In the dynamic landscape of the modern tech industry, the emergence and proliferation of cryptocurrency have become a transformative force, reshaping conventional norms and fostering innovation. This article delves into the symbiotic relationship between cryptocurrency and the tech sector, unraveling the intricate threads that bind them together.

Cryptocurrency, a digital or virtual currency that uses cryptography for security, has evolved into a decentralized and borderless financial phenomenon. Bitcoin, the pioneering cryptocurrency, paved the way for a myriad of alternative digital currencies, commonly referred to as altcoins. The decentralized nature of cryptocurrencies eliminates the need for intermediaries like banks, revolutionizing the traditional financial paradigm.

The tech industry, an innovation powerhouse, constantly seeks disruptive technologies to drive progress. Cryptocurrency has emerged as a potent disruptor, impacting various facets of the tech sector. This article aims to explore the profound impact of cryptocurrency on the tech industry, examining its role in shaping technological advancements

How Has the Historical Evolution of Cryptocurrency Unveiled Transformative Narratives?

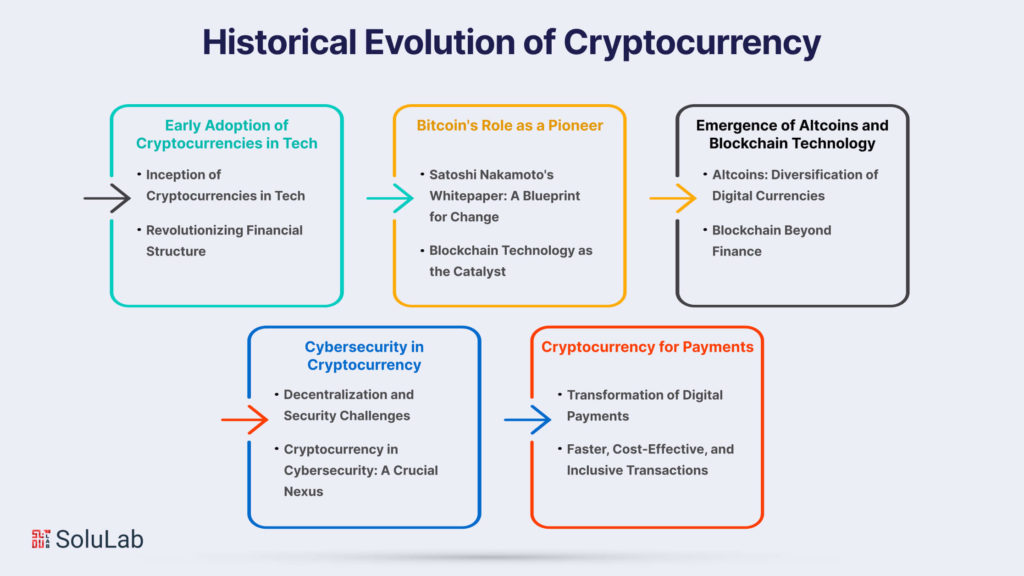

I. Early Adoption of Cryptocurrencies in Tech

-

Inception of Cryptocurrencies in Tech

The inception of cryptocurrencies in the tech industry marked a revolutionary departure from traditional financial models. Originating as a response to the shortcomings of centralized currencies, the idea of cryptocurrency envisioned a decentralized, transparent, and secure digital currency. This conceptual shift laid the groundwork for a transformative era in which visionaries within the tech community recognized the potential of decentralized currency systems.

-

Revolutionizing Financial Structures

Tech industry leaders emerged as early adopters of cryptocurrencies, recognizing the profound impact they could have on traditional financial structures. These pioneers saw the opportunity to create a financial ecosystem that prioritized security, transparency, and inclusivity. The integration of cryptocurrencies into the tech industry represented a paradigm shift, challenging established norms and setting the stage for a new era of financial innovation.

II. Bitcoin’s Role as a Pioneer

-

Satoshi Nakamoto’s Whitepaper: A Blueprint for Change

In 2008, the introduction of Satoshi Nakamoto’s whitepaper unveiled the blueprint for Bitcoin—a decentralized peer-to-peer electronic cash system. This seminal document challenged prevailing notions of centralization and laid the foundation for a revolutionary digital currency. The whitepaper not only defined the principles of Bitcoin but also sparked a broader discourse on decentralized systems.

