For people who can react quickly, the volatile cryptocurrency market provides a plethora of chances. Flash loan arbitrage bots are gaining popularity as a powerful tool for traders to capitalize on price differences between exchanges. These bots execute trades using flash loans—instant, unsecured loans that are borrowed and repaid within a single transaction. By leveraging large amounts of borrowed cryptocurrency, traders can exploit fleeting arbitrage opportunities, such as buying an asset at a lower price on one platform and selling it at a higher price on another, all in mere seconds. Aave, a leading DeFi protocol, has seen substantial activity in flash loan transactions. For example, in July 2020, the daily value of flash loans issued by Aave grew from $11 million to over $130 million within a month.

In this blog, we’ll provide a detailed guide on how to build a flash loan arbitrage bot, starting from the basics of flash loans to step-by-step instructions for coding and deploying your bot. You’ll also learn about the tools and platforms required to create your bot, best practices for securing transactions, and tips for maximizing profitability in a volatile market.

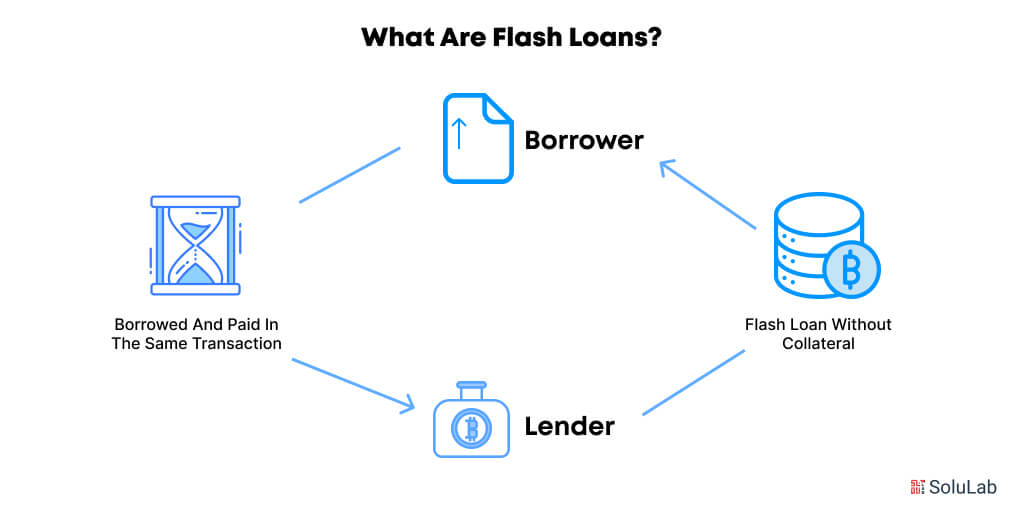

What Are Flash Loans?

Flash loans are a unique and innovative financial tool in the decentralized finance (DeFi) ecosystem. Unlike traditional loans, flash loans allow users to borrow large amounts of cryptocurrency without needing to provide collateral. These loans are executed within a single blockchain transaction, ensuring that the borrowed amount is repaid before the transaction is finalized. If the loan is not repaid, the transaction is reversed, leaving no impact on the lender.

One of the most popular use cases for flash loans is the flash loan arbitrage smart contract, where traders exploit price discrepancies across decentralized exchanges (DEXs). For instance, in a single transaction, a trader may take out a flash loan, purchase an asset at a cheaper price on one exchange, offer it at a higher price on another, and then pay back the loan.

Flash loans rely on flash loan arbitrage Smart contracts—self-executing agreements with terms directly written into code. These flash loan arbitrage smart contracts ensure that the loan conditions, including repayment, are met automatically, making the process seamless and secure.

Key Features of Flash Loans

Here are some of the key features of flash loans:

- No Collateral Required: Borrowers do not need to pledge assets, as repayment is guaranteed within the transaction itself.

- Instant Execution: The loan, its use, and its repayment occur within seconds, thanks to the blockchain’s efficiency.

