Gen AI in Banking and Finance

Generative AI (Gen AI) is at the forefront of innovation in the banking and finance industry. It encompasses advanced algorithms and models capable of creating new content and insights from existing data. Financial institutions are leveraging Gen AI to automate processes, enhance decision-making, and offer personalized services. This technology is not just a tool for efficiency but a driver of strategic transformation, helping banks and financial firms stay competitive in a rapidly evolving landscape.

AI Adoption Rate

50% of financial services firms

Market Share

35%

Clients

Around 750,000

Efficiency Increase

30% with AI solutions

Projected Saving

$1 trillion annually by 2030

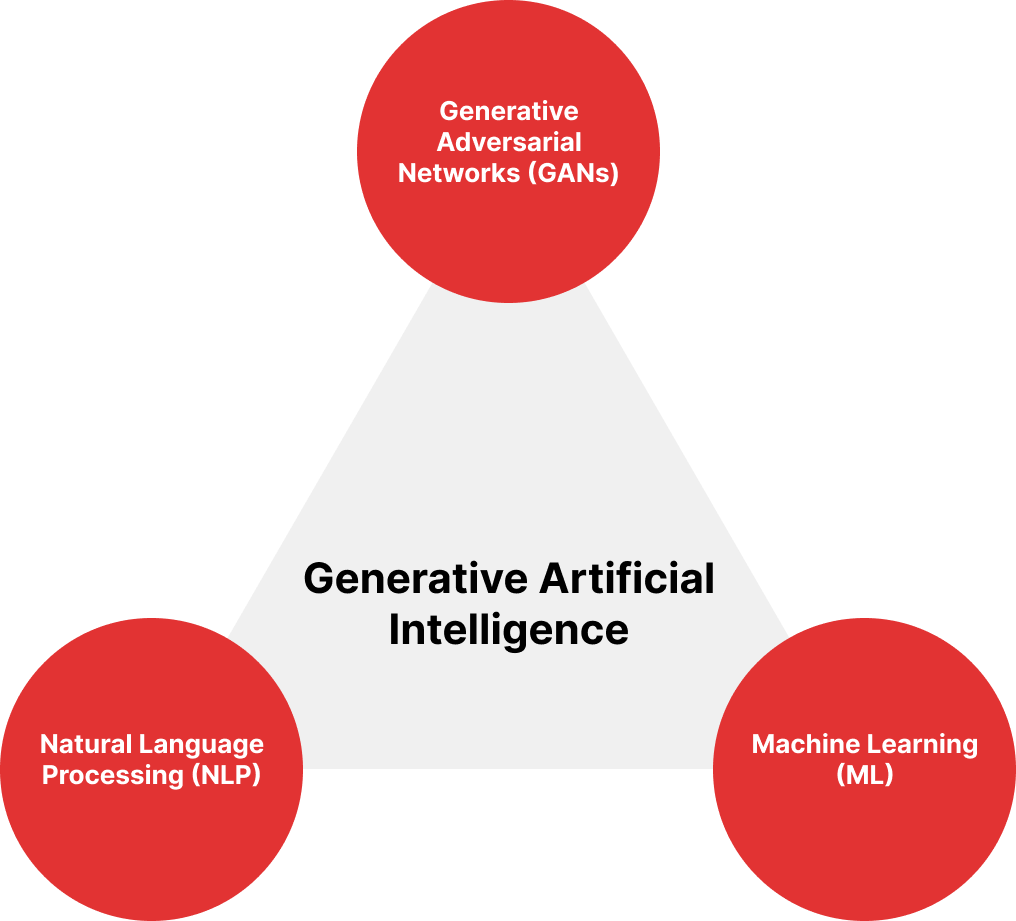

Key Technologies

GANs consist of two neural networks, a generator, and a discriminator, that work together to create new data. In the banking sector, GANs generate synthetic data for training fraud detection systems, simulate market conditions for risk management, and create realistic financial scenarios for stress testing.

NLP enables machines to understand, interpret, and respond to human language. In finance, NLP is utilized for sentiment analysis, automated report generation, and customer service chatbots. It helps banks analyze vast amounts of unstructured data, such as news articles and social media posts, to gauge market sentiment and inform trading strategies.

