The rise of decentralized finance (DeFi) on Solana has opened up exciting opportunities for traders, but doing everything manually is impossible. That’s why using automated tools like Solana trading bots is necessary to stay ahead of the competition.

If you’re a trader, you’ve probably faced the frustration of missed opportunities, emotional decisions that lead to losses, or struggling to monitor several trading pairs at once. Solana can theoretically handle up to 65,000 transactions per second, depending on transaction complexity and demand. It leads traders to overthink but what if you can build an automated bot that can work for you 24/7? Want to know how?

Solana trading bots solve these problems by running 24/7, analyzing market data, and executing trades with millisecond precision. These crypto trading bots can handle everything from arbitrage to more advanced strategies like market-making, all while taking advantage of Solana’s low fees and high transaction speeds. With automated execution, they optimize trading opportunities and maximize profitability in the fast-paced crypto market.

In this guide, we’ll help you understand how to build your Solana trading bot. From understanding the basics to implementing advanced features, you’ll learn how to stay ahead in this competitive market.

What is a Solana Trading Bot?

A Solana trading bot is an automated software program that trades Solana (SOL) and other tokens on the Solana blockchain on behalf of users. Let me break this down to help you understand it better:

At its core, a Solana trading bot:

1. Monitors the Solana market continuously, watching prices, trading volumes, and other market indicators across various decentralized exchanges in cryptocurrency exchange (DEXs) on Solana

2. Makes trading decisions based on pre-programmed rules, strategies, and conditions that can include:

- Price differences between exchanges

- Technical indicators like moving averages

- Volume patterns

- Market momentum signals

3. Executes trades automatically when conditions are met, taking advantage of Solana’s fast transaction speeds and low fees

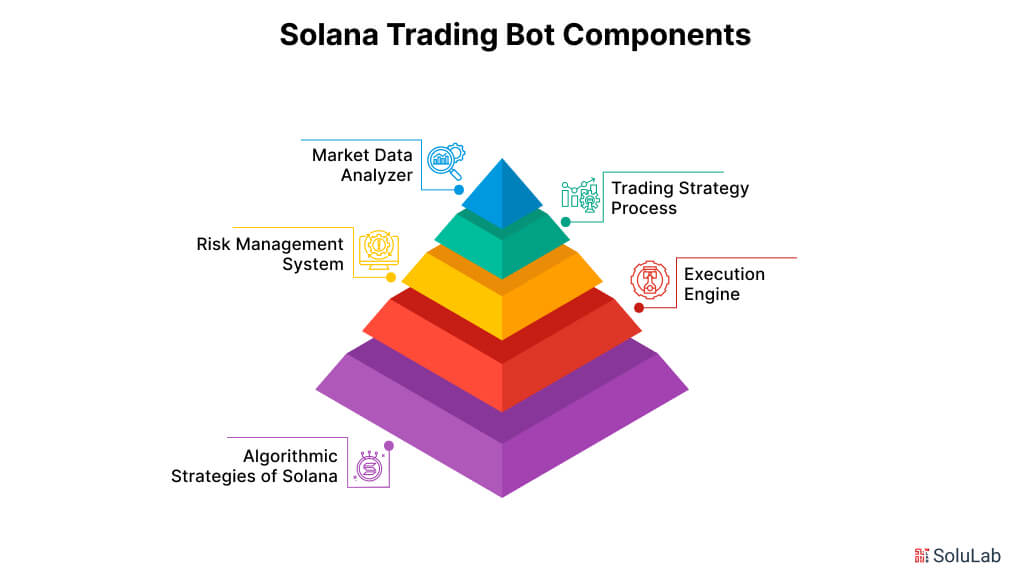

Components of a Solana Trading Bot

A Solana trading bot combines multiple components to analyze market trends, execute trades, and manage risks. It uses Solana’s high-speed blockchain capabilities to offer efficient and profitable trading solutions.

- Market Data Analyzer: This component gathers real-time data, such as price trends and trading volumes, scanning the blockchain for actionable market indicators. It ensures the bot stays updated on market conditions.

- Trading Strategy Processor: Strategies are programmed here to guide the bot’s actions. For instance, it may buy assets when the 30-day moving average surpasses the 60-day average and sell when the reverse occurs. These rules automate decision-making.