- Flexibility: Flash loans can be used for arbitrage, refinancing loans, or even manipulating protocol incentives.

Flash loans have gained traction for their ability to generate profits through arbitrage and other financial strategies. However, they also come with risks, particularly when exploited maliciously. As a result, DeFi platforms continually refine their systems to balance innovation with security.

What is Crypto Arbitrage?

Crypto arbitrage is a trading strategy that involves capitalizing on price differences for the same cryptocurrency across different platforms or exchanges. In simpler terms, it’s the process of buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another, pocketing the difference as profit. This strategy relies on the inefficiencies of cryptocurrency markets, where prices can vary due to differences in trading volume, liquidity, or regional demand.

One of the most advanced methods of executing arbitrage strategies in the decentralized finance (DeFi) ecosystem involves flash loan arbitrage. This technique allows traders to borrow large sums of cryptocurrency through flash loans—loans that don’t require collateral and are repaid within a single blockchain transaction. Flash loans have made it possible to execute arbitrage opportunities without upfront capital, making the process more accessible and efficient.

For those looking to leverage this opportunity, many traders and developers are exploring flash loan arbitrage bot development costs as they consider building automated solutions. These bots are designed to identify arbitrage opportunities, execute trades, and repay loans within seconds, ensuring maximum profitability.

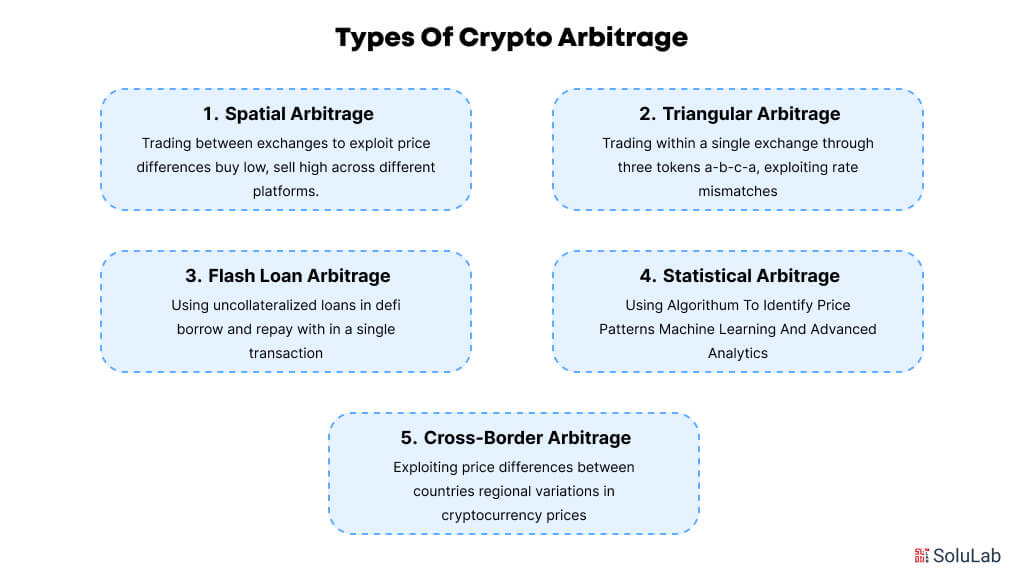

Types of Crypto Arbitrage

Here are the types of crypto arbitrage:

1. Spatial Arbitrage

Spatial arbitrage involves trading cryptocurrencies between two exchanges to exploit price differences. Traders buy assets where the price is lower and sell them on an exchange where the price is higher, profiting from the discrepancy. This type is widely used due to the frequent price differences between exchanges.

However, it requires speed and efficiency, as prices can change quickly. Automated trading systems or bots are often employed to execute trades rapidly, minimizing the impact of time delays and transaction fees.

2. Triangular Arbitrage

Triangular arbitrage takes place within a single exchange, where price discrepancies exist among three cryptocurrency pairs. Traders cycle through conversions, such as Token A to Token B to Token C, and back to Token A, to make a profit from mismatched exchange rates.

