Cryptocurrencies have changed how we think about money, but their environmental cost is hard to ignore. Bitcoin alone consumes nearly 127 terawatt-hours of electricity each year and emits around 65 megatons of CO2, comparable to large corporations. As adoption rises, so does concern over the sustainability of digital currencies.

In response, the crypto industry is turning to greener alternatives. Eco-friendly cryptocurrencies use low-energy consensus mechanisms like Proof-of-Stake or Directed Acyclic Graphs, avoiding the heavy power use of traditional mining. These green solutions are gaining popularity among environmentally conscious users and investors.

This blog explores what makes a cryptocurrency “green” and how green cryptocurrencies support a more sustainable future. From their energy-saving technologies to their growing impact, we’ll look at how green crypto is shaping a cleaner path forward for blockchain.

Introduction of Green Cryptocurrencies

Green cryptocurrencies are digital assets that prioritize sustainability and energy efficiency to lessen their impact on the environment.

Green cryptos use the latest innovations to lower their carbon emissions, in contrast to traditional cryptos that depend on energy-intensive procedures. They serve as Ethereum’s and Bitcoin’s environment-friendly substitutes.

They are renowned for their growing significance for the following reasons:

- Reduced Energy Use: The Proof of Work (PoW) consensus process, which is used by cryptocurrencies like Bitcoin, requires a significant amount of processing power. Alternative techniques like Proof of Stake (PoS), which use a lot less energy, are occasionally used by green coins.

- Decreased Carbon Footprint: Investors who value environmental responsibility and long-term sustainability will find these eco-friendly digital assets appealing because they are made to reduce carbon emissions.

- Conformity with ESG Objectives: Green cryptos offer a promising path forward as more and more organizations and investors emphasize Environmental, Social, and Governance (ESG) factors. They align with global climate goals and the rise of the sustainable cryptocurrency movement.

What is the Need for Green Cryptocurrencies

The cryptocurrency industry is seeing an increase in demand for sustainable solutions as environmental concerns grow. Green cryptocurrencies are essential to the development of blockchain technology because they offer a way to maintain innovation while reducing carbon emissions. The following justifies the necessity of green cryptocurrencies for a sustainable future:

- Transition to Eco-Friendly Blockchain Infrastructure

Energy-efficient blockchain networks that significantly reduce environmental impacts are the foundation of green cryptocurrencies. These eco-friendly blockchain systems ensure that innovation doesn’t compromise the well-being of our planet by replacing energy-intensive procedures with sustainable ones.

- Using Low-Carbon Crypto to Promote Sustainability

Sustainable mining operations save a substantial amount of energy. Because low-carbon cryptocurrency models greatly reduce energy consumption and emissions while promoting clean technology, they provide a workable solution for investors, consumers, and organizations that care about the environment.

- Emergence of Green DeFi Solutions

While the decentralized finance (DeFi) industry is thriving, its sustainability is also very important. Green DeFi systems show that finance can be both decentralized and environmentally sustainable by offering comparable financial autonomy and transparency to traditional DeFi while significantly lowering energy consumption.

- Green Token Development Solutions

Sustainability can now be incorporated into new developments from the very beginning. Developers and businesses can start digital assets that prioritize minimal environmental effects by using green token creation options, guaranteeing responsible growth right from the start.

Green Cryptocurrency Mining

Green cryptocurrency mining is transforming how transactions are verified on blockchain networks, focusing on energy efficiency, sustainability, and reduced environmental impact. Rather than using traditional energy-heavy methods, green crypto mining companies adopt cleaner technologies and protocols that align with global sustainability goals.

