Cryptocurrency exchanges are becoming quite necessary in our time. With new digital assets such as NFTs, currency, and tokens gaining traction, the need for an exchange platform is greater than ever. Many companies are determined to have their share in such a growing market, and this is understandable.

Setting up a digital asset exchange is not a child’s play. There are so many components to factor in, including the technical aspect of your platform and the range of unique propositions you provide to your users. In this piece, let us walk you through the steps you will need to perform to establish a digital asset exchange putting into perspective if this is the right step in the evolution of your business or a process that you would want to incorporate within the existing operations of your business.

What Are Digital Asset Exchanges?

A digital asset exchange (DAX) is a kind of market whereby the users exchange their digital assets on a given platform. Due to its rapid growth and broad applicability, it is helped by the newly created market environment which is based on disruptive technology.

A decentralized exchange development (DEX) company, sometimes called a cryptocurrency exchange, allows users to trade different tokens and currencies for a profit. It is somewhat like a traditional stock exchange market, where the buyers and sellers place orders but have to wait for a counter order to get matched. Some exchanges provide extra services, including wallets, leverage trading, and OTC functions.

Key Components of a Digital Exchange Platform

DAX (Digital asset exchange) is an electronic marketplace designed to facilitate the provision of such services as buying, trading, and selling of digital commodities including tokens, and cryptocurrencies. Here are the key features of digital asset exchange:

-

Matching Order Engine

This matching component is basic in transferring buy and sell orders thus enhancing trading a real-time capability, which is an essential process enabling a self-contained and consistent transaction flow. As a result of the sustenance of such seamlessness, their orders will be executed within very short periods.

-

User Interface

Simply interacting with the website, the UIs are the most visible parts of it all. User-friendly and simple designs with various options including charts, order books, and market information should be integrated.

-

Security Features

To protect end-user accounts and investment funds against frauds and hacking attacks stringent security measures are in place including encryption technology, two-factor authentication (2FA), and a withdrawal whitelist these go a long way in lessening possible frauds or hacking.

-

Wallets

Digital wallets storage is used to safeguard customer’s valuables. Hot wallets are online, allowing for relatively quick trading while cold wallets are offline, providing enhanced protection from cyber attacks.

-

Smart Contracts

Smart contracts that allow trades to be peer-to-peer without third parties whenever applicable automate contracts allowing trading pro.

Types of Present Exchanges

Different types of present exchanges can be broadly categorized into two types – crypto centralized exchanges( CEXs) and decentralized exchanges ( DEXs).

1. Centralized Exchanges CEXs are created and operated by one individual or company. This type of transaction is more prone to failure because of its higher centralization. Users stand to lose their funds when a parent company of the exchange declares bankruptcy or gets hacked; such was the case with the current FTX scandal. Of all the crews, the most popular ones are Binance and Coinbase.

2. Decentralized Exchanges On the other hand, decentralized crypto exchanges (DEX) are operated by a group of users. Even if a single-user server was to go down, the exchange would remain operational. DEXs include PancakeSwap and UniSwap as the most widely known ones. It is LinkedIn that stresses the importance of making the right choice of cryptocurrency because it will help you to make smart decisions regarding the software, licensing to use for storing the cryptocurrency, attempt to manage your liquidity, and the wish to accept fiat currencies in the future.

Why should you Build a Digital Asset Exchange?

The rise of digital asset exchange for tokenized real-world assets has transformed the financial system and provided investors and companies with previously never-seen chances. This new era is supported by digital asset exchange making it easy to trade and manage tokenized assets. To build a digital asset exchange is the smart step for the following reasons:

| Reason | Description |

| Tokenized Market | Tokenization is the process of turning assets, such as commodities, real,estate, or artwork into digital tokens. |

| Global Accessibility | Users can invest in tokenized assets from anywhere in the world, and your user base grows as a result of this democratization of access. |

| Blockchain’s Security | Blockchain technology powers digital asset exchanges which provide effective, secure, and transparent transactions. |

| Generate Income | Buying fees, coin listings, and additional features like margin trading are examples of the revenue generation potential of tokenized assets. |