Machine learning algorithms are central to Gen AI, powering predictive analytics, credit scoring, risk assessment, and algorithmic trading. ML Model learn from historical data to make accurate predictions and automate complex decision-making processes, improving efficiency and accuracy in financial operations.

Industry Overview

The banking and finance industry industry is undergoing significant digital transformation driven by rapid technological advancements and changing customer expectations. The banking and finance sector is increasingly adopting Gen AI technologies to stay competitive and improve operational efficiency. Key trends include the rise of fintech, increased regulatory scrutiny, and a growing emphasis on cybersecurity and data privacy. Financial institutions are leveraging Gen AI to stay competitive, improve service delivery, and mitigate risks.

Current Landscape

The traditional banking model is being reshaped by digital transformation, characterized by the integration of advanced technologies such as artificial intelligence, blockchain, and Cloud Computing. Gen AI, a subset of artificial intelligence, stands out for its ability to create new data and scenarios, offering unparalleled opportunities for innovation in financial services.

Challenges

The banking and finance industry is navigating a complex and rapidly evolving landscape marked by technological advancements, regulatory changes, and shifting customer expectations. These dynamics present several challenges that financial institutions must address to remain competitive and resilient.

Innovation and Digital Transformation

Customer Experience and Personalization

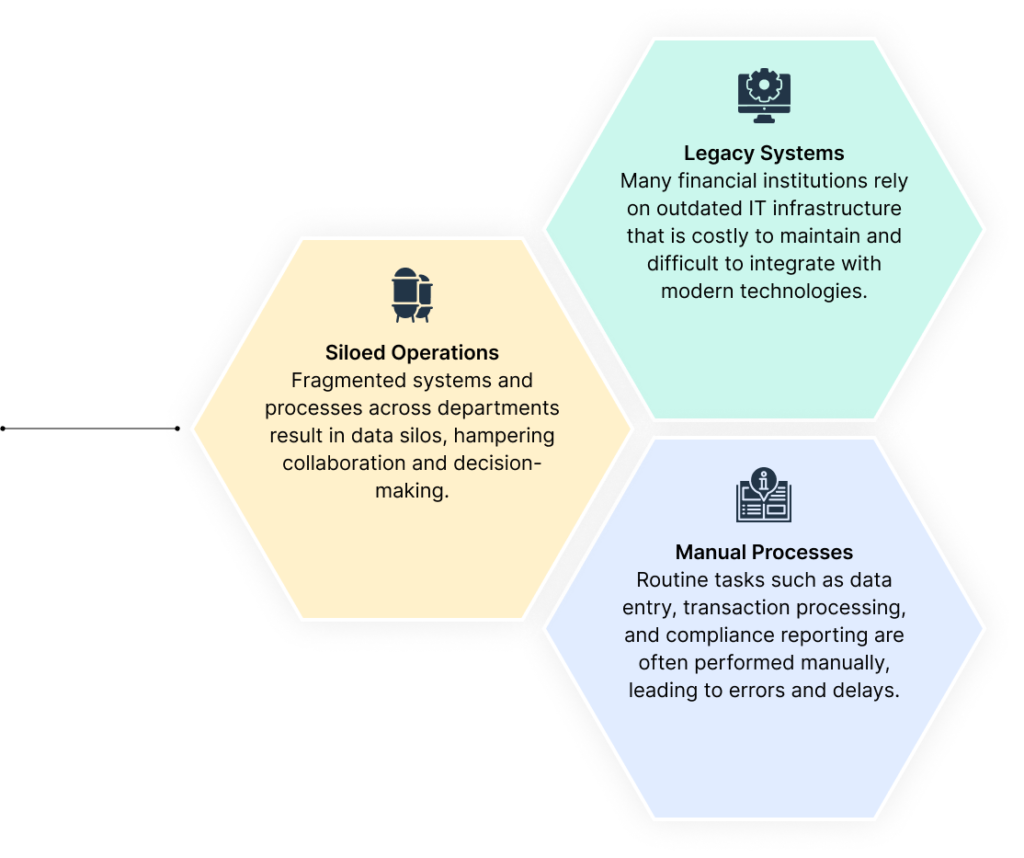

Operational Inefficiencies

Risk Management

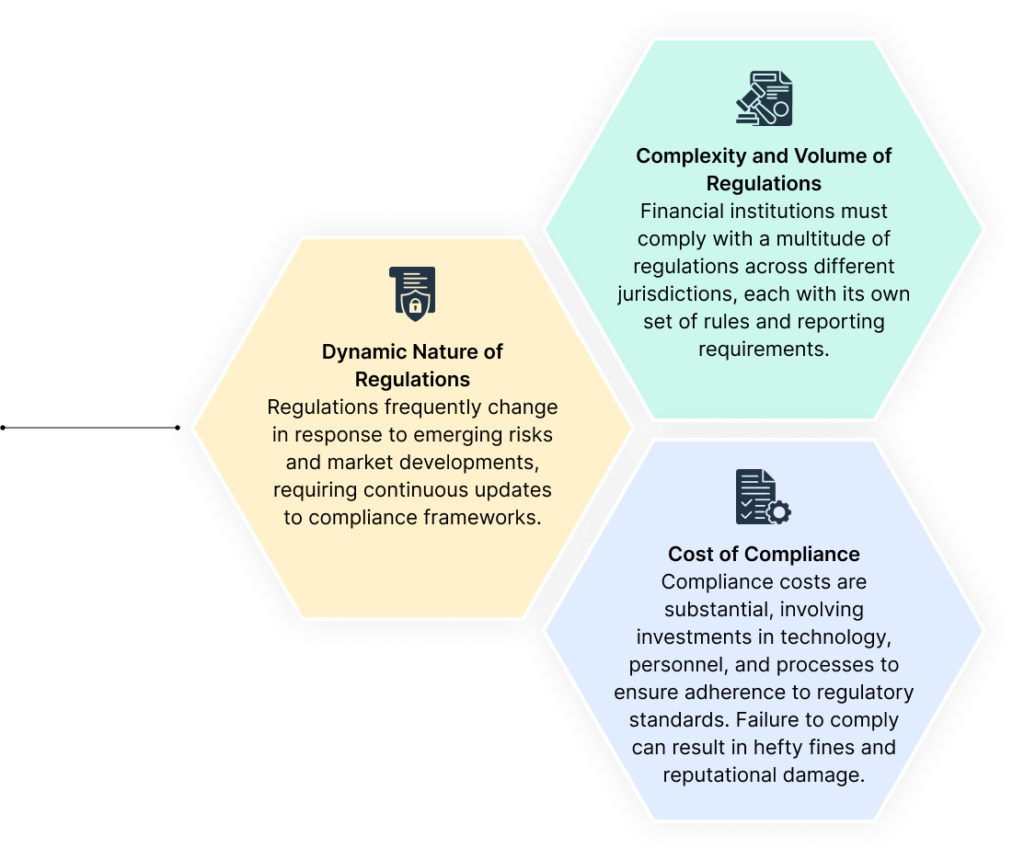

Increasing Regulatory Compliance and Oversight

