In modern times, an inspection of insurance and on-boarding processes are either outsourced to third-party entities or are totally solved with the help of digital tools and modern technology. Data plays a significant role in the establishment of any strong ‘Know your customer’ (KYC) and anti-fraud function. Here, we shall discuss the importance of blockchain in KYC and on-boarding can solve existing hurdles and gain efficiencies.

Do you really think the data your customer is providing is reliable, accurate and verifiable?

Now,we would look into some challenges faced by the insurance industry:

Chances of error and time consumption with human dependency

Human intervention is evident when policyholders, workers, and agents are not able to view policy information. This elevates the chances of errors, delays claims resolution and increases costs. In various countries, the challenge increases rapidly with complex insurance programs or managing policies. Furthermore, it involves strict legal and regulatory adherence.

Complexity and infectivity

Firstly, there is a rise of online insurance brokers. However, many consumers still call insurance brokers to buy new policies. Mostly all policies are processed on paper contracts. Due to which processing of claims and payments tend to cause an error and usually require human control. Compounding this is the inherent complexity of insurance, which involves consumers, brokers, insurers, and reinsurers, as well as insurance’s main product — risk.

Claims processing

For a policyholder, making a claim can be a long and tiring process. We have to wait for a long time, as hundreds of insurers and reinsurers need to figure out

- where contracts are,

- which are correct,

- who are already paid,

- what, and which ledger has the right accounting

It’s a process that can take quite a while, even if you don’t factor in the extra time needed to adhere to tighter regulations for combating fraudulent claims.

Lack of trust

There’s a crisis of trust in the financial services industry. However, the large banks are significant, the erosion of trust influence all businesses. Lack of trust, high costs and inefficiency of the insurance industry all play a part in the extraordinarily high levels of under-insurance. To handle the trust issues, blockchain in KYC and on-boarding is going to play a major role.

Chances of fraud

An estimated 5 to 10 percent of all claims are fraudulent which, according to the FBI, costs the U.S. on health insurers more than $40 billion per year.

Customer on-boarding & KYC verification

To satisfy compliance requirements such as KYC (know your customer), insurance providers must collect, validate and verify key documents to prove characteristics such as name, address, birth, health, and economic status. Time delays are quite common as different third parties and internal departments must review the data to finish their due diligence processes. Afterward, companies spend huge resources fixing any mistake that occurred while records were being reconciled.

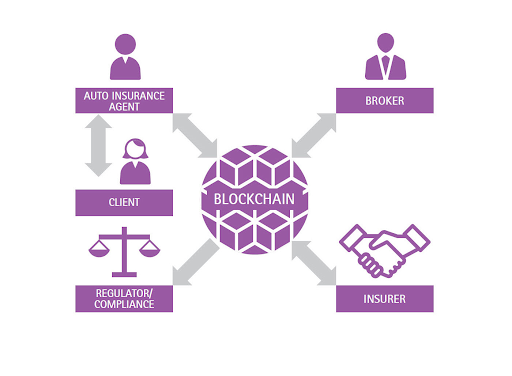

How Blockchain in KYC And on-boarding Helps Insurance Industry

Nearly half (46 percent) of insurers expect to integrate blockchain within the next two years, and the vast majority (84 percent) say blockchain-based ledgers and smart contracts are reinventing the way they engage with new partners.

Proof of blockchain’s popularity is evident, with $1.9 billion having been invested in 891 blockchain startups as of early 2017.

Read More: Is blockchain technology ripe to enter the Insurance ecosystem?

Unlike banking and capital markets, which have established exchanges that are particularly vulnerable to disruption by blockchain, insurance doesn’t have a natural exchange to which the technology can be applied. However, that doesn’t mean it doesn’t promise to reshape the industry’s processes.

Blockchain technology can solve the legal and regulatory problems to become the default standard across the insurance industry. But, the possibilities are endless. And insurance companies and startups alike are exploring insurance applications for the technology at full throttle. While blockchain might not be able to end all problems faced by insurers, it does provide foundation technology that promotes trust, transparency, and stability.

Customer identification

A blockchain is a distributed network. Hence, it is possible to make the necessary documentation available to whoever has permission access. The records are secured with cryptography and linked together, which prevents them from being altered retroactively.

This will help in enabling the secure sharing of information across an company and to relevant third parties.

Claims processing

Blockchain development solutions can be a vital link across a vast ecosystem of third-party administrators and service provider networks. Employers can benefit from its characteristics shared ledger transparency, i.e; fewer errors resulting in better claims processing, superior provider management, and reduce operational expense.

Reduce errors and complexity

With Blockchain insurance companies can convert multiple policies into “smart contracts” giving a single, consolidated view of policy data and documentation in real time. The solution allows visibility into coverage and premium payments, delivering automated notifications to network participants following payment event

Fraud detection & risk prevention

By moving insurance claims onto an immutable ledger, blockchain technology can help eliminate common sources of fraud in the insurance industry.

Health insurance

With the help blockchain technology, the health insurance ecosystem will increase, medical records can be cryptographically protected and shared between health providers.

Reinsurance

With the implication, blockchain can simplify the flow of information and payments between insurers and reinsurers.

Some of the insurance companies who have already started using Blockchain in KYC and on-boarding

A report from EY, “Blockchain in insurance: applications and pursuing a path to adoption,” states, “the insurance industry must make investments now to be in a position to take advantage of efficiencies and opportunities blockchain technology can deliver long term.”

The insurance industry will still have a hurdle to overcome. However, blockchain’s potential to provide complete transparency, accountability and security will help insurers save time and money. Also, blockchain in KYC and on-boarding will enhance customer satisfaction. Moreover, it will help to establish a good level of trust between the insurer and the insured and will build stronger and more powerful relationships as well.