Generative AI in Insurance

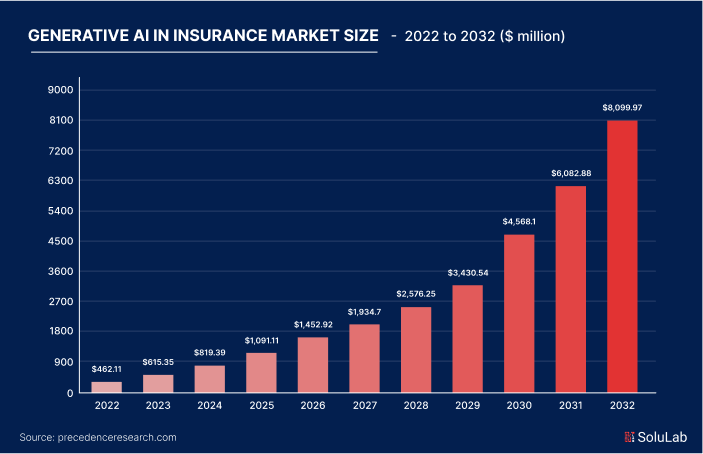

The insurance industry, a behemoth with a market size surpassing $5 trillion, is poised for transformation. The rapid adoption of AI presents a monumental opportunity, potentially revolutionising efficiency, reducing costs, and enhancing customer experiences. As the sector grapples with challenges like fraud and regulatory compliance, the strategic integration of generative AI in inurance could redefine its future, promising a more agile, responsive, and customer-centric industry.

Adoption Rate

55% adoption rate

Market Share

Capture 20% of the market by 2025

Clients

Over 70% of policyholders are using AI-enabled services

Efficiency Increase

Efficiency improved by up to 40%

Projected Saving

Cost savings of up to 30%

Industry Overview

The insurance industry is a cornerstone of the global economy, providing essential risk management services to individuals and businesses. With a market size exceeding $5 trillion and projected to surpass $8 trillion by 2025, it encompasses a broad spectrum of products, from health and life insurance to property and casualty coverage. AI-driven solutions are predicted to improve claims processing times by up to 50% and reduce operational costs by 30%. Additionally, insurance AI

has already been integrated into the operations of 55% of insurance companies, enhancing customer experiences and operational efficiency. By 2025, AI-driven insurance solutions are expected to capture 20% of the market.

Generative AI

stands out as a pivotal development, offering unprecedented opportunities to create new value propositions and drive innovation. This technology promises to streamline operations, provide personalized customer interactions, and deliver advanced data analysis, solidifying its role as a critical driver of the insurance industry's future.

Current Landscape

The current landscape of insurance industry is evolving with a blend of traditional practices and innovative technologies. Around 55% of insurers have integrated generative AI for insurance into their workflows, enhancing efficiency and customer satisfaction. Despite this, challenges like regulatory compliance (costing $274 billion annually), fraud detection (costing $40 billion annually in the U.S.), and maintaining customer trust remain significant.

Generative AI in insurance offers new solutions, such as improving fraud detection accuracy by up to 90% and boosting policyholder retention rates by 15-20%. Predictive modeling can provide more accurate risk assessments, reducing underwriting costs by 30%. With AI-driven solutions expected to capture 20% of the market by 2025, insurers that leverage generative AI effectively will gain a competitive edge, driving growth and improving service delivery.

Industry Challenges

Regulatory Compliance

Navigating complex regulations across different regions

Insurers must adhere to diverse regulatory frameworks in multiple jurisdictions, often facing varying laws and standards that can be complex and costly to manage.

Ensuring data privacy and security

Adapting to evolving compliance requirements

Fraud Detection

Identifying sophisticated fraud schemes

Implementing real-time detection mechanisms

Balancing fraud prevention with customer experience

Customer Trust

Addressing concerns over data usage

Providing transparent and fair services

Maintaining a positive brand reputation

Operational Efficiency

Streamlining claims processing

Reducing administrative overhead

Integrating legacy systems with new technologies

Market Competition

Competing with insurtech startups

Innovating to meet changing customer expectations

Differentiating services in a crowded market

Generative AI Use Cases in Insurance

Personalised Policy Recommendations

Generative AI can analyse vast amounts of customer data, including demographic information, purchasing behaviour, and lifestyle preferences, to offer highly personalised policy recommendations. By tailoring policies to individual needs, insurers can enhance customer satisfaction and retention rates. This approach not only meets the specific needs of policyholders but also helps insurers identify cross-selling and up-selling opportunities, leading to increased revenue.