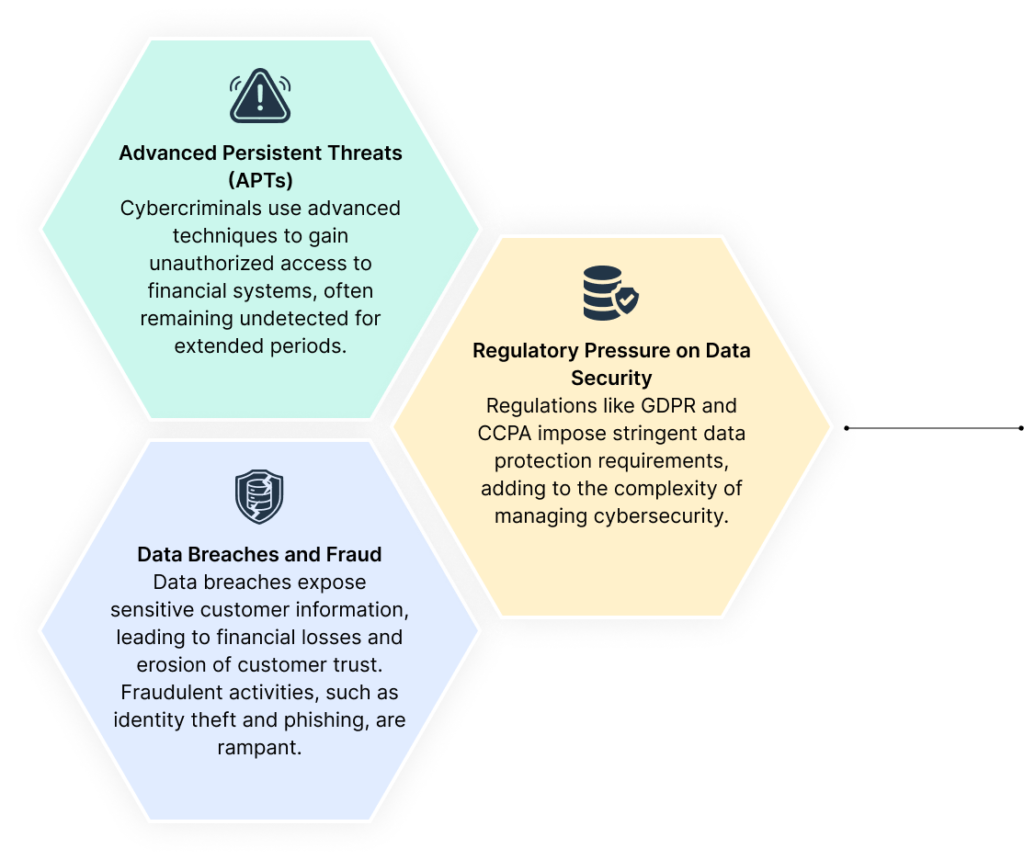

Evolving Cyber Threats

Need for Gen AI in Banking and Finance

Regulatory Compliance: The banking and finance industry operates under stringent regulatory frameworks designed to ensure financial stability, protect consumers, and maintain market integrity. Compliance with these regulations is complex and resource-intensive, requiring institutions to continually adapt to new rules and standards. Generative AI (Gen AI) can significantly ease this burden by automating compliance processes and enhancing regulatory reporting.

Automated Compliance Checks: Gen AI can automate the process of monitoring transactions and activities to ensure they comply with regulatory standards. This reduces the need for extensive manual checks, saving time and reducing errors. AI systems can provide real-time compliance monitoring, instantly flagging any activities that deviate from regulatory norms. This enables quicker responses to potential compliance breaches. By automating compliance processes, financial institutions can significantly reduce the costs associated with manual compliance checks and audits.

Regulatory Reporting: Gen AI can generate regulatory reports with greater accuracy and speed than traditional methods. This ensures timely submission of reports to regulatory bodies, avoiding penalties for late or incorrect filings. AI systems can be quickly updated to reflect changes in regulatory requirements, ensuring continuous compliance even as regulations evolve.

Fraud Detection: Fraud is a major concern in the banking and finance sector, causing significant financial losses and undermining customer trust. Traditional fraud detection methods, which often rely on predefined rules and patterns, can be insufficient in the face of increasingly sophisticated fraud techniques. Gen AI enhances the ability to detect and prevent fraud through advanced data analysis and pattern recognition.