This method requires precise calculations and fast execution to minimize slippage. Many traders use pre-programmed algorithms or bots to automate these complex trades, ensuring accuracy and efficiency.

3. Flash Loan Arbitrage

Flash loan arbitrage utilizes flash loans, uncollateralized loans that are borrowed and repaid within a single blockchain transaction. Traders exploit price mismatches across decentralized exchanges or liquidity pools, profiting without requiring upfront capital.

This type of arbitrage has gained popularity due to its efficiency and accessibility in decentralized finance (DeFi). Understanding flash loan arbitrage bot development cost is crucial for those looking to build automated solutions for this strategy.

4. Statistical Arbitrage

Statistical arbitrage uses algorithms and quantitative models to identify price patterns or correlations between cryptocurrencies. Traders use these insights to predict and execute profitable trades across multiple assets or exchanges.

This type of arbitrage often involves machine learning or advanced crypto arbitrage trading bots. The flash loan arbitrage bot development cost for such systems can be higher due to the need for sophisticated analytics and infrastructure.

5. Cross-Border Arbitrage

Cross-border arbitrage focuses on price discrepancies between exchanges in different countries, often caused by regional regulations, demand, or liquidity. Traders buy cryptocurrencies in markets with lower prices and sell them in markets where prices are higher.

This method can be profitable but involves challenges like regulatory compliance and transaction delays. Automated systems can assist in identifying opportunities and executing trades efficiently.

Pre-Requisites to Building a Flash Loan Bot

Building a flash loan arbitrage bot requires a combination of technical expertise, financial knowledge, and a solid understanding of blockchain technology. This is not a plug-and-play process—it involves careful planning, precise coding, and efficient execution. Here are the key pre-requisites:

1. Understanding Smart Contracts: Flash loan bots rely heavily on smart contracts to interact with blockchain protocols. Developers must have a strong grasp of programming languages like Solidity (for Ethereum) or Rust (for Solana) to create and deploy efficient, secure smart contracts. These contracts handle the borrowing, trading, and repayment processes automatically within a single transaction.

2. Familiarity with Blockchain Protocols: A deep understanding of blockchain mechanics is essential. Developers need to know how flash loans work, the platforms offering them (e.g., Aave, dYdX), and how decentralized exchanges (DEXs) operate. Familiarity with gas fees, transaction speeds, and the nuances of specific blockchains is also critical.

3. Technical Infrastructure: Setting up the right infrastructure is crucial. This includes access to a blockchain node, either by running your own or through a reliable node provider, to execute transactions quickly. Additionally, having a high-performance server for hosting the bot ensures low latency, which is vital in arbitrage scenarios.

4. Proficiency in Arbitrage Logic: Developers must understand how to identify arbitrage opportunities and integrate this logic into the bot. This involves scanning multiple DEXs in real time, calculating potential profits, and executing trades seamlessly. Efficiency is key, as arbitrage opportunities are fleeting and competitive.

5. Risk Management Skills: Flash loan bots operate in high-stakes environments where errors can lead to financial loss. Developers must implement safeguards, such as simulating transactions on testnets, limiting transaction costs, and ensuring the bot only executes when the profit is above a certain threshold.

6. Knowledge of Compliance and Security: Building a flash loan bot also requires adhering to legal regulations and ensuring security best practices. Developers must protect their bot from exploits, such as front-running attacks, and ensure it complies with the policies of the platforms and jurisdictions it operates within.

These prerequisites provide the foundation for building a functional and efficient flash loan bot, capable of executing complex financial strategies in the DeFi technology.

How Flash Loan Arbitrage Bots Work?

