Hyperliquid achieved a historic milestone with the greatest airdrop in the cryptocurrency sector, significantly altering discussions around airdrop techniques. The introduction of HYPE, Hyperliquid’s new points-based incentive layer, has caused quite a stir in the cryptocurrency derivatives industry. Hyperliquid surpassed big rivals like dYdX and GMX in daily trading volume, reaching a record $2.8 billion in just the first week of March 2025.

The future of finance is perceived as decentralized; nevertheless, achieving this vision needs platforms that exhibit the speed as well as the effectiveness of traditional exchanges while assuring trustlessness and transparency. Hyperliquid provides a high-performance, on-chain trading platform designed for this purpose.

In this blog, we will explore the Hyperliquid ecosystem and dissect HYPE, the recently introduced points-based rewards system that’s shaking up the decentralized trading arena.

What Exactly is Hyperliquid?

Hyperliquid’s proprietary decentralized exchange (DEX), known as Hyperliquid Chain (HyperEVM), focuses on optimizing the user experience, scalability, and overall efficiency. The platform is purpose-built for perpetual futures trading, offering professional-grade tools like scale orders, copy-trading, and ultra-fast, low-cost executions.

Hyperliquid has transformed the concept of a decentralized exchange (DEX) by combining the advantages of both centralized and decentralized exchanges. It provides users with direct control over their assets and operates entirely on-chain, eliminating intermediaries, all while maintaining the performance generally associated with centralized platforms.

The Hyperliquid Chain is fundamentally designed to provide users, ranging from individual investors to institutions, with real-time liquidity, ultra-responsive order execution, and one-click efficiency. Hyperliquid is establishing a new standard for trading in the crypto ecosystem by utilizing its innovative infrastructure, which is designed to redefine the interaction between digital assets as a whole.

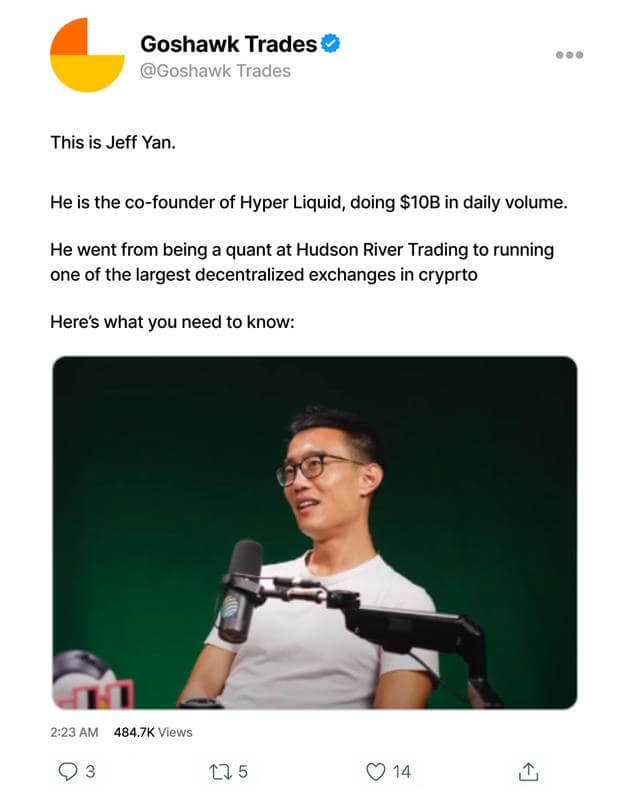

Who Built the Hyperliquid Ecosystem?

The Hyperliquid ecosystem is fundamentally anchored by Hyperliquid Labs, the team tasked with developing and sustaining the platform. The project was co-founded by Jeff Yan and Iliensinc, two Harvard alumni who amalgamated their expertise in finance and blockchain technology to develop one of the most advanced decentralized exchanges now available on the market.