Enhanced Detection Capabilities: Gen AI algorithms can analyze vast amounts of transaction data to identify anomalies that may indicate fraudulent activity. These algorithms learn from historical data and continuously adapt to new fraud patterns. AI can predict potential fraud risks by analyzing customer behavior and transaction history. This allows institutions to take preventive measures before fraud occurs.

Real-time Fraud Prevention: Gen AI systems can provide real-time alerts for suspicious activities, enabling immediate action to prevent fraud. This reduces the likelihood of financial losses and protects customers' assets. AI can automate responses to detected fraud, such as blocking transactions, freezing accounts, and notifying customers, ensuring swift and effective mitigation.

Customer Expectations: Modern customers expect personalized, convenient, and real-time banking services. Meeting these expectations is crucial for customer satisfaction and loyalty. Gen AI plays a pivotal role in delivering personalized Financial Services and enhancing the overall customer experience.

Personalized Services: Gen AI analyzes customer data to gain insights into individual preferences, spending habits, and financial goals. This enables banks to offer personalized product recommendations and financial advice. AI-driven systems can tailor communication based on customer behavior and preferences, ensuring relevant and timely interactions.

Real-time Service Delivery: AI-powered chatbots and virtual assistants provide round-the-clock customer support, handling routine inquiries and transactions efficiently. This improves accessibility and convenience for customers. Gen AI enables real-time processing of transactions, reducing wait times and enhancing the customer experience.

