The ever-revolving world of cryptocurrencies has traders constantly looking for ways to speed up their trading tactics. Traders aim to optimize market fluctuation and SS, their own, and other traders’ potential for financial gain. Cryptocurrency sniper bots are more frequent trading solutions that software uses to complete transactions more quickly than people, outperforming them in accuracy and speed in their attempt to boost profits.

Crypto Sniper Bot Development is nothing new. The purchasers, auction attendees, and participants in auctions have made extensive views of them since their first use on eBay. They are seen as the deadliest force as well as dearest friends. The NFT and cryptocurrency exchanges have extensively used all these automated cryptosystems since 2019.

According to recent research, properly programmed AI trading boards can reduce emotional trade errors by 96% and reach a win rate of 60% to 65% in the trading market. They work throughout, every day of the year, monitoring more than 500 trading pads at once and completing trades in less than 50 ms.

Before we go any further, let’s examine what our sniper trading bots are and why they are necessary. How to create a crypto trading bot, and why have they become so well-known in the crypto-verse?

Understanding Sniper Bot

Shortly after tokens are listed on the decentralized stock exchange like UniSwap, PankcakeSwap, and others, a specific type of trade called a crypto sniper bot is used to snipe them. Essentially, it is designed to avoid the backlog, allowing users to obtain new tokens more quickly than the general public.

Crypto industry snipers keep an eye on block memory pools, which are typically used for temporary storage of pending transactions. These both are set up to search for the most recent posting of tokens. Wherever the bot finds a new token, promptly executes the purchase order, and the four significant demand increases, it does so at a price that may be lower or greater than the existing price. The creation of a triangular arbitrage trading bot might give season traders, a significant, specifically in a market like this we are keeping a profitable position that requires early access.

What are Sniper Bots Used For?

With the help of sniper bot development, it gives us numerous key characteristics of its deployment, you can improve your trading strategy and booster profit. These features include:

-

Quickness

Sniper bots are designed to close transactions quickly, usually in a matter of milliseconds. This speed is crucial in the cryptocurrency space, where token prices can fluctuate significantly in just a couple of seconds. For example, during total launches, awards could increase by over 100% in a few minutes, and help secure tokens at lower initial prices until manual traders can respond.

-

Automated

After being set up, sniper bots can operate on their own, looking for opportunities by analyzing blockchain liquidity for events like token releases. Due to the 24/7 availability of this feature, it eliminates the need for constant manual monitoring, allowing traders to seize opportunities even at slower times throughout the day. According to a binance poll, over 40% of cryptocurrency traders use automated tools to increase their efficiency.

-

Earnings

The profit potential is found in the fact the Crypto Arbitrage bots can make significant returns by purchasing tokens at a discount during the initial list process or availability and enhancement. For instance, data from TokenSniffer shows that early traders in decentralized exchanges like UniSwap have the potential to make over 300% in a single day when tokens see a sharp rise in popularity following their launch.

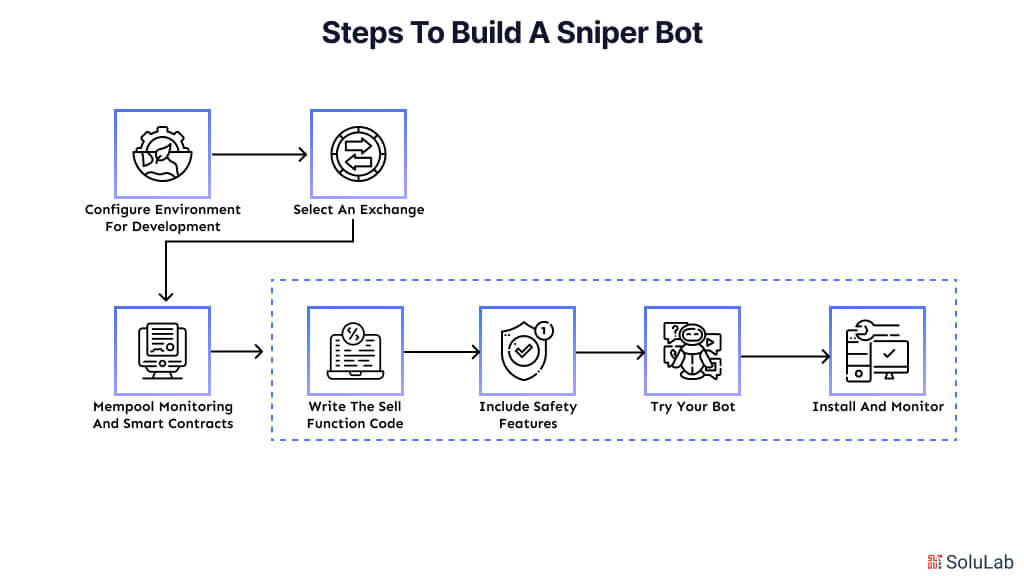

Steps to Build a Sniper Bot

Here is a step-by-step guide to how to create a sniper bot :

1. Configure Environment for Development

Make sure you have the appropriate tools installed before beginning the coding portion. To get started if you’re new to coding, think about making us sniper-bought templates first. To begin, you’ll need the following:

Installing Node.js and NPM is essential because the majority of sniping bots and crypto are written in JavaScript.