The project’s other co-founder, Iliensinc, complements Jeff’s finance background with deep expertise in blockchain technology infrastructure implementation. Despite his pseudonymous public persona, he is highly esteemed in cryptocurrency circles for his technological achievements and strategic foresight. His emphasis is on the construction of scalable, decentralized systems—crucial components that underpin the Hyperliquid Chain’s Layer-1 HyperEVM and its capacity to function independently of other blockchains.

Their collective expertise connects Wall Street-level trading systems with Web3-native ideas. Hyperliquid Labs prioritized organic growth, product-centric development, and community alignment, distinguishing the project among several VC-funded DeFi protocols.

How Does Hyperliquid Chain Work?

Hyperliquid functions on a proprietary high-performance Layer-1 blockchain, driven by HyperBFT, a customized consensus system influenced by HotStuff. This configuration guarantees sub-second finality, facilitating rapid and safe on-chain transactions.

Hyperliquid integrates the efficacy of centralized exchanges with the transparency of decentralized finance via its hybrid order book model—orders are matched off-chain for expediency but settled on-chain for trustworthiness and verifiability.

Below is an analysis of the principal elements that drive the Hyperliquid ecosystem:

- HyperEVM: A high-performance Ethereum-compatible environment protected by HyperBFT, facilitating the smooth execution of smart contracts inside the ecosystem.

- Cross-Chain Compatibility: Exchange assets across several blockchains without the necessity of bridging or changing networks. This multi-chain versatility expands prospects for traders.

- Native Bridge to Ethereum: Hyperliquid incorporates a native bridge for rapid and decentralized transactions between the Hyperliquid Chain and Ethereum, ensuring the security of user money while preserving efficiency.

- Smart Contract Security: All transactions are executed via audited smart contracts, eliminating intermediaries and mitigating the danger of manipulation.

- HYPE Token Staking and Governance: Users may stake HYPE tokens with validators to enhance network security and get incentives. Token holders have governance rights to vote on protocol enhancements and policy modifications.

- Time-Weighted Average Price (TWAP) Orders: Substantial deals are systematically divided into smaller segments, performed at intervals to mitigate slippage and minimize market effect.

- Clearinghouse & Oracle System: The integrated clearing house oversees user balances, margins, and liquidations, while validators refresh Oracle prices every three seconds to ensure precise pricing and financing rates.

- Advanced Risk Controls: The system employs real-time liquidation monitoring and dynamic margin adjustments to avoid cascade failures and safeguard traders from substantial losses.

- Developer APIs: Developer APIs will permit any developer to build the tools they need and easily integrate trading capabilities, thus bringing value to the Hyperliquid platform.

- Intuitive Interface: A simple and clean dashboard will give traders real-time market data, performance indicators, and comprehensive risk management tools.

- Extensive Liquidity Pools: Extensive liquidity pools from market makers and algorithmic traders significantly affirm substantial liquidity, ensuring the prompt execution of large orders with low slippage.

They, all together, build the next-generation on-chain trading framework, rapid, safe, and scalable, positioning Hyperliquid Chain as a formidable competitor within decentralized finance.

