Generative AI has made a significant impact globally, and it has become impossible to attend an industry event, engage in a business meeting, and personalize planning with GenAI as the center of preparations. In 2022, around 22% of customers raised their voices against dissatisfaction with P&R insurance providers. AI use cases mainly focus on enhancing efficiency, with proper implementation, and offer minimal solutions for benefits. GenAI is constantly transforming how data is used, automating tasks, and enhancing chatbots for more advanced solutions. Insurers are experiencing the advantages of using GenerativeAI for insurance. Don’t feel left behind.

For industries reliant on data like insurance this blog is for you, there is always a new creative idea poised to bring significant transformations into the future.

What is Generative AI?

Generative AI is a kind of AI tech that can generate various content such as text, images, audio, and synthetic data. GenAI stems from user-friendly interfaces that allow quick creation of not only text but also visuals and videos within seconds. Generative AI and Automation first appeared during the 1960s with chatbots, However, it was not until 2014 that the advent of generative adversarial networks (GANs) is a type of machine learning algorithm. GenAI gained the ability to produce remarkably authentic images, videos, and audio featuring real individuals. In 2022, the global market for GAI in insurance was estimated to be $462.11 million and is expected to grow to $8,099.97 million by 2032. Here are the following models of Generative AI use cases:

- Generative Adversarial Network

GANs a GenAI model includes two neural networks- a generator that allows crafting synthetic data and aims to detect real and fake data. In other words, a creator competes with a critic to produce more realistic and creative results. GANs excel in generating images. Apart from creating content, they can also be used to design new characters and create lifelike portraits.

- Variational Autoencoder (VAE)

VAE functions in two phases. The encoder inputs data into minute components, that allow the decoder to generate entirely new content from these small parts. The decoder works more like a creative author. It makes use of important elements from the encoder and uses them to create real content for crafting a new story. VAE is important for tasks like data analysis and swift generation. Also, the quality of Generative AI depends on the complexity of the data.

- Transformer-Based Models

AI tech depends on extensive language models that empower it to comprehend and interpret human language. These AI models focus on all words with the self-attention mechanism irrespective of the length and position. These models can aid with many writing, translation, and research tasks. Furthermore, GenAI can also assist you with generating texts from scratch like research papers, scripts, and social media posts, for instance, ChatGpt.

- Diffusion Models

Unlike transformer-based models, diffusion models do not predict the upcoming token based on preceding information. GenAI in diffusion models works on information gradually spreading within a data sequence. This model also makes use of denoising score techniques often for understanding the process step-by-step. Training these models requires computational resources because of the complexity of the architecture.