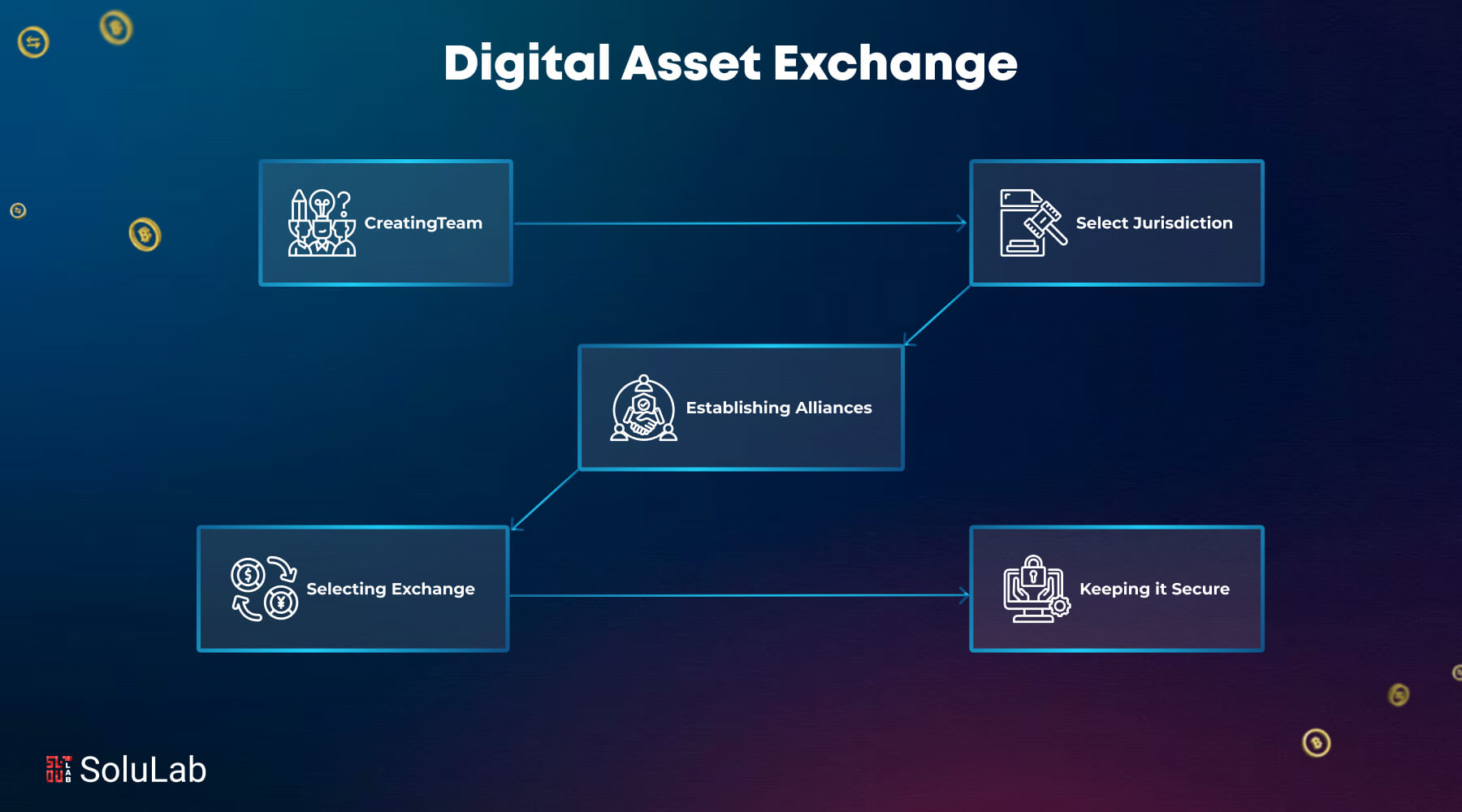

Step-by-Step Process of Building Digital Asset Exchange From Scratch

Step-by-Step Process of Building DEX Platform from Scratch to Make Use of Digital Asset Exchange Solutions, here is your guide to building a digital asset exchange from scratch from making your team to integrating the technology according to your needs and preferences:

1. Creating Your Team

Putting together a competent team is the first step in creating an effective digital asset exchange (DEX). This is how the procedure goes:

Technological Team

- Blockchain engineers: They can create blockchain protocols as well as such basic technologies as smart contracts.

- Front-end engineers: You apply for the construction of robust back-end systems that support smooth operations.

- Security Engineers: Ensure the protection of data and systems against potential online threats.

Operational Team

- Marketing Professionals: To attract users and publicize the trade, advertising is essential.

- Customer Service: To give users timely assistance, users must be provided with appropriate help.

- Business Development: Leverage opportunities and partnerships to accelerate growth

Legal Team: Legal paperwork and compliance as well as minimal regulatory risk have to be managed.

As an alternative, you can concentrate on operational improvement and market expansion by collaborating with external providers of technical development in the market for technical development.

2. Select Jurisdiction and Acquire Licences

A compliant and lawfully running digital asset exchange is dependent upon selecting the appropriate cou

Recognising Rules of Jurisdiction

- Examine the laws in the areas where you intend to conduct business.