- Risk Management System: This system sets parameters such as stop-loss orders and profit-taking points to mitigate risks. It protects investments from significant losses and ensures a balanced trading approach.

- Execution Engine: This part handles the actual execution of trades on exchanges. Its speed and precision are critical to reducing slippage, directly impacting the bot’s profitability.

- Algorithmic Strategies of Solana: Solana employs advanced strategies to enhance its blockchain capabilities. Proof of History (PoH) timestamps events, ensuring low latency and high throughput. Tower BFT and innovative protocols like Turbine, Gulf Stream, and Sealevel enable efficient consensus, transaction validation, and parallel execution, making Solana one of the fastest blockchains available.

These elements together enable Solana trading bots to operate effectively, making them indispensable for traders seeking automation and efficiency.

How to Develop a Solana Trading Bot?

Building a trading bot for the Solana ecosystem, especially for trading Solana meme coins, requires careful planning, architecture, and a deep understanding of both trading mechanics and blockchain technology. Here’s a step-by-step process to create a Solana trading bot.

1. Create Goals and Strategies

Before going all into code, establish clear objectives for your trading bot. Consider whether you aim for arbitrage opportunities, market making, or implement specific trading strategies like mean reversion or momentum trading. Your goals will directly influence the complexity and architecture of your bot.

2. Select Development Tools and Ecosystem

Selecting the right development tools and technology is essential. While Rust is the primary language for Solana development, JavaScript/TypeScript with web3.js offers an alternative for bot implementation. Install Solana’s SDK, which includes important libraries and tools to build Solana applications. Additionally, understanding Solana Smart Contract Architecture is key for deploying, managing contracts, and running scripts effectively. The setup is crucial for deployment, contracts, and scripts to ensure smooth operations.

3 . Understand the Integration of Solana

First, understand the complex architecture of Solana, and know more about how its transactions are processed. Learn how smart contracts work ( executed on-chain program) along with how to use serum or radium to interface with Solana’s DEX platform.

4. Implementation of API

Integrate API between crypto exchange and trading bot API to get the information of the market. This involves order books, trading volume, and prices that help traders execute trades. Handling connection failures is also essential to maintain uninterrupted operations.

5. Create Trading Algorithms

Efficient trading algorithms form the backbone of a successful bot. These algorithms should process market data in real-time, execute trades based on predefined conditions, and effectively manage position sizing and risk parameters. By integrating advanced techniques, such as Natural Language Processing (NLP) for analyzing market sentiment, alongside high-end algorithms and coded trading signals, you can strategically optimize your trading bot for better performance.

6. Implement High-End Security

Essential measures include secure storage and management of private keys, integration of hardware, rate limiting, and request validation. Implementing monitoring systems to detect unusual activities, conducting regular security audits, and ensuring updates like API key management.

7. Backtesting and Simulation

Thorough testing is important before deploying a trading bot. This involves creating a historical data pipeline for backtesting, implementing paper trading functionality, and simulating market conditions. Additionally, testing system performance under high load and validating risk management systems helps identify and address potential issues.

8. Live Deployment and Tracking

When launching a bot using Solana via magnet or testnet, it is advisable to start with small position sizes and implement comprehensive logging systems. Real-time monitoring dashboards, automated alerts for critical events, and redundancy in critical systems enhance reliability and performance during live operations.

9. Update and Innovate

To maintain and improve the bot’s performance, developers must regularly update and optimize code, refine strategies based on performance analysis, and stay updated with market conditions. Applying new trading strategies and continuously monitoring competitive developments ensures the bot is effective and ahead of the curve.

Features of Solana Trading Bot

Here’s a detailed look at its key features:

- Trading Efficiency: Advanced algorithms enable real-time market analysis and instant execution, minimizing slippage and maximizing profit potential. The bot’s ability to process multiple trading pairs simultaneously is because to predefined criteria optimized by the trader. Maintaining precise order management ensures optimal performance across various market conditions. Smart order routing and position sizing further enhance overall trading effectiveness.

