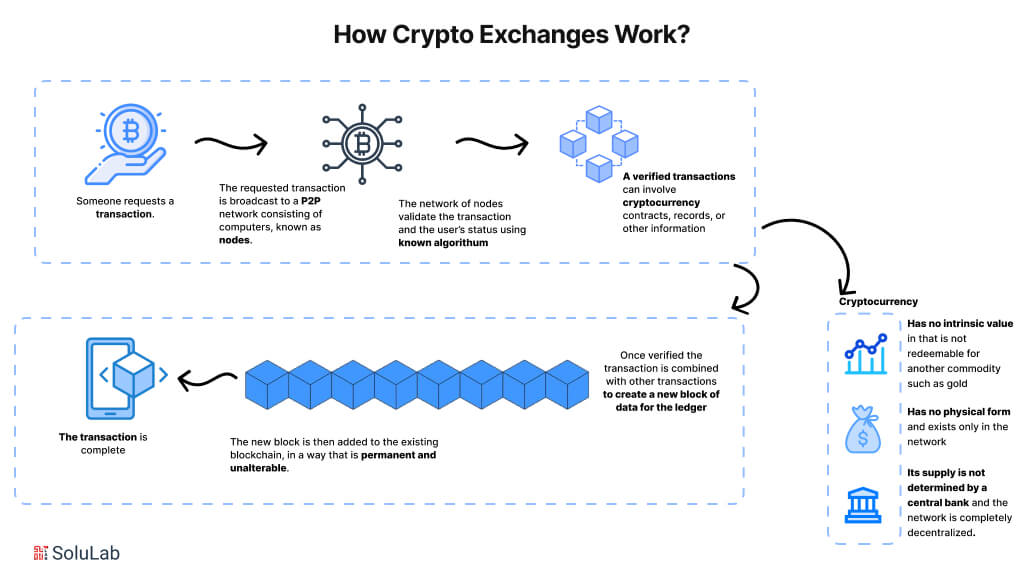

A cryptocurrency exchange is a digital platform that enables holders of cryptocurrencies to trade digital assets for other forms of currency or assets. Acting as an intermediary, a cryptocurrency exchange connects buyers and sellers of digital currencies, facilitating trades based on market demand.

To start trading, users must create an account on a cryptocurrency exchange. Once set up, they can buy, sell, or trade a range of cryptocurrencies, including well-known options like Bitcoin (BTC), Dogecoin (DOGE), and Ether (ETH).

Popular crypto exchanges include Binance, Coinbase, FTX, Kraken, and KuCoin. Each exchange varies in the number of supported cryptocurrencies and available features. For instance, while some platforms allow users to transfer cryptocurrency to personal wallets, others restrict this, keeping the assets exchange ecosystem.

The image below provides a visual representation of the operational flow of a crypto exchange ecosystem.

What are P2P Exchanges?

Peer-to-peer (P2P) crypto exchanges are platforms that facilitate direct cryptocurrency trades between users without needing an intermediary, such as a traditional exchange. Unlike centralized exchanges, where a central authority manages transactions, a P2P platform allows users to connect directly to negotiate terms, set prices, and choose from a variety of payment methods. This setup enhances flexibility, privacy, and accessibility, especially in regions where access to traditional exchanges is limited due to financial or regulatory constraints.

In 2025, the best P2P crypto exchanges in the USA are expected to lead the way by offering secure, user-friendly environments with diverse payment options. Leading P2P platforms, such as Binance P2P, LocalBitcoins, and Paxful, have implemented systems like escrow services, reputation scores, and multi-factor authentication (MFA) to enhance security and protect users. These features have made them some of the best P2P crypto exchanges in the USA for 2025, appealing to users looking for privacy and control over their transactions.

With P2P exchanges, buyers can often transact using local payment methods, and sellers have the flexibility to set their own prices, allowing for a more personalized trading experience. These platforms are particularly popular in emerging markets, where P2P trading helps users overcome limited banking infrastructure and navigate currency volatility.

Importance of P2P Crypto Exchanges

P2P crypto exchanges play a crucial role in the cryptocurrency ecosystem by providing direct, decentralized trading options, enabling users to buy and sell cryptocurrencies without the need for an intermediary authority. These platforms facilitate greater flexibility, accessibility, and financial inclusion, especially for users in regions with limited access to traditional banking and financial services. As we approach 2025, the top P2P cryptocurrency exchanges are expected to lead this trend, empowering more people globally to participate in crypto trading on their own terms.