Furthermore, AI-driven personalization can streamline the customer journey, reducing the time and effort required to find suitable policies. This level of customization builds trust and loyalty, as customers feel understood and valued by their insurer. Additionally, the ability to provide real-time recommendations enhances the overall customer experience, making insurance services more responsive and user-friendly.

Risk Assessment and Underwriting

Generative AI can transform the underwriting process by providing more precise and comprehensive risk assessments. AI systems can analyse a wide range of data sources, including social media activity, environmental data, and historical claims information, to evaluate risk with greater accuracy. This enables insurers to set premiums that more accurately reflect the true level of risk, leading to fairer pricing for customers.

In addition to improving risk assessment accuracy, AI can streamline the underwriting process, making it faster and more efficient. Automated underwriting systems can quickly analyse applications, identify potential issues, and make recommendations, reducing the time needed to issue policies. This not only enhances the customer experience but also allows insurers to process a higher volume of applications, boosting overall productivity and profitability.

Fraud Detection and Prevention

Generative AI can play a crucial role in detecting and preventing fraud by analysing patterns and anomalies in large datasets. AI algorithms can identify suspicious behaviour and flag potential fraudulent activities in real-time, allowing insurers to take proactive measures. This capability is essential in combating the increasingly sophisticated tactics used by fraudsters.

By implementing AI-driven fraud detection systems, insurers can significantly reduce financial losses due to fraudulent claims. These systems can also enhance the accuracy of fraud detection, reducing false positives and ensuring legitimate claims are processed without unnecessary delays. Furthermore, the continuous learning capabilities of AI mean that fraud detection systems can evolve and improve over time, staying ahead of emerging threats and maintaining the integrity of insurance operations.

Automated Claims Processing

Generative AI has the potential to revolutionise claims processing by automating many of the tasks traditionally handled by human agents. AI systems can quickly and accurately assess claims, identify relevant policy details, and determine the validity of claims, significantly reducing the time needed to process them. This leads to faster payouts and improved customer satisfaction.

In addition to speeding up the claims process, AI can also enhance accuracy by minimising human errors and inconsistencies. By leveraging AI, insurers can ensure that claims are processed uniformly and fairly, reducing the risk of disputes and enhancing trust in the system. Moreover, automated claims processing frees up human agents to focus on more complex cases, improving overall efficiency and service quality.

Customer Service and Support

Generative AI can significantly enhance customer service by powering AI chatbots and virtual assistants that provide 24/7 support. These AI-driven tools can handle a wide range of customer queries, from policy information and claim status updates to billing inquiries, offering instant and accurate responses. This improves customer satisfaction by providing quick and efficient service, even outside of regular business hours.

In addition to handling routine inquiries, AI chatbots

can also assist with more complex issues by guiding customers through processes step-by-step or escalating cases to human agents when necessary. This seamless integration of AI and human

support ensures that customers receive the help they need in a timely manner. Moreover, by offloading routine tasks to AI, human agents can focus on higher-value interactions, further enhancing the quality of customer service and support.

Benefits of Generative AI in Insurance

Increased Efficiency

Generative AI insurance technology streamlines processes through automation, significantly reducing the time needed to complete tasks such as claims processing and underwriting. By automating these functions, insurers can process more transactions with greater accuracy, enhancing overall operational efficiency.

Additionally, the reduction in manual labour leads to lower operational costs. AI systems can work continuously without the limitations of human employees, ensuring that processes are carried out swiftly and consistently. This increased efficiency allows insurers to allocate resources to more strategic initiatives, further driving business growth.

Enhanced Customer Experience

Generative AI for insurance industry offers highly personalised services and products by analysing customer data to tailor offerings to individual needs. This personalised approach increases customer satisfaction and loyalty, as clients feel understood and valued by their insurer.

Moreover, AI provides quicker and more accurate responses to customer inquiries. AI-powered chatbots and virtual assistants can handle routine questions and requests instantly, improving response times and freeing human agents to focus on more complex issues. This results in a more seamless and satisfying customer experience.