Operational Efficiency: Operational efficiency is critical for financial institutions to maintain profitability and competitiveness. Many banks and financial firms face inefficiencies due to outdated systems and manual processes. Gen AI can automate routine tasks, streamline operations, and reduce costs, leading to significant improvements in efficiency.

Automation of Routine Tasks: Gen AI can automate a wide range of routine tasks, such as data entry, transaction processing, and report generation. This reduces the need for manual intervention, minimizing errors and speeding up processes. AI systems can optimize workflows by identifying bottlenecks and recommending process improvements. This enhances overall productivity and efficiency.

Cost Reduction: By automating repetitive tasks, banks can reallocate human resources to higher-value activities, such as strategic planning and customer service. Automation leads to significant cost savings by reducing the need for manual labor and minimizing operational errors.

Improved Decision-Making: Gen AI provides actionable insights from large datasets, enabling better decision-making. Financial institutions can leverage these insights to optimize operations and improve service delivery. AI can predict when systems and equipment are likely to fail, allowing for proactive maintenance and reducing downtime.

Risk Management: Effective risk management is essential for the financial stability of institutions. Traditional risk management approaches often struggle to keep pace with the complexity and speed of modern financial markets. Gen AI offers advanced risk analysis and management capabilities, enhancing the ability to predict and mitigate risks.

Advanced Risk Analysis: Gen AI uses predictive modeling to analyze historical data and forecast potential risks. This includes market risk, credit risk, and operational risk, enabling institutions to make informed decisions. AI can simulate various market scenarios and stress tests, helping banks understand the potential impact of different events on their portfolios.

Real-time Risk Monitoring: AI systems provide continuous monitoring of market conditions, financial transactions, and other risk factors. This allows for real-time risk assessment and quicker responses to emerging threats. AI can generate automated alerts for unusual activities or potential risks, enabling timely intervention and risk mitigation.

Strategic Risk Management: AI-driven analytics help optimize investment portfolios by balancing risk and return. This improves the overall performance and resilience of the portfolios. Gen AI ensures that risk management practices comply with regulatory requirements, reducing the risk of non-compliance penalties.Use Cases in Banking and Finance

Chatbot Integration (Customer Service and Support):

Gen AI-powered chatbots and virtual assistants have transformed customer service in the banking and finance sector. These Gen AI systems can handle various customer inquiries, from account balance checks to complex financial advice. By providing instant and accurate responses, Gen AI enhances the customer experience and reduces the workload on human Customer Service agents.

Gen AI chatbots use natural language processing (NLP) to understand and respond to customer queries. They can also learn from interactions, improving their responses over time. This ensures that customers receive timely and relevant support, enhancing satisfaction and loyalty.

Voice AI Agents

Voice AI agents utilize natural language processing (NLP) to enable customers to interact with banking services through voice commands. These agents can assist with routine banking tasks, provide financial advice, and even carry out transactions.

Voice AI agents can provide personalized financial advice based on the customer’s transaction history and financial goals. It enhances accessibility for visually impaired customers and those who prefer voice interactions over typing. Voice commands offer a hands-free and intuitive way for customers to interact with banking services.

Customers can check account balances, review transaction history, and make payments using voice commands. Voice AI can also provide updates on loan applications and investment performance. AI agents can proactively notify customers about unusual account activity, upcoming bill payments, and financial health tips, ensuring customers stay informed.

Personalized Financial Advice

Gen AI enables financial institutions to offer personalized financial advice to their customers. By analyzing individual financial data, spending habits, and investment preferences, Gen AI can provide Gen AI tailored recommendations for savings, investments, and financial planning.

Gen AI-driven advisory systems use machine learning to predict future financial trends and identify the best opportunities for each customer. This personalized approach helps customers make informed decisions, achieve their financial goals, and feel more confident in their financial management.

Mobile Wallet and Contactless Payments

Mobile wallets and contactless payments are digital payment solutions that use AI to enhance transaction security, streamline the payment process, and provide personalized financial services. AI is used to detect and prevent fraudulent activities by analyzing transaction patterns and identifying anomalies in real time.