Key Benefits of P2P Exchanges

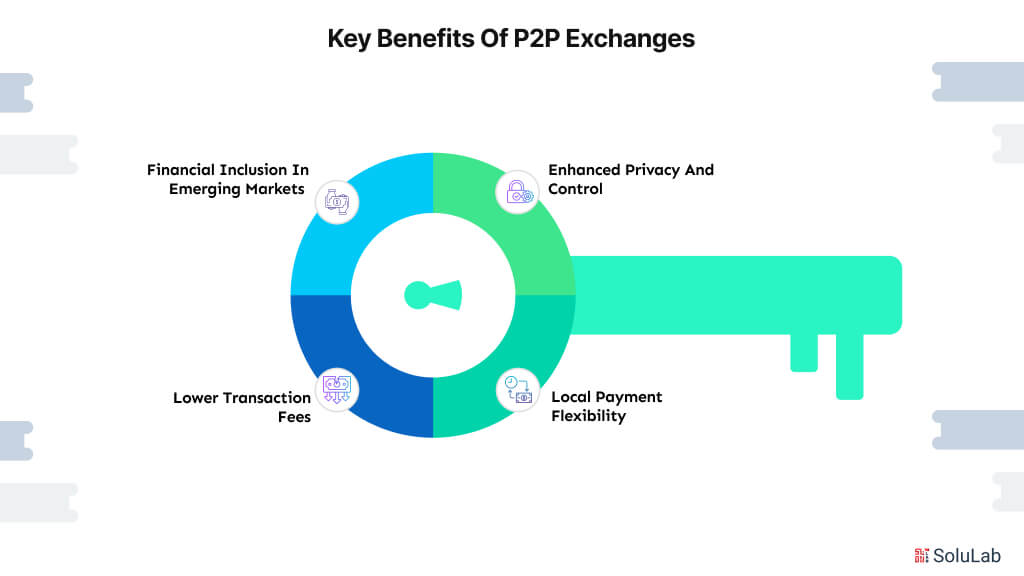

Here are some of the benefits of P2P Exchanges and using a crypto trading bot:

1. Enhanced Privacy and Control: Unlike centralized exchanges, where a third party handles transactions, P2P exchanges allow users to interact directly with each other, providing increased privacy and control over trading terms. This aspect has fueled P2P exchange development as demand grows for platforms that prioritize user autonomy. By eliminating the need for extensive identity verification in some cases, P2P exchanges appeal to privacy-conscious users and those in areas with strict financial regulations.

2. Local Payment Flexibility: P2P exchanges enable users to choose from diverse local payment methods, such as bank transfers, mobile payments, and even cash, making them more accessible than traditional exchanges. This flexibility is particularly valuable in emerging markets, where access to conventional banking is limited. Leading platforms like Binance P2P and Paxful have thrived in these regions by allowing users to transact with their local currency, making crypto accessible to a broader audience

3. Lower Transaction Fees: Since P2P exchanges connect buyers and sellers directly, transaction fees are often lower compared to centralized exchanges, where fees are charged for each transaction. Some platforms, like Binance P2P, even offer zero-taker fees, making trading more cost-effective for users. For high-frequency traders, these low fees can make a significant difference in maximizing profits and ensuring efficient trading.

4. Financial Inclusion in Emerging Markets: P2P exchanges are especially important in countries with unstable currencies, where residents seek alternatives to preserve wealth. For instance, in regions like Latin America and Africa, P2P platforms have become the preferred method for obtaining crypto, as they bypass the financial restrictions that prevent access to traditional banking and international markets. Platforms like LocalBitcoins have gained traction in such regions, allowing users to mitigate risks from currency devaluation by converting assets into crypto.