Key Features of Hyperliquid

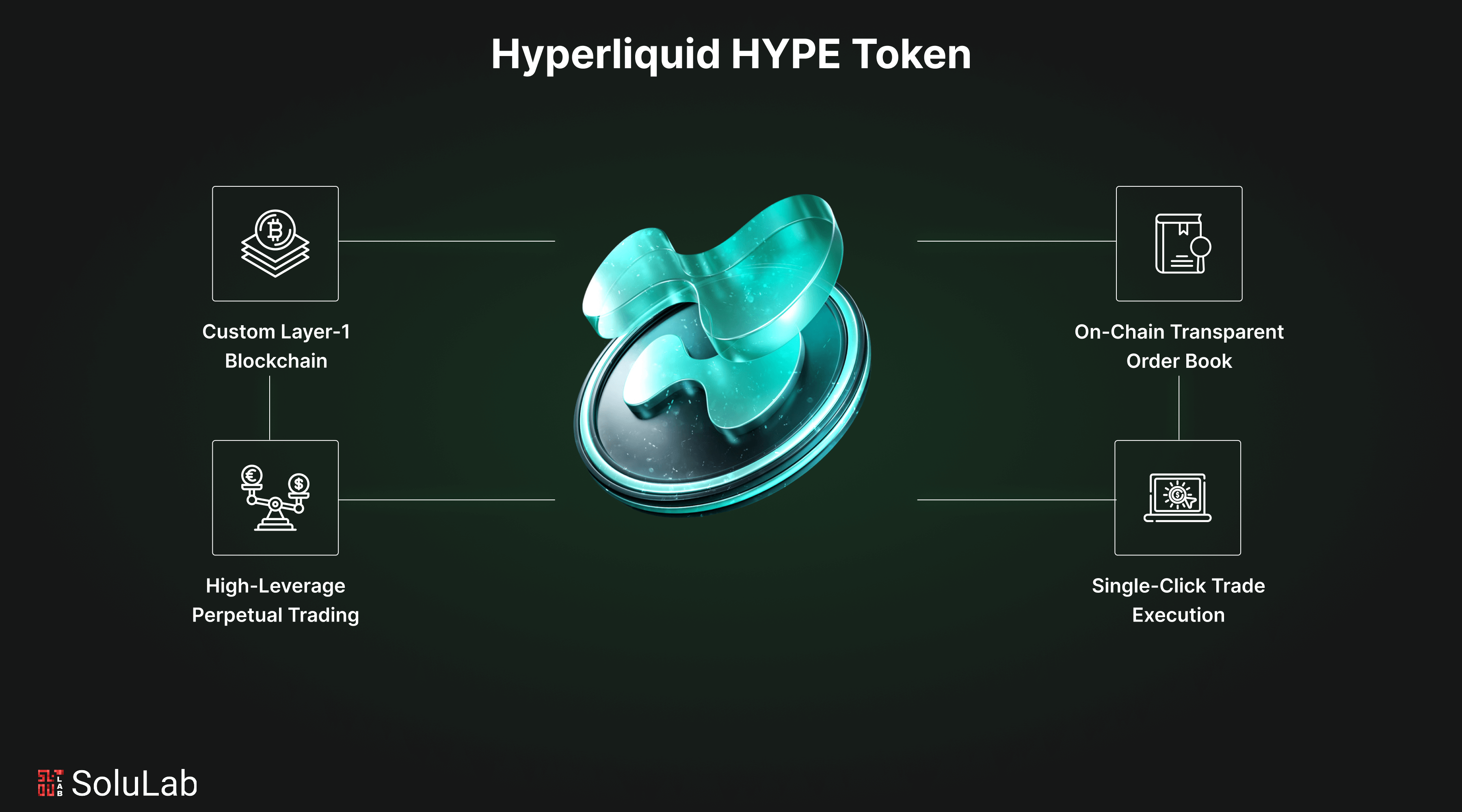

Hyperliquid distinguishes itself in the decentralized trading arena with its amalgamation of rapidity, transparency, and intuitive design. Built on its own Layer-1 blockchain, it provides an uninterrupted trading experience without sacrificing performance or decentralization.

- Custom Layer-1 Blockchain (Hyperliquid Chain)

Hyperliquid operates on its unique Layer-1 network, utilizing the HyperBFT consensus algorithm, which can handle up to 100,000 orders per second. This facilitates rapid transactions with sub-second finality, which is crucial for real-time trading.

- On-Chain Transparent Order Book

In contrast to most DEXs that depend on off-chain elements, Hyperliquid maintains its whole order book on-chain. This guarantees that each transaction and order is publicly verifiable, fostering equity, transparency, and confidence within the ecosystem.

- No Gas Fees

Traders get the advantage of zero gas fees, incurring just nominal maker (0.01%) and taker (0.035%) charges. This price structure is designed to benefit both retail and high-frequency traders, markedly decreasing transaction expenses.

