The nature of DeFi applications is transforming finance by disintermediating it and allowing open and transparent access to all financial services to anyone who can access the internet. It is booming at a notable pace and is projected to reach USD 48.02 billion by 2031.

Before understanding how to build a DeFi app, it is essential to understand the difference between DeFi apps and dApps, which are decentralized applications. DeFi apps only provide the financial services of lending, borrowing, and trading through blockchain technology. dApps have a more extensive range, from games to education and other spheres.

In this guide, we will walk you through every phase of DeFi app development, from identifying the right use case to selecting platforms and ensuring security implementation. So, let’s get started!

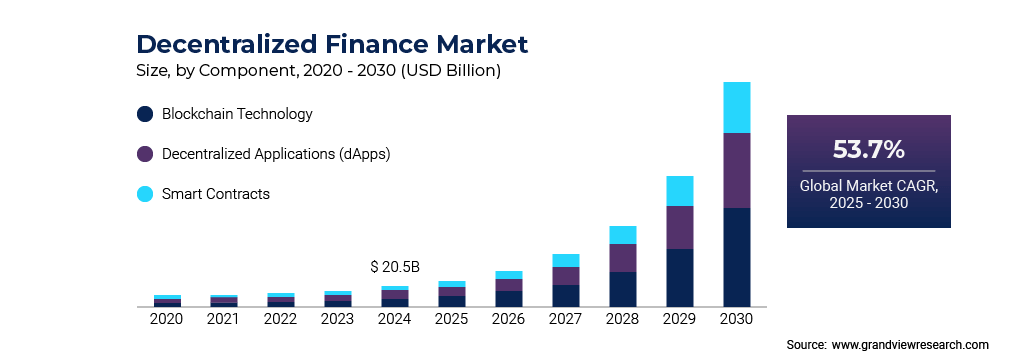

Market Size and Trends in Decentralized Finance

The global decentralized finance market is valued at USD 20.48 billion in 2024, and it is expected to grow with a compounded annual growth rate (CAGR) of 53.7% from 2025 to 2030. The rapid adoption of DeFi has significantly transformed the financial sector by being one of the key driving forces of growth. It has recently caught a lot of attention in both DeFi and decentralized blockchain technology. The reason most people are paying increasing attention to DeFi is that it helps remove intermediaries in financial transactions.

With the increasing interest in DeFi, many individuals are seeking a reliable guide for DeFi development to fully understand its capabilities. The technology provides a universal, borderless financial system enabling users to mitigate risks, get decentralized loans, and participate in safe cryptocurrency trading, all facilitated by blockchain-based platforms. Many of the best DeFi apps are already showcasing the potential of this transformation.

Essential Features for Developing a DeFi App

Smart contracts and interoperability form the fundamental components of a DeFi application’s development. Including elements that enhance usability, security, and engagement will help one create a strong, user-centric platform. Here are the fundamental components:

-

Cryptocurrency Transactions

Help users to securely and instantly move digital assets. Compared to traditional banking systems, peer-to-peer transactions speed processing and lower costs.

-

Support for Multiple Currencies

Let users manage and transact on a single platform using many cryptocurrencies, including Bitcoin, Ethereum, and others. This adaptability streamlines portfolio management and trading.

-

Decentralized Administration

Using governance systems that let users vote on platform changes, funding distribution, and updates helps to involve communities. This encourages transparency and helps consumers to feel responsible.

-

Advanced Analytical Tools

Furnish users with instantaneous data and insights on market trends, investment performance, and associated hazards. These tools assist users in making astute financial decisions and monitoring their progress efficiently.

-

Yield Farming and Staking

Enabling users to earn incentives via yield farming and staking provides passive revenue options. These attributes enhance engagement and foster sustained platform utilization.

-

Smart Search and Filters

Improve user experience with effective search and filtering capabilities. These tools facilitate straightforward and intuitive discovery for users exploring tokens, investing methods, or trending possibilities.

Working with a professional DeFi app development company guarantees perfect integration of these features, improving the visibility of your application in the quickly growing distributed financial industry.