Types of P2P Crypto Exchanges

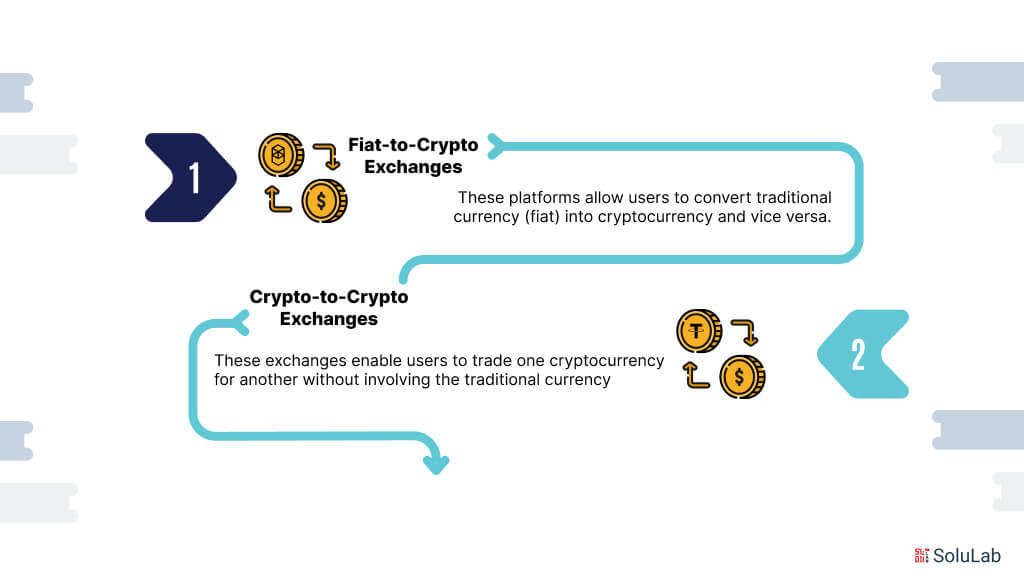

There are two main types of exchanges:

- Fiat-to-Crypto Exchanges: These platforms allow users to convert traditional currency (fiat) into cryptocurrency and vice versa.

- Crypto-to-Crypto Exchanges: These exchanges enable users to trade one cryptocurrency for another without involving the traditional currency.

Need for BitValve Crypto P2P Restriction

Peer-to-peer (P2P) cryptocurrency trading platforms, such as BitValve, have become increasingly popular due to their decentralized approach, affordable fees, and easy-to-use design. However, as their usage grows, certain restrictions are necessary to maintain security, ensure compliance, and facilitate smooth operations. BitValve, a P2P exchange, has its own rules and limitations that traders must follow. This section will look into the need for BitValve crypto P2P restrictions for both beginners and experienced traders.

1. KYC and Account Verification

To promote user security and comply with anti-money laundering (AML) laws, BitValve requires traders to complete a Know Your Customer (KYC) process.

This involves providing identification documents like a passport or driver’s license. While this step may discourage users who prefer to remain anonymous, it plays a critical role in deterring fraud and illegal activities. By verifying its users, BitValve creates a safer trading environment, ensuring only legitimate participants can access the platform.

2. Geographic Limitations

As with many other P2P platforms, BitValve is subject to local laws and regulations, which means users in some countries may be restricted from using the service. These geographic restrictions are typically the result of legal requirements or government-imposed sanctions.

For traders in these restricted areas, this can pose a significant challenge, especially if no similar platforms are available locally. However, these limitations are essential for keeping BitValve compliant with international regulations, ensuring its continued operation and adherence to legal standards.

3. Transaction Caps for Unverified Users

BitValve sets trading limits on accounts that have not completed the verification process. These unverified accounts are allowed to trade only within a fixed limit, which can frustrate users wanting to conduct high-volume trades without going through the KYC process.

The purpose of these caps is to reduce risks, such as fraud and money laundering, by controlling the flow of funds through the platform. Verified users, on the other hand, enjoy higher transaction limits, which allows for more significant trading opportunities.

4. Limits on Trading Volumes

BitValve may impose restrictions on trading volumes for specific cryptocurrencies or during times of market volatility. These controls help prevent price manipulation and contribute to market stability.

While such measures may seem inconvenient, they are designed to protect traders from extreme market fluctuations and ensure a fair and stable trading environment. By curbing excessive trading activity, BitValve promotes a balanced platform for all users.