- GitHub: Helpful for open-source library access, and version control.

- Code Editor: For convenience of use, pick one such as sublime text or visual studio code.

2. Select an Exchange

Transaction prices and speeds may vary between Blockchain, which may affect how well your body performs. The court changes required for your body will depend on the Blockchain you select as of its affordability, a lot of developers choose to begin on the Binance smart chain. The most among well-liked choices are:

- Ethereum: Popular for Defi tokens, but notorious for its expensive gas fees.

- Binance Smart Chain: Better for novices because it’s quicker and less expensive.

- Avalanche and Polygon: Gaining traction for quicker and less expensive purchases.

3. Mempool Monitoring and Smart Contracts

You must have a fundamental understanding of smart contract operation to create a sniper trading bot that works. Upon launch, tokens often begin trading through a smart contract. The bot searches the main pool for fresh contracts and, upon detecting a relevant transaction, initiates a by-order.

Here are the important steps you have to be aware of:

Learning about Web3.js or Erhers.js as these libraries provide communication with Blockchain that supports Ethereum. Configuring monitoring for mempools, keeping an eye on the mempool, configuring a node, or using APIs. Another option is to look into open-source initiatives that offer mempool data. The core for your cryptocurrency sniping bought is the buying function, this function should initiate an order when you find a new token.

This is an example of a Javascript by functional structure:

Within this code:

- Token Address: The token’s address that needs to be purchased.

- Quantity: The sum of BNB or ETH needed to purchase the token.

- Gas Limit and Gas Price: Regulate speed and expense, and set these values using the Blockchain.

4. Write the Sell Function Code

You’ll need an exit strategy for a full-featured crypto arbitrage flash loan bot. Usually, a sell function that initiates a specific percentage or price point gain is included. This is a simple sale function:

Include Safety Features

Rock pools and scans, in which dishonest people introduce a token and subsequently deplete its liquidity, a common in the cryptocurrency market. Think about, including the safety features to safeguard your investment:

- Checking Liquidity: Before purchasing, make sure that the token you have chosen has locked liquidity

- Ownership Renouncement: To lower the possibility of malevolent modifications, find out if the owner of the contract has given up control.

- Token Blacklist: Steel, clear of specific wallets, addresses, or tokens that have a history of fraud.

5. Try Your Bot

Try or run your sniping crypto bot on a test net, such as the BSC Testnet or Ropsten (for Ethereum), before putting it on the mainnet. By doing this, you can make sure that your bot works as intended and find any issues without having the risk of using real money.

6. Install and Monitor

After testing is finished, launch your bot and keep an eye on its functionality. Monitoring its earnings, transactions, and possible problems. Depending on the state of the market, you may need to modify the buying/selling criteria or gas prices.

Why Should You Build a Sniper Bot?

For traders navigating the erratic cryptocurrency market, sniper bots are an essential tool, particularly when token launching and during periods of heavy trading demand. This is how the cryptocurrency trading:

1. Seizing Early Chances

Launches of new tokens frequently create a lot of excitement and cause prices to so in a matter of seconds. Speed processing competition and Blockchain make it practically hard to buy these tokens by hand. This procedure is automated by a sniper bot, which immediately recognizes and purchases tokens as soon as they become available, guaranteeing traders to enter at the best price.

2. Preventing Front-Running

Due to front running, which occurs when the parties pay greater gas fees to execute traits before you do, a delay in decentralized exchange might result in lost opportunities or higher prices. By automatically giving priority to transactions with the best gas prices, sniper Bose, reduces delays and guarantees that your trade is completed promptly.

3. Handling Volatility

Due to the extreme volatility of cryptocurrency markets, token prices can change significantly in a matter of minutes, to guard against unexpected losses and profit from quick price movements without humans involved, sniper, robots are built with present settings, such as self-threshold and slippage restrictions.

4. Avoiding Human Mistakes

Emotions, exhaustion, and distractions can all have an impact on the precision and attentiveness needed for manual trading. An algorithm trading bot performs trade flawlessly, according to the pre-program instructions, eliminating any kind of human mistake.