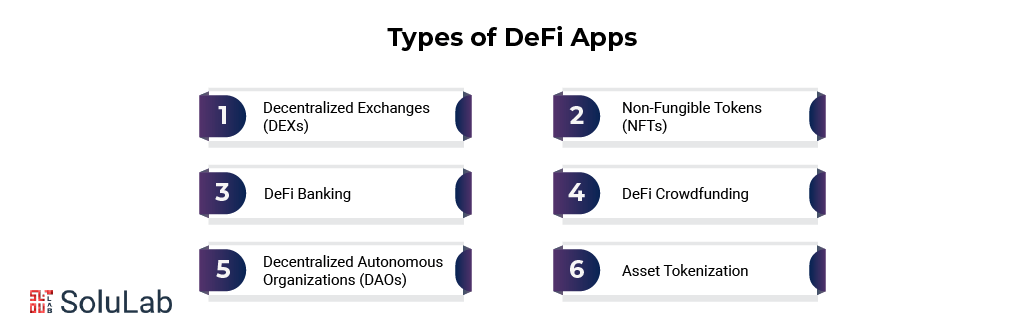

Different Types of DeFi Apps

DeFi apps have been developed to fulfill several financial functions, each addressing distinct market demands. Below are many of the most prevalent categories of DeFi applications:

1. Decentralized Exchanges (DEXs)

Online markets for crypto transactions between users free from centralized authorities are known as decentralized exchanges (DEXs). When it comes to DEXs, there is no custody of the assets, meaning you trade directly from your wallet. In simpler terms, DEXs empower you with control of your funds and privacy.

2. Non-Fungible Tokens (NFTs)

Several definitions describe NFTs as distinct digital assets reflecting ownership of anything from virtual real estate to art to music. NFTs are multifaceted in their roles in the DeFi sector, from collateral for loans to gaming ecosystems. They make finance fun in that registered users can buy, sell, and exchange unique products over blockchain networks.

3. DeFi Banking

DeFi banking seeks to bring traditional banking activities into a decentralized environment. Users get interest on deposits made in cryptocurrencies, borrow, and are given credit without the interference of banks. Just like a bank in your pocket, constantly operating, never charging fees, and never making you wait for long hours.

4. DeFi Crowdfunding

Defi crowdfunding helps individuals fundraise from the community while actively disallowing banks or venture capitalists from stepping in. Users can invest in ideas and companies by giving away their cryptocurrencies. It’s a fun way to invest in ideas that will hopefully give you some return.

5. Decentralized Autonomous Organizations (DAOs)

Unlike conventional management structures, distributed autonomous organizations (DAOs) are run by smart contracts on a blockchain. By voting on decisions and proposals with their tokens, members of a DAO help to guarantee a democratic approach to the handling of resources or projects. With a guarantee of openness and fairness, DAOs let users help to manage community resources and fund projects.

6. Asset Tokenization

Asset tokenization is the activity of turning mostly real estate or artwork into digital tokens on the blockchain. This makes the acquisition, disposal, and transfer of such assets extremely simple, relieving people from the typical paperwork and any middleman involvement.

How A DeFi App Functions?

The term DeFi (Decentralized Finance) is used to refer to those applications that operate via a blockchain other than ETH, such as Solana, that permit the execution of financial services by everyone without including any banks or brokers in between. This is where smart contracts- the self-executing codes that streamline transactions while maintaining transparency of the rules- come into play.

Then, you are led to connect a crypto wallet, usually called the best DeFi wallet application, like MetaMask or Trust Wallet. This is the device connecting you to a decentralized world where you can carry out dealings with DeFi applications in a safe and private manner.

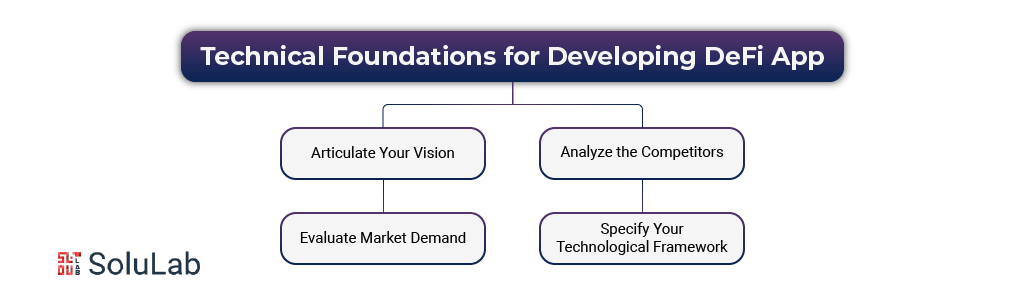

Criteria for Choosing the Technical Foundations for Developing a DeFi App

Building a DeFi app requires a careful choice of suitable technological infrastructure. A good tech stack guarantees long-term adaptation as well as the safety, scalability, and maintainability of your application. This shows that as your application grows and advances, you are not limited to a specific framework or programming language..