5. Withdrawal Caps and Delays

BitValve imposes withdrawal limits based on the verification status of user accounts. Unverified accounts are subject to stricter caps, while verified users can withdraw larger amounts. Additionally, withdrawal requests may sometimes experience delays due to security checks or network congestion.

Although these restrictions can be frustrating, they are vital for maintaining security. By setting withdrawal limits and conducting thorough checks, BitValve minimizes the risk of unauthorized transactions and enhances the overall safety of the platform.

6. Payment Methods and Associated Fees

BitValve offers a range of payment options, but the availability of certain methods may depend on the trader’s geographic location. For instance, some payment processors may not be accessible in specific countries due to legal or regulatory barriers.

Additionally, transaction fees can vary depending on the payment method chosen. Some methods may incur higher costs than others, which may feel restrictive to users. However, these measures ensure compliance with financial regulations while providing secure and reliable payment options.

7. Dispute Resolution and Arbitration

A key feature of BitValve is its dispute resolution system, which helps resolve conflicts during transactions. However, the arbitration process can sometimes take time, delaying trades or the release of funds.

While these delays might be inconvenient, the arbitration system is essential for ensuring fairness and transparency. It protects traders from scams and disputes, fostering a safer and more reliable trading environment.

8. Trading Downtime and Maintenance

Although BitValve operates around the clock, there are instances of scheduled maintenance or unexpected downtime, temporarily limiting trading activity. These interruptions can be inconvenient, particularly during periods of high trading demand.

However, maintenance is crucial to keep the platform secure and efficient. By periodically restricting access for updates and repairs, BitValve ensures a smoother and safer user experience in the long run.

9. Limits on Specific Cryptocurrencies

BitValve may place restrictions on the trading of certain cryptocurrencies, particularly those considered highly volatile or risky. Additionally, regulatory concerns can lead to the temporary or permanent removal of specific digital assets from the platform.

While these limitations may reduce the range of assets available to traders, they are essential for maintaining the platform’s integrity and compliance with legal standards. By focusing on reliable and compliant cryptocurrencies, BitValve ensures a safer and more regulated trading environment for its users.

10. User Conduct and Account Limitations

BitValve has strict policies to govern user behavior. Accounts can be restricted or even suspended for actions such as spamming, fraudulent activities, or violating the platform’s terms of service. In severe instances, funds may be frozen while investigations are conducted.

Although these actions may seem stringent, they are necessary to uphold a secure and trustworthy trading ecosystem. By removing malicious actors, BitValve protects honest traders from scams and unethical behavior, ensuring the platform remains a reliable space for P2P trading.

Understanding the restrictions on BitValve is essential for traders aiming to use the platform effectively. While these rules may feel limiting at times, they are designed to prioritize security, legal compliance, and a stable trading experience. By adhering to these guidelines, users can reduce risks and carry out smooth, successful transactions on BitValve.

How Did We Compile the List of 10 Best P2P Crypto Exchanges in 2025?

To curate the top 10 P2P crypto exchange platforms in 2025, we analyzed multiple factors that are critical for safe, efficient, and flexible peer-to-peer trading. Here’s an overview of the key criteria that informed our selections:

-

Security Measures

We evaluated each platform’s security features, such as multi-factor authentication, escrow services, and encryption protocols, to ensure they prioritize user protection. Platforms like Binance P2P and LocalBitcoins were chosen for their robust security frameworks, as they are recognized for safeguarding user funds and data.

-

User Experience and Accessibility

A user-friendly interface is essential for P2P trading, as it enhances the experience for both beginners and advanced traders. Platforms were rated based on their design, ease of navigation, and the availability of customer support. Additionally, the number of payment methods and local currency options available on platforms like Paxful and KuCoin P2P helped make them accessible to a diverse, global user base

-

Transaction Fees

Lower fees are a significant advantage in P2P exchanges, especially for frequent traders. To provide users with cost-effective trading, we prioritized platforms offering minimal or zero taker fees, such as Binance P2P. We deprioritized platforms with high fees or complex fee structures in favor of those offering transparent and competitive rates.

-

Reputation and Trustworthiness

The reputation of each platform was considered, particularly their history of successful transactions and the reliability of their escrow systems. Platforms with verified merchants, reputation scores, and a history of secure trades were highly rated for their ability to foster trust among users.