- High-Leverage Perpetual Trading

Hyperliquid provides leverage of up to 50x on perpetual futures, enabling customers to enhance their exposure across more than 130 supported assets. This creates an opportunity for smart trading while upholding risk management protocols.

- Single-Click Trade Execution

The platform is designed for user-friendliness, facilitating single-click transaction execution following the first wallet connection. The absence of frequent confirmations facilitates quicker responses and enhances trading experiences, making it suitable for both novices and experts.

What Distinguishes Hyperliquid from Other Decentralized Exchanges?

Hyperliquid distinguishes itself in the decentralized trading environment by providing unparalleled speed, scalability, and an intuitive user experience. In contrast to conventional decentralized exchange (DEX) systems that depend on automated market makers (AMMs), Hyperliquid employs a completely on-chain order book, establishing a novel benchmark for efficiency in decentralized trading.

The core of its ecosystem is the Derivatives Exchange, the first product introduced by Hyperliquid and its premier service. This derivatives platform has a pivotal role within the overall product ecosystem, highlighting its fundamental capabilities and strategic ambition for the future. Hyperliquid functions on a proprietary Layer 1 blockchain, capable of handling up to 100,000 transactions per second.

A significant advantage of Hyperliquid is the eradication of gas costs. This substantially reduces trading costs while preserving great performance. Its seamless interface offers a centralized exchange-like experience, featuring one-click order execution and eliminating redundant wallet confirmations.

The Derivatives Exchange supports over 130 assets and provides leveraging options up to 50x, offering functionality while maintaining full decentralization. Utilizing its HyperBFT consensus system, Hyperliquid attains sub-second finality, exceeding the slow performance of networks such as Ethereum.

How is Hyperliquid Put to Use?

With its adaptable architecture, Hyperliquid can meet all of your crypto trading requirements. Its primary function is to facilitate real-time trading by providing tools such as an enhanced order book and the ability to execute orders with a single click. With these tools, you may trade with ease, reducing slippage and increasing efficiency.

Within Hyperliquid’s ecosystem, the HYPE token is crucial. It establishes a system for governance as the native token of the platform and gives you a voice in decisions that will determine the platform’s destiny. In addition to rewarding early adopters and encouraging trade, HYPE tokens are utilized to foster a vibrant and active community.

Hyperliquid allows third-party apps that make use of its infrastructure to function, in addition to trading. To further expand Hyperliquid’s capabilities, developers can build decentralized apps (dApps) and other tools that connect with it. There are a lot of ways to get the most out of the trading platform, but community incentives and staking chances are two of the best.