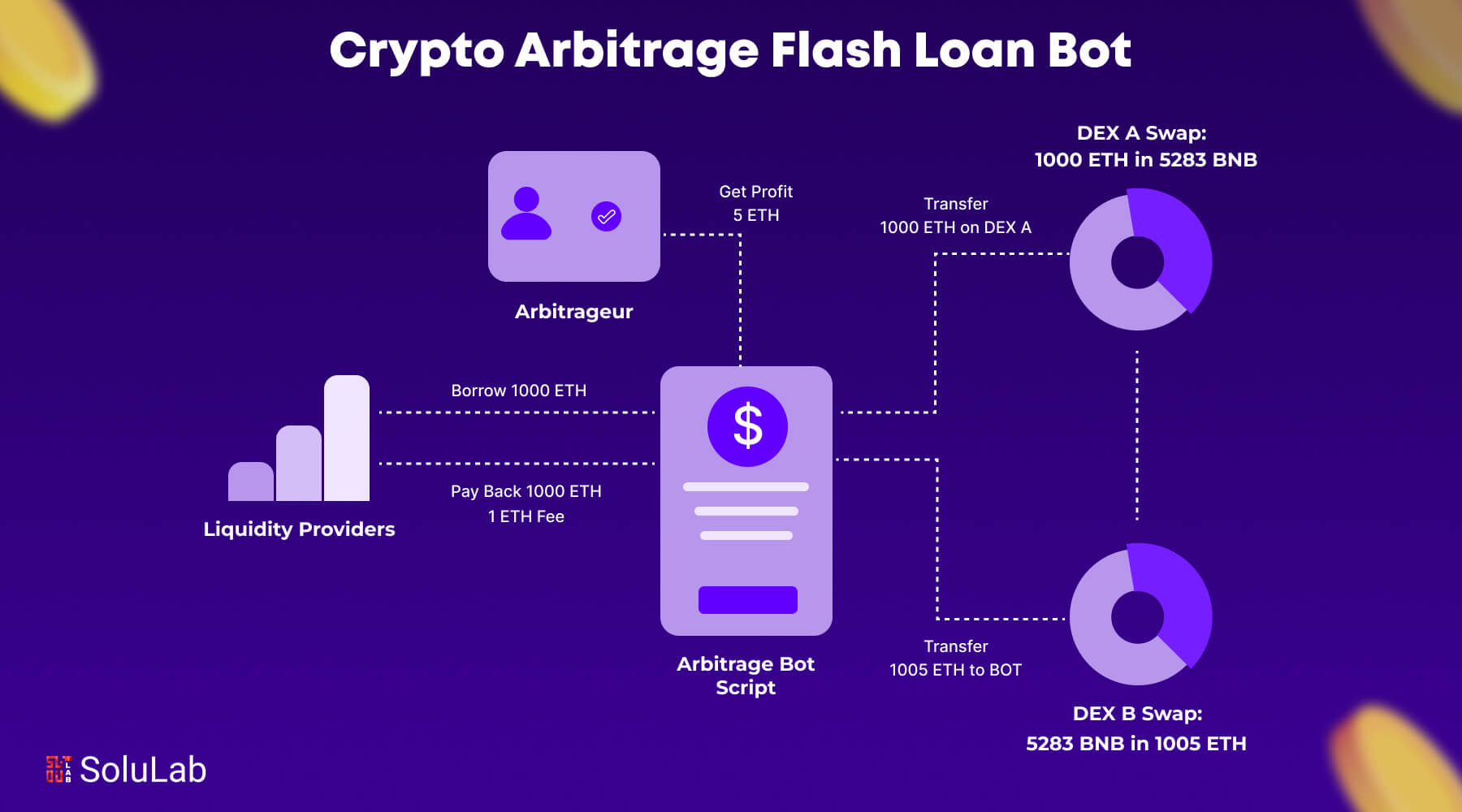

Flash loan arbitrage bots facilitate seamless interactions between two primary parties: lenders and borrowers. Borrowers leverage smart contracts to access and utilize flash loans from providers like Uniswap, Aave, or dYdX, executing sophisticated operations before repaying the borrowed amount. These bots are designed to ensure atomic transactions, where either every step is completed successfully, or the entire process is reverted, eliminating any risk of partial failure.

Key Components of a Flash Loan Arbitrage Bot

Here are the key components of a flash loan arbitrage bot:

1. Loan Acquisition: Borrowers initiate the process by requesting loans from flash loan providers. These loans are collateral-free but must be repaid within the same blockchain transaction, ensuring no lasting debt.