-

Geographical Availability and Local Payment Methods

Global reach is essential, especially for users in emerging markets. Platforms like Paxful and LocalBitcoins were selected for their widespread availability and support for a variety of local payment options, including cash deposits, mobile wallets, and bank transfers. This flexibility is particularly valuable for users in countries with limited banking infrastructure or restrictive financial regulations.

-

Crypto Asset Variety

Platforms offering a wide range of cryptocurrencies were prioritized with the rise of crypto wallets, as they allow users to diversify their investments. The ability to trade multiple cryptocurrencies makes platforms like KuCoin P2P and OKX P2P more attractive for users seeking variety.

By considering these factors, we compiled a well-rounded list of the Top 10 P2P Crypto Exchange Platforms in 2025, aiming to help users choose platforms that offer not only flexibility and security but also reliable trading experiences tailored to their needs.

Top 10 P2P Crypto Exchanges to Look Out in 2025

Now, let us explore the top 10 P2P crypto exchanges in 2025:

1. Binance P2P

Binance P2P has established itself as one of the best P2P crypto exchanges for 2025 thanks to its extensive user base, global reach, and minimal transaction fees. With support for over 70 local currencies and 300+ payment methods, Binance P2P allows users worldwide to buy and sell cryptocurrencies using local payment options. The platform is renowned for its security features, including multi-factor authentication, an escrow system, and an active support team, which help protect users from scams and fraudulent activity. Binance’s focus on verified merchants also ensures that users have access to trusted sellers, enhancing the platform’s credibility

What truly sets Binance P2P apart is its zero-taker fee structure, allowing traders to maximize their profits. The platform offers extensive flexibility, from low-cost transactions to high liquidity, catering to both new and experienced traders. Binance P2P is especially popular in emerging markets due to its range of local payment methods, making it accessible to a broad demographic. Its interface is user-friendly, and Binance’s educational resources further support users who may be new to P2P trading, cementing its position as a top choice for global P2P trading.

2. Paxful

Paxful is one of the top P2P platforms, particularly for users in regions with limited access to traditional banking. Known for its user-friendly approach, Paxful supports over 350 payment methods, including bank transfers, cash payments, and mobile wallets, making it a go-to for people seeking diverse payment options. Paxful’s secure escrow service is a standout feature, holding funds until both parties confirm the transaction, which helps prevent scams. Additionally, Paxful does not charge buyers any transaction fees, making it one of the most affordable options for newcomers.

The platform’s commitment to financial inclusion has made it especially popular in Africa and Latin America, where users leverage its broad payment network to gain access to cryptocurrency. Paxful’s reputation system helps build trust by allowing users to rate and review their transactions. With 24/7 support and a simple interface, Paxful is an ideal choice for users who prioritize accessibility and security, contributing to its ranking as one of the best P2P crypto exchanges for 2025.

3. LocalBitcoins

LocalBitcoins is one of the oldest and most established P2P exchanges, focused primarily on Bitcoin trading. The platform operates in over 190 countries, making it accessible to users worldwide. LocalBitcoins offers a wide variety of payment methods and has a strong reputation system where users can view each other’s ratings and trade history. Its escrow system ensures secure transactions, protecting both buyers and sellers during trades. The platform’s flexibility and long-standing reputation make it a top choice among top P2P crypto exchanges for 2025.

A key advantage of LocalBitcoins is its support for private, in-person transactions, allowing users to trade directly if preferred. The platform doesn’t charge buyers fees, and with its simple interface, LocalBitcoins is suitable for both beginners and experienced traders. LocalBitcoins is particularly popular in regions where access to traditional financial systems is limited, as it allows for cash-based Bitcoin purchases, catering to users who value privacy and flexibility in their trading.

4. Hodl Hodl

Hodl Hodl takes a unique, non-custodial approach to P2P trading, meaning it never holds users’ funds, which significantly reduces risks associated with centralized exchanges. The platform is available globally, supports Bitcoin and Litecoin, and doesn’t enforce strict KYC requirements, which appeal to privacy-focused traders. Hodl Hodl uses an escrow system in the form of multi-signature contracts, allowing users to control their funds while still ensuring transaction security.