AI algorithms analyze spending habits to offer personalized discounts, rewards, and financial advice directly through the mobile wallet app. Facilitates quick and secure payments through NFC (Near Field Communication) technology, QR codes, and mobile banking apps, reducing the need for physical cash or cards.

AI-driven fraud detection ensures safe transactions, protects users from potential fraud, and Simplifies the payment process, making it faster and more convenient for customers along with Providing valuable insights into customer spending patterns, helping financial institutions to tailor their services and offers.

Predictive Analytics for Risk Management

Predictive analytics in risk management uses AI to analyze historical data, identify patterns, and predict future risks. This helps financial institutions to mitigate potential risks and make informed decisions. AI models evaluate a customer’s creditworthiness by analyzing various data points, such as credit history, transaction behavior, and socioeconomic factors, to predict the likelihood of default.

AI analyzes market trends, economic indicators, and geopolitical events to forecast market risks and inform investment strategies. Identifies potential operational risks, such as system failures or fraud, by analyzing internal data and external threats.

Customer Journey Optimization

Optimizing the customer journey is essential for enhancing customer experience and building loyalty. AI enables banks to understand and personalize the entire customer journey, from initial contact to ongoing engagement.

AI maps out the entire customer journey, identifying key touchpoints and potential pain points. This helps financial institutions understand customer behavior and preferences, enabling them to tailor their services accordingly. By analyzing customer data, AI can personalize interactions, offers, and services based on individual preferences and behaviors. This level of personalization can significantly enhance customer satisfaction. AI enables real-time engagement through personalized messages, notifications, and offers, enhancing customer satisfaction and loyalty. This immediate interaction helps keep customers engaged and satisfied.

Digital Onboarding and KYC (Know Your Customer)

Digital onboarding and KYC processes are crucial for compliance and customer experience. AI enhances these processes by automating document verification and using biometrics for secure identity verification. This reduces manual effort and time in verification, ensuring faster and more accurate onboarding.

AI also monitors customer activities continuously to detect suspicious behavior, aiding in fraud prevention and regulatory compliance. A streamlined onboarding process not only improves efficiency but also enhances customer satisfaction and retention, crucial for maintaining trust and avoiding regulatory penalties.

Smart ATMs and Interactive Kiosks

Smart ATMs and kiosks offer services such as cash withdrawals, deposits, bill payments, and account inquiries. AI enables personalized interactions and recommendations based on customer preferences, making banking more convenient. AI-driven voice and facial recognition ensures secure authentication and personalized services. This enhances security and ensures that customers receive tailored services. Provides real-time assistance through AI-powered virtual assistants, helping customers navigate through various services and transactions. This ensures that customers can complete their transactions smoothly and efficiently.

AI-driven authentication methods enhance the security of transactions and customer data. This ensures that customers can trust the services provided by smart ATMs and kiosks. Gen AI will reduce the need for physical branches and staff, lowering operational costs and enhancing service efficiency. This can lead to significant cost savings for financial institutions.

Robotic Process Automation

Robotic Process Automation (RPA)

uses AI to automate repetitive and rule-based tasks, improving efficiency and accuracy in banking operations. This technology can transform various back-office functions, making them more streamlined and cost-effective.

AI-driven RPA can manage and analyze large volumes of data, ensuring accuracy and consistency across various processes. This ensures that data management tasks are performed accurately and efficiently. Automates routine tasks such as data entry, transaction processing, and compliance checks, freeing up human resources for higher-value activities. This improves overall operational efficiency. Automates regulatory reporting and compliance tasks, ensuring timely and accurate submissions. This reduces the risk of non-compliance and associated penalties.

Data-Driven Marketing Campaigns

Data-driven marketing campaigns use AI to analyze customer data and develop targeted marketing strategies. This approach enhances the effectiveness of marketing efforts and helps financial institutions reach their target audience more efficiently.

AI analyzes customer data to segment the audience based on demographics, behavior, and preferences, allowing for more targeted marketing campaigns. This ensures that marketing efforts are focused on the most relevant audience. Uses predictive analytics to forecast customer behavior and optimize marketing strategies for better results. This ensures that marketing campaigns are data-driven and more likely to succeed. Develops personalized marketing messages and offers based on individual customer profiles, increasing engagement and conversion rates. Personalized marketing can significantly enhance customer satisfaction and loyalty.