-

Articulate Your Vision

Before commencing development, it is essential to delineate your app’s fundamental objective. What issue does it address? What distinctive features would it provide? What are its constraints, and how will it provide tangible benefits to users? Learn the characteristics of your audience and the reasons they would favor your solution over alternatives.

-

Analyze the Competitors

Examining current items and DeFi lending platforms can provide you with a significant advantage. Check how your attributes measure against competitors in the market. Do your competitors possess features that you lack? Does your application include distinctive characteristics that are not offered by others? Analyzing rivals is essential for recognizing chances for difference.

-

Evaluate Market Demand

Understanding the broader DeFi ecosystem is essential. Examine the present environment, pinpoint neglected sectors, and analyze consumption trends in existing applications. This will assist you in identifying gaps that your product may address and ensure that your solution aligns with consumer demand and trends.

-

Specify Your Technological Framework

Ultimately, discover the technical specifications of your goods. What categories of data will you manage? What is the volume of data, and what is the required processing speed? Which programming languages and frameworks are most compatible with these requirements?

Numerous DeFi lending apps and platforms have been built on existing protocols such as Compound, Dharma, MakerDAO, or Kleros. These protocols establish the foundational regulations and smart contract capabilities. Above this base resides your application layer, where you architect the user interface, execute analytics, include security protocols, and cultivate a cohesive user experience.