Improved Risk Management

Generative AI in life insurance leverages vast amounts of data for better risk assessment, enabling insurers to evaluate potential risks more accurately. This enhanced assessment leads to more precise underwriting, ensuring that premiums are set appropriately and fairly.

Furthermore, AI improves the accuracy of claims processing by detecting inconsistencies and potential fraud in real-time. This not only reduces the incidence of fraudulent claims but also ensures that legitimate claims are processed swiftly and correctly, enhancing trust in the insurance provider.

Cost Savings

Generative AI in life insurance lowers administrative and processing costs by automating routine tasks. This reduction in manual intervention decreases the need for extensive administrative staff, leading to significant cost savings for insurers.

In addition to reducing operational expenses, AI minimizes losses due to fraud and errors. Advanced fraud detection algorithms quickly identify suspicious activities, preventing fraudulent claims from being paid out. Accurate processing reduces the likelihood of costly errors, further contributing to overall cost savings and enhancing the efficiency and reliability of insurance operations.

Enhanced Decision Making

Generative AI for insurance provides insurers with deep insights derived from data analysis, supporting more informed decision-making. By leveraging predictive analytics, insurers can anticipate market trends, customer behavior, and potential risks more accurately.

This enhanced decision-making capability allows insurers to develop more effective strategies and respond proactively to emerging challenges. With AI-driven insights, companies can optimize their product offerings, improve risk management practices, and ultimately achieve better financial performance. Additionally, AI can personalize customer interactions and streamline claims processing, further enhancing service quality and customer satisfaction.

Scalability and Flexibility

Generative AI offers insurers the ability to scale operations efficiently and flexibly. As business demands grow, AI systems can easily handle increased workloads without the need for proportional increases in human resources. This scalability ensures that insurers can meet customer needs and market demands promptly.

Moreover, generative AI allows for greater flexibility in developing and deploying new insurance products. Insurers can quickly adapt to changing market conditions and customer preferences by leveraging AI-driven insights to modify or create new offerings. This adaptability helps companies stay competitive and responsive in a fast-paced industry, ensuring long-term growth and success.

Future Trends

Integration with Quantum Computing

Integration of Gen AI with quantum computing promises exponentially faster data processing speeds and more complex data analysis capabilities. This could revolutionize risk assessment, algorithmic trading, and fraud detection in real time.

Enhancing Gen AI with Quantum Computing:Integrating Gen AI with quantum computing promises to revolutionize various aspects of banking and finance by enabling exponentially faster data processing speeds and more complex data analysis capabilities.

Algorithmic Trading: Algorithmic trading relies on analyzing market data and executing trades at high speeds. Quantum computing can significantly boost AI's capabilities in this domain by performing complex calculations and pattern recognition tasks much faster than classical computers. Quantum algorithms can identify market trends, optimize trading strategies, and execute trades with minimal latency. This can lead to higher profitability, reduced trading risks, and improved market efficiency. Moreover, quantum-enhanced AI can adapt to rapidly changing market conditions, ensuring that trading strategies remain effective over time.Blockchain and AI Synergies

Combining AI with blockchain technology can improve security through decentralized, immutable ledgers. This synergy can streamline regulatory compliance, secure transactions, and enhance customer data privacy.

Enhanced Security: Blockchain's decentralized nature and cryptographic techniques ensure that data is securely stored and tamper-proof. By integrating AI with blockchain, financial institutions can further enhance security measures. AI algorithms can monitor blockchain transactions in real-time, identifying suspicious activities and potential security breaches. For example, AI can detect patterns indicative of fraud or unauthorized access, triggering automated responses to mitigate risks. This combination of AI and blockchain provides a robust defense against cyber threats and ensures the integrity of financial transactions.

Securing Transactions: Blockchain technology ensures that transactions are securely recorded and cannot be altered once confirmed. By integrating AI, financial institutions can enhance the security and efficiency of transaction processing. AI can verify the authenticity of transactions, detect fraudulent activities, and ensure compliance with security protocols. Additionally, AI-powered smart contracts on the blockchain can automate and enforce contractual agreements, reducing the need for intermediaries and minimizing the risk of disputes.Expansion of Robo-Advisors

Robo-advisors powered by AI will evolve to offer more personalized and comprehensive financial advice, integrating broader datasets and offering real-time portfolio adjustments based on market conditions and customer preferences.