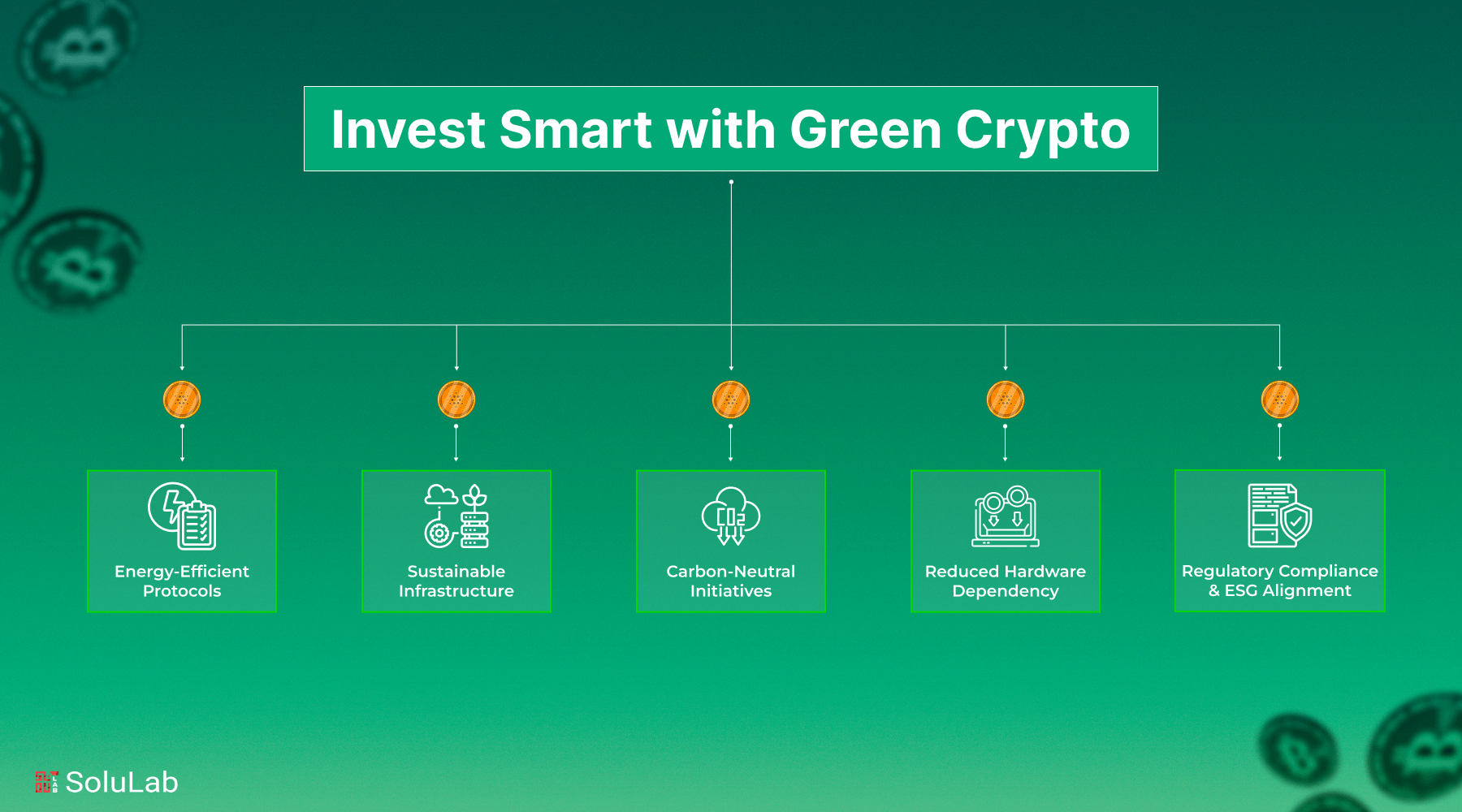

Key aspects of green crypto mining include:

- Energy-Efficient Protocols

Unlike Proof of Work (PoW), which requires massive amounts of computational power, green mining favors consensus mechanisms like Proof of Stake (PoS) or Proof of Authority (PoA). These methods validate transactions without needing to solve complex mathematical puzzles, drastically cutting down electricity usage.

- Sustainable Infrastructure

Many green crypto mining companies operate data centers powered by renewable energy sources such as solar, wind, geothermal, or hydroelectric power. This shift helps reduce their dependency on fossil fuels and lowers their overall carbon footprint.