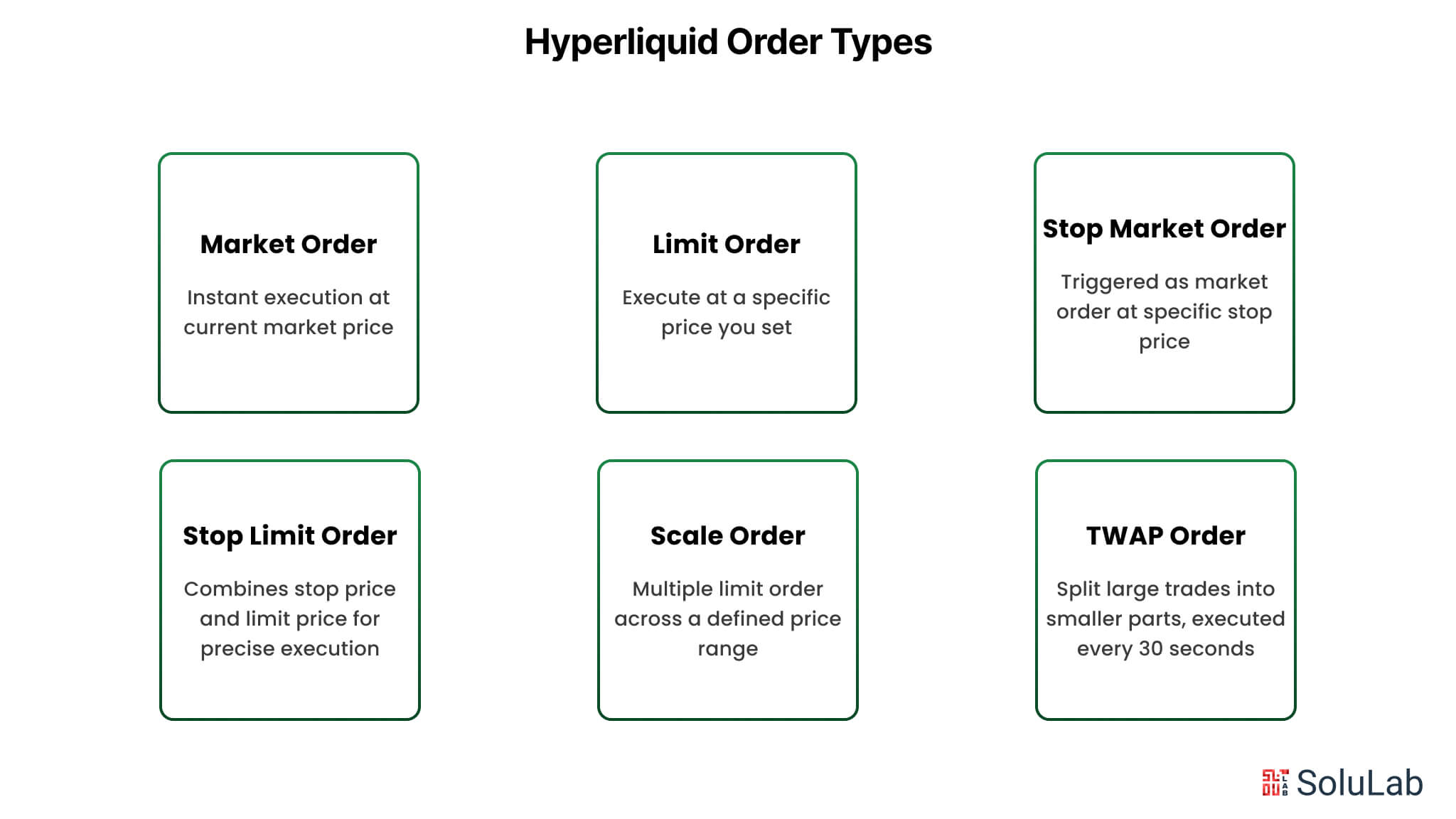

Hyperliquid Order Types

Hyperliquid provides several order types that accommodate various trading methods by balancing speed, control, and accuracy. The platform offers versatile tools for all types of traders, whether they are looking for quick execution or more strategic entry and exit points. Here are some of the types:

- Market Orders: When time to execution is more critical than price control, a market order—executed immediately at the current market price—is the way to go.

- Limit Orders: With a limit order, you may specify a desired price and then sit tight until the market meets it. Although this offers you more control, it does not ensure execution until the price objective is met.

- Stop Market Orders: Market orders that are triggered as stop orders are executed when a certain price is reached. They are often used as stop-loss systems to limit losses or secure gains.

- Stop Limit Orders: To get more specific results, use a stop-limit order, which combines a stop price with a limit price. Although there is a chance it won’t fill if the market moves swiftly, the order is only executed at your set limit or greater; it is activated at the stop price.

- Scale Orders: You may use scale orders to enter or exit a trade more gradually when prices change within a certain range by spreading out numerous limit orders across that range.

- TWAP Orders: To minimize market effect and produce a more stable average price, TWAP (Time-Weighted Average Price) orders, which are designed for bigger transactions, are executed every 30 seconds with a maximum slippage of 3%. The orders are broken into smaller sections.