5. Enhanced Trade Liquidity

Sniper robots can identify when decentralized exchange at liquidity, indicating when tokens are ready for trading. This enables traders to secure a position and profitable transaction by acting instantaneously, even before the wider market notices.

Sniper box gift, cryptocurrency traders, a competitive edge by automating, trading tactics, which helps them better. The integration of a Blockchain-based market seizes opportunities and lowers risk.

How Much Does It Cost to Build a Sniper Bot?

The cost to build a crypto sniper bot associated with developing a sniper trading, crypto bot can vary greatly, depending on several parameters, including the location and the experience of the development team, which can have a considerable impact on the cost associated with the project as well as the development process takes longer and cost more money. More sophisticated, and more advanced features are used according to the complexity, and and lastly, ongoing maintenance and upgrades to ensure that the board continues to work at its highest potential in a market that is constantly changing.

When it comes to the development of a complex, sniper bot, the cost of the crypto arbitrage bot for trading often runs anywhere from $30,000-$60,000 depending on the particular specifications and scope of the project. Given this, it is recommended that this needs to be communicated to the service provider and that they be requested to offer a quote.

Key Benefits of Sniper Bots

Now that you’re aware of what is a sniper bot, and how to build one here is the breakdown of key benefits of using sniper bots for your trading purposes:

1. Support Multiple Exchanges

This means that assassination bots that work must also operate on numerous exchanges simultaneously. It makes it possible for the bot to do more kinds of deals and increases the chances of finding an arbitrage.

2. Closing Costly Stock

Transaction costs as well as cost for change are known to fluctuate over some time in the exchanges. When all such charges are included, then complex bots know charges to compute so that trades will generate profits continually.

3. Adaptive Order Dispatching

This feature provides the best ways to arrange the execution of the deals when operating in several exchanges simultaneously. They eradicate the impacts of slippage to the largest extent possible and enhance the overall efficiency of deals.

4. High-Frequency Trading

Some sniper bots like the Solana trading bot are designed for high-frequency trading and trading thousands of deals per second. Any high-frequency trading bot needs to contain algorithms that are reasonably optimized and link to exchanges with the lowest possible response time.

5. Importing Machine Learning Processes

When machine learning is applied, bot systems are capable of making decisions independently through having experience from previous deals.

How can SoluLab Help Building Bots for Your Business

For developers, looking to take advantage of robotic accuracy and speed in the trading. Space, sniper bots are an amazing tool. Crypto sniper development is a profitable endeavor for an organization with experience in traditional hedge funds, cryptocurrency exchanges, asset management, firms, money markets, and digital start-ups because these tools are highly sought after.

We at SoluLab, a Crypto Arbitrage Bot Development Company, help you create a chatbot for improving corporate communication that could change your client experience. With the help of this complex technology, you can teach your chatbot to answer calls, welcome customers by phone or SMS, give precise information about offerings, and even help customers make appointments depending on available times. Simplify processes, save time, and guarantee that your customers always receive timely, courteous service.

Don’t miss the chance to use modern Blockchain technology to advance a company collaborate with SoluLab right now to begin a part of success and creativity. Get in touch with this right now.

FAQs

1. What exactly is the function of a sniper bot?

Sniper bots are computer programs that automate the practice of sniping, which refers to the art of placing a bid at the very last second on an item that is being auctioned off.

2. Which crypto trading bot has the highest potential for success?

Cryptohopper, 3Commas, ArbitrageScanner.io, and Pionex are some of the best bots that are currently available. They are simple to operate and come with a variety of automation features.

3. Do bots pose any danger to their users?

Internet boards and Melva boards can be created or compromised to send spam, search for contact details on the internet, access user accounts, and carry out other destructive task. Attackers may disperse malicious bots in a botnet, or bot network to execute these attacks and conceal the origin of the attack traffic.

4. What do sniper bots aim to achieve?

Businesses may gain from bots via an extension of business hours and offer services whenever needed. Reach a larger audience and make the most of your current resources, release human workers from repetitive, and tiresome work.

5. What are the types of crypto sniper bots?

Exchange-specific, multi-exchange, entry/exit, scaling, Abhiraj, technical indicator, AI-powered, market making, trend following, NFT, and DeFi sniper boards are among the several kinds of sniper bots.

6. What are Flash Loan Arbitrage Bot Solutions?

Flash Loan Arbitrage Bot Solutions are programs or services that use flash loans to automate arbitrage tactics. They seek to make money without needing up-front funding by spotting price discrepancies among decentralized exchanges, making trades, and paying back the loan all at once.

7. How is SoluLab making customers carry out blockchain operations easily?

SoluLab offers customized solutions that streamline deployment and management, making blockchain operations simple for clients. By emphasizing intuitive user interfaces, smooth integration, and sophisticated analytics, SoluLab lowers technical hurdles.