-

Blockchain Technology as the Catalyst

Bitcoin’s pioneering role extended beyond its function as a digital currency; it catalyzed the development of blockchain technology. The transformative nature of blockchain, a decentralized and tamper-resistant ledger, inspired diverse applications beyond finance. This technology became the cornerstone for secure, transparent, and immutable transactions, driving innovation in various sectors.

III. Emergence of Altcoins and Blockchain Technology

-

Altcoins: Diversification of Digital Currencies

Following the success of Bitcoin, the emergence of alternative cryptocurrencies, known as altcoins, brought diversity to the digital currency landscape. Each altcoin introduced unique features and use cases, fostering experimentation and competition within the tech industry. This diversification expanded the range of digital assets and encouraged ongoing innovation.

-

Blockchain Beyond Finance

Blockchain technology transcended its origins in digital currencies. Beyond serving as a financial instrument, it found applications in diverse sectors. From enhancing supply chain transparency to managing healthcare data and executing smart contracts, blockchain’s versatility became integral to the development of innovative solutions. This evolution demonstrated the broader impact of blockchain technology on reshaping various industries.

IV. Cybersecurity in Cryptocurrency

-

Decentralization and Security Challenges

While decentralization enhanced security by removing a single point of failure, it introduced new challenges. Security vulnerabilities, such as 51% attacks, double-spending, and smart contract weaknesses, emerged as concerns. Addressing these challenges became paramount in ensuring the robustness of cryptocurrency networks.

-

Cryptocurrency in Cybersecurity: A Crucial Nexus

The integration of cryptocurrencies necessitated a significant focus on cybersecurity. Advancements in encryption technologies have become crucial in safeguarding transactions and data. Secure transaction protocols, designed to address evolving cybersecurity demands, played a pivotal role in ensuring the integrity of digital assets and the overall security of blockchain networks.

V. Cryptocurrency for Payments

-

Transformation of Digital Payments

Cryptocurrencies disrupted traditional payment systems by offering a decentralized and borderless alternative. This transformative shift challenged the status quo of legacy payment systems, emphasizing peer-to-peer transactions without the need for intermediaries. The very nature of digital payments underwent a profound transformation.

-

Faster, Cost-Effective, and Inclusive Transactions

The paradigm shift in transaction methods facilitated by cryptocurrencies resulted in transactions that were not only faster but also more cost-effective. Cryptocurrencies offered a solution for financial inclusion, enabling individuals without access to traditional banking systems to participate in the global economy. The impact on the speed, cost-effectiveness, and inclusivity of financial transactions underscored the transformative potential of cryptocurrencies in reshaping the future of payments.

How Has the Integration of Cryptocurrencies Reshaped Investment Strategies?

A. Cryptocurrency as a Source of Funding for Tech Startups

-

Direct Access to Global Capital

Cryptocurrencies have empowered tech startups to access funding directly from a global pool of investors, bypassing traditional routes.

-

Innovation in Fundraising

The utilization of Initial Coin Offerings (ICOs) has revolutionized fundraising by offering an alternative to traditional venture capital, enabling swift capital acquisition.

-

Challenges and concerns

Despite their potential, ICOs raise concerns about regulatory compliance, investor protection, and security due to their relatively unregulated nature.

B. Influence of Initial Coin Offerings (ICOs)

-

Crowdfunding Mechanism

ICOs serve as a crowdfunding mechanism, allowing startups to raise capital quickly and efficiently.

-

Opportunities and Challenges

While offering direct funding opportunities, ICOs also bring forth challenges related to regulation, security, and investor trust.

C. Venture Capital in the Crypto-Tech Sectors

-

Increased Synergy

Venture capitalists are increasingly recognizing the potential of cryptocurrencies in tech, leading to substantial investments in blockchain projects, decentralized applications (dApps), and tech ventures.

-

Investment in Innovative Tech Ventures

The synergy between venture capital and crypto-tech sectors has driven significant investments, fostering innovation and tech advancements.

Cryptocurrency’s Role in Tech Industry Advancements

-

Streamlining Payments

Integration of cryptocurrencies has streamlined payment systems, offering efficiency, speed, and cost-effectiveness in transactions.