HYPE Tokenomics

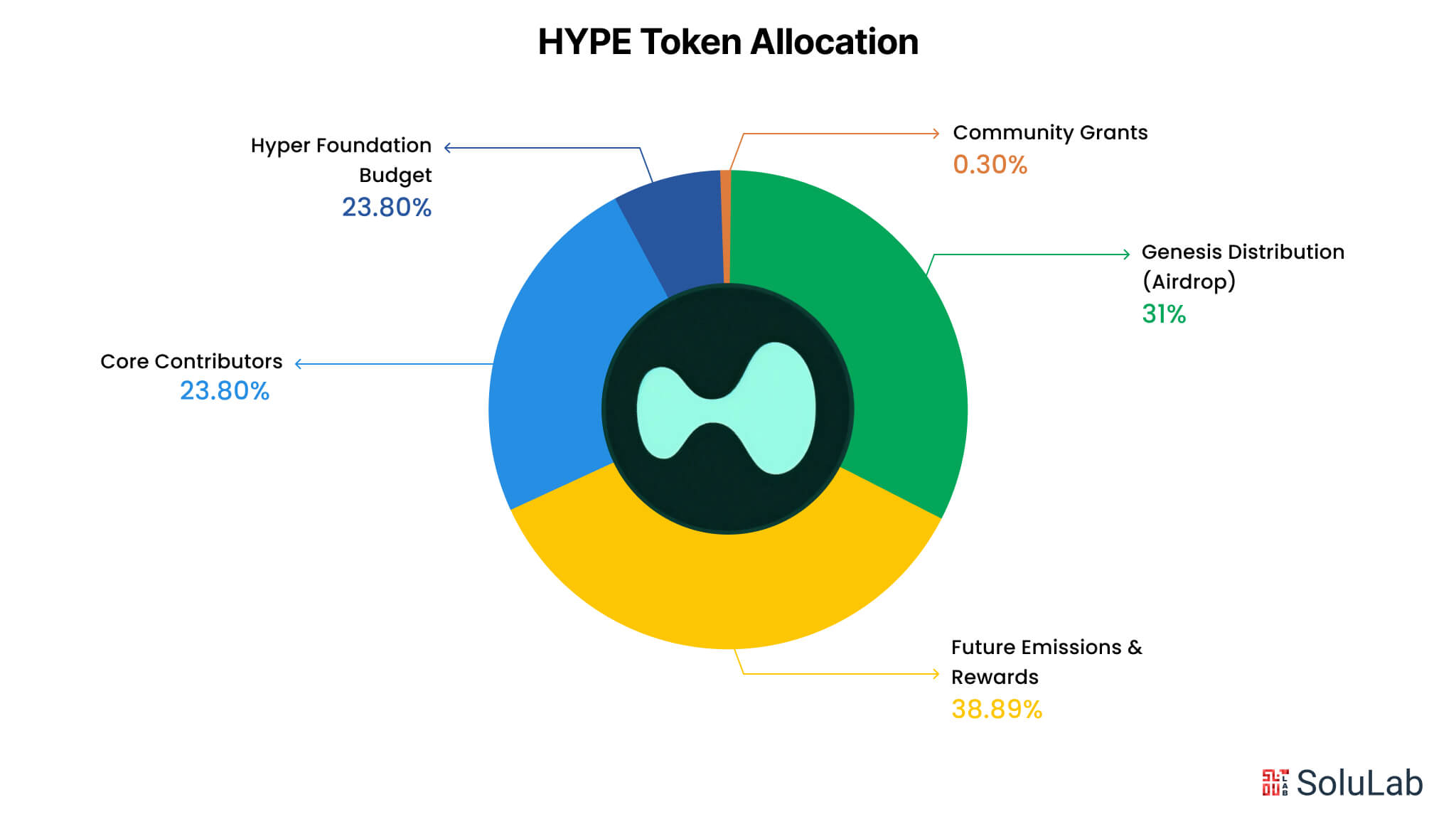

When it comes to the tokenomics of the Hyperliquid platform, the native token, HYPE, is essential. With a maximum supply of 1 billion tokens, HYPE was launched via an airdrop campaign that distributed 310 million tokens, or 31% of the total, to about 94,000 users.