Evolution of Robo-Advisors: Gen AI is driving the evolution of robo-advisors, enabling them to offer more personalized and comprehensive financial advice by integrating broader datasets and providing real-time portfolio adjustments based on market conditions and customer preferences.

Real-Time Portfolio Adjustments: Market conditions can change rapidly, requiring timely adjustments to investment portfolios. Gen AI enables robo-advisors to perform real-time portfolio analysis and rebalancing based on current market data and customer preferences. AI algorithms can monitor market movements, assess the impact on individual portfolios, and execute trades to optimize performance. This ensures that customers' investments remain aligned with their financial goals and risk tolerance, even in volatile market conditions.

Next-Generation Robo-Advisors: Beyond basic financial advice, next-generation robo-advisors will leverage advanced AI to offer dynamic investment strategies that adapt to changing market conditions in real time. These AI-driven platforms will use sophisticated algorithms to analyze market data, economic indicators, and even geopolitical events to optimize investment portfolios. Integration of Broader Datasets: Gen AI allows robo-advisors to integrate a broader range of datasets beyond traditional financial metrics. For instance, AI can analyze social media sentiment, geopolitical events, and macroeconomic indicators to provide a comprehensive view of market trends. By incorporating diverse data sources, AI-driven robo-advisors can offer more informed and accurate financial advice. This holistic approach enhances the ability to identify investment opportunities, manage risks, and provide actionable insights to customers.Next-Generation Robo-Advisors:

Integration of Gen AI with quantum computing promises exponentially faster data processing speeds and more complex data analysis capabilities. This could revolutionize risk assessment, algorithmic trading, and fraud detection in real time.

Enhancing Gen AI with Quantum Computing: Integrating Gen AI with quantum computing promises to revolutionize various aspects of banking and finance by enabling exponentially faster data processing speeds and more complex data analysis capabilities.

Algorithmic Trading: Algorithmic trading relies on analyzing market data and executing trades at high speeds. Quantum computing can significantly boost AI's capabilities in this domain by performing complex calculations and pattern recognition tasks much faster than classical computers. Quantum algorithms can identify market trends, optimize trading strategies, and execute trades with minimal latency. This can lead to higher profitability, reduced trading risks, and improved market efficiency. Moreover, quantum-enhanced AI can adapt to rapidly changing market conditions, ensuring that trading strategies remain effective over time.Potential Risks and Regulatory Implications

Data Privacy Concerns

Generative AI systems require extensive personal data, raising privacy issues and necessitating strict adherence to regulations like GDPR and CCPA. Ensuring robust data protection measures is vital to prevent breaches and avoid significant penalties.

Bias and Fairness in AI

AI systems can inherit biases from historical data, leading to unfair treatment in underwriting and claims processing. Insurers must implement fairness algorithms and regular audits to ensure equitable and transparent AI-driven decisions.

Regulatory Compliance

The evolving nature of AI regulations poses challenges for insurers, requiring constant updates to compliance practices. Staying abreast of diverse regulatory requirements across jurisdictions is essential to avoid legal issues.

Technological Dependence

Heavy reliance on AI technology can lead to operational risks if systems fail. Insurers should have contingency plans and maintain human oversight to ensure resilience and minimise disruptions.

Security Threats

Generative AI systems are vulnerable to cyberattacks, including data breaches and adversarial threats. Investing in advanced cybersecurity measures and continuous monitoring is crucial to protect AI infrastructure from potential exploitation.

Transform Your Insurance Services With Generative Al

Generative AI is transforming the insurance industry by automating tasks like claims processing, reducing costs by up to 30%, and speeding up processing times by 50%. It also enhances customer satisfaction through personalized policy recommendations and improves fraud detection accuracy by 90%. Overall, AI adoption streamlines operations and gives insurers a competitive edge.

Inquire Now!

Latest Blogs

How to build an MVP using Blockchain or Generative AI?

Learn how to build an MVP with GenAI or blockchain. Discover key steps, best practices, and tools to launch a scalable, cost-effective minimum viable product with both.

Read MoreGenerative AI in Accounting: 10 Use Cases & Examples

Discover how Generative AI is streamlining accounting processes, from auditing to financial forecasting, saving time and boosting business efficiency.

Read MoreThe Benefits of Generative AI in Creating Unique Game Assets

How is generative AI reshaping online casino game development? Discover how AI is transforming visuals, gameplay, and personalization in unexpected ways.

Read More