- Carbon-Neutral Initiatives

To further offset environmental impact, several companies participate in carbon offsetting programs. These include planting trees, investing in carbon credits, or partnering with climate-positive organizations to achieve a net-zero emission model.

- Reduced Hardware Dependency

Since PoS and similar protocols don’t require continuous, high-power computing, green mining setups use less hardware, resulting in lower energy needs and less electronic waste. This also makes entry into mining more accessible and eco-friendly.

- Regulatory Compliance & ESG Alignment

With increasing regulatory focus on environmental responsibility, green crypto mining aligns well with Environmental, Social, and Governance (ESG) standards. This proactive approach helps companies future-proof their operations while attracting responsible investors.

Why Invest in Green Cryptos in 2025?

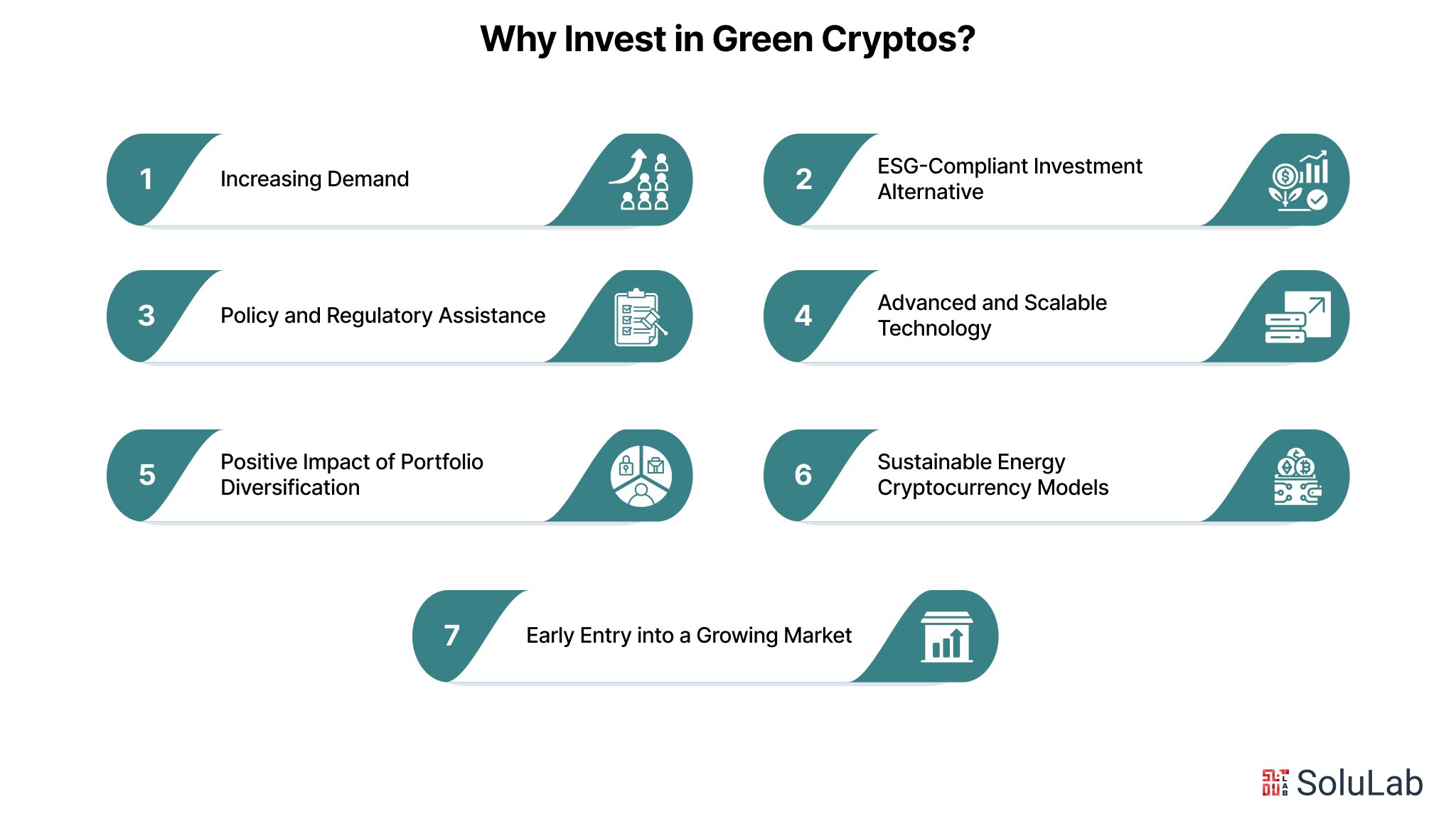

As sustainability arises as a worldwide need, the cryptocurrency sector is redirecting its attention towards environmentally friendly, energy-efficient alternatives. By 2025, green cryptocurrencies will transcend ethical considerations and become smart investments for blockchain technology. Here are some of the benefits of green blockchain solutions:

- Increasing Demand

As consumers and organizations advocate for sustainable alternatives, eco-friendly cryptocurrencies are receiving significant attention due to their minimal energy use and ethical design.

- ESG-Compliant Investment Alternative

Green cryptocurrencies seamlessly integrate into ESG-oriented portfolios, enabling investors to align their money with environmental and social principles.

- Policy and Regulatory Assistance

Investing in green cryptocurrencies positions you advantageously in light of governmental support for sustainable technology and forthcoming compliance trends and global energy laws.

- Advanced and Scalable Technology

Constructed on low-energy frameworks such as Proof of Stake, green cryptocurrencies provide enhanced efficiency, expedited transactions, and sustainable scalability.

- Positive Impact of Portfolio Diversification

Green cryptocurrency assets provide diversification while fostering a sustainable future, merging financial returns with significant impact.

- Sustainable Energy Cryptocurrency Models

Investing in green energy cryptocurrency projects signifies endorsing the extensive shift toward renewable-powered blockchain infrastructure.

- Early Entry into a Growing Market

Early endorsement of green energy cryptocurrency activities may provide substantial long-term rewards as demand, adoption, and innovation escalate.