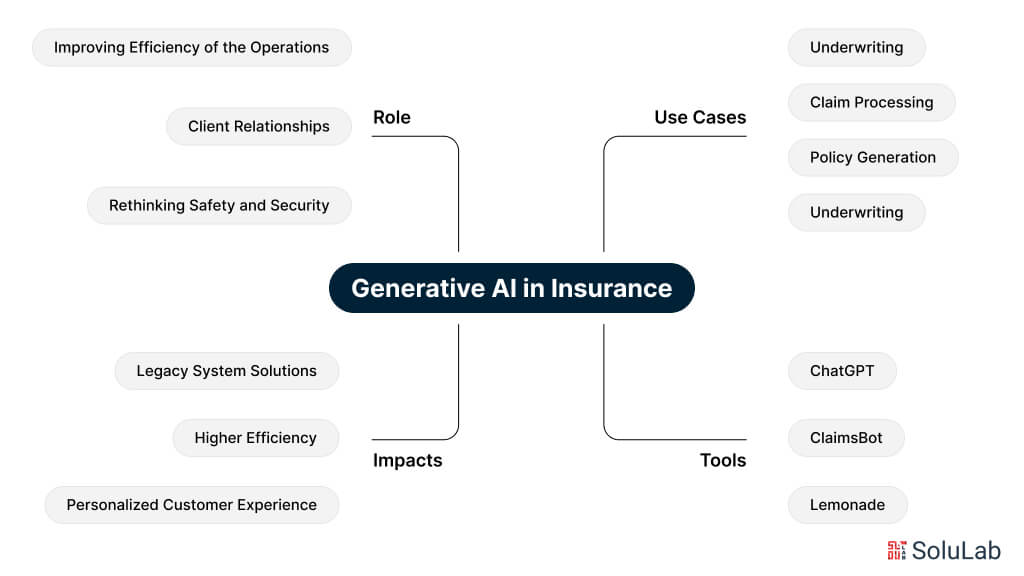

Role of Generative AI in Insurance

The use of Generative AI in insurance may transform the industry and improve efficiency, meet customer needs and expectations, and modify the approach to risk management. By applying this technology, insurers can tender great processes and administrative decisions undergoing vast databases with the help of mile-simple algorithms. Around 59% of businesses in the insurance industry are already leveraging insurance-generative AI.

1. Improving The Efficiency of the Operations

Several processes within the insurance industry such as the underwriting process, claims handling and fraud detection are easily customizable with the help of generative AI insurance. Distribution operations benefit from similar automation. Platforms like Producerflow automate producer licensing workflows, appointment tracking, and compliance monitoring to reduce manual overhead while ensuring regulatory adherence across all 50 states.

2. Enhancing Client Relationships

With the help of generative AI, insurers can give individual experiences for their clients in terms of plans and coverage options that will suit the client’s needs and wants. This customization is rather crucial nowadays because more often clients expect specific services. In addition, Generative AI for the insurance industry makes it possible to use virtual assistants who can address and answer consumers’ questions thus relieving the agents.

3. Rethinking Safety and Security

Drastically, it will change the process of managing risks in the insurance industry. In general, knowing the clients and their previous claims, and the circumstances occurring in the environment, Generative AI and insurance can operate more accurately in terms of risk identification and the following generation of suitable approaches to addressing it. This must also mean that where the insurers raise the risk assessment, they may be able to price their insurance more effectively, reach good decisions, and avoid or minimize loss.

The Impact Generative AI Has on Insurance

Generative AI for insurance can be considered a kind of generative disruption for insurers in the sense that it can open new clients, new optimized processes, and new product needs. Massive amounts of data are analyzed with the assistance of complex formulae and can provide insurance companies with the ability to automate tens of thousands of processes and erroneous determinations.

-

Improved Risk Evaluation

There is also another impact of Generative AI in life insurance which is improved risk assessment. This is one of the virtues associated with generative AI. This leads to improved chances at risk evaluation for generating improved price strategies and this decreases fraud occurrences in the insurance business. The improved risk assessment therefore enables clients to pay for insurance premiums that correspond to the risk caliber and in this way, insurers stand a better chance at improved profitability.

-

Streamlining Processing Claims

Thanks to Generative AI, claims are allowed to be automated and their assessment can be performed much faster. With the help of the generative AI insurance industry, the work of insurers on claims may be accelerated and made more efficient in their handling, while on the other hand, all the information from the submitted documents to the claims is assumed to be worked with significantly higher efficiency. This makes consumers happy or in the language used in business ‘jolly’, while the insurer has confidence in the firm because of the change it has effected in handling this matter of claims.

-

Personalized Customer Experience

Indeed, the introduction of generative AI insurance has already transformed the insurance market and, most significantly, the communication between the insurance firm and the purchaser. Perhaps insurance organizations would be providing highly specific, individual services, based on client data as evaluated by Generative AI and insurance as a byproduct of this. This comprises a policy implication of a certain target market and customer-centered advertisements. This is likely to lead to higher customer retention as well as increased customer satisfaction through measurable parameters and loyalty resulting from insurers being told they ought to do a perfect job in recognition of serving their customers.

Generative AI in Insurance Tools

Through improved risk assessment, simpler operations, and improved client experiences Generative AI is promising a transformed future for the insurance industry. It can be made possible with the use of these particular tools:

-

ChatGPT

ChatGPT is used by insurance businesses for deploying chatbots that will offer personalized services to customers according to their needs and preferences. Once these chatbots are deployed they can help with policy assistance, answer queries, and lead the clients through claim processes. As a result, customer satisfaction will increase and 24/7 assistance can be provided which becomes difficult manually.

-

ClaimsBot

This tool makes it swift and rapid for insurance companies to extract pertinent data from several documents with automation of the claims processing method. Using a claims bot, organizations can speed up the entire process of settling the claims with quick legal legitimacy, the coverage they must provide, and all the required pieces of evidence.