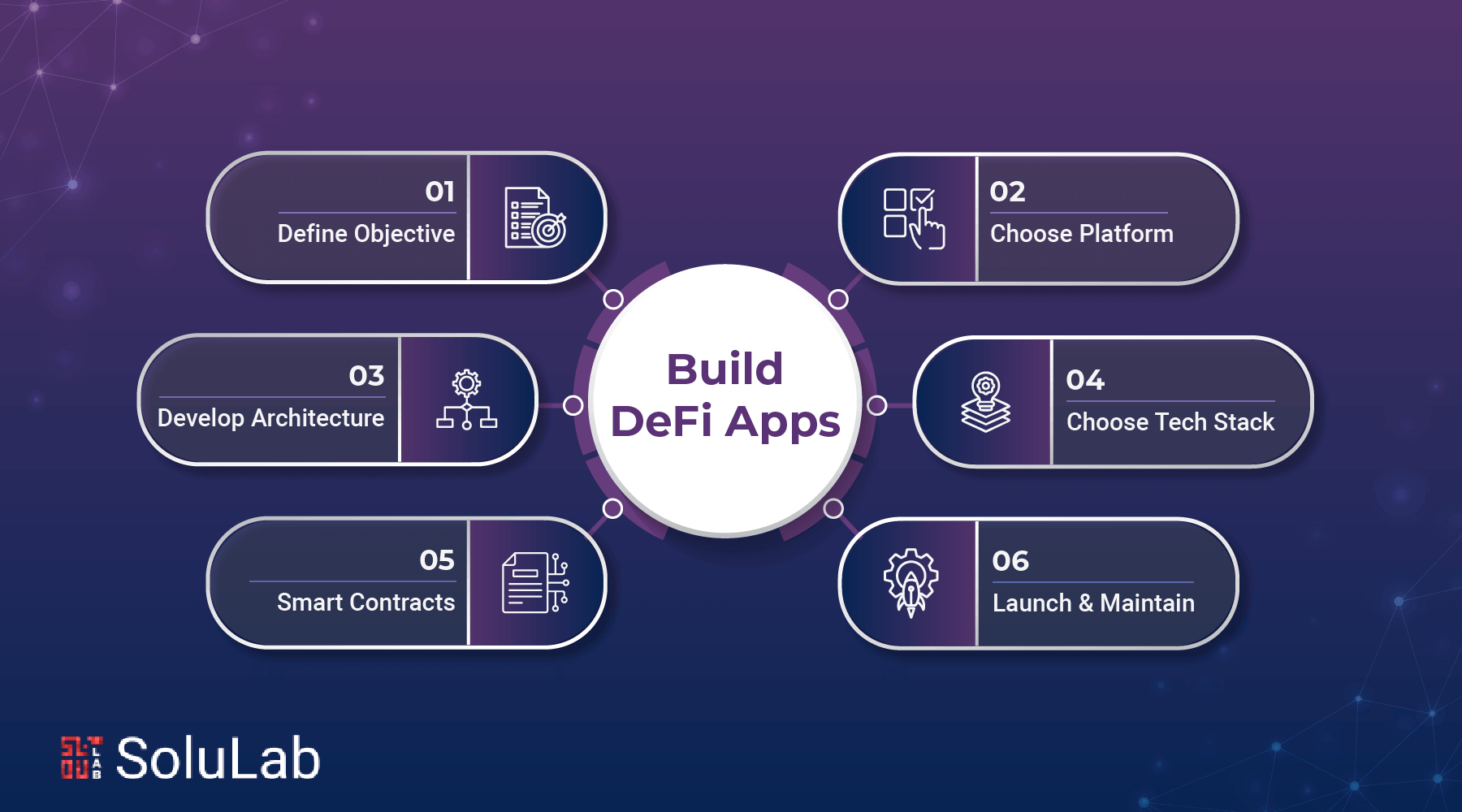

Steps to Create a DeFi App From Scratch

The increasing popularity of DeFi development has attracted interest in the formulation of unique DeFi solutions. One should acquire the skills to develop a DeFi application from the ground up by adhering to the best practices advocated by specialists. Below are the essential steps necessary for developing a DeFi app.

Step 1: Define the Objective of Your DeFi App

Begin by determining the specific functionalities you desire for your application. Your selection will determine the trajectory of all subsequent actions.

Do you want to develop a loan platform, a decentralized exchange, or an alternative solution?

Subsequently, define your target audience.

Finally, outline your application’s unique selling proposition.

Step 2: Choose a Blockchain Platform

It is now time to choose a blockchain platform. Consider aspects like security, scalability, transaction costs, interoperability, and the development community. Common blockchain platforms to explore for DeFi application development include Ethereum, Binance Smart Chain (BSC), Solana, and Polygon.

Step 3: Develop the Architecture of the DeFi Application

Designing your app’s architecture entails strategizing the integration of all components. It is essential to contemplate user interaction with your application and the flow of information. An explicit strategy enhances your application’s functionality and accommodates numerous users.

Step 4: Choose the Right Technology Stack

Selecting an appropriate tech stack involves identifying the tools necessary for app development, including programming languages and blockchain platforms. Select tools that align with your application’s requirements and those with which your team is proficient.

Step 5: Create and Test Smart Contracts

After selecting the technology stack, concentrate on the development of smart contracts. Compose the code meticulously to ensure it functions just as intended. Subsequent to composition, one should do testing. Conduct tests to identify and rectify any issues prior to launch.

Step 6: Launch and Maintain Your Application

The final stage entails deploying your DeFi application. Inform them about it and motivate them to experience it. Continuously monitor the app’s performance, rectify any errors, and implement updates for user feedback. Consistent maintenance ensures customer satisfaction and encourages repeat engagement.

What are the Costs Associated With Developing a DeFi App?

The expense of DeFi app development might fluctuate significantly based on the platform’s complexity, desired features, selected blockchain network, and the expertise of the development team. The cost of developing a fundamental DeFi application typically ranges from $30,000 to over $150,000.

Below is an analysis of essential cost elements:

- Planning and Research: Preliminary market research, competitive analysis, and the development of a product roadmap may incur expenses ranging from $5,000 to $15,000.

- Smart Contract Development: The creation, testing, and deployment of secure smart contracts is a crucial and costly endeavor, often ranging from $10,000 to $40,000 based on complexity.

- Frontend and Backend Development: The creation of user-friendly interfaces and integration with backend services often costs between $15,000 and $50,000.

- Security Audits: Expert audits are essential because DeFi platforms manage financial transactions. The costs might range from $5,000 to over $50,000, depending on the extent of the project.