Hodl Hodl’s user interface is straightforward, and it allows users to create customizable contracts for their trades, offering added flexibility. This P2P exchange is ideal for users who prioritize security, as it doesn’t store funds, reducing the risk of hacks or theft. As one of the top P2P cryptocurrency exchanges in 2025, Hodl Hodl appeals to privacy-conscious users who prefer decentralized, user-controlled transactions.

5. Bybit P2P

Bybit P2P is a relatively new but fast-growing platform that has gained popularity for its user-friendly experience and strong security features. With a smooth and intuitive interface, Bybit P2P is especially appealing to novice users. Bybit supports a variety of payment methods and enables transactions in several local currencies, making it accessible to users from different regions. The platform also includes security features like multi-factor authentication (MFA) and a well-organized customer support system.

Bybit’s low fees and ease of access make it a great choice for beginners looking to get into P2P trading. The platform’s streamlined design ensures that users can quickly find trading pairs and payment options, contributing to a smooth trading experience. Bybit’s focus on user support and security makes it one of the top 10 P2P platforms to consider in 2025.

6. OKX P2P (formerly OKEx P2P)

OKX P2P rebranded from OKEx, is recognized for its high liquidity and fast transaction speeds. This platform supports multiple cryptocurrencies and is known for its minimal transaction fees, which makes it attractive to frequent traders. OKX’s escrow service ensures secure transactions by holding funds until both parties confirm the trade, reducing risks associated with peer-to-peer transactions

With OKX’s extensive user base and support for a wide range of payment options, users can quickly find suitable trading pairs and complete trades efficiently. Its flexibility and liquidity make it popular among experienced traders looking for a reliable P2P platform. OKX P2P’s efficient system and competitive fees make it one of the top P2P cryptocurrency exchanges in 2025.

7. KuCoin P2P

KuCoin P2P is ideal for users seeking variety in cryptocurrency trading options, as it offers a large selection of assets compared to other P2P platforms. Known for its flexibility, KuCoin P2P provides multiple payment methods and an escrow system to safeguard transactions. KuCoin’s user interface is beginner-friendly and does not require strict KYC for low-volume traders, making it more accessible

This platform appeals to traders who want access to diverse assets and flexible trading conditions. KuCoin’s P2P platform is designed to accommodate both novice and seasoned traders, featuring various crypto pairs and a secure escrow system. Its broad selection and user-friendly experience make it one of the best P2P crypto exchanges for 2025.

8. BitValve

BitValve is a P2P crypto exchange designed with versatility and accessibility in mind. Unlike many P2P platforms that focus exclusively on Bitcoin, BitValve supports multiple cryptocurrencies, including Ethereum and Litecoin, making it appealing to traders interested in a diversified portfolio. BitValve offers low fees and supports various payment options, including bank transfers, PayPal, and even in-person cash trades. The platform’s decentralized structure enhances security by preventing direct custody of funds, while its escrow feature adds a layer of protection, ensuring both parties fulfill transaction terms

One of BitValve’s standout features is its focus on anonymity and privacy, which is particularly valued by users in regions with strict financial regulations. The platform’s ease of use, coupled with 24/7 support and a reputation system for vetting traders, makes it a competitive choice among the top 10 P2P platforms for 2025. BitValve’s commitment to flexibility and security makes it a go-to option for users who prioritize decentralized trading and a wider range of crypto assets.

9. Remitano

Remitano is a popular P2P crypto exchange in Asia and Africa, known for its seamless user experience and comprehensive customer support. This platform offers a secure environment with an escrow system, it provides multiple payment methods, including bank transfers, mobile payments, and local payment options. Remitano is designed to be highly user-friendly, allowing even beginners to buy and sell crypto with minimal effort. The platform supports popular assets like Bitcoin, Ethereum, and USDT, making it a well-rounded choice for users looking to invest in top cryptocurrencies

One of Remitano’s strengths is its focus on financial inclusion in emerging markets, where access to traditional banking services is often limited. Remitano’s peer-to-peer model helps users in these regions acquire crypto without needing a centralized exchange, allowing for fast, low-cost transactions. With robust security measures and easy navigation, Remitano is an excellent choice for users seeking a straightforward P2P trading experience, establishing it as one of the best P2P crypto exchanges for 2025.