2. Smart Contract Interaction: Once the loan is secured, borrowers engage other smart contracts to perform specific operations like arbitrage, liquidation, or yield farming, maximizing potential profit from market inefficiencies.

3. Loan Repayment: After the operations conclude, the borrowed amount, along with any applicable fees, is repaid in full to the lender within the same transaction cycle.

Five Stages of the Flash Loan Process

The working of the flash loan process happens in five basic stages, such as:

1. Loan Transfer: Flash loan providers transfer the requested assets to the borrower’s smart contract for immediate use. This transfer is the starting point for executing the intended operations.

2. Invocation: Borrowers invoke the smart contract to execute pre-defined functions, initiating the planned sequence of operations.

3. Operation Execution: Using the borrowed assets, the borrower interacts with various decentralized exchanges and other smart contracts. Operations like arbitrage (buying assets on one exchange and selling them on another for a profit) or liquidation (paying off bad debt to claim collateral) are executed. These operations aim to generate profits or fulfill specific financial strategies.

4. Loan Repayment: Upon completion of operations, the borrowed assets, including any required interest or fees, are returned to the flash loan provider. This repayment is automated within the smart contract, ensuring compliance with the loan terms.

5. Balance Verification: The flash loan provider verifies the repayment. If the funds are insufficient or operations fail to generate the required amount, the entire transaction is reverted, undoing all actions to avoid any loss or debt.

Step-by-Step Guide to Building a Crypto Arbitrage Flash Loan Bot

The process of developing a machine that can carry out arbitrage transactions utilizing flash loans is known as building a crypto arbitrage flash loan bot. This step-by-step guide will walk you through the essential components of building a flash loan arbitrage bot, from selecting the right protocol to deploying the final product. Here’s how to get started:

1. Choosing the Right DeFi Protocol

The first step in how to build a flash loan arbitrage bot is selecting the appropriate decentralized finance (DeFi) protocol. Platforms like Aave, dYdX, and Uniswap are popular choices for executing flash loans and arbitrage trades. Evaluate each platform based on:

- Supported assets.

- Transaction fees (gas costs).

- Liquidity pools and arbitrage opportunities.

- Ease of integration with your bot.

For instance, Aave is known for its robust flash loan functionality, making it a popular choice for developers interested in flash loan arbitrage bot development.

2. Writing the Flash Loan Smart Contract

A smart contract for flash loan arbitrage is the backbone of your bot. This contract handles borrowing, executing trades, and repaying the loan within a single blockchain transaction. Here’s what to include in the smart contract:

- Flash Loan Functionality: Integrate with the DeFi protocol to borrow the desired asset.

- Arbitrage Execution: Define the logic to perform arbitrage trades on decentralized exchanges (DEXs).

- Repayment and Error Handling: Ensure the borrowed amount plus fees is repaid; if not, the transaction should revert.

Use Solidity for Ethereum-based development or Rust for Solana. Your contract should be optimized for gas efficiency, as high fees can erode profits.

3. Integrating Arbitrage Logic

After creating the smart contract for flash loan arbitrage, integrate the logic to identify and execute arbitrage opportunities. This involves:

- Scanning DEXs: Use APIs to fetch real-time price data from multiple DEXs.

- Profit Calculation: Include algorithms to calculate potential profits based on price discrepancies, transaction fees, and gas costs.

- Automated Execution: Ensure the bot can execute trades instantly, leveraging the borrowed funds for maximum efficiency.

Efficient arbitrage logic is crucial in building a flash loan arbitrage bot as it ensures profitability and speed in highly competitive markets.

4. Testing and Deploying the Bot

Testing is a critical phase in flash loan arbitrage bot development. Start by deploying your bot on a testnet (e.g., Ethereum’s Goerli or Rinkeby testnet) to simulate transactions without risking real funds. Key testing steps include:

- Verifying smart contract functionality.