How Green Cryptos Reduce Environmental Impact?

Green cryptocurrencies are transforming the relationship between digital currency and the environment by reducing energy consumption and fostering sustainability. Traditional cryptocurrencies, such as Bitcoin, rely significantly on energy-consuming mechanisms like Proof of Work (PoW), whereas environmentally friendly cryptocurrencies utilize more efficient consensus models like Proof of Stake (PoS) and Proof of Space-and-Time (PoST), which substantially reduce electricity consumption. These advances guarantee that the verification and incorporation of transactions into the blockchain are safe while minimizing carbon emissions.

The ecological benefits of green cryptocurrencies are enhanced when utilized via blockchain-as-a-service platforms. These technologies enable developers and companies to construct and expand blockchain applications with cloud infrastructure designed for energy efficiency. This concept diminishes the necessity for operating substantial on-site mining equipment, thereby reducing the total environmental impact of blockchain networks.

The essence of these breakthroughs lies in the progress of blockchain technology. Modern green cryptocurrency initiatives use intelligent architecture and energy-efficient design at the protocol level. This encompasses attributes such as diminished block sizes, enhanced validation processes, and efficient data storage—all fostering a more orderly and accountable digital environment.

Sustainable blockchain development services offer the necessary tools and frameworks for businesses looking to connect with sustainability objectives and establish eco-friendly cryptocurrency platforms. These services ensure that all processes—from token creation to transaction validation—are executed with little environmental impact, enabling businesses to innovate without compromise.

Future of Green Crypto Assets

Green crypto assets are expected to significantly influence the development of a more environmentally aware digital finance ecosystem. As global sustainability initiatives intensify, these assets will persist in their evolution, propelled by adoption, innovation, and strategic partnership. Here’s how it will affect environmental sustainability in the future:

- Increasing Popularity and Adoption

As the cryptocurrency community grows more cognizant of the environmental disadvantages of conventional digital currencies, demand for more sustainable alternatives is fast growing. An increasing number of stakeholders, ranging from retail investors to multinational organizations and governmental institutions, are advocating for low-impact solutions to mitigate their carbon footprints.