- Lower Costs: Solana’s minimal transaction fees translate to significant cost savings for traders, especially during high-frequency operations, including trading Ethereum Meme Coins. The efficient consensus mechanism, known as Proof of History (PoH), combines with Proof of Stake (PoS) to reduce operational overhead. This cost structure makes it feasible to execute numerous small trades without a heavy fee burden. Traders can execute a high volume of trades with minimal cost compared to other platforms, allowing even smaller traders to participate due to lower costs.

- High Speed Exceptionally fast block times and parallel transaction processing enable near-instantaneous trade execution, often completing within 400 milliseconds. The bot capitalizes on Solana’s impressive throughput of 65,000 transactions per second, allowing it to capture fleeting market opportunities and execute complex trading strategies with minimal latency.

How Does Solana Trading Bot Work?

A Solana trading bot is an automated program designed to trade on Solana-based decentralized exchanges (DEXs) such as Raydium or Serum, following predefined strategies set by traders.

It connects to Solana’s blockchain through the web3.js library and JSON RPC API, enabling interaction with smart contracts, fetching real-time data, and executing trades.

The bot securely manages transactions via a wallet and private keys.

- Trading strategies: Trading strategies are algorithm-based, analyzing key indicators like price movements, trading volume, and patterns. A basic strategy might involve buying below a set price and selling above it, while more advanced bots use tools like moving averages or RSI to inform decisions.

- Real-time price monitoring: allows for fast trade execution when conditions align with programmed criteria, considering factors such as slippage tolerance and transaction fees.

- High-speed, low-cost infrastructure: Solana supports rapid trades, making it ideal for strategies like arbitrage and quick market reactions.

- Risk management: It includes stop-loss orders and position sizing, which are integrated to minimize potential losses.

- Portfolio rebalancing: Advanced bots include portfolio rebalancing to maintain asset allocations and backtesting tools to test strategies on historical data before going live.

- Error handling: Ensures that issues like failed transactions, network congestion, and sudden market shifts are managed effectively.

- Alerts and monitoring systems: keep users informed about critical events or issues, ensuring continuous oversight.

Challenges in Solana Trading Bot Development

While the Solana trading bot is good for making things work fast, it also comes with its own set of complex hurdles that developers and traders must know:

1. Technical Expertise: Building Solana trading bots demands in-depth knowledge of multiple domains, from blockchain architecture to advanced trading algorithms. Developers must master Solana’s unique programming model along with its transaction processing and proof-of-history consensus mechanism.

Additionally, cross-program invocation (CPI) and account management are crucial for creating efficient and reliable trading systems.

2. Security Infrastructure: Trading bots, including a Crypto Arbitrage Flash Loan Bot, manage financial assets, and securing your trading bot from cyber attacks is crucial. Private key management and secure storage solutions need careful consideration to prevent unauthorized access. Regular security audits and testing are essential. Additionally, regular updates are necessary to adapt to new regulatory frameworks and maintenance costs. While trading using Solana is fast and profitable, it requires overcoming technical, security, and regulatory barriers.

Organizations must invest resources in expertise, infrastructure, and compliance measures to build and maintain effective trading bots.

Types of Solana Trading Bots

Trading bots have become increasingly popular in the Solana ecosystem. It’s an automated way to trade and interact with the blockchain’s high-speed, low-cost environment. Let’s explore three common types:

1. Solana Sniper Bot

Solana Sniper bot is an automated software tool. It is used to execute sell and buy stocks strategically with accuracy and speed as well. The Solana Sniper bot is well-versed in making split-second decisions, which is quite impossible for humans.

These specialized bots monitor Solana’s blockchain for newly launched tokens or NFT mints, aiming to execute rapid purchases as soon as trading begins. They help traders capitalize on early price movements and potential gains from new project launches.

2. Jito Solana MEV Bot

MEV ( maximal extractable value) is an automated platform that identifies opportunities and performs transactions on the Ethereum blockchain.MEV bot uses an advanced algorithm to get maximum value from trade transactions. The main function of the Jito SOLANA MEV bot is transaction pool monitoring, profit distribution, block proposal, and transaction prioritization.

Operating at the validator level, Jito MEV bots search for and exploit Maximal Extractable Value opportunities on Solana. They analyze transaction ordering to find profitable arbitrage possibilities, liquidations, and other market inefficiencies across decentralized exchanges.