-

Lemonade

Maya powered by Lemonade using Generative AI. This tool can see the client’s journey which helps in the assistance of signing of claim forms. With the help of lemonade insurance companies can handle claims, process payments, and provide quotations as per customer needs and preferences, this raises the standard of customer transparency.

Top 4 Use Cases of Generative AI in Insurance

The Insurance Industry chain is a complicated one because of tasks like risk assessment and claim processing, which poses a potential challenge for insurance companies. Here are some Generative AI use cases in insurance that demonstrate making things easier for the Insurance Industry:

-

Improved Underwriting

Generative AI can improve the underwriting process, normally underwriters have to go through intense paperwork to accurately clarify policy terms and make informed decisions to underwrite an insurance policy. For example, GenAI is used in the Banking sector for training using customer applications and profiles for customizing insurance policies based on data. It can also assist with pricing coverage suggestions. This allows for enhancing results for the underwriting process.

-

Enhanced Risk Evaluation

Insurance companies conduct risk assessments to make it easier to determine whether the potential consumers are willing to fill out the claim or not. Firms can make better decisions by grasping risk profiles and offering coverage pricing. AI in insurance use cases can enhance this process in many ways. It can be trained on data to generate predictions and evaluate risks. It can be used for simulating various scenarios and anticipating potential claims. Generative AI helps programmers in code review and bug detection too.

-

Claim Processing

Generative AI brings pivotal benefits for simplifying insurance claims processing and automating tasks that require more human attention like data entry. Here are the different types of claims and how Generative AI assists in them:

a. Car Insurance Claims

Generative AI can simply input data from accident reports, and repair estimates, reduce errors, and save time. Claims can be tailored by urgency, which deals with cases promptly.

b. Property Claims

AI tools can summarize long property reports and legal documents allowing adjusters to focus on decision-making more than paperwork. Generative AI can also analyze data and property records for detecting patterns.

c. General Insurance Claims

Generative AI can process vast amounts of claims data, and spot trends that can aid in predicting future claims and fraudulent activities. AI can also manage claims concerning their complexity and the resources that are required to resolve them.

-

Policy Generation

Generative AI can streamline the process of creating insurance policies and all the related paperwork. It can help with the generation of documents, invoices, and certificates with preset templates and customer details.