- Testing arbitrage trades under different market conditions.

- Ensuring seamless repayment of flash loans.

Once testing is complete, deploy the bot on the mainnet. Use a reliable blockchain node provider to minimize latency and ensure consistent performance. Finally, monitor the bot’s performance in real-world scenarios to fine-tune its operations.

By following these steps, you can learn how to build a flash loan arbitrage bot that is efficient, profitable, and secure. Developing and deploying a successful bot requires a blend of technical expertise, market knowledge, and careful execution. With the right approach, your bot can leverage flash loans to capitalize on crypto arbitrage bot opportunities.

Key Challenges in Building a Flash Loan Arbitrage Bot and How to Overcome Them

Building a flash loan arbitrage bot is an exciting opportunity to capitalize on decentralized finance (DeFi) markets, but it comes with significant challenges. Addressing these challenges effectively is crucial for ensuring the bot’s profitability and reliability. The following are the main obstacles and methods for overcoming them:

1. High Gas Fees

One of the biggest obstacles in flash loan arbitrage bot development is the cost of gas fees, especially on networks like Ethereum. High fees can significantly eat into arbitrage profits, making some trades unviable.

How to Overcome It: Optimize your smart contract for flash loan arbitrage to reduce computational complexity and save gas costs. Deploy your bot on low-cost networks like Binance Smart Chain, Polygon, or Layer 2 solutions such as Arbitrum or Optimism. Monitor gas fee trends and execute trades during periods of lower network activity.

2. Latency and Competition

Arbitrage opportunities are fleeting, often lasting only a few seconds. Bots that operate with even slight delays may miss profitable trades or lose to competitors.

How to Overcome It: Use a high-performance server or virtual private server (VPS) to minimize latency. Subscribe to a reliable blockchain node provider to ensure your bot receives real-time updates. Integrate fast execution mechanisms into your how to build a flash loan arbitrage bot plan to improve response times.

3. Price Slippage

Price slippage occurs when the price of a cryptocurrency changes during the transaction, leading to lower-than-expected profits or even losses.

How to Overcome It: Incorporate slippage tolerance settings into your bot to limit the impact of price changes. Reduce the influence on the market by making smaller deals. Use decentralized exchanges (DEXs) with high liquidity to minimize slippage risks.

4. Smart Contract Vulnerabilities

A poorly coded smart contract for flash loan arbitrage can be exploited by malicious actors or fail during execution, leading to losses or security breaches.

How to Overcome It: Conduct thorough audits of your smart contract using tools like MythX or ConsenSys Diligence. Before launching your contract on the mainnet, thoroughly test it on testnets. Stay updated on the latest security practices and implement safeguards against exploits such as reentrancy attacks.

5. Complexity in Arbitrage Logic

Identifying profitable arbitrage opportunities across multiple exchanges and assets can be computationally intensive and prone to errors.

How to Overcome It: Use advanced algorithms to automate the identification of arbitrage opportunities. Leverage machine learning models to predict profitable trades more accurately. Start with simpler strategies and gradually scale up as you refine your bot’s performance.

6. Regulatory and Compliance Issues

Some jurisdictions may impose regulations on the use of arbitrage bots or flash loans, creating legal challenges for developers and users.

How to Overcome It: Research and understand the legal framework in your target markets. Ensure your bot complies with the terms and conditions of the DeFi protocols and exchanges it interacts with. Avoid practices that might be deemed manipulative or fraudulent.

By addressing these challenges systematically, developers can build robust and efficient bots capable of executing profitable trades. Successful flash loan arbitrage bot development requires technical expertise, strategic planning, and continuous optimization. With the right approach, you can navigate these challenges and create a bot that thrives in the DeFi world.

Tips for Maximizing Arbitrage Profits

Maximizing profits in arbitrage trading requires a strategic approach and the right tools. Here are some practical tips to help you get the most out of your arbitrage ventures:

-

Choose the Right Arbitrage Opportunities

Focus on markets with high volatility and significant price discrepancies. Cross-platform arbitrage, such as trading between decentralized exchanges (DEXs) and centralized exchanges (CEXs), often presents lucrative opportunities.