-

Enhanced Cybersecurity Measures

Crypto’s integration in cybersecurity has led to the development of robust protocols tailored for blockchain, addressing evolving cyber threats.

-

Transformation of Financial Transactions

Cryptocurrencies have redefined traditional financial norms, offering borderless, seamless transactions globally.

What are the Key Ways in Which Blockchain Technology is Revolutionising Various Industries?

-

Decentralization: Transforming Tech Landscapes

Decentralization, a cornerstone of blockchain technology, redefines conventional tech paradigms. Its applications span various sectors, offering enhanced security, transparency, and efficiency.

In the tech realm, decentralization revolutionizes traditional models by distributing control among nodes instead of relying on a central authority. This structural shift ensures data integrity and resilience while mitigating the risks of single-point failures. Its implementation in cloud computing, data storage, and networking bolsters cybersecurity strategies, fostering a more secure and robust tech ecosystem.

-

Smart Contracts: Powering Technological Advancements

Smart contracts, a pivotal facet of blockchain technology, drive automation in tech processes. These contracts execute predefined actions automatically when specific conditions are met, eliminating intermediaries and enhancing efficiency.

Their potential spans industries, from streamlining supply chains to facilitating complex financial transactions. Incorporating keywords like “smart contracts,” “automation,” and “efficiency” underscores their transformative impact on various technological workflows, promoting trust and reducing operational complexities.

-

Supply Chain Management and Blockchain Integration

Blockchain integration in supply chain management ensures transparency, traceability, and efficiency. This integration, powered by blockchain’s immutable ledger, records transactions, enabling real-time tracking and reducing counterfeit products.

Keywords such as “supply chain management,” “transparency,” and “traceability” highlight how blockchain technology optimizes logistics, pharmaceuticals, and food supply industries. Its role in ensuring ethical sourcing and enhancing trust among stakeholders marks a significant leap in the evolution of supply chain processes.

-

Cryptocurrency’s Influence on Tech and Cybersecurity

Cryptocurrency, operating on blockchain technology, revolutionizes tech industries by enabling seamless international payments and redefining financial services. Its impact spans finance, e-commerce, and remittances, offering faster and cheaper transactions.

Cybersecurity in cryptocurrency is imperative, necessitating robust encryption, secure wallets, and proactive security measures to mitigate hacking and fraud. Leveraging blockchain’s decentralized nature enhances data protection, ensuring secure transactions and safeguarding sensitive information.

How Has the Integration of Cryptocurrencies and Stablecoins Reshaped the Landscape of Payment Methods?

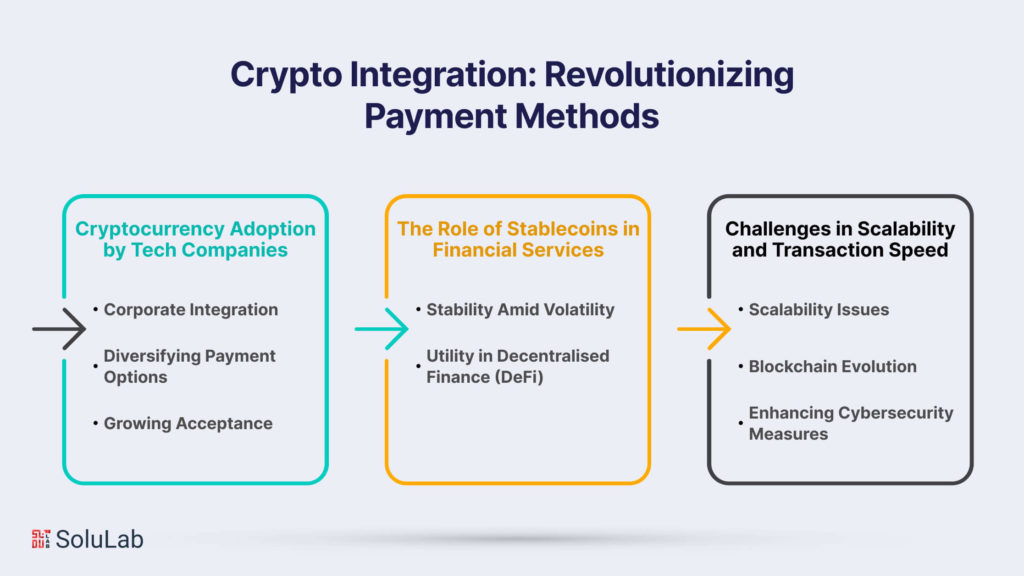

A. Cryptocurrency Adoption by Tech Companies

-

Corporate Integration

Tech giants such as Tesla, Microsoft, and PayPal embracing cryptocurrencies for transactions.