Real-time Fraud Detection

Fraud is a significant challenge in the banking and finance sector, often resulting in substantial financial losses and reputational damage. Gen AI has revolutionized fraud detection and prevention by leveraging machine learning algorithms to identify patterns and anomalies in transactions. These algorithms can analyze vast amounts of data in real-time, detecting suspicious activities that deviate from established patterns.

Gen AI systems can continuously learn and adapt to new fraud tactics, making them more effective over time. They can flag unusual behavior, such as unexpected large transactions, frequent small transactions, or transactions from unusual locations.

Benefits of Gen AI in Banking and Finance

Increased Accuracy

Gen AI enhances fraud detection through real-time analysis of transactional data using machine learning, reducing false positives and identifying subtle patterns of fraud. It integrates diverse data sources for comprehensive risk assessment, accurately predicting default risks and supporting informed lending decisions.

In financial forecasting, AI's advanced analytics and predictive modeling provide precise insights into market trends and financial performance, facilitating strategic planning and decision-making processes.

Innovative Solutions

Gen AI drives product innovation by analyzing market trends and customer preferences to identify gaps and recommend personalized financial products such as tailored investment portfolios and customized insurance plans.

AI-powered analytics offer deep insights into market dynamics and customer behavior, enabling financial institutions to anticipate trends, optimize marketing strategies, and enhance customer engagement through personalized communications and support initiatives. This customer-centric approach improves satisfaction and loyalty, enhancing competitiveness in the financial services sector.

Cost Reduction

Gen AI automates routine tasks such as data entry, transaction processing, and compliance checks using machine learning and natural language processing (NLP).

This automation reduces operational costs, minimizes errors, and allows human employees to focus on higher-value activities such as strategic planning and customer relationship management. By optimizing efficiency and productivity, AI enhances job satisfaction and employee engagement within financial institutions.

Enhanced Customer Experience

Gen AI enables financial institutions to offer personalized services based on individual customer profiles and preferences. AI analyzes customer data to provide tailored recommendations and offers, such as customized investment plans and loan products.

AI-powered chatbots and virtual assistants deliver round-the-clock customer support, addressing inquiries and resolving issues promptly through natural language understanding (NLP). This continuous availability and personalized interaction improve customer satisfaction and loyalty, positioning financial institutions competitively in the market.

Future Trends

Integration with Quantum Computing

Integration of Gen AI with quantum computing promises exponentially faster data processing speeds and more complex data analysis capabilities. This could revolutionize risk assessment, algorithmic trading, and fraud detection in real time.

Enhancing Gen AI with Quantum Computing: Integrating Gen AI with quantum computing promises to revolutionize various aspects of banking and finance by enabling exponentially faster data processing speeds and more complex data analysis capabilities.

Algorithmic Trading: Algorithmic trading relies on analyzing market data and executing trades at high speeds. Quantum computing can significantly boost AI's capabilities in this domain by performing complex calculations and pattern recognition tasks much faster than classical computers. Quantum algorithms can identify market trends, optimize trading strategies, and execute trades with minimal latency. This can lead to higher profitability, reduced trading risks, and improved market efficiency. Moreover, quantum-enhanced AI can adapt to rapidly changing market conditions, ensuring that trading strategies remain effective over time.

Blockchain and AI Synergies

Combining AI with can improve security through decentralized, immutable ledgers. This synergy can streamline regulatory compliance, secure transactions, and enhance customer data privacy.

Enhanced Security: Blockchain's decentralized nature and cryptographic techniques ensure that data is securely stored and tamper-proof. By integrating AI with blockchain, financial institutions can further enhance security measures. AI algorithms can monitor blockchain transactions in real-time, identifying suspicious activities and potential security breaches. For example, AI can detect patterns indicative of fraud or unauthorized access, triggering automated responses to mitigate risks. This combination of AI and blockchain provides a robust defense against cyber threats and ensures the integrity of financial transactions.

Securing Transactions:

Blockchain technology ensures that transactions are securely recorded and cannot be altered once confirmed. By integrating AI, financial institutions can enhance the security and efficiency of transaction processing. AI can verify the authenticity of transactions, detect fraudulent activities, and ensure compliance with security protocols. Additionally, AI-powered smart contracts on the blockchain can automate and enforce contractual agreements, reducing the need for intermediaries and minimizing the risk of disputes.