Post-launch maintenance and upgrades, encompassing bug corrections, feature enhancements, and security updates, may incur yearly expenses of around 15–25% of the initial development cost.

Partnering with a proficient DeFi app development firm or team that comprehends both the technological and economic ramifications is essential. Investing in superior development and security from the outset guarantees streamlined operations, user confidence, and long-term scalability.

What Makes a DeFi App Necessary for Businesses?

Decentralized finance (DeFi) app development is becoming more popular as a means for organizations to get access to new sources of revenue, increase transparency, and provide novel financial services. Brands may take center stage in the financial technology revolution by launching their own DeFi apps.

Here’s why it makes sense:

1. Capitalize on an Expanding Market

Protocols and platforms in the DeFi industry have attracted billions of dollars, leading to exponential expansion. You may tap into a worldwide audience looking for decentralized alternatives to conventional banking by developing a DeFi app.

2. Provide Nationwide Financial Services

In contrast to traditional systems, DeFi apps are available at all times and are not limited by location. This allows your company to service customers globally without worrying about obtaining permits in each nation.

3. Maximize Earnings Potential

Token utilities, staking incentives, loan spreads, and transaction fees are some of the greatest ways for DeFi apps to make money. Providing customers with comparable features allows your organization to consistently earn money while also satisfying their needs.

4. Make Things More Transparent and Secure

Apps developed by DeFi, which use blockchain technology, remove middlemen from financial transactions and make them fully transparent. Not only does this increase user confidence, but it also decreases operating expenses.

5. Distribute Financial Authority to Your Users

Users get complete control over their assets and decisions using DeFi. You can build a dedicated customer base that shares your principles of independence, privacy, and decentralized financial tools by focusing on your users first.

To stay ahead of the curve and meet the needs of the future generation of customers who want ownership over their own money, consider implementing some of the finest features seen in the best DeFi apps. These include decentralized exchanges, lending pools, and yield farming.

The Bottom Line

When it comes to capital, DeFi applications are changing the experience for customers as well as businesses. By doing tasks like facilitating borderless transactions and eliminating intermediaries, DeFi is paving the way for future financial systems that are more accessible, open, and transparent. Integrating DeFi into your company strategy is now essential for companies aiming to innovate and grow.

The team at SoluLab is dedicated to helping businesses transform their innovative ideas into practical DeFi solutions. As an example, as a DeFi development company, we recently worked with E-Motive, a decentralized car marketplace that cuts out the middleman and drastically lowers commission fees for buyers. E-Motive is the first decentralized automobile platform merging sustainability with the latest Web3 technology; it was built utilizing blockchain technology and governed by eco-friendly principles.

Ready to launch your own DeFi project? Let SoluLab be your tech partner. From ideation to launch, we bring expertise, innovation, and proven success in the DeFi space. Book a free consultation to discuss your project today!

FAQs

1. What is a DeFi app, and how is it different from traditional finance apps?

A DeFi (Decentralized Finance) app is a blockchain-based application that offers financial services like lending, borrowing, and trading without intermediaries such as banks. Unlike traditional finance apps, DeFi apps run on smart contracts and operate transparently on decentralized networks like Ethereum or Solana.

2. Which blockchain should I use to build a DeFi app?

It depends on your use case, target audience, and scalability needs. Ethereum is the most popular choice due to its mature ecosystem, but other options like Binance Smart Chain, Solana, and Polygon offer faster and more cost-effective alternatives.

3. Do I need to know Solidity to build a DeFi app?

If you’re building on Ethereum or compatible chains, yes — Solidity is the primary programming language for writing smart contracts. However, for blockchains like Solana, you’ll need Rust. Familiarity with JavaScript, Web3.js, or Ethers.js is also helpful for front-end development.

4. How do DeFi apps generate revenue?

DeFi apps can earn revenue through transaction fees, interest rate spreads (in lending protocols), token issuance, staking, and liquidity provision incentives. Tokenomics plays a key role in designing a sustainable business model.

5. Are there regulatory concerns when launching a DeFi app?

Yes, regulations around DeFi are still evolving globally. It’s crucial to consult legal experts to ensure compliance with local laws, especially around KYC, AML, and securities regulations, even if your app is fully decentralized.