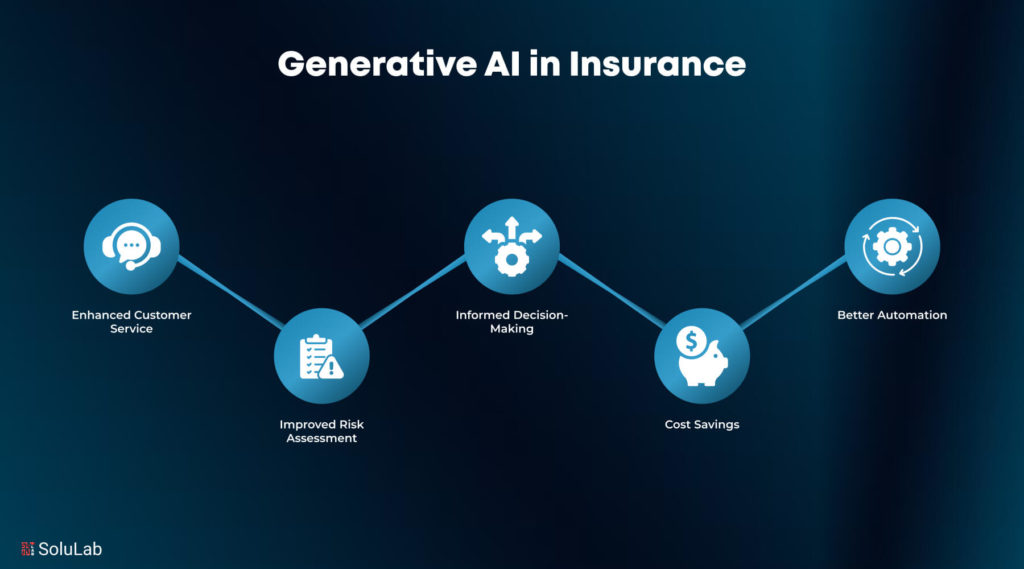

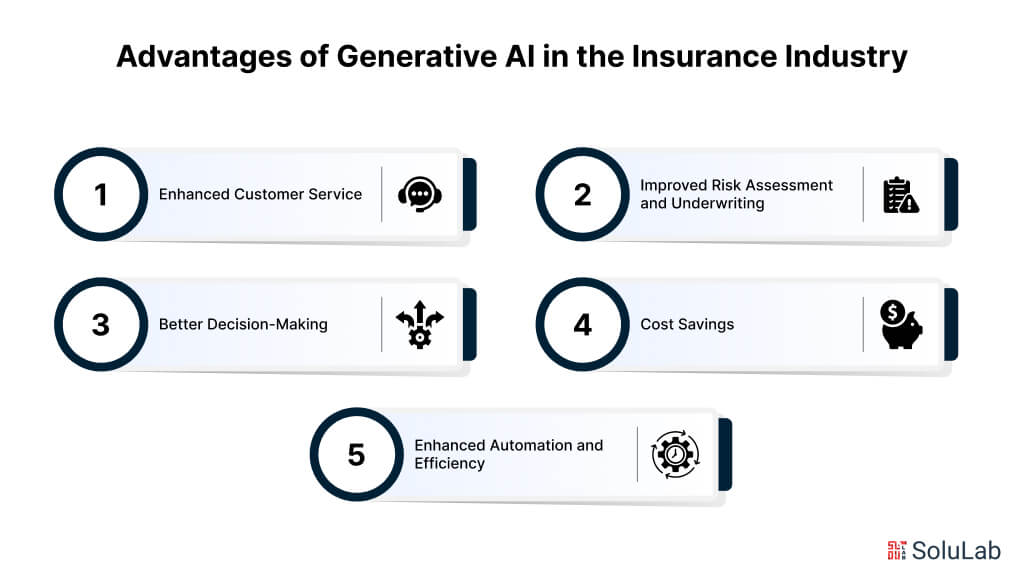

Advantages of Generative AI in the Insurance Industry

Concerning generative AI, content creation and automation are shifting the way how it is done. Now it is time to explore exactly what makes it possible to harness Generative AI for Insurance and obtain truly impressive results.

1. Enhanced Customer Service

GenAI shall therefore help insurance firms to provide their customers with more personalized services. Analyzing all customer data, AI Algorithms to propose insurance services considering individual peculiarities and tendencies. In addition, real-time communications such as policy questions, claims on services, and other customer complaints and requests also can be solved by a virtual assistant which is developed by Generative AI for customer service to promote customer satisfaction and customer loyalty.

2. Improved Risk Assessment and Underwriting

Understanding and quantifying such risks can be done, and policies written with more precision and speed employing generative AI. The algorithms of AI in banking programs provide a better projection of such risks, placed against the background of such reviewed information. The insurers can, therefore, be in a position to provide better underwriting decisions, the right coverage, and innovative risk selection.

3. Better Decision-Making

In this case, generative AI insurance provides decision-supporting information on pricing the identification of inherent risks, and the formulation of the underwriting policies from the resultant pattern and trends derived from the collected data. The changes that an insurer can now address in that market and the needs of their clients can be effectively improved in terms of decision-making skills.

4. Cost Savings

To insurance firms, the implication of Generative AI for insurance in operations is that it can cause a decrease in the cost of the processes. The following are some of the benefits that Engen can accrue from this method: Operating costs are also low except in areas where long cycle times, many errors, and many handlings of material are normally incurred. It might be possible for the insurer to improve its market standing by extending the benefits to the consumer’s side by way of cheaper premiums.

5. Enhanced Automation and Efficiency

Generative AI for the insurance industry relieves the drudgery for human workers in that it handles such tasks as the feeding of data, review of documents, and adjustment of claims. This makes work easier while human workers can achieve higher profile and more important tasks. Also, it is beneficial for the insurers as well as the customers because it reduces the time for response to increase effectiveness.

How Can You Get Started With Generative AI in Insurance?