3. Solana Telegram Bot

A crypto Telegram bot is a program designed to automate cryptocurrency-related tasks within the Telegram messaging platform. These bots interact with users through Telegram chat interfaces, offering various functionalities such as tracking prices, managing trades, providing market updates, and even facilitating transactions.

Users can chat, and operate it via commands like buy, help, log out, start etc. These bots integrate with Telegram messaging, allowing traders to monitor market conditions, receive alerts, and execute trades directly through chat commands. They serve as a convenient bridge between trading strategies and everyday communication platforms.

Advantages of Using Solana

Solana is a blockchain platform that provides users and developers with unmatched benefits. It is a popular option for blockchain-based projects and decentralized apps (dApps) due to its distinctive architecture and cutting-edge consensus techniques. The following are some main benefits of utilizing Solana:

-

High Throughput

One of the quickest blockchains on the market, Solana is built to handle thousands of transactions per second (TPS). The platform’s ability to manage extensive applications and satisfy the requirements of worldwide adoption is guaranteed by its high throughput.

-

Low Costs of Transactions

Solana’s extremely low transaction fees are one of its best qualities. Transaction costs stay at less than one cent even during periods of high network traffic, making it a cost-effective choice for both users and developers.

-

Decreased Latency

Near-instant transaction confirmation is ensured by Solana’s block finality, which is reached in milliseconds. For real-time applications like gaming, DeFi, and payments, this low latency is essential.

-

Scalability

Solana’s parallel processing capabilities and distinctive Proof of History (PoH) methodology allow it to grow easily as network demand rises. This guarantees steady performance without sacrificing affordability or speed.

-

Efficiency of Energy

Solana has a more energy-efficient consensus algorithm than conventional Proof of Work (PoW) blockchains, which lessens its environmental impact without sacrificing security or performance.

-

Developer-Friendly Environment

Strong development tools, thorough documentation, and a vibrant developer community are all offered by Solana. This additionally broadens the ecosystem of the platform by making it simpler for developers to create and implement dApps.

Conclusion

Building a Solana trading bot is a complex process that requires continuous refinement and monitoring. As you’ve seen, the journey involves mastering both technical implementation and trading strategy design. Remember that successful bot trading isn’t about creating the most complex algorithms, but rather about developing reliable, well-tested systems that can operate consistently in various market conditions. Start small, test thoroughly, and expand your bot’s capabilities as you gain confidence in its performance. Keep security at the forefront of your development process, and always maintain human oversight of your automated trading systems.

SoluLab partnered with Obor Tech to design a Solana trading bot. The team used the web3.js library and JSON RPC API to build blockchain interactions, enabling the bot to connect securely and execute trades on DEXs like Raydium and Serum.

SoluLab’s experts in blockchain development enabled Obor Tech to deploy a Solana trading bot tailored to its unique requirements. This partnership with SoluLab crypto bot development company, addressed the technical and security challenges and empowered Obor Tech to stay ahead in the fast-paced decentralized trading market.

At SoluLab, a Solana blockchain development company, we have a team of experts who can create such bots, apply strategies, and gain clarity on your crypto trading objective. So, if you want to work with us, contact us today!

FAQs

1. How can I ensure my trading bot executes trades quickly on Solana?

Optimizing your bot’s performance on Solana requires careful consideration of RPC node selection, efficient transaction batching, and proper account management to minimize latency and maximize execution speed.

2. What are the common risks when running a Solana trading bot?

Trading bots on Solana face risks including network congestion, smart contract vulnerabilities, and market volatility, requiring robust risk management strategies and careful monitoring.

3. What are the essential components needed for a basic Solana trading bot?

A functional Solana trading bot requires key components including a reliable RPC connection, wallet integration, market data feeds, and a well-defined trading strategy implementation.

4. How do I monitor and maintain my trading bot’s performance?

Effective bot maintenance involves implementing comprehensive logging systems, performance metrics tracking, and regular strategy optimization based on historical trading data.

5. What security measures should I implement in my trading bot?

Security for Solana trading bots should focus on private key management, regular code audits, and implementing circuit breakers to prevent unexpected losses during market anomalies.