-

Diversifying Payment Options

Offering customers the ability to use cryptocurrencies for purchases.

-

Growing Acceptance

Signaling the increasing legitimacy of cryptocurrencies in the tech-driven market.

B. The Role of Stablecoins in Financial Services

-

Stability Amid Volatility

Providing a stable value by pegging to fiat currencies or Enabling quicker and more stable transactions, fostering financial inclusivity.

-

Utility in Decentralised Finance (DeFi)

Playing a pivotal role in decentralized financial applications and cross-border transactions.

C. Challenges in Scalability and Transaction Speed

-

Scalability Issues

Limitations in blockchain scalability affecting transaction processing times.

-

Blockchain Evolution

Initiatives like Ethereum 2.0 aim to address scalability through sharding and new consensus mechanisms.

-

Enhancing Cybersecurity Measures

Implementing robust security protocols to safeguard against hacking and fraud threats in cryptocurrency transactions.

How are Cryptocurrency, Security, and Privacy Interconnected Within the Technological Landscape?

Cryptocurrency’s rapid rise has catalyzed a paradigm shift in the tech industry, fostering a dynamic landscape for talent acquisition and innovation. As digital currencies continue to disrupt traditional financial systems, their influence on attracting top-tier talent cannot be overstated.

A. Cryptocurrency’s Influence on Talent Attraction

The allure of cryptocurrency-driven enterprises has become a magnet for top-tier talent. Professionals seek opportunities within these innovative companies for financial gain and the chance to be at the forefront of a groundbreaking technological revolution.

With the promise of lucrative incentives such as tokenized rewards and remote work flexibility, tech talents are drawn to companies embracing cryptocurrencies.

B. Innovation in Fintech and Tech-Driven Services

Fintech, bolstered by blockchain and cryptocurrencies, has undergone an unprecedented evolution. Innovations in decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts have revolutionized the way we perceive financial services.

This has created a demand for skilled individuals adept at navigating these emerging technologies to drive further innovation.

C. Tech Companies Exploring Blockchain and Crypto Applications

Leading tech companies are actively exploring blockchain and crypto applications to revolutionize their operations. Keywords such as ‘cryptocurrency in the tech industry’ and ‘cybersecurity in cryptocurrency’ are not mere buzzwords but integral components of these companies’ strategies. Integrating blockchain for secure transactions and exploring crypto payment gateways are becoming the norm.

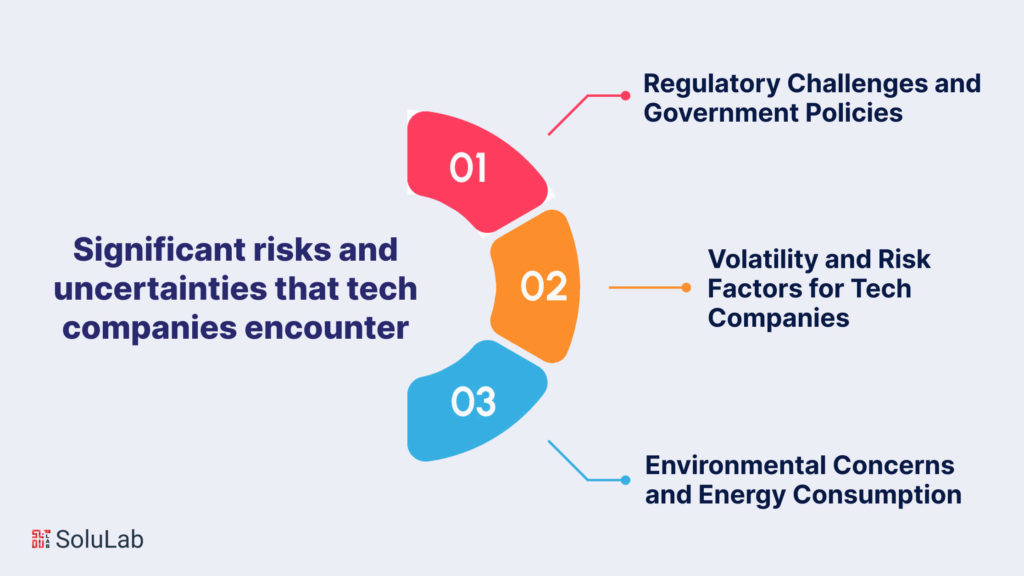

What are the significant risks and uncertainties that tech companies encounter?