- Support from Institutional Investors

The need for ESG-aligned investing methods is prompting substantial investors to reevaluate their capital allocation. Green crypto assets, characterized by their low-emission profiles, are increasingly favored and may soon become integral components of ESG-focused portfolios, enhancing liquidity and market trust.

- Significant Advancements

Continuous advancements in blockchain technology are facilitating more sustainable practices. As protocols advance, novel consensus mechanisms and technical enhancements are anticipated to increase energy efficiency while maintaining security and decentralization.

- Reduced Resource Consumption

As environmentally sustainable cryptocurrency systems advance, they are anticipated to manage increased transaction volumes with reduced energy use. This enhancement in scalability will enable environmentally sustainable cryptocurrencies to rival conventional assets in terms of performance and sustainability.

- Alignment with Environmental Initiatives

Green digital currencies are starting integration with carbon offset systems, enabling direct contributions to emissions reduction programs. Their involvement in these initiatives may enhance climate impact transparency in finance.

- Collaborations with Renewable Energy Suppliers

An increasing possibility exists for green cryptocurrency initiatives to collaborate with renewable energy firms. These agreements may facilitate the incorporation of renewable energy sources into cryptocurrency infrastructure, fostering environmentally friendly ecosystems from mining to transaction validation.

Conclusion

With the increasing worldwide demand for environmentally friendly technology, green cryptocurrencies are developing as a sustainable alternative to conventional crypto assets. Green crypto assets are transforming the future of financial services through energy-efficient consensus methods, alignment with ESG objectives, and inclusion in various environmental programs. They not only mitigate the environmental effects of blockchain but also facilitate the transition to a low-carbon economy that integrates innovation with accountability.

SoluLab, as a leading cryptocurrency development company, is at the forefront of creating sustainable and future-oriented blockchain solutions. Our recent project NovaPay Nexus enables organizations to establish their own cryptocurrency ecosystems, providing safe, frictionless, and sustainable payment options for their consumers.

If you’re looking to develop your own green crypto solution or integrate digital currency payments into your business, SoluLab is here to help. Contact us today to discover how our customized blockchain development services can help actualize your vision while promoting a more sustainable financial future.

FAQs

1. What makes a cryptocurrency “green”?

A green cryptocurrency is designed to minimize environmental impact by using energy-efficient consensus mechanisms like Proof of Stake (PoS) or Proof of Space-and-Time (PoST). These systems drastically reduce the energy consumption typically associated with traditional cryptocurrencies such as Bitcoin, which rely on energy-intensive Proof of Work (PoW) models.

2. Can green cryptocurrencies still be secure and scalable?

Absolutely. Green cryptocurrencies maintain robust network security through modern consensus algorithms that don’t compromise performance. In fact, many green crypto projects are built with scalability in mind, offering faster transaction speeds and lower fees while still ensuring decentralization and transparency.

3. How do green cryptocurrencies support global sustainability goals?

Green crypto projects often integrate with sustainability initiatives such as carbon credit trading, renewable energy verification, and transparent supply chain tracking. By aligning with objectives like the UN’s Sustainable Development Goals (SDGs), they contribute to real-world environmental and social impact.

4. What is the role of green cryptocurrencies in decentralized finance (DeFi)?

Green cryptocurrencies are powering the next generation of DeFi platforms that prioritize sustainability. These platforms offer the same benefits, such as yield farming, lending, and token swaps, while operating on eco-friendly blockchain networks that use significantly less energy.

5. Do green cryptocurrencies offer benefits beyond environmental impact?

Yes, green cryptocurrencies not only reduce energy consumption but also often come with faster transaction speeds, lower network fees, and improved scalability. Their modern infrastructure makes them ideal for real-world applications in payments, DeFi, and NFTs. Additionally, supporting green crypto projects can enhance a brand’s reputation by showcasing commitment to innovation and sustainability.