- Select a location that complements your business plan and meets your operating requirements.

Safe Permits and Licences

- Determine the particular permits needed to conduct business in the jurisdiction of your choice.

- Verify adherence to counterterrorism financing (CTF) and anti-money laundering (AML) regulations.

Selecting a KYC Provider

- Choose a custom digital asset exchange according to their capacity to comply with local laws.

- Put in place procedures for customer verification, like checks for identity and transaction tracking.

- Establish transaction, withdrawal, and deposit restrictions following legal regulations.

Practicing Due Diligence

- Verify that the KYC provider you have selected satisfies the standards for verification set by the company and authorities.

- Verify the provider’s capacity to facilitate in several different jurisdictions.

3. Establish Alliances with the Financial Sector

The operational work with the primary currencies in blockchain technology gives way to productive relationships with the relevant financial institutions. Local currency trading pairs exist only if there are other accounts opened such as custodial accounts or treasury accounts that facilitate the deposits and withdrawals of clients’ funds. Accounts are required to facilitate the management of the client’s money which in this context is deposited by the client. Ensuring that the process of making sure that the facility for deposit, as well as withdrawal, is effective and uncomplicated enhances customer satisfaction, compliance with the regulatory framework, and the effectiveness of the business.

Further, integrating into a payment provider’s platform reduced possibilities for cash payment transactions and improved ease of use. Trust and transparency are the two building blocks which enable one to nurture good business relations with clients in the long run and also assist in guiding the clients on the procedures, fees, and periods that will be required to complete the deposits.

4. Select the Exchange Software

When beginning a digital asset exchange, it is crucial to select the proper one that will suit the business. That is why a semi-captive, white-label solution like ChainUp is preferable for an investment because it is much easier to adapt it to your company and redesign it accordingly than building a new unique software that can take a lot of operational time and financial resources.

The choice of software must be based on the main properties of the product which consists of the kinds of trades for your exchange and, if any, special tools required. Cold storage and universal wallet are crucial in ensuring the security and protection of users’ cash from cyber criminals online. Your decision should also incorporate possibilities to customize a service and its ability to meet the needs of specialized areas.

5. Make Sure It’s Secure

Transaction protection and client data security are crucial to any exchange for an exchange to be successful. Advanced technology, secure signals, and continuous development should be part of the measures in a perfect strategy. Things that are considered prior and measures include multiple signatures, cold storage, two-factor authentication, anti-phishing measures, and strict access controls. As important are the continuous audits, the training of users on security best practices, and the monitoring. While, there are two reasons for an integrated approach, firstly, a comprehensive theme ensures protection against evolving risks that are being faced on the World Wide Web.

6. Start Marketing Initiatives

Marketing is another critical success factor since it will take an aggressive marketing strategy with current clients to retain them and attract new ones for business expansion. Being a fundamental aspect for both, laying a strong background for your brand and building up the interaction with users, start with an interesting website. That should be used with pay-per-click advertising or making posts on social pages so that a greater number of people can view it.

Increase awareness through database services in the acquisition of new clients and disseminating press releases to the Crypto media. Blogging results in better SEO and good organic traffic while relationship and community is built from conferences and events. This is where when you want to boost the exposure of your product, you should consider partnering with ChainUp. Last but not least successful working of your company needs a talented workforce, a team dedicated to the cause of the enterprise. As for digital assets, such a combined strategy ensures compliance, and constant development throughout all the mentioned areas.

Are these Digital Asses Exchange Secure?

While using the case of asset tokenization, it can be seen that the security of trading is a function of how well the platform manages its affairs and of the knowledge that the user has of the platform. Popular exchanges use strict security to protect the users’ money and details from hackers. To minimize the risk of hacking, these are features like; the use of multiple signatures for the wallet, most of its assets stored in an offline environment (cold storage), and the use of complex encryption. For preserving the user’s account, two-factor authentication is also employed, as well as other anti-phishing measures.

Despite all these measures, no exchange is safe for threats such as fraud or hacking to occur. Recommendations for forged have been provided by the users, including creating a tough and unique password, enabling an authenticator, and not keeping long-term investments in exchanges but in hardware wallets. Even though a significant number of digital asset transactions are secure, their safety ultimately rests on the platform infrastructure.

Read Our Blog Post: Digital Asset Treasury in UAE

How does Digital Asset Exchange Work?

A platform that enables the purchasing of, trading in, and selling of digital assets including tokenized securities, and non-fungible crypto assets is termed a digital asset exchange. They also provide a risk-free and effective environment for connecting Buyers and Sellers in the given transactions.

- To meet legal standards, required users sign up to the platform and complete the identification process (like, KYC).