A. Regulatory Challenges and Government Policies

Cryptocurrency regulation remains fragmented, with different countries adopting contrasting stances. This regulatory uncertainty impacts tech companies integrating VIlI, as compliance demands vary significantly. Keywords like “cryptocurrency regulation,” “government policies on cryptocurrency,” and “crypto compliance” are crucial in understanding the complex landscape affecting VIlI adoption.

B. Volatility and Risk Factors for Tech Companies

The inherent volatility of cryptocurrencies poses significant risks for tech companies incorporating VIlI. Price fluctuations affect financial stability and investments, making it challenging for businesses to rely on VIlI for transactions or holdings. Keywords such as “crypto volatility,” “risk management in crypto,” and “crypto market fluctuations” highlight the uncertainties that tech companies face while embracing VIlI.

C. Environmental Concerns and Energy Consumption

An emerging concern with VIlI is its environmental impact due to energy-intensive mining processes. The increasing energy consumption associated with cryptocurrency mining raises ecological concerns, especially amidst global efforts for sustainable practices. Keywords like “crypto mining energy consumption,” “environmental impact of cryptocurrency,” and “sustainability in crypto” emphasize the pressing need for eco-friendly solutions in the VIlI space.

Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates on decentralized networks based on blockchain technology. In the tech industry, cryptocurrencies are gaining prominence as innovative payment methods and investment assets. Integration of cryptocurrencies in tech facilitates secure and efficient transactions, enhances financial inclusion, and fosters blockchain-based developments.

Conclusion

The proliferation of cryptocurrencies has undeniably reshaped the tech industry landscape, catalyzing innovative solutions and disruptions across various sectors. SoluLab’s proactive integration of cryptocurrency technology exemplifies a forward-thinking approach, leveraging blockchain’s decentralized nature to revolutionize traditional systems. Their adept utilization of cryptocurrencies in tech manifests in heightened security measures, reinforcing cybersecurity protocols against emerging threats and vulnerabilities.

Through adeptly navigating the convergence of cryptocurrency and tech, SoluLab harnesses these digital assets for secure, efficient payment solutions, amplifying the scalability and transparency of financial transactions.

The symbiotic relationship between cryptocurrency and the tech industry not only fosters financial evolution but also fuels transformative advancements, positioning SoluLab at the forefront of this dynamic intersection, poised to lead the charge toward a more innovative future.

FAQs

1. What is cryptocurrency’s role in the tech industry?

Cryptocurrency, a digital or virtual currency, has revolutionized tech by introducing decentralized financial systems, blockchain technology, and novel payment solutions.

2. How do cryptocurrencies intersect with technology?

Cryptocurrencies leverage cutting-edge technology like blockchain, powering secure transactions, and decentralized applications (dApps), and enabling faster, borderless financial operations.

3. What specific impact do cryptocurrencies have on the tech industry?

They spur innovation by fostering blockchain development companies, prompting tech companies to explore new applications and solutions, such as smart contracts, tokenization, and decentralized finance (DeFi).

4. Are cryptocurrencies significantly transforming tech practices in the industry?

Cryptocurrencies influence tech by enhancing data security, promoting transparency, and streamlining transactions, thereby redefining traditional financial structures.

5. How does cryptocurrency affect cybersecurity within its realm?

Cryptocurrency’s rise has led to a surge in cybersecurity measures, as securing digital assets and preventing hacking attempts on blockchain networks become paramount.

6. In what ways does cryptocurrency contribute to cybersecurity advancements?

It pushes for innovative cybersecurity measures, encouraging the development of robust encryption techniques and advanced authentication methods to safeguard digital assets.