HYPE offers several useful functions-

- Voting on platform improvements and suggestions is one way token holders may be involved in governance.

- Staking is another feature of the token that allows users to earn up to 55% APY for locking their tokens and contributing to the security of the network.

- HYPE can power the development of decentralized apps (dApps) and serve as a medium for transaction fees.

- A burn mechanism has permanently removed 110,000 tokens from circulation, which will help sustain their value in the long run.

The distribution of the whole stock is as follows:

- Community awards and future emissions account for 38.888% or 388.88 million tokens.

- 31% were given out by the Genesis airdrop.

- A portion of the stock, 23.8%, is set aside for key contributors and will vest between 2027 and 2028.

- 6% set aside for the operational expenses of the Hyper Foundation

- Community grants get 0.3%.

- 0.012% designated for HIP-2 programs

Fees of Trading Hyperliquid

All members of the community may benefit from Hyperliquid’s open-cost structure. A fixed rate of 2.5 bps taker and 0.2 bps maker rebate was implemented for trading costs in June of 2023 when the mainnet emerged from its closed alpha. 10% of the taking fees for referees were also paid to the referrers.

Hyperliquid is unique among platforms in that it allocates 100% of its revenues to community initiatives like the Hyperliquid Protocol and the HYPE support fund, rather than to platform insiders. To create an incentive where the community directly benefits from the platform’s development and activity, this assistance fund retains a substantial amount of its total assets as a HYPE token.

Two categories of costs exist: maker fees and taker fees. Paying a taker fee means you’re removing liquidity from the market by making an immediate purchase or sale. In order to enhance liquidity, such as placing orders that are completed in a delayed fashion, makers charge a fee.

The frequent customers of Hyperliquid incur maker fees of 0.01% and taker fees of 0.035%. The taker cost decreases to 0.019% and the maker fee disappears altogether for trades over $2 billion.

Where to Buy Hyperliquid Crypto?

The native Hyperliquid coin, HYPE, is not yet available on Binance or Coinbase, two of the most prominent centralized exchanges in the world. Rather, it may be traded mostly via Hyperliquid’s exchange interface and decentralized platforms.

Here are the steps to purchase HYPE:

- The Native Exchange of Hyperliquid

Buying HYPE via the Hyperliquid platform is the quickest and easiest option. To use Hyperliquid’s Layer 1, you’ll need a network connection and a wallet that is compatible with it, such WalletConnect or MetaMask. After logging in, users will be able to trade supported assets for HYPE straight from the platform.

- Decentralized Markets (DEXs)

On certain DEXs that allow cross-chain swaps, you could also find some liquidity. But supply is low and often reliant on liquidity pools created by users. Be wary of frauds and phony tokens by always checking the contract address before trading.

- Aggregators or Bridges

If you own assets on an alternative chain, a bridge service or DEX aggregator that facilitates token exchanges across networks may be necessary. Depending on the liquidity, services such as Jumper, Rango Exchange, or LiFi may provide cross-chain access.

Use Cases for HYPE Token

An essential component of the Hyperliquid ecosystem, the HYPE token facilitates not just functioning but also community engagement. It is more than simply a digital asset. Because of its importance to the platform’s trading, governance, and network incentive functions, users must have it.

The most common use cases of HYPE are as follows:

- Governance Participation

Members of the Hyperliquid community may shape the future of the platform by casting votes on important protocol updates, new features, and community recommendations. Users will be able to influence the platform’s future development thanks to this decentralized governance mechanism.

- Staking for Rewards

Staking HYPE tokens allows users to earn a rewarding annual percentage yield (APY) of up to 55 percent. Staking helps keep the network secure and stable while also providing passive revenue.

- Transaction Fee Payments

On the Hyperliquid exchange, HYPE may cover transaction costs and trades. Because of this, the token becomes more useful and more appealing to users, who are more likely to hold onto it for regular trade.