-

Utilize Flash Loan Arbitrage

Flash loans have become a game-changer in arbitrage trading. By using borrowed funds for a single transaction, you can capitalize on price differences without the need for upfront capital. However, ensure you have a robust flash loan arbitrage bot in place to execute these trades seamlessly.

Read Blog: How to Create A Crypto Trading Bot?

-

Optimize Bot Speed and Performance

The speed and efficiency of your arbitrage bot can make or break your profitability. Invest in high-quality flash loan arbitrage bot development to reduce latency and handle high-frequency trades effectively. Bots that operate in milliseconds are essential for capturing fleeting opportunities.

-

Understand Development Costs and ROI

Before building or purchasing an arbitrage bot, assess the flash loan arbitrage bot development cost in relation to potential returns. A well-designed bot might seem expensive upfront but can yield significant profits over time if it performs well in dynamic markets.

-

Monitor Gas Fees and Slippage

On-chain arbitrage profits can quickly diminish due to gas fees and slippage. Use platforms that offer low transaction costs and optimize your trade execution to minimize these expenses.

-

Keep a Close Eye on Market Trends

Arbitrage opportunities often arise from market inefficiencies caused by high trading volume or sudden price movements. Stay updated on market trends and use real-time monitoring tools to identify profitable trades.

By combining these tips with advanced tools and strategies, you can enhance your arbitrage profits while minimizing risks. Always remember to calculate your costs and potential gains carefully to ensure sustainable trading practices.

Conclusion

Building a crypto arbitrage flash loan bot necessitates a thorough comprehension of smart contracts, blockchain technology, and market conditions. By leveraging the potential of flash loans and automated trading, these bots can unlock significant opportunities for arbitrage traders. However, the process involves overcoming challenges such as high gas fees, market volatility, and the complexity of bot development. With the right approach and a reliable development partner, you can design a bot that not only optimizes profits but also ensures seamless operation in a highly competitive market.

At SoluLab, we specialize in providing tailored solutions for blockchain and cryptocurrency projects. For instance, we partnered with Crypto Mining, a pioneering e-commerce company, to build a decentralized marketplace powered by blockchain technology and smart contracts. This innovative platform streamlines the purchase of mining hardware while offering hosting services during miner market inaccessibility. By combining technical expertise and user-centric design, we help businesses leverage blockchain for breakthrough solutions.

Ready to take the next step? Contact us today to explore how SoluLab can bring your crypto and blockchain projects to life with expert development solutions. Let’s build the future together!

FAQs

1. What is a crypto arbitrage flash loan bot?

A crypto arbitrage flash loan bot is an automated program that leverages price discrepancies across different cryptocurrency exchanges to execute profitable trades. It uses flash loans to borrow capital without collateral and completes the transaction within the same blockchain transaction, minimizing risk.

2. How does a flash loan arbitrage bot work?

A flash loan arbitrage bot identifies price differences for a cryptocurrency on various exchanges, executes a flash loan to borrow funds, performs a buy-and-sell operation to capitalize on the price gap, and repays the loan—all in a single transaction. This ensures there are no risks of holding the borrowed amount.

3. What are the key components of a flash loan arbitrage bot?

The main components include an exchange price scanner to identify arbitrage opportunities, a flash loan smart contract for capital, an execution module to trade across platforms, and gas optimization mechanisms to minimize transaction costs.

4. What are the challenges in developing a crypto arbitrage flash loan bot?

Some common challenges include high gas fees, competition from other bots, slippage during trades, and the complexity of writing secure and efficient smart contracts. Ensuring low latency and real-time data access is also crucial for success.

5. How can SoluLab help with crypto bot development?

SoluLab offers end-to-end blockchain and cryptocurrency development services, including custom flash loan arbitrage bot development. We bring expertise in crypto development where we built a decentralized e-commerce marketplace powered by blockchain and smart contracts. Contact us to discuss your bot development needs!