Expansion of Robo-Advisors

Robo-advisors powered by AI will evolve to offer more personalized and comprehensive financial advice, integrating broader datasets and offering real-time portfolio adjustments based on market conditions and customer preferences.

Evolution of Robo-Advisors: Gen AI is driving the evolution of robo-advisors, enabling them to offer more personalized and comprehensive financial advice by integrating broader datasets and providing real-time portfolio adjustments based on market conditions and customer preferences.

Real-Time Portfolio Adjustments: Market conditions can change rapidly, requiring timely adjustments to investment portfolios. Gen AI enables robo-advisors to perform real-time portfolio analysis and rebalancing based on current market data and customer preferences. AI algorithms can monitor market movements, assess the impact on individual portfolios, and execute trades to optimize performance. This ensures that customers' investments remain aligned with their financial goals and risk tolerance, even in volatile market conditions.

Next-Generation Robo-Advisors: Beyond basic financial advice, next-generation robo-advisors will leverage advanced AI to offer dynamic investment strategies that adapt to changing market conditions in real time. These AI-driven platforms will use sophisticated algorithms to analyze market data, economic indicators, and even geopolitical events to optimize investment portfolios.

Integration of Broader Datasets: Gen AI allows robo-advisors to integrate a broader range of datasets beyond traditional financial metrics. For instance, AI can analyze social media sentiment, geopolitical events, and macroeconomic indicators to provide a comprehensive view of market trends. By incorporating diverse data sources, AI-driven robo-advisors can offer more informed and accurate financial advice. This holistic approach enhances the ability to identify investment opportunities, manage risks, and provide actionable insights to customers.

Predictive Analytics in Customer Insights

AI-driven predictive analytics will enable banks to offer hyper-personalized services based on individual customer behaviors, preferences, and life events. This could include customized product recommendations and proactive financial advice.

AI-Driven Predictive Analytics: Gen AI enhances predictive analytics by leveraging advanced machine learning algorithms and large datasets to offer hyper-personalized services and proactive financial advice based on individual customer behaviors, preferences, and life events.

Hyper-Personalized Services: Traditional customer segmentation methods often group customers based on broad demographic categories. Gen AI allows financial institutions to go beyond basic segmentation by analyzing individual customer data in detail. AI algorithms can identify unique patterns in spending habits, transaction histories, and financial goals. This enables institutions to offer hyper-personalized services, such as customized investment recommendations, tailored loan products, and personalized savings plans. For example, AI can identify a customer's propensity to save for a specific goal and offer targeted savings products that align with their objectives.

Proactive Financial Advice: AI-driven predictive analytics enables financial institutions to provide proactive financial advice based on individual customer circumstances. For example, AI can analyze a customer's spending patterns and identify potential financial challenges, such as overspending or inadequate savings. The AI system can then offer personalized advice to address these issues, such as budgeting tips or automated savings plans. Additionally, AI can monitor market conditions and provide real-time alerts and recommendations to help customers optimize their investment strategies.

Transform Your Financial Services With Generative AI

Nowadays, banks need to adopt Generative AI to stay in the game. If you don't, your competitors will get ahead. Since Generative AI is still new, now is the perfect time to learn how to use it in your business. By starting now, your business can grow and adapt to this technology, implementing Generative AI step by step. At SoluLab, we offer Generative AI tools tailored for different industries, including financial services and banking. If you want to take your financial business to the next level, we can help. Our self-service AI banking solutions include tools like account setup and management, payment tracking, transaction history viewing, stolen and lost card replacements, dispute transaction management, and much more. Contact us today or book an AI demo! We look forward to learning more about your business and finding the right Generative AI tools for you!

Latest Blogs

Agentic AI vs Generative AI: Key Differences and Use Cases

Discover the key differences between Agentic AI and Generative AI, their unique use cases, and how each powers innovation across industries and businesses.

Read MoreHow Generative AI Empowers ESG Transformation?

Explore how Generative AI is transforming ESG with real use cases, ethical insights, and future-ready business strategies.

Read MoreGenerative AI Project Ideas for Data Science Students

Explore practical and creative generative AI project ideas perfect for students in data science programs, with real tools, NLP, image models, and more.

Read More