10. WazirX P2P

WazirX P2P is a prominent P2P exchange in India and Southeast Asia, providing a secure, no-fee platform for buying and selling USDT, which can then be used to trade other cryptocurrencies. WazirX’s innovative auto-matching engine quickly connects buyers and sellers, ensuring efficient, fast trades without the need for manual negotiation. WazirX P2P is integrated into the broader WazirX exchange, giving users easy access to a wide range of cryptocurrencies.

The platform’s zero-fee model and auto-matching system make it ideal for users who prioritize efficiency and low-cost trading. With extensive support for local bank transfers and a responsive support team, WazirX P2P appeals to users in India and neighboring regions. Its streamlined experience and strong market presence in Asia solidify WazirX as one of the top P2P crypto exchanges for 2025, particularly for those looking to convert fiat into crypto without additional fees.

Each of these platforms offers distinct advantages in terms of security, payment flexibility, and user experience, making them excellent choices for traders looking to navigate the P2P cryptocurrency landscape in 2025. Whether you prioritize privacy, asset variety, or transaction speed, these top P2P crypto exchanges provide robust options for every type of trader.

Conclusion

In conclusion, P2P cryptocurrency exchanges are revolutionizing how individuals access and trade digital assets by offering direct, decentralized transactions. These platforms provide users with increased flexibility, diverse payment methods, and greater privacy compared to traditional exchanges, especially in regions where financial restrictions limit access to centralized financial services. As the demand for secure, user-centric P2P trading solutions grows, exchanges that prioritize escrow services, verified merchants, and user-friendly interfaces will continue to lead the market.

At SoluLab, as a P2P development company, we specialize in developing customized, secure P2P cryptocurrency exchange platforms designed to support robust functionality and user-centric features. Whether you’re looking to launch a new exchange or enhance an existing platform, our team of experts can provide end-to-end solutions tailored to meet your needs. Contact us today to learn how SoluLab can help you create a secure, scalable, and efficient P2P crypto exchange platform that keeps pace with the dynamic world of cryptocurrency.

FAQs

1. What is a cryptocurrency exchange, and how does it work?

A cryptocurrency exchange is a digital platform that facilitates the buying, selling, and trading of cryptocurrencies, acting as an intermediary between buyers and sellers. Users create accounts, fund them with either cryptocurrency or fiat currency, and can trade various assets like Bitcoin, Ether, and Dogecoin. Exchanges can be fiat-to-crypto, where users exchange traditional currency for crypto, or crypto-to-crypto, where one cryptocurrency can be traded for another. Each exchange varies in supported assets, features, and transaction options.

2. What is the difference between P2P and traditional crypto exchanges?

P2P (peer-to-peer) crypto exchanges connect buyers and sellers directly, allowing them to negotiate terms, choose payment methods, and set prices without needing a centralized authority. Traditional exchanges, on the other hand, act as intermediaries that manage all transactions on the platform. P2P exchanges offer more flexibility in payment options, often lower fees, and enhanced privacy, making them especially popular in regions with limited banking infrastructure. However, traditional exchanges usually provide higher liquidity and faster trade execution.

3. Are P2P cryptocurrency exchanges safe?

Yes, P2P cryptocurrency exchanges are generally safe when they implement robust security features like escrow services, which hold funds until both parties confirm a trade, and verified merchant systems to screen trusted sellers. Many P2P platforms also use reputation systems where users rate each other based on past transactions. That said, users should always verify buyer/seller information, use secure payment methods, and avoid deals that seem suspicious.

4. What are the benefits of using a P2P crypto exchange?

P2P crypto exchanges and cryptocurrency development solutions offer several benefits, including flexibility in payment options, lower transaction fees, and direct interaction with other traders. They often allow for local payment methods, like bank transfers or even cash, that may not be supported on centralized exchanges. P2P platforms can also provide a greater degree of privacy, as some don’t require extensive identity verification, making them ideal for users who prioritize privacy and control over their trading experience.

5. How can SoluLab help in developing a P2P crypto exchange platform?

SoluLab specializes in creating secure, scalable P2P cryptocurrency exchange solutions and crypto exchange development services that prioritize user experience, security, and flexibility. Our team can build custom platforms tailored to your needs, incorporating features like escrow services, multi-factor authentication, diverse payment options, and user-friendly interfaces.