- Building and Powering dApps

Hype is a cryptocurrency that developers using Hyperliquid’s platform may use to power their decentralized apps. The implementation of smart contracts, in-app purchases, and other ecosystem connections fall under this category.

- Ecosystem Incentives and Rewards

HYPE encourages participation in the community, trades, and the availability of liquidity. Tokens are the backbone of many incentive systems, including community reward programs, trade contests, and airdrops.

- Burn Mechanism for Value Support

Burning some HYPE at regular intervals lowers supply and helps maintain value in the long run. Many tokenomics schemes that reward holders for the long run are in line with this deflationary dynamic.

How Safe is Hyperliquid?

With its proprietary Layer 1 (L1) blockchain architecture, Hyperliquid ensures that customers’ digital assets are highly secure and reliable. Data integrity and ledger transparency are ensured via a decentralized network of validation nodes, upon which this foundation is built. The platform eliminates potential weak points and greatly reduces the likelihood of network breaches or hostile assaults by using the HyperBFT consensus method.

Hyperliquid uses robust encryption algorithms to secure sensitive information, including as wallet data and transaction history, in addition to its decentralized architecture. In order to make the network more resilient as a whole, the team also performs regular security audits to find and patch any vulnerabilities.

Hyperliquid is still gaining community trust; this is particularly true as more people want to buy HYPE tokens and participate in its expanding ecosystem.

The Final Words

Hyperliquid has established itself as an established leader in the decentralized trading arena, thanks to its advanced order types, lightning-fast execution, and strong Layer 1 infrastructure. The platform is gaining popularity among developers and traders because of its native token, HYPE, which powers governance, staking, and utility.

As a well-known crypto token development company, we at SoluLab are experts in developing crypto tokens. We’ve just teamed up with Token World, an innovative launchpad that helps blockchain projects get off the ground and connects them with investors all over the world. Investors may discover high-potential initiatives with ease, and creators can list their businesses to seek funding on a safe and user-friendly website that our team helped create.

If you are looking for expert guidance in the blockchain arena, want to create a decentralized platform, or are interested in launching your cryptocurrency token, SoluLab is the right spot for you. Reach out to our team and take the first step toward bringing your Web3 vision to life.

FAQs

1. What chain is Hyperliquid on, and how is it different from other DEXs?

Hyperliquid runs on its custom Layer 1 blockchain, purpose-built to handle high-frequency trading with ultra-low latency. Unlike most DEXs that operate on Layer 2 solutions like Arbitrum or Avalanche, Hyperliquid’s native chain enables it to process up to 100,000 orders per second and achieve sub-second transaction finality. This unique infrastructure allows for a smoother, faster trading experience with reduced gas fees and greater scalability.

2. How is Hyperliquid different from other perpetual DEXs like dYdX or GMX?

Hyperliquid sets itself apart by operating on its own Layer 1 blockchain rather than relying on Layer 2 solutions. It features a fully on-chain order book (not AMM-based), supports over 130 assets, and allows leverage up to 50x. Its high-speed performance and CEX-like user experience give it a major edge in the decentralized derivatives trading space.

3. Can I stake HYPE tokens, and what are the benefits?

Yes, you can stake HYPE tokens to earn rewards of up to 55% APY. By staking, you contribute to the network’s stability while earning passive income. Stakers may also gain additional influence in governance proposals depending on the platform’s evolving roadmap.

4. Where can I buy HYPE tokens?

Currently, HYPE tokens can be purchased directly through Hyperliquid’s native exchange platform. You’ll need a supported wallet like MetaMask to connect and trade. It may also be available on select decentralized exchanges, but always verify token details from official sources to avoid scams.

5. How does Hyperliquid ensure low slippage during trades?

Hyperliquid uses an on-chain order book system instead of an AMM model, which allows for better price matching and lower slippage, especially during high-volume trades. The platform also supports advanced order types like TWAP and scale orders to help traders execute large positions smoothly across price ranges.