- Fiat money; such as credit cards, bank transfers, and other means of cryptography money is lodged into the user’s exchange wallets.

- To enhance the ease of trading the exchange offers various pairings that include; Bitcoin/U.S Dollar, and Ethereum/Bitcoin, among others.

- Users make orders to buy or sell:

Market Order: Some transactions have now to be made at the best price.

Limit Order: When you input a price to buy or sell at, the exchange will counter that price the moment it appears.

- The exchange employs a model derived from the order book to connect buyers and sellers in a way that ensures that the completed transactions are effective.

- It oversees the execution of the order and modifies users’ balance almost simultaneously after the match.

- Profits or holdings can be withdrawn by users using other connected bank accounts for cash or third-party wallets for the cryptocurrency.

Benefits of Building Digital Asset Exchange

1. Streamlined Access

Since the resources such as photos, videos, and audio files can readily be accessed, and used within marketing teams, the idea of digital assets enhances the productiveness of marketing teams. Since version control is maintained and access to the most updated content is ensured in a centralized DAM system, efficient teamwork is provided within the organization’s teams. By reducing the time required to search for files, it becomes possible to focus on strategic work and content creation, while also improving both user experience and performance.

2. File Sharing and Management

Coordination and control over the dispersal of material within a central office or all through the organization, allowing access to all who need it. DAM system helps to organize the creative assets because, with its help, pictorial, graphic, audio, and video files from different sources can be stored in one central location. Of course, it includes sharing and managing videos, images, and any marketing content a team may need. In optimizing the work output, components such as legally mandated DRM and expiration tracking measures are provided.

3. Version Control

Being able to centrally control and manage the versions of assets that are used by each active team effectively curbed the problem of dated assets that are rife in some DAM systems. A single source of truth for documents with integrated change tracking is instrumental in following teamwork as well as saving time. Hence it enhances the user experience and provides an effective manner in running the campaign, as well as creating consistency across the different marketing channels.

4. Security of Content

Two safety aspects should provide access to the content while at the same time protecting it from unauthorized download. There is encryption of digital assets within the DAM systems to ensure that ownership and authorship are well protected. [[Securitization of data]] in cooperation encourages permission levels as it ensures that only the marketing, creative department, and sales departments gain access to the information they need. Thus, the relationships between security and accessibility respond to the need to preserve brand integrity and compliance.

5. Monitoring compliance

Through it, assets having auto expiration dates ensure that campaigns are up to date and in line with the law. DAM system optimizes activities and puts an end to the circulation of archaic content by helping groups supervise active and outdated material. This proactive strategy enhances the NPSP program’s mitigations of social inequality risks by providing earlier and more effective interventions to prevent harms associated with social inequality.

Can SoluLab Help You with Building Digital Asset Exchange?

The process of creating digital asset exchange is a complex process, which requires an understanding of the principles of the blockchain, inspiration, and expertise. Due to the complicated nature of digital asset management, it can be overwhelming for a firm to manage it with no outside help. They are the ideal choice for any enterprise that would like to enter or further develop the digital asset sector because of their focus on designing secure, efficient, and easy-to-use solutions.

The capability of SoluLab is demonstrated in Casino Trustbet, an innovative online gambling platform. Trustbet is interested in using blockchain as one of the tools for the further development of its business aimed at ensuring the safety and openness of the environment and making it interesting for users. Establishing trust in the gaming sector is among the strategic goals of Trustbet.

Getting the help of SoluLab can be your next strategic move if you are also planning to launch a digital asset exchange platform or upgrade your existing one. Contact today!

FAQs

1. How much does it cost to build a digital asset exchange?

The average investment needed to build a controlled exchange, like Binance, is between $50,000-$75,000. The cost of developing this cryptocurrency exchange may go up depending on the platform’s complexity and particular needs.

2. How can I purchase digital assets?

Digital assets which can be exchanged without the involvement of third parties are known as cryptocurrencies. Crypto exchanges, brokerages, and payment services are the three main ways to purchase cryptocurrency.

3. Do digital assets provide profits?

Digital assets may be created without additional labor or funding and are scaleable. Since all forms of income include some degree of labor, none are passive. However, selling digital goods is the most passive activity there is.

4. What is the number of exchanges for digital assets?

Exchanges are ranked and scored by CoinMarketCap according to congestion, trading volumes, money, and trust in the veracity of reported trade volumes. They monitor 252 spot trades with a $1.56/hr volume.

5. How does SoluLab help you with tokenizing your digital assets?

Solulab offers a wide range of services like as smart contract development, token modeling, and security audits to assist you with tokenizing digital assets. These solutions are secure and effective.