The insurance industry needs to tread cautiously but strategically when using generative AI. The main steps to be taken for including or implementing generative AI are as follows: –

- Define Objectives: Clearly define what use cases and objectives need to be achieved by the insurance industry through its integration with generative AI, like risk assessment, client segmentation, fraud detection, or automated underwriting.

- Data Readiness: A good diversity in the choice of high-quality datasets needs to be available. High-quality training data lies at the root of learning within generative AI models to create meaningful results.

- Choose the Right Models: Choose generative AI models that would be most appropriate for use cases. Either GANs VAEs, or other relevant models could be appropriate depending on the application.

- Model Validation and Training: Train the chosen model using historical data. Test the efficiency of the model to ascertain if it is going to detect relationships and trends in data accurately.

- Constant Monitoring and Improvement : Establish systems that will allow for constant monitoring of generative artificial intelligence models. For better accuracy and adaptation to the changing trends of data, often retrain and update models.

- Collaborate with Subject Matter Experts : The results of the model should be closely reviewed with domain experts of insurance to ensure that the output is relevant. Domain knowledge can help enhance and optimize the performance of the model.

- User Training and Adoption: Train the users at the edge—claims processor or underwriter—to use the output from generative AI efficiently. Drive adoption and understanding of technology among stakeholders.

The Future Landscape

Currently, the insurance industry is under the influence of what can be referred to as generative artificial intelligence or GenAI, which can enable a disruptive leap forward. Another advantage we anticipate in this technology is the dramatic increase in customer satisfaction and firm performance as a larger number of enterprises adopt it. The use of virtual assistants providing round-the-clock support and tailored insurance products allows providing individual levels of consumer experience for every buyer in GenAI.

The identification of better underwriting processes and risk assessment is one of the main areas affected by changes. It creates difficult-to-detect patterns where Insurance companies can utilize GenAI’s huge data set analysis capacity, making improvements to their pricing strategies and reducing the incidence of false claims. Computerization in claims processing will also help to reduce the number of procedures as well as the number of evaluations made and this, in the long run, will be of help to the clients.

Considering that GenAI is set to become a powerful tool in the future of Gen AI, this can be done if you hire a Gen AI developer, insurers must regulate its application according to the main guidelines of its functioning, as well as maintain the clients’ trust to guarantee its systematic usage in their business.

How is SoluLab Navigating the Transformative Generative AI in Insurance

The fusion of artificial intelligence in the insurance industry has the potential to transform the traditional ways in which operations are done. As we are becoming a major part of this technological era, businesses and organizations in the insurance industry have embraced Generative AI to gain a competitive edge and pave a new and creative way toward growth.

With the increase in demand for AI-driven solutions, it has become rather important for insurers to collaborate with a Generative AI development company like SoluLab. Our experts are here to assist you with every step of leveraging Generative AI for your needs. Our dedication to creating your projects as leads and provide you with solutions that will boost efficiency, improve operational abilities, and take a leap forward in the competition.

We have launched Generative AI-powered Chatbot Development and Voice AI Development for handling a large number of customer queries with an instant response and making it easier to interact with banking using natural voice commands for a hands-free experience. All AI solutions at SoluLab are targeted to address customer needs and preferences with feature phones and technical skills.

Get in touch with us to understand the profound concept of Generative AI in a much simpler way and leverage it for your operations to improve efficiency.

FAQs

1. How is GenAI being utilized for Insurance?

The use of generative AI in insurance is done by chatbots, analysis of documents, crafting customized policies, enhanced user experience, and risk evaluation.

2. How is fraud detection improved with Generative AI?

With proper analysis of previous patterns and anomalies within data, Generative AI improves fraud detection and flags potential fraudulent claims.

3. Can unstructured data be processed in insurance claims using generative AI/

Yes, Generative AI can process unstructured data for insurance claims with natural language processing to get valuable insights for smooth claim handling.

4. What does the future look like for Generative AI in Insurance?

Generative AI is revolutionizing the insurance industry with enhanced customer engagement, automating the processing of claims, and marketing boosts leading to a satisfied customer experience.

5. How is SoluLab contributing to the advancements of Generative AI?

With developing AI chatbots, voice AI agents, NLPs, and implementing machine learning algorithms in the insurance sector, SoluLab is